Om Prakash Arora / Profil

- Bilgiler

|

5+ yıl

deneyim

|

0

ürünler

|

0

demo sürümleri

|

|

0

işler

|

0

sinyaller

|

0

aboneler

|

Om Prakash Arora

Dollar headed for weekly loss

The dollar headed for its first losing week in three as new signs of weakness in the U.S. jobs market dented investor expectations about the pace of a pandemic recovery.

The dollar headed for its first losing week in three as new signs of weakness in the U.S. jobs market dented investor expectations about the pace of a pandemic recovery.

Om Prakash Arora

Euro Flat, German Inflation Soars

The euro fell below the symbolic 1.20 line last week, for the first time in 2020. The US dollar appeared to have some momentum and a drive towards the 1.19 line appeared likely. However, last week ended with an anemic US nonfarm payrolls report, which was just what the doctor ordered for the euro. The US dollar index has retreated after making a move towards the 91 level, and the euro has moved back into 1.21 territory.

The euro fell below the symbolic 1.20 line last week, for the first time in 2020. The US dollar appeared to have some momentum and a drive towards the 1.19 line appeared likely. However, last week ended with an anemic US nonfarm payrolls report, which was just what the doctor ordered for the euro. The US dollar index has retreated after making a move towards the 91 level, and the euro has moved back into 1.21 territory.

Om Prakash Arora

Dollar Weakens; Optimism of Economic Recovery Grows

The dollar edged lower in early European trading Wednesday, trading near two-week lows, as optimism over a global economic recovery weakens demand for this safe haven.

The dollar edged lower in early European trading Wednesday, trading near two-week lows, as optimism over a global economic recovery weakens demand for this safe haven.

Om Prakash Arora

Dollar Down as Doubts Creep In Over Safe-Haven's Recent Rally

The dollar was down on Tuesday morning in Asia, hovering near its lowest level in a week as doubts began to creep in about a recent rally fueled by hopes of a faster U.S. economic recovery from COVID-19 than elsewhere.

The USD/JPY pair inched down 0.08% to 105.14. The dollar remained mostly flat against the yen, after climbing to 105.765 at the end of the previous week for the first time since October 2020.

The dollar was down on Tuesday morning in Asia, hovering near its lowest level in a week as doubts began to creep in about a recent rally fueled by hopes of a faster U.S. economic recovery from COVID-19 than elsewhere.

The USD/JPY pair inched down 0.08% to 105.14. The dollar remained mostly flat against the yen, after climbing to 105.765 at the end of the previous week for the first time since October 2020.

Om Prakash Arora

https://www.mql5.com/en/signals/849167

Subscribe us!!

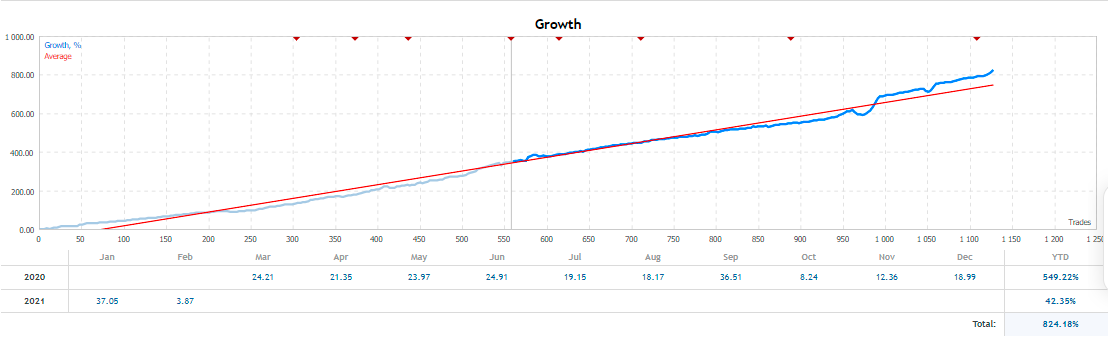

3.87% profit in first week of Feb'21 more than 43% profit this year.

Subscribe us!!

3.87% profit in first week of Feb'21 more than 43% profit this year.

Om Prakash Arora

USDJPY Price; Bulls are Struggling to Break Up a Significant Resistance Level

An increase in the bulls’ momentum may increase the price up to $105.7 and $106.4 provided the resistance level of $105.0 does not hold. In case the resistance level of $105.0 is defended by the bears, then, the price may reverse towards the $104.3, $103.8 and $103.2.

Key levels:

Resistance levels: $105.0, 105.7, $106.4

Support levels: $104.3, $103.8, $103.2

An increase in the bulls’ momentum may increase the price up to $105.7 and $106.4 provided the resistance level of $105.0 does not hold. In case the resistance level of $105.0 is defended by the bears, then, the price may reverse towards the $104.3, $103.8 and $103.2.

Key levels:

Resistance levels: $105.0, 105.7, $106.4

Support levels: $104.3, $103.8, $103.2

Om Prakash Arora

Dollar Weakens; Stimulus Progression Boosts Risk Sentiment

The dollar edged lower in early European trading Tuesday, retreating from earlier highs as progress towards a stimulus plan helped risk sentiment.

The dollar edged lower in early European trading Tuesday, retreating from earlier highs as progress towards a stimulus plan helped risk sentiment.

Om Prakash Arora

https://www.mql5.com/en/signals/849167

Subscribe us!!

After successful 1st month of 2021 we are ready to score more in February.

Join us to increase your earnings.

Subscribe us!!

After successful 1st month of 2021 we are ready to score more in February.

Join us to increase your earnings.

[Silindi]

2021.01.31

good

Om Prakash Arora

As promised we have delivered our most profitable this month so far with more than 37%, that means a person subscribed to us with 1000$ equity have booked around 370$ profit with our trading in January.

Thanks for confidence on us.

We are receiving your appreciation in messages daily and that definitely motivates us to maintain the consistency.

Thanks for confidence on us.

We are receiving your appreciation in messages daily and that definitely motivates us to maintain the consistency.

vonhagtm

2021.01.30

Keep up the good work Om. I can see another good year. Slow and steady and minimal risk. That's the key. Well done once again !!

Om Prakash Arora

https://www.mql5.com/en/signals/849167

Subscribe us!!

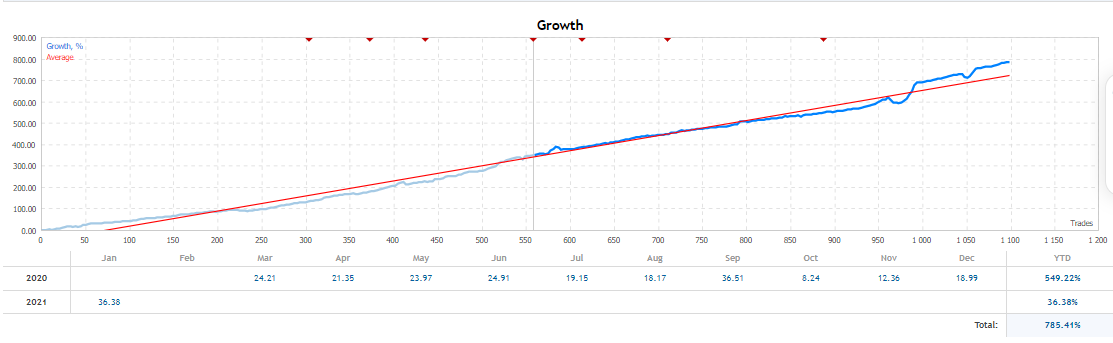

More than 36% profit booked this month, Thanks for subscribing

Subscribe us!!

More than 36% profit booked this month, Thanks for subscribing

Om Prakash Arora

Dollar edges before Fed meeting, euro slips

The dollar edged higher against a basket of currencies on Wednesday as markets waited for comments from Federal Reserve Chair Jerome Powell, who is likely to renew a commitment to ultra-easy policy.

The dollar reversed declines against riskier currencies, even as pandemic recovery hopes got a boost from the International Monetary Fund's upgrading its forecast for 2021 global growth.

Treasury yields, whose rise had supported the dollar at the start of this year, declined overnight amid caution about the eventual size of and delays to President Joe Biden's $1.9 trillion fiscal stimulus plan.

The dollar edged higher against a basket of currencies on Wednesday as markets waited for comments from Federal Reserve Chair Jerome Powell, who is likely to renew a commitment to ultra-easy policy.

The dollar reversed declines against riskier currencies, even as pandemic recovery hopes got a boost from the International Monetary Fund's upgrading its forecast for 2021 global growth.

Treasury yields, whose rise had supported the dollar at the start of this year, declined overnight amid caution about the eventual size of and delays to President Joe Biden's $1.9 trillion fiscal stimulus plan.

Om Prakash Arora

Dollar firm as jittery markets look to Fed for catalysts

The U.S. dollar steadied on Tuesday as rising coronavirus cases and doubts over the speed and size of U.S. stimulus tempered financial markets' upbeat mood, while investors were also cautious ahead of the Federal Reserve's review later in the week.

Bets the U.S. dollar keeps falling, to extend a downtrend which began last March, hit an almost decade high last week, positioning data shows.

However risk appetite has waned in the meantime as familiar disagreements have emerged to so far delay passage of President Joe Biden's $1.9 trillion.

The U.S. dollar steadied on Tuesday as rising coronavirus cases and doubts over the speed and size of U.S. stimulus tempered financial markets' upbeat mood, while investors were also cautious ahead of the Federal Reserve's review later in the week.

Bets the U.S. dollar keeps falling, to extend a downtrend which began last March, hit an almost decade high last week, positioning data shows.

However risk appetite has waned in the meantime as familiar disagreements have emerged to so far delay passage of President Joe Biden's $1.9 trillion.

Om Prakash Arora

Dollar's bounce fades as risk appetite rises

The dollar was headed for its worst week of the year on Friday, as investors cheered in the Joe Biden administration by buying riskier currencies and refreshed bets that a pandemic recovery could push the greenback lower still.

Against the euro, the dollar is down almost 0.8% this week and it touched a week-low of $1.2173 per euro on Friday. The dollar index has fallen by the same weekly margin, and was steady at 90.075 early in the Asia session.

The dollar was headed for its worst week of the year on Friday, as investors cheered in the Joe Biden administration by buying riskier currencies and refreshed bets that a pandemic recovery could push the greenback lower still.

Against the euro, the dollar is down almost 0.8% this week and it touched a week-low of $1.2173 per euro on Friday. The dollar index has fallen by the same weekly margin, and was steady at 90.075 early in the Asia session.

Om Prakash Arora

USD/JPY Technical Analysis: Long-Term Outlook Still Favors Bears

As a pairing of arguably the planet’s two most important “safe haven” currencies, USD/JPY usually sidesteps this confusing dynamic and serves as purer measure of the relative attractiveness of each currency. In other words, examining the trends in USD/JPY provides valuable insight into how traders are viewing the US dollar and Japanese yen in isolation.

As a pairing of arguably the planet’s two most important “safe haven” currencies, USD/JPY usually sidesteps this confusing dynamic and serves as purer measure of the relative attractiveness of each currency. In other words, examining the trends in USD/JPY provides valuable insight into how traders are viewing the US dollar and Japanese yen in isolation.

Catarina Nunes

2021.01.20

I cant receive your signals today I just receive only 2, please help me, sea your messages

mehdikarimii55

2021.01.21

I have problem same as another user today i just got two signals !! please handle this problem. thanks for your attention.

Om Prakash Arora

Dollar slips as U.S. stimulus hopes lift mood

The U.S. dollar nursed losses on Wednesday and the euro hung on to gains as investors' mood brightened in the wake of a better-than-expected sentiment survey in Germany and big spending talk from U.S. Treasury Secretary nominee Janet Yellen.

The U.S. dollar nursed losses on Wednesday and the euro hung on to gains as investors' mood brightened in the wake of a better-than-expected sentiment survey in Germany and big spending talk from U.S. Treasury Secretary nominee Janet Yellen.

Om Prakash Arora

https://www.mql5.com/en/signals/849167

Subscribe us!!

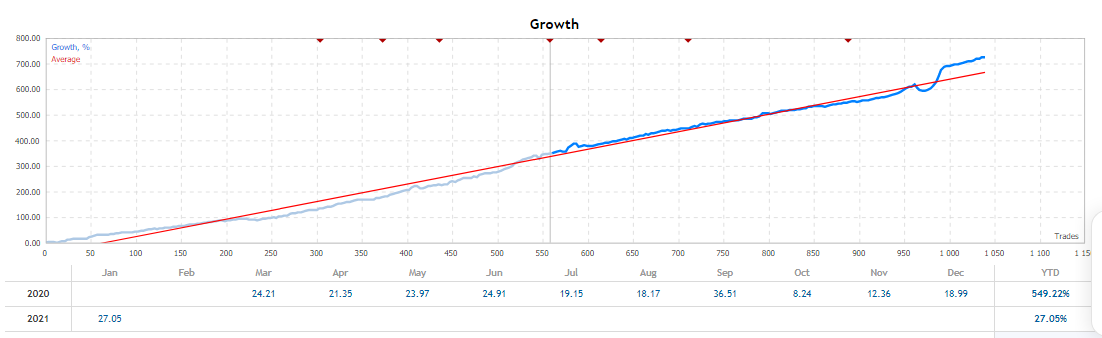

Over 27% return in 1st Fortnight of January. New year started with a bash for all.

Subscribe us!!

Over 27% return in 1st Fortnight of January. New year started with a bash for all.

Dicas123

2021.01.20

HE REALLY DESERVES THE SIGNALS THAT WE PAY EACH MONTH. ITS WORTHY. Really glad with my results as well. thank you for the good work keep focus motivated, we believe in you. block all the people talking negativate. All good vibes.NAMASTE.

Om Prakash Arora

Pound to US Dollar (GBP/USD) Subdued from Weekly Highs

The Pound to US Dollar (GBP/USD) exchange rate tumbled as the US Dollar (USD) rebounded today. Investors have been buying into the safe-haven currency as global market sentiment remains cautious.

The Pound to US Dollar (GBP/USD) exchange rate tumbled as the US Dollar (USD) rebounded today. Investors have been buying into the safe-haven currency as global market sentiment remains cautious.

Om Prakash Arora

Dollar Down, Slows Rally Over Treasury Yields Retreat

The dollar was down on Wednesday morning in Asia, with a retreat in U.S. Treasury yields sapping momentum from the U.S. currency’s recent rally and investors cautiously resumed bets on a continuous slide for the dollar.

The U.S. Dollar Index that tracks the greenback against a basket of other currencies inched down 0.08% to 89.940 by 9:51 PM ET (2:51 AM GMT).

The USD/JPY pair edged down 0.15% to 103.59.

The AUD/USD pair inched down 0.08% to 0.7765, while the NZD/USD pair edged up 0.19% to 0.7229.

The dollar was down on Wednesday morning in Asia, with a retreat in U.S. Treasury yields sapping momentum from the U.S. currency’s recent rally and investors cautiously resumed bets on a continuous slide for the dollar.

The U.S. Dollar Index that tracks the greenback against a basket of other currencies inched down 0.08% to 89.940 by 9:51 PM ET (2:51 AM GMT).

The USD/JPY pair edged down 0.15% to 103.59.

The AUD/USD pair inched down 0.08% to 0.7765, while the NZD/USD pair edged up 0.19% to 0.7229.

: