Piyush Lalsingh Ratnu / Profil

Piyush Lalsingh Ratnu

- Trader & Analyst in Piyush Ratnu Gold Market Research

- Vereinigte Arabische Emirate

- 296

- Information

|

1 Jahr

Erfahrung

|

0

Produkte

|

0

Demoversionen

|

|

0

Jobs

|

2

Signale

|

0

Abonnenten

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Freunde

19

Anfragen

Ausgehend

Piyush Lalsingh Ratnu

🆘 JUST IN: The Pentagon is considering striking Iranian personnel in "Syria or Iraq or Iranian naval assets in the Persian Gulf," according to Politico.

The outlet said that the "retaliation would likely begin in the next couple of days."

The outlet said that the "retaliation would likely begin in the next couple of days."

Piyush Lalsingh Ratnu

📌 Gold price lacks any firm direction ahead of the key central bank event risk

• Traders opt to move on the sidelines ahead of the critical FOMC monetary policy meeting starting this Tuesday, which leads to subdued range-bound price action around the Gold price on Tuesday.

• The Fed decision on Wednesday and the accompanying policy statement will be scrutinized for cues about the timing of the first rate cut, which will influence the non-yielding yellow metal.

• In the meantime, the ongoing downfall in the US Treasury bond yields, along with the risk of a further escalation of geopolitical tensions in the Middle East, lends support to the safe-haven XAU/USD.

• The US Treasury lowered its forecast for federal borrowing to $760 billion from a prior estimate of $816 billion and dragged the yield on the benchmark 10-year US government bond closer to 4.0%.

• Reports suggest that President Joe Biden will authorize US military action in response to the drone attack by pro-Iranian militias near the Jordan-Syria border that killed three American soldiers.

• A direct US confrontation with Iran will adversely impact global Crude Oil supplies, which could eventually trigger a possible inflation shock for the world economy and hinder global growth.

• Tuesday's release of the Prelim GDP prints from the Eurozone, along with the Conference Board's Consumer Confidence Index and JOLTS Job

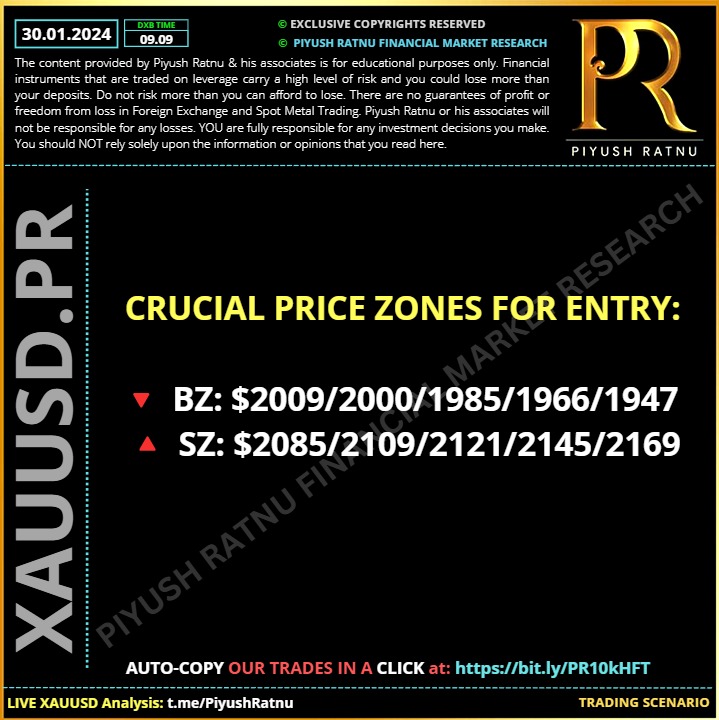

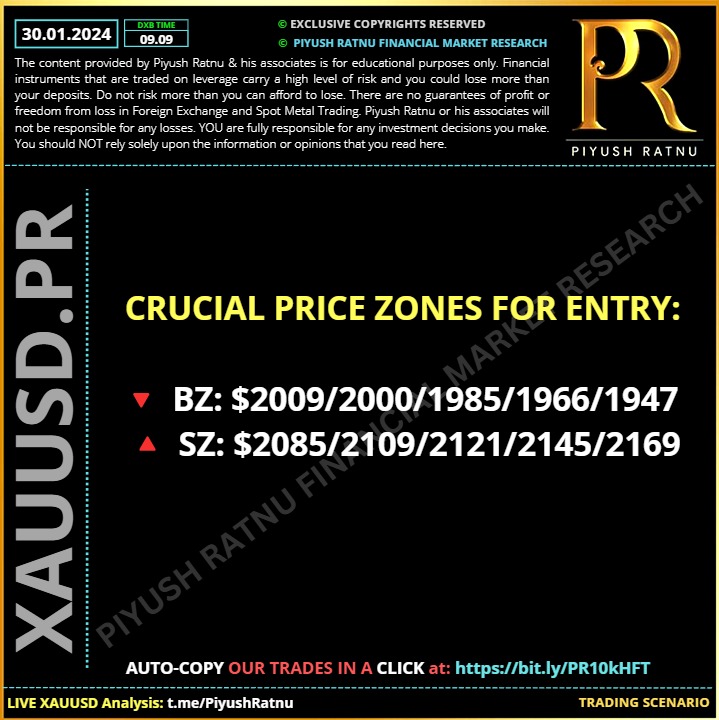

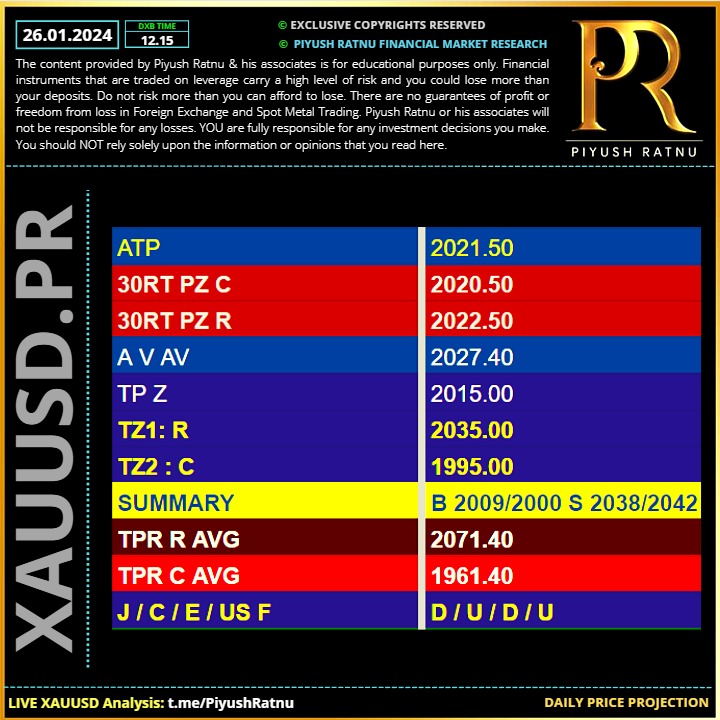

➡️ Crucial Price Zones for entry:

🔻 BZ: $2009/2000/1985/1966/1947

🔺 SZ: $2085/2109/2121/2145/2169

• Traders opt to move on the sidelines ahead of the critical FOMC monetary policy meeting starting this Tuesday, which leads to subdued range-bound price action around the Gold price on Tuesday.

• The Fed decision on Wednesday and the accompanying policy statement will be scrutinized for cues about the timing of the first rate cut, which will influence the non-yielding yellow metal.

• In the meantime, the ongoing downfall in the US Treasury bond yields, along with the risk of a further escalation of geopolitical tensions in the Middle East, lends support to the safe-haven XAU/USD.

• The US Treasury lowered its forecast for federal borrowing to $760 billion from a prior estimate of $816 billion and dragged the yield on the benchmark 10-year US government bond closer to 4.0%.

• Reports suggest that President Joe Biden will authorize US military action in response to the drone attack by pro-Iranian militias near the Jordan-Syria border that killed three American soldiers.

• A direct US confrontation with Iran will adversely impact global Crude Oil supplies, which could eventually trigger a possible inflation shock for the world economy and hinder global growth.

• Tuesday's release of the Prelim GDP prints from the Eurozone, along with the Conference Board's Consumer Confidence Index and JOLTS Job

➡️ Crucial Price Zones for entry:

🔻 BZ: $2009/2000/1985/1966/1947

🔺 SZ: $2085/2109/2121/2145/2169

Piyush Lalsingh Ratnu

📌 Gold price lacks any firm direction ahead of the key central bank event risk

• Traders opt to move on the sidelines ahead of the critical FOMC monetary policy meeting starting this Tuesday, which leads to subdued range-bound price action around the Gold price on Tuesday.

• The Fed decision on Wednesday and the accompanying policy statement will be scrutinized for cues about the timing of the first rate cut, which will influence the non-yielding yellow metal.

• In the meantime, the ongoing downfall in the US Treasury bond yields, along with the risk of a further escalation of geopolitical tensions in the Middle East, lends support to the safe-haven XAU/USD.

• The US Treasury lowered its forecast for federal borrowing to $760 billion from a prior estimate of $816 billion and dragged the yield on the benchmark 10-year US government bond closer to 4.0%.

• Reports suggest that President Joe Biden will authorize US military action in response to the drone attack by pro-Iranian militias near the Jordan-Syria border that killed three American soldiers.

• A direct US confrontation with Iran will adversely impact global Crude Oil supplies, which could eventually trigger a possible inflation shock for the world economy and hinder global growth.

• Tuesday's release of the Prelim GDP prints from the Eurozone, along with the Conference Board's Consumer Confidence Index and JOLTS Job

➡️ Crucial Price Zones for entry:

🔻 BZ: $2009/2000/1985/1966/1947

🔺 SZ: $2085/2109/2121/2145/2169

• Traders opt to move on the sidelines ahead of the critical FOMC monetary policy meeting starting this Tuesday, which leads to subdued range-bound price action around the Gold price on Tuesday.

• The Fed decision on Wednesday and the accompanying policy statement will be scrutinized for cues about the timing of the first rate cut, which will influence the non-yielding yellow metal.

• In the meantime, the ongoing downfall in the US Treasury bond yields, along with the risk of a further escalation of geopolitical tensions in the Middle East, lends support to the safe-haven XAU/USD.

• The US Treasury lowered its forecast for federal borrowing to $760 billion from a prior estimate of $816 billion and dragged the yield on the benchmark 10-year US government bond closer to 4.0%.

• Reports suggest that President Joe Biden will authorize US military action in response to the drone attack by pro-Iranian militias near the Jordan-Syria border that killed three American soldiers.

• A direct US confrontation with Iran will adversely impact global Crude Oil supplies, which could eventually trigger a possible inflation shock for the world economy and hinder global growth.

• Tuesday's release of the Prelim GDP prints from the Eurozone, along with the Conference Board's Consumer Confidence Index and JOLTS Job

➡️ Crucial Price Zones for entry:

🔻 BZ: $2009/2000/1985/1966/1947

🔺 SZ: $2085/2109/2121/2145/2169

Piyush Lalsingh Ratnu

Technical Analysis:

Gold price struggles to build on strength beyond 50-day SMA, remains below a key hurdle

From a technical perspective, 🔺bulls might still wait for a sustained move beyond the $2,040-2,042 supply zone before placing fresh bets and positioning for any further gains.

💎Given that oscillators on the daily chart have just started moving into the positive territory, the Gold price could then climb to the $2,085 resistance zone before aiming to reclaim the $2,100 round-figure mark.

🔻On the flip side, the overnight swing low, around the $2,020-2,019 area, now seems to protect the immediate downside ahead of the $2,012-2,010 zone and the $2,000 psychological mark.

A convincing break below the latter will be seen as a fresh trigger for bearish traders and expose the 100-day SMA, currently near the $1,978-1,977 region. The Gold price could eventually drop to the very important 200-day SMA, near the 🆘 $1,966 region.

Gold price struggles to build on strength beyond 50-day SMA, remains below a key hurdle

From a technical perspective, 🔺bulls might still wait for a sustained move beyond the $2,040-2,042 supply zone before placing fresh bets and positioning for any further gains.

💎Given that oscillators on the daily chart have just started moving into the positive territory, the Gold price could then climb to the $2,085 resistance zone before aiming to reclaim the $2,100 round-figure mark.

🔻On the flip side, the overnight swing low, around the $2,020-2,019 area, now seems to protect the immediate downside ahead of the $2,012-2,010 zone and the $2,000 psychological mark.

A convincing break below the latter will be seen as a fresh trigger for bearish traders and expose the 100-day SMA, currently near the $1,978-1,977 region. The Gold price could eventually drop to the very important 200-day SMA, near the 🆘 $1,966 region.

Piyush Lalsingh Ratnu

📌 Co-relations alert:

USDJPY net crash observed since yesterday:

1200 pips

Possible impact on XAUUSD:

$30 | + observed: $18 | pending: $12/15

USDJPY net crash observed since yesterday:

1200 pips

Possible impact on XAUUSD:

$30 | + observed: $18 | pending: $12/15

Piyush Lalsingh Ratnu

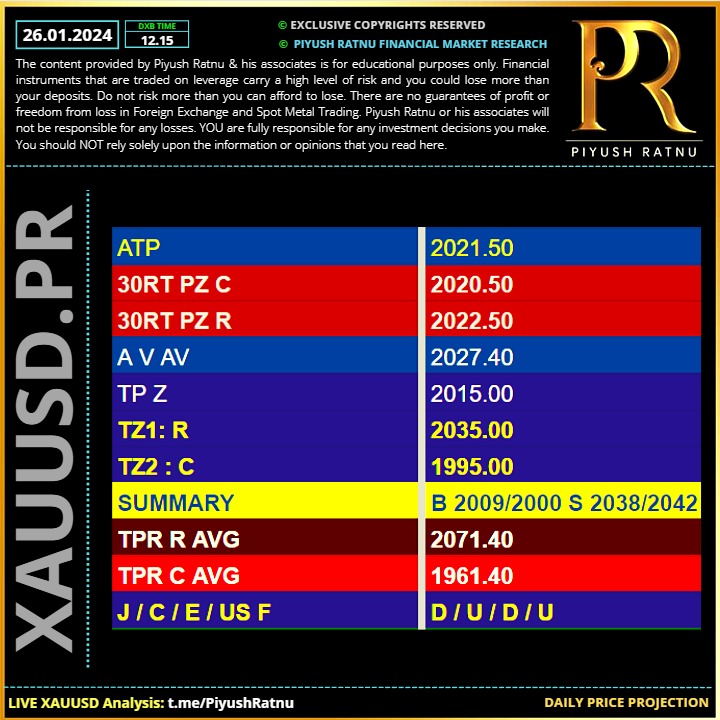

26.01.2024 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

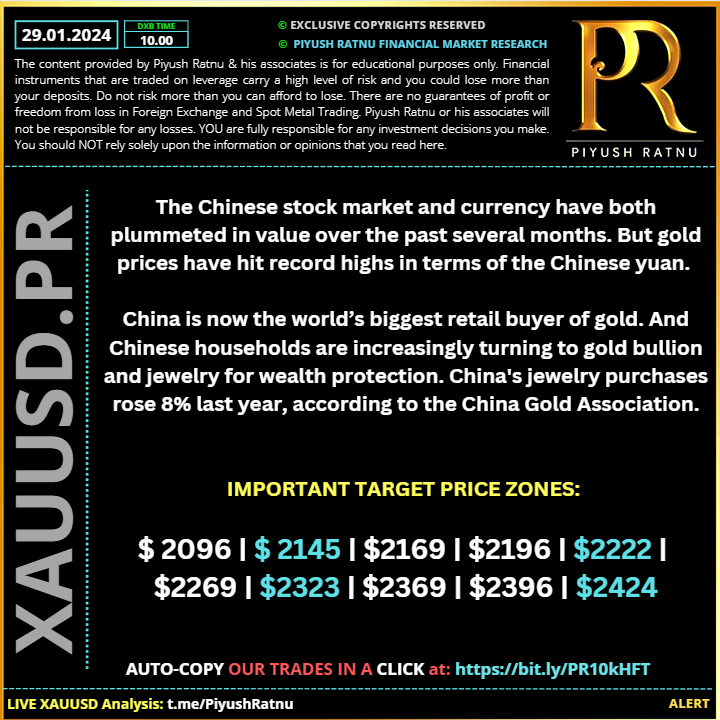

The Chinese stock market and currency have both plummeted in value over the past several months. But gold prices have hit record highs in terms of the Chinese yuan.

China is now the world’s biggest retail buyer of gold. And 🟢 Chinese households are increasingly turning to gold bullion and jewelry for wealth protection. China's jewelry purchases rose 8% last year, according to the China Gold Association.

Meanwhile, 🟢 demand for gold coins jumped nearly 16% in 2023. Chinese gold-backed exchange-traded products added 10 tons to their holdings. And the People’s Bank of China increased its gold reserves by a whopping 225 tons.

The PBOC has also implemented measures to make it easier for bank account depositors to convert cash into gold. Chinese officials may be viewing 🟢 gold as a geopolitical tool amid rising tensions with the United States.

The U.S. dollar is steadily losing market share in terms of global central bank currency reserves while gold is gaining.

It’s not ultimately China or Russia or other U.S. adversaries that pose the biggest threat to U.S. dollar hegemony. 📌 It’s reckless U.S. fiscal and monetary policy that is undermining global confidence in its currency.

Possible impact: $200+ price movement in XAUUSD price after a major crash (as witnessed multiple times earlier).

🆘 Possible Target Price Zones in next 3 months:

$ 2096

$ 2145

$2222

$2269

$2323

$2369

$2396

$2424

🆘 The question remains intact:

XAUUSD: $2424 in 2024?

The best trading plan: trade as per PRSRD1 W1

Avoid big lots, avoid heavy shorts

Buy Lows | Exit in NAP | Apply Range Based trades

China is now the world’s biggest retail buyer of gold. And 🟢 Chinese households are increasingly turning to gold bullion and jewelry for wealth protection. China's jewelry purchases rose 8% last year, according to the China Gold Association.

Meanwhile, 🟢 demand for gold coins jumped nearly 16% in 2023. Chinese gold-backed exchange-traded products added 10 tons to their holdings. And the People’s Bank of China increased its gold reserves by a whopping 225 tons.

The PBOC has also implemented measures to make it easier for bank account depositors to convert cash into gold. Chinese officials may be viewing 🟢 gold as a geopolitical tool amid rising tensions with the United States.

The U.S. dollar is steadily losing market share in terms of global central bank currency reserves while gold is gaining.

It’s not ultimately China or Russia or other U.S. adversaries that pose the biggest threat to U.S. dollar hegemony. 📌 It’s reckless U.S. fiscal and monetary policy that is undermining global confidence in its currency.

Possible impact: $200+ price movement in XAUUSD price after a major crash (as witnessed multiple times earlier).

🆘 Possible Target Price Zones in next 3 months:

$ 2096

$ 2145

$2222

$2269

$2323

$2369

$2396

$2424

🆘 The question remains intact:

XAUUSD: $2424 in 2024?

The best trading plan: trade as per PRSRD1 W1

Avoid big lots, avoid heavy shorts

Buy Lows | Exit in NAP | Apply Range Based trades

Piyush Lalsingh Ratnu

Gold price snaps the two-week losing streak during the early Asian session on Monday. The escalating tension in the Middle East boosts the safe-haven demand, which lifts the yellow metal.

Three US troops were killed and dozens injured after an unmanned aerial drone attack on US forces stationed in northeastern Jordan near the Syrian border, US officials said on Sunday. The rising tension in the Middle East might boost a safe-haven asset like gold.

The spotlight this week will be the Federal Open Market Committee (FOMC) meeting on Wednesday, which is expected to keep rates at 5.25–5.50%.

The markets anticipate the Federal Reserve (Fed) to keep rates steady at 5.25–5.50% at its January meeting on Wednesday. Traders will take more cues from the press conference. If Fed Chairman Jerome Powell signals a possible rate cut in March, this could exert some selling pressure on the Greenback.

🆘 CMP $2025

Three US troops were killed and dozens injured after an unmanned aerial drone attack on US forces stationed in northeastern Jordan near the Syrian border, US officials said on Sunday. The rising tension in the Middle East might boost a safe-haven asset like gold.

The spotlight this week will be the Federal Open Market Committee (FOMC) meeting on Wednesday, which is expected to keep rates at 5.25–5.50%.

The markets anticipate the Federal Reserve (Fed) to keep rates steady at 5.25–5.50% at its January meeting on Wednesday. Traders will take more cues from the press conference. If Fed Chairman Jerome Powell signals a possible rate cut in March, this could exert some selling pressure on the Greenback.

🆘 CMP $2025

Piyush Lalsingh Ratnu

📌 All long positions implemented at and below $2027 are in Net Average Profit now, kindly book profits and exit the trade set.

Piyush Lalsingh Ratnu

• The CME Fed watch tool is showing that the chances in favour of a 25-basis point (bp) rate cut in March ahave rebounded to 50% after a slowdown in underlying price pressures.

• While struggle for Fed policymakers remain unabated as the US economy is resilient on multiple grounds.

• The US economy expanded at a robust pace of 3.3% in the final quarter of 2023 while market participants projected a slower growth rate of 2.0%. This has uplifted the economic outlook, which could keep price pressures elevated.

• US Treasury Secretary Janet Yellen said surprisingly strong economic growth came from higher productivity and robust consumer spending without escalating inflation risks.

• Going forward, market participants will shift their focus towards the Fed’s first monetary policy of 2024, which will be announced next week.

• The Fed is widely anticipated to keep interest rates unchanged in the range of 5.25-5.50% for the fourth time in a row. Investors will keenly focus on the timing of when the Fed will start reducing interest rates.

• Till now, Fed policymakers have been considering expectations of rate-cuts from March as “premature” due to resilient US economic prospects and stubborn inflationary pressures.

• Fed policymakers have been warning that rate cuts at this stage would be premature, which could lead to a surge in overall demand and dampen efforts made to bring down core inflation to its current 3.9% level.

• While struggle for Fed policymakers remain unabated as the US economy is resilient on multiple grounds.

• The US economy expanded at a robust pace of 3.3% in the final quarter of 2023 while market participants projected a slower growth rate of 2.0%. This has uplifted the economic outlook, which could keep price pressures elevated.

• US Treasury Secretary Janet Yellen said surprisingly strong economic growth came from higher productivity and robust consumer spending without escalating inflation risks.

• Going forward, market participants will shift their focus towards the Fed’s first monetary policy of 2024, which will be announced next week.

• The Fed is widely anticipated to keep interest rates unchanged in the range of 5.25-5.50% for the fourth time in a row. Investors will keenly focus on the timing of when the Fed will start reducing interest rates.

• Till now, Fed policymakers have been considering expectations of rate-cuts from March as “premature” due to resilient US economic prospects and stubborn inflationary pressures.

• Fed policymakers have been warning that rate cuts at this stage would be premature, which could lead to a surge in overall demand and dampen efforts made to bring down core inflation to its current 3.9% level.

Piyush Lalsingh Ratnu

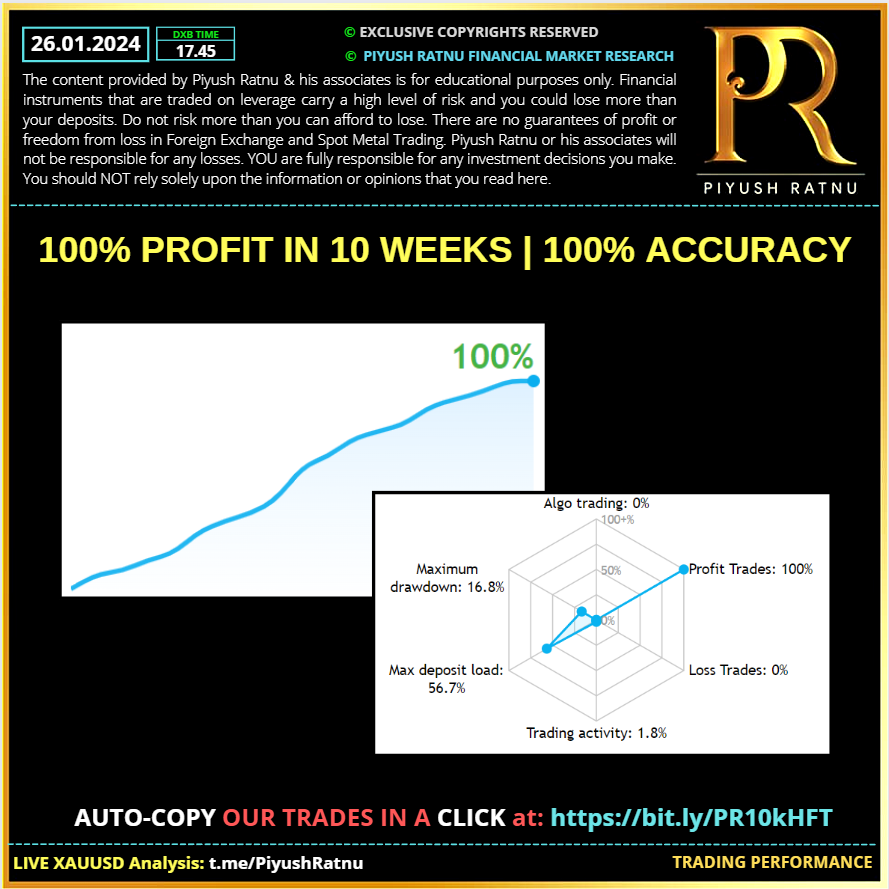

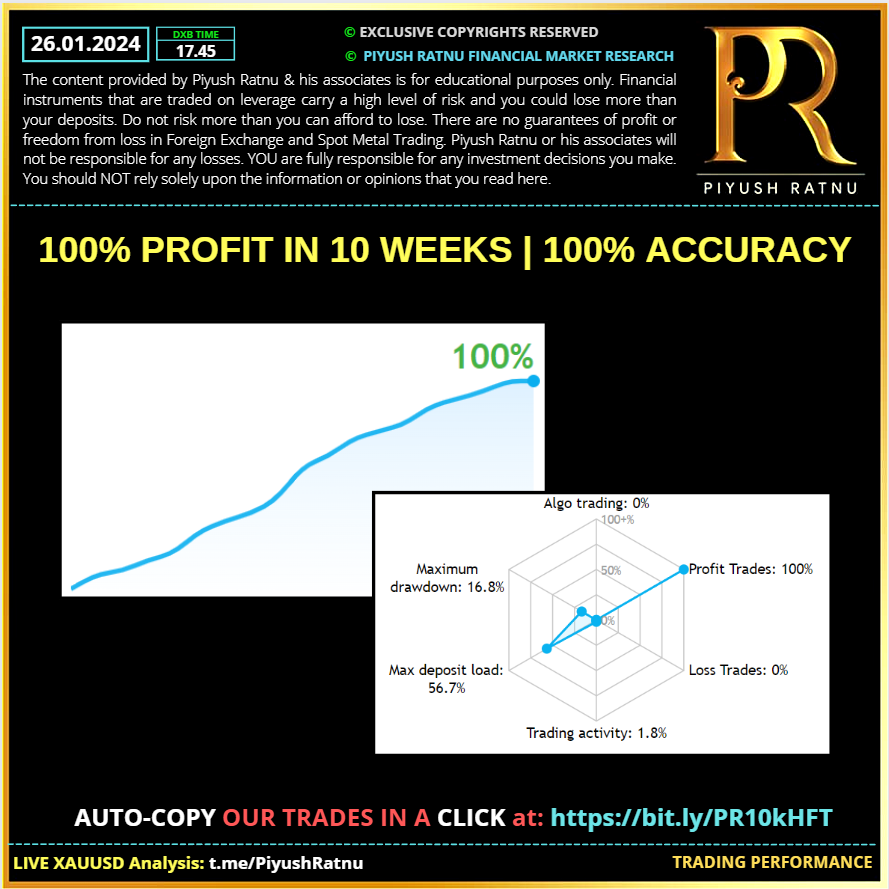

100% profit booked in 10 weeks with 100% trading accuracy.

#PiyushRatnu #SpotGold #Trader #MarketResearch #Forex

AUTO-COPY OUR TRADES IN A CLICK at: https://bit.ly/PR10kHFT

#PiyushRatnu #SpotGold #Trader #MarketResearch #Forex

AUTO-COPY OUR TRADES IN A CLICK at: https://bit.ly/PR10kHFT

Piyush Lalsingh Ratnu

100% profit booked in 10 weeks with 100% trading accuracy.

#PiyushRatnu #SpotGold #Trader #MarketResearch #Forex

AUTO-COPY OUR TRADES IN A CLICK at: https://bit.ly/PR10kHFT

#PiyushRatnu #SpotGold #Trader #MarketResearch #Forex

AUTO-COPY OUR TRADES IN A CLICK at: https://bit.ly/PR10kHFT

Piyush Lalsingh Ratnu

🟥 USDJPY and XAUUSD:

Both instruments under PPZ.

Avoid entries.

XAUUSD S2 2007 | R2 2033

USDJPY S2: 146.970 | R2: 148.348

Both instruments under PPZ.

Avoid entries.

XAUUSD S2 2007 | R2 2033

USDJPY S2: 146.970 | R2: 148.348

Piyush Lalsingh Ratnu

🟢 All LONG Trades closed in Net Average Profit.

XAUUSD: Entry Price Zones (Yesterday):

2023/2020/2017/2014/2011

XAUUSD: Entry Price Zones (Yesterday):

2023/2020/2017/2014/2011

Piyush Lalsingh Ratnu

🟥 XAUUSD: PRSRZ W1

S2: 2001

S3: 1979

S4: 1966

S5: 1944

R1: 2036

R2: 2058

R3: 2079

R4: 2093

R5: 2115

Gold price (XAU/USD) ekes out small gains on Thursday and reverses a part of the overnight heavy losses to the $2,011 area, or a multi-day low, though the uptick lacks bullish conviction. In the absence of any fresh fundamental trigger, subdued US Dollar (USD) price action is seen as a key factor lending some support to the commodity amid worries about escalating geopolitical tensions in the Middle East. Any meaningful appreciating move, however, still seems elusive in the wake of growing acceptance that the Federal Reserve (Fed) will not rush to cut interest rates.

The expectations were reaffirmed by the better-than-expected US data on Wednesday, which showed that the economy kicked off 2024 on a stronger note. The S&P Global flash US Manufacturing PMI rebounded from 47.9 to a 15-month high of 50.3 in January and the gauge for the services sector climbed to 52.9, or the highest reading since last June. Furthermore, the flash US Composite PMI Output Index increased to 52.3 this month, or the highest since last June. This reaffirms the view that the world's largest economy is in good shape and forces investors to further scale back their bets for a more aggressive Fed policy easing in 2024. This, in turn, allows the yield on the benchmark 10-year US government bond to hold steady near a more than one-month high touched last week, which favours the USD bulls and should cap gains for the non-yielding Gold price.

📌 Crucial Zones: BZ: $1990/1985 SZ: $2035/2042 📌

S2: 2001

S3: 1979

S4: 1966

S5: 1944

R1: 2036

R2: 2058

R3: 2079

R4: 2093

R5: 2115

Gold price (XAU/USD) ekes out small gains on Thursday and reverses a part of the overnight heavy losses to the $2,011 area, or a multi-day low, though the uptick lacks bullish conviction. In the absence of any fresh fundamental trigger, subdued US Dollar (USD) price action is seen as a key factor lending some support to the commodity amid worries about escalating geopolitical tensions in the Middle East. Any meaningful appreciating move, however, still seems elusive in the wake of growing acceptance that the Federal Reserve (Fed) will not rush to cut interest rates.

The expectations were reaffirmed by the better-than-expected US data on Wednesday, which showed that the economy kicked off 2024 on a stronger note. The S&P Global flash US Manufacturing PMI rebounded from 47.9 to a 15-month high of 50.3 in January and the gauge for the services sector climbed to 52.9, or the highest reading since last June. Furthermore, the flash US Composite PMI Output Index increased to 52.3 this month, or the highest since last June. This reaffirms the view that the world's largest economy is in good shape and forces investors to further scale back their bets for a more aggressive Fed policy easing in 2024. This, in turn, allows the yield on the benchmark 10-year US government bond to hold steady near a more than one-month high touched last week, which favours the USD bulls and should cap gains for the non-yielding Gold price.

📌 Crucial Zones: BZ: $1990/1985 SZ: $2035/2042 📌

Piyush Lalsingh Ratnu

ECB EURO Interest Rate Decision | How to trade EURUSD? Analysis by Piyush Ratnu

The European Central Bank (ECB) will have its first monetary policy meeting of the year on Thursday, but little is to be expected from European policymakers. The Main Refinancing Operations Rate will likely be maintained unchanged at 4.50%, and the Deposit Facility Rate at 4%. If something is, the central bank will continue “tightening” through the reduction of reinvestments in the Pandemic Emergency Purchase Programme (PEPP).

As per Economists at TD Securities:

Base Case (65%)

The ECB delivers another hold and makes no major changes to the press statement. The Governing Council emphasizes its broad reaction function and reiterates the importance of economic data in determining the ECB's policy stance. President Lagarde suggests that cuts are likely to come around the summer. That said, the President makes it clear that the exact timing is still very much up in the air, and will ultimately be decided by the data. EUR/USD -0.15%.

Hawkish (30%)

In a hawkish turn, President Lagarde pushes back hard against discussions about the potential timing of rate cuts. Lagarde argues that cuts will come, probably some time this year, and while market pricing looks too dovish, it is too early to comment on when cuts are likely to come. While inflation developments have been promising, Lagarde stresses that the tight labour market adds upside risks to the policy outlook. EUR/USD +0.75%.

Dovish (5%)

Despite recently pushing back against market expectations for spring cuts, President Lagarde fails to do so at the press conference – seemingly offering some credibility to market bets. EUR/USD -0.50%.

EURUSD under PPZ: avoid entries

ECB interest rate decision is scheduled at 15.15 hours, followed US GDP, Core Durable Goods Orders at 17.30 and press conference at 17.45 hours. Further ECB P speech is scheduled at 19.15 hours.

A dead price trap zone might be witnessed followed by a sudden spike/crash, hence kindly follow PRSR W1 strictly on XAUUSD, USDJPY and EURUSD.

🟥 EURUSD: PRSRZ

S2: 1.07979

S3: 1.07219

S4: 1.065750

R2: 1.09967

R3: 1.10727

R4: 1.11196

EURUSD: Expected recovery (50%) of crash/rise: 9 trading days.

The European Central Bank (ECB) will have its first monetary policy meeting of the year on Thursday, but little is to be expected from European policymakers. The Main Refinancing Operations Rate will likely be maintained unchanged at 4.50%, and the Deposit Facility Rate at 4%. If something is, the central bank will continue “tightening” through the reduction of reinvestments in the Pandemic Emergency Purchase Programme (PEPP).

As per Economists at TD Securities:

Base Case (65%)

The ECB delivers another hold and makes no major changes to the press statement. The Governing Council emphasizes its broad reaction function and reiterates the importance of economic data in determining the ECB's policy stance. President Lagarde suggests that cuts are likely to come around the summer. That said, the President makes it clear that the exact timing is still very much up in the air, and will ultimately be decided by the data. EUR/USD -0.15%.

Hawkish (30%)

In a hawkish turn, President Lagarde pushes back hard against discussions about the potential timing of rate cuts. Lagarde argues that cuts will come, probably some time this year, and while market pricing looks too dovish, it is too early to comment on when cuts are likely to come. While inflation developments have been promising, Lagarde stresses that the tight labour market adds upside risks to the policy outlook. EUR/USD +0.75%.

Dovish (5%)

Despite recently pushing back against market expectations for spring cuts, President Lagarde fails to do so at the press conference – seemingly offering some credibility to market bets. EUR/USD -0.50%.

EURUSD under PPZ: avoid entries

ECB interest rate decision is scheduled at 15.15 hours, followed US GDP, Core Durable Goods Orders at 17.30 and press conference at 17.45 hours. Further ECB P speech is scheduled at 19.15 hours.

A dead price trap zone might be witnessed followed by a sudden spike/crash, hence kindly follow PRSR W1 strictly on XAUUSD, USDJPY and EURUSD.

🟥 EURUSD: PRSRZ

S2: 1.07979

S3: 1.07219

S4: 1.065750

R2: 1.09967

R3: 1.10727

R4: 1.11196

EURUSD: Expected recovery (50%) of crash/rise: 9 trading days.

: