Mohammed Abdulwadud Soubra / 个人资料

- 信息

|

8+ 年

经验

|

7

产品

|

1086

演示版

|

|

134

工作

|

1

信号

|

1

订阅者

|

我从2005年开始涉足外汇交易。

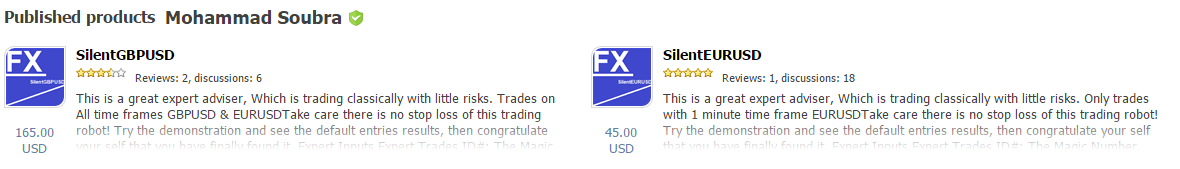

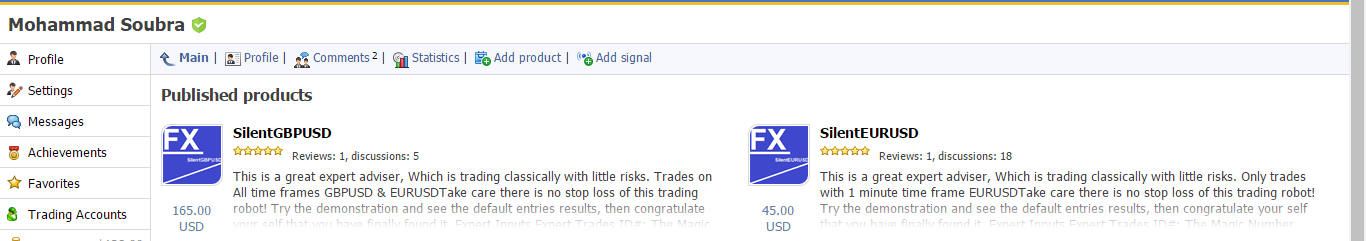

查看此产品:

https://www.mql5.com/en/users/soubra2003/seller

有关US30和美国股票的有希望的交易信号:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

如需即时支持,请加入此WhatsApp群组:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

查看此产品:

https://www.mql5.com/en/users/soubra2003/seller

有关US30和美国股票的有希望的交易信号:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

如需即时支持,请加入此WhatsApp群组:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Mohammed Abdulwadud Soubra

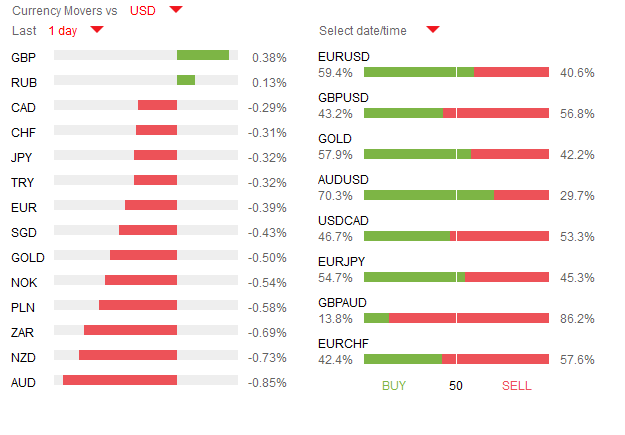

It’s the Aussie and euro feeling the pressure at the start of the European session and for very different reasons. The Aussie has reacted to comments from RBA Governor Stevens, where he talked in more detail about the continued low inflation outlook, with indications that he expects this to persistent for foreseeable future. This has given some life to expectations of further rate cuts, hence the push towards the 0.7060 level as we enter the European session. Meanwhile, the euro appears to be finding the going tougher as the dollar becomes more confident regarding the prospects of a tightening of rates as early as June. Furthermore, ahead of the main G7 meeting later this week, investors are becoming more cautious of going long the yen vs. the USD, even though the indications from this weekend’s meeting of finance ministers and central bank governors suggested there was a wide gap between the US and Japan on the appropriate response.

With less than a month go to until the EU referendum in the UK, BoE Governor Mark Carney appears before the UK Parliamentary Treasury Committee today. He’s been in some hot water in recent weeks for appearing to favour remaining in the EU, which does not fit with the Bank’s remit of independence and impartiality. Expect him to have a tough time of it. Meanwhile, the currency appears to be gaining more confidence that the result will be a win for the ‘remain’ camp, but the result is far from a done deal at this point in time. As such, we’re likely to see sterling continuing to take greater notice of polls in the coming days.

