hi friends,

I've written an EA and I anytime I test it by ST-tester it gives me a correct result but when I execute it in Real-time Market I take a different result.(even in a same day and date)

does anybody know about the problem and its solution?

What is the difference in the Spread in the ST compared to live ?

There is not so much difference and I'm sure it's not relevant to Spread, I think it must be due to something else.

I've never used the MT4 backtester, can be pretty much a waste of time, depending on the strategy. But you view it the wrong way, the real market test is right (unless it was a demo account), and the ST is wrong.

There's many threads about the differences between ST and real trading, have a search.

As for the solution, it depends on the specifics of your strategy and what factors affect it

What is the average and range of the spread in you broker. What spread did you use in the tester

You think it must be something else. Do you expect a mind reader to answer you? What information have you provided. Have you printed the spread and slippage when you open and close.

There is not so much difference and I'm sure it's not relevant to Spread, I think it must be due to something else.

So you don't know what is causing the difference but you know it isn't the Spread . . . OK, out of interest what was the Spread for the ST run and the live ? I guess you don't know . . . yet you know the cause isn't the Spread ?

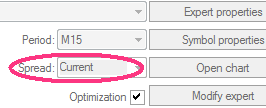

I choose the " current " as the spread type in ST tester,and I said it is not related to spread because it is obvious in my code.

I choose the " current " as the spread type in ST tester,and I said it is not related to spread because it is obvious in my code.

And do you know what "current" means ? if you know the problem is in your code then fix your code . . . we can't fix it for you . . . we can't even see it.

Dear RaptorUK(Simon), I always learn many things from your comments in topics but now I think I must fix it myself.

anyway, thank you all for your comments,

ST uses pseudo ticks, whereas in real time, you get real ticks.

I usually find that an ST run compared to a real time run always has better returns because there is no slippage in ST.

Eg. Yesterday, 7th November, there was a dramatic downmove in EURUSD. My EA did not enter because price moved beyond the EA stipulated range too quickly.

If I run the same EA in ST, it will enter the trade and exit at TP.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

hi friends,

I've written an EA and I anytime I test it by ST-tester it gives me a correct result but when I execute it in Real-time Market I take a different result.(even in a same day and date)

does anybody know about the problem and its solution?