Hedge MA

- 专家

- Abdelhak Bekkali

- 版本: 1.20

- 更新: 9 五月 2018

- 激活: 10

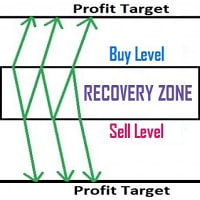

Hedge MA is both a moving average cross EA and hedging EA, designed to recover a loss of a losing trade by opening an opposite trade, or more, if necessary. If the initial trade will be lost, the hedge trade will win. If the initial trade wins, then the hedge trade might not even get triggered and will be cancelled.

- The EA is designed for МТ5 hedge accounts.

- Recommended account - cent МТ5 hedge, at least 15000 USD cents ($150), leverage - 1:500.

- Recommended timeframe - М5.

- The default settings are optimized for the EURUSD pair.

- For better visualization, it is recommended to attach the ATR indicator with the period of 2 to the chart.

Trading strategy

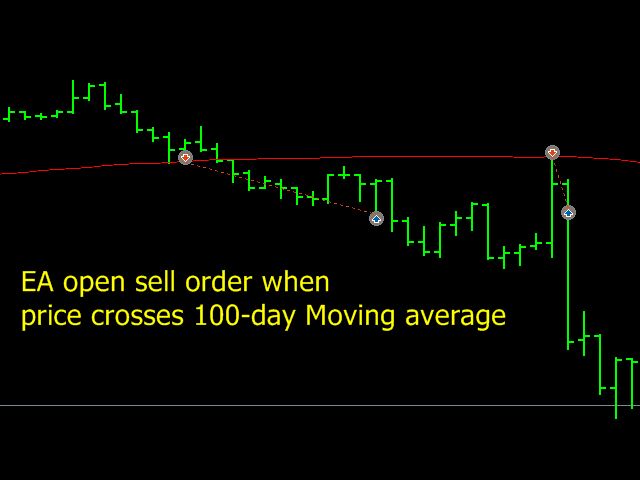

- The EA opens a sell order when price crosses 100-day moving average below.

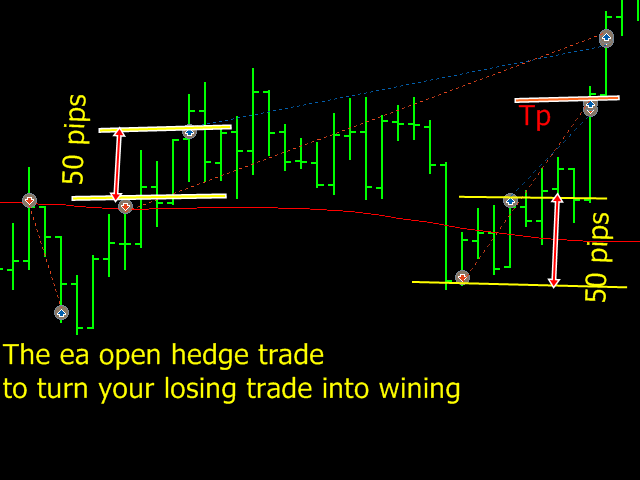

- The EA opens hedge trades when your original trade reaches a certain predetermined loss point.

- An opposite order is opened after a specified Delta distance 50 pips with the volume increased.

EA parameters

- Timeframes: The timeframe on which the EA should work regardless what timeframe your chart is set to.

Moving average

- Moving_Average_period: Averaging period of the Moving Average (default 100).

- MA_SHIFT: The indicator shift relative to the chart (default is 0).

- MA_METHOD: The methods of the price series.

Hedge

- Initial_LOT: initial lot size.

- Hedge_LOT_1: the lot Size of the first hedge trade (order opposite).

- Hedge_LOT_2: the lot Size of the second hedge trade.

- Distance_Recovery: distance between orders (50 points).

- Initial_TP: Take Profit of initial trade.

- Hedge_TP_1: Take Profit of the first hedge trade.

- Hedge_TP_2: Take Profit of the second hedge trade.