With less than a month go to until the EU referendum in the UK, BoE Governor Mark Carney appears before the UK Parliamentary Treasury Committee today. He’s been in some hot water in recent weeks for appearing to favour remaining in the EU, which does not fit with the Bank’s remit of independence and impartiality. Expect him to have a tough time of it. Meanwhile, the currency appears to be gaining more confidence that the result will be a win for the ‘remain’ camp, but the result is far from a done deal at this point in time. As such, we’re likely to see sterling continuing to take greater notice of polls in the coming days.

Mohammed Abdulwadud Soubra

Today's important market news Time: GMT

Med 08:30 UK Public Sector Net Borrowing

Med 09:00 Ger ZEW Survey - Current Situation

Med 09:00 Ger ZEW Survey - Economic Sentiment

High 09:00 UK Inflation Report Hearings

Med 09:00 EU ZEW Survey - Economic Sentiment

Med 12:00 EU Eurogroup meeting

Med 12:00 EU EU Financial Stability Review

Med 14:00 US New Home Sales (MoM)

Med 14:00 US New Home Sales Change (MoM)

Med 22:45 AUS Trade Balance (MoM)

Med 22:45 AUS Exports

Med 22:45 AUS Trade Balance (YoY)

Med 22:45 AUS Imports

Med 08:30 UK Public Sector Net Borrowing

Med 09:00 Ger ZEW Survey - Current Situation

Med 09:00 Ger ZEW Survey - Economic Sentiment

High 09:00 UK Inflation Report Hearings

Med 09:00 EU ZEW Survey - Economic Sentiment

Med 12:00 EU Eurogroup meeting

Med 12:00 EU EU Financial Stability Review

Med 14:00 US New Home Sales (MoM)

Med 14:00 US New Home Sales Change (MoM)

Med 22:45 AUS Trade Balance (MoM)

Med 22:45 AUS Exports

Med 22:45 AUS Trade Balance (YoY)

Med 22:45 AUS Imports

Mohammed Abdulwadud Soubra

NEWS

Monday, May 23, 2016 5:41 pm +03:00

Webinar: USD Crosses in Focus as Index Eyes Resistance

Setups we’re tracking as the USDOLLAR attempts a fourth consecutive week of gains. Here are the updated targets & invalidation le...Continue Reading

Monday, May 23, 2016 3:00 pm +03:00

USDOLLAR Index Turns to Fed Speakers for Breakout Catalysts

Monday, May 23, 2016 11:37 am +03:00

EUR/USD Slightly Lower After Soft Markit Euro-Zone PMI Figures

Monday, May 23, 2016 6:06 am +03:00

Euro to Look Past PMI Data, US Dollar May Rise on Fed Comments

Monday, May 23, 2016 5:41 pm +03:00

Webinar: USD Crosses in Focus as Index Eyes Resistance

Setups we’re tracking as the USDOLLAR attempts a fourth consecutive week of gains. Here are the updated targets & invalidation le...Continue Reading

Monday, May 23, 2016 3:00 pm +03:00

USDOLLAR Index Turns to Fed Speakers for Breakout Catalysts

Monday, May 23, 2016 11:37 am +03:00

EUR/USD Slightly Lower After Soft Markit Euro-Zone PMI Figures

Monday, May 23, 2016 6:06 am +03:00

Euro to Look Past PMI Data, US Dollar May Rise on Fed Comments

Mohammed Abdulwadud Soubra

Latest News

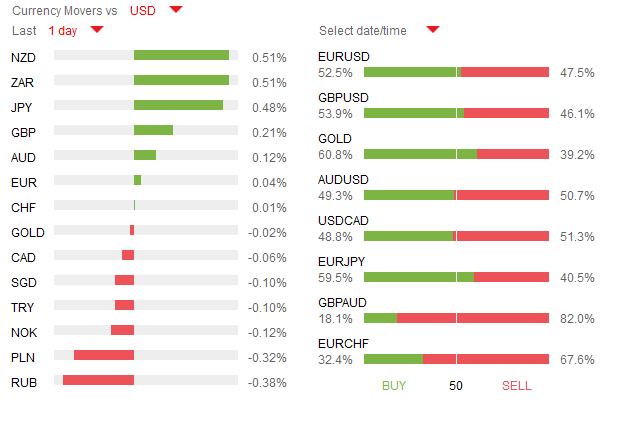

The USDJPY pair dipped below 110 this morning following the release of disappointing Japanese trade balance and manufacturing data which showed that exports fell 10.1% year-on-year in April. Boston’s FED president, Eric Rosengreen, stated that the US is on the edge of meeting most of the economic conditions set forth in order for FOMC members to be able to raise interest rates at the June meeting. Despite the latest chatter by hawkish FED members, the options markets has begun pricing in less of a chance for the US to raise interest rates in June – currently at 26% versus last week’s +30% probability.

Europe will publish services and manufacturing PMI figures this morning, both expected to have risen marginally in April. The FED’s James Bullard (Voter, Hawk) is scheduled to speak in Beijing this morning about US economic and monetary policy. The North American session will see volumes slightly lower as Canadian banks are off due to a public holiday. Meanwhile, the US is anticipated to show that the manufacturing sector slightly rebounded in April as it releases its latest flash manufacturing PMI figures.

The USDJPY pair dipped below 110 this morning following the release of disappointing Japanese trade balance and manufacturing data which showed that exports fell 10.1% year-on-year in April. Boston’s FED president, Eric Rosengreen, stated that the US is on the edge of meeting most of the economic conditions set forth in order for FOMC members to be able to raise interest rates at the June meeting. Despite the latest chatter by hawkish FED members, the options markets has begun pricing in less of a chance for the US to raise interest rates in June – currently at 26% versus last week’s +30% probability.

Europe will publish services and manufacturing PMI figures this morning, both expected to have risen marginally in April. The FED’s James Bullard (Voter, Hawk) is scheduled to speak in Beijing this morning about US economic and monetary policy. The North American session will see volumes slightly lower as Canadian banks are off due to a public holiday. Meanwhile, the US is anticipated to show that the manufacturing sector slightly rebounded in April as it releases its latest flash manufacturing PMI figures.

Mohammed Abdulwadud Soubra

Pivot Points WEEKLY Last Updated: May 23, 1:00 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.091 1.10787 1.11473 1.12474 1.1316 1.14161 1.15848 USD/JPY 105.456 107.581 108.835 109.706 110.96 111.831 113.956 GBP/USD 1.38334 1.41648 1.43297 1.44962 1.46611 1.48276 1.5159 USD/CHF 0.94788 0.96662 0...

分享社交网络 · 1

84

Mohammed Abdulwadud Soubra

Pivot Points Daily Last Updated: May 23, 1:00 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.11339 1.11748 1.11953 1.12157 1.12362 1.12566 1.12975 USD/JPY 108.69 109.429 109.759 110.168 110.498 110.907 111.646 GBP/USD 1.42753 1.44028 1.44487 1.45303 1.45762 1.46578 1.47853 USD/CHF 0.98396 0...

分享社交网络

73

Mohammed Abdulwadud Soubra

已发布文章Pivot Points Hourly

Pivot Points Hourly Last Updated: May 23, 1:00 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.12024 1.12101 1.1213 1.12178 1.12207 1.12255 1.12332 USD/JPY 109.84 109.983 110.036 110.126 110.179 110.269 110.412 GBP/USD 1.44705 1.44824 1.44885 1.44943 1.45004 1.45062 1.45181 USD/CHF 0.98669 0...

分享社交网络

86

Mohammed Abdulwadud Soubra

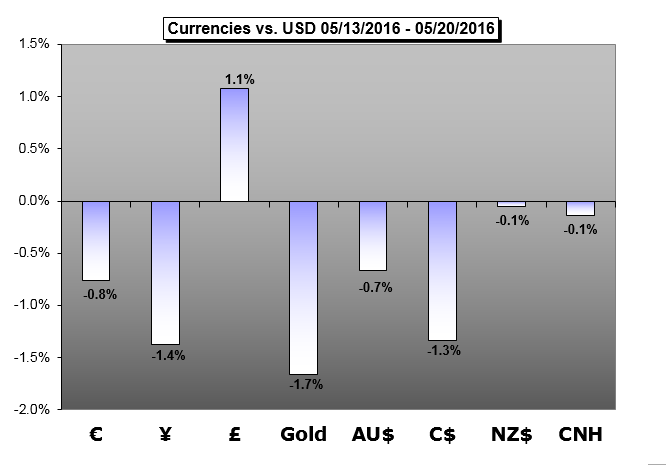

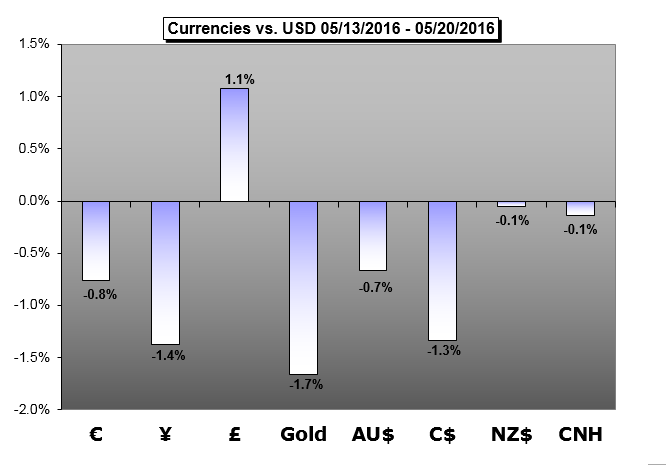

The Dollar has advanced for 3 straight weeks as the freeze from rate skeptics finally thawed. Can the BoJ also regain influence or does it need to take it by force?

US Dollar Forecast – Fed Provides Dollar Lift, FOMC Speak and SPX May Play Key Roles

The Dollar is finding some serious reprieve from a painful three months of selling pressure.

Euro Forecast – Don’t Be Surprised if You See More of the Same from the Euro

While there are no “high” rated events on the DailyFX Economic Calendar for the coming week for the Euro, there are almost twenty “medium” ranked events that bear enough significance to drive price action across the EUR-crosses.

British Pound Forecast – BoE Warns of Weakness, Even Without Brexit

The British Pound put in a strong week of gains through Thursday, snapping the two-week losing streak that the Sterling put in against the US Dollar after running up to a new nine-month high earlier in May.

Chinese Yuan (CNH) Forecast – Chinese Yuan Torn Between PBOC, Fed

Both the onshore Yuan (CNY) and offshore Yuan (CNH) traded lower against the US Dollar this week due to the increased expectations of a Fed rate hike in June after FOMC April minutes were released on Wednesday.

Australian Dollar Forecast – Aussie Dollar to Track Risk Trends on Fed Outlook, Brexit Bets

The Australian Dollar is likely to fall in with broad-based risk sentiment trends as markets size up the Fed policy outlook and Brexit probabilities in the week ahead.

Canadian Dollar Forecast – USD/CAD to Eye Fresh May Highs on Hawkish Fed Rhetoric, Dovish BoC

The near-term advance in USD/CAD may gather pace in the week ahead should the Bank of Canada (BoC) endorse a dovish outlook for monetary policy, while Federal Reserve officials show a greater willingness to implement higher borrowing-costs over the coming months.

New Zealand Dollar Forecast – New Zealand’s Migration Boom Could Keep RBNZ on Hold & Support NZD

The US Dollar surprised a lot of G10 currencies last week, but the New Zealand Dollar held firm.

Gold Forecast – Gold Decline Intensified as Fed Hints of Rate Hikes Ahead

Gold prices are down for a third consecutive week with the precious metal off 1.69% to trade at 1251 ahead of the New York close on Friday.

US Dollar Forecast – Fed Provides Dollar Lift, FOMC Speak and SPX May Play Key Roles

The Dollar is finding some serious reprieve from a painful three months of selling pressure.

Euro Forecast – Don’t Be Surprised if You See More of the Same from the Euro

While there are no “high” rated events on the DailyFX Economic Calendar for the coming week for the Euro, there are almost twenty “medium” ranked events that bear enough significance to drive price action across the EUR-crosses.

British Pound Forecast – BoE Warns of Weakness, Even Without Brexit

The British Pound put in a strong week of gains through Thursday, snapping the two-week losing streak that the Sterling put in against the US Dollar after running up to a new nine-month high earlier in May.

Chinese Yuan (CNH) Forecast – Chinese Yuan Torn Between PBOC, Fed

Both the onshore Yuan (CNY) and offshore Yuan (CNH) traded lower against the US Dollar this week due to the increased expectations of a Fed rate hike in June after FOMC April minutes were released on Wednesday.

Australian Dollar Forecast – Aussie Dollar to Track Risk Trends on Fed Outlook, Brexit Bets

The Australian Dollar is likely to fall in with broad-based risk sentiment trends as markets size up the Fed policy outlook and Brexit probabilities in the week ahead.

Canadian Dollar Forecast – USD/CAD to Eye Fresh May Highs on Hawkish Fed Rhetoric, Dovish BoC

The near-term advance in USD/CAD may gather pace in the week ahead should the Bank of Canada (BoC) endorse a dovish outlook for monetary policy, while Federal Reserve officials show a greater willingness to implement higher borrowing-costs over the coming months.

New Zealand Dollar Forecast – New Zealand’s Migration Boom Could Keep RBNZ on Hold & Support NZD

The US Dollar surprised a lot of G10 currencies last week, but the New Zealand Dollar held firm.

Gold Forecast – Gold Decline Intensified as Fed Hints of Rate Hikes Ahead

Gold prices are down for a third consecutive week with the precious metal off 1.69% to trade at 1251 ahead of the New York close on Friday.

: