For a full translation to H1 chart this would imply:

SL= 3.5pips

T1= 0.4pips

T2=~1pip

as you can expect only a 24rth of the movement

Even if you can implement these settings keep in mind that the 'house advantage' is 24 times bigger then with your original settings.

I would analyze why the strategy fails at the lower timeframes? Entering to late? Exiting to soon/last? Loosing too much in sideway markets?

just a few things you could do, but as ubzen pointed out, different timeframes have different price action. Its not likely that the same strategy can be traded on D1 and M1 chart profitable

If you have an EA that makes money then you can increase the lots to make money faster but from your graph there are many points where if you started it the result would be a busted account. I would suggest you move the start point about to see what I mean. If it started at trade 20 or 128 for instance it would bust.

Hello Ruptor, that is not the case. Only 5-6% of capital is risked at any given trade. I would need 15 negative trades in a row. I'll work with it.

I don't think you have enough trades, 227, to be sure that this will be profitable over the next 2 months on a daily or in another timeframe with a larger amount trades. I would guess that the more trades you add into the mix the lower your win % is going to be. Your avg win\loss is ratio is not good, 1:8 If you win % drops a few percent you will bust the account.

hmmm... if I'm looking at this right, on the average, the system trades every 10 days (estimated). It only made about $1800 on $2000 over 12 years. For that kind of gain, wouldn't there be safer ways to make $1800 over 12 years?

Right! Lousy return xD

For a full translation to H1 chart this would imply:

SL= 3.5pips

T1= 0.4pips

T2=~1pip

as you can expect only a 24rth of the movement

Even if you can implement these settings keep in mind that the 'house advantage' is 24 times bigger then with your original settings.

I would analyze why the strategy fails at the lower timeframes? Entering to late? Exiting to soon/last? Loosing too much in sideway markets?

just a few things you could do, but as ubzen pointed out, different timeframes have different price action. Its not likely that the same strategy can be traded on D1 and M1 chart profitable

I don't think you have enough trades, 227, to be sure that this will be profitable over the next 2 months on a daily or in another timeframe with a larger amount trades. I would guess that the more trades you add into the mix the lower your win % is going to be. Your avg win\loss is ratio is not good, 1:8 If you win % drops a few percent you will bust the account.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hello,

This is my first serious post and I am developing a scalper. I have programming background and this is my first EA ever. I have some good results but I need some help.

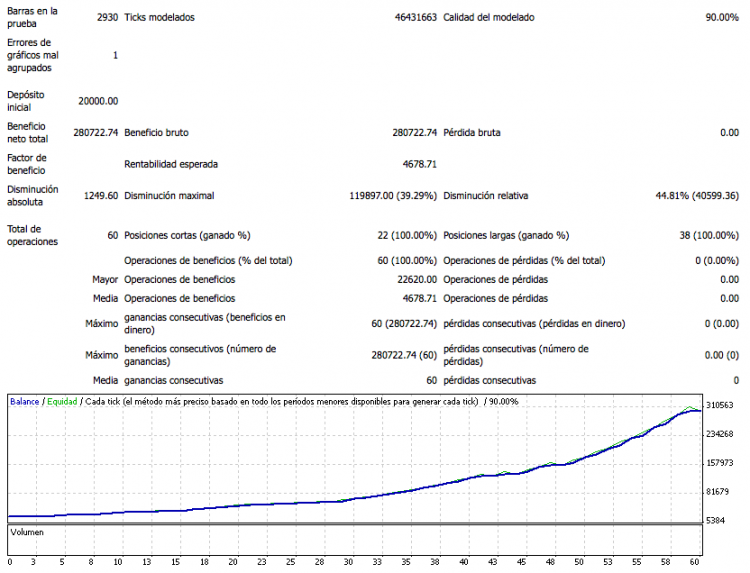

I' show a backtesting (2001-2012) to hook you guys up, and then proceed to tell you how it works -not in extreme detail- and the problems I have.

As you can see, it doubles capital from 2001 to now. It is a poor return for 10 years but I am trying to make it work for 30M, 1H and 4H charts. This is what this post is about.

How it currently works:

My EA is a scalper that uses daily charts and aims to win 10-25pips for each position. It uses simple indicators, moving averages and highs and lows, nothing fancy:

A) Positions are targeted when a bearish trend attemps to reverse. This is if MA30 and EMA30 reverse, we target positions into that direction.

B) Positions are targeted if we are on a strong trend. We will operate whenever a high or a low is breached.

C) Shorts are opened when A or B applies, and current price drops below last candle's low and all other indicators agree (ADX > 25 and current signal bearish, WPR(8) not oversold)

D) Longs are opened when A or B aplies, and current price rallies above last candle's high and all other indicators agree (ADX > 25 and current signal bullish, WPR(8) not overbought)

E) Positions are avoided if we are over or below the Bollinger Bands(50,2) upper or lower threshold.

Money management:

Customizable. 4% risk by default.

Entry and exit:

I get constant results in EURUSD with...

SL: 85pips

T1: 10pips -half position closed and SL moved to open price-

T2: 25pips -rest of position closed-

The problem

This seems to be a solid scalper that selects 90% profitable positions. However, the daily return is low. I am trying to adapt it to H1 and H4 timeframes with no success.

I always wind up losing in H1 and H4 timeframes, no matter which parameters I add. It seems there is not enough moving for me to make a profit and overcome the spread.

I have tried to select only volatile moments using ATR with no success: perhaps I am not doing it right.

I would like to know your opinions regarding this matter. How can I select volatile moments to open positions? ATR returns an absolute value that helps me very little.

Cheers and thanks, sorry about my english I am from Spain.