RvR Ventures / Профиль

Специалист по финансовому анализу, трейдингу и стратегии с общим опытом работы 9 лет на рынке Форекс.

Остановить Потерять свои с трудом заработанные деньги для умных брокеров и компаний Forex.

Мы узнали, КАК не проиграть, проиграв в реальном времени и экспериментируя на реальных торгах. Обладая опытом работы, сильными техническими и аналитическими навыками, мы надеемся поделиться устойчивыми и последовательными торговыми сигналами. Как говорит наш основатель: Торгуйте меньше, но торгуйте хорошо. Одной ошибки достаточно, чтобы убить 100% капитала + прибыль, и одного правильного шага в нужное время достаточно, чтобы умножить свой капитал на прибыль в 100%.

Желаю вам всего наилучшего! Для получения дополнительной информации и запросов обращайтесь по адресу ask.rvr@gmail.com.

ПРЕДУПРЕЖДЕНИЕ О ВЫСОКИМ РИСКЕ: Торговля иностранной валютой несет высокий уровень риска, который может не подходить для всех инвесторов. Кредитное плечо создает дополнительный риск и экспозицию потери. Прежде чем вы решите торговать иностранной валютой, тщательно рассмотрите свои инвестиционные цели, уровень опыта и толерантность к риску. Вы можете потерять часть или все свои первоначальные инвестиции; Не вкладывайте деньги, которые вы не можете позволить себе потерять. Мы строго следим за международными правилами и политикой по борьбе с отмыванием денег. Подписка на сигнальные сервисы не гарантирует получение прибыли каким-либо прямым или косвенным образом. Подписавшись на этот сигнал, вы берете 100% ответственности за прибыли или убытки, сделанные вами в результате этой подписки.

Настоящим вы обязуетесь не передавать / публиковать информацию / анализ / расчеты / с помощью этого сигнала любой третьей стороне любым прямым или косвенным образом на любой платформе - электронной, печатной или беспроводной.

Для получения дополнительной информации и запросов обращайтесь по адресу ask.rvr@gmail.com.

Spetsialist po finansovomu analizu, treydingu i strategii s obshchim opytom raboty 9 let na rynke Foreks.

Ostanovit' Poteryat' svoi s trudom zarabotannyye den'gi dlya umnykh brokerov i kompaniy Forex.

My uznali, KAK ne proigrat', proigrav v real'nom vremeni i eksperimentiruya na real'nykh torgakh. Obladaya opytom raboty, sil'nymi tekhnicheskimi i analiticheskimi navykami, my nadeyemsya podelit'sya ustoychivymi i posledovatel'nymi torgovymi signalami. Kak govorit nash osnovatel': Torguyte men'she, no torguyte khorosho. Odnoy oshibki dostatochno, chtoby ubit' 100% kapitala + pribyl', i odnogo pravil'nogo shaga v nuzhnoye vremya dostatochno, chtoby umnozhit' svoy kapital na pribyl' v 100%.

Zhelayu vam vsego nailuchshego! Dlya polucheniya dopolnitel'noy informatsii i zaprosov obrashchaytes' po adresu ask.rvr@gmail.com.

PREDUPREZHDENIYe O VYSOKIM RISKE: Torgovlya inostrannoy valyutoy neset vysokiy uroven' riska, kotoryy mozhet ne podkhodit' dlya vsekh investorov. Kreditnoye plecho sozdayet dopolnitel'nyy risk i ekspozitsiyu poteri. Prezhde chem vy reshite torgovat' inostrannoy valyutoy, tshchatel'no rassmotrite svoi investitsionnyye tseli, uroven' opyta i tolerantnost' k risku. Vy mozhete poteryat' chast' ili vse svoi pervonachal'nyye investitsii; Ne vkladyvayte den'gi, kotoryye vy ne mozhete pozvolit' sebe poteryat'. My strogo sledim za mezhdunarodnymi pravilami i politikoy po bor'be s otmyvaniyem deneg. Podpiska na signal'nyye servisy ne garantiruyet polucheniye pribyli kakim-libo pryamym ili kosvennym obrazom. Podpisavshis' na etot signal, vy berete 100% otvetstvennosti za pribyli ili ubytki, sdelannyye vami v rezul'tate etoy podpiski.

Nastoyashchim vy obyazuyetes' ne peredavat' / publikovat' informatsiyu / analiz / raschety / s pomoshch'yu etogo signala lyuboy tret'yey storone lyubym pryamym ili kosvennym obrazom na lyuboy platforme - elektronnoy, pechatnoy ili besprovodnoy.

Dlya polucheniya dopolnitel'noy informatsii i zaprosov obrashchaytes' po adresu ask.rvr@gmail.com.

Остановить Потерять свои с трудом заработанные деньги для умных брокеров и компаний Forex.

Мы узнали, КАК не проиграть, проиграв в реальном времени и экспериментируя на реальных торгах. Обладая опытом работы, сильными техническими и аналитическими навыками, мы надеемся поделиться устойчивыми и последовательными торговыми сигналами. Как говорит наш основатель: Торгуйте меньше, но торгуйте хорошо. Одной ошибки достаточно, чтобы убить 100% капитала + прибыль, и одного правильного шага в нужное время достаточно, чтобы умножить свой капитал на прибыль в 100%.

Желаю вам всего наилучшего! Для получения дополнительной информации и запросов обращайтесь по адресу ask.rvr@gmail.com.

ПРЕДУПРЕЖДЕНИЕ О ВЫСОКИМ РИСКЕ: Торговля иностранной валютой несет высокий уровень риска, который может не подходить для всех инвесторов. Кредитное плечо создает дополнительный риск и экспозицию потери. Прежде чем вы решите торговать иностранной валютой, тщательно рассмотрите свои инвестиционные цели, уровень опыта и толерантность к риску. Вы можете потерять часть или все свои первоначальные инвестиции; Не вкладывайте деньги, которые вы не можете позволить себе потерять. Мы строго следим за международными правилами и политикой по борьбе с отмыванием денег. Подписка на сигнальные сервисы не гарантирует получение прибыли каким-либо прямым или косвенным образом. Подписавшись на этот сигнал, вы берете 100% ответственности за прибыли или убытки, сделанные вами в результате этой подписки.

Настоящим вы обязуетесь не передавать / публиковать информацию / анализ / расчеты / с помощью этого сигнала любой третьей стороне любым прямым или косвенным образом на любой платформе - электронной, печатной или беспроводной.

Для получения дополнительной информации и запросов обращайтесь по адресу ask.rvr@gmail.com.

Spetsialist po finansovomu analizu, treydingu i strategii s obshchim opytom raboty 9 let na rynke Foreks.

Ostanovit' Poteryat' svoi s trudom zarabotannyye den'gi dlya umnykh brokerov i kompaniy Forex.

My uznali, KAK ne proigrat', proigrav v real'nom vremeni i eksperimentiruya na real'nykh torgakh. Obladaya opytom raboty, sil'nymi tekhnicheskimi i analiticheskimi navykami, my nadeyemsya podelit'sya ustoychivymi i posledovatel'nymi torgovymi signalami. Kak govorit nash osnovatel': Torguyte men'she, no torguyte khorosho. Odnoy oshibki dostatochno, chtoby ubit' 100% kapitala + pribyl', i odnogo pravil'nogo shaga v nuzhnoye vremya dostatochno, chtoby umnozhit' svoy kapital na pribyl' v 100%.

Zhelayu vam vsego nailuchshego! Dlya polucheniya dopolnitel'noy informatsii i zaprosov obrashchaytes' po adresu ask.rvr@gmail.com.

PREDUPREZHDENIYe O VYSOKIM RISKE: Torgovlya inostrannoy valyutoy neset vysokiy uroven' riska, kotoryy mozhet ne podkhodit' dlya vsekh investorov. Kreditnoye plecho sozdayet dopolnitel'nyy risk i ekspozitsiyu poteri. Prezhde chem vy reshite torgovat' inostrannoy valyutoy, tshchatel'no rassmotrite svoi investitsionnyye tseli, uroven' opyta i tolerantnost' k risku. Vy mozhete poteryat' chast' ili vse svoi pervonachal'nyye investitsii; Ne vkladyvayte den'gi, kotoryye vy ne mozhete pozvolit' sebe poteryat'. My strogo sledim za mezhdunarodnymi pravilami i politikoy po bor'be s otmyvaniyem deneg. Podpiska na signal'nyye servisy ne garantiruyet polucheniye pribyli kakim-libo pryamym ili kosvennym obrazom. Podpisavshis' na etot signal, vy berete 100% otvetstvennosti za pribyli ili ubytki, sdelannyye vami v rezul'tate etoy podpiski.

Nastoyashchim vy obyazuyetes' ne peredavat' / publikovat' informatsiyu / analiz / raschety / s pomoshch'yu etogo signala lyuboy tret'yey storone lyubym pryamym ili kosvennym obrazom na lyuboy platforme - elektronnoy, pechatnoy ili besprovodnoy.

Dlya polucheniya dopolnitel'noy informatsii i zaprosov obrashchaytes' po adresu ask.rvr@gmail.com.

RvR Ventures

15.02.2022 | SR Zone | XAUUSD Analysis | RvR Ventures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

RvR Ventures

11.02.2022 | Sell alert on 10.02.2022 | SR Zone | XAUUSD Analysis | RvR Ventures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

RvR Ventures

09.02.2022 | Co-relations | RvR Spot Gold | XAUUSD Analysis

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

RvR Ventures

08.02.2022 | Target 1818.18 Achieved | Spot Gold Analysis | XAUUSD Analysis | RvR Ventures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

RvR Ventures

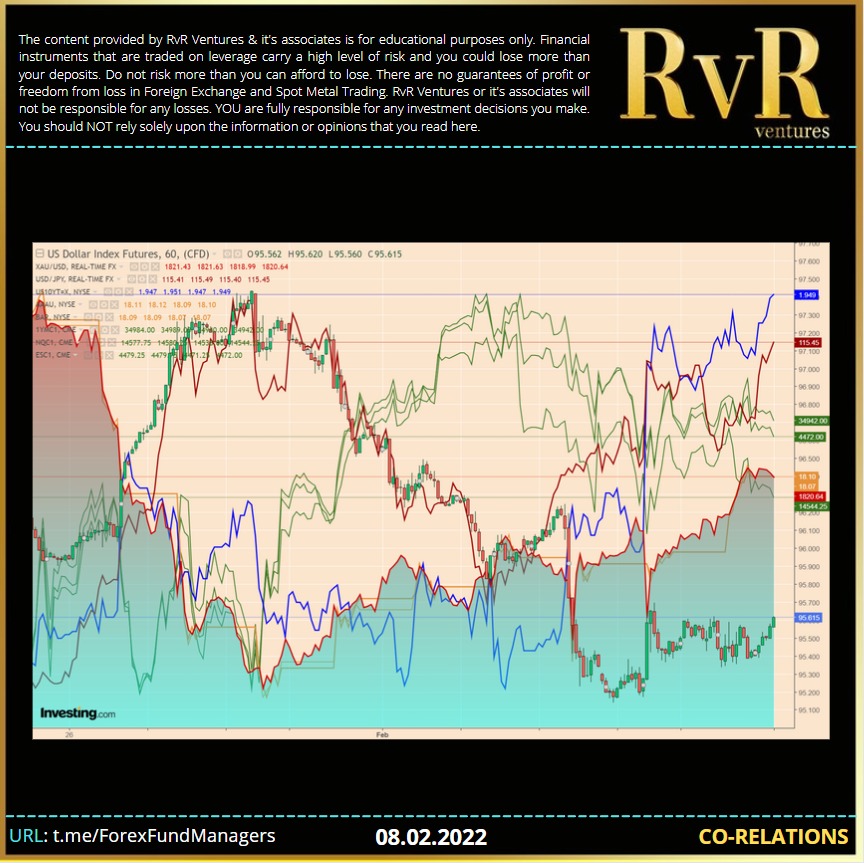

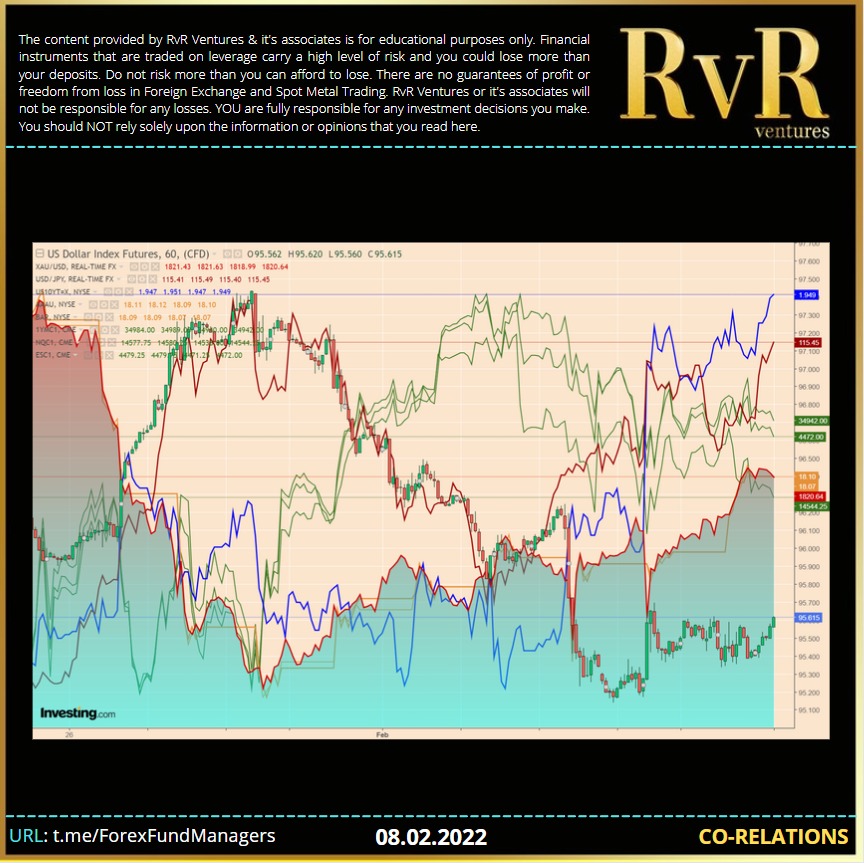

08.02.2022 | Co-relations | RvR Spot Gold | XAUUSD Analysis

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

RvR Ventures

07.02.2022 GRTP | SR | RT | SGN | PR Spot Gold | XAUUSD Analysis

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

RvR Ventures

07.02.2022 | Co-relations | RvR Spot Gold | XAUUSD Analysis

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

RvR Ventures

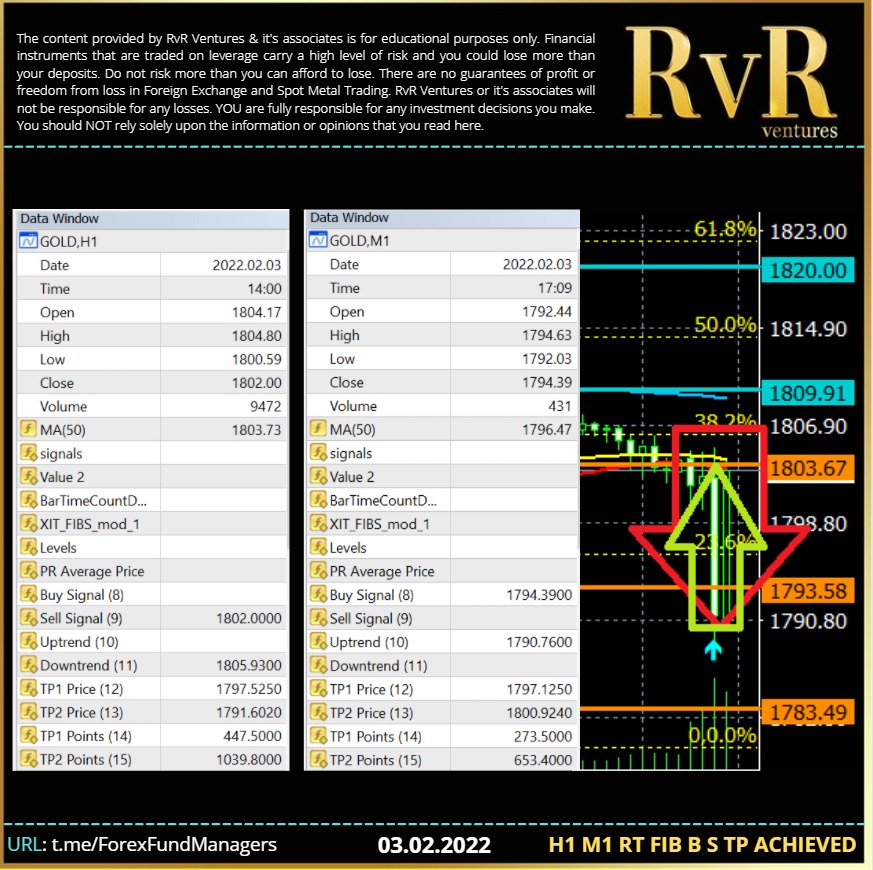

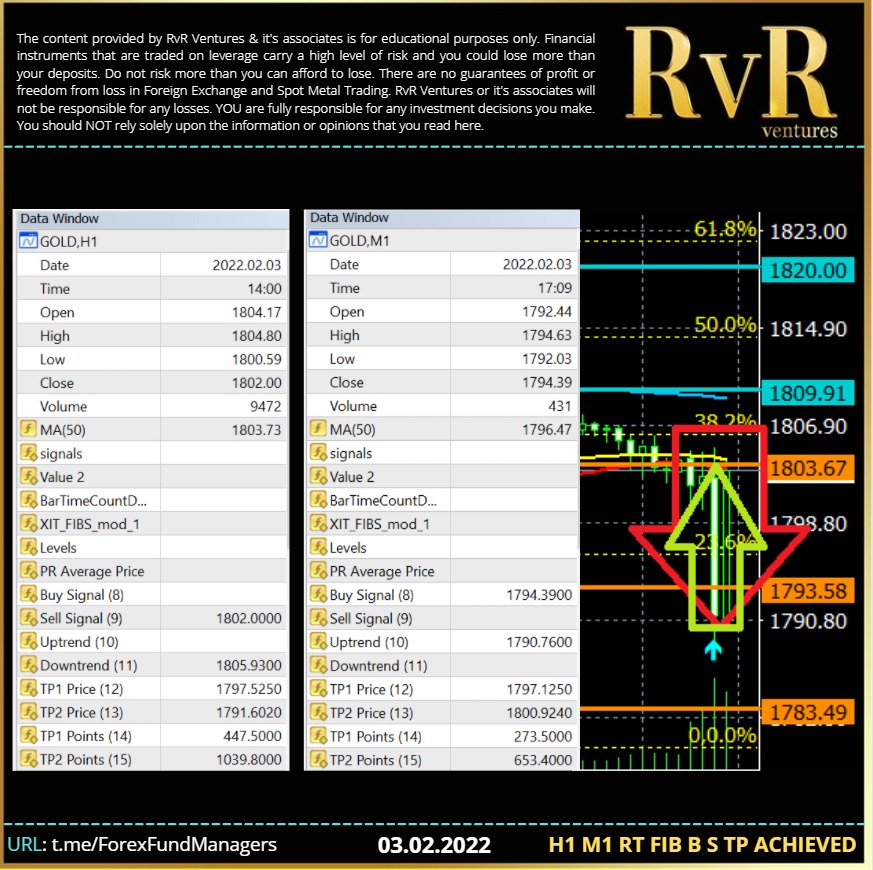

03.02.2022 | H1 M1 RT FIB B S TP Achieved | Spot Gold Analysis | XAUUSD Analysis | RvR Ventures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

RvR Ventures

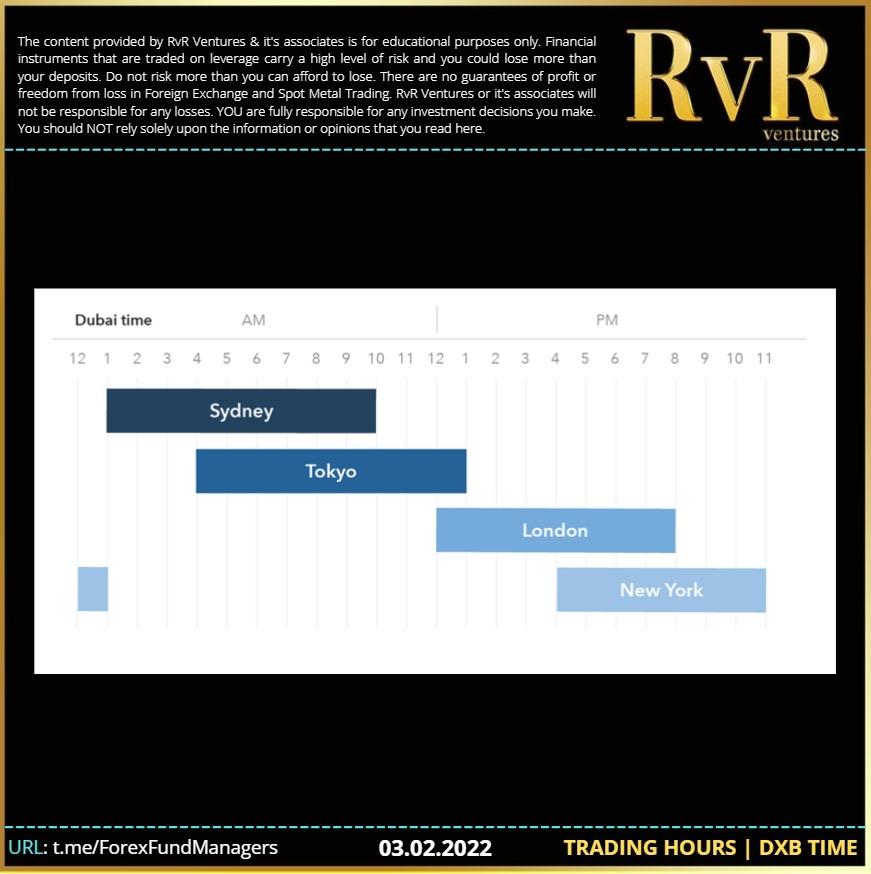

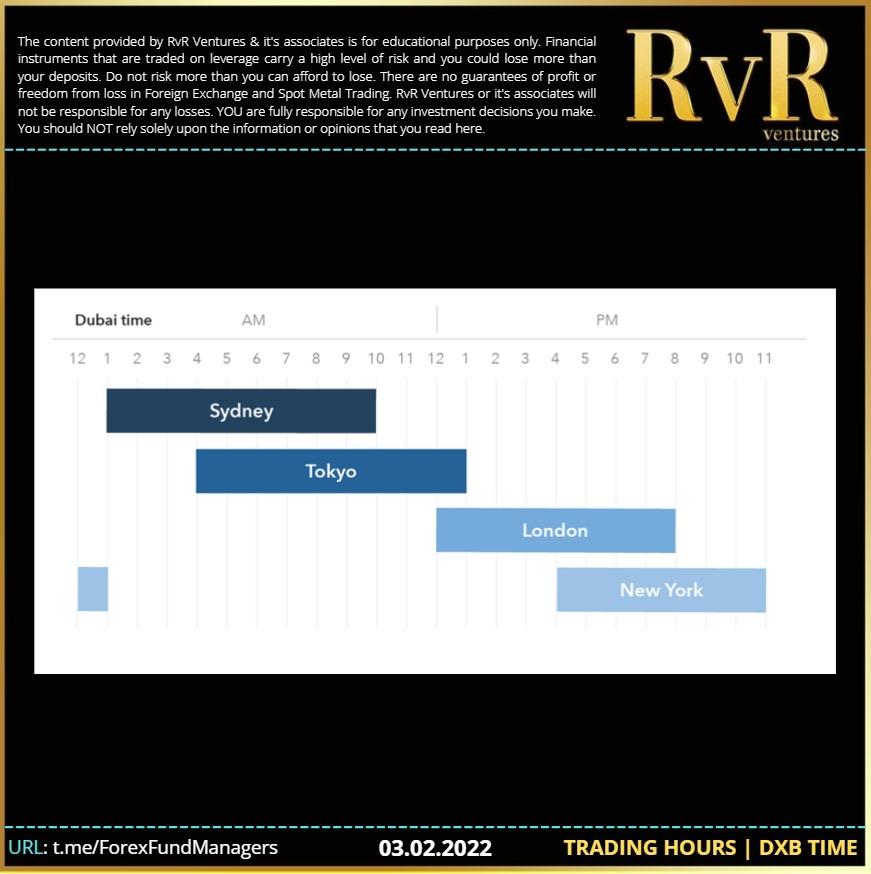

Forex Trading Time | DXB Time | RvR Ventures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

RvR Ventures

02.02.2022 | SR RT Zones| RvR Spot Gold | XAUUSD Analysis

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

RvR Ventures

02.02.2022 | Co-relations | RvR Spot Gold | XAUUSD Analysis

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

RvR Ventures

02.02.2022 | GTPS | PRS | SR | Spot Gold Analysis | XAUUSD Analysis | RvR Ventures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

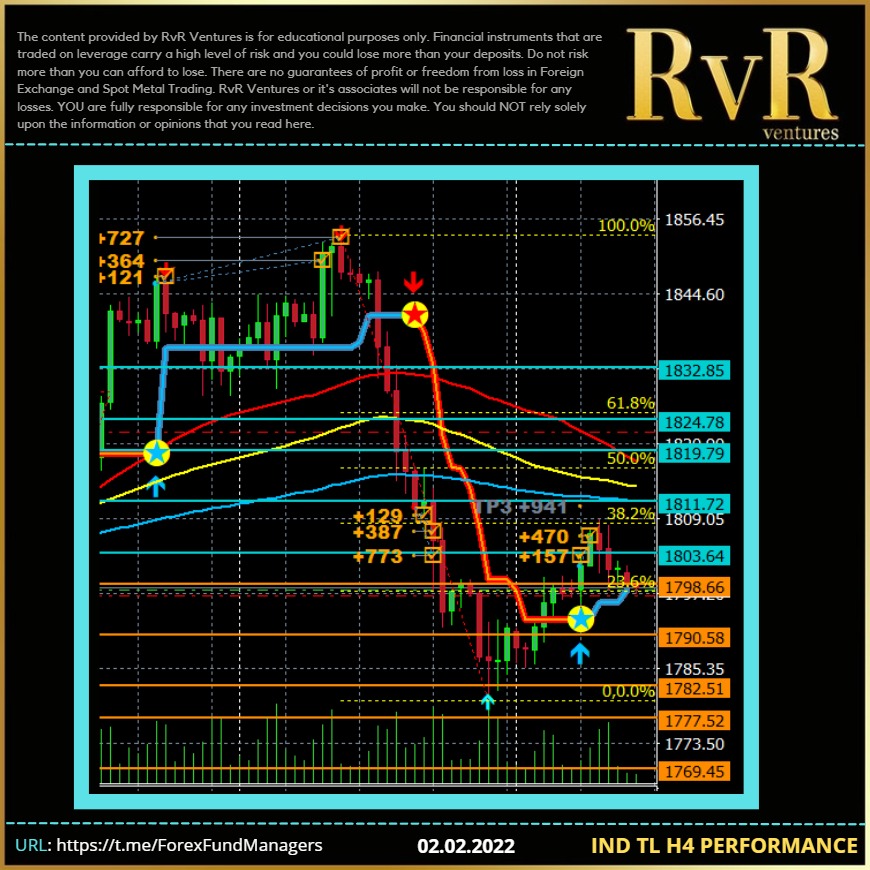

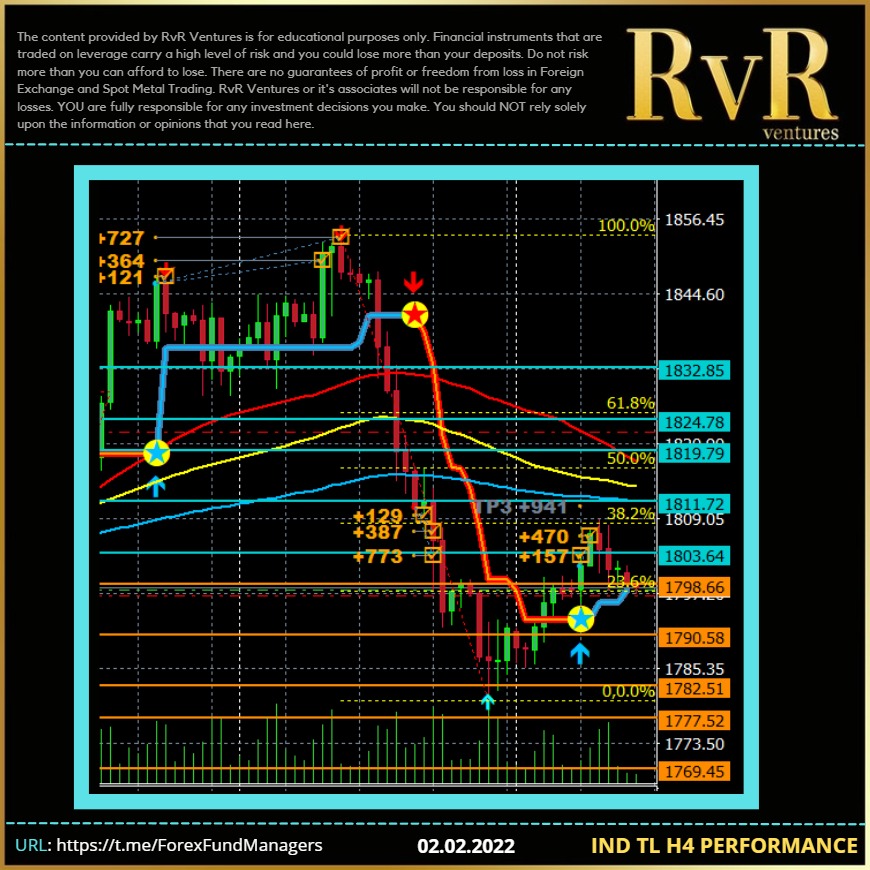

RvR Ventures

02.02.2022 | IND TL H4 Performance | Spot Gold | XAUUSD Analysis | RvR Ventures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

RvR Ventures

02.02.2022 | ST | SOK | MTD | MP | FF | SR | Spot Gold Analysis | XAUUSD Analysis | RvR Ventures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

RvR Ventures

02.02.2022 | Price Channel | Support and Resistance Zone | Spot Gold | XAUUSD Analysis | RvR Ventures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

RvR Ventures

01.02.2022 | Past Data based Support and Resistance Zone | Spot Gold | XAUUSD Analysis | RvR Ventures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

RvR Ventures

19.01.2022 | Co-relations | RvR Spot Gold | XAUUSD Analysis

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

RvR Ventures

18.01.2022 Co-relations | RvR Spot Gold | XAUUSD Analysis

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

Join our Telegram channel to get latest updates and analysis: https://t.me/ForexFundManagers

#XAUUSD #Gold #Analysis #Forex #ForexTrading #RvRVentures

RvR Ventures

Evergrande collapse could have a ‘domino effect’ on China’s property sector

A spillover of the crisis at China Evergrande Group into other parts of the economy could become a systemic problem, a sizable number of developers in the offshore dollar market appear to be “highly distressed” and may not survive much longer if the refinancing channel remains shut for a prolonged period.

China’s “highly distressed” real estate companies are at risk of collapse as the country’s highly indebted developer Evergrande is on the brink of default. Evergrande, the world’s most indebted property developer, is crumbling under the weight of more than $300 billion of debt and warned more than once it could default. Banks have reportedly declined to extend new loans to buyers of uncompleted Evergrande residential projects, while ratings agencies have repeatedly downgraded the firm, citing its liquidity crunch.

The financial position of the other Chinese property developers also took a hit following rules outlined by the Chinese government to rein in borrowing costs of the real estate firms. The measures included placing a cap on debt in relation to a company’s cash flows, assets and capital levels.

Evergrande bosses face ‘severe punishment’ after securing early redemptions

Six senior Evergrande executives face “severe punishment” for securing early redemptions on investment products that the indebted Chinese property group subsequently told retail investors it could not repay on time, the company has said.

The admission comes ahead of a critical fortnight for the developer, which is struggling to repay investors, banks and bondholders, as well as complete flats for homebuyers who paid for their new properties in advance.

Hong Kong-listed shares in Evergrande fell as much as 18.9 per cent on Monday, while broader concerns about the health of China’s real estate sector triggered a wider sell-off.

Last week hundreds of retail investors protested at Evergrande’s headquarters in the southern city of Shenzhen, after executives said they needed more time to pay the interest and principal on high-yielding wealth management products issued by the group. They were joined by suppliers who said they had also not been paid.

Du Liang, a senior company executive, told investors that Evergrande had used at least Rmb40bn ($6.2bn) from wealth management sales to fund construction projects across the country, according to people who participated in settlement negotiations. In addition to the money Evergrande has borrowed from 80,000 retail investors, the group owes other creditors and suppliers an estimated $300bn.

In a statement at the weekend, Evergrande said that as of May 1 more than 40 group executives had purchased its investment products. Six of them, who had secured early redemptions of their investments, will return the money.

“All funds redeemed by the managers must be returned and severe penalties will be imposed,” said the company, which has also offered to repay investors with discounted flats and parking lots.

It is common for the owners and employees of heavily indebted Chinese companies to buy such products to help fund operations. Ding Yumei, wife of Evergrande founder and chair Hui Ka Yan, paid Rmb20m for group investment products in July.

Evergrande’s attempts to calm investor anger highlight the many challenges its debt crisis poses for the Chinese government, which is reluctant to bail out the company even though its collapse could have wide-ranging consequences.

Some Evergrande bonds have recently traded as low as 20 cents on the dollar, while yields on other Chinese property groups’ debt have risen sharply.

The value of Evergrande’s Hong Kong-traded shares have fallen almost 90 per cent over the past year.

The Chinese government recently organised a bailout of Huarong, a heavily indebted state-owned asset manager, by other government-controlled asset managers and banks. But it is reluctant to do the same for a large private-sector company such as Evergrande.

IMPACT: STRONGER DOLLAR. Volatility in GOLD | Panic based SELLING in Equities

A spillover of the crisis at China Evergrande Group into other parts of the economy could become a systemic problem, a sizable number of developers in the offshore dollar market appear to be “highly distressed” and may not survive much longer if the refinancing channel remains shut for a prolonged period.

China’s “highly distressed” real estate companies are at risk of collapse as the country’s highly indebted developer Evergrande is on the brink of default. Evergrande, the world’s most indebted property developer, is crumbling under the weight of more than $300 billion of debt and warned more than once it could default. Banks have reportedly declined to extend new loans to buyers of uncompleted Evergrande residential projects, while ratings agencies have repeatedly downgraded the firm, citing its liquidity crunch.

The financial position of the other Chinese property developers also took a hit following rules outlined by the Chinese government to rein in borrowing costs of the real estate firms. The measures included placing a cap on debt in relation to a company’s cash flows, assets and capital levels.

Evergrande bosses face ‘severe punishment’ after securing early redemptions

Six senior Evergrande executives face “severe punishment” for securing early redemptions on investment products that the indebted Chinese property group subsequently told retail investors it could not repay on time, the company has said.

The admission comes ahead of a critical fortnight for the developer, which is struggling to repay investors, banks and bondholders, as well as complete flats for homebuyers who paid for their new properties in advance.

Hong Kong-listed shares in Evergrande fell as much as 18.9 per cent on Monday, while broader concerns about the health of China’s real estate sector triggered a wider sell-off.

Last week hundreds of retail investors protested at Evergrande’s headquarters in the southern city of Shenzhen, after executives said they needed more time to pay the interest and principal on high-yielding wealth management products issued by the group. They were joined by suppliers who said they had also not been paid.

Du Liang, a senior company executive, told investors that Evergrande had used at least Rmb40bn ($6.2bn) from wealth management sales to fund construction projects across the country, according to people who participated in settlement negotiations. In addition to the money Evergrande has borrowed from 80,000 retail investors, the group owes other creditors and suppliers an estimated $300bn.

In a statement at the weekend, Evergrande said that as of May 1 more than 40 group executives had purchased its investment products. Six of them, who had secured early redemptions of their investments, will return the money.

“All funds redeemed by the managers must be returned and severe penalties will be imposed,” said the company, which has also offered to repay investors with discounted flats and parking lots.

It is common for the owners and employees of heavily indebted Chinese companies to buy such products to help fund operations. Ding Yumei, wife of Evergrande founder and chair Hui Ka Yan, paid Rmb20m for group investment products in July.

Evergrande’s attempts to calm investor anger highlight the many challenges its debt crisis poses for the Chinese government, which is reluctant to bail out the company even though its collapse could have wide-ranging consequences.

Some Evergrande bonds have recently traded as low as 20 cents on the dollar, while yields on other Chinese property groups’ debt have risen sharply.

The value of Evergrande’s Hong Kong-traded shares have fallen almost 90 per cent over the past year.

The Chinese government recently organised a bailout of Huarong, a heavily indebted state-owned asset manager, by other government-controlled asset managers and banks. But it is reluctant to do the same for a large private-sector company such as Evergrande.

IMPACT: STRONGER DOLLAR. Volatility in GOLD | Panic based SELLING in Equities

RvR Ventures

So much money printed. Excessive debt. Even pandemic! And gold failed to hold gains. But that’s how markets work, no matter what gold permabulls say. Lots of money has been already printed, and the world has been suffering from the pandemic for well over a year. Gold should be soaring in this environment! Silver should be soaring! Gold stocks should be soaring too!

This is what happened in the previous 3 cases after the retail sales report:

• gold declined after retail sales disappointed in June

• gold topped after retail sales outperformed in July

• gold paused its rally after retail sales disappointed in August

• gold declined after retail sales outperformed in September

Gold failed to hold its gains above its 2011 highs. Can you imagine that? So much money printed. Excessive debts. Even pandemic! And gold still failed to hold gains above its 2011 highs. If this doesn’t make you question the validity of the bullish narrative in the medium term in the precious metals sector, consider this:

Silver – with an even better fundamental situation than gold – wasn’t even close to its 2011 highs (~50). The closest it got to this level was a brief rally above $30. And now, after even more money was printed, silver is in its low 20s.

And gold stocks? Gold stocks are not above their 2011 highs, they were not even close. They were not above their 2008 highs either. In fact, the HUI Index – the flagship proxy for gold stocks – is trading below its 2003 high! And that’s in nominal prices. In real prices, it’s even lower. Just imagine how weak the precious metals sector is if the part of the sector that is supposed to rally first (that’s what we usually see at the beginning of major rallies) is underperforming in such a ridiculous manner.

And that’s just the beginning of the decline in the mining stocks.

More to Come!

*Stay Alert| Do not pile up positions. Maintain price gap, implement intraday trades. Exit trades in net profit, do not hold trades. A Major market correction $100-130 expected before 10 October, 2021 or between 09-19 November, 2021.*

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our analysis. Invest only as much as you can afford to recover in case of losses.

This is what happened in the previous 3 cases after the retail sales report:

• gold declined after retail sales disappointed in June

• gold topped after retail sales outperformed in July

• gold paused its rally after retail sales disappointed in August

• gold declined after retail sales outperformed in September

Gold failed to hold its gains above its 2011 highs. Can you imagine that? So much money printed. Excessive debts. Even pandemic! And gold still failed to hold gains above its 2011 highs. If this doesn’t make you question the validity of the bullish narrative in the medium term in the precious metals sector, consider this:

Silver – with an even better fundamental situation than gold – wasn’t even close to its 2011 highs (~50). The closest it got to this level was a brief rally above $30. And now, after even more money was printed, silver is in its low 20s.

And gold stocks? Gold stocks are not above their 2011 highs, they were not even close. They were not above their 2008 highs either. In fact, the HUI Index – the flagship proxy for gold stocks – is trading below its 2003 high! And that’s in nominal prices. In real prices, it’s even lower. Just imagine how weak the precious metals sector is if the part of the sector that is supposed to rally first (that’s what we usually see at the beginning of major rallies) is underperforming in such a ridiculous manner.

And that’s just the beginning of the decline in the mining stocks.

More to Come!

*Stay Alert| Do not pile up positions. Maintain price gap, implement intraday trades. Exit trades in net profit, do not hold trades. A Major market correction $100-130 expected before 10 October, 2021 or between 09-19 November, 2021.*

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our analysis. Invest only as much as you can afford to recover in case of losses.

: