Francisco Javier Garzon Mendez / 个人资料

- 信息

|

2 年

经验

|

1

产品

|

8

演示版

|

|

0

工作

|

1

信号

|

0

订阅者

|

I am a systematic (algorithmic) trader with rigorous training in quantitative analysis and risk management. My approach centers on the systematic search for statistical edges through data mining, feature engineering, and robust hypothesis validation.

I do not rely on intuition or anecdotal patterns. Instead, I develop strategies grounded in empirical testing:

- Extraction and cleaning of large-scale market datasets (prices, order flow, volume, macroeconomic indicators).

- Selection of predictive features using regularization techniques, mutual information-based selection, and time-series cross-validation.

- Rigorous backtesting with adjustments for overfitting, transaction costs, and survivorship bias.

- Robustness evaluation across multiple market regimes (high/low volatility, trending/ranging conditions, exogenous shocks).

My goal is not to “win every trade,” but to build systems with positive long-term expectancy while controlling drawdown and minimizing correlation to traditional risk factors. Discipline, reproducibility, and adaptability are the cornerstones of my process.

In a market where efficiency is asymptotic, edge resides not in luck—but in the quality of the process. That is my philosophy.

I do not rely on intuition or anecdotal patterns. Instead, I develop strategies grounded in empirical testing:

- Extraction and cleaning of large-scale market datasets (prices, order flow, volume, macroeconomic indicators).

- Selection of predictive features using regularization techniques, mutual information-based selection, and time-series cross-validation.

- Rigorous backtesting with adjustments for overfitting, transaction costs, and survivorship bias.

- Robustness evaluation across multiple market regimes (high/low volatility, trending/ranging conditions, exogenous shocks).

My goal is not to “win every trade,” but to build systems with positive long-term expectancy while controlling drawdown and minimizing correlation to traditional risk factors. Discipline, reproducibility, and adaptability are the cornerstones of my process.

In a market where efficiency is asymptotic, edge resides not in luck—but in the quality of the process. That is my philosophy.

Francisco Javier Garzon Mendez

发布MetaTrader 4信号

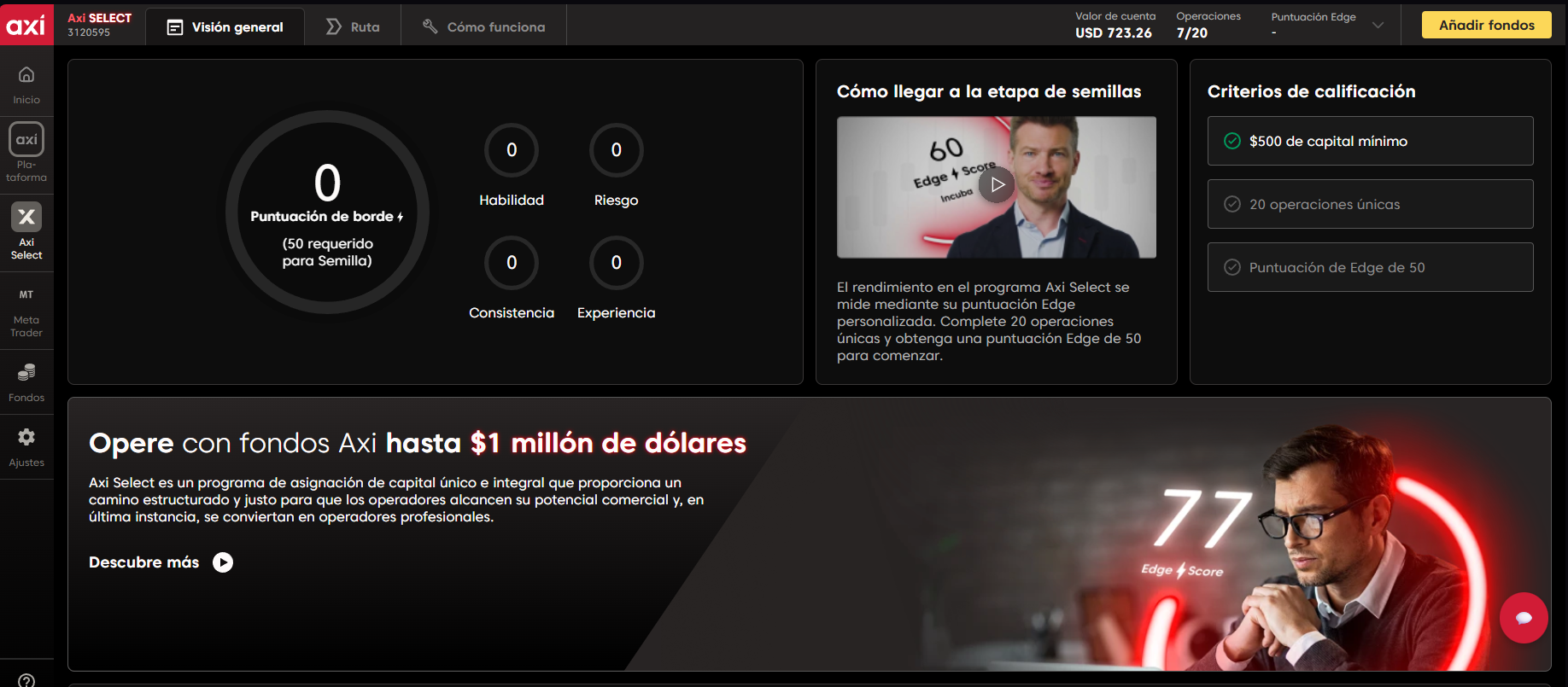

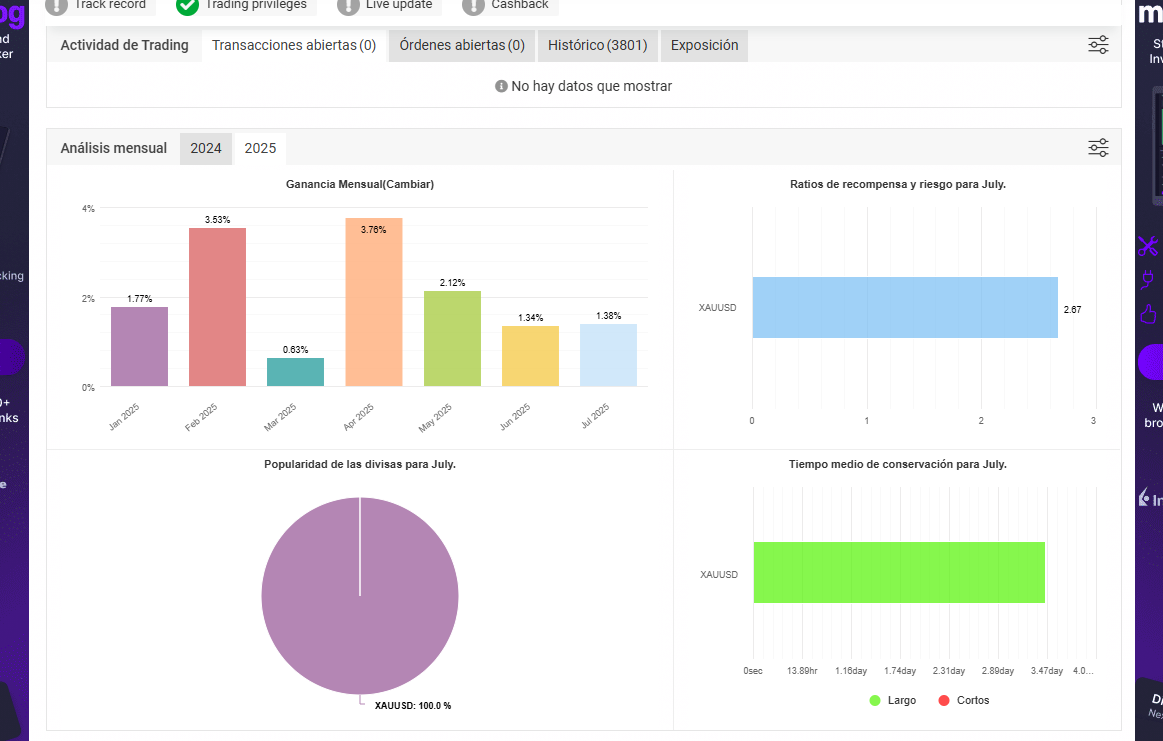

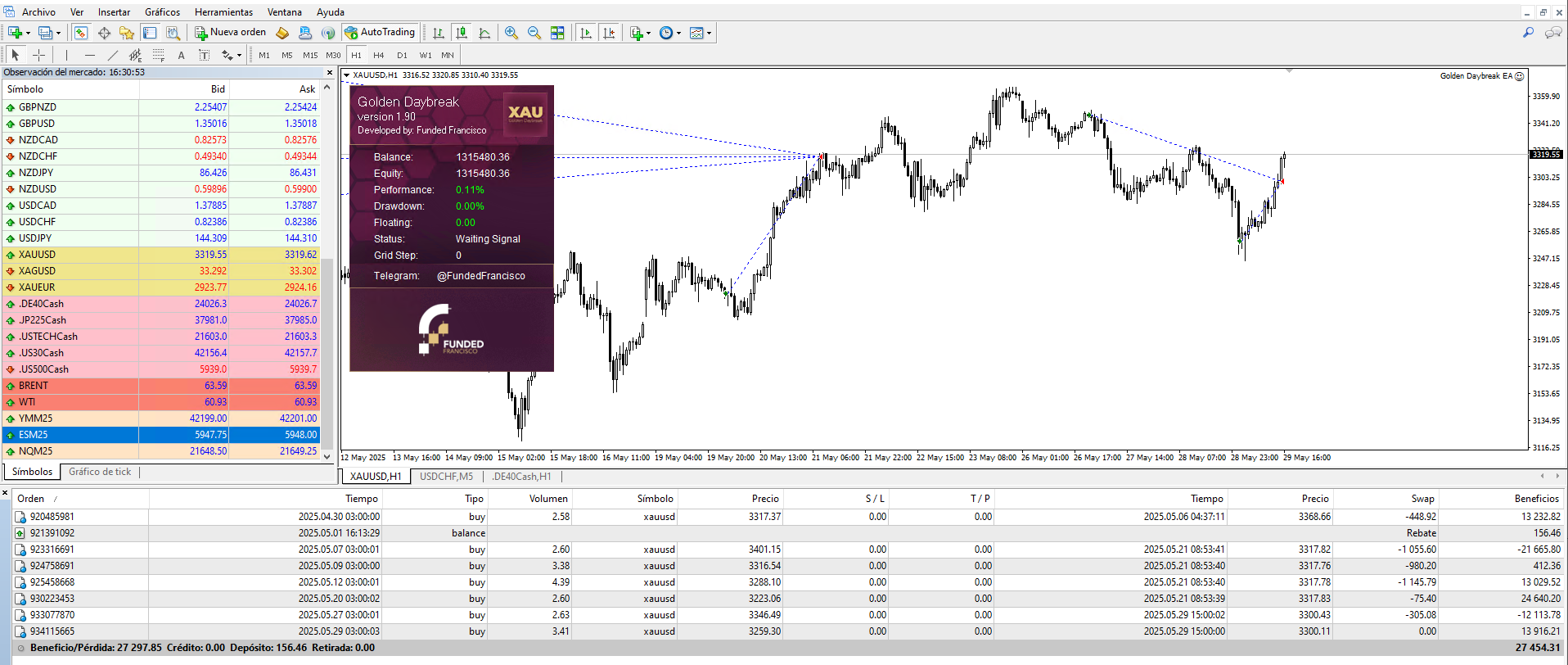

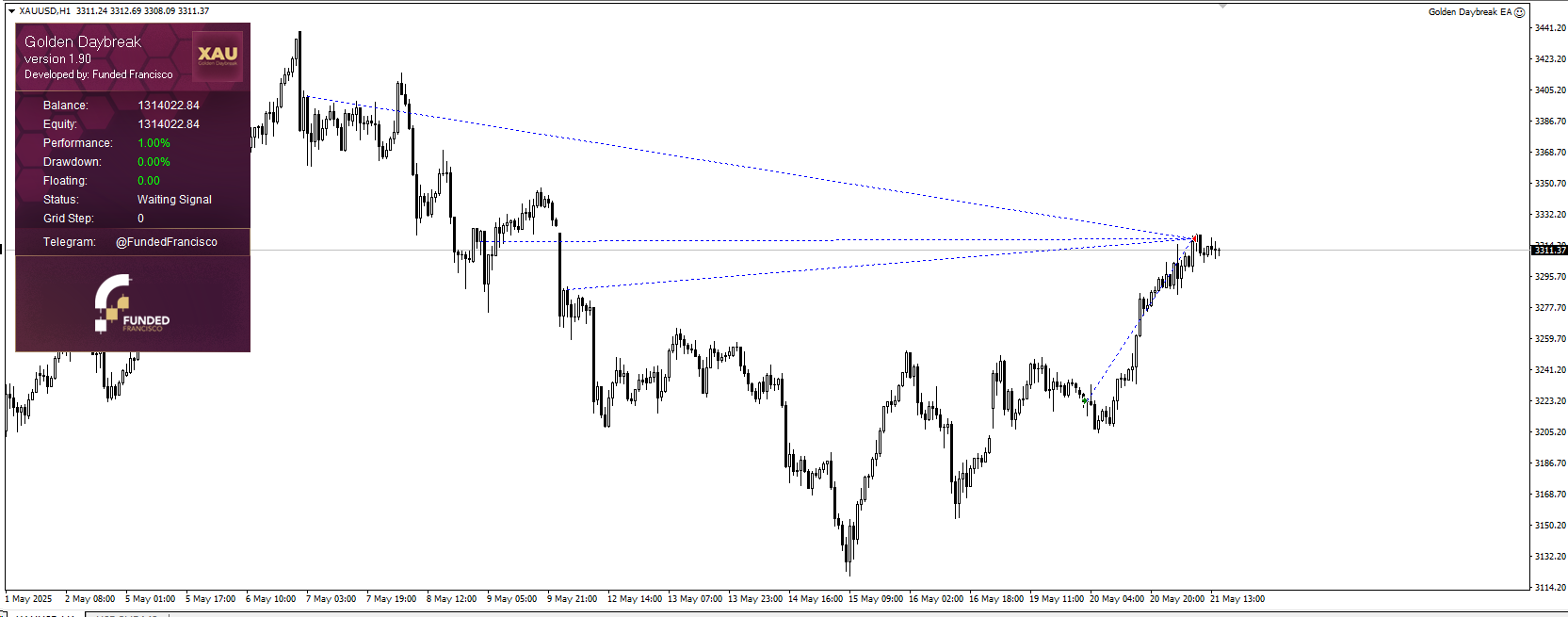

Any kind of spread, H1 market, 500usd min (No grid, No Martingale, All entrys with Stop Loss and Take Profit. Money managament with Trailing Stop) As an Algo Trader, I have developed algorithmic trading strategies for Gold (XAU) and Nasdaq, with expansion plans to include currency pairs. My methodology combines rigorous statistical analysis with data mining. Development Process (4 months of intensive work): Exhaustive Backtesting - 10 years of historical data analyzed to identify

Francisco Javier Garzon Mendez

已发布产品

IMPORTANT! Only Works in XAU/USD 30% Discount on the first 5 purchases Introducing a sophisticated algorithmic trading strategy, meticulously designed for the exclusive operation on the Gold (XAU/USD) currency pair. This Expert Advisor is based on the confluence of specific hourly confirmation signals and the validation of the CCI indicator, exclusively generating high-probability buy signals. Trade execution occurs only when predefined and rigorous criteria are met, with an automatic closure

: