Enrique Enguix / 个人资料

- 信息

|

3 年

经验

|

4

产品

|

2566

演示版

|

|

0

工作

|

6

信号

|

0

订阅者

|

🔵 TELEGRAM: https://t.me/+Jwdm825813I1Nzk0

🔴 YOUTUBE: https://bit.ly/3QXYBuy

📈 ALL OUR SIGNALS: https://www.mql5.com/en/signals/author/envex

🤖 ALL OUR EXPERT ADVISORS: https://www.mql5.com/en/users/envex/seller

Even though the strategy has passed robustness tests positioning it as a good strategy, I will be closely monitoring it while testing it in the incubator. I want to determine if we have something that’s over-optimized or if there is a true edge in the market.

⚠️Even if a (bad) developer does not have that intention, it is common and has an explanation.

Most expert advisors are built on temporary statistical advantages that eventually get exhausted.

The problem of over-optimization

Many developers fall into the trap of tuning their EAs to achieve perfect results in the past, without understanding that this perfection will not work in the future market.

Furthermore, everything is built to make it difficult for retailers to make money: spreads, swaps, commissions, delays, etc.

You'll be surprised to know that those few who make money from trading even pay more than 50% of their profits in one way or another.

The importance of diversification

And with how difficult it is to profit, most traders do not know how to diversify correctly, either because they do not understand the concept or do not have the necessary tools to do so.

If you use the same EA on EUR/USD and GBP/USD (which are strongly correlated), when EUR/USD trades lose, so will GBP/USD trades.

And what about EAs that compensate losing trades with winning trades?

Developers strive to create an EA that never fails in tests. But the market is never the same, so if the EA fails, this technique will wipe out months of profits in one trade.

Therefore. We need an EA that:

✅Does not exploit a temporary statistical advantage but can read the market and adapt.

✅It does not predict the market but follows it wherever it goes.

✅It does not work in correlated markets, so that when trades are lost in one market, they are not lost in the rest.

✅Allows for failure and assumes losses from time to time.

✅It is not optimized to have a perfect curve in backtests. Because a perfect curve only tells us that the EA has been over-optimized.

Do you want to know more?: https://www.mql5.com/en/market/product/90877

In the world of algorithmic trading, accuracy in candle close prices is essential for obtaining reliable results in Expert Advisor (EA) backtests. In this study, we meticulously compared candle close prices between Brokers X and Y, and analyzed how these differences affect EA backtest results.

Study Objectives:

Our main objective was to evaluate discrepancies in candle close prices between these two brokers and understand how these differences influence EA backtest results under identical strategy conditions.

Methodology:

Using specialized tools, we analyzed and compared candle close prices for various currency pairs over a significant period of trading.

Results:

Notable differences were observed in candle close prices between Brokers X and Y, even under similar market conditions. These discrepancies directly impacted EA backtest results, generating significant variations in final outcomes.

Analysis and Interpretation:

It is important to note that these differences in candle close prices between brokers can influence the profitability and effectiveness of automated strategies. While these variations may pose challenges, they can also offer opportunities to optimize strategies and adapt to different market conditions.

Conclusions:

When conducting EA backtests, it is crucial to consider and adjust parameters based on differences in candle close prices between brokers. We recommend conducting comprehensive tests across different brokers to better understand the real impact of these discrepancies on our automated trading strategies.

Share your experiences and observations on this topic in the comments to enrich the discussion!

Best of luck in your analysis and trading operations!

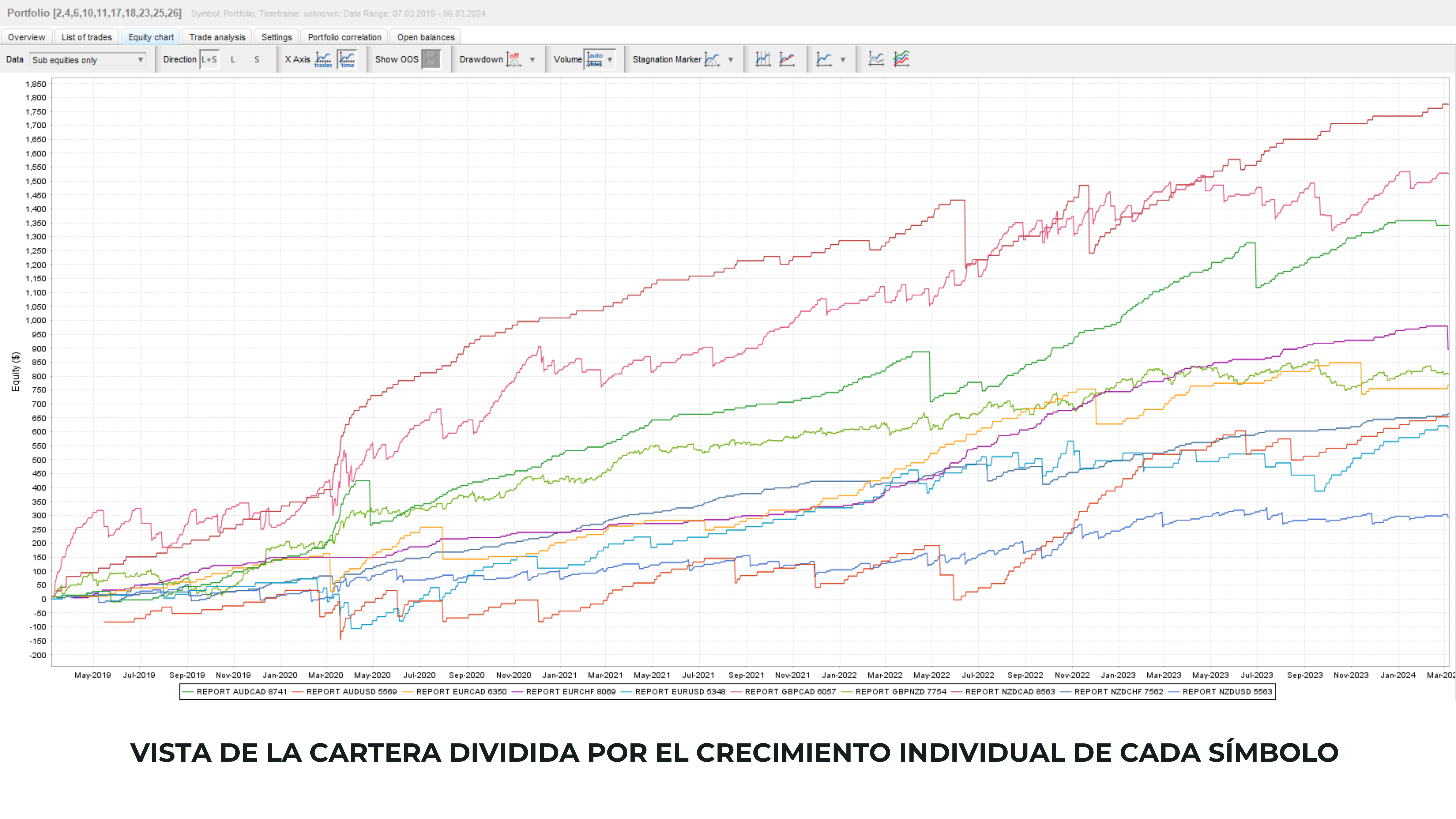

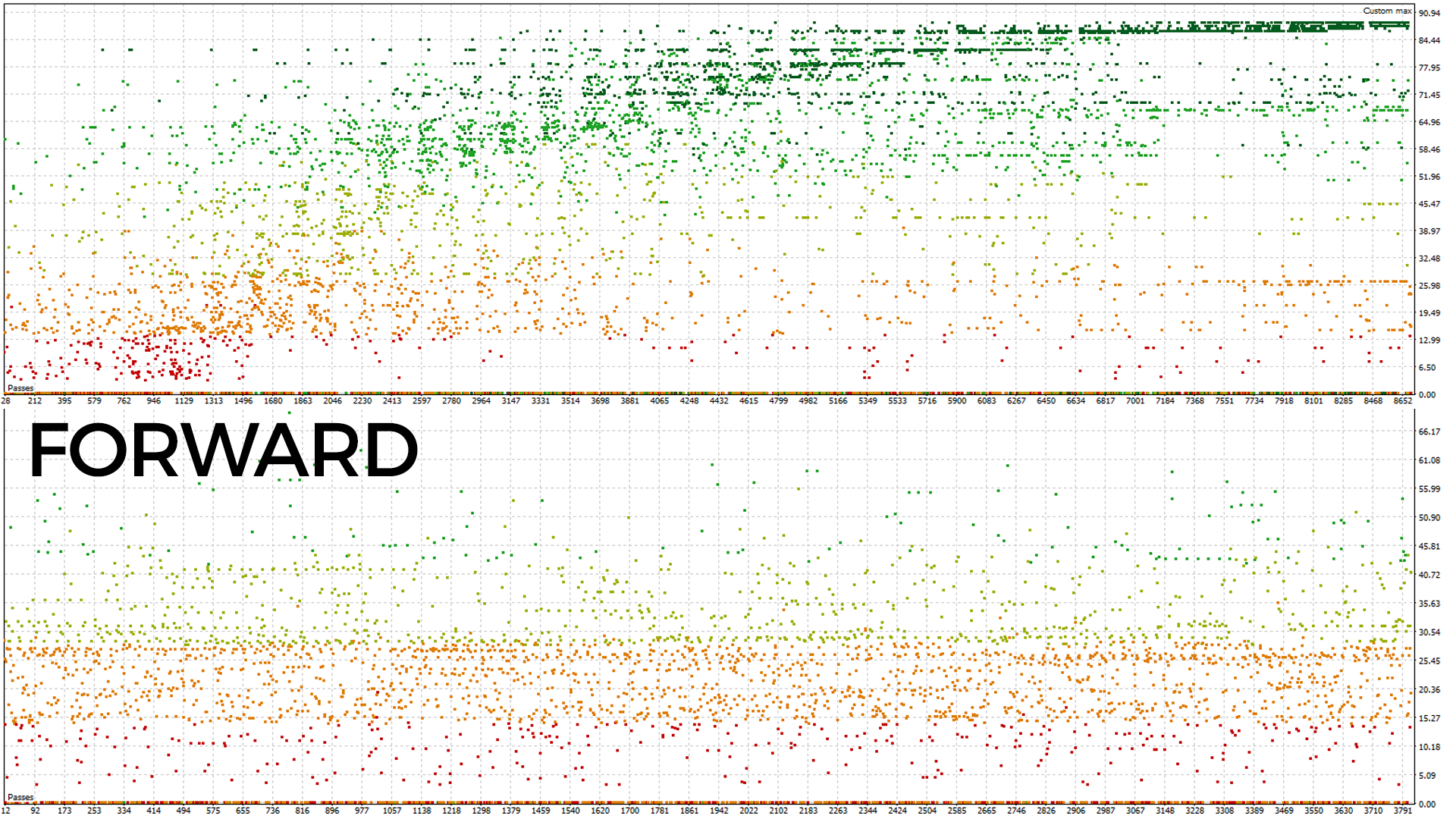

On the other hand, our approach is different: we also optimize over an extended period, but then validate out of sample to verify the real effectiveness of the strategy, which results in more robust sets (although not as visually striking, second image ), generating fewer sales but offering results that are more in line with reality.

Our goal is to attract traders who understand that the important thing is not superficial beauty, but obtaining results that reflect with a higher degree of probability the future conditions of the market.

For over 3 years, my Expert Advisor has shown solid results, but I've always been concerned about the risk associated with its strategy.

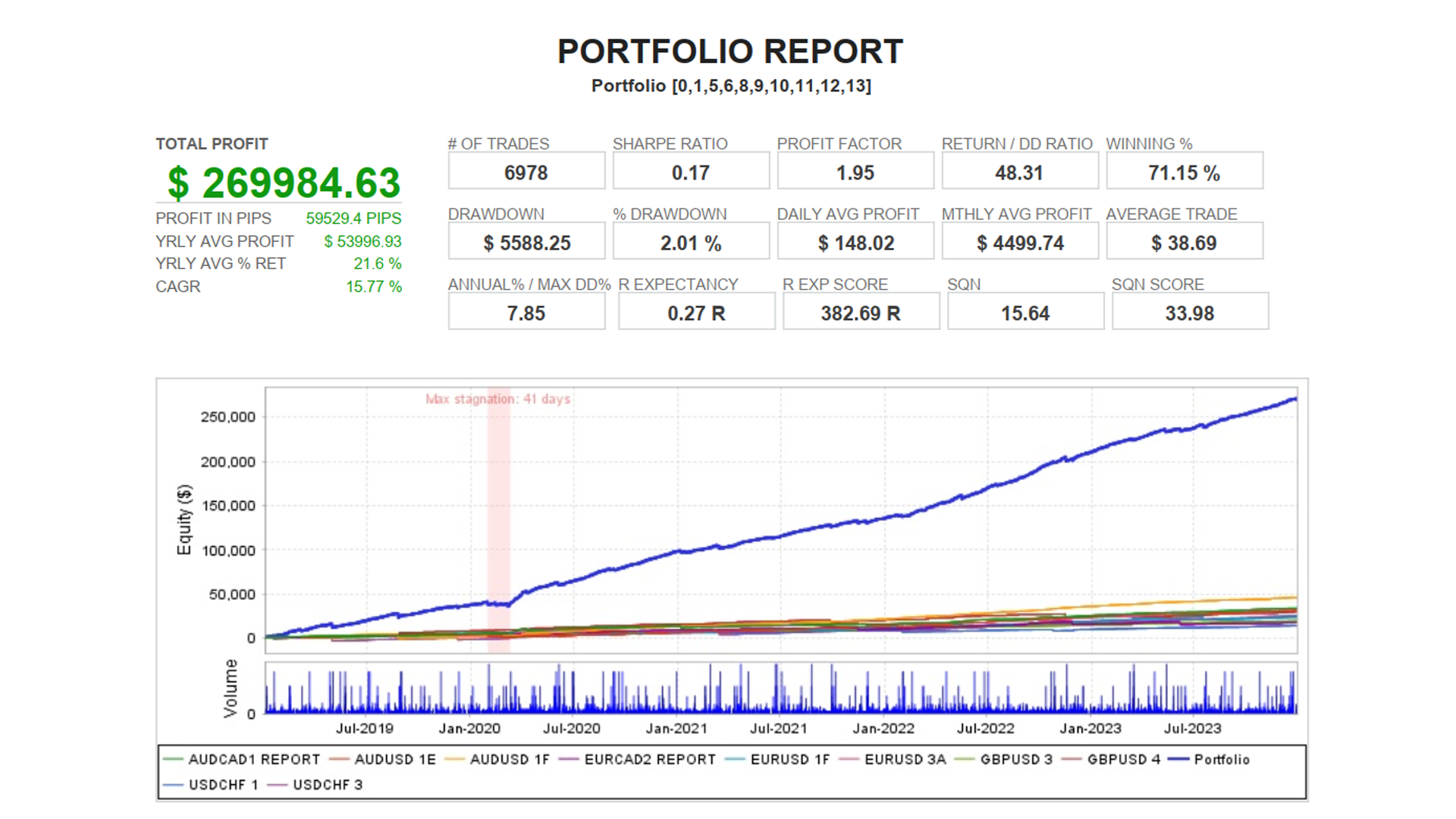

So, from a new perspective, I've created more robust strategies and less over-optimized sets. I've also developed my own formulation to evaluate results, considering 10 key parameters such as Sharpe Ratio, number of trades, and Drawdown.

The incorporation of Software #QuantAnalyzer and its Portfolio Master has been crucial, allowing me to evaluate results from different angles, including asset decorrelation.

Moreover, the Monte Carlo evaluation has confirmed the strength of my new portfolio.

I'll soon begin testing this third phase with my own capital!

为什么大多数EA失败? 许多专家顾问依赖于临时的统计优势,当市场变化时这些优势会消失,而市场变化是持续不断的。 过度优化的问题 此外,大多数开发者陷入了微调他们的EA以在过去取得完美结果的陷阱中,却没有意识到这不会转化为未来市场表现。 关键是进行考虑未来情景的测试。 分散投资的重要性 将所有投资集中在一个选项上是非常危险的,尤其是在一起波动的市场中。 例如,如果我们使用相同的策略来交易两个高度相关的货币对,如EUR/USD和GBP/USD,如果出现问题,我们可能会增加损失。 因此,分散我们的投资策略是保护我们资金的关键。 没有止损的EA怎么样? 一些EA旨在避免测试中的任何失败,但在任何时候保护账户是至关重要的。 许多交易者由于没有采取适当的保护措施而经历了突然的账户损失。 NEXUS提供了什么? 1. 市场适应性:NEXUS不依赖于临时优势,而是调整以适应变化的市场条件。 2. 趋势跟随:关键不是预测市场,而是准确地跟随其方向。 3. 智能分散:避免在相关市场交易,以保护不同情况下的投资。 4. 风险管理:包括诸如止损等措施,以保护账户并控制损失。 NEXUS是如何开发的?

想要像专业人士一样交易吗? Tank v1 EA旨在满足投资者和财务爱好者的需求,融合简单性和强大的性能。 主要特点: - 每日1次交易 - 每次交易设置止损和获利 - 挂单交易,如Buy Stop和Sell Stop - 精确管理风险。 - 每日结束时关闭订单 - 不交易星期五 根据您的需求调整: 尽管最初针对GBP/USD货币对的H1时间框架进行了优化,但Tank v1邀请您创建自定义设置。 适用于各级别: Tank v1被视为Prop Firm交易的多功能资源。 其在Metatrader 5上的用户友好设置使得即使是mql5.com上的新手也能轻松浏览其功能。 在Telegram上关注我们,保持最新信息! 已经有超过1000人这样做了! 准备好像专业人士一样开始交易了吗? 立即下载Tank v1,享受更智能的交易体验。 参数: Time_Hour: 起始小时 Time_Min: 起始分钟 Close_Time_Hour: 结束小时 Close_Time_Min: 结束分钟 TP_Points: 止盈点数 Trail_Points: 移动止损点数

体验Center EA的强大力量,主导外汇市场! 基于价格行动的交易,深度分析市场运动。 Center以其趋势特性脱颖而出。 即时下载: 加入已经利用这一机会并立即下载Center EA的30,000多人。 经过验证的盈利性: 使用Center EA可以成功达到80%的交易! 基于价格行动的策略: 使用Center EA的策略准确最大化您的收益。 我们满意的用户说什么? "Center EA改变了我的外汇交易方式。推荐!" "多亏了Center EA,我现在对我的交易更有信心。棒极了!" "非常、非常好,我甚至想说太棒了。干得好。" "我对性能和结果感到惊讶。祝贺开发者。" 您是否在寻找 卓越 的专家顾问? 发现我们为您准备的内容 ! 我们有适用于符号EURUSD、USDCAD、AUDUSD和GBPUSD的4个特殊套装。 推荐: 推荐的时间框架:M1、M5、M15等,具有适当设置。 支持的货币对:EURUSD、GBPUSD、AUDUSD、USDCAD等,根据用户配置。 提升性能:使用低延迟的VPS获得更好的结果。 根据您的特定设置调整杠杆和存款。 常见问题: