What does it mean a currency to be Overbought and Oversold?

In my opinion : nothing.

If you need more classical answer, see here for example. Please use the search engine before posting.

What does it mean a currency to be Overbought and Oversold?

What does it mean a currency to be Overbought and Oversold?

I am about for waking this old thread up but it may be good place for posting it sorry

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.24 19:29

Overbought vs. Oversold (baseed on dailyfx article)

- Overbought means an extended price move to the upside; oversold to the downside.

- When price reaches these extreme levels, a reversal is possible.

- The Relative Strength Index (RSI) can be used to confirm a reversal.

Overbought vs. Oversold

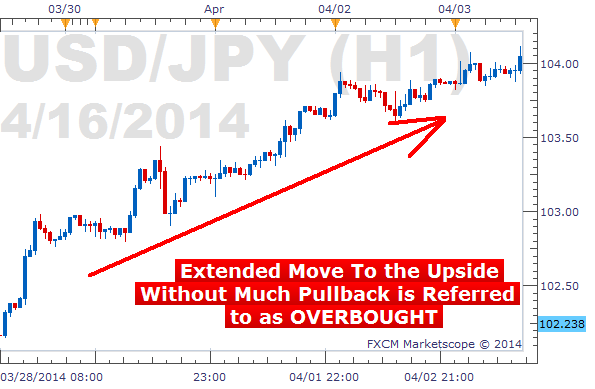

These two terms actually describe themselves pretty well. Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback. This is clearly defined by a chart showing price movement from the “lower-left to upper-right” like the chart shown below.

Learn Forex: USDJPY Hourly Chart – Overbought

The term Oversold describes a period of time where there has been a significant and consistent downward move in price over a period of time without much pullback. Basically a move from the “upper-left to the lower-right.”

Because price cannot move in one direction forever, price will turn around at some point. Currency pairs that are overbought or oversold sometimes have a greater chance of reversing direction, but could remain overbought or oversold for a very long time. So we need to use an oscillator to help us determine when a reversal is actually occurring.

But, we must be patient before we enter our trades, because sometimes the RSI can stay overbought or oversold for quite awhile. The worst thing we can do is try to pick a top or a bottom of a strong move that continues to move into further overbought or oversold territory. So we must wait until the RSI crosses back under 70 or crosses back above 30.

When the RSI falls below 30, same rules apply. We want to wait until the RSI crosses back above 30 before we place a buy trade.

Putting RSI to Work

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

What does it mean a currency to be Overbought and Oversold?