Damyan Malinov / Perfil

- Informações

|

6+ anos

experiência

|

2

produtos

|

116

versão demo

|

|

0

trabalhos

|

0

sinais

|

0

assinantes

|

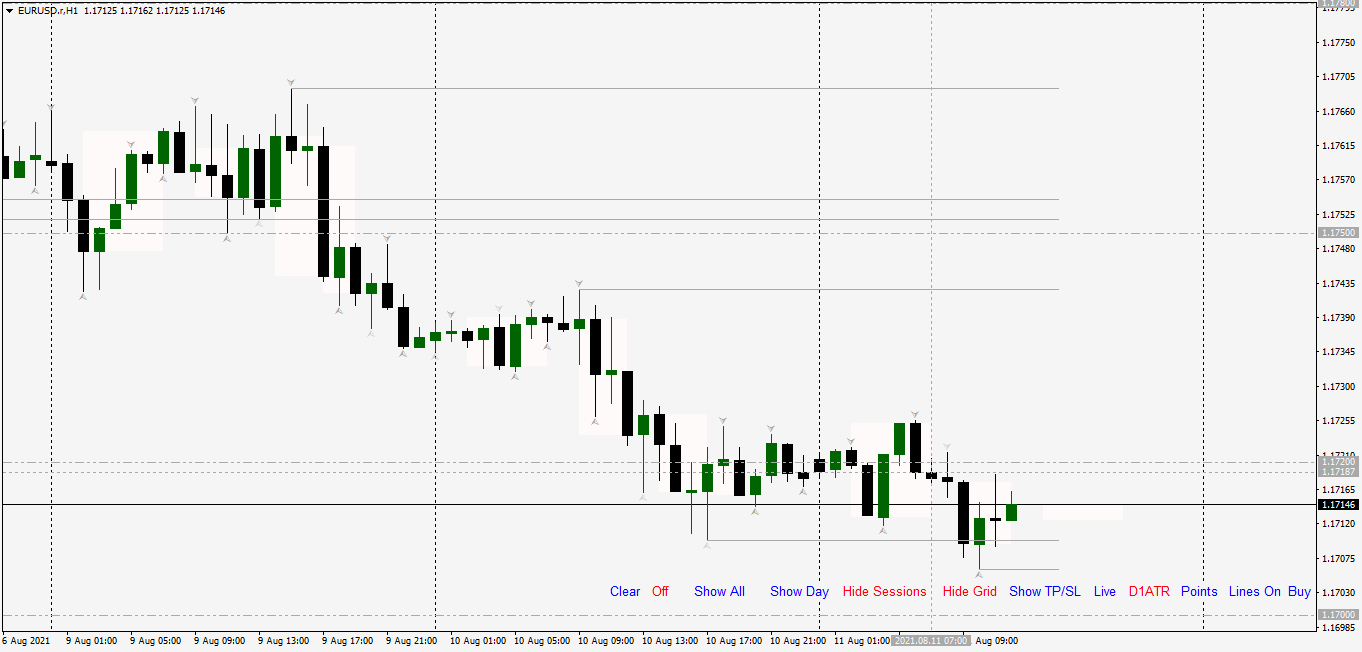

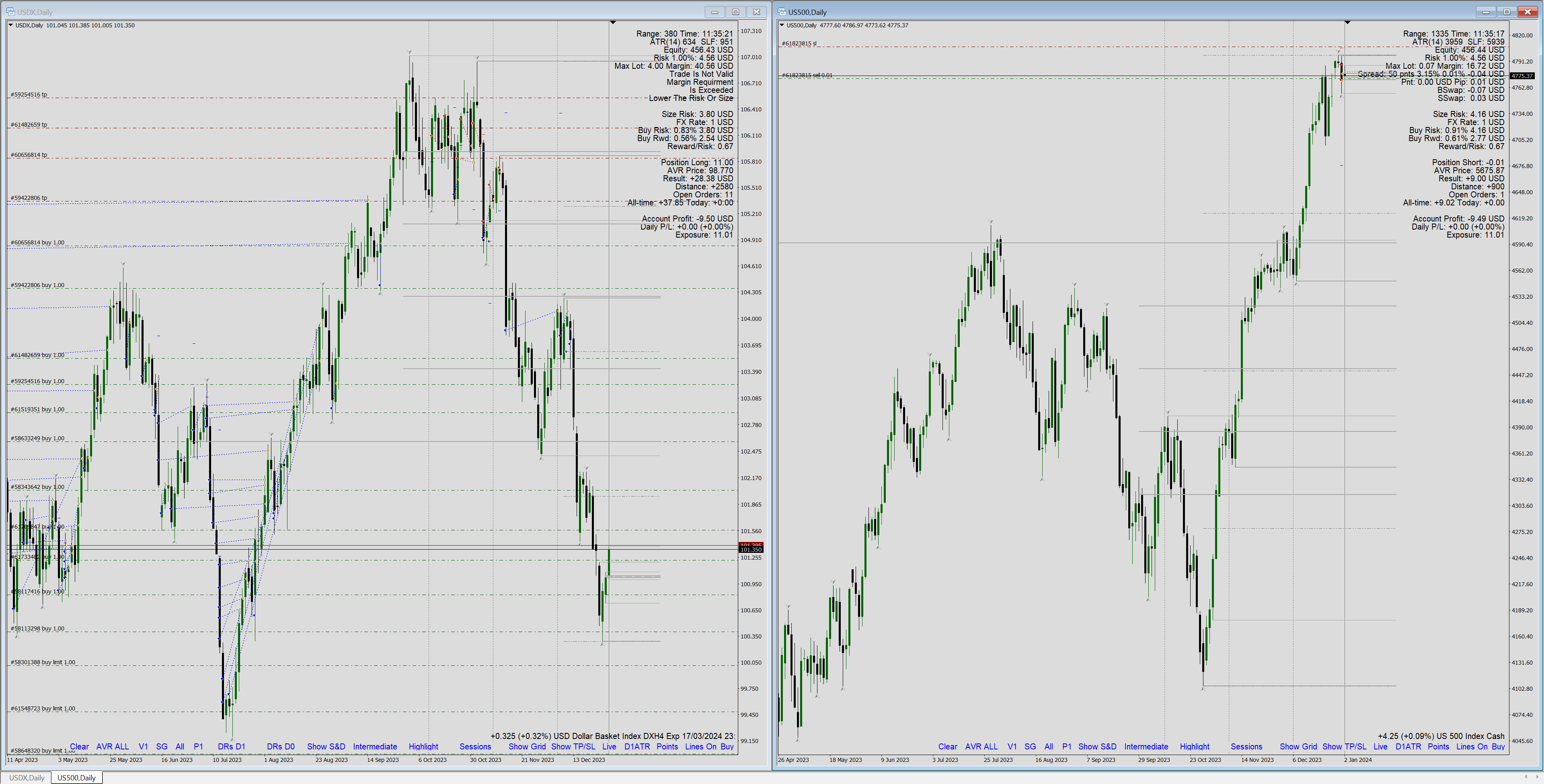

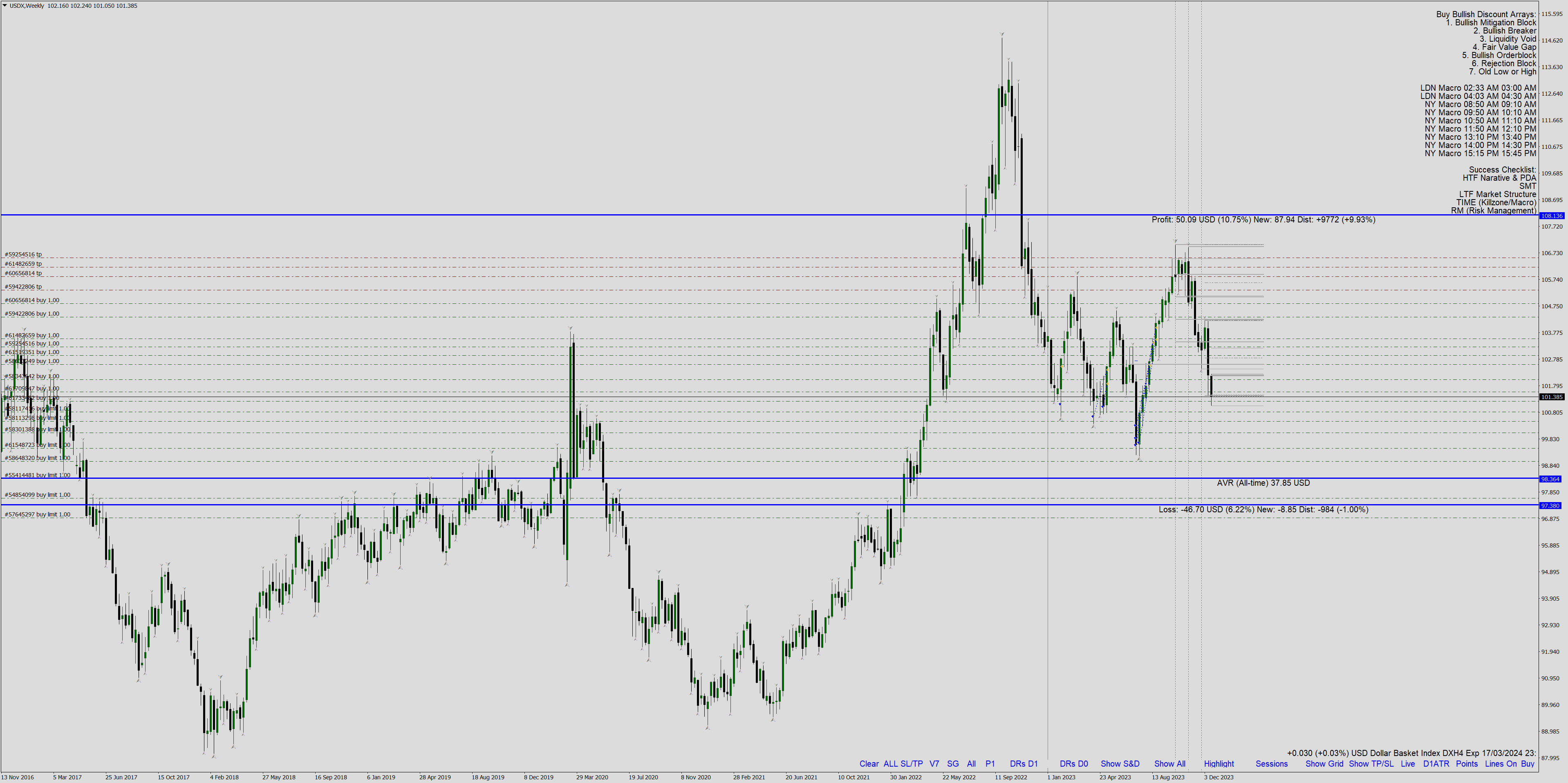

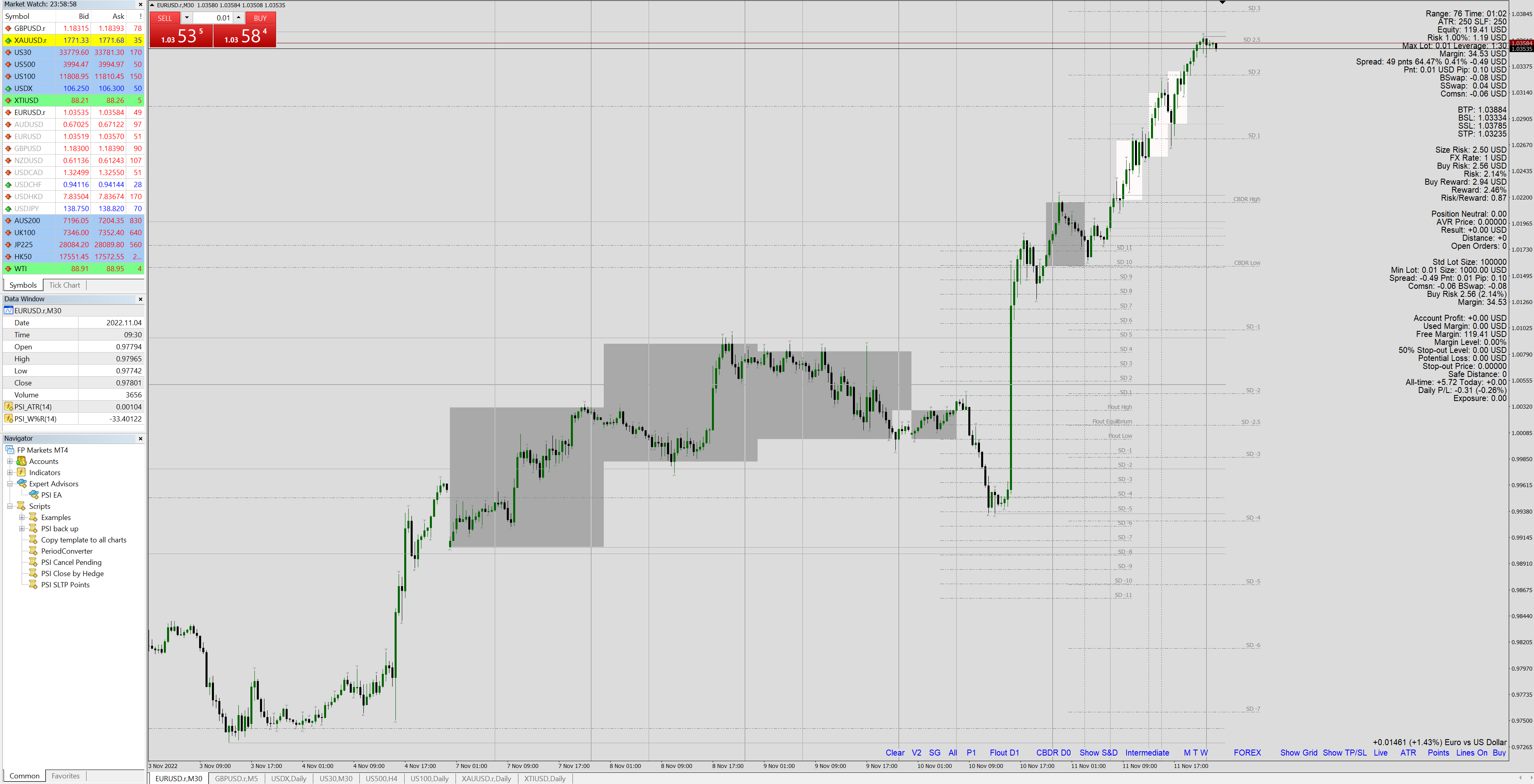

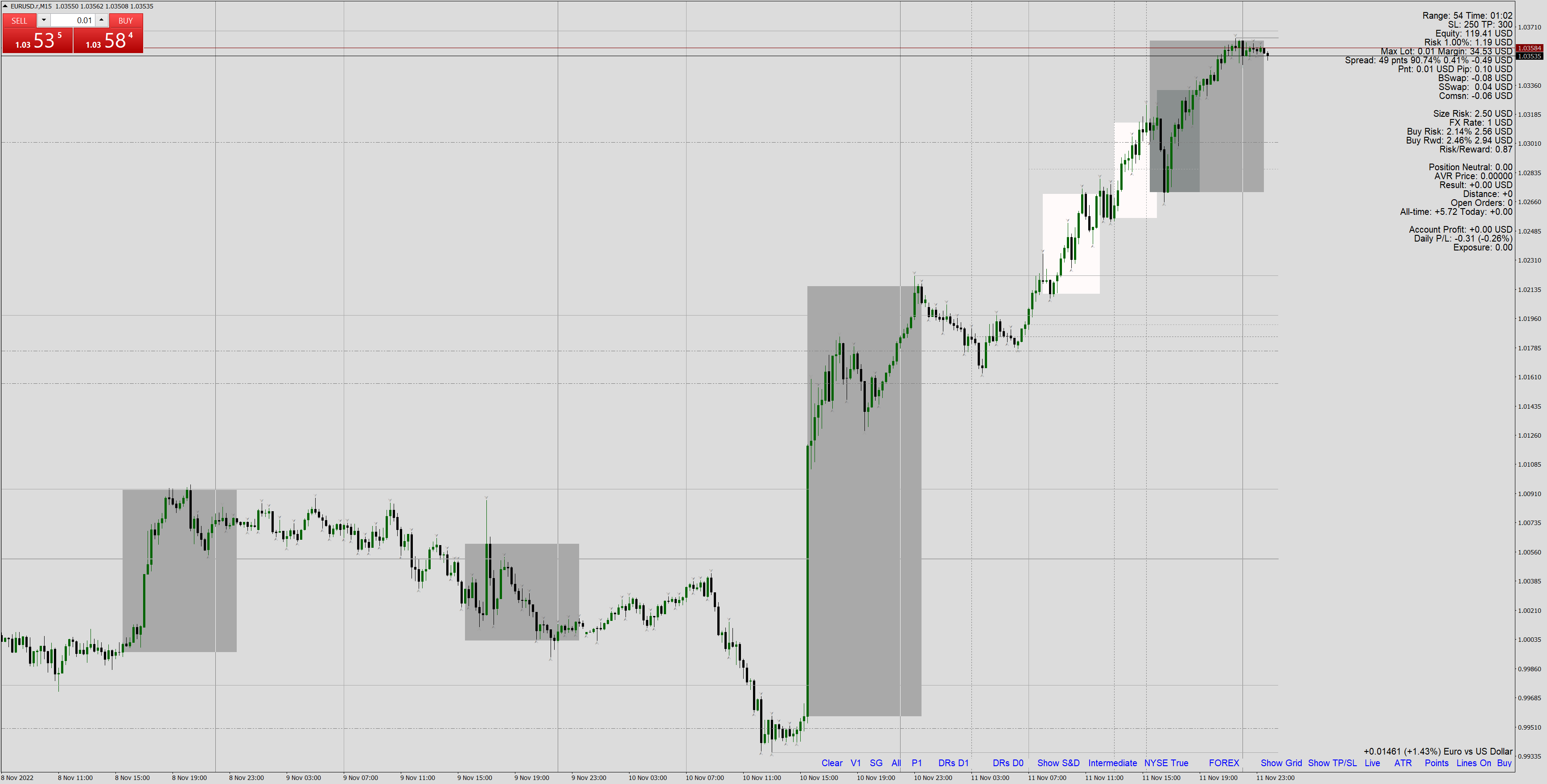

ICT Core Content Concepts turned into indicator plus all previous tools known from the Position Smart Indicator . This makes it the Full PSI Private Version ( read more ) restricted up to now but available only after the Mentorship Core Content was made public on YouTube. You will find many price action study tools like: Central Bank Dealing Range - CBDR Asian Range FLOUT Profiles and SD targets on the CBRD, Asian Range and Flout both on the wicks and on

ICT Core Content Concepts turned into indicator plus all previous tools known from the Position Smart Indicator . This makes it the Full PSI Private Version ( read more ) restricted up to now but available only after the Mentorship Core Content was made public on YouTube. You will find many price action study tools like: Central Bank Dealing Range - CBDR Asian Range FLOUT Profiles and SD targets on the CBRD, Asian Range and Flout both on the wicks and on

ICT Core Content Concepts turned into indicator plus all previous tools known from the PSI Indicator. This makes it the Full PSI Private Version restricted up to now but available only after the Mentorship Core Content was made public in YouTube.

You will find many tools like:

Central Bank Dealing Range - CBDR

Asian Range

FLOUT

Profiles on the CBRD, Asian Range and Flout both on the wicks and on the bodies

IPDA 20, 40 and 60

Monthly Swing Grades

W%R

As longs as the usual monthly, weekly, daily levels included are the IPDA levels plus GMT0 line, Daily Divider and many more from the following list - "NY Midnight Line", "GMT0 Midnight Line", "London Target Lines", "Monthly Range High", "Monthly Range Low", "Swing Grade First Zone", "Swing Grade Middle Zone", "Swing Grade Third Zone", "Monthly Range Grade First Zone", "Monthly Range Grade Middle Zone", "Monthly Range Grade Third Zone", "NY 10:00 A.M. Line", "GMT0 Midnight Vertical Line", "Day Divider Vertical Line", "NY Midnight Vertical Line", "NY Real Close Vertical Line", "IPDA Level Lines", "NYSE Open Vertical Line", "NYSE Close Vertical Line", "CME Open Vertical Line", "NYSE AM Safe Zone Vertical Line", "NYSE Lunch Hour Vertical Line", "NYSE PM Session Start Vertical Line", "NYSE PM Safe Zone Vertical Line", "NYSE Close Vertical Line" and more.

Many Overlays for sessions - "ASIA", "EURO", "USA", "Asia Sweet Spot", "London Open Sweet Spot" , "12AM to 12PM" , "NY Open Sweet Spot" , "London Close Sweet Spot", "Bond Market Sweet Spot", "US Market SPOOZ Sweet Spot", "The Last Hour", "NYSE A.M. Session", "NYSE Lunch", "NYSE P.M. Session", "NYSE True Day"

Many Overlays for daily focus studies - "The PSI Day on Focus", "Monday, Tuesday, Wednesday trio", "NYSE A.M. Session", "NYSE Lunch", "NYSE P.M. Session", "True Day", "Time Distortions"

All tools from the PSI Indicator that already had other ICT free tools before the 2022 Mentorship and the release of the private lessons.

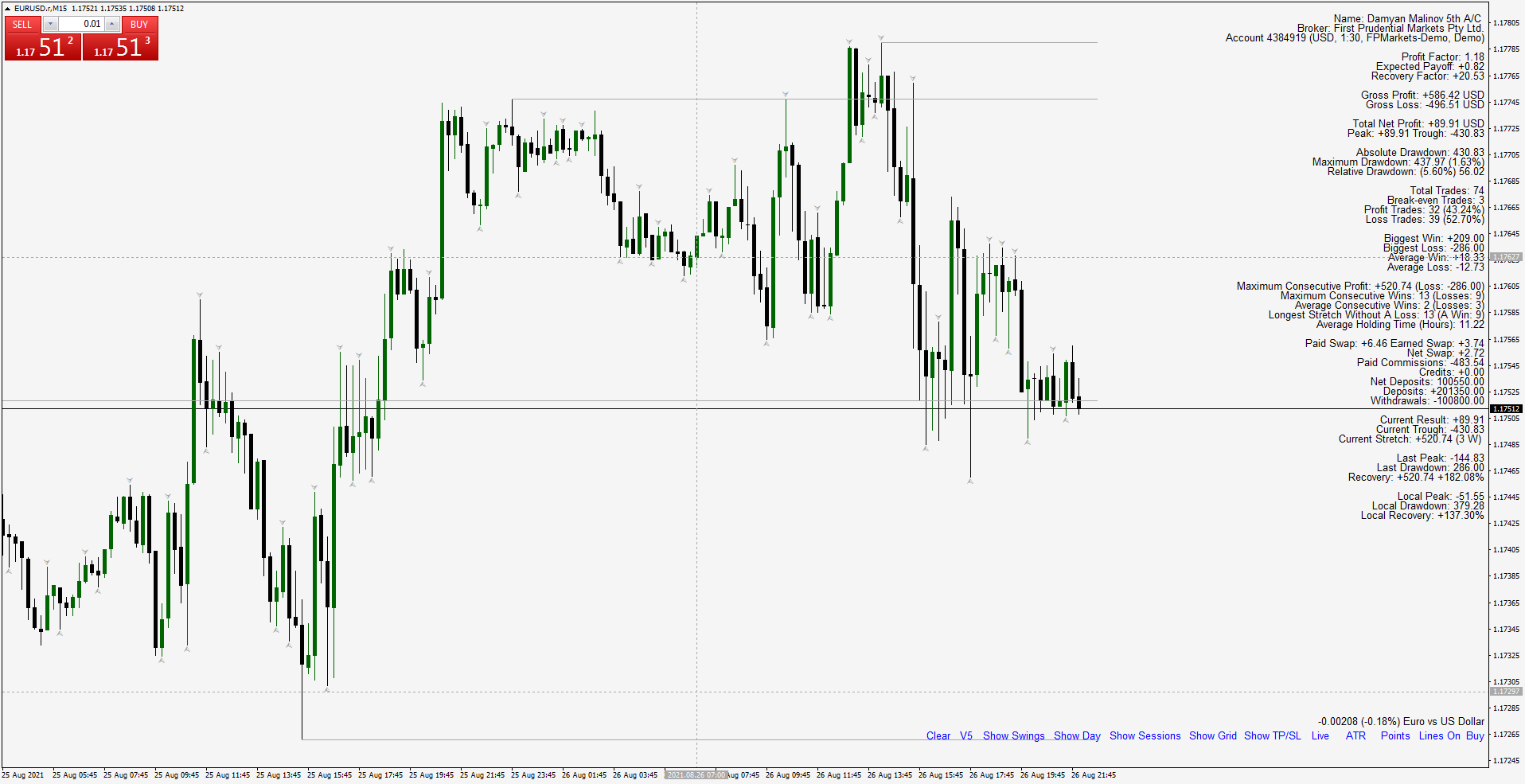

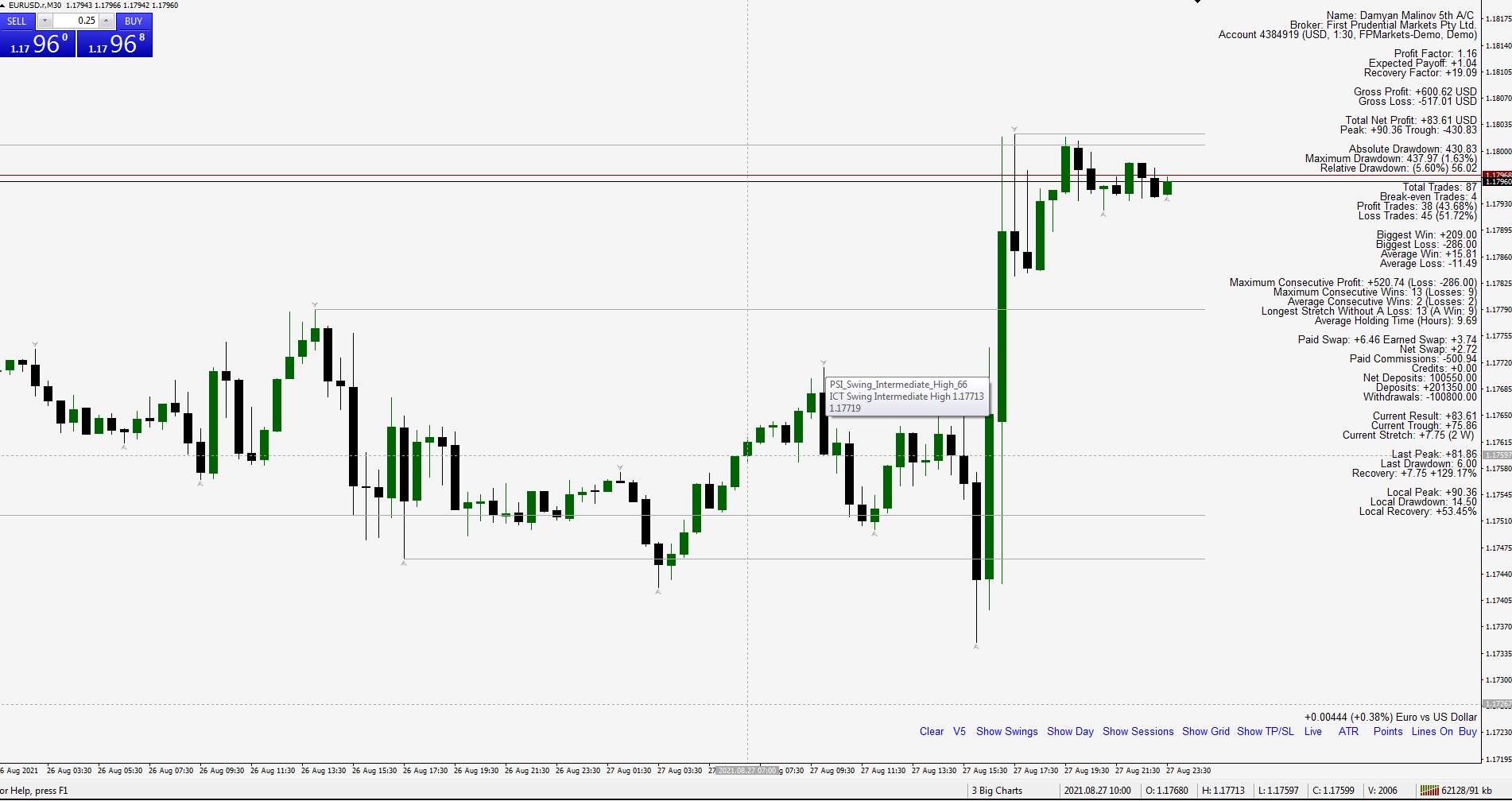

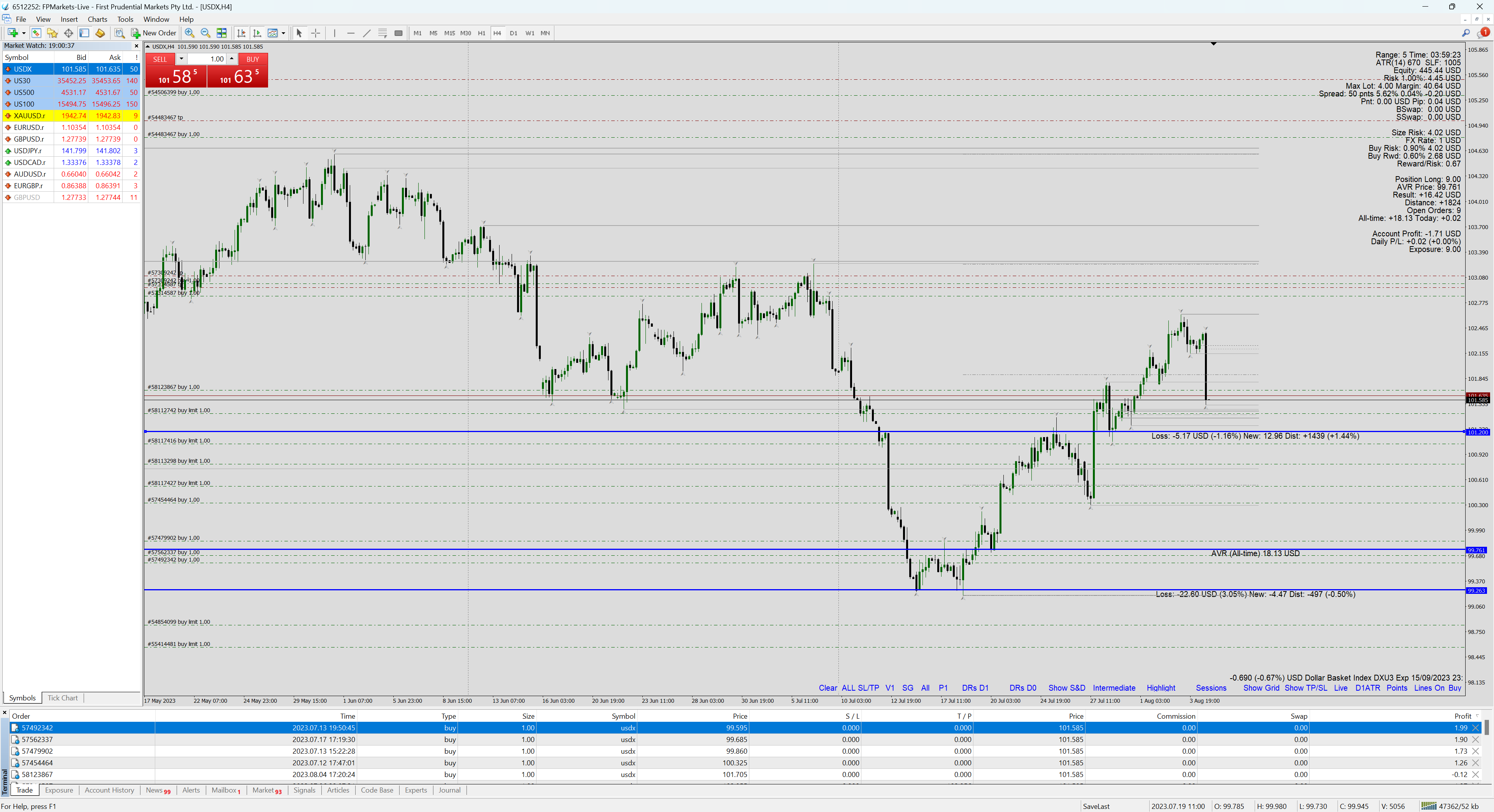

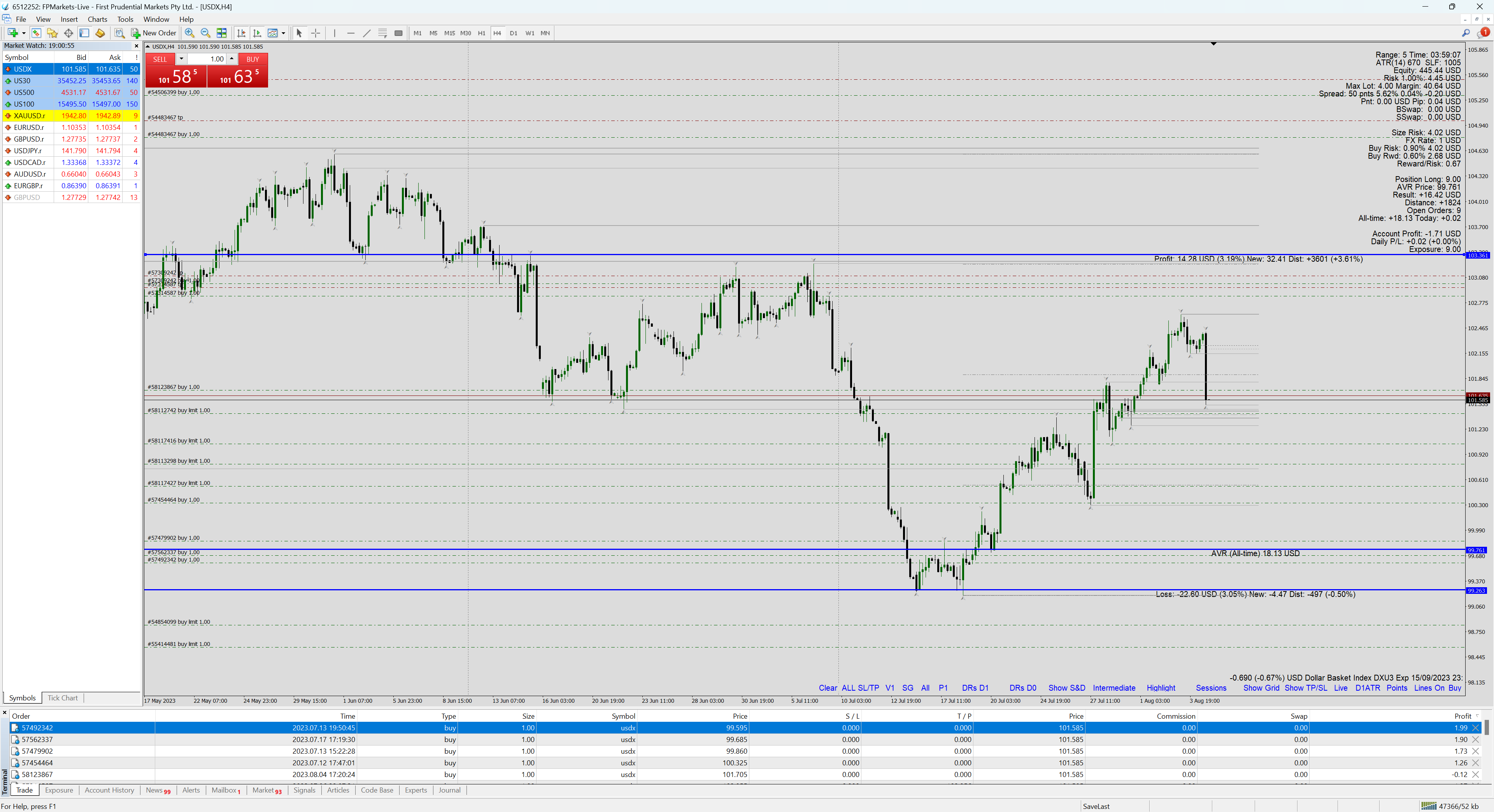

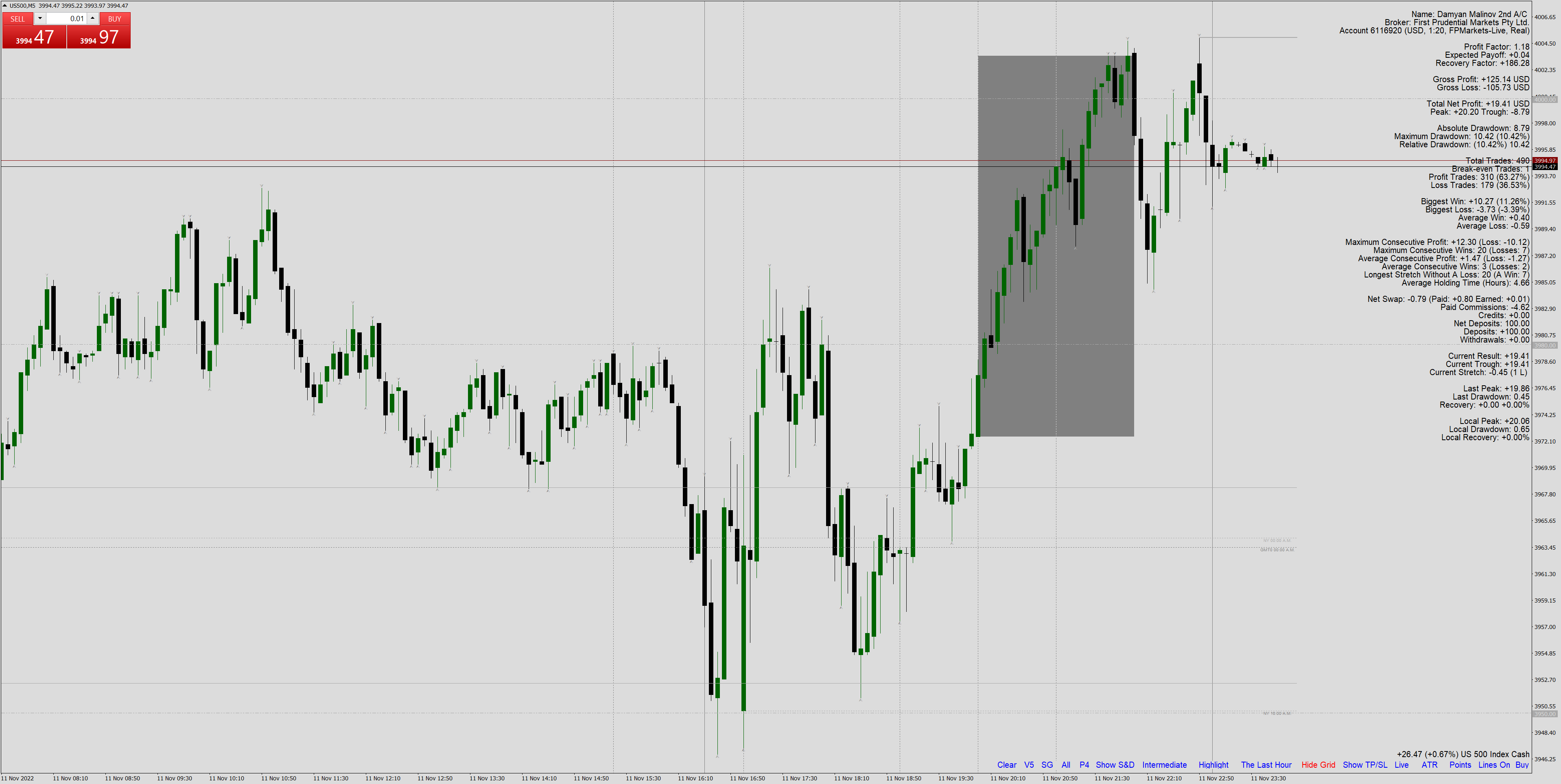

If you have an open trade and you closed 3 partials in profit out of it and price eventually hits your stop loss at BE MetaTrader4 will register that as 3 small wins out of 4 trades. In reality this is just 1 actual trade that is a combination of 4 separate partial closes.

Another example your first trade hits your stop loss. You make another trade and compensate for it as along the way you managed to close 6 partials on profit. MetaTrader4 will report that you have 6 tiny wins and 1 big loss. In reality you traded only two times and managed to pull a small win for the day. This way MetaTrader4 skews the statistics for win to lose ratio making it unrealistically high or the stats of the biggest win towards the biggest loss making them very bad and so on important statistics. The PSI Detailed Report address that issue.