Cameron Gill / Perfil

- Informações

|

10+ anos

experiência

|

0

produtos

|

0

versão demo

|

|

0

trabalhos

|

0

sinais

|

0

assinantes

|

ATUALIZAÇÃO DO GOLD TRADER:

Em meados de agosto de 2020, uma estratégia nova e revisada no Gold Trader foi implementada com o objetivo principal de evitar a geração de negócios quando ocorrem grandes vendas de ouro.

Gold Trader agora é manual, negocia posições longas e curtas e negocia em XAUUSD, XAUEUR e XAUAUD.

O núcleo da estratégia revisada é o uso de 2 indicadores em 2 intervalos de tempo diferentes com um filtro de linha de tendência para determinar a direção da negociação.

As negociações são principalmente no pregão asiático, com negociações limitadas às sextas-feiras.

VISÃO GERAL DO TRADER FX:

O FX Trader usa a mesma metodologia do Gold Trader e negocia em EURUSD, USDCHF, AUDUSD, USDCAD e GBPUSD. A estratégia funciona bem em outros pares, mas a preferência é focar em várias moedas mais líquidas.

As negociações são normalmente colocadas durante o pregão asiático.

Em meados de agosto de 2020, uma estratégia nova e revisada no Gold Trader foi implementada com o objetivo principal de evitar a geração de negócios quando ocorrem grandes vendas de ouro.

Gold Trader agora é manual, negocia posições longas e curtas e negocia em XAUUSD, XAUEUR e XAUAUD.

O núcleo da estratégia revisada é o uso de 2 indicadores em 2 intervalos de tempo diferentes com um filtro de linha de tendência para determinar a direção da negociação.

As negociações são principalmente no pregão asiático, com negociações limitadas às sextas-feiras.

VISÃO GERAL DO TRADER FX:

O FX Trader usa a mesma metodologia do Gold Trader e negocia em EURUSD, USDCHF, AUDUSD, USDCAD e GBPUSD. A estratégia funciona bem em outros pares, mas a preferência é focar em várias moedas mais líquidas.

As negociações são normalmente colocadas durante o pregão asiático.

Cameron Gill

Hello friends and followers,

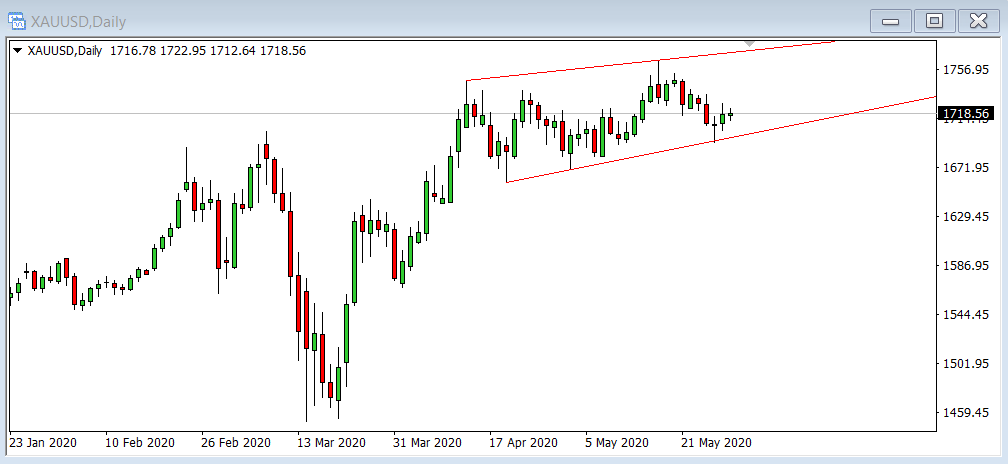

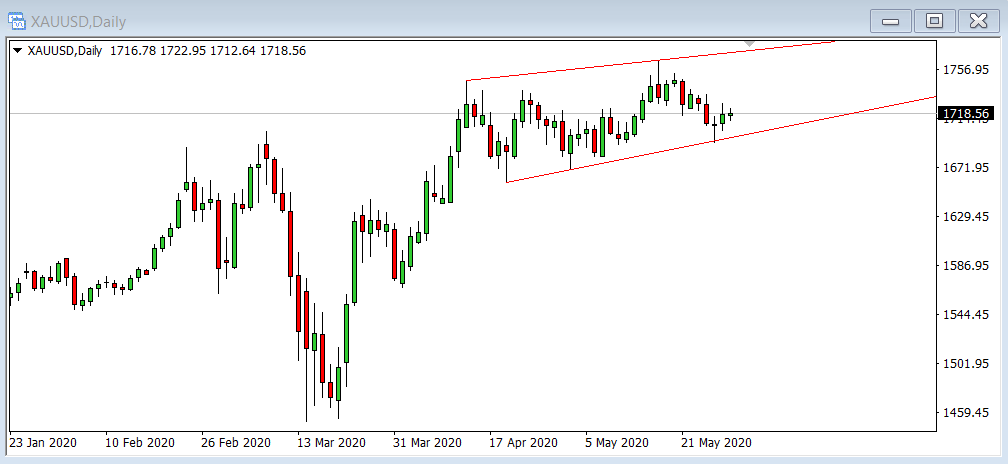

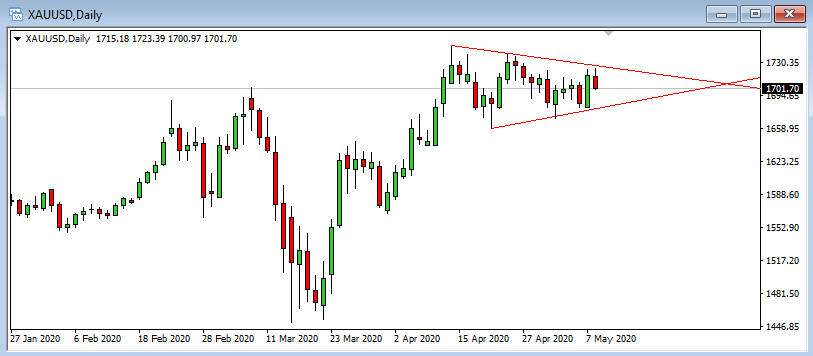

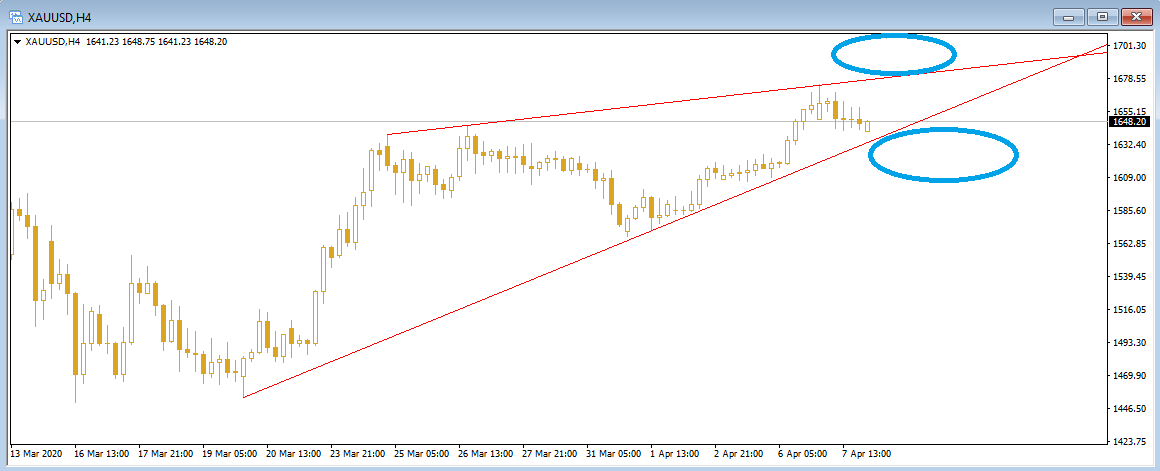

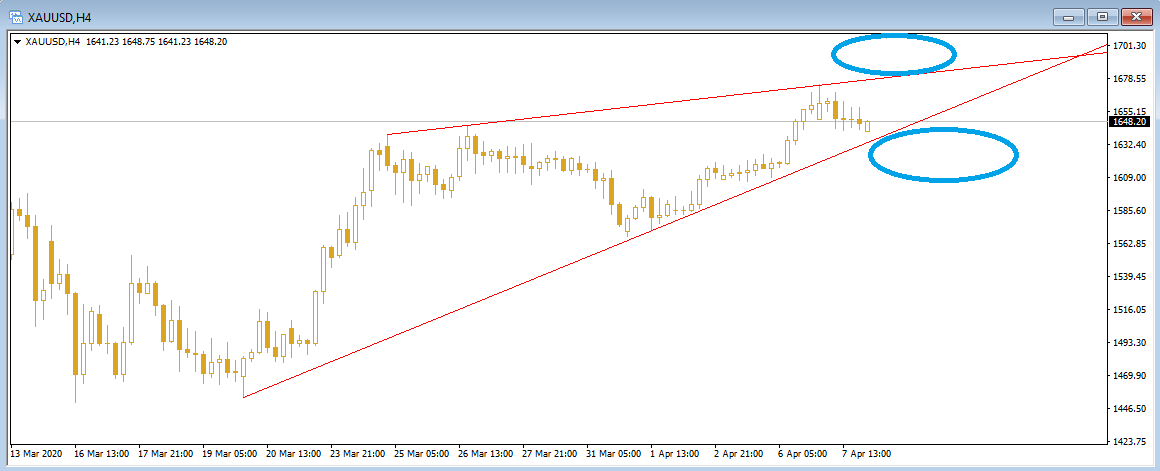

An interesting time for Gold/USD on the daily. It is the third crack at the top red trend-line and is either going to hammer through or retreat back towards the lower red trend-line.

There will certainly be sellers out there taking profit and traders trying to prevent this major break upwards that has been brewing for some time.

Am just going to wait and see as it could go either way and do not want to be caught on the wrong side.

An interesting time for Gold/USD on the daily. It is the third crack at the top red trend-line and is either going to hammer through or retreat back towards the lower red trend-line.

There will certainly be sellers out there taking profit and traders trying to prevent this major break upwards that has been brewing for some time.

Am just going to wait and see as it could go either way and do not want to be caught on the wrong side.

[Excluído]

2020.08.25

[Excluído]

Cameron Gill

Hello friends and followers,

Gold took another blow last week and it just does not make sense, especially when the US dollar is finally coming back to reality.

We have now seen a proper break of the lower (red) trend-line and this is not good for the gold bulls. However, and these days there always needs to be a however, you just don't know and it could jump up next week and take out the new upper (blue) bearish channel.

The gold to silver ratio has come back a bit, so silver is increasing in price. Will be watching silver over the next 2-3 weeks to see if it can take out the high and break up.

Regards,

Cameron

Gold took another blow last week and it just does not make sense, especially when the US dollar is finally coming back to reality.

We have now seen a proper break of the lower (red) trend-line and this is not good for the gold bulls. However, and these days there always needs to be a however, you just don't know and it could jump up next week and take out the new upper (blue) bearish channel.

The gold to silver ratio has come back a bit, so silver is increasing in price. Will be watching silver over the next 2-3 weeks to see if it can take out the high and break up.

Regards,

Cameron

Cameron Gill

Hello friends and followers,

Having dusted off the Gold Trader EA and run over the data from May and if running Gold Trader EA it would have returned +7.2%. So have set up a VPS and am now running the EA again. The spread has improved and is not as bad as what it has been over the last 2-3 months.

Regards,

Cameron

Having dusted off the Gold Trader EA and run over the data from May and if running Gold Trader EA it would have returned +7.2%. So have set up a VPS and am now running the EA again. The spread has improved and is not as bad as what it has been over the last 2-3 months.

Regards,

Cameron

Cameron Gill

Hello friends and followers,

Have now re-grouped after the trade on XAUEUR two days ago and have put in measures to prevent draw-down of this size again. I was thinking it was the end of the world, however in reality it was a mere flesh wound (in Monty Python terms!) and my intention is to claw back and resume previous returns. The buy signal that appeared on the XAUEUR chart the other day did not appear on the XAUUSD chart.

REVISED 'GOLD TRADER' STRATEGY:

- Maximum open trades = 2

- Lot sizing 0.01 per $500 (each trade)

- No trading of XAUEUR, only XAUUSD

- Gold Trader is long only trades, Gold Trader II is long + short trades

When re-drawing the major trend-lines on the daily gold charts (XAUUSD) after the recent sell-off, the bullish trend is still in play. The unknown is the US dollar strength/weakness and this is in-line impacted by the demand for dollars outside US.

Have now re-grouped after the trade on XAUEUR two days ago and have put in measures to prevent draw-down of this size again. I was thinking it was the end of the world, however in reality it was a mere flesh wound (in Monty Python terms!) and my intention is to claw back and resume previous returns. The buy signal that appeared on the XAUEUR chart the other day did not appear on the XAUUSD chart.

REVISED 'GOLD TRADER' STRATEGY:

- Maximum open trades = 2

- Lot sizing 0.01 per $500 (each trade)

- No trading of XAUEUR, only XAUUSD

- Gold Trader is long only trades, Gold Trader II is long + short trades

When re-drawing the major trend-lines on the daily gold charts (XAUUSD) after the recent sell-off, the bullish trend is still in play. The unknown is the US dollar strength/weakness and this is in-line impacted by the demand for dollars outside US.

Pedro Defaveri

2020.05.30

Glad you are back! No doubts we will be back on track! On your revised strategy above, have you also considered the time you opened that position? I have noticed that you did a little later than the your standards previously....maybe the volatility was much higher that time... and your system didn’t catch it properly... just some food for thoughts ...cheers!

Cameron Gill

Hello,

Just had to close out a series of trades on XAUEUR. I had the stop level at 1558.50 however needed to close.

Why gold keeps going down in this economic climate is beyond me.

I still believe in the Gold Trader strategy and am going to maintain it. However, will not longer be trading XAUEUR as if I was only trading XAUUSD the trade today would not have been picked up. There have been many good trades on XAUEUR in the past however this trade is the end and too much damage done to returns graph.

Will not be adding any other pairs, no XAGUSD.

This just does not make sense. Knowing my luck the chart will turn around. However better to be out of a trade than trying to ride out and have to accept higher loss.

Just had to close out a series of trades on XAUEUR. I had the stop level at 1558.50 however needed to close.

Why gold keeps going down in this economic climate is beyond me.

I still believe in the Gold Trader strategy and am going to maintain it. However, will not longer be trading XAUEUR as if I was only trading XAUUSD the trade today would not have been picked up. There have been many good trades on XAUEUR in the past however this trade is the end and too much damage done to returns graph.

Will not be adding any other pairs, no XAGUSD.

This just does not make sense. Knowing my luck the chart will turn around. However better to be out of a trade than trying to ride out and have to accept higher loss.

Mostrar todos os comentários (5)

[Excluído]

2020.05.30

Luca's EA is SCAM.Be Careful

Cameron Gill

Hello followers,

There was quite a bull-trap on XAUUSD yesterday and massive sell-off due to the strengthening USD (on worse jobless figures!). Normally on gold you get those sorts of moves as bear-traps, so perhaps the bias is changing.

The gold bull in me is looking for a move down to the $1710 region and then bounce off the lower trend-line upwards. However a decent break of the lower trend-line could be on the cards and in that case will reassess.

It is definitely a gold bull market when you look at the daily chart and have seen some crazy moves over the last few months. The longer term traders out there that bought XAUUSD on that dip down to $1450 would be sleeping well at night, same with those that bought Bitcoin when it crashed to $4000!

There was quite a bull-trap on XAUUSD yesterday and massive sell-off due to the strengthening USD (on worse jobless figures!). Normally on gold you get those sorts of moves as bear-traps, so perhaps the bias is changing.

The gold bull in me is looking for a move down to the $1710 region and then bounce off the lower trend-line upwards. However a decent break of the lower trend-line could be on the cards and in that case will reassess.

It is definitely a gold bull market when you look at the daily chart and have seen some crazy moves over the last few months. The longer term traders out there that bought XAUUSD on that dip down to $1450 would be sleeping well at night, same with those that bought Bitcoin when it crashed to $4000!

Cameron Gill

Hello followers,

Yesterday we finally saw the breakout on the daily chart and it was a strong move upwards.

What normally happens now is that the price comes back to re-test the back of the upper trend-line, which is around the 1710 to 1750 territory before a stronger move upwards. Will wait and see...

Unfortunately Gold Trader did not pick this move as the over-sold condition was not met and trades are not actioned during that time frame (due to common volatility). Gold Trader tends to pick up the range-bound long trades and not the big moves (up or down).

Yesterday we finally saw the breakout on the daily chart and it was a strong move upwards.

What normally happens now is that the price comes back to re-test the back of the upper trend-line, which is around the 1710 to 1750 territory before a stronger move upwards. Will wait and see...

Unfortunately Gold Trader did not pick this move as the over-sold condition was not met and trades are not actioned during that time frame (due to common volatility). Gold Trader tends to pick up the range-bound long trades and not the big moves (up or down).

Cameron Gill

Hello followers,

The dollar strengthening is continuing. If you have time go to YouTube and look up a chap by the name of Brent Johnson (Santiago Capital) and his talks on the 'dollar milkshake theory'.

What is interesting though is that Gold is holding up with the strengthening dollar.

Gold has been moving sideways for some time now and we are all waiting to see which trend-line is broken to determine the direction.

The dollar strengthening is continuing. If you have time go to YouTube and look up a chap by the name of Brent Johnson (Santiago Capital) and his talks on the 'dollar milkshake theory'.

What is interesting though is that Gold is holding up with the strengthening dollar.

Gold has been moving sideways for some time now and we are all waiting to see which trend-line is broken to determine the direction.

Cameron Gill

Hello followers,

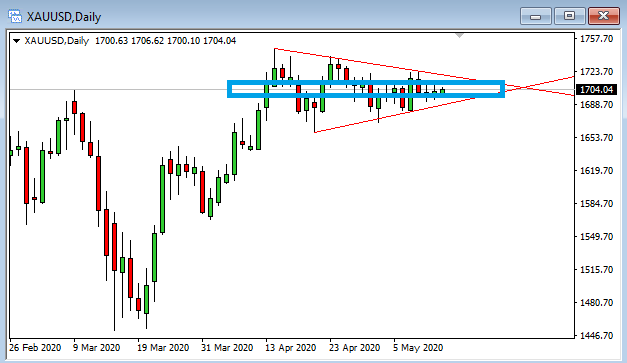

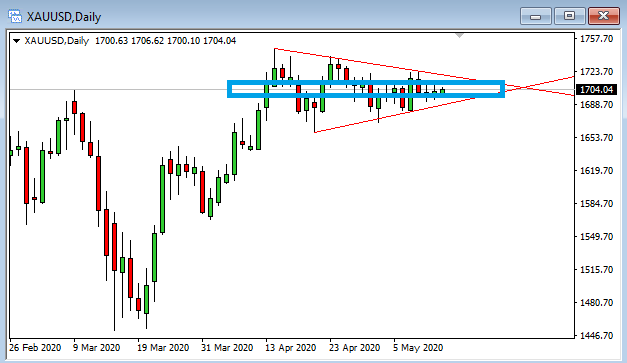

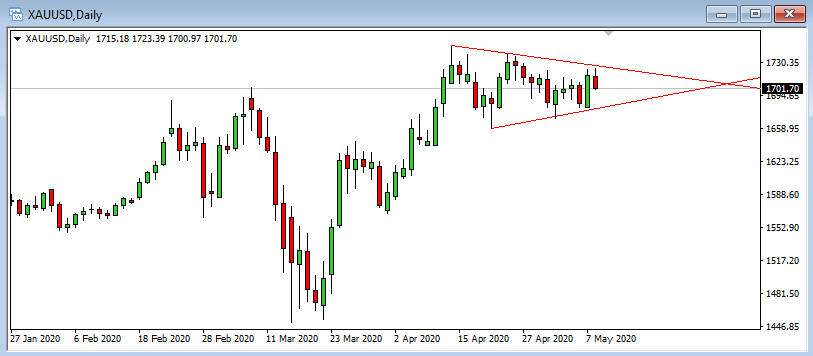

We have seen a continued sideways movement on gold over the last week with the price coming back to the 1700 mark over and over.

What is odd however is the economic data coming out of the US and the impact on the price of gold. Last week we had ADP Employment going from -27K to -20236K and on Friday had the popular NFP reading from -701K to -20500K with the glimmer of hope being the average hourly earning rate increasing. However, and please note that I am not an economist (and I also believe that economists have no idea what is going on!), this just does not make sense that gold is not stronger.

The NFP yesterday (Fri) we saw the price of gold weaken. Either there is some major manipulation going on or I am clearly missing something. Yesterday gold dropped against both USD and EUR, so it is not USD specific.

Am patiently waiting for trade signals to appear and you can see we are in the middle of the wedge on the daily chart. Still there is going to be a future break of this wedge either to to the upside or downside.

We have seen a continued sideways movement on gold over the last week with the price coming back to the 1700 mark over and over.

What is odd however is the economic data coming out of the US and the impact on the price of gold. Last week we had ADP Employment going from -27K to -20236K and on Friday had the popular NFP reading from -701K to -20500K with the glimmer of hope being the average hourly earning rate increasing. However, and please note that I am not an economist (and I also believe that economists have no idea what is going on!), this just does not make sense that gold is not stronger.

The NFP yesterday (Fri) we saw the price of gold weaken. Either there is some major manipulation going on or I am clearly missing something. Yesterday gold dropped against both USD and EUR, so it is not USD specific.

Am patiently waiting for trade signals to appear and you can see we are in the middle of the wedge on the daily chart. Still there is going to be a future break of this wedge either to to the upside or downside.

Cameron Gill

Hello followers,

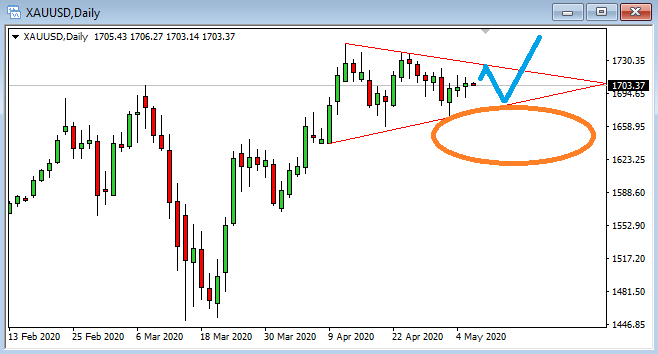

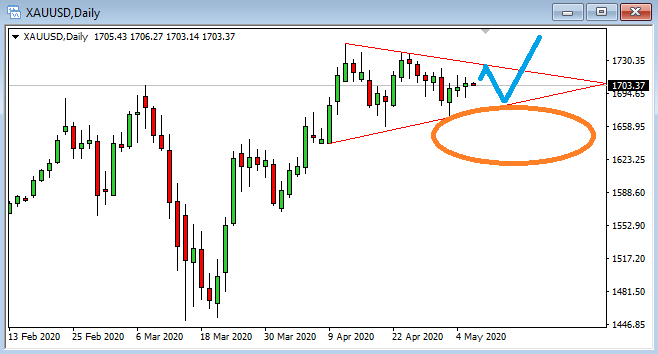

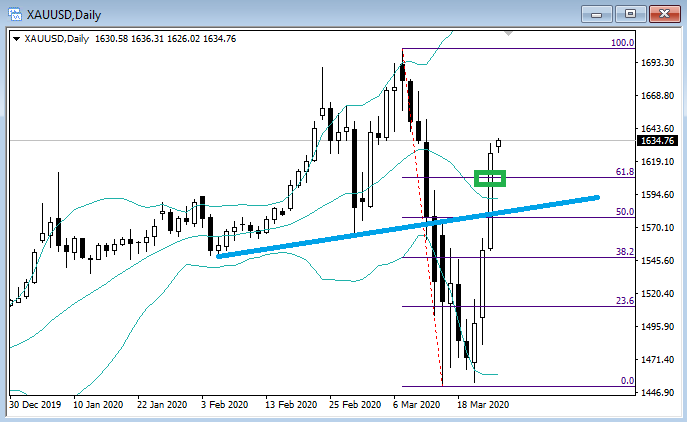

The daily gold (XAUUSD) chart is in another triangular pattern. So now it is a matter of waiting to see which line will be broken. Given the money printing underway it could be a matter of having a small pickup, then move down to lower trend-line and then a more solid move back up to take out previous highs. See blue line below.

If there is a break of the lower trend-line then we could see a move back to the 1560 territory.

It was also interesting to see the comparison between XAUUSD and XAUEUR yesterday. There is obvious bullish sentiment on USD, however it later evened out again.

The daily gold (XAUUSD) chart is in another triangular pattern. So now it is a matter of waiting to see which line will be broken. Given the money printing underway it could be a matter of having a small pickup, then move down to lower trend-line and then a more solid move back up to take out previous highs. See blue line below.

If there is a break of the lower trend-line then we could see a move back to the 1560 territory.

It was also interesting to see the comparison between XAUUSD and XAUEUR yesterday. There is obvious bullish sentiment on USD, however it later evened out again.

Cameron Gill

Hello followers,

We are getting dangerously close to breaking the lower trend-line on the XAUUSD pair. There have been a couple of attempts and am waiting for outcomes from the FOMC meeting to be analysed by the market.

Bitcoin had a massive bullish move yesterday and would have thought that gold would have picked up on this, however it has mainly been in a sideways pattern for a couple of days now after that sell off earlier in the week.

Will be interesting to see what happens over the next few days.

We are getting dangerously close to breaking the lower trend-line on the XAUUSD pair. There have been a couple of attempts and am waiting for outcomes from the FOMC meeting to be analysed by the market.

Bitcoin had a massive bullish move yesterday and would have thought that gold would have picked up on this, however it has mainly been in a sideways pattern for a couple of days now after that sell off earlier in the week.

Will be interesting to see what happens over the next few days.

Enrico Annovi

2020.05.01

indeed it broke to down side and looking to close below march high... Excellent Cameron!

Cameron Gill

Hello followers,

We have seen a massive sell-off on gold today and am closing off Gold Trader for the next few days. The reason for closing is as follows; 1) end of month tends to see more volatility on gold pairs, 2) we have FOMC interest rate decision on Wed, 3) the spread is still an issue on gold pairs (across multiple brokers), and 4) we should be seeing a NFP reading on Friday (otherwise will be the following Friday).

The Gold Trader EA does not trade on Fridays, however this is not activated at the moment.

We have seen a massive sell-off on gold today and am closing off Gold Trader for the next few days. The reason for closing is as follows; 1) end of month tends to see more volatility on gold pairs, 2) we have FOMC interest rate decision on Wed, 3) the spread is still an issue on gold pairs (across multiple brokers), and 4) we should be seeing a NFP reading on Friday (otherwise will be the following Friday).

The Gold Trader EA does not trade on Fridays, however this is not activated at the moment.

Cameron Gill

Hello followers,

What an amazing two months of price movement on the gold pairs.

First we had the initial financial market shock. Whilst it appears the virus was what popped the debt bubble (and correction we have been waiting for on stock markets), it is not over. Then central banks came out with QE Infinity. So the bubble has been kept from popping by patching over with excessive money printing, and whilst some air has been released from the bubble, it is still inflating at a rate of knots.

What this means for gold is that gold followed down the financial markets, especially as the virus could not be priced into the markets on all fronts. Then the money printing started and we saw a 'V' recovery which has since continued.

The next question is this... where is gold going from here? Late March gold analysts were talking down gold and around the 1630 mark were saying it was going back to 1400. What transpired was a move from 1580 past the more recent 1703 high right up to 1750 territory. The price could not hold about 1703 and yesterday saw a move back to 1680. The daily momentum moved from bullish to bearish on last Wed/Thur, so am looking for a potential move back to 1620.

Whereas before we could discuss physical supply, it is now very apparent that mints and bullion dealers are dry. I checked Perth Mint to buy some silver bullion and they only had 1 oz bars left, no 10 oz or 1 kg. Whist at the moment it is not appearing to impact the spot price, I suspect that in the coming weeks it will, especially as industry starts back up again and they need silver for their manufacturing (circuit boards, pace-makers, solar panels etc...).

Fascinating times.

Gold Trader does not pick up on the major moves, only the small range bound zig-zag buy opportunities. Am waiting to see what happens next week.

What an amazing two months of price movement on the gold pairs.

First we had the initial financial market shock. Whilst it appears the virus was what popped the debt bubble (and correction we have been waiting for on stock markets), it is not over. Then central banks came out with QE Infinity. So the bubble has been kept from popping by patching over with excessive money printing, and whilst some air has been released from the bubble, it is still inflating at a rate of knots.

What this means for gold is that gold followed down the financial markets, especially as the virus could not be priced into the markets on all fronts. Then the money printing started and we saw a 'V' recovery which has since continued.

The next question is this... where is gold going from here? Late March gold analysts were talking down gold and around the 1630 mark were saying it was going back to 1400. What transpired was a move from 1580 past the more recent 1703 high right up to 1750 territory. The price could not hold about 1703 and yesterday saw a move back to 1680. The daily momentum moved from bullish to bearish on last Wed/Thur, so am looking for a potential move back to 1620.

Whereas before we could discuss physical supply, it is now very apparent that mints and bullion dealers are dry. I checked Perth Mint to buy some silver bullion and they only had 1 oz bars left, no 10 oz or 1 kg. Whist at the moment it is not appearing to impact the spot price, I suspect that in the coming weeks it will, especially as industry starts back up again and they need silver for their manufacturing (circuit boards, pace-makers, solar panels etc...).

Fascinating times.

Gold Trader does not pick up on the major moves, only the small range bound zig-zag buy opportunities. Am waiting to see what happens next week.

Cameron Gill

Hello followers,

Gold has broken to the upside and unfortunately no trades were triggered for the Gold Trader strategy. Gold is not coming back to oversold areas for decent entries however do not want to get in and then the price comes down to draw-down and risk loss.

This is a positive for gold pairs where several analysts were talking about a correction straight after Easter.

My opinion is that all this fiat money printing is going to have to put bullish pressure on gold and silver. It is common sense that if the dollar is being devalued further, interest rates are super low and stock markets being propped up with further downside in sight, that gold is a solid store of value.

Also keep in mind that the futures price for gold is higher than the spot. Plus inventory at mints and bullion dealers are very very low. Bullion prices now have a considerable premium.

Saying that, it appears that people are moving into survival modes and keeping cash. The central banks would also not want gold price to strengthen as they want people to retain faith and confidence in dollar (over gold), and it is a sign of higher inflation.

Gold has broken to the upside and unfortunately no trades were triggered for the Gold Trader strategy. Gold is not coming back to oversold areas for decent entries however do not want to get in and then the price comes down to draw-down and risk loss.

This is a positive for gold pairs where several analysts were talking about a correction straight after Easter.

My opinion is that all this fiat money printing is going to have to put bullish pressure on gold and silver. It is common sense that if the dollar is being devalued further, interest rates are super low and stock markets being propped up with further downside in sight, that gold is a solid store of value.

Also keep in mind that the futures price for gold is higher than the spot. Plus inventory at mints and bullion dealers are very very low. Bullion prices now have a considerable premium.

Saying that, it appears that people are moving into survival modes and keeping cash. The central banks would also not want gold price to strengthen as they want people to retain faith and confidence in dollar (over gold), and it is a sign of higher inflation.

Cameron Gill

Hello followers,

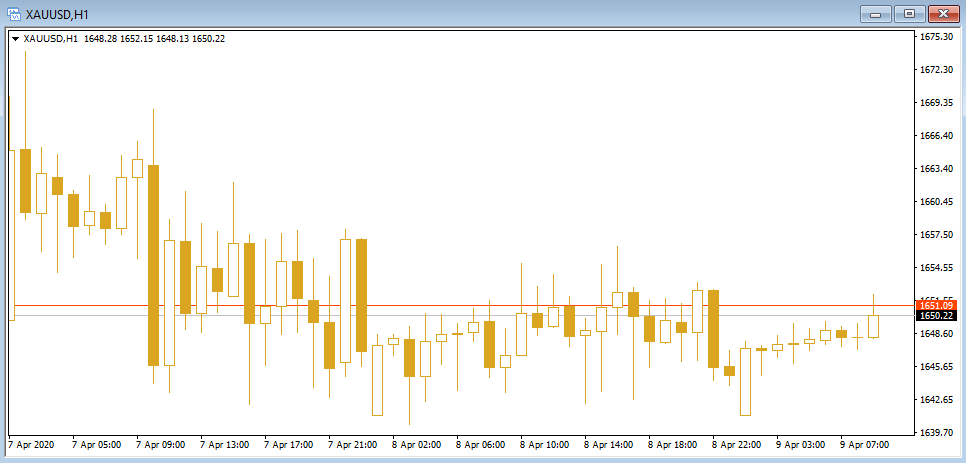

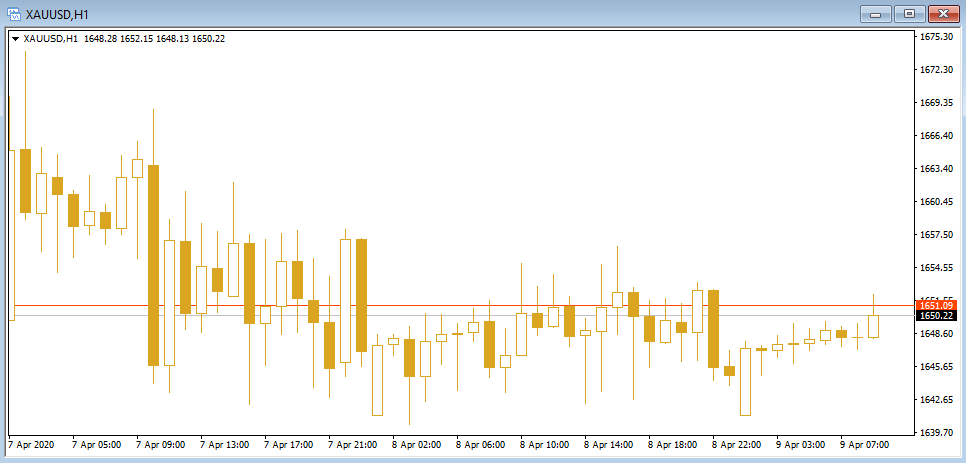

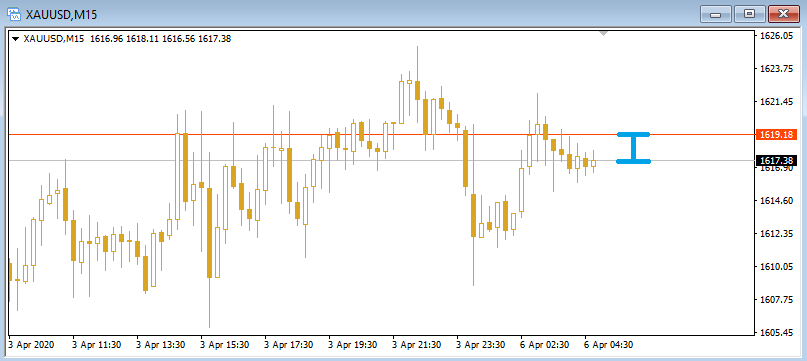

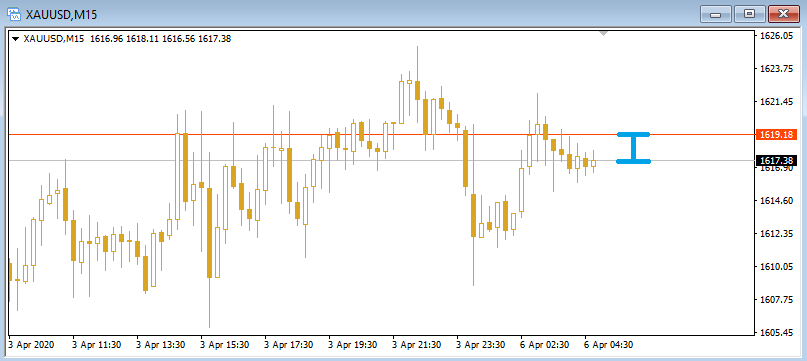

Check out the sideways movement on gold. It has been days now and no trades have been triggered.

Whilst I would love to have trades opened I am also cautious and do not want to trade for the sake of having an open position. The spreads are still considerable and there is a jumpy nature in the movement of the price on gold.

Due to the fact that no trades have now been activated in almost a week I am looking to add a ranging trade component to pick up at the lower oversold region. Am testing and plan to add next week after Easter holidays.

Check out the sideways movement on gold. It has been days now and no trades have been triggered.

Whilst I would love to have trades opened I am also cautious and do not want to trade for the sake of having an open position. The spreads are still considerable and there is a jumpy nature in the movement of the price on gold.

Due to the fact that no trades have now been activated in almost a week I am looking to add a ranging trade component to pick up at the lower oversold region. Am testing and plan to add next week after Easter holidays.

Cameron Gill

Gold is just going sideways and still jumpy with large spread.

Will be very interesting to see which trend-line is broken.

Some analysts are talking gold down and saying that after Easter there should be a break-down. Others are expecting a retest of the 1702 mark hit a few months back. They may both be right!!

Will be very interesting to see which trend-line is broken.

Some analysts are talking gold down and saying that after Easter there should be a break-down. Others are expecting a retest of the 1702 mark hit a few months back. They may both be right!!

Cameron Gill

Hello followers,

Should have had a trade come on this morning however the spreads on gold pairs are high again on Pepperstone.

Have checked and the spreads on currency pairs are normal so am not sure why gold pairs are impacted. Pepperstone said that all brokers are affected however am going to do some comparisons.

Given that the Non Farms on Friday were terrible for USD I am surprised that gold did not shoot up further. This demonstrates that people are converting to USD, so we have a combination of dollar conversion and gold holding up in the circumstances.

Please also note that the difference between spot gold/silver and bullion is increasing even further, especially on silver. It does appear that spot and physical pricing of precious metals will continue to distance from each-other.

Should have had a trade come on this morning however the spreads on gold pairs are high again on Pepperstone.

Have checked and the spreads on currency pairs are normal so am not sure why gold pairs are impacted. Pepperstone said that all brokers are affected however am going to do some comparisons.

Given that the Non Farms on Friday were terrible for USD I am surprised that gold did not shoot up further. This demonstrates that people are converting to USD, so we have a combination of dollar conversion and gold holding up in the circumstances.

Please also note that the difference between spot gold/silver and bullion is increasing even further, especially on silver. It does appear that spot and physical pricing of precious metals will continue to distance from each-other.

Cameron Gill

Hello followers,

A quick update... Gold Trader does not trade the last 2 days of the month so am waiting for mid week for more trades.

End of month is a common time of volatility and expiring options. Also commercial traders often close positions at the end of the month.

Gold is still showing very high spreads and has been side-ways for the last 4 days. It feels like a major move is brewing. Analyst are predicting further downside, I am on the fence and am waiting for the charts to tell the story.

A quick update... Gold Trader does not trade the last 2 days of the month so am waiting for mid week for more trades.

End of month is a common time of volatility and expiring options. Also commercial traders often close positions at the end of the month.

Gold is still showing very high spreads and has been side-ways for the last 4 days. It feels like a major move is brewing. Analyst are predicting further downside, I am on the fence and am waiting for the charts to tell the story.

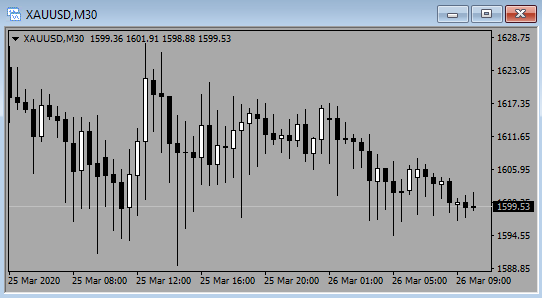

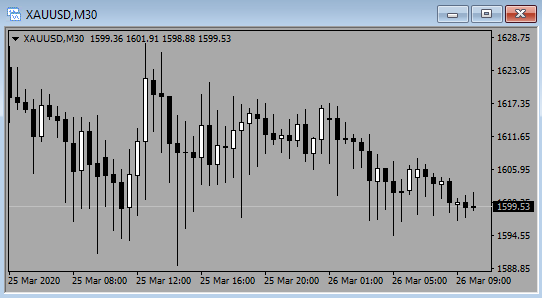

Cameron Gill

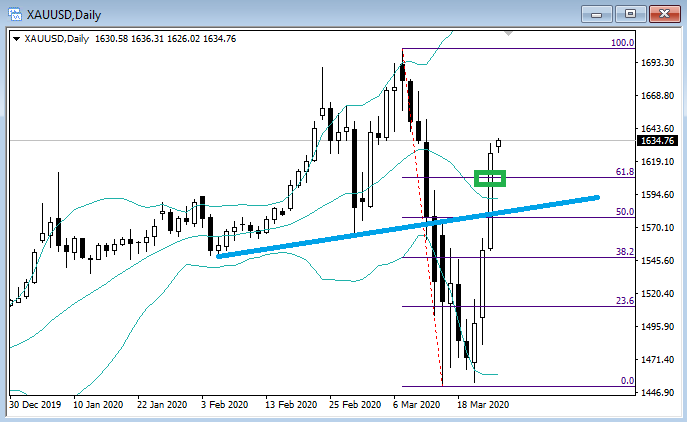

Look at this chart, have never seen this sort of price-action before.

Be careful at the moment on gold pairs. The spreads are very inflated and impacting Gold Trader profitability.

It is almost as if the charts are expecting something and cannot make up its mind as to what direction to go in.

Be careful at the moment on gold pairs. The spreads are very inflated and impacting Gold Trader profitability.

It is almost as if the charts are expecting something and cannot make up its mind as to what direction to go in.

Cameron Gill

Hello followers,

Wow, we have seen quite a recovery on gold.

I have still maintained my bullish view on Gold, especially considering the massive global money printing in play at the moment.

The last few days have been remarkable and my feeling is that with yesterday's performance on the stock markets that there is still further downside around the corner. Stock markets have been up 5% one day, down 10% the next and very choppy as the markets are trying to price in this global pandemic (the pin) as well as the collapse of financial markets (the over-inflated bubble).

What is interesting is that the spread on XAUUSD and XAUEUR has jumped for no apparent reason, almost to $5.00. I have contacted Pepperstone to ask for an explanation.

As for Gold Trader, unfortunately it does not pick up major moves like we have seen in the last few days. So am sitting on my hands waiting for some settling in price.

Wow, we have seen quite a recovery on gold.

I have still maintained my bullish view on Gold, especially considering the massive global money printing in play at the moment.

The last few days have been remarkable and my feeling is that with yesterday's performance on the stock markets that there is still further downside around the corner. Stock markets have been up 5% one day, down 10% the next and very choppy as the markets are trying to price in this global pandemic (the pin) as well as the collapse of financial markets (the over-inflated bubble).

What is interesting is that the spread on XAUUSD and XAUEUR has jumped for no apparent reason, almost to $5.00. I have contacted Pepperstone to ask for an explanation.

As for Gold Trader, unfortunately it does not pick up major moves like we have seen in the last few days. So am sitting on my hands waiting for some settling in price.

: