Market Cycles Order Flow

Contact me through PM for a 20% special discount on every purchase of all my EAs.

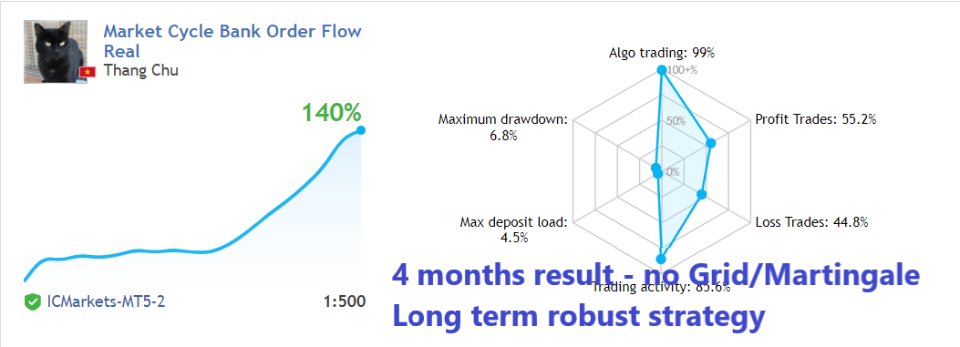

The best NON martingale, grid or averaging EA in mql5 market.

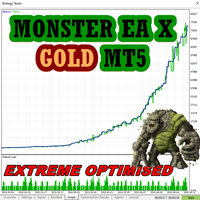

This algorithm has been running live for private accounts for over 3.5+ years since 2020, returning over 26,000 pips with exceptional risk stability. Now upgraded to MT5 platform with additional enhancements to market regime recognition and additional indicator filtering.

The algorithm utilizes a proprietary AI model based on retail trader sentiment and 9 different indicators to identify and predict relevant market cycles of up and down trends, including MACD, Smoothed Moving Average, RSI, TDI, ADX and some others less common indicators to find the best entry during a trend.

Sentiment data used for the AI models. The data has been collected for many years and feeding to the AI engine to learn the patterns of retail traders and consistently trade against them.

This EA is part of Nexus Portfolio - the most long term stable EA in mql5 market.

The price will increase gradually as the EA proves its stability and profitability in real trading.

Starting Price: $1600. Current Price: $2000. Next price: $2400

Important: To backtest and run the EA correctly you'll need the BankOrderFlow indicator. Download it from the comment section and put it in MQL5\Indicators folder.

Set ValidationOnly to False before trading or backtesting

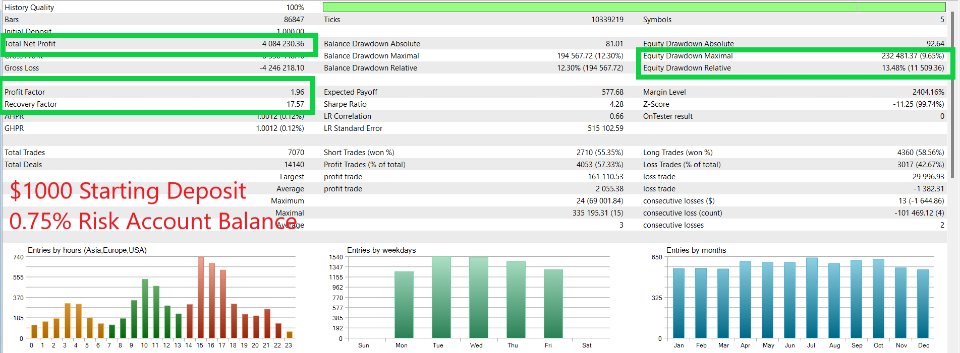

Best is to use IC Markets platform to test from 2017. You'll get the same backtest result as mine.

- No Martingale, grid or holding on losses to infinity. This algorithm is used for private funds and clients with strict risk management guidelines.

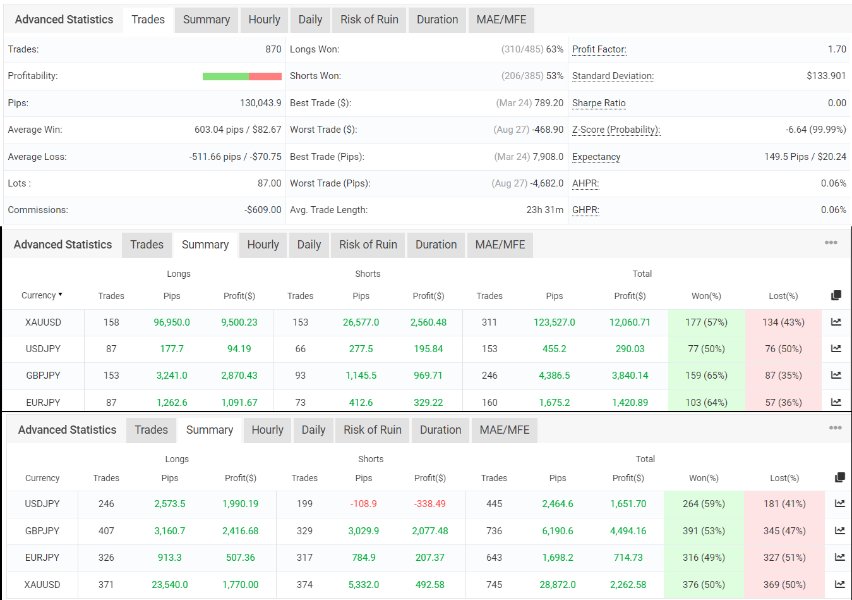

- Supported pairs: XAUUSD, USDJPY, GBPJPY, EURJPY, XAUJPY

- Trades always have SL and TP

- Simple to setup: select the risk, attach the EA on one USDJPY M5 chart. ( Remember to set ValidationOnly to False ).

- Proven edge: it has proven edge in both backtest since 2017 and live trading since 2020

- Built with long term stability and risk management in mind with fully diversified portfolio of multi strategies, multi assets, multi timeframes.

- Backtested with 0.1 fixed lot yield $110,000 in profit over the last 6 years with Recovery Factor of 49.98

- It will have periods of drawdowns but it is a tradeoff for long term capital safety

- Requires hedging account and standard New York close brokers time zone( GMT+2 +3)

Unlike most other EAs in the market, I always assure every single of my EAs are of highest quality:

- Real trades will match backtesting.

- No loss hiden techniques to hide historical losses, no manipulated backtest to make backtesting curve smooth without loss (only naive traders believe in smooth upward curve with no risk - they are most likely scamming).

- Have multi-years verified statistical trading edge.

- Robust and long term stable with sensible risk management.

- Not sensitive to spreads or executions, M1 backtesting will 99% matches with Every tick modelling.