Of all the three method I will side on martingale as long that it is based on a good strategy with good winning rate, of course you need to be prepare that your capital can absorbed up to 20 consecutive loses, grid and hedging is way much more riskier to use.

Unless you have a $millions in your account, you can't absorb 10 consecutive losses. Martingale, guaranteed to blow your account eventually.

It depends on what lot size you are using, you can also use cents account so that you have enough funds to support such activity.

On a Cent account, your gains are also in cents and therefore 100 times less that normal accounts but still limited by the same maximum number of lots that brokers allow (many have a limit of 100 Lots and many others a limit of 50 Lots).

The following table for a normal account shows how quickly it can "blow" your balance, trading for example on EUR/USD or GBP/USD or many other xxx/USD currency pairs:

Consecutive Martingale Orders Lots 10 pips loss 100 pips loss 1 0.01 $1.00 $10.00 2 0.02 $2.00 $20.00 3 0.04 $4.00 $40.00 4 0.08 $8.00 $80.00 5 0.16 $16.00 $160.00 6 0.32 $32.00 $320.00 7 0.64 $64.00 $640.00 8 1.28 $128.00 $1,280.00 9 2.56 $256.00 $2,560.00 10 5.12 $512.00 $5,120.00 11 10.24 $1,024.00 $10,240.00 12 20.48 $2,048.00 $20,480.00 13 40.96 $4,096.00 $40,960.00 14 81.92 $8,192.00 $81,920.00 Max Lots (on many brokers) 100.00 $10,000.00 $100,000.00

PS! Actually my table is conservative, because losses are cumulative, so actual values are double the losses shown on this table!So, draw your own conclusions!!!

On a Cent account, your gains are also in cents and therefore 100 times less that normal accounts but still limited by the same maximum number of lots that brokers allow (many have a limit of 100 Lots and many others a limit of 50 Lots).

The following table for a normal account shows how quickly it can "blow" your balance, trading for example on EUR/USD or GBP/USD or many other xxx/USD currency pairs:

Consecutive Martingale Orders Lots 10 pips loss 100 pips loss 1 0.01 $1.00 $10.00 2 0.02 $2.00 $20.00 3 0.04 $4.00 $40.00 4 0.08 $8.00 $80.00 5 0.16 $16.00 $160.00 6 0.32 $32.00 $320.00 7 0.64 $64.00 $640.00 8 1.28 $128.00 $1,280.00 9 2.56 $256.00 $2,560.00 10 5.12 $512.00 $5,120.00 11 10.24 $1,024.00 $10,240.00 12 20.48 $2,048.00 $20,480.00 13 40.96 $4,096.00 $40,960.00 14 81.92 $8,192.00 $81,920.00 Max Lots (on many brokers) 100.00 $10,000.00 $100,000.00

PS! Actually my table is conservative, because losses are cumulative, so actual values are double the losses shown on this table!So, draw your own conclusions!!!

The consecutive losses that we are talking here are just the worst case scenario, of course you have to find a strategy that wont utilize bigger stop loss, between 20 to 30 pips stop loss is the best settings to minimize the losses and the strategy must be very good to have better chance of success, 10000$ in a cents account is just equivalent to 100$ so if you have 1000$ account that is equivalent to 100000$ in cents which can be good enough to cover a mini lot martingale. I have a martingale system that is under test at the moment and so far it never pass beyond 2 consecutive loses, so even if it will go 10 consecutive loses still it can be easily covered by a cents account or even a standard account with 10k deposit. I am not saying that martingale is applicable to all traders because this is a very risk approach, but it does not mean that their is no other way to capitalize such approach either, and I bet their must be a way but of course it is up to the trader itself how he figure out an acceptable strategy that can take advantage a martingale approach.

The key here is to find a strategy that wont give you more than 10 consecutive loses at any point of time, if you can achieve lower than 10 the better. The strategy must be at least tested for 1 year before you apply a martingale approach. This is of course in the assumption that you follow your trading rule consistently, because if you diverse or become impulsive along the way this approach wont work.

10 in a row is much more common, yes definitely because majority of traders are losers, that is why it is a common thing to majority of traders, but the point also is to create a strategy that will not give you more than 10 executive losing trades, do you think it is impossible I dont think so, I will try to prove that it is possible. Do not limit the possibilities.

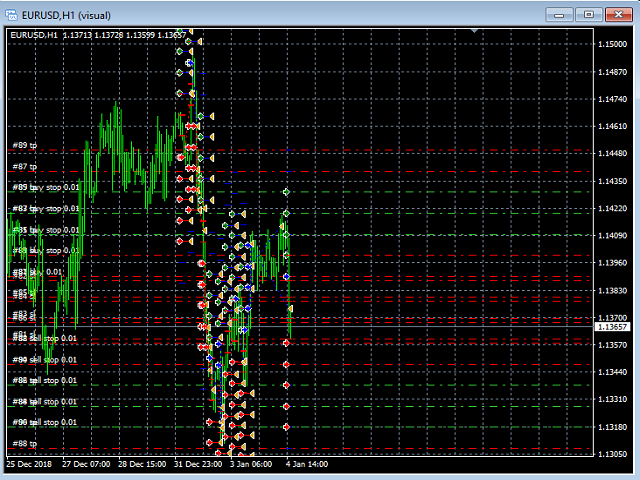

Grid Template EA - expert for MetaTrader 4

Grid Template EA places a grid with pending stop orders at each side of price. Rule for placing new grid - As soon as expiration hours exceeded and all remaining positions that were not triggered. Does not use rule for 'new bar' detection and therefor new grid's placed any time as soon as there are no existing positions.

This template you can use for further development adding what ever you like...for example trailing stop, entry signals, other rules and such.

- www.mql5.com

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Martingale, Hedging and Grid <<< MHG >>> My Holy Grail

Over 50% of freelance jobs can be classified as one form or another of MHG.

I wonder why ?

Martingale : A gambling system of continually doubling the stakes in the hope of an eventual win that must yield a net profit.

Hedging : Taking equal and opposite positions in two different markets. However what most traders do is hedging on same pair at same price or on losing positions.

Grid : Adding positions on fixed distance in one or both directions regardless of price action.

So what's so special and tempting about these concepts ?

Do you really think you will find your holy grail using these methods ?

I understand that better custom forms of these methods can be used in trading, provided that you already have a trading system with an edge :