roby_widjaja: ....The question is, how can we make Expert Advisor codes that can influence next Ask/Bid prices of a currency symbol ?...

In my opinion, we cannot make code to influence prices. We could place orders to influence prices but most of us are too small to move markets. Thus, most of us try to forecast or follow the prices.ubzen, so George Soros' Theory will only work with huge amount of money on our hand ? :-)

If both you and George Soros are right, than our ( money being traded on currencies ) destiny will be on those billions US Dollars fund managers. is that conclusion right ?

Because, only them in the market who can drive the market direction and price.

Which one is easier, knowing those huge billions US Dollars Fund Manager decisions ( their current and next open long/short orders ), or developing Expert Advisor codes for following/forecasting the market ? :-D

In currencies trading, market prices move so fast. We could divide market prices information by 3 categories:

1. Past market prices ( That's what we see on the charts ).

2. Present market prices ( That's what we see on Ask/Bid Prices Tables ).

3. Future market prices ( That's what we could not see ).

Currencies Traders who will win most of the time are the traders with third category information, Future Market Prices. There are only two ways to get future market prices, forecasting or driving it. If we use forecasting, it means our ( money ) destiny will be on other people's hand. If we could drive where future market prices will go, just like those billions US Dollars fund managers, our ( money ) destiny will be on our own hand.

What do you think ?

Thank you very much for your comment, ubzen :-)

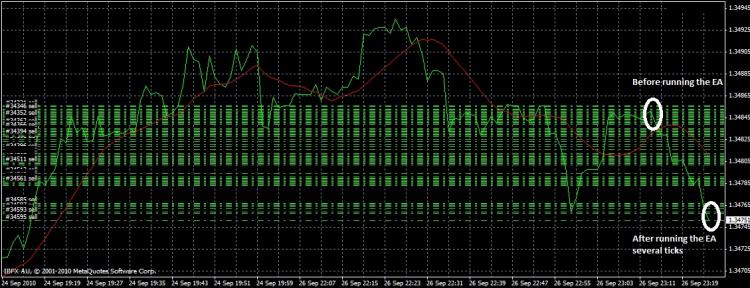

This is an example EA Codes which could X% possibility influence the next Bid prices. Could anybody make better codes which will make the next Bid prices going lower faster ?

//| Copyright © 2010, MetaQuotes Software Corp. | //| http://www.metaquotes.net | //+------------------------------------------------------------------+ #property copyright "Copyright © 2010, MetaQuotes Software Corp." #property link "http://www.metaquotes.net" //+------------------------------------------------------------------+ //| expert initialization function | //+------------------------------------------------------------------+ int init() { //---- return(0); } //+------------------------------------------------------------------+ //| expert deinitialization function | //+------------------------------------------------------------------+ int deinit() { //---- //---- return(0); } //+------------------------------------------------------------------+ //| expert start function | //+------------------------------------------------------------------+ int start() { int ticket; //---- ticket=OrderSend(Symbol(),OP_SELL,0.02,Bid,1,0,0); OrderClose(ticket,0.01,Bid,10,CLR_NONE); //---- return(0); } //+------------------------------------------------------------------+

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Dear Friends,

On the Theory of Reflexivity ( by George Soros ), if there are two subjects ( A and B for instance ), both A and B could influence each other. A could influence what B will do or react based on what A did. B could influence what A will do or react based on what B did.

If we apply this theory on Currencies Trading, A is traders ( me, you, we, and us ) and B is market prices ( The present Ask and Bid price, and the next Ask and Bid price ). We make decision based on past and present Ask/Bid price. Our decision determine our action, Open Order and Close Order. Our action will influence the next Ask/Bid Price from the market.

The question is, how can we make Expert Advisor codes that can influence next Ask/Bid prices of a currency symbol ? I know it is impossible to determine next Ask/Bid Prices 100% based on our present Open/Close Orders, but it is possible to determine ( 100 - X ) % the next Ask/Bid prices from the market by our present Open/Close Orders.

Thank you very much.

Sincerely,

Roby Widjaja.

http://www.amazon.com/Alchemy-Finance-Reading-Mind-Market/dp/0471043133/ref=sr_1_2?s=gateway&ie=UTF8&qid=1285376047&sr=8-2

http://www.usatoday.com/money/economy/2008-05-12-soros_N.htm

https://en.wikipedia.org/wiki/Reflexivity_(social_theory)

https://en.wikipedia.org/wiki/George_Soros