Gabriel D Arco / Perfil

- Informações

|

9+ anos

experiência

|

0

produtos

|

0

versão demo

|

|

0

trabalhos

|

0

sinais

|

0

assinantes

|

Personal trader

em

Marseille (France)

Gabriel D Arco

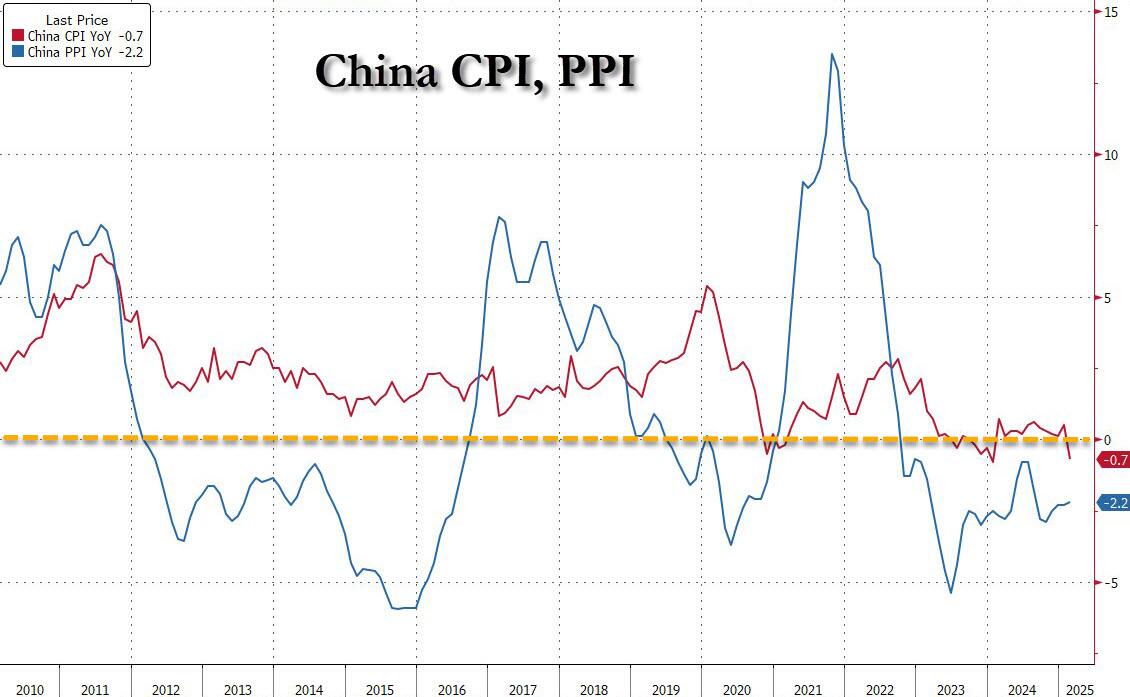

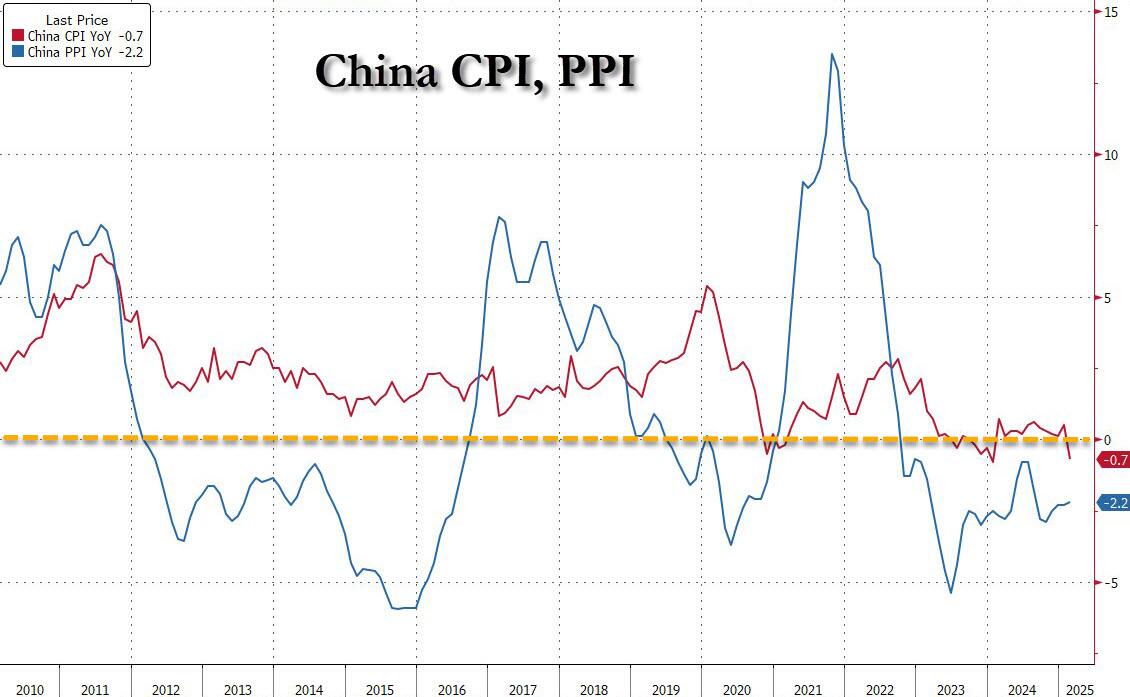

After a year of modest, barely perceptible inflation, China's CPI tumbled back far more than expected to fall below zero for the first time in 13 months, an assessment skewed by seasonal distortions but also a sign of deflationary pressures persisting in the economy. Here is the summary:

CPI: -0.7% yoy (-3.5% mom annualized*) in February vs. Bloomberg consensus: -0.4% yoy; January: +0.5% yoy (-1.7% mom annualized).

Food: -3.3% yoy in February (-13.1% mom annualized*) vs. +0.4% yoy in January.

Non-food: -0.1% yoy in February (-2.1% mom annualized*) vs. +0.5% yoy in January.

PPI: -2.2% yoy in February (-1.3% mom annualized*) vs. GS: -2.2% yoy, Bloomberg consensus: -2.1% yoy; January: -2.3% yoy (-0.8% mom annualized).

CPI: -0.7% yoy (-3.5% mom annualized*) in February vs. Bloomberg consensus: -0.4% yoy; January: +0.5% yoy (-1.7% mom annualized).

Food: -3.3% yoy in February (-13.1% mom annualized*) vs. +0.4% yoy in January.

Non-food: -0.1% yoy in February (-2.1% mom annualized*) vs. +0.5% yoy in January.

PPI: -2.2% yoy in February (-1.3% mom annualized*) vs. GS: -2.2% yoy, Bloomberg consensus: -2.1% yoy; January: -2.3% yoy (-0.8% mom annualized).

Gabriel D Arco

Hedge funds and market makers have one key advantage over us: power. With billions in liquidity, cutting-edge algorithms, and access to dark pools (hidden order books invisible to retail traders), they can move prices in ways we can’t predict using traditional analysis alone. Their trades aren’t random—they’re calculated strikes designed to exploit the behavior of smaller players.

Gabriel D Arco

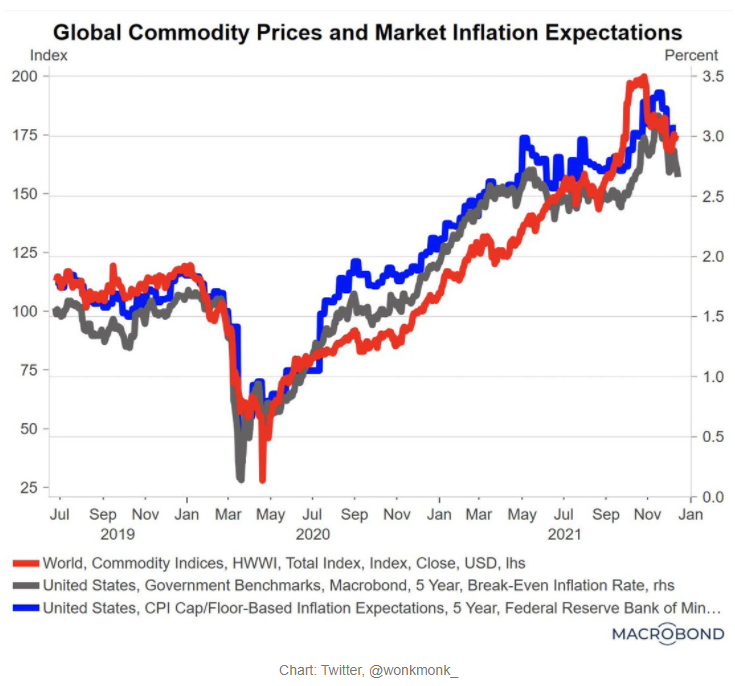

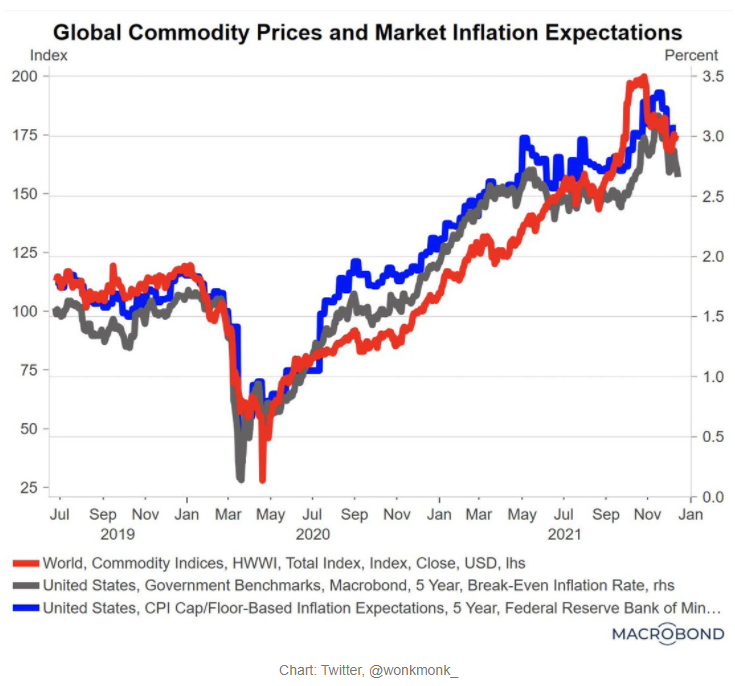

I continue to believe they represent an inflation hedge and are entering a “super cycle” that will end in consolidation in both hards and softs at meaningfully higher prices in 2022.

But this week, my attention turned back to another commodity I hadn’t looked at in a while: silver.

I added some exposure to silver yesterday by purchasing call options on the iShares Silver Trust (SLV) and may add to already existing positions in either the Sprott Physical Silver Trust (PSLV) or any of a host of miners, including Pan American Silver Corp. (PAAS) if the price of silver moves meaningfully lower and/or dislocates from the price of gold further.

My reasoning for the purchase was twofold:

Monetary policy is a plane that is headed directly into a mountain, as confirmed by Fed chair Powell yesterday. We’ll discuss.

The gold/silver ratio, which has traditionally indicated when silver is cheap relative to gold, is back over 80:1, indicating a large dislocation from historical norms.

As a quick overture, I’d like to state that, in general, I like the climate for both gold and silver here - both are unloved for reasons I will discuss in moments - but I think silver represents the better opportunity, at least for the time being.

It was confirmed yesterday that the Fed is still at least considering speeding up and following through with a taper. Jerome Powell postured on Wednesday that tapering and rate hikes would be well on their way throughout 2022 and into 2023.

Surprisingly, Powell’s comments yesterday were seen by the market as dovish despite the accelerated rate with which the Fed announced it would taper. Indexes screamed higher after a quick initial selloff.

I believe yesterday’s rally was unjustified and, as I wrote a couple days ago, still believe that the taper will eventually crash the markets if the Fed tries to follow through with it.

I also don’t happen to believe that the Fed is going to follow through with their announced plans, however, because the first second the market starts to crash, we can look for an easing of language from them. This, in turn, will send a signal to the precious metals market that the taper isn’t quite as serious as Powell has postured, which will likely send gold into the 2000s next year, in my opinion.

Silver, with the gold the silver ratio now out of proportion, would likely have a disproportionately larger move higher if gold were to make such a move heading into the new year. This is part of the reason I wanted to have more exposure to silver than I have had over the last few months, as sentiment around the precious metals has been absolutely terrible.

But again, this terrible sentiment has only been a result of the fact that the market believes that the Fed will actually follow through with tapering . I simply don’t believe that this is possible or will be the case.

In other words, I’m calling the Fed’s bluff with my increased exposure to silver.

The precious metals have been unloved and even bulls like Peter Schiff have admitted recently that they could continue to be unloved until the reality of the Fed’s true plan of action comes to light. We won’t know whether or not we can call the Fed’s bluff until early next year. Until then, precious metal investors may have to endure a little more pain, which I will see as as opportunities to add further.

But, with the gold to silver ratio once again over 80:1, it looks like silver may be the precious metal worth considering in this instance. As was pointed out in an excellent writeup by Peter Schiff and Zero Hedge, the gold/silver ratio is now back near historical highs.

But this week, my attention turned back to another commodity I hadn’t looked at in a while: silver.

I added some exposure to silver yesterday by purchasing call options on the iShares Silver Trust (SLV) and may add to already existing positions in either the Sprott Physical Silver Trust (PSLV) or any of a host of miners, including Pan American Silver Corp. (PAAS) if the price of silver moves meaningfully lower and/or dislocates from the price of gold further.

My reasoning for the purchase was twofold:

Monetary policy is a plane that is headed directly into a mountain, as confirmed by Fed chair Powell yesterday. We’ll discuss.

The gold/silver ratio, which has traditionally indicated when silver is cheap relative to gold, is back over 80:1, indicating a large dislocation from historical norms.

As a quick overture, I’d like to state that, in general, I like the climate for both gold and silver here - both are unloved for reasons I will discuss in moments - but I think silver represents the better opportunity, at least for the time being.

It was confirmed yesterday that the Fed is still at least considering speeding up and following through with a taper. Jerome Powell postured on Wednesday that tapering and rate hikes would be well on their way throughout 2022 and into 2023.

Surprisingly, Powell’s comments yesterday were seen by the market as dovish despite the accelerated rate with which the Fed announced it would taper. Indexes screamed higher after a quick initial selloff.

I believe yesterday’s rally was unjustified and, as I wrote a couple days ago, still believe that the taper will eventually crash the markets if the Fed tries to follow through with it.

I also don’t happen to believe that the Fed is going to follow through with their announced plans, however, because the first second the market starts to crash, we can look for an easing of language from them. This, in turn, will send a signal to the precious metals market that the taper isn’t quite as serious as Powell has postured, which will likely send gold into the 2000s next year, in my opinion.

Silver, with the gold the silver ratio now out of proportion, would likely have a disproportionately larger move higher if gold were to make such a move heading into the new year. This is part of the reason I wanted to have more exposure to silver than I have had over the last few months, as sentiment around the precious metals has been absolutely terrible.

But again, this terrible sentiment has only been a result of the fact that the market believes that the Fed will actually follow through with tapering . I simply don’t believe that this is possible or will be the case.

In other words, I’m calling the Fed’s bluff with my increased exposure to silver.

The precious metals have been unloved and even bulls like Peter Schiff have admitted recently that they could continue to be unloved until the reality of the Fed’s true plan of action comes to light. We won’t know whether or not we can call the Fed’s bluff until early next year. Until then, precious metal investors may have to endure a little more pain, which I will see as as opportunities to add further.

But, with the gold to silver ratio once again over 80:1, it looks like silver may be the precious metal worth considering in this instance. As was pointed out in an excellent writeup by Peter Schiff and Zero Hedge, the gold/silver ratio is now back near historical highs.

Gabriel D Arco

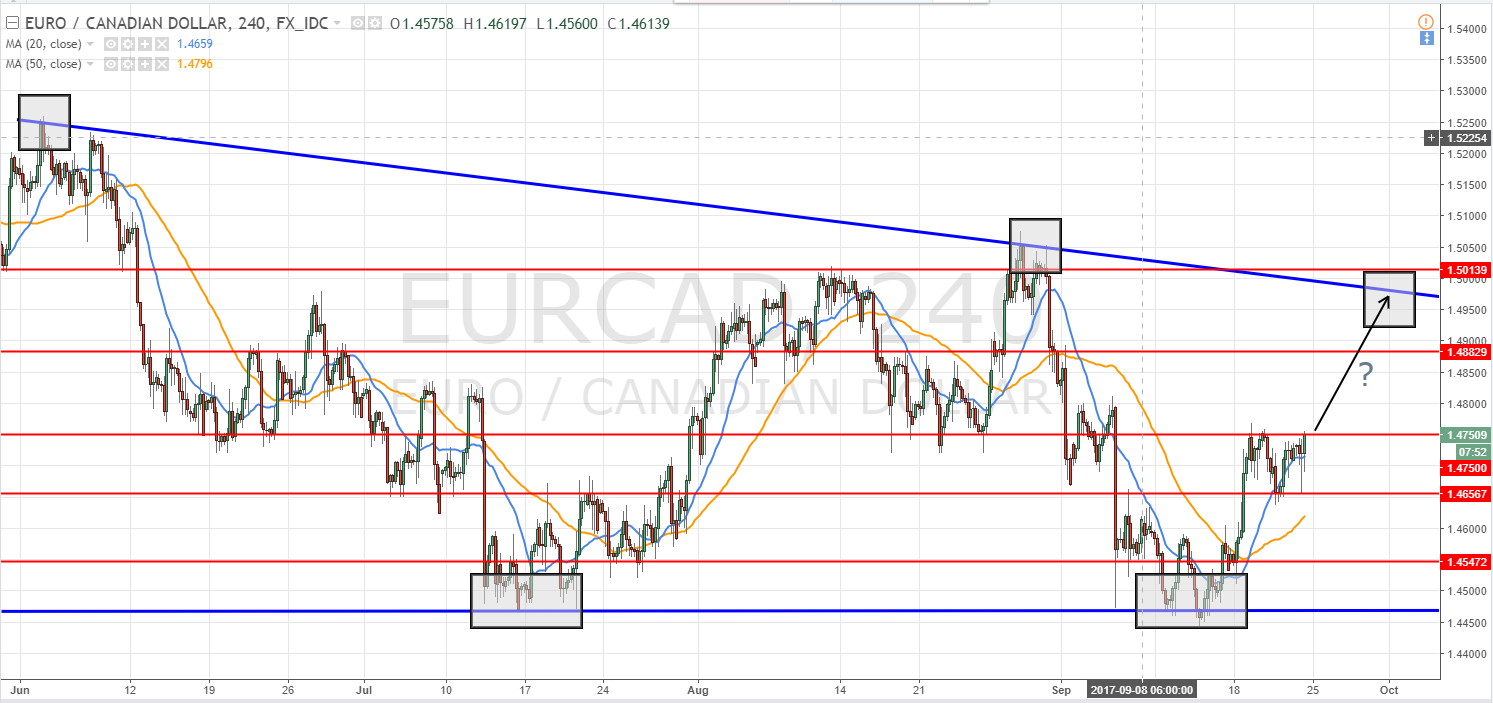

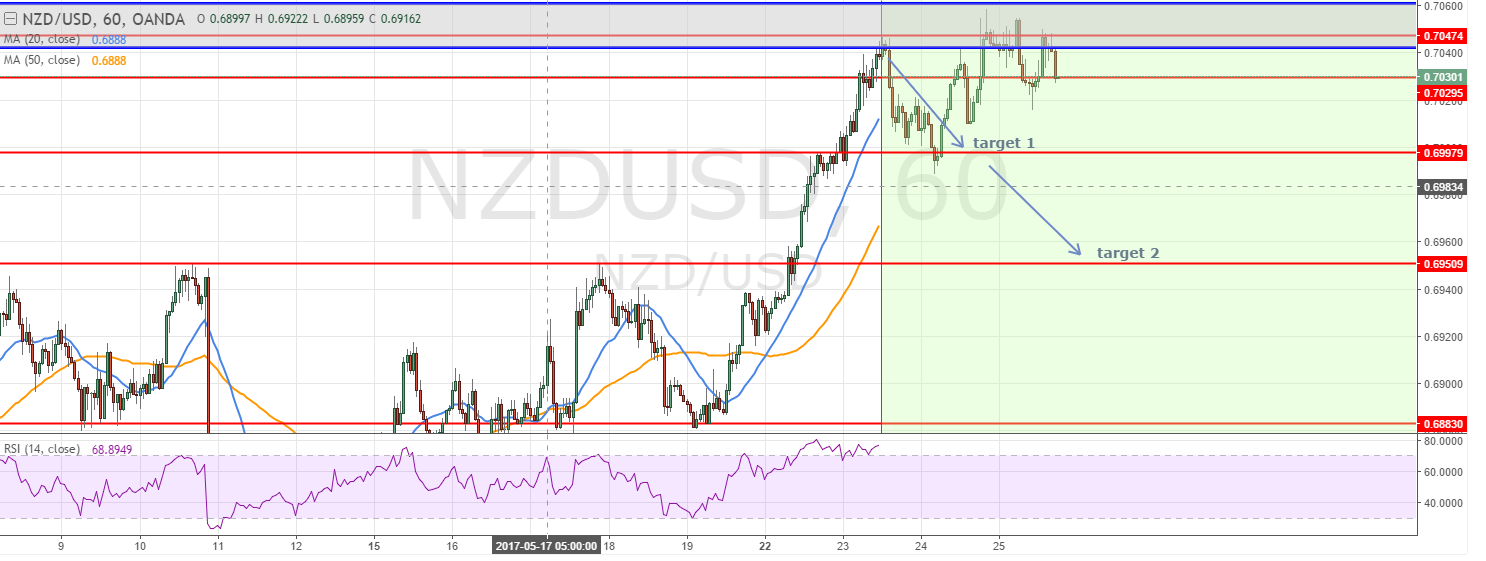

basic H4 view let see a bearish engulfing anf not pass is down T-mine since january high can make think he can down to a psychological leval of 0.7700 with amid bad china ppi and cpi and geopolital tension+ an hawkish FED bad on good us CPI report

Gabriel D Arco

usdcad chart setup for next week.. enter around 1.2515-20 for target the weekly resistance at 1.2665 a break down about the bullish channel and ma50 aound 1.2470-75 will cancel the trade

Gabriel D Arco

Eurgbp setup for next week,i think we have to wait a breckout of the rsi wedge for get the next short time move..

Gabriel D Arco

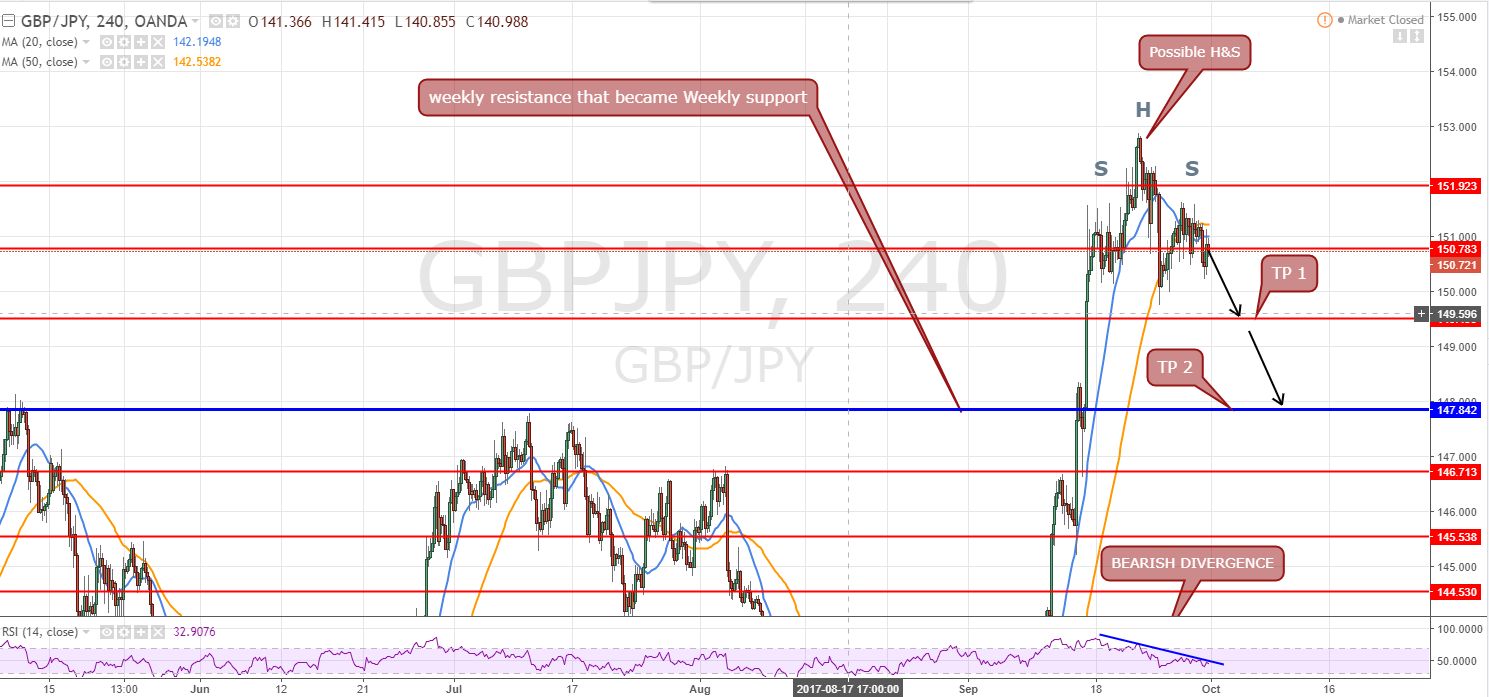

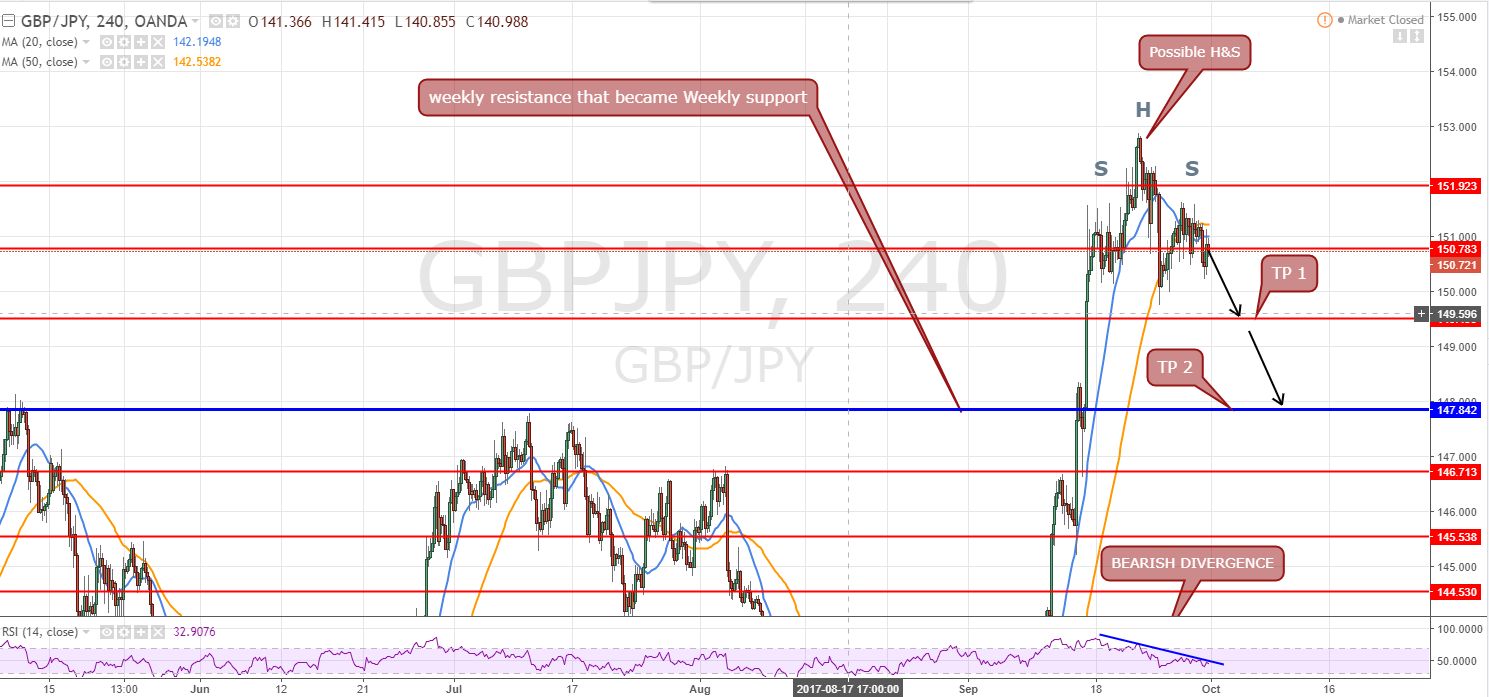

In technical analysis i see a possible H&S and even the weekly support is right Far ,usually when a price Breakout this kind of strong resistance the AT suggest that he will pullback on for bounce more up after. so i think with the h&S formation is good to try it.

Also i got a kind of RSI BEARISH DIVERGENCE in H4 chart

In fundamental.

Carney talk abour rate hike yes but they alredy talk about it before so i thought market have priced it already.

Brexit sill confuse topic and not all line in good ,it still again a little mess

missed his GDP forecast even other data are very good

The gbpusd -0.32% fail to pass the resistance many time at 1.3610 and even he still on bullish trend short/middle time,he have room to consolidate more.

the usdjpy 0.13% dont know wher eto go is in range since 3days and i think trump administration,fiscl policy details and maybe again NK -0.18% will weight on this cross

so i just think i may wrong like all trade we do but i wanna try this idea,with a good MM and ration

Also i got a kind of RSI BEARISH DIVERGENCE in H4 chart

In fundamental.

Carney talk abour rate hike yes but they alredy talk about it before so i thought market have priced it already.

Brexit sill confuse topic and not all line in good ,it still again a little mess

missed his GDP forecast even other data are very good

The gbpusd -0.32% fail to pass the resistance many time at 1.3610 and even he still on bullish trend short/middle time,he have room to consolidate more.

the usdjpy 0.13% dont know wher eto go is in range since 3days and i think trump administration,fiscl policy details and maybe again NK -0.18% will weight on this cross

so i just think i may wrong like all trade we do but i wanna try this idea,with a good MM and ration

Gabriel D Arco

2017.10.07

was a good idea ..gbpjoy since this post than lore than ly target 2 so more than 320 pips

Gabriel D Arco

Evan wirh Hakwkish Caeney and BOE + very good data Gbpusd attemps many time to breakout 1.3610 and reject all time so i try s hort in swing for a pullback

Gabriel D Arco

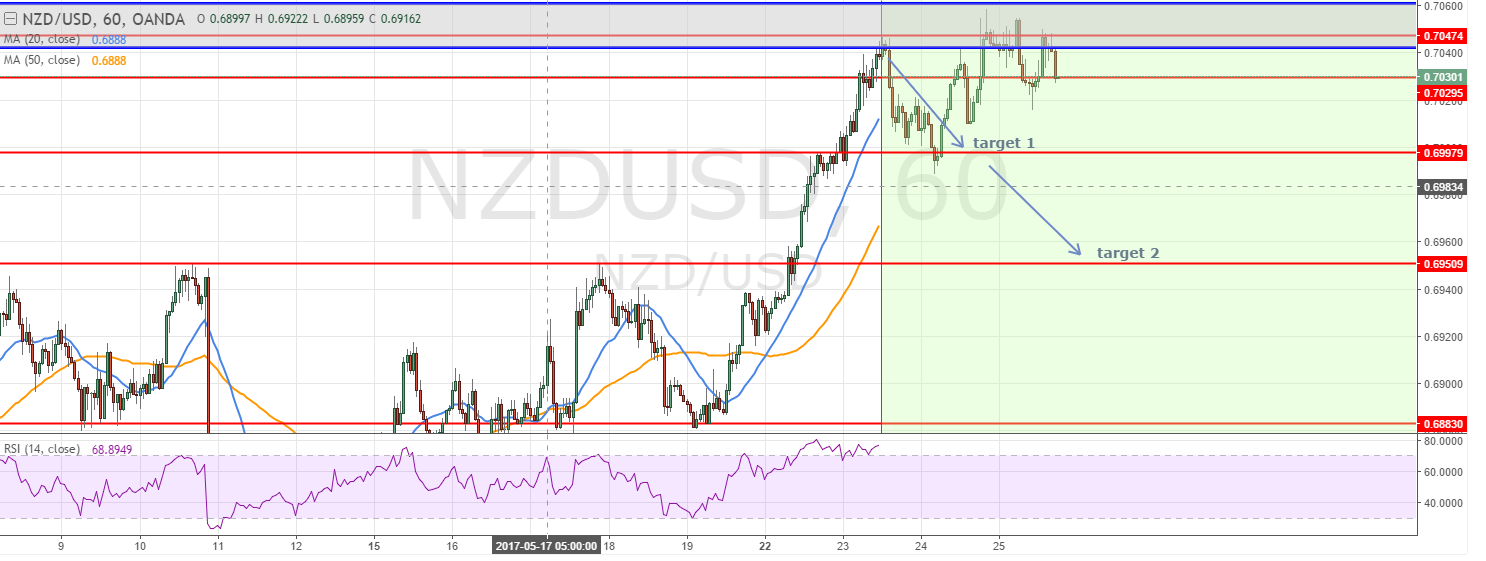

Daily view..can see an evening star + dovish Rba just before the FOMC.. take a short now or waiting a break of the support ?

Gabriel D Arco

Publicado o postagem eurnzd h4 view

eurnzd still in his downtrend channel.but keep his major support..waiting for a new Signal...

Compartilhar nas redes sociais · 1

195

Gabriel D Arco

same as eurcad we got first target..i cut half position in full profit ad i let now the other in swing trading

: