Piyush Lalsingh Ratnu / Профиль

- Информация

|

3 года

опыт работы

|

0

продуктов

|

0

демо-версий

|

|

0

работ

|

1

сигналов

|

0

подписчиков

|

Piyush Lalsingh Ratnu

TRADERS GEAR UP FOR FED RATE DECISION!

Gold trimmed Monday’s gains amid resurgent US Dollar demand, with XAU/USD trading around $2,154 in the mid-American session. The Greenback found strength following central banks’ mostly dovish announcements, as the Reserve Bank of Australia (RBA) and the Bank of Japan (BoJ) unveiled their monetary policy decisions.

The RBA left rates unchanged and maintained its cautious outlook on economic progress and easing inflation. The BoJ, on the other hand, delivered as expected, lifting rates for the first time in 17 years and dropping the Yield Curve Control (YCC) program. However, the BoJ still doubted it could maintain healthy inflation and pledged to continue buying bonds.

It’s a calm before the US Federal Reserve (Fed) interest rate decision storm, as Gold traders turn on the sidelines, refraining from placing any fresh positional bets on the bright metal. Markets are turning caution, as tensions mount in the run-up to the Fed showdown, with markets eagerly awaiting fresh hints on the timing and scope of the Fed’s first interest cut this year.

Volatility dropped in the US session as investors gear up for the Federal Reserve (Fed) announcement. The United States (US) central bank will unveil its decision on Wednesday alongside fresh economic projections. Financial markets head into the event with high levels of caution, as recent data suggest US policymakers may hold rates higher for longer.

Markets are currently pricing in just about 60% of a June Fed rate cut. While the December Fed’s Dot Plot chart projects three rate cuts, it remains to be seen what the central bank’s outlook on interest rate cuts offers. Also, of note, will be Fed Chair Jerome Powell’s comments at the post-policy meeting press conference for fresh impact on the value of the US Dollar and the non-interest-bearing Gold price.

On Tuesday, Gold price snapped its early rebound and fell as low as $2,148 before recovering losses to settle near $2,158. The downtick in the Gold price was sponsored by a renewed US Dollar buying interest.

The USD/JPY pair rallied hard, following the expected interest rate hike by the Bank of Japan (BoJ), driving the US Dollar higher while weighing on the US Dollar. However, some modest weakness in the US Treasury bond yields and a risk-on rally on Wall Street indices capped the US Dollar upside, allowing Gold price to stage a decent comeback.

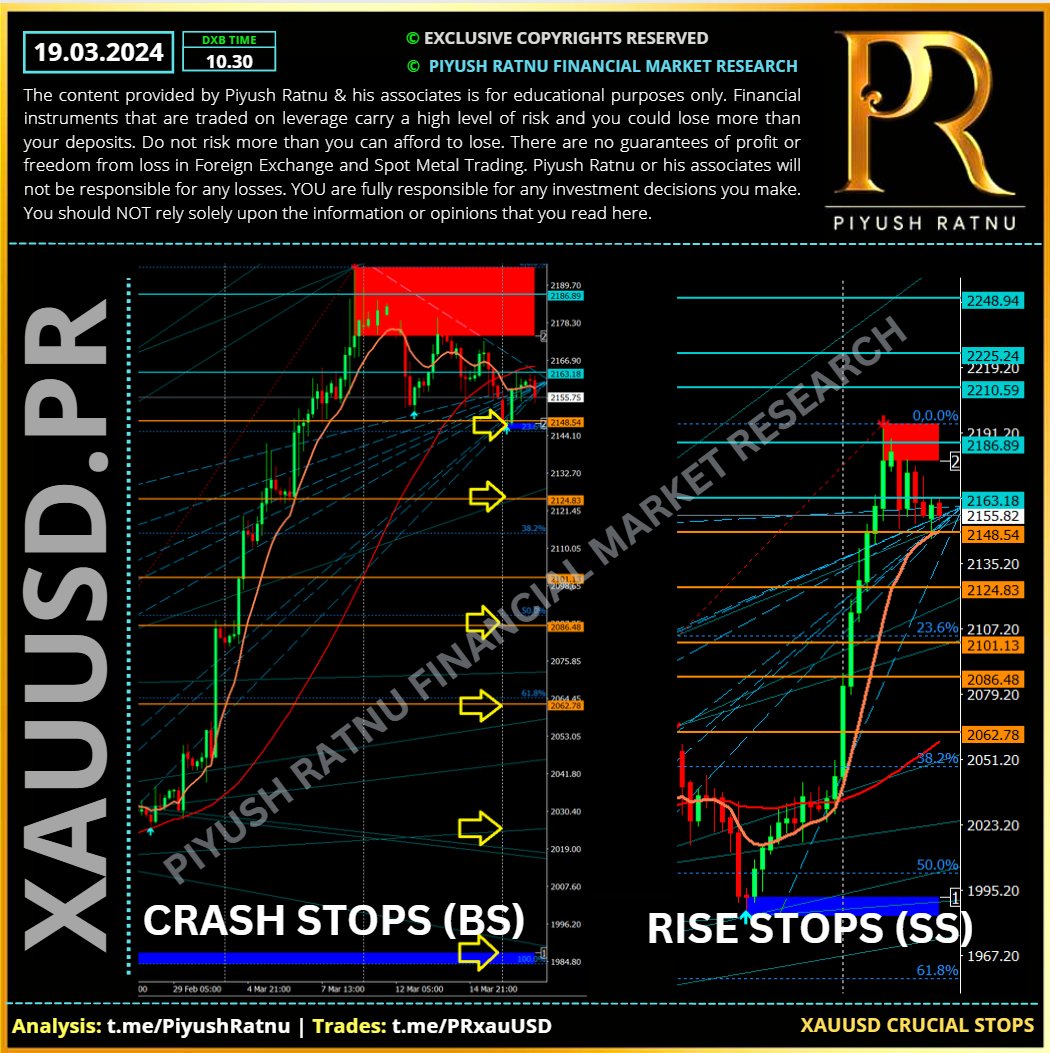

🟢 Crucial Price Zones for next 15 trading days:

BS: C: $2121/2100/2085/2048

SS: R: $2196/2200/2233/2266

🟢 I expect A pattern:

I will SELL HIGHS to pull NAP above $2130/2145 in case of higher price rallies. PG $30 | Exit NAP

🆘Current DD: 2% | Margin available: 58,000%

Current NAP: $2141 | Expected Exit: $2130/2121

🟢 D1 PRSRZ | Price Zones | XAUUSD

📌 PPZ R1 2160 S1 2154

R2 2170

R3 2179

R4 2185

R5 2194

S2 2144

S3 2135

S4 2129

S5 2118

🟢 W1 PRSRZ | Price Zones

📌 PPZ R1 2163 S1 2148

R2 2186

R3 2210

R4 2225

R5 2248

S2 2124

S3 2101

S4 2086

S5 2062

🔘 GFA Parameters:

SMA

XAUUSD at H4S5

H4S1 $2121 H4S2 $2075 crucial stops

🍎A Patterns:

H1A0.0 2144

H4A50 2121

H4A618 2101

H4A100 2042

🍎 V patterns:

H1V100 2170

H4V0.0 2196

🔘 Co-relations:

📌 USDJPY: CMP 151.555: at HIGHS of

🔺16.10.2022: Price: 151.800

🔺12.11.2023: Price: 151.800

📌 Price of XAUUSD CMP: $2157, past price track record:

🔻 16.10.2022: Price: $1626

🔻 12.11.2023: Price: $1936

🟢 Technical Co-relations:

🔺USD S 62

🔻JPY S 11

🔺AUD S 60

🔺DXY 103.500 (RT+)

🔺US10YT 4.293 RT+)

US F RT+ H1S5

Gold trimmed Monday’s gains amid resurgent US Dollar demand, with XAU/USD trading around $2,154 in the mid-American session. The Greenback found strength following central banks’ mostly dovish announcements, as the Reserve Bank of Australia (RBA) and the Bank of Japan (BoJ) unveiled their monetary policy decisions.

The RBA left rates unchanged and maintained its cautious outlook on economic progress and easing inflation. The BoJ, on the other hand, delivered as expected, lifting rates for the first time in 17 years and dropping the Yield Curve Control (YCC) program. However, the BoJ still doubted it could maintain healthy inflation and pledged to continue buying bonds.

It’s a calm before the US Federal Reserve (Fed) interest rate decision storm, as Gold traders turn on the sidelines, refraining from placing any fresh positional bets on the bright metal. Markets are turning caution, as tensions mount in the run-up to the Fed showdown, with markets eagerly awaiting fresh hints on the timing and scope of the Fed’s first interest cut this year.

Volatility dropped in the US session as investors gear up for the Federal Reserve (Fed) announcement. The United States (US) central bank will unveil its decision on Wednesday alongside fresh economic projections. Financial markets head into the event with high levels of caution, as recent data suggest US policymakers may hold rates higher for longer.

Markets are currently pricing in just about 60% of a June Fed rate cut. While the December Fed’s Dot Plot chart projects three rate cuts, it remains to be seen what the central bank’s outlook on interest rate cuts offers. Also, of note, will be Fed Chair Jerome Powell’s comments at the post-policy meeting press conference for fresh impact on the value of the US Dollar and the non-interest-bearing Gold price.

On Tuesday, Gold price snapped its early rebound and fell as low as $2,148 before recovering losses to settle near $2,158. The downtick in the Gold price was sponsored by a renewed US Dollar buying interest.

The USD/JPY pair rallied hard, following the expected interest rate hike by the Bank of Japan (BoJ), driving the US Dollar higher while weighing on the US Dollar. However, some modest weakness in the US Treasury bond yields and a risk-on rally on Wall Street indices capped the US Dollar upside, allowing Gold price to stage a decent comeback.

🟢 Crucial Price Zones for next 15 trading days:

BS: C: $2121/2100/2085/2048

SS: R: $2196/2200/2233/2266

🟢 I expect A pattern:

I will SELL HIGHS to pull NAP above $2130/2145 in case of higher price rallies. PG $30 | Exit NAP

🆘Current DD: 2% | Margin available: 58,000%

Current NAP: $2141 | Expected Exit: $2130/2121

🟢 D1 PRSRZ | Price Zones | XAUUSD

📌 PPZ R1 2160 S1 2154

R2 2170

R3 2179

R4 2185

R5 2194

S2 2144

S3 2135

S4 2129

S5 2118

🟢 W1 PRSRZ | Price Zones

📌 PPZ R1 2163 S1 2148

R2 2186

R3 2210

R4 2225

R5 2248

S2 2124

S3 2101

S4 2086

S5 2062

🔘 GFA Parameters:

SMA

XAUUSD at H4S5

H4S1 $2121 H4S2 $2075 crucial stops

🍎A Patterns:

H1A0.0 2144

H4A50 2121

H4A618 2101

H4A100 2042

🍎 V patterns:

H1V100 2170

H4V0.0 2196

🔘 Co-relations:

📌 USDJPY: CMP 151.555: at HIGHS of

🔺16.10.2022: Price: 151.800

🔺12.11.2023: Price: 151.800

📌 Price of XAUUSD CMP: $2157, past price track record:

🔻 16.10.2022: Price: $1626

🔻 12.11.2023: Price: $1936

🟢 Technical Co-relations:

🔺USD S 62

🔻JPY S 11

🔺AUD S 60

🔺DXY 103.500 (RT+)

🔺US10YT 4.293 RT+)

US F RT+ H1S5

Piyush Lalsingh Ratnu

18.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

#XAUUSD $2048 on the cards? Co-relations hint so!

Piyush Ratnu Financial Market Research | Dubai | Abu Dhabi | Mumbai

Piyush Ratnu Financial Market Research | Dubai | Abu Dhabi | Mumbai

Piyush Lalsingh Ratnu

Key Economic Data today:

10:30 JPY BoJ Press Conference

16:30 USD Building Permits (Feb) 1.500M 1.489M

16:30 USD Housing Starts (Feb) 1.430M 1.331M

16:30 USD Housing Starts (MoM) (Feb) -14.8%

20:30 USD Atlanta Fed GDPNow (Q1) 2.3% 2.3%

21:00 USD 20-Year Bond Auction 4.595%

10:30 JPY BoJ Press Conference

16:30 USD Building Permits (Feb) 1.500M 1.489M

16:30 USD Housing Starts (Feb) 1.430M 1.331M

16:30 USD Housing Starts (MoM) (Feb) -14.8%

20:30 USD Atlanta Fed GDPNow (Q1) 2.3% 2.3%

21:00 USD 20-Year Bond Auction 4.595%

Piyush Lalsingh Ratnu

📌 Summary of the BoJ policy statement

• To guide overnight call rate in range of 0% to 0.1%.

• To apply 0.1% interest to all excess reserves parked with BoJ.

• To continue its jgb purchases at broadly same amount as before.

• To end ETF, J-REIT buying.

• To gradually reduce amount of purchases of CP, corporate bond.

• To discontinue purchases of CP, corporate bonds in about one year.

• BoJ makes decision on long-term JGB buying by 8-1 vote.

• Makes decision on asset buying other than long-term JGBs by unanimous vote.

• Makes decision on treatment of new loan disbursements under fund-provisiong measuer to stimulate bank lending etc by unanimous vote.

• BoJ will nimbly increase JGB buying regardless of monthly scheduled buying amount.

• Announces change in monetary policy framework.

• Assessed virtuous cycle between wages and prices.

• Judged it came in sight that price stability target of 2% would be achieved in sustainable, stable manner toward end of projection period.

• Considers QQE, YCC and negative rate policy have fulfilled their roles.

• With price target of 2%, BoJ will conduct monetary policy as appropriate.

• Will guide short-term interest rate as primary policy tool.

• Given current outlook for economic activity and prices, BoJ antiicpates accommodative financial conditions to be kept for time being.

• BoJ will continue roughly current amount of JGB buying

• Expect to maintain accomodative monetary environment for time being

• BoJ judged that inflation-overshooting commitment on monetary base has fulfilled conditions for achievement.

• In case of rapid rise in yields, BoJ will make nimble response such as increasing amount of JGB buying.

• Japan's economy likely to continue recovering moderately for time being.

• Year-on-year increase in CPI likely to be above 2% through fiscal 2024.

• Underlying CPI inflation likely to increase gradually toward achieving price target.

• There are extremely high uncertainties on Japan's economy, prices.

• Must pay due attention to developments in markets, FX, and impact on economy.

• BoJ will continue to announce planned amount of JGB buying with range, conduct buying while taking into account of market developments, supply-demand conditions for JGBs.

🟢 Market reaction to the BoJ policy announcements

USD/JPY jumped to test 150.00 following the BoJ’s policy announcements. The pair is currently trading at 149.78, up 0.44% on the day. The hawkish policy was widely priced in by the Yen markets.

🆘 Co-relation Alert:

USDJPY: 1100+ pips +

Possible Impact on XAUUSD:

$30 crash from CMP

🟢 Expected price zone: $2121

• To guide overnight call rate in range of 0% to 0.1%.

• To apply 0.1% interest to all excess reserves parked with BoJ.

• To continue its jgb purchases at broadly same amount as before.

• To end ETF, J-REIT buying.

• To gradually reduce amount of purchases of CP, corporate bond.

• To discontinue purchases of CP, corporate bonds in about one year.

• BoJ makes decision on long-term JGB buying by 8-1 vote.

• Makes decision on asset buying other than long-term JGBs by unanimous vote.

• Makes decision on treatment of new loan disbursements under fund-provisiong measuer to stimulate bank lending etc by unanimous vote.

• BoJ will nimbly increase JGB buying regardless of monthly scheduled buying amount.

• Announces change in monetary policy framework.

• Assessed virtuous cycle between wages and prices.

• Judged it came in sight that price stability target of 2% would be achieved in sustainable, stable manner toward end of projection period.

• Considers QQE, YCC and negative rate policy have fulfilled their roles.

• With price target of 2%, BoJ will conduct monetary policy as appropriate.

• Will guide short-term interest rate as primary policy tool.

• Given current outlook for economic activity and prices, BoJ antiicpates accommodative financial conditions to be kept for time being.

• BoJ will continue roughly current amount of JGB buying

• Expect to maintain accomodative monetary environment for time being

• BoJ judged that inflation-overshooting commitment on monetary base has fulfilled conditions for achievement.

• In case of rapid rise in yields, BoJ will make nimble response such as increasing amount of JGB buying.

• Japan's economy likely to continue recovering moderately for time being.

• Year-on-year increase in CPI likely to be above 2% through fiscal 2024.

• Underlying CPI inflation likely to increase gradually toward achieving price target.

• There are extremely high uncertainties on Japan's economy, prices.

• Must pay due attention to developments in markets, FX, and impact on economy.

• BoJ will continue to announce planned amount of JGB buying with range, conduct buying while taking into account of market developments, supply-demand conditions for JGBs.

🟢 Market reaction to the BoJ policy announcements

USD/JPY jumped to test 150.00 following the BoJ’s policy announcements. The pair is currently trading at 149.78, up 0.44% on the day. The hawkish policy was widely priced in by the Yen markets.

🆘 Co-relation Alert:

USDJPY: 1100+ pips +

Possible Impact on XAUUSD:

$30 crash from CMP

🟢 Expected price zone: $2121

Piyush Lalsingh Ratnu

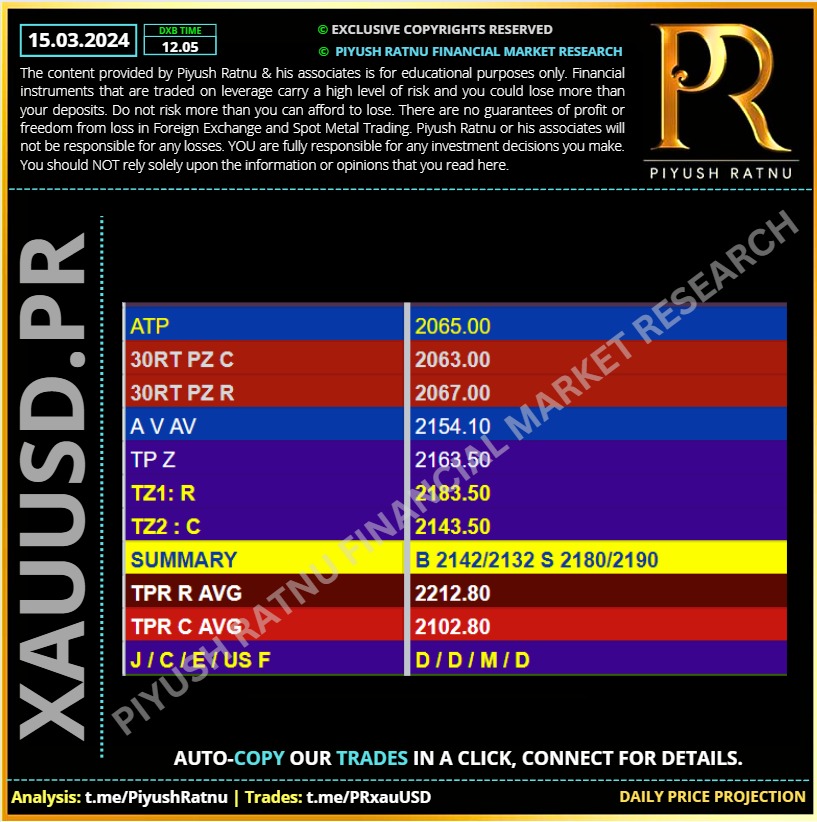

15.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

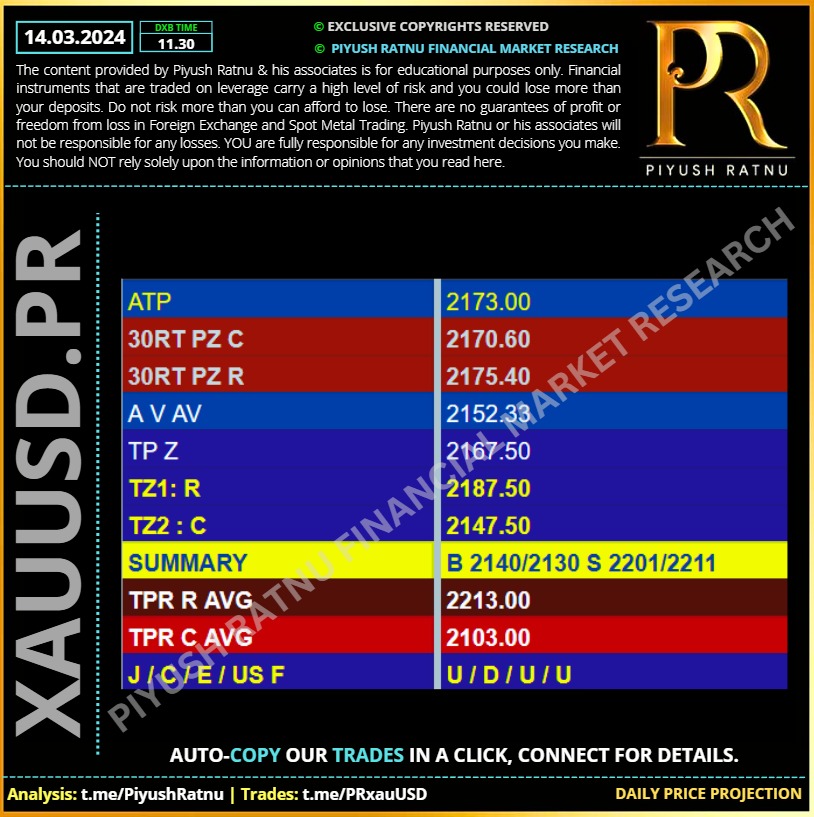

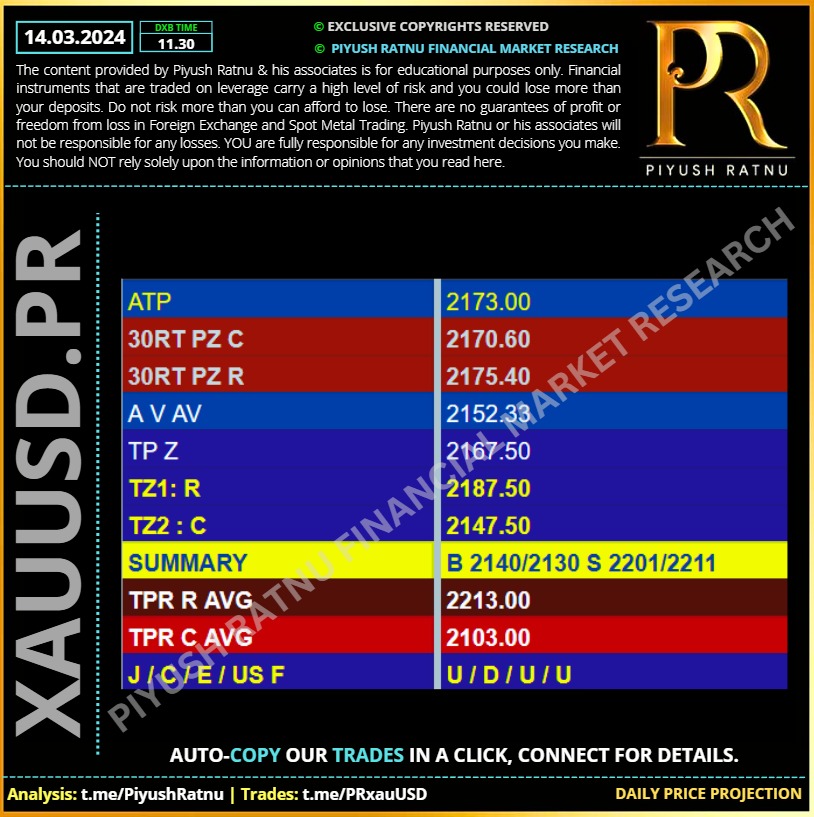

14.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

13.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

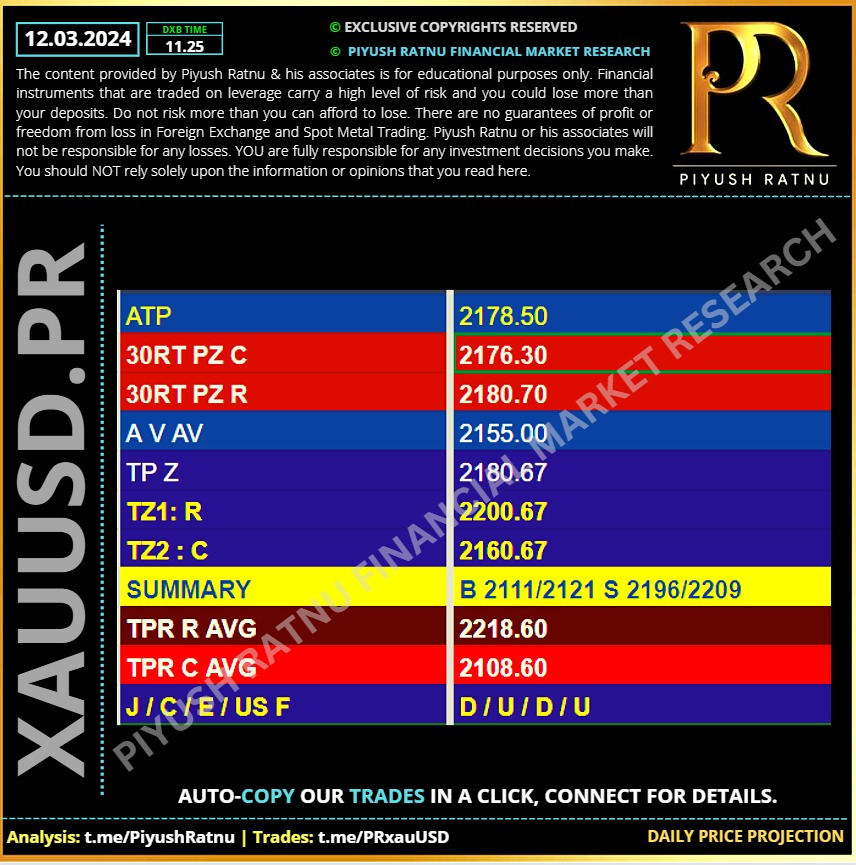

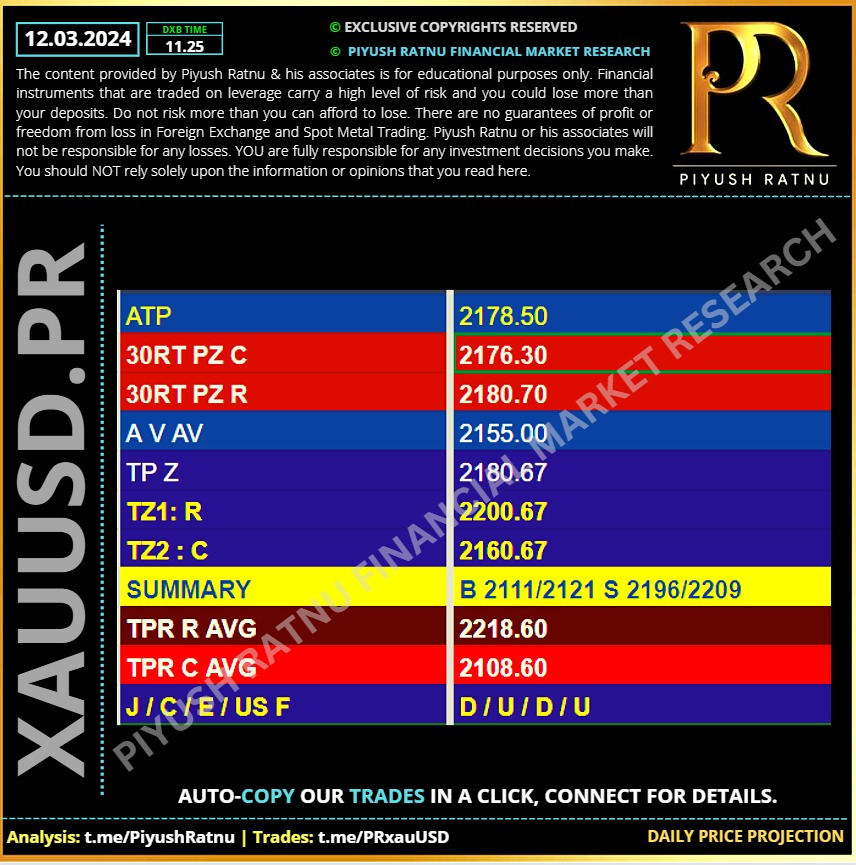

12.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🆘 The Fed is widely expected to hold interest rates steady for a fifth straight meeting when policymakers gather March 19-20. Much of the focus by investors will be on the Federal Open Market Committee’s quarterly forecasts for rates, including whether fresh employment and inflation figures have prompted any changes.

Piyush Lalsingh Ratnu

Crucial Economic Data today:

18:30 USD Crude Oil Inventories 0.900M1.367M

18:30 USD Cushing Crude Oil Inventories 0.701M

21:00 USD 30-Year Bond Auction 4.360%

#XAUUSD #forex #piyushratnu #gold #goldtrading

18:30 USD Crude Oil Inventories 0.900M1.367M

18:30 USD Cushing Crude Oil Inventories 0.701M

21:00 USD 30-Year Bond Auction 4.360%

#XAUUSD #forex #piyushratnu #gold #goldtrading

Piyush Lalsingh Ratnu

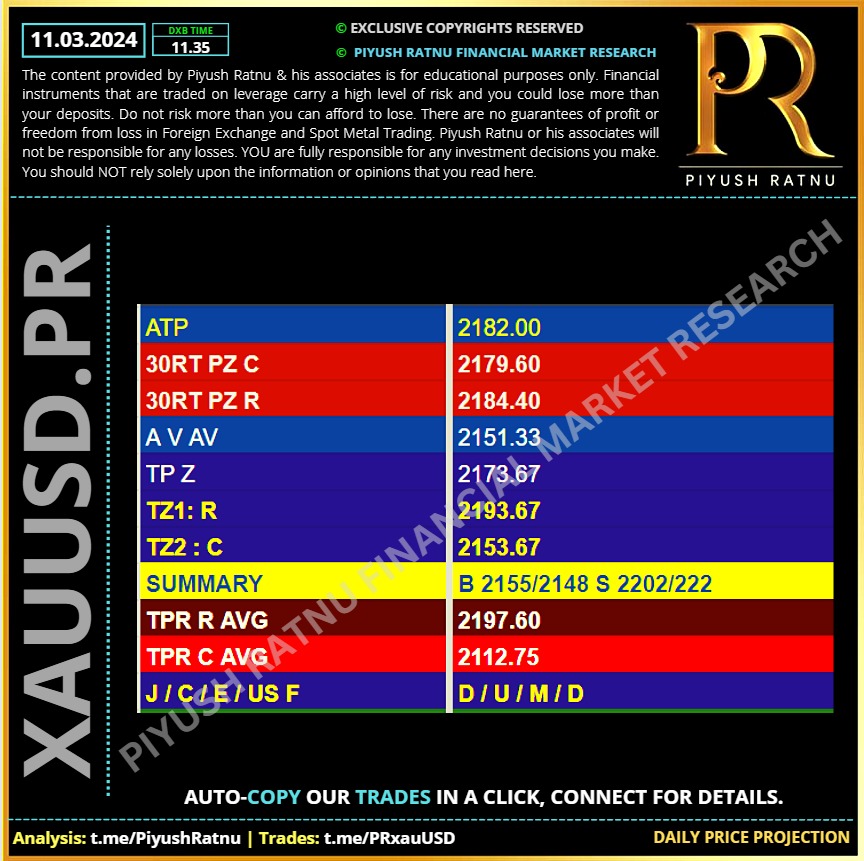

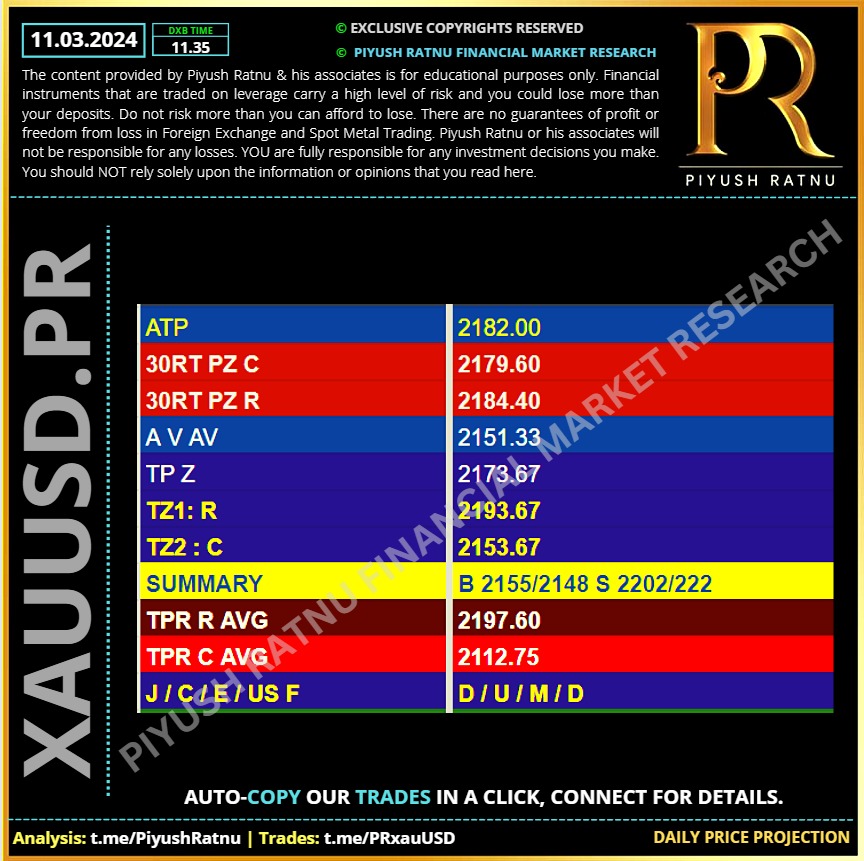

11.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🆘 Key Events today:

16:00 USD OPEC Monthly Report

16:30 USD Core CPI (MoM) (Feb) 0.3% 0.4%

16:30 USD Core CPI (YoY) (Feb) 3.7% 3.9%

16:30 USD CPI (MoM) (Feb) 0.4% 0.3%

16:30 USD CPI (YoY) (Feb) 3.1% 3.1%

20:00 USD EIA Short-Term Energy Outlook

21:00 USD 10-Year Note Auction 4.093%

22:00 USD Federal Budget Balance (Feb) -298.5B -22.0B

The US Dollar has entered a phase of downside consolidation heading into the all-important US Consumer Price Index (CPI) inflation data release on Tuesday at 12:30 GMT. The focus remains on the key inflation gauge, especially after a sharp downward revision to the January Nonfarm Payrolls number and a slew of disappointing economic data from the United States (US).

Markets are currently pricing in about a 70% chance that the Fed could begin easing rates in June, a tad lower than a 75% probability seen on Monday, according to the CME FedWatch Tool.

📌 Check CME FedWatch Tool here:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

The annual US CPI is seen rising 3.1% in February, at the same pace as seen in January while the core inflation is seen easing from 3.9% in January to 3.7% YoY in the reported period. The more important monthly CPI is expected to rise 0.4% last month vs. a 0.3% increase in January. The Core CPI inflation is foreseen at 0.3% MoM vs. 0.4% in the first month of the year.

A downside surprise in the monthly headline and core CPI inflation is likely to seal in a June interest rate cut by the US Federal Reserve (Fed), triggering a fresh sell-off in the US Dollar while sending Gold price to a new record high. US Treasury bond yields will come under intense bearish pressure on a US CPI negative surprise, initiating a fresh uptrend in the non-interest-bearing Gold price.

On the other hand, Gold price could see a sharp correction if the US Inflation data comes in hotter-than-expected and weighs heavily on the expectations of a dovish Fed policy pivot as early as in June.

In the run-up to the US CPI release, Gold price is likely to maintain its cautious trading momentum, as risk sentiment remains slightly upbeat.

🟢 Summary:

🔺A downside surprise in the US CPI numbers could propel Gold price toward the all-time high of $2,195, above which a sustained break above the $2,200 threshold is needed to take on the $2222 and 2,244 price targets.

🔻On the flip side, hot US inflation data is likely to extend the Gold price correction toward the March 8 low of $2,154 and 6 March low $2121.

16:00 USD OPEC Monthly Report

16:30 USD Core CPI (MoM) (Feb) 0.3% 0.4%

16:30 USD Core CPI (YoY) (Feb) 3.7% 3.9%

16:30 USD CPI (MoM) (Feb) 0.4% 0.3%

16:30 USD CPI (YoY) (Feb) 3.1% 3.1%

20:00 USD EIA Short-Term Energy Outlook

21:00 USD 10-Year Note Auction 4.093%

22:00 USD Federal Budget Balance (Feb) -298.5B -22.0B

The US Dollar has entered a phase of downside consolidation heading into the all-important US Consumer Price Index (CPI) inflation data release on Tuesday at 12:30 GMT. The focus remains on the key inflation gauge, especially after a sharp downward revision to the January Nonfarm Payrolls number and a slew of disappointing economic data from the United States (US).

Markets are currently pricing in about a 70% chance that the Fed could begin easing rates in June, a tad lower than a 75% probability seen on Monday, according to the CME FedWatch Tool.

📌 Check CME FedWatch Tool here:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

The annual US CPI is seen rising 3.1% in February, at the same pace as seen in January while the core inflation is seen easing from 3.9% in January to 3.7% YoY in the reported period. The more important monthly CPI is expected to rise 0.4% last month vs. a 0.3% increase in January. The Core CPI inflation is foreseen at 0.3% MoM vs. 0.4% in the first month of the year.

A downside surprise in the monthly headline and core CPI inflation is likely to seal in a June interest rate cut by the US Federal Reserve (Fed), triggering a fresh sell-off in the US Dollar while sending Gold price to a new record high. US Treasury bond yields will come under intense bearish pressure on a US CPI negative surprise, initiating a fresh uptrend in the non-interest-bearing Gold price.

On the other hand, Gold price could see a sharp correction if the US Inflation data comes in hotter-than-expected and weighs heavily on the expectations of a dovish Fed policy pivot as early as in June.

In the run-up to the US CPI release, Gold price is likely to maintain its cautious trading momentum, as risk sentiment remains slightly upbeat.

🟢 Summary:

🔺A downside surprise in the US CPI numbers could propel Gold price toward the all-time high of $2,195, above which a sustained break above the $2,200 threshold is needed to take on the $2222 and 2,244 price targets.

🔻On the flip side, hot US inflation data is likely to extend the Gold price correction toward the March 8 low of $2,154 and 6 March low $2121.

Piyush Lalsingh Ratnu

🟢 XAUUSD: Crucial Zones:

C: $2145/2121

R: $2190/2222

This week, attention shifts to the US CPI print, due tomorrow. The headline inflation is expected to steady near 3.1% on a yearly basis, core inflation is expected to have eased from 3.9% to 3.7%. But the monthly figures could print another strong month. If that’s the case, we shall see a softening in dovish Fed expectations. Remember, Fed Chair Powell said last week that the Fed ‘can and will’ start cutting the rates this year, but he also said that they are in no rush.

Inflation in China rose for the first time in 6 months thanks to the Lunar New Year holiday boost in spending, but producer prices fell 2.7%. Nearby, the Japanese stocks fell as the USDJPY sank below 147 on rising speculation that the BoJ could exit the negative rates as soon as this month.

📌 Gold traders will focus on the US CPI and Retail Sales for February for fresh impetus, due later this week. The CPI inflation figure is expected to show an increase of 0.4% MoM and 3.1 YoY in February, while the Retail Sales is forecast to climb 0.7% MoM in the same period.

C: $2145/2121

R: $2190/2222

This week, attention shifts to the US CPI print, due tomorrow. The headline inflation is expected to steady near 3.1% on a yearly basis, core inflation is expected to have eased from 3.9% to 3.7%. But the monthly figures could print another strong month. If that’s the case, we shall see a softening in dovish Fed expectations. Remember, Fed Chair Powell said last week that the Fed ‘can and will’ start cutting the rates this year, but he also said that they are in no rush.

Inflation in China rose for the first time in 6 months thanks to the Lunar New Year holiday boost in spending, but producer prices fell 2.7%. Nearby, the Japanese stocks fell as the USDJPY sank below 147 on rising speculation that the BoJ could exit the negative rates as soon as this month.

📌 Gold traders will focus on the US CPI and Retail Sales for February for fresh impetus, due later this week. The CPI inflation figure is expected to show an increase of 0.4% MoM and 3.1 YoY in February, while the Retail Sales is forecast to climb 0.7% MoM in the same period.

Piyush Lalsingh Ratnu

🔺 Six central banks increased their gold reserves (of a tonne or more) during the month; all six have been regular buyers of late:

• The Central Bank of Turkey was the largest buyer, increasing official gold holdings by 12t.2 This helped lift total gold holdings to 552 tonnes, just 6% off the all-time high of 587 tonnes back in February 2023

• Gold reserves at the People’s Bank of China rose by 10t – the 15th consecutive month of additions. Total gold holdings now stand at 2,245t, nearly 300t higher than at the end of October 2022 when the bank resumed reporting gold purchases

• The Reserve Bank of India added nearly 9t. This is the first monthly increase in its gold reserves since October 2023 and the largest since July 2022; its gold holdings now total 812t

• The National Bank of Kazakhstan bought 6t of gold, the first monthly addition since January 2023

• The Central Bank of Jordan bought 3t in January, the second consecutive month of additions, lifting total gold holdings to 75t

• The Czech National Bank added nearly 2t – the eleventh consecutive month of buying. Over that period gold reserves have surged from 12t to more than 32t (+170%).

https://www.gold.org/goldhub/gold-focus/2024/03/central-banks-accumulate-more-gold-january-starting-2024-they-mean-go

• The Central Bank of Turkey was the largest buyer, increasing official gold holdings by 12t.2 This helped lift total gold holdings to 552 tonnes, just 6% off the all-time high of 587 tonnes back in February 2023

• Gold reserves at the People’s Bank of China rose by 10t – the 15th consecutive month of additions. Total gold holdings now stand at 2,245t, nearly 300t higher than at the end of October 2022 when the bank resumed reporting gold purchases

• The Reserve Bank of India added nearly 9t. This is the first monthly increase in its gold reserves since October 2023 and the largest since July 2022; its gold holdings now total 812t

• The National Bank of Kazakhstan bought 6t of gold, the first monthly addition since January 2023

• The Central Bank of Jordan bought 3t in January, the second consecutive month of additions, lifting total gold holdings to 75t

• The Czech National Bank added nearly 2t – the eleventh consecutive month of buying. Over that period gold reserves have surged from 12t to more than 32t (+170%).

https://www.gold.org/goldhub/gold-focus/2024/03/central-banks-accumulate-more-gold-january-starting-2024-they-mean-go

Piyush Lalsingh Ratnu

🆘 XAUUSD UPTREND PATTERNS / RT PATTERNS

1966-1985

2069-2085

2169-2185

🔷 REPETITION OF NUMBERS OBSERVED

1966-1985

2069-2085

2169-2185

🔷 REPETITION OF NUMBERS OBSERVED

Piyush Lalsingh Ratnu

🍎 #XAUUSD CMP $2157

Gold buyers are trading with caution early Friday, as a correction could be in the offing after the recent upsurge and on another upside in the US NFP headline figure. The US #economy is likely to have added 200K jobs last month, as against a surprise gain of 353K in January. Average Hourly Earnings are set to rise at an annual pace of 4.4% in the reported period, down from the 4.5% registered previously.

Spot #Gold reached a fresh all-time high of $2,164.76 a troy ounce on Thursday, as speculative interest kept selling the US Dollar. The bright metal lost momentum early in the American session, and XAU/USD currently trades at around $2,155, holding on to modest intraday gains. Across the board, however, the US Dollar extended its slump to reach fresh multi-week lows against most major rivals.

Several factors affected the USD. On the one hand, Bank of #Japan (BoJ) policymakers offered some relatively hawkish comments on monetary policy that boosted the Japanese Yen (JPY) against the Greenback. Governor Kazuo Ueda said it is “fully possible to seek an exit from stimulus while striving to achieve the 2% inflation target.” Additionally, BoJ’s Board member Junko Nakagawa said the local economy is making steady progress toward achieving its price goal, backed by solid wage growth.

It is worth adding that Treasury yields remained under modest pressure, falling to fresh multi-week lows ahead of Wall Street’s opening. The 10-year Treasury note currently yields 4.11%, pretty much flat for the day after trimming early losses, while the 2-year note offers 4.52%, down 3 basis points (bps).

🟢 ALERT:

Disappointing US labor #market report is likely to exacerbate the pain in the US #Dollar while lifting Gold price to a fresh lifetime high, as it could affirm the increasing expectations of a US Federal Reserve (Fed) interest rates cut in June.

Fed policymakers are still not convinced that continued progress toward their 2% inflation objective is “assured,” and that it won’t make sense to cut interest rates until they are confident. The day of Powell’s testimony accentuated the decline in the US Dollar, as it hit the lowest level in two months against its major counterparts.

Gold #traders also remain wary of the end-of-the-week flows and profit-taking the bright metal, as they gear up for next week’s Consumer Price Index (CPI) inflation data from the United States.

🆘 Crucial #Price Zones: in next 7 days subject to NFP data

🔺 R: $2185/2200/2222

🔻 C: $2121/2109/2085

#PiyushRatnu #ForexMarket #NonfarmPayrolls #NFP

Gold buyers are trading with caution early Friday, as a correction could be in the offing after the recent upsurge and on another upside in the US NFP headline figure. The US #economy is likely to have added 200K jobs last month, as against a surprise gain of 353K in January. Average Hourly Earnings are set to rise at an annual pace of 4.4% in the reported period, down from the 4.5% registered previously.

Spot #Gold reached a fresh all-time high of $2,164.76 a troy ounce on Thursday, as speculative interest kept selling the US Dollar. The bright metal lost momentum early in the American session, and XAU/USD currently trades at around $2,155, holding on to modest intraday gains. Across the board, however, the US Dollar extended its slump to reach fresh multi-week lows against most major rivals.

Several factors affected the USD. On the one hand, Bank of #Japan (BoJ) policymakers offered some relatively hawkish comments on monetary policy that boosted the Japanese Yen (JPY) against the Greenback. Governor Kazuo Ueda said it is “fully possible to seek an exit from stimulus while striving to achieve the 2% inflation target.” Additionally, BoJ’s Board member Junko Nakagawa said the local economy is making steady progress toward achieving its price goal, backed by solid wage growth.

It is worth adding that Treasury yields remained under modest pressure, falling to fresh multi-week lows ahead of Wall Street’s opening. The 10-year Treasury note currently yields 4.11%, pretty much flat for the day after trimming early losses, while the 2-year note offers 4.52%, down 3 basis points (bps).

🟢 ALERT:

Disappointing US labor #market report is likely to exacerbate the pain in the US #Dollar while lifting Gold price to a fresh lifetime high, as it could affirm the increasing expectations of a US Federal Reserve (Fed) interest rates cut in June.

Fed policymakers are still not convinced that continued progress toward their 2% inflation objective is “assured,” and that it won’t make sense to cut interest rates until they are confident. The day of Powell’s testimony accentuated the decline in the US Dollar, as it hit the lowest level in two months against its major counterparts.

Gold #traders also remain wary of the end-of-the-week flows and profit-taking the bright metal, as they gear up for next week’s Consumer Price Index (CPI) inflation data from the United States.

🆘 Crucial #Price Zones: in next 7 days subject to NFP data

🔺 R: $2185/2200/2222

🔻 C: $2121/2109/2085

#PiyushRatnu #ForexMarket #NonfarmPayrolls #NFP

Piyush Lalsingh Ratnu

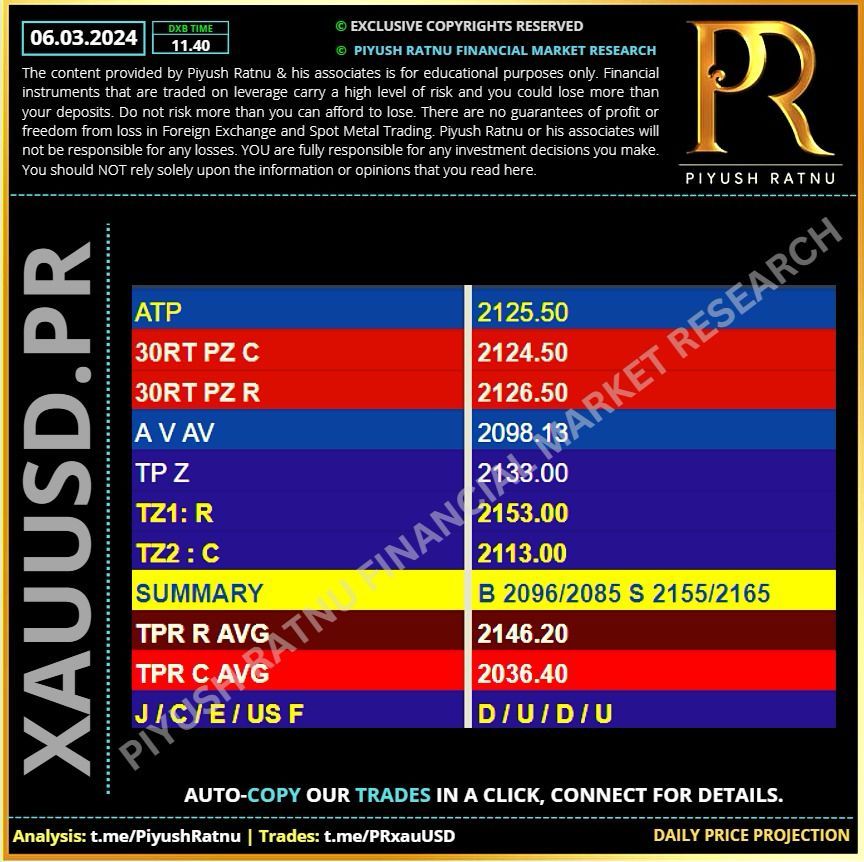

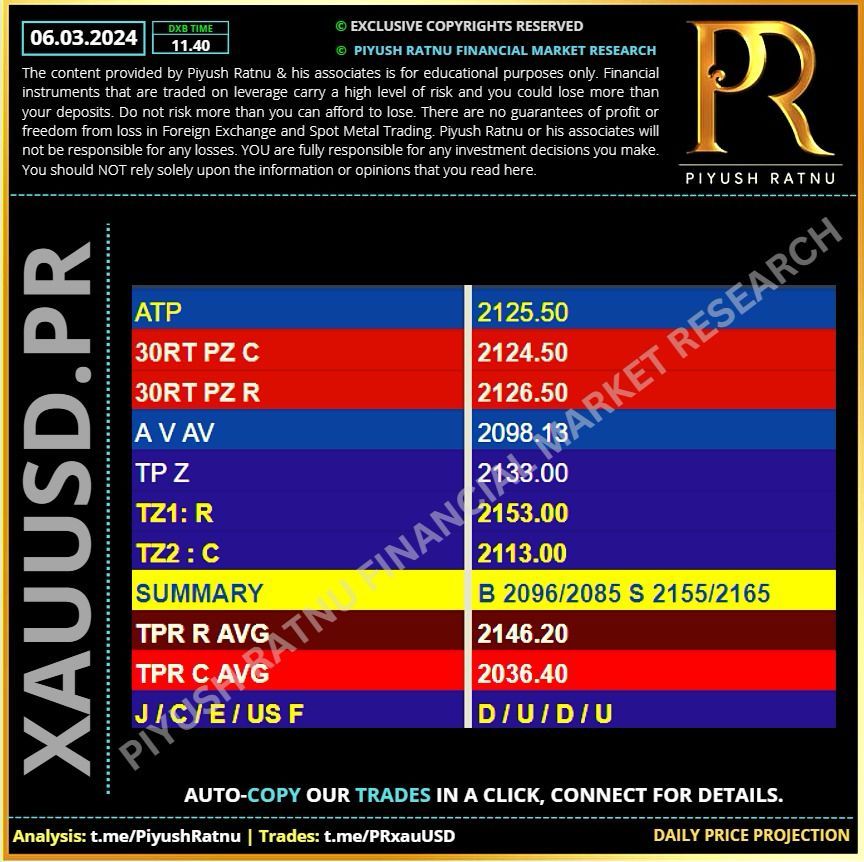

06.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🟢 Key Events today:

29 min USD Continuing Jobless Claims 1,889K 1,905K

29 min USD Exports 258.20B

29 min USD Imports 320.40B

29 min USD Initial Jobless Claims 217K 215K

29 min USD Nonfarm Productivity (QoQ) (Q4) 3.1% 3.2%

29 min USD Trade Balance (Jan) -63.40B -62.20B

29 min USD Unit Labor Costs (QoQ) (Q4) 0.7% 0.5%

19:00 USD Fed Chair Powell Testifies

20:30 USD Atlanta Fed GDPNow (Q1) 2.5% 2.5%

20:30 USD FOMC Member Mester Speaks

29 min USD Continuing Jobless Claims 1,889K 1,905K

29 min USD Exports 258.20B

29 min USD Imports 320.40B

29 min USD Initial Jobless Claims 217K 215K

29 min USD Nonfarm Productivity (QoQ) (Q4) 3.1% 3.2%

29 min USD Trade Balance (Jan) -63.40B -62.20B

29 min USD Unit Labor Costs (QoQ) (Q4) 0.7% 0.5%

19:00 USD Fed Chair Powell Testifies

20:30 USD Atlanta Fed GDPNow (Q1) 2.5% 2.5%

20:30 USD FOMC Member Mester Speaks

: