You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

angevoyageur (hard name to write :D)

The "logic"is the following:

I know that for each bad trade, I need 3 consecutive winners to recover the loss, but, instead, I increase the size lot.

For example:

0.01 = -30.00 (-30pips)

0.04 = 40.00 (10 pips)

So.. the "avoid" that I am talking about, is do not trade if last trade was a bad trade, but, trade in the next opportunity.

So, if I used to get 3 consecutive trades.. in this way I can get 2 (that "decrease" 33% of the risk)

The "logic"is the following:

I know that for each bad trade, I need 3 consecutive winners to recover the loss, but, instead, I increase the size lot.

For example:

0.01 = -30.00 (-30pips)

0.04 = 40.00 (10 pips)

So.. the "avoid" that I am talking about, is do not trade if last trade was a bad trade, but, trade in the next opportunity.

So, if I used to get 3 consecutive trades.. in this way I can get 2 (that "decrease" 33% of the risk)

My 2c:

The approach to increase lot size when losing is wrong because you really have no idea in what order you will see losers in real life so your system would most likely see your account bankrupt in monte-carlo test. Monte carlo test is based on assumption that the order of profitable and losing trades live can be quite different from back-test results. IMHO you should stop doubling your losers and rather either decrease the number of losers or increase the size/number of winners.

How the probability to win or lost a trade is related on the result of the previous one ? How do you know you will get only 3 (or 2) losses in a row ? Only on basis of the backtest shown above ?

Ange,

It isn't related on the result of the previous one. But what I've been coding is deny a trade after a bad trade (trying to decrease consecutive bad trades). I know that I can get 3 or 2 losses in a row based in backtesting, live, real and demo accounts, but, in my system, I will have a mechanism that calculates this probability based on last X (50 or other value defined) rows of history trades.

It's the reason why I am needing guys to work with me on this project.

Raptor.

About the risk, it allows 37%.

About the spread. I changed it to fixed (3 pips), because variable was a little bit weird.

My 2c:

The approach to increase lot size when losing is wrong because you really have no idea in what order you will see losers in real life so your system would most likely see your account bankrupt in monte-carlo test. Monte carlo test is based on assumption that the order of profitable and losing trades live can be quite different from back-test results. IMHO you should stop doubling your losers and rather either decrease the number of losers or increase the size/number of winners.

Thank you for 2c Jozef.

I never heard about Monte-Carlo test, but I am going to study about it. About decreasing the number of losers, well, it's what I am looking for. It's the second step that I am coding for... filters.

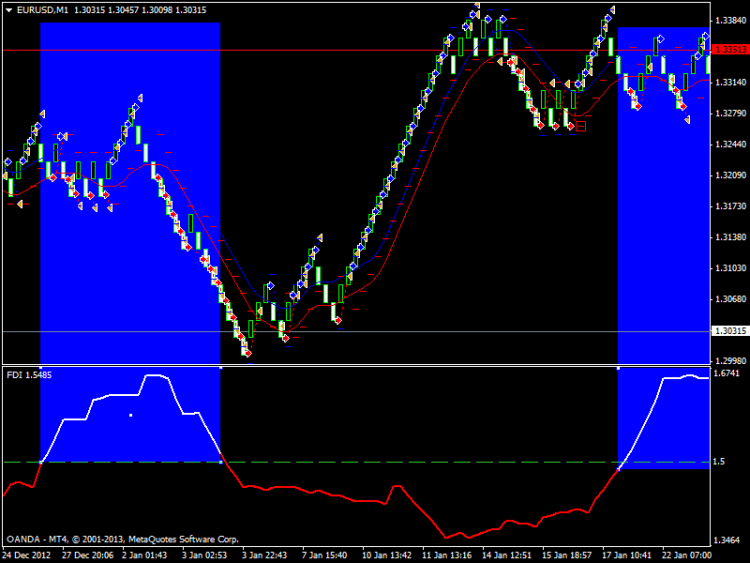

When I am saying filters.. I am saying 2 ways for trading... in stagnation and in trend (as we can see at this picture... blue shape means "stagnation")

Thank you for 2c Jozef.

I never heard about Monte-Carlo test, but I am going to study about it. About decreasing the number of losers, well, it's what I am looking for. It's the second step that I am coding for... filters.

When I am saying filters.. I am saying 2 ways for trading... in stagnation and in trend (as we can see at this picture... blue shape means "stagnation")

Also.. could you help me how to do the Monte-Carlo test using backtesting statement?

Thank you for 2c Jozef.

I never heard about Monte-Carlo test, but I am going to study about it. About decreasing the number of losers, well, it's what I am looking for. It's the second step that I am coding for... filters.

When I am saying filters.. I am saying 2 ways for trading... in stagnation and in trend (as we can see at this picture... blue shape means "stagnation")

Here's a good summary of what monte carlo is about: http://www.mellyforex.com/blog/risk-simulation-and-the-monte-carlo-method-forex-article . In that blog you will find a note that martingale systems (which your EA seems to be) generally fail because the test assumes fixed lot size.

The point I'm trying to get across is that to me any sound EA is profitable with fixed lot size and variable position sizing will only make such an EA more profitable due to compounding effect. I'll be happy if someone can convince me otherwise but if an EA is loser with fixed lots and variable position sizing turn it into a winner then such an EA is not robust enough to be traded live.

bearnaked:

I know that I can get 3 or 2 losses in a row based in backtesting, live, real and demo accounts, but, in my system, I will have a mechanism that calculates this probability based on last X (50 or other value defined) rows of history trades.

You cannot rely on statistics in which order the winners or losers will come because this information has nothing to do with what the price of the traded instruments is doing. The decision whether to take a trade or not should be purely based on what the current market conditions are, i.e. what the price of the traded instrument is/was doing. In other words, entry conditions assume certain current/past price action of eur/usd and eur/usd price action is completely unrelated to the result of your last trade.

Here's a good summary of what monte carlo is about: http://www.mellyforex.com/blog/risk-simulation-and-the-monte-carlo-method-forex-article . In that blog you will find a note that martingale systems (which your EA seems to be) generally fail because the test assumes fixed lot size.

The point I'm trying to get across is that to me any sound EA is profitable with fixed lot size and variable position sizing will only make such an EA more profitable due to compounding effect. I'll be happy if someone can convince me otherwise but if an EA is loser with fixed lots and variable position sizing turn it into a winner then such an EA is not robust enough to be traded live.

bearnaked:

You cannot rely on statistics in which order the winners or losers will come because this information has nothing to do with what the price of the traded instruments is doing. The decision whether to take a trade or not should be purely based on what the current market conditions are, i.e. what the price of the traded instrument is/was doing. In other words, entry conditions assume certain current/past price action of eur/usd and eur/usd price action is completely unrelated to the result of your last trade.

I have too much work to do on this ea yet.... I got big DD.

Well, I am looking for guys that want to work with me...

@jxjozef,

I did few tests based on Monte Carlo study.

What do you think about this projection?

I guess, this is the right Balance x Equity chart