Barclays made a fundamental forecast for EURUSD expecting big volatility for this pair and for USD/JPY as well:

-

"Last week saw a significant improvement in global risk sentiment,

benefitting risky assets, despite soft data prints and cautious central

bank rhetoric (Figures 1 and 2). However, the market is likely heading into an environment of lower growth, soft inflation and additional policy stimulus."

- "Central bank rhetoric is starting to reflect this new reality. The September FOMC minutes showed that the decision not to hike was not a close call, though some FOMC participants had described it as such.. At the same time, the ECB highlighted downside risks to euro area growth and inflation while the BoE also erred on the side of caution."

- "We look for the ECB to announce further easing before year-end and have frontloaded our call for additional BoJ easing at its 30 October meeting."

-

"Strategically, we like being long USD heading into those central bank meetings."

-

"In line with this view, we maintains a short EUR/USD position in

its portfolio from 1.1278, with a stop at 1.1562, and a targets at

1.0460."

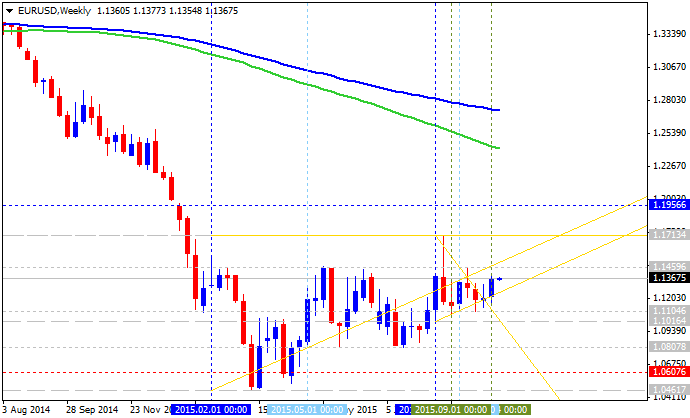

So, Barclays is still keeping sell position with 1.0460 take profit and stop loss as 1.1562. And as we see from the chart above - the price is on bearish market condition for the secondary ranging within 1.0461 key support level and 1.1713 key resistance level, so 1.0460 may be the real bearish target at year-end for example.