Philani Mthembu / 个人资料

- 信息

|

2 年

经验

|

5

产品

|

65

演示版

|

|

0

工作

|

0

信号

|

0

订阅者

|

The Market Structure Analyzer is a powerful tool designed for traders who follow market structure and smart money concepts. This comprehensive indicator provides a suite of features to assist in identifying key market levels, potential entry points, and areas of liquidity. Here's what it offers: 1. Swing High/Low Detection : Accurately identifies and marks swing highs and lows, providing a clear view of market structure. 2. Dynamic Supply and Demand Zones: Draws precise supply and demand zones

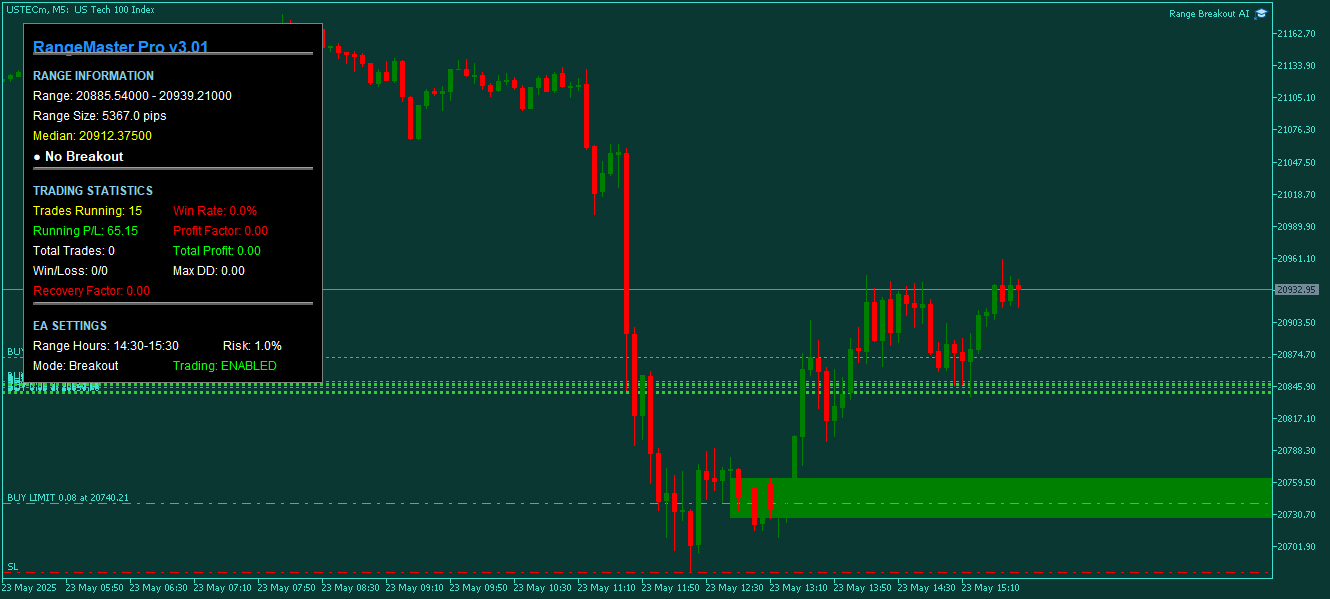

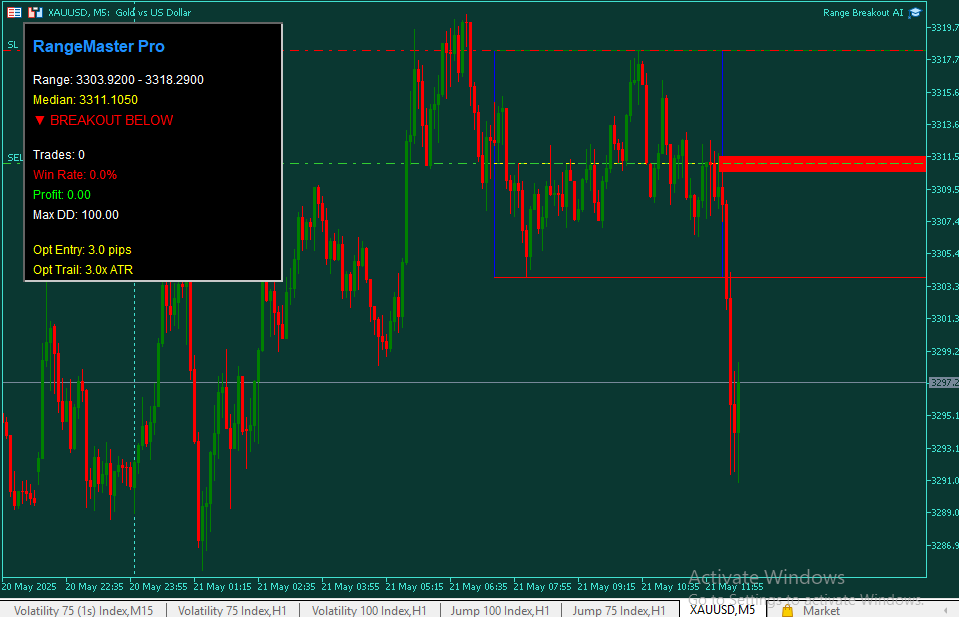

Liquidity Hunter EA for MetaTrader 5 The Liquidity Hunter EA is an automated trading tool designed for MetaTrader 5, incorporating Smart Money Concepts (SMC) to identify and trade liquidity zones in the market. It detects key swing highs/lows, plots liquidity clusters, and executes limit orders with advanced risk management. Key Features Liquidity Detection: Identifies swing extremes and internal levels to mark potential stop zones. Pending Limit Orders: Enters trades at

Swing High/Low Identifier Swing High/Low Identifier 是一个为 MetaTrader 5 (MT5) 设计的自定义指标,用于突出显示图表上的重要摆动点。该指标基于可配置的柱范围识别并标记高摆动和低摆动点。 高摆动点以红色箭头标记在相应的蜡烛上方。 低摆动点以蓝色箭头标记在相应的蜡烛下方。 该工具帮助交易者快速发现重要的价格水平和模式,这对于做出明智的交易决策至关重要。 有效策略 趋势反转识别: 高摆动点可以指示潜在的阻力水平,可能会开始下跌趋势。 低摆动点可以指示潜在的支撑水平,可能会开始上升趋势。 支撑和阻力分析: 使用标记的高摆动点和低摆动点绘制水平线或通道,作为关键的支撑和阻力水平。 价格行为交易: 将指标与价格行为技术(如蜡烛图模式或突破策略)结合使用,以确认在摆动点的进出点。 摆动交易: 利用高摆动点和低摆动点,根据观察到的价格摆动和潜在的反转区域确定进出点。 其他指标的确认: 使用摆动点确认其他技术指标(如移动平均线或振荡器)的信号,以增强交易信号的可靠性。

This Expert Advisor (EA) implements an automated trading strategy based on the ZigZag Indicator. Key features include: - Utilizes ZigZag indicator to identify potential price swings - Incorporates Fibonacci retracement levels for entry and exit signals - Designed for both short-term (scalping) and medium-term (swing) trading approaches Configurable risk management settings: • Default lot size: 0.01 (adjustable) • Stop Loss: 1.5% of current price • Take Profit: 1.5 times the

The Daily Highs and Lows Indicator is a versatile tool that combines support and resistance levels with real-time market dynamics. By incorporating previous daily highs and lows, it provides valuable insights into market psychology and identifies potential areas of price reversals or breakouts. With its ability to adapt to changing market conditions and customizable options, traders can stay ahead of trends and make informed decisions. This indicator is suitable for various trading styles and

The Daily Highs and Lows Indicator is a versatile tool that combines support and resistance levels with real-time market dynamics. By incorporating previous daily highs and lows, it provides valuable insights into market psychology and identifies potential areas of price reversals or breakouts. With its ability to adapt to changing market conditions and customizable options, traders can stay ahead of trends and make informed decisions. This indicator is suitable for various trading styles and