KT RSI Divergence Robot MT5

- Experts

- KEENBASE SOFTWARE SOLUTIONS

- 버전: 1.1

- 업데이트됨: 2 5월 2023

- 활성화: 5

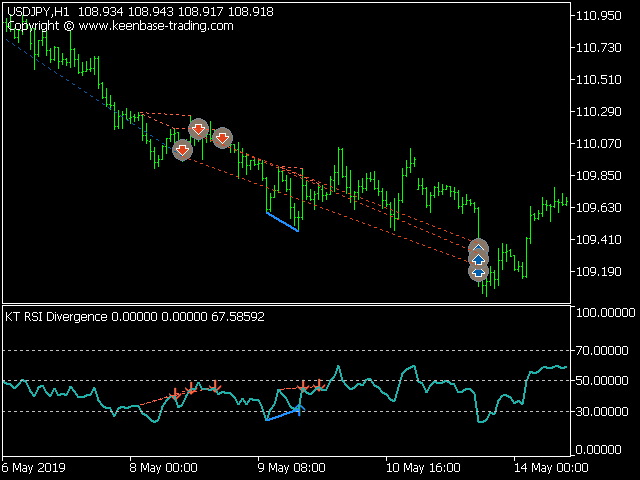

KT RSI Divergence robot is a 100% automated expert advisor that trades regular and hidden divergence built between the price and Relative

Strength Index (RSI) oscillator. The divergence signals are fetched from our freely available RSI divergence indicator.

Not every divergence ends up in a successful price reversal, that's why this ea combines the raw divergences signals with its inbuilt technical analysis module to exploit the price inefficiency that occurs after some selected divergence signals.

MT4 Version is available here https://www.mql5.com/en/market/product/44644

Recommendations

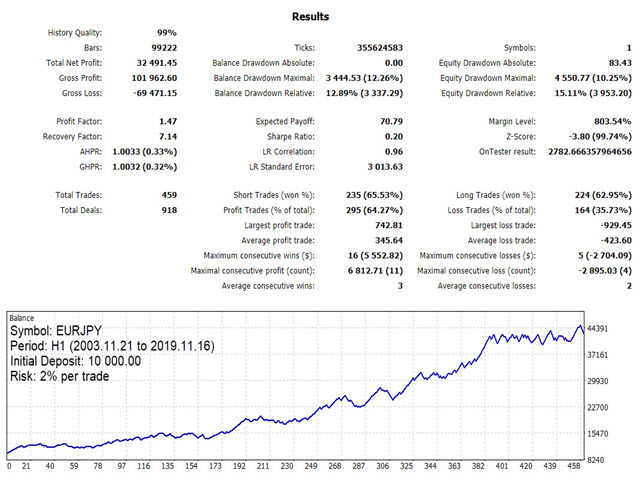

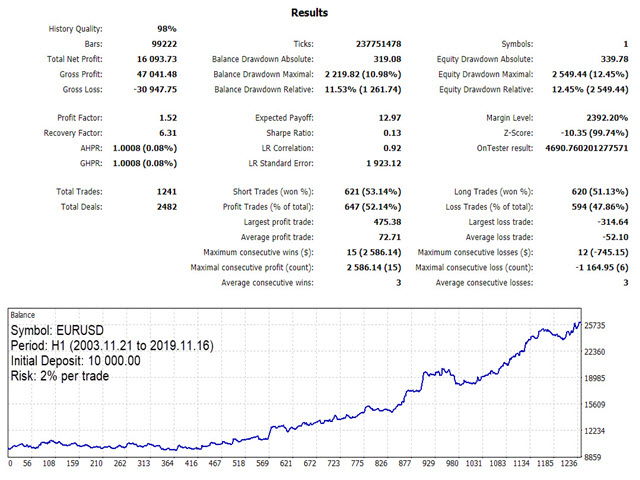

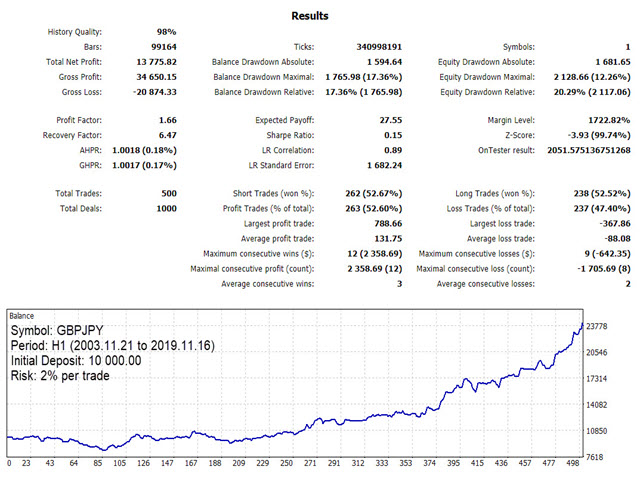

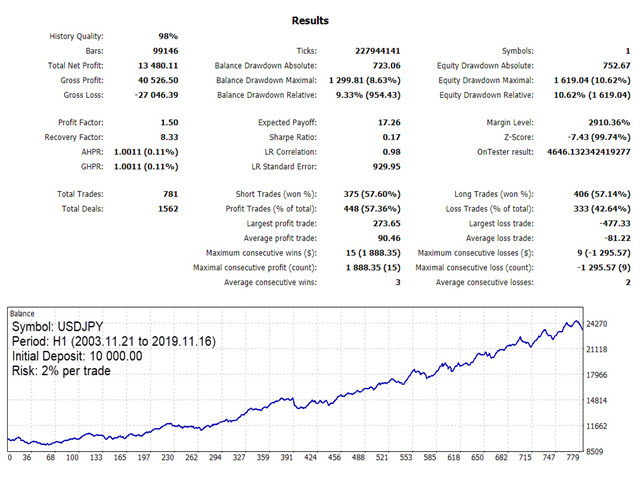

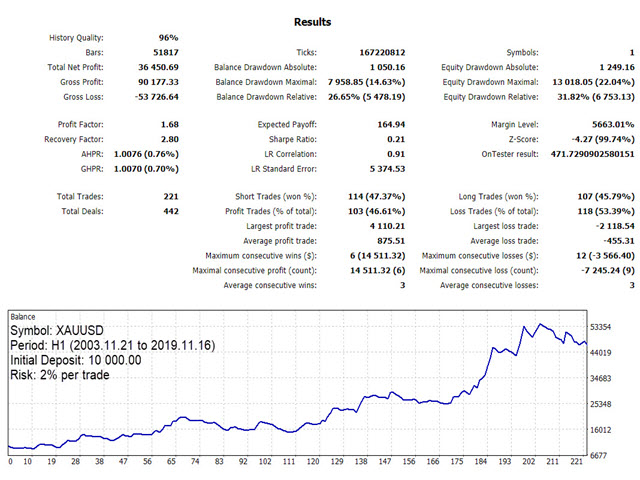

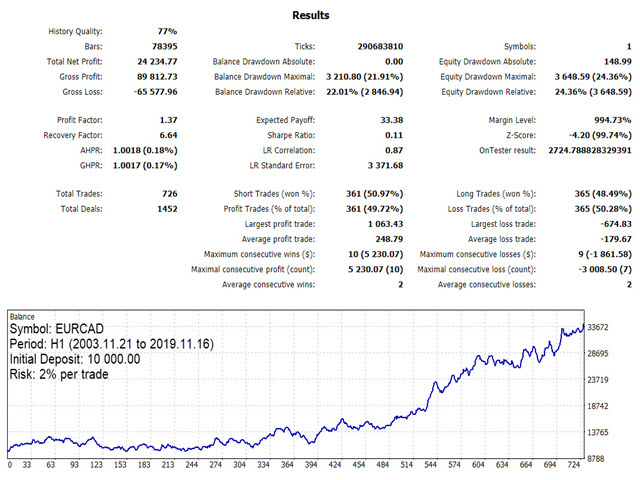

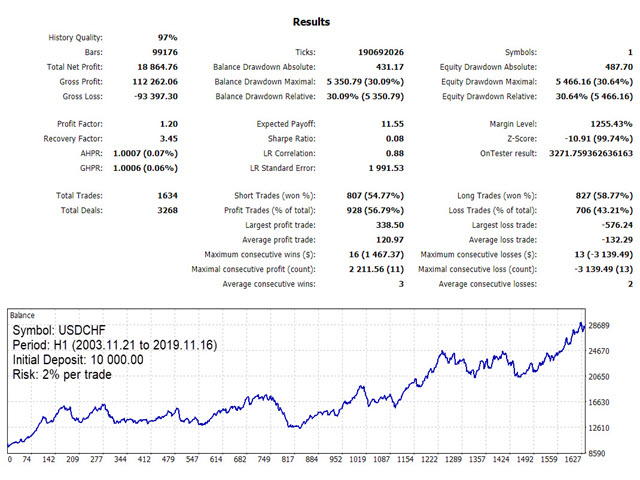

- Pairs: EURUSD, EURCAD, EURCHF, EURJPY, GBPJPY,USDCHF, USDJPY, XAUUSD.

- Time-Frame: 1-Hour

- Account Type: Any

- Leverage: 1:100

- Risk: 1% per trade

Features

- Successfully trades the RSI divergence signals with a lot of advancements that are nearly impossible to implement in manual trading.

- Volatility based stop loss and profit target to achieve more stable and proportional growth.

- It is equipped with multiple entry filters such as trend filter, vortex filter, volatility filter, MMI, and week days filter.

- Fixed fractional money management to achieve an exponential equity growth.

- Allow multiple positions to coexist together in the same direction, which supports the mean reversion nature of divergence signals.

Input Parameters

----- Strategy Settings -----

RSI Period: choose a RSI period between 14 to 100.

Apply to: Price Close (we don't recommend to change this value.)

Trade Regular Divergence: if true, EA will trade the regular divergence signals.

Trade Hidden Divergence: if true, EA will trade the hidden divergence signals.

Trade only Overbought/Oversold Divergences: if true, EA will trade the divergences only if they occurs

above/below the overbought/oversold levels.

Max. Positions: Maximum number of positions to co-exist in a same direction.

----- Trade Settings -----

Lot Size Method: fixed lot size / auto lot sizing

Risk per trade: we recommend 1% risk per trade.

----- Exit Settings -----

Stoploss Method: none / pips / volatility

Takeprofit Method: none / pips / volatility

SL Trailing Method: none / pips / volatility

----- Set the filters -----

Trend Filter: if true, EA open positions only in the direction of trend (more information here).

Volatility Filter: if true, EA allows positions only in a duration of high volatility (more information

here).

Vortex Filter: if true, EA filters the entries using the Vortex filter (more information here).

MMI Filter: if true, EA filters the positions using the Market Meanness Index.

Day Filter: allows or debar the trades on certain days of the week.