Abdalla Mohamed Mahmoud Taha / 프로필

- 정보

|

8+ 년도

경험

|

0

제품

|

0

데몬 버전

|

|

0

작업

|

0

거래 신호

|

0

구독자

|

my name Abdalla Mohamed, I have more than 11 years experience in forex market .

I am very professional scalping trader and I own research and studies on the pairs of the British pound

, i have signals providers at MT4 / MT5 , available through the MQL5.com Market.

I am very professional scalping trader and I own research and studies on the pairs of the British pound

, i have signals providers at MT4 / MT5 , available through the MQL5.com Market.

Abdalla Mohamed Mahmoud Taha

GBP/AUD: 1-hour

Support alert!

GBP/AUD is about to hit the 1.7575 area that’s near the 200 SMA on the 1-hour chart. What’s more, it’s also around a major area of interest!

Bulls who believe that GBP will continue to gain pips against AUD can start scaling in at current levels and then add positions as soon as there’s bullish momentum.

If you’d rather pay attention to the (just) broken trend line support, though, or if you think that GBP/AUD will go back to its longer-term downtrend, then you can consider placing short positions once the pair has clearly broken below the 200 SMA support.

Watch how GBP/AUD reacts to the 200 SMA to see which direction the pair will head next!

Support alert!

GBP/AUD is about to hit the 1.7575 area that’s near the 200 SMA on the 1-hour chart. What’s more, it’s also around a major area of interest!

Bulls who believe that GBP will continue to gain pips against AUD can start scaling in at current levels and then add positions as soon as there’s bullish momentum.

If you’d rather pay attention to the (just) broken trend line support, though, or if you think that GBP/AUD will go back to its longer-term downtrend, then you can consider placing short positions once the pair has clearly broken below the 200 SMA support.

Watch how GBP/AUD reacts to the 200 SMA to see which direction the pair will head next!

소셜 네트워크에 공유 · 1

Abdalla Mohamed Mahmoud Taha

GBP/USD: 4-hour

Cable has formed lower highs and found support around the 1.3000 mark, creating a descending triangle on its 4-hour time frame.

Price is inching closer to testing the triangle support, which might still hold as a floor. After all, Stochastic is already indicating oversold conditions or exhaustion among sellers.

Once the oscillator pulls higher, pound bulls could take this as their cue to bring GBP/USD back up to the resistance at 1.3100. If you’re counting on this to happen, watch out for reversal candlesticks around the support zone.

Just be careful since the 100 SMA is below the 200 SMA to signal that there’s a chance the floor might break. If that happens, the pair could tumble by the same height as the triangle pattern, which spans a little over 400 pips.

Cable has formed lower highs and found support around the 1.3000 mark, creating a descending triangle on its 4-hour time frame.

Price is inching closer to testing the triangle support, which might still hold as a floor. After all, Stochastic is already indicating oversold conditions or exhaustion among sellers.

Once the oscillator pulls higher, pound bulls could take this as their cue to bring GBP/USD back up to the resistance at 1.3100. If you’re counting on this to happen, watch out for reversal candlesticks around the support zone.

Just be careful since the 100 SMA is below the 200 SMA to signal that there’s a chance the floor might break. If that happens, the pair could tumble by the same height as the triangle pattern, which spans a little over 400 pips.

소셜 네트워크에 공유 · 1

Abdalla Mohamed Mahmoud Taha

Tips for Forex Trading Beginners

As a beginner, you’ve taken your first steps towards learning the basics of forex trading.

But it only gets harder from here. Just like learning how to walk, you have to take baby steps, and in between, you will fall, but you get back up and press forward.

If you’re trying your hand at forex trading for the first time, know that most beginner traders are best served by keeping things simple.

Here are some trading tips every trader should keep in mind before trading currencies.

1. Educate Yourself

We can’t emphasize enough the importance of educating yourself and learning as much as you can about the forex market.

Find quality forex education sources like our The School of Pipsology.

Before risking real money, make sure to study the different currency pairs and understand what makes their prices go up and down.

2. Create a Plan and Stick to the Plan

You are the most rational before placing a trade and most irrational during your trade.

This is why you need to always have a plan prior to opening a position.

Creating a trading plan is a critical component of successful trading.

A trading plan is an organized approach to executing a trading system that you’ve developed based on your market analysis and outlook while factoring in risk management and personal psychology.

With a trading plan, you’re able to know if you’re headed in the right direction. You’ll have a framework to measure your trading performance, which you’ll be able to monitor continually.

This allows you to trade with less emotion and stress.

3. Practice

In real life, you may have a plan to drive from Point A to Point B if you don’t know how to drive the car that’ll get you there, then your plan is futile.

The same applies to your trading plan. You should “test drive” your trading plan first until you become proficient in executing the plan.

It’s important to learn how to use the features of a trading platform before you start trading on it.

Fortunately, traders can test out each platform using a demo account, which means no real money is at risk.

A demo account allows you to put your trading plan to the test in real-market conditions, without risking any real money.

4. Keep It Slow and Steady

One key to trading is consistency.

All traders have lost money, but if you maintain a positive edge, you have a better chance of staying profitable.

Educating yourself and creating a trading plan is good, but the real test is sticking to that plan through hardcore discipline.

A trading plan is only effective if it’s followed. You have to stick with it.

5. Know Your Limits

As a new trader, you have to know your limits.

First of all, do you have enough money to trade? Forex will not make you rich quickly! So make sure that the money you’ll be putting at risk (called “risk capital“) is money that you can actually lose.

If you need that money to pay the bills, then you should think twice about trading.

If you do have the money, then you need to know how much you’re willing to risk on each trade, sticking with leverage ratios within those risk limits, and never opening a position size that’s so big that it could blow your account.

A lot of traders fail because they don’t understand trading with margin and ignore the effects of leverage. This shouldn’t be you.

Homeless due to Overleverage

6. Keep Your Emotions in Check

To become consistently profitable, you have to stay rational and emotionally detached.

Many novice traders ride an emotional rollercoaster, feeling on top of the world after a win, but down in the dumps after a loss.

In contrast, most experienced traders stay calm and relaxed even after a series of losses. They don’t let the natural ups and downs of trading affect them emotionally.

Don’t fall prey to the most dangerous emotion in trading.

Emotional stability, matched with proper risk management, is the name of the game.

7. Stay Open-Minded

While having discipline is a very important trait for a trader, you also have to be wary that if you’re too stuck in your ways, you’ll end up imposing our ideas on what the market should do, instead of reacting to what is actually happening.

Constantly question the market and your trading plan.

Asking questions enables you to look at different perspectives of the market that you initially may not be aware of.

This practice will make you think of other potential scenarios that may emerge and enable you to become a better “listener” of the markets, rather an “imposer” of your own thoughts and views that in reality, may not mean zilch to the market.

As a beginner, you’ve taken your first steps towards learning the basics of forex trading.

But it only gets harder from here. Just like learning how to walk, you have to take baby steps, and in between, you will fall, but you get back up and press forward.

If you’re trying your hand at forex trading for the first time, know that most beginner traders are best served by keeping things simple.

Here are some trading tips every trader should keep in mind before trading currencies.

1. Educate Yourself

We can’t emphasize enough the importance of educating yourself and learning as much as you can about the forex market.

Find quality forex education sources like our The School of Pipsology.

Before risking real money, make sure to study the different currency pairs and understand what makes their prices go up and down.

2. Create a Plan and Stick to the Plan

You are the most rational before placing a trade and most irrational during your trade.

This is why you need to always have a plan prior to opening a position.

Creating a trading plan is a critical component of successful trading.

A trading plan is an organized approach to executing a trading system that you’ve developed based on your market analysis and outlook while factoring in risk management and personal psychology.

With a trading plan, you’re able to know if you’re headed in the right direction. You’ll have a framework to measure your trading performance, which you’ll be able to monitor continually.

This allows you to trade with less emotion and stress.

3. Practice

In real life, you may have a plan to drive from Point A to Point B if you don’t know how to drive the car that’ll get you there, then your plan is futile.

The same applies to your trading plan. You should “test drive” your trading plan first until you become proficient in executing the plan.

It’s important to learn how to use the features of a trading platform before you start trading on it.

Fortunately, traders can test out each platform using a demo account, which means no real money is at risk.

A demo account allows you to put your trading plan to the test in real-market conditions, without risking any real money.

4. Keep It Slow and Steady

One key to trading is consistency.

All traders have lost money, but if you maintain a positive edge, you have a better chance of staying profitable.

Educating yourself and creating a trading plan is good, but the real test is sticking to that plan through hardcore discipline.

A trading plan is only effective if it’s followed. You have to stick with it.

5. Know Your Limits

As a new trader, you have to know your limits.

First of all, do you have enough money to trade? Forex will not make you rich quickly! So make sure that the money you’ll be putting at risk (called “risk capital“) is money that you can actually lose.

If you need that money to pay the bills, then you should think twice about trading.

If you do have the money, then you need to know how much you’re willing to risk on each trade, sticking with leverage ratios within those risk limits, and never opening a position size that’s so big that it could blow your account.

A lot of traders fail because they don’t understand trading with margin and ignore the effects of leverage. This shouldn’t be you.

Homeless due to Overleverage

6. Keep Your Emotions in Check

To become consistently profitable, you have to stay rational and emotionally detached.

Many novice traders ride an emotional rollercoaster, feeling on top of the world after a win, but down in the dumps after a loss.

In contrast, most experienced traders stay calm and relaxed even after a series of losses. They don’t let the natural ups and downs of trading affect them emotionally.

Don’t fall prey to the most dangerous emotion in trading.

Emotional stability, matched with proper risk management, is the name of the game.

7. Stay Open-Minded

While having discipline is a very important trait for a trader, you also have to be wary that if you’re too stuck in your ways, you’ll end up imposing our ideas on what the market should do, instead of reacting to what is actually happening.

Constantly question the market and your trading plan.

Asking questions enables you to look at different perspectives of the market that you initially may not be aware of.

This practice will make you think of other potential scenarios that may emerge and enable you to become a better “listener” of the markets, rather an “imposer” of your own thoughts and views that in reality, may not mean zilch to the market.

소셜 네트워크에 공유 · 1

Abdalla Mohamed Mahmoud Taha

When Is It Okay To Take The Contrarian Approach On Trends?

Some days most forex pairs are just going in one particular direction and it makes no sense to go against the herd.

However, if you’re a fan of picking tops or bottoms and if you think that these strong trends are already exhausted, you shouldn’t be afraid to take a contrarian approach to your forex trades.

When all charts point to a single direction and the current market sentiment is supported by the newswires, it’s easy to understand why many traders hesitate to go against the herd.

But as investment pundit Warren Buffett famously said, “We should also be fearful when others are greedy and greedy when others are fearful.”

You see, just because a majority of the traders out there have a certain trading bias, it doesn’t necessarily mean that they’re right.

Sometimes, strong momentum merely reflects the entrance of trading amateurs that just go with the flow without knowing what’s driving price action.

This is why following the flock blindly can lead to herding bias – one of the 5 common trading mistakes traders make.

Ask anyone who has successfully tried trading against the herd and they will tell you that it can feel intimidating when your analysis leads you to an unpopular bias. But sometimes, it pays to go against the herd and be the odd one out – to be the contrarian.

Contrarian trading is a forex strategy that favors going against the current market bias in anticipation of a shift in market sentiment. It involves buying a currency when it is weak and selling it when it’s strong.

Contrarian traders try to take advantage of moments when the markets get carried away by strong momentum.

When everyone and his grandma is ready and willing to push prices higher, it can sometimes lead to overpriced assets. Likewise, when everyone is hell-bent on selling an asset, opportunities to buy at a bargain arise.

One of the main benefits of contrarian trading is that it allows you to get good prices and catch reversals right as they begin. In turn, this often leads to very attractive reward-to-risk ratios, giving you more bang for your buck.

However, contrarians trade against the trend, and that doesn’t always work out in their favor. As the saying goes, “the trend is your friend,” but it can be a mean son of a gun when you fight it.

When a trend is particularly strong, it can bust right throw potential reversal points and wash away those who go against the flow.

By no means am I saying that you should go against the trend just for the heck of it.

What I’m merely saying is that if, after thoroughly conducting your own fundamental and technical analysis, you have enough reason to believe that the market is about to turn, don’t be afraid to go against the herd and take a contrarian position.

Remember, you don’t always have to go with the flow; plenty of lucrative trading opportunities arise from straying from the crowd.

But always keep in mind that although contrarian trading can be rewarding, it’s not without its dangers.

Some days most forex pairs are just going in one particular direction and it makes no sense to go against the herd.

However, if you’re a fan of picking tops or bottoms and if you think that these strong trends are already exhausted, you shouldn’t be afraid to take a contrarian approach to your forex trades.

When all charts point to a single direction and the current market sentiment is supported by the newswires, it’s easy to understand why many traders hesitate to go against the herd.

But as investment pundit Warren Buffett famously said, “We should also be fearful when others are greedy and greedy when others are fearful.”

You see, just because a majority of the traders out there have a certain trading bias, it doesn’t necessarily mean that they’re right.

Sometimes, strong momentum merely reflects the entrance of trading amateurs that just go with the flow without knowing what’s driving price action.

This is why following the flock blindly can lead to herding bias – one of the 5 common trading mistakes traders make.

Ask anyone who has successfully tried trading against the herd and they will tell you that it can feel intimidating when your analysis leads you to an unpopular bias. But sometimes, it pays to go against the herd and be the odd one out – to be the contrarian.

Contrarian trading is a forex strategy that favors going against the current market bias in anticipation of a shift in market sentiment. It involves buying a currency when it is weak and selling it when it’s strong.

Contrarian traders try to take advantage of moments when the markets get carried away by strong momentum.

When everyone and his grandma is ready and willing to push prices higher, it can sometimes lead to overpriced assets. Likewise, when everyone is hell-bent on selling an asset, opportunities to buy at a bargain arise.

One of the main benefits of contrarian trading is that it allows you to get good prices and catch reversals right as they begin. In turn, this often leads to very attractive reward-to-risk ratios, giving you more bang for your buck.

However, contrarians trade against the trend, and that doesn’t always work out in their favor. As the saying goes, “the trend is your friend,” but it can be a mean son of a gun when you fight it.

When a trend is particularly strong, it can bust right throw potential reversal points and wash away those who go against the flow.

By no means am I saying that you should go against the trend just for the heck of it.

What I’m merely saying is that if, after thoroughly conducting your own fundamental and technical analysis, you have enough reason to believe that the market is about to turn, don’t be afraid to go against the herd and take a contrarian position.

Remember, you don’t always have to go with the flow; plenty of lucrative trading opportunities arise from straying from the crowd.

But always keep in mind that although contrarian trading can be rewarding, it’s not without its dangers.

소셜 네트워크에 공유 · 1

Abdalla Mohamed Mahmoud Taha

Week Ahead in FX (Apr. 18 – 22): Consumer Data From U.K. and Canada And A PMI Parade From Major Economies

ready to get your pips in?

This week, we’re looking at retail sales data from Canada and the U.K. as well as a bunch of PMI reports from the major economies.

ICYMI, I’ve written a quick recap of the market themes that pushed currency pairs around last week. Check it!

Which calendar events will be under the spotlight and what are markets expecting? Here’s a list:

Major Economic Events:

China’s data dump (Apr 18, 2:00 am GMT) – In a few minutes, China will print its quarterly GDP and annualized retail sales, fixed asset investment, and industrial production numbers.

Annualized GDP is expected to improve from 4.0% to 4.2% but the rest of the reports are expected to reflect the impacts of higher energy prices and fresh COVID lockdowns in China’s key cities.

Canada’s inflation (Apr 20, 12:30 pm GMT) – Consumer prices rose by 1.0% from January but registered a 5.7% increase from a year ago in February. That’s the highest since August 1991!

Analysts see inflation accelerating to 6.0% in March. A high figure would not only justify the Bank of Canada’s (BOC) decision to raise its interest rates by 50 basis points to 1.00% but also set the stage for another 50-bp rate hike in June.

UK’s retail sales (Apr 22, 6:00 am GMT) – Increased confidence to go out and higher demand for services dragged retail activity 0.3% lower in February. This surprised GBP bulls who were celebrating a 1.9% gain in January.

Increased services spending and higher petrol prices are expected to slow retail trading further in March. Markets see a 0.1% decline with the annual rates slowing down from 7.0% to 2.9%. Yipes!

Global PMI reports – A parade of manufacturing and services PMIs from major economies is expected to paint a picture of the global economic growth.

Australia will start the program with its numbers scheduled on Thursday at 11:00 pm GMT and the U.K., Germany, France, Eurozone, U.K., and the U.S. will follow with their releases on Friday during the London and U.S. sessions.

ALL April PMIs are expected to print slightly lower figures but keep an eye out for significant upside or downside surprises!

ready to get your pips in?

This week, we’re looking at retail sales data from Canada and the U.K. as well as a bunch of PMI reports from the major economies.

ICYMI, I’ve written a quick recap of the market themes that pushed currency pairs around last week. Check it!

Which calendar events will be under the spotlight and what are markets expecting? Here’s a list:

Major Economic Events:

China’s data dump (Apr 18, 2:00 am GMT) – In a few minutes, China will print its quarterly GDP and annualized retail sales, fixed asset investment, and industrial production numbers.

Annualized GDP is expected to improve from 4.0% to 4.2% but the rest of the reports are expected to reflect the impacts of higher energy prices and fresh COVID lockdowns in China’s key cities.

Canada’s inflation (Apr 20, 12:30 pm GMT) – Consumer prices rose by 1.0% from January but registered a 5.7% increase from a year ago in February. That’s the highest since August 1991!

Analysts see inflation accelerating to 6.0% in March. A high figure would not only justify the Bank of Canada’s (BOC) decision to raise its interest rates by 50 basis points to 1.00% but also set the stage for another 50-bp rate hike in June.

UK’s retail sales (Apr 22, 6:00 am GMT) – Increased confidence to go out and higher demand for services dragged retail activity 0.3% lower in February. This surprised GBP bulls who were celebrating a 1.9% gain in January.

Increased services spending and higher petrol prices are expected to slow retail trading further in March. Markets see a 0.1% decline with the annual rates slowing down from 7.0% to 2.9%. Yipes!

Global PMI reports – A parade of manufacturing and services PMIs from major economies is expected to paint a picture of the global economic growth.

Australia will start the program with its numbers scheduled on Thursday at 11:00 pm GMT and the U.K., Germany, France, Eurozone, U.K., and the U.S. will follow with their releases on Friday during the London and U.S. sessions.

ALL April PMIs are expected to print slightly lower figures but keep an eye out for significant upside or downside surprises!

Abdalla Mohamed Mahmoud Taha

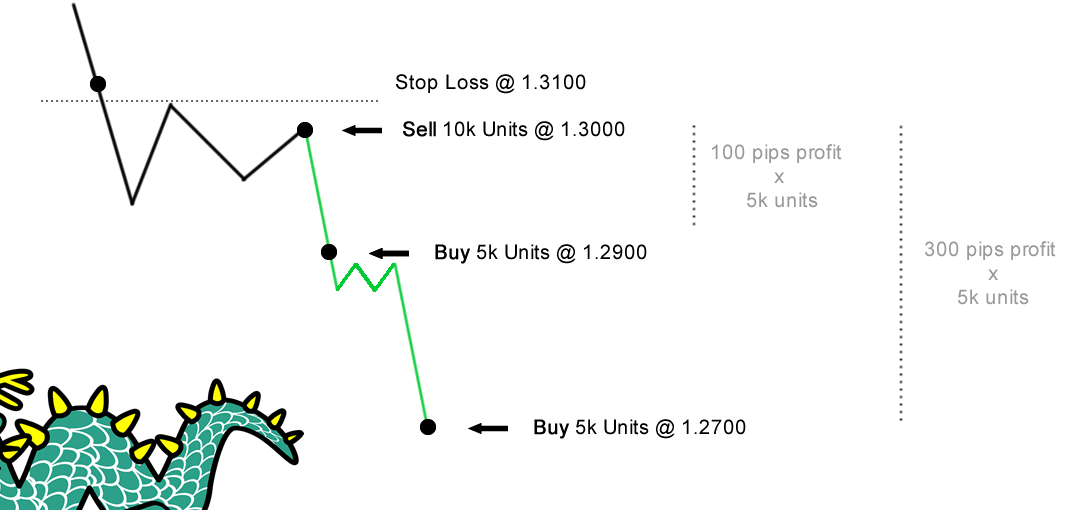

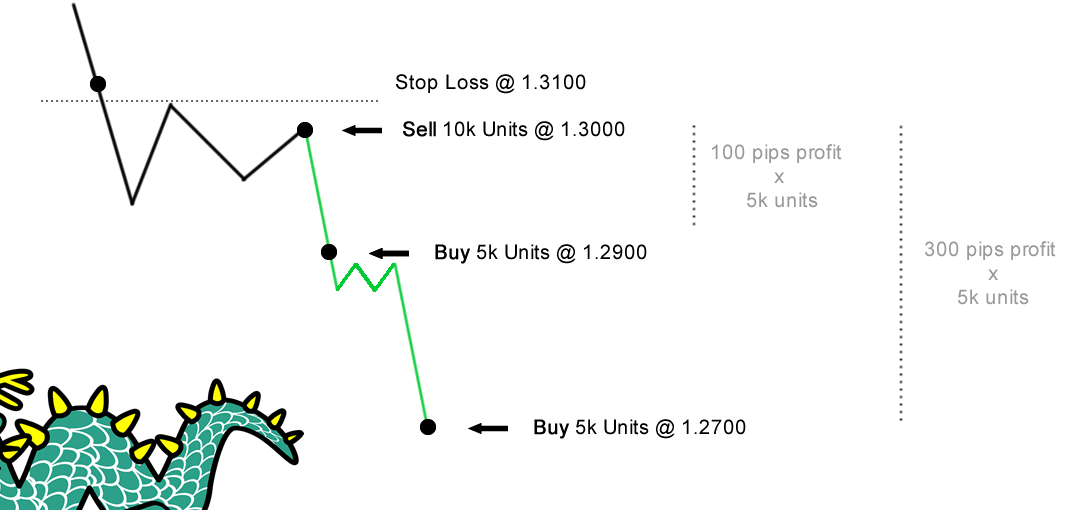

How To Scale Out Of Positions

As mentioned earlier, scaling out has the obvious benefit of reducing your risk as you are taking away exposure to the market…whether you are in a winning or losing position.

When used with trailing stops, there is also the benefit of locking in profits and creating a “nearly” risk-free trade.

We’ll go through a trade example to show you how this can be done.

Example: Scaling out of EUR/USD

Let’s say you have a $10,000 account and you shorted 10k units of EUR/USD at 1.3000.

You placed your stop at 1.3100 and your profit target is 300 pips below your entry at 1.2700.

With 10k units of EUR/USD (pip value of this position is $1) and a stop of 100 pips, your total risk is $100, or 1% of your account.

A few days later, the EUR/USD has moved lower to 1.2900, or 100 pips in your favor. This means you have a total profit of $100, or a 1% gain.

All of a sudden, the Fed releases dovish comments that may weaken the USD in the short term.

You think to yourself, “This may bring dollar sellers back into the market, and I don’t know if EUR/USD will keep going down… I should lock in some profits.”

You decide to close half of your position by buying 5k units of EUR/USD at the current exchange rate of 1.2900.

This locks in $50 of profit into your account [at 5k units of EUR/USD, 1 pip is valued at $0.50…. you have closed a profit of 100 pips (100 pips x $0.50 = $50)]

This leaves you with an open position of 5k units short EUR/USD at 1.3000. From here, you can adjust your stop to breakeven (1.3000) to create a “risk-free” trade.

If the pair moves back higher and triggers your adjusted stop at 1.3000, then you close out the remaining position with no loss, and if it moves lower then you can just ride the trade to more profits.

Obviously, the trade-off for “taking some off the table” is that your original max profit is reduced.

Now, if EUR/USD ended up falling to 1.2700 and you had caught the 300-pip move with a 10k unit position of EUR/USD, then your profit would be $300.

Instead, you closed 5k units at a 100-pip gain for $50, and then you closed your remaining 5k at a 300-pip gain for a $150 gain ($0.50 per pip * 300 pips = $150).

Together, this makes a $200 gain versus your original $300 max profit.

Here’s a chart to help you visualize the different times when to scale out. (Ignore the dragon trying to bring his scales out.)

The decision to take some profit off the table is always up to you… you just have to weigh the pros and cons.

In this example, the trade-off is a better profit versus the peace of mind of a smaller locked-in profit and creating a risk-free trade.

Which is better for you?

50% more profit or being able to better sleep at night?

Remember, there is the possibility of the market moving beyond your profit target and adding more bling-bling to your account.

There’s always much to consider when adjusting trades, and with practice over many trades, you’ll find a process of taking off trades most comfortable to you.

Next up, we’ll teach you how to scale into positions.

You may be asking, “Why? Why would I wanna scale into a trade?”

Scaling into positions, if done correctly, will give you the benefit of increasing your max profit.

But as they say, “Higher reward means higher risk.”

If done incorrectly, the value of your account could drop faster than you can even think about clicking the close button on your trade.

Before you know it, you’ll be staring at your computer screen, eyes wide open watching your account get margin called.

Now we don’t want that to happen right?

So pay attention in class!

What separates “the correct way” from “the incorrect way” is the profitability of your open position when you add, how much more you add, and how you adjust your stops.

In the next two sections, we’ll teach you two potential scenarios for scaling into a position.

Since traders are “risk managers” first, we’ll also touch upon the “No, No’s” of adding to an open position.

As mentioned earlier, scaling out has the obvious benefit of reducing your risk as you are taking away exposure to the market…whether you are in a winning or losing position.

When used with trailing stops, there is also the benefit of locking in profits and creating a “nearly” risk-free trade.

We’ll go through a trade example to show you how this can be done.

Example: Scaling out of EUR/USD

Let’s say you have a $10,000 account and you shorted 10k units of EUR/USD at 1.3000.

You placed your stop at 1.3100 and your profit target is 300 pips below your entry at 1.2700.

With 10k units of EUR/USD (pip value of this position is $1) and a stop of 100 pips, your total risk is $100, or 1% of your account.

A few days later, the EUR/USD has moved lower to 1.2900, or 100 pips in your favor. This means you have a total profit of $100, or a 1% gain.

All of a sudden, the Fed releases dovish comments that may weaken the USD in the short term.

You think to yourself, “This may bring dollar sellers back into the market, and I don’t know if EUR/USD will keep going down… I should lock in some profits.”

You decide to close half of your position by buying 5k units of EUR/USD at the current exchange rate of 1.2900.

This locks in $50 of profit into your account [at 5k units of EUR/USD, 1 pip is valued at $0.50…. you have closed a profit of 100 pips (100 pips x $0.50 = $50)]

This leaves you with an open position of 5k units short EUR/USD at 1.3000. From here, you can adjust your stop to breakeven (1.3000) to create a “risk-free” trade.

If the pair moves back higher and triggers your adjusted stop at 1.3000, then you close out the remaining position with no loss, and if it moves lower then you can just ride the trade to more profits.

Obviously, the trade-off for “taking some off the table” is that your original max profit is reduced.

Now, if EUR/USD ended up falling to 1.2700 and you had caught the 300-pip move with a 10k unit position of EUR/USD, then your profit would be $300.

Instead, you closed 5k units at a 100-pip gain for $50, and then you closed your remaining 5k at a 300-pip gain for a $150 gain ($0.50 per pip * 300 pips = $150).

Together, this makes a $200 gain versus your original $300 max profit.

Here’s a chart to help you visualize the different times when to scale out. (Ignore the dragon trying to bring his scales out.)

The decision to take some profit off the table is always up to you… you just have to weigh the pros and cons.

In this example, the trade-off is a better profit versus the peace of mind of a smaller locked-in profit and creating a risk-free trade.

Which is better for you?

50% more profit or being able to better sleep at night?

Remember, there is the possibility of the market moving beyond your profit target and adding more bling-bling to your account.

There’s always much to consider when adjusting trades, and with practice over many trades, you’ll find a process of taking off trades most comfortable to you.

Next up, we’ll teach you how to scale into positions.

You may be asking, “Why? Why would I wanna scale into a trade?”

Scaling into positions, if done correctly, will give you the benefit of increasing your max profit.

But as they say, “Higher reward means higher risk.”

If done incorrectly, the value of your account could drop faster than you can even think about clicking the close button on your trade.

Before you know it, you’ll be staring at your computer screen, eyes wide open watching your account get margin called.

Now we don’t want that to happen right?

So pay attention in class!

What separates “the correct way” from “the incorrect way” is the profitability of your open position when you add, how much more you add, and how you adjust your stops.

In the next two sections, we’ll teach you two potential scenarios for scaling into a position.

Since traders are “risk managers” first, we’ll also touch upon the “No, No’s” of adding to an open position.

Abdalla Mohamed Mahmoud Taha

Market Maker

A market maker is a financial intermediary that stands ready to buy or sell assets by continuously quoting bid and ask prices that are accessible to other traders or registered participants of a trading platform.

A market maker is an individual or institution that buys and sells large amounts of a particular asset in order to facilitate liquidity.

In practice, a market maker, also known as a liquidity provider, is a company or individual that quotes the bid and ask price of any commodity or financial product in order to make a profit from the bid/ask spread.

A market maker is a market participant that buys and sells large amounts of a particular asset in order to facilitate liquidity and ensure the smooth running of financial markets.

An individual can be a market maker, but due to the quantity of each asset needed to enable the required volume of trading, a market maker is more commonly a large institution.

Market makers will have a certain amount of the asset (or assets) that they deal in.

By displaying a buy and sell quote and executing trades at those prices rapidly, market makers can create a straightforward way to place trades.

They are most common in stock trading but can also act in other markets.

If we take the stock market, a market maker can only sell the number of shares that they can acquire themselves.

However, they are obliged to meet the Normal Market Size (NMS), the minimum number of securities, which varies from share to share.

The meaning of market maker comes from the practice of setting market prices at levels needed for supply and demand to find balance.

When markets become volatile, market makers have to remain stable and continue to be responsible for market performance, which opens them up to a large amount of risk.

This is why market makers make their money by maintaining a spread on the assets that they enable you to trade, to compensate for the risk of buying an asset that may devalue.

How do market makers make money?

To compensate for the risk of buying an asset that may devalue, market makers maintain a spread on the assets that they enable you to trade.

For example, a market maker may offer to purchase 100 equities from you at $10 each (the ask price), and then offer to sell them to a buyer at $10.02 (the bid price).

Though this is only a $0.02 difference, in high-volume trading, the profits will soon add up.

Buy me a coffee

Find this content helpful? Support our efforts by buying us a

A market maker is a financial intermediary that stands ready to buy or sell assets by continuously quoting bid and ask prices that are accessible to other traders or registered participants of a trading platform.

A market maker is an individual or institution that buys and sells large amounts of a particular asset in order to facilitate liquidity.

In practice, a market maker, also known as a liquidity provider, is a company or individual that quotes the bid and ask price of any commodity or financial product in order to make a profit from the bid/ask spread.

A market maker is a market participant that buys and sells large amounts of a particular asset in order to facilitate liquidity and ensure the smooth running of financial markets.

An individual can be a market maker, but due to the quantity of each asset needed to enable the required volume of trading, a market maker is more commonly a large institution.

Market makers will have a certain amount of the asset (or assets) that they deal in.

By displaying a buy and sell quote and executing trades at those prices rapidly, market makers can create a straightforward way to place trades.

They are most common in stock trading but can also act in other markets.

If we take the stock market, a market maker can only sell the number of shares that they can acquire themselves.

However, they are obliged to meet the Normal Market Size (NMS), the minimum number of securities, which varies from share to share.

The meaning of market maker comes from the practice of setting market prices at levels needed for supply and demand to find balance.

When markets become volatile, market makers have to remain stable and continue to be responsible for market performance, which opens them up to a large amount of risk.

This is why market makers make their money by maintaining a spread on the assets that they enable you to trade, to compensate for the risk of buying an asset that may devalue.

How do market makers make money?

To compensate for the risk of buying an asset that may devalue, market makers maintain a spread on the assets that they enable you to trade.

For example, a market maker may offer to purchase 100 equities from you at $10 each (the ask price), and then offer to sell them to a buyer at $10.02 (the bid price).

Though this is only a $0.02 difference, in high-volume trading, the profits will soon add up.

Buy me a coffee

Find this content helpful? Support our efforts by buying us a

Abdalla Mohamed Mahmoud Taha

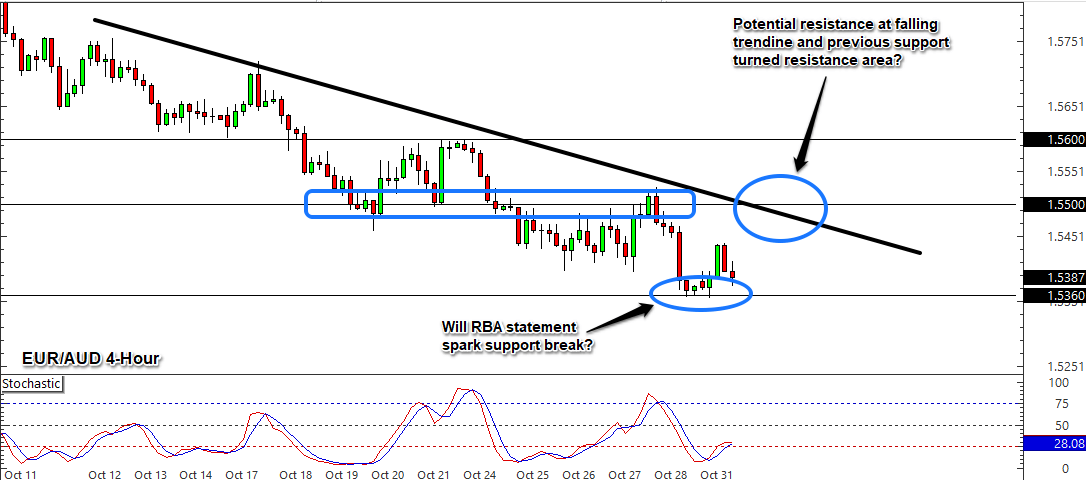

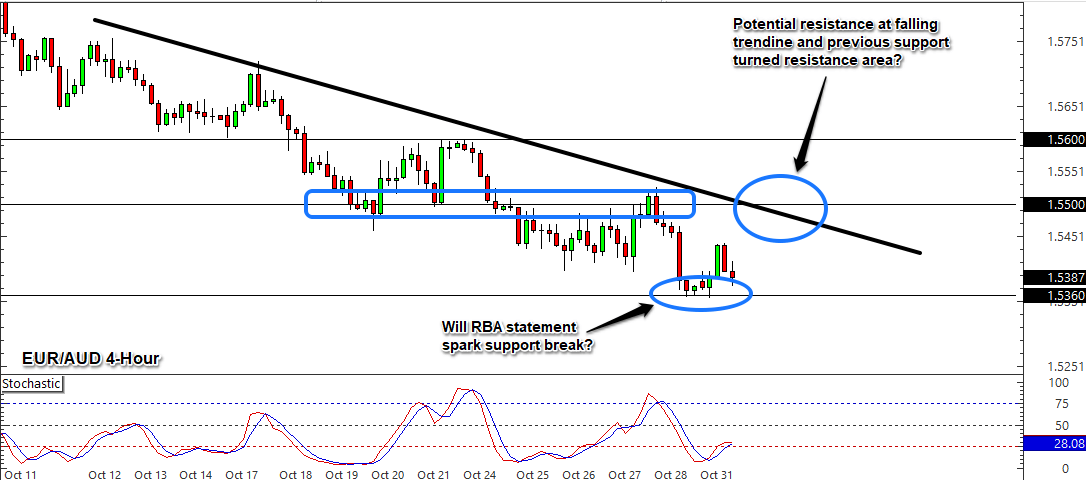

RBA to Keep the Downtrend in EUR/AUD Going?

We’ve got a big catalyst for the AUD right around the corner, making the longer-term downtrend in EUR/AUD one to watch for potential trade opportunities. Will the RBA keep the sell momentum going?

Downtrending charts don’t get much cleaner or more textbook than the four hour chart of EUR/AUD above. The pair has been in a serious downtrend since mid-September, likely on speculation that the Reserve Bank of Australia will have to tightening monetary policy sooner than previously expected due to high inflation.

This is a very different situation than the euro as Europe has see economic growth slow over the past month, as well as experience energy and supply chain issues, lowering the odds significantly that the ECB will take tightening action on monetary policy to combat their inflation issues.

Well, we’re going to hear from the RBA very soon as they will give their latest monetary policy statement in the upcoming Asia session at 3:30 am GMT. Expectations are for the RBA to hold on policy, but may get more hawkish on the time of its possible rate hike, currently expected in 2024.

Now, after a massive run to the downside like we’ve seen in EUR/AUD (from 1.6237 to 1.5360, a roughly 5.35% move), it’s perfectly normal to expect a “buy-the-rumor, sell-the-news” scenario may play out, as some traders would likely take some profits no matter what the RBA says. If we get the expected scenario of no policy moves and hawkish rhetoric from the RBA, then a pop higher after the event is one to watch for a potential opportunity to jump in the downtrend at better prices, possibly around the falling trendline or previous strong area of interest around the 1.5500 major psychological level.

We also have to be open to the possibility of a downside break of current support if the RBA does sound hawkish, and if the market does break lower, we’ll be on the lookout for sustained trade below that 1.5350 area before considering setting up a short position.

In the low probability scenario where the RBA maintains no rate hikes until 2024 or beyond (possibly on covid fears or export weakness due to falling demand or supply chain issues), then that raises the probability of a swing move to the upside developing pretty quickly. In that scenario, we’ll be on the lookout for a sustain break above the falling trendline and 1.5500 level before considering a short or swing term position long.

What do you all think? Will the RBA keep the Aussie bull train going? Let me know in the comments section below!

We’ve got a big catalyst for the AUD right around the corner, making the longer-term downtrend in EUR/AUD one to watch for potential trade opportunities. Will the RBA keep the sell momentum going?

Downtrending charts don’t get much cleaner or more textbook than the four hour chart of EUR/AUD above. The pair has been in a serious downtrend since mid-September, likely on speculation that the Reserve Bank of Australia will have to tightening monetary policy sooner than previously expected due to high inflation.

This is a very different situation than the euro as Europe has see economic growth slow over the past month, as well as experience energy and supply chain issues, lowering the odds significantly that the ECB will take tightening action on monetary policy to combat their inflation issues.

Well, we’re going to hear from the RBA very soon as they will give their latest monetary policy statement in the upcoming Asia session at 3:30 am GMT. Expectations are for the RBA to hold on policy, but may get more hawkish on the time of its possible rate hike, currently expected in 2024.

Now, after a massive run to the downside like we’ve seen in EUR/AUD (from 1.6237 to 1.5360, a roughly 5.35% move), it’s perfectly normal to expect a “buy-the-rumor, sell-the-news” scenario may play out, as some traders would likely take some profits no matter what the RBA says. If we get the expected scenario of no policy moves and hawkish rhetoric from the RBA, then a pop higher after the event is one to watch for a potential opportunity to jump in the downtrend at better prices, possibly around the falling trendline or previous strong area of interest around the 1.5500 major psychological level.

We also have to be open to the possibility of a downside break of current support if the RBA does sound hawkish, and if the market does break lower, we’ll be on the lookout for sustained trade below that 1.5350 area before considering setting up a short position.

In the low probability scenario where the RBA maintains no rate hikes until 2024 or beyond (possibly on covid fears or export weakness due to falling demand or supply chain issues), then that raises the probability of a swing move to the upside developing pretty quickly. In that scenario, we’ll be on the lookout for a sustain break above the falling trendline and 1.5500 level before considering a short or swing term position long.

What do you all think? Will the RBA keep the Aussie bull train going? Let me know in the comments section below!

Abdalla Mohamed Mahmoud Taha

GBP/USD Intraday: under pressure.

Anchor point:

1.3670

Favorite scenario:

Short positions below the 1.3670 level, with targets at 1.3630 and 1.3610.

Alternative scenario:

Above 1.3670, targeting 1.3690 & 1.3710 as targets.

Technical Comment:

RSI is mixed with a bearish bias

Anchor point:

1.3670

Favorite scenario:

Short positions below the 1.3670 level, with targets at 1.3630 and 1.3610.

Alternative scenario:

Above 1.3670, targeting 1.3690 & 1.3710 as targets.

Technical Comment:

RSI is mixed with a bearish bias

소셜 네트워크에 공유 · 1

Abdalla Mohamed Mahmoud Taha

Weekly Forex Market Recap: Oct. 25 – 29

Central bank events and inflation data appeared to be the main drivers for FX this week, and likely why currency price action was relatively limited to choppy, short-term moves as traders waited on the sidelines.

Overall, the Aussie dollar took the top spot thanks to high inflation updates and rate hike speculation, while traders looked bearish on the euro all week, possibly on low expectations of rate hike rhetoric and weak economic updates from the Euro area.

Notable News & Economic Updates:

Moderna says covid shot for younger kids showed strong results

Turkish lira bounces back from record low on Tuesday after Erdogan soothes diplomatic fears

Bank of Canada accelerates potential timing of rate hikes top possibly Q1 or Q2 of 2022

European Central Bank holds stimulus operations at €1.85T; will keep through March 22 or later if needed

U.S. shows weakest quarter of growth on supply woes; Advanced read of third quarter GDP at 2.0% vs. 6.7% in Q2

Bank of Japan holds monetary policy as-is as it lowered outlook for growth & inflation

China Evergrande is said to make another bond payment, avoiding default for a second time.

GDP up by 2.2% in the euro area and by 2.1% in the EU; Eurozone inflation rises to 4.1% in Oct. (13-year high)

FDA authorizes Pfizer’s Covid vaccine for kids ages 5 to 11

Intermarket Weekly Recap

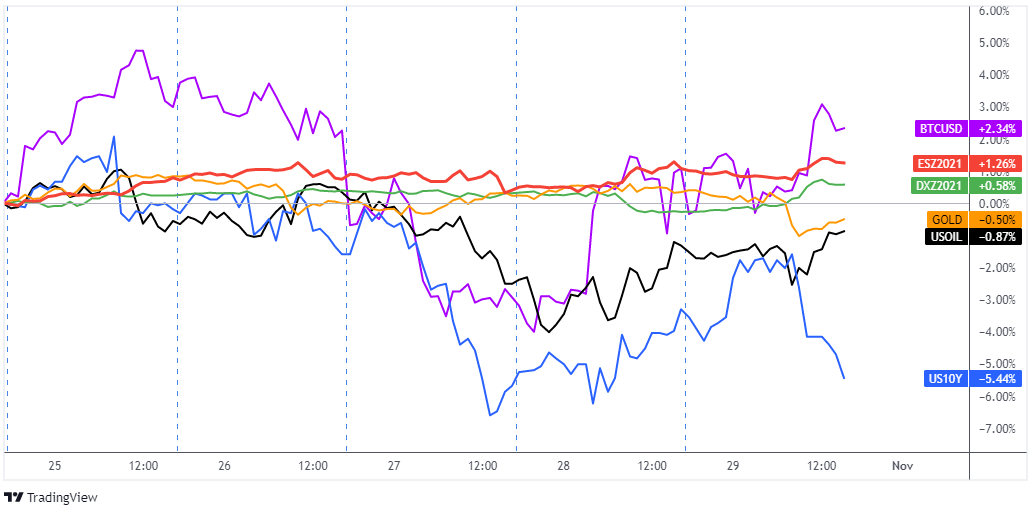

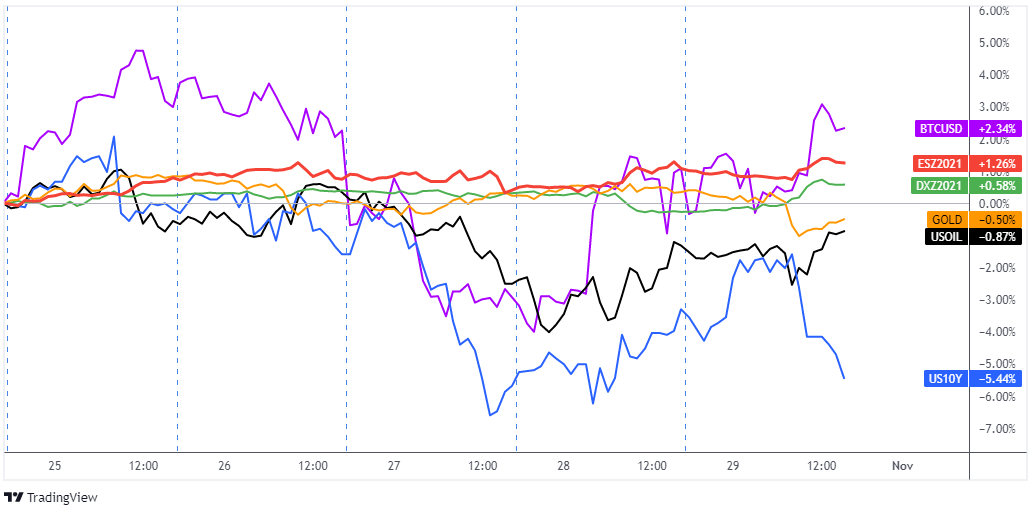

Dollar, Gold, S&P 500, Oil, T-Bond Futures, Bitcoin Overlay 1-HourDollar, Gold, S&P 500, Oil, T-Bond Futures, Bitcoin Overlay 1-Hour

Price action was a mixed bag this week across the financial markets as each asset class seemed to be moving to the beat of their own drums.

Equities stayed green this week with another net positive round of earnings releases, while bond prices rose/bond yields fell on Wednesday, possibly on lowered expectations of Fed tightening as we saw weak U.S. export data and retailer supply data hint at a lower growth outlook. Also risk sentiment was arguably negative to start the week, likely on the continued Chinese property developer issues and fears of debt defaults.

Oil fell earlier this week but eventually found a bid, likely on comments from OPEC who forecasted that a tighter global oil market may be ahead in the fourth quarter. U.S. inventory data was also a likely contributor to the bounce in oil prices (market nearly retested $80/barrel on WTI) as it showed supply shrink rapidly (supply fell by 1.81M barrels last week.

In the crypto space, bitcoin pulled back from all-time highs as ETF euphoria likely faded. This seemed to have pulled most of the crypto space with it, with exception to meme coins. Shiba Inu (SHIB) coin once again rocketed higher to new all-time highs after last week’s consolidation, gaining over 100% intraweek before pulling back. It’s likely the push for Robinhood to list the meme coin is the main catalyst, and seems to be dragging other meme coins higher with it like the previous meme coin king, Dogecoin.

Looking at the FX charts below, we can see that the forex markets traded mostly sideways, with few pops of volatility here and there. It appears this week’s round of inflation updates and central bank events were the main focus for currency traders, and likely kept many on the sidelines to avoid possible event risk.

There were no major surprises as all central banks held off from interest rate changes for now and most re-iterated uncertainty with inflation expectations, but the Bank of Canada did shake things up a bit by ending their bond buying program on Wednesday. They also hinted that interest rate hikes may come sooner than expected, possibly in the first or second quarter of 2022.

Central bank events and inflation data appeared to be the main drivers for FX this week, and likely why currency price action was relatively limited to choppy, short-term moves as traders waited on the sidelines.

Overall, the Aussie dollar took the top spot thanks to high inflation updates and rate hike speculation, while traders looked bearish on the euro all week, possibly on low expectations of rate hike rhetoric and weak economic updates from the Euro area.

Notable News & Economic Updates:

Moderna says covid shot for younger kids showed strong results

Turkish lira bounces back from record low on Tuesday after Erdogan soothes diplomatic fears

Bank of Canada accelerates potential timing of rate hikes top possibly Q1 or Q2 of 2022

European Central Bank holds stimulus operations at €1.85T; will keep through March 22 or later if needed

U.S. shows weakest quarter of growth on supply woes; Advanced read of third quarter GDP at 2.0% vs. 6.7% in Q2

Bank of Japan holds monetary policy as-is as it lowered outlook for growth & inflation

China Evergrande is said to make another bond payment, avoiding default for a second time.

GDP up by 2.2% in the euro area and by 2.1% in the EU; Eurozone inflation rises to 4.1% in Oct. (13-year high)

FDA authorizes Pfizer’s Covid vaccine for kids ages 5 to 11

Intermarket Weekly Recap

Dollar, Gold, S&P 500, Oil, T-Bond Futures, Bitcoin Overlay 1-HourDollar, Gold, S&P 500, Oil, T-Bond Futures, Bitcoin Overlay 1-Hour

Price action was a mixed bag this week across the financial markets as each asset class seemed to be moving to the beat of their own drums.

Equities stayed green this week with another net positive round of earnings releases, while bond prices rose/bond yields fell on Wednesday, possibly on lowered expectations of Fed tightening as we saw weak U.S. export data and retailer supply data hint at a lower growth outlook. Also risk sentiment was arguably negative to start the week, likely on the continued Chinese property developer issues and fears of debt defaults.

Oil fell earlier this week but eventually found a bid, likely on comments from OPEC who forecasted that a tighter global oil market may be ahead in the fourth quarter. U.S. inventory data was also a likely contributor to the bounce in oil prices (market nearly retested $80/barrel on WTI) as it showed supply shrink rapidly (supply fell by 1.81M barrels last week.

In the crypto space, bitcoin pulled back from all-time highs as ETF euphoria likely faded. This seemed to have pulled most of the crypto space with it, with exception to meme coins. Shiba Inu (SHIB) coin once again rocketed higher to new all-time highs after last week’s consolidation, gaining over 100% intraweek before pulling back. It’s likely the push for Robinhood to list the meme coin is the main catalyst, and seems to be dragging other meme coins higher with it like the previous meme coin king, Dogecoin.

Looking at the FX charts below, we can see that the forex markets traded mostly sideways, with few pops of volatility here and there. It appears this week’s round of inflation updates and central bank events were the main focus for currency traders, and likely kept many on the sidelines to avoid possible event risk.

There were no major surprises as all central banks held off from interest rate changes for now and most re-iterated uncertainty with inflation expectations, but the Bank of Canada did shake things up a bit by ending their bond buying program on Wednesday. They also hinted that interest rate hikes may come sooner than expected, possibly in the first or second quarter of 2022.

Abdalla Mohamed Mahmoud Taha

USDJPY

Expected proactive wave trajectory of price movements in the medium to long term on the 12-hour time frame

The current expected wave arrangement for the five-impulsive bullish wave, awaiting the breach of 114.70, with the positive momentum remaining in the direction of the 116 barrier.

Expected proactive wave trajectory of price movements in the medium to long term on the 12-hour time frame

The current expected wave arrangement for the five-impulsive bullish wave, awaiting the breach of 114.70, with the positive momentum remaining in the direction of the 116 barrier.

소셜 네트워크에 공유 · 1

Abdalla Mohamed Mahmoud Taha

USDJPY - H1

Buy the pair around 114.25 with a target price of 114.88

alternative scenario

Selling the pair around 113.88 with a target price of 113.20

comment

Trading above support and averages favors a rise.

Buy the pair around 114.25 with a target price of 114.88

alternative scenario

Selling the pair around 113.88 with a target price of 113.20

comment

Trading above support and averages favors a rise.

소셜 네트워크에 공유 · 1

Abdalla Mohamed Mahmoud Taha

first scenario

Selling the pair around 1.3694 with a target price of 1.3600

alternative scenario

Buy the pair around 1.3755 with a target price of 1.3848

comment

Trading below the resistance and the averages favors the decline

Selling the pair around 1.3694 with a target price of 1.3600

alternative scenario

Buy the pair around 1.3755 with a target price of 1.3848

comment

Trading below the resistance and the averages favors the decline

Abdalla Mohamed Mahmoud Taha

Daily Asia-London Sessions Watchlist: EUR/JPY

We’ve got not one but two central bank events coming around the corner to potentially shake up EUR/JPY. Will the upcoming monetary policy statements from the Bank of Japan and European Central Bank be enough to get both currencies moving?

Before moving on, ICYMI, today’s Daily U.S. Session Watchlist looked at a simple break-and-retest setup on EUR/GBP, so be sure to check that out to see if there is still a potential play!

Intermarket Update:

Equity Markets Bond Yields Commodities & Crypto

DAX: 15705.81 -0.33%

FTSE: 7253.27 -0.33%%

S&P 500: 4551.68 -0.51%

NASDAQ: 15235.84 0.00% US 10-YR: 1.548% -0.07

Bund 10-YR: -0.186% -0.007

UK 10-YR: 0.976% -0.009

JPN 10-YR: 0.084% -0.017 Oil: 82.08 -3.02%

Gold: 1,798.40 +0.28%

Bitcoin: $58,652.88 -5.40%

Ether: $3,962.30 -5.92%

BNB: $451.15 -7.27%

Fresh Market Headlines and Economic Data:

Bank of Canada ends bond-buying program and moves up expectations of rate hike, possibly as early as Q1 2022

U.S. exports drop in September, increasing the merchandise-trade gap to a record $96.3B

New orders for U.S. manufactured durable goods in September decreased $B or 0.4% to $261.3B

U.K. Chancellor Sunak announced £75B of stimulus to boost economy

Tensions rise between the U.K. and France over fishing access

Shiba Inu surges to record as Robinhood petition signups reach 300K signatures

Bitcoin dips below $60K as bullish ETF reaction fades

Upcoming Potential Catalysts on the Economic Calendar

Japan Retail Sales at 11:50 pm GMT

Australia Import & Export Prices at 12:30 am GMT (Oct. 28)

Bank of Japan Monetary Policy Statement at 3:00 am GMT (Oct. 28)

Germany Unemployment Rate at 6:00 am GMT (Oct. 28)

Spain Unemployment Rate, Inflation Rate at 7:00 am GMT (Oct. 28)

Italy Consumer Confidence at 8:00 am GMT (Oct. 28)

Euro Area Economic Sentiment, Consumer Confidence at 9:00 am GMT (Oct. 28)

European Central Bank Monetary Policy Statement at 11:45 am GMT (Oct. 28)

If you’re not familiar with the forex market’s main trading sessions, check out our Forex Market Hours tool.

What to Watch: EUR/JPY

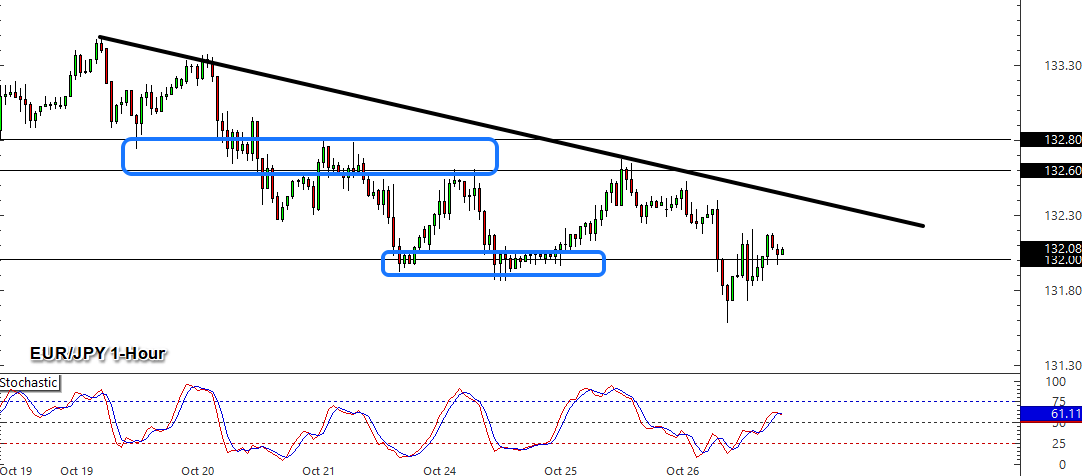

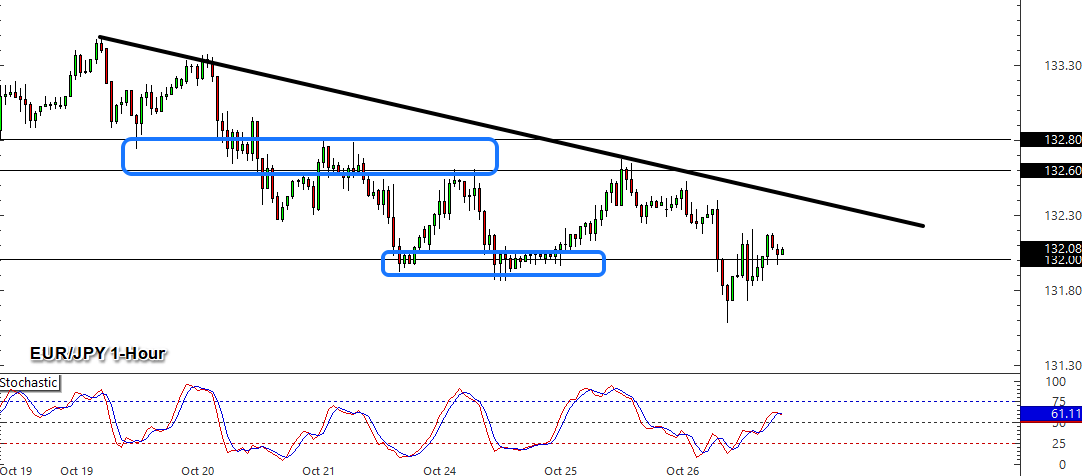

EUR/JPY 1-Hour Forex ChartEUR/JPY 1-Hour Forex Chart

On the one hour chart above of EUR/JPY, we’ve got a pretty clear downtrend in the works over the past week, albeit at a slow and steady pace. Support and resistance levels seem to be clearly defined, with the market now hovering around the strong support area around the 132.00 major psychological level.

Actually, prices seem to be consolidating tightly at the moment, which makes sense given that traders are likely waiting on the sidelines ahead of monetary policy statements from both the Bank of Japan and European Central Bank in the upcoming Thursday session.

Expectations for the BOJ event are for it to be a snoozer as no changes are forecasted, while the ECB may be the event to get EUR/JPY moving as traders will closely watch for the ECB’s comments on current European risks like the energy crisis and supply chain issues.

We think the issues in Europe will likely be the main focus for EUR/JPY traders, and unless the ECB gives some sort of optimistic view that Europe will be able to get past those issues quickly, the trend in EUR/JPY is likely to remain lower as traders price in no rate hikes for the foreseeable future.

In that scenario, any pick up in volatility could turn into a swing or longer-term short position opportunity if the market bounces up to the falling trendline marked on the chart above/previous area of interest (between 132.60 – 132.80). Be on the look out there for bearish reversal candles, especially if the ECB gives a relatively negative outlook on how long it will take Europe to overcome the energy and supply chain challenges.

Also be on the look out for a sustained break of the 132.00 support area as it could draw in momentum sellers if we do get a negative take from the ECB tomorrow, or even if broad market sentiment sours in the upcoming session.

We’ve got not one but two central bank events coming around the corner to potentially shake up EUR/JPY. Will the upcoming monetary policy statements from the Bank of Japan and European Central Bank be enough to get both currencies moving?

Before moving on, ICYMI, today’s Daily U.S. Session Watchlist looked at a simple break-and-retest setup on EUR/GBP, so be sure to check that out to see if there is still a potential play!

Intermarket Update:

Equity Markets Bond Yields Commodities & Crypto

DAX: 15705.81 -0.33%

FTSE: 7253.27 -0.33%%

S&P 500: 4551.68 -0.51%

NASDAQ: 15235.84 0.00% US 10-YR: 1.548% -0.07

Bund 10-YR: -0.186% -0.007

UK 10-YR: 0.976% -0.009

JPN 10-YR: 0.084% -0.017 Oil: 82.08 -3.02%

Gold: 1,798.40 +0.28%

Bitcoin: $58,652.88 -5.40%

Ether: $3,962.30 -5.92%

BNB: $451.15 -7.27%

Fresh Market Headlines and Economic Data:

Bank of Canada ends bond-buying program and moves up expectations of rate hike, possibly as early as Q1 2022

U.S. exports drop in September, increasing the merchandise-trade gap to a record $96.3B

New orders for U.S. manufactured durable goods in September decreased $B or 0.4% to $261.3B

U.K. Chancellor Sunak announced £75B of stimulus to boost economy

Tensions rise between the U.K. and France over fishing access

Shiba Inu surges to record as Robinhood petition signups reach 300K signatures

Bitcoin dips below $60K as bullish ETF reaction fades

Upcoming Potential Catalysts on the Economic Calendar

Japan Retail Sales at 11:50 pm GMT

Australia Import & Export Prices at 12:30 am GMT (Oct. 28)

Bank of Japan Monetary Policy Statement at 3:00 am GMT (Oct. 28)

Germany Unemployment Rate at 6:00 am GMT (Oct. 28)

Spain Unemployment Rate, Inflation Rate at 7:00 am GMT (Oct. 28)

Italy Consumer Confidence at 8:00 am GMT (Oct. 28)

Euro Area Economic Sentiment, Consumer Confidence at 9:00 am GMT (Oct. 28)

European Central Bank Monetary Policy Statement at 11:45 am GMT (Oct. 28)

If you’re not familiar with the forex market’s main trading sessions, check out our Forex Market Hours tool.

What to Watch: EUR/JPY

EUR/JPY 1-Hour Forex ChartEUR/JPY 1-Hour Forex Chart

On the one hour chart above of EUR/JPY, we’ve got a pretty clear downtrend in the works over the past week, albeit at a slow and steady pace. Support and resistance levels seem to be clearly defined, with the market now hovering around the strong support area around the 132.00 major psychological level.

Actually, prices seem to be consolidating tightly at the moment, which makes sense given that traders are likely waiting on the sidelines ahead of monetary policy statements from both the Bank of Japan and European Central Bank in the upcoming Thursday session.

Expectations for the BOJ event are for it to be a snoozer as no changes are forecasted, while the ECB may be the event to get EUR/JPY moving as traders will closely watch for the ECB’s comments on current European risks like the energy crisis and supply chain issues.

We think the issues in Europe will likely be the main focus for EUR/JPY traders, and unless the ECB gives some sort of optimistic view that Europe will be able to get past those issues quickly, the trend in EUR/JPY is likely to remain lower as traders price in no rate hikes for the foreseeable future.

In that scenario, any pick up in volatility could turn into a swing or longer-term short position opportunity if the market bounces up to the falling trendline marked on the chart above/previous area of interest (between 132.60 – 132.80). Be on the look out there for bearish reversal candles, especially if the ECB gives a relatively negative outlook on how long it will take Europe to overcome the energy and supply chain challenges.

Also be on the look out for a sustained break of the 132.00 support area as it could draw in momentum sellers if we do get a negative take from the ECB tomorrow, or even if broad market sentiment sours in the upcoming session.

소셜 네트워크에 공유 · 2

Abdalla Mohamed Mahmoud Taha

5 Physical Habits That Can Improve Your Trading

Because trading can often turn into an intense mental activity, most traders tend to forget their physical well-being.

After all, you don’t really need to have washboard abs or maintain a single-digit body fat percentage to do well in the markets, do you?

Day traders can simply roll right out of bed, eat a Pop Tart, check their trading platforms, stare at the screen all day, grab an energy drink, stay up watching the charts all night… and still manage to make millions!

While this kind of lifestyle works for some, it doesn’t exactly seem sustainable or healthy at all.

In fact, just like any other high-performance sport, your trading skills can benefit from a holistic approach that takes physical well-being into account.

Here are some simple habits that can improve your trading performance:

1. Get enough sleep

Getting the recommended 7 to 9 hours of shut-eye might be a challenge for forex traders who work around a 24-hour market.

It can be tempting to pull an all-nighter to stay awake during an active trading session or catch a top-tier news event!

But constantly staying up all day and night just to watch open positions has its drawbacks, as sleep deprivation can impair cognitive and motor abilities.

Getting enough quality sleep can help you manage your emotions and stay level-headed when making trading decisions, as this ensures your brain muscles have relaxed and your mental state is refreshed regularly.

2. Take screen breaks

In line with getting enough sleep, you should also make it a habit to step away from the screen every now and then.

This means giving your eyes a break from the strain and also stretching your muscles after sitting in front of your computer for long hours.

In doing so, you can release tension from your back, shoulders, and neck that might be negatively affecting your ability to stay focused.

If you’re worried you might miss big market moves the moment you take a break, try to come up with a daily schedule that works around the best timing for your trading strategies.

3. Get proper exercise

This doesn’t necessarily mean starting a Crossfit workout or running a half-marathon!

What’s important is that you allocate some time – it can be as short as 15-30 minutes – to get blood flowing to your muscles and your brain.

Going for a short jog, doing some pushups, or taking your dog out for a walk could be enough to do the trick.

From a physiological standpoint, trading stress gets blood flow redirected away from the cerebral cortex towards the amygdala, which is responsible for the “fight or flight” response.

However, it’s actually the cerebral cortex that is in charge of the calm, reasoning ability to make sound decisions.

Physical exercise gets blood flowing back smoothly to the cerebral cortex, which aids impulse control, planning, and fear management in the long run.

4. Slow down and take deep breaths

Just as it’s essential to get your blood flowing, it’s also equally important to get your oxygen on!

5. Eat well and stay hydrated

Lastly, don’t forget that the body and brain function best when fueled by proper nourishment from water, minerals, and nutrients.

You don’t have to create a fancy diet of organic food and vitamin water, but it’s enough to make sure that you get balanced meals with the right amount of carbs, protein and fiber.

This could mean cutting down on sugary snacks, energy drinks, and instant ramen. Listen to your momma and eat your veggies yo!

And don’t forget to take the recommended 8 glasses of water a day, too.

This is a simple habit you can build into your schedule, along with screen breaks and exercise. If it helps, you can use smartphone apps that remind you to stand up, take deep breaths, stretch, and hydrate.

These aren’t exactly difficult habits to develop or incorporate in your daily routine, but they can go a long way in terms of improving your decision-making, emotional control, and overall trading mindset.

Because trading can often turn into an intense mental activity, most traders tend to forget their physical well-being.

After all, you don’t really need to have washboard abs or maintain a single-digit body fat percentage to do well in the markets, do you?

Day traders can simply roll right out of bed, eat a Pop Tart, check their trading platforms, stare at the screen all day, grab an energy drink, stay up watching the charts all night… and still manage to make millions!

While this kind of lifestyle works for some, it doesn’t exactly seem sustainable or healthy at all.

In fact, just like any other high-performance sport, your trading skills can benefit from a holistic approach that takes physical well-being into account.

Here are some simple habits that can improve your trading performance:

1. Get enough sleep

Getting the recommended 7 to 9 hours of shut-eye might be a challenge for forex traders who work around a 24-hour market.

It can be tempting to pull an all-nighter to stay awake during an active trading session or catch a top-tier news event!

But constantly staying up all day and night just to watch open positions has its drawbacks, as sleep deprivation can impair cognitive and motor abilities.

Getting enough quality sleep can help you manage your emotions and stay level-headed when making trading decisions, as this ensures your brain muscles have relaxed and your mental state is refreshed regularly.

2. Take screen breaks

In line with getting enough sleep, you should also make it a habit to step away from the screen every now and then.

This means giving your eyes a break from the strain and also stretching your muscles after sitting in front of your computer for long hours.

In doing so, you can release tension from your back, shoulders, and neck that might be negatively affecting your ability to stay focused.

If you’re worried you might miss big market moves the moment you take a break, try to come up with a daily schedule that works around the best timing for your trading strategies.

3. Get proper exercise

This doesn’t necessarily mean starting a Crossfit workout or running a half-marathon!

What’s important is that you allocate some time – it can be as short as 15-30 minutes – to get blood flowing to your muscles and your brain.

Going for a short jog, doing some pushups, or taking your dog out for a walk could be enough to do the trick.

From a physiological standpoint, trading stress gets blood flow redirected away from the cerebral cortex towards the amygdala, which is responsible for the “fight or flight” response.

However, it’s actually the cerebral cortex that is in charge of the calm, reasoning ability to make sound decisions.

Physical exercise gets blood flowing back smoothly to the cerebral cortex, which aids impulse control, planning, and fear management in the long run.

4. Slow down and take deep breaths

Just as it’s essential to get your blood flowing, it’s also equally important to get your oxygen on!

5. Eat well and stay hydrated

Lastly, don’t forget that the body and brain function best when fueled by proper nourishment from water, minerals, and nutrients.

You don’t have to create a fancy diet of organic food and vitamin water, but it’s enough to make sure that you get balanced meals with the right amount of carbs, protein and fiber.

This could mean cutting down on sugary snacks, energy drinks, and instant ramen. Listen to your momma and eat your veggies yo!

And don’t forget to take the recommended 8 glasses of water a day, too.

This is a simple habit you can build into your schedule, along with screen breaks and exercise. If it helps, you can use smartphone apps that remind you to stand up, take deep breaths, stretch, and hydrate.

These aren’t exactly difficult habits to develop or incorporate in your daily routine, but they can go a long way in terms of improving your decision-making, emotional control, and overall trading mindset.

소셜 네트워크에 공유 · 3

Abdalla Mohamed Mahmoud Taha

Expected Surprises: How to Deal with Market Shocks

The markets are a dangerous place. Out of the blue, events can cause sudden and violent moves in the markets.

Unfortunately, we’ve all been on the wrong side of one of these. It seems very rare indeed that a surprise suits your market position.

Non-Farm Payroll data*, GDP Numbers*, interest rate changes*, assassinations, terrorist attacks, extreme weather*, profit warnings, resignations, bankruptcies*, technology failures …

Here we look at the nature of shocks. How to survive – and even thrive – from the seemingly random.

Shocks and surprises – they’re not the same

Imagine you have a position in front of a Non-Farm Payroll release. You are living dangerously. You know that the release is often a big surprise.

It can be way off from economists’ estimates and the markets’ expectations. So, under your breath, you count down: 5 – 4 – 3 – 2 – 1.

Finally, the results land, the market spikes and within seconds reverses against the direction of the news and seems determined to stop out all longs and shorts. Does this sound familiar?

But hold on, the number was a shock, but it was not a surprise. We counted down to it.

NFPs are released (usually) on the first Friday of each month at 08:30 EST or 12:30 GMT. The release is as regular as clockwork each month. Hardly a surprise, but they are often way off consensus expectations and shock the market.

Non-Farm Payrolls and all of the * events listed above are not surprises, but they are often shocks. Only in a few cases above are the events both surprises and shocks.

The truly random event is very rare, so market shocks happen less often than most people imagine.

Nonetheless, shocks are rarely pleasant surprises. So, what trading strategies can you apply to avoid or even profit from market shocks?

Living peacefully

Many traders close their positions in front of “big” data releases. The advantage of this is you will never be adversely affected by an expected market shock.

But you are as vulnerable as anyone else to a random event. Moreover, the closing and re-opening of positions are costly, and you may have to re-enter at a terrible price level.

Putting up with it

Is there a way to stay in the market through the violence of data releases?

There is a way, but you need to have your Stop Loss far away from the market – beyond the expected price volatility range of the data releases.

The expected price volatility range at data releases is a measurable thing.

For example, take the hi-lo range of price movements in the 15 minutes following the release of the US GDP numbers.

Sometimes the data releases are in line, and the move is muted. Sometimes they surprise the market, and the price surges and falls.

So look at two things:

The maximum range

The average range

To be moderately conservative, place your Stop beyond the average post-release price swing. To be very conservative, beyond the largest price swing.

To do this, you will probably need to deleverage your position. This means reducing the exposure so you can have such a wide Stop. But unfortunately, this is the price you have to pay for ‘putting up with it.

Do place a Stop, though. They have a purpose. They are there to limit your loss to a controllable amount. It can be good news if your Stop is executed because you were wrongly positioned, and the data release initiates a trend change against you. Consider yourself lucky in getting out of the way cheaply.

Living dangerously

After a data release surprise, volatile price moves are an opportunity, too. There are a couple of things you can be confident about. Firstly, there will be a big move.

Big moves mean s significant potential for profit if you can catch them correctly. Secondly, the first price move following the release is frequently followed by a reaction to the price before the release. After that, the price may rise or fall, but there is very often a pullback.

A strategy that aggressive traders like to use to capitalize on this effect is to enter against the direction of the move following the release and covering on the reaction.

For example, the release is better than expected, and the price jumps. This move is too fast to catch. Do not try to compete with High-Frequency Traders. You will lose.

On the first lower price point, sell for the reaction move. Place a Stop Loss above the high. Take profit at 50% of the distance from the high to the pre-release price.

Using this strategy, you live dangerously but have an excellent chance of making a decent profit in exchange for a modest risk.

Take the fear out of shocks and surprises

We have looked at the nature of shocks and surprises and see that genuine shocks are less frequent than many believe. We have seen that expected shocks can be avoided, lived with, or even engaged head on. By understanding the seemingly unknown, we can fear it less or even learn to love it.

The markets are a dangerous place. Out of the blue, events can cause sudden and violent moves in the markets.

Unfortunately, we’ve all been on the wrong side of one of these. It seems very rare indeed that a surprise suits your market position.

Non-Farm Payroll data*, GDP Numbers*, interest rate changes*, assassinations, terrorist attacks, extreme weather*, profit warnings, resignations, bankruptcies*, technology failures …

Here we look at the nature of shocks. How to survive – and even thrive – from the seemingly random.

Shocks and surprises – they’re not the same

Imagine you have a position in front of a Non-Farm Payroll release. You are living dangerously. You know that the release is often a big surprise.

It can be way off from economists’ estimates and the markets’ expectations. So, under your breath, you count down: 5 – 4 – 3 – 2 – 1.

Finally, the results land, the market spikes and within seconds reverses against the direction of the news and seems determined to stop out all longs and shorts. Does this sound familiar?

But hold on, the number was a shock, but it was not a surprise. We counted down to it.

NFPs are released (usually) on the first Friday of each month at 08:30 EST or 12:30 GMT. The release is as regular as clockwork each month. Hardly a surprise, but they are often way off consensus expectations and shock the market.

Non-Farm Payrolls and all of the * events listed above are not surprises, but they are often shocks. Only in a few cases above are the events both surprises and shocks.

The truly random event is very rare, so market shocks happen less often than most people imagine.

Nonetheless, shocks are rarely pleasant surprises. So, what trading strategies can you apply to avoid or even profit from market shocks?

Living peacefully

Many traders close their positions in front of “big” data releases. The advantage of this is you will never be adversely affected by an expected market shock.

But you are as vulnerable as anyone else to a random event. Moreover, the closing and re-opening of positions are costly, and you may have to re-enter at a terrible price level.

Putting up with it

Is there a way to stay in the market through the violence of data releases?

There is a way, but you need to have your Stop Loss far away from the market – beyond the expected price volatility range of the data releases.

The expected price volatility range at data releases is a measurable thing.

For example, take the hi-lo range of price movements in the 15 minutes following the release of the US GDP numbers.

Sometimes the data releases are in line, and the move is muted. Sometimes they surprise the market, and the price surges and falls.

So look at two things:

The maximum range

The average range

To be moderately conservative, place your Stop beyond the average post-release price swing. To be very conservative, beyond the largest price swing.

To do this, you will probably need to deleverage your position. This means reducing the exposure so you can have such a wide Stop. But unfortunately, this is the price you have to pay for ‘putting up with it.

Do place a Stop, though. They have a purpose. They are there to limit your loss to a controllable amount. It can be good news if your Stop is executed because you were wrongly positioned, and the data release initiates a trend change against you. Consider yourself lucky in getting out of the way cheaply.

Living dangerously

After a data release surprise, volatile price moves are an opportunity, too. There are a couple of things you can be confident about. Firstly, there will be a big move.

Big moves mean s significant potential for profit if you can catch them correctly. Secondly, the first price move following the release is frequently followed by a reaction to the price before the release. After that, the price may rise or fall, but there is very often a pullback.

A strategy that aggressive traders like to use to capitalize on this effect is to enter against the direction of the move following the release and covering on the reaction.

For example, the release is better than expected, and the price jumps. This move is too fast to catch. Do not try to compete with High-Frequency Traders. You will lose.

On the first lower price point, sell for the reaction move. Place a Stop Loss above the high. Take profit at 50% of the distance from the high to the pre-release price.

Using this strategy, you live dangerously but have an excellent chance of making a decent profit in exchange for a modest risk.

Take the fear out of shocks and surprises

We have looked at the nature of shocks and surprises and see that genuine shocks are less frequent than many believe. We have seen that expected shocks can be avoided, lived with, or even engaged head on. By understanding the seemingly unknown, we can fear it less or even learn to love it.

소셜 네트워크에 공유 · 3

Abdalla Mohamed Mahmoud Taha