Klik on this link Why does my EA keeps giving negative profit when back testing?

and read there this posting from

| Moderator 7423 | RaptorUK 2013.01.30 13:23 |

Klik also there in the links of that posts iMA() and iRSI() will be explained

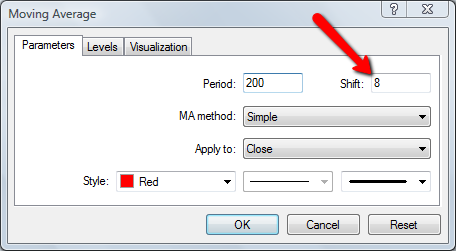

Yes. This would work for you. But this would give you the Moving Averages with an offset of 8. (https://docs.mql4.com/indicators/ima)

i dun understand the bolded part. would you please explain in detail?

There is nothing to explain in detail or not. ANSWER the question: Why are YOU using a MA with an offset of 8?

If you do not understand what an offset is, then RTFM.

MA200

MA200

iMA(NULL=the currency pair that you dropped the Moving average on,

1440= 1 Day(1440Minutes),

Note how the 200,8,simple,close are entered in the same order as they appear in the form.

200=Number of bars considered,

8= How much you want the Moving average shifted on your chart,(Change to Zero to make it a normal non-shifted Ma)

MODE_SMA=Simple Moving Average,

PRICE_CLOSE=Calculated from the close of the last 200 candles,

1=Calculated from the last completed candle back 200 candles.);(the one being drawn at the moment is candle 0)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

MA5 = iMA(NULL, 1440, 5, 8,MODE_SMA,PRICE_CLOSE, 1);

1440 sets the timeframe to 1Day, and 200 and 5 each represents the days for calculating moving average

am i doing this right?