Vadym Zhukovskyi / プロファイル

Vadym Zhukovskyi

- associate Professor of the Department of General Physics において University

- ウクライナ

- 1294

5

(11)

- 情報

|

4 年

経験

|

2

製品

|

737

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

物理学の博士号-数学的なシンセ、トレーダー、プログラマー、オデッサ

Butsurigaku no hakushigō - sūgaku-tekina shinse, torēdā, puroguramā, Odessa

Butsurigaku no hakushigō - sūgaku-tekina shinse, torēdā, puroguramā, Odessa

Vadym Zhukovskyi

🎁A gift in honor of spring from our VISTmany project!

A month (March) of free access to all forecasts on financial instruments on our official website.👉 Click it! (https://vistmany.com/status?token=eyJhbGciOiJIUzI1NiIsInR5cCI6IkpXVCJ9.eyJ1c2VybmFtZSI6InZpcCIsImV4cCI6MTc3NDkyMzYzMX0.n3Wl1eudf1fNNQOm5AboB7NT2GNZ4AXf-L3mcZib63w) 🎁

🎁The one who paid for the month of March will be given the month of April as a gift, so that everything is fair.

Respect the risks and work with pleasure!❤️

A month (March) of free access to all forecasts on financial instruments on our official website.👉 Click it! (https://vistmany.com/status?token=eyJhbGciOiJIUzI1NiIsInR5cCI6IkpXVCJ9.eyJ1c2VybmFtZSI6InZpcCIsImV4cCI6MTc3NDkyMzYzMX0.n3Wl1eudf1fNNQOm5AboB7NT2GNZ4AXf-L3mcZib63w) 🎁

🎁The one who paid for the month of March will be given the month of April as a gift, so that everything is fair.

Respect the risks and work with pleasure!❤️

Vadym Zhukovskyi

How much is the time you spend analyzing charts?

Every trader knows:

📊 it takes the most time to find an entry point;

📈 Market structure analysis;

Waiting for the "perfect moment".

But what if a significant part of this work can be automated?

⸻

🔥 Fast scalping indicator iVISTscalp5 for MetaTrader 5:

✔️ Calculates the exact time of the expected entry;

✔️ Shows the potential number of points;

✔️ Generates a forecast for the week ahead;

✔️ Works with any financial instrument.

You can see possible trading windows in advance and understand what kind of movement the iVISTscalp5 system is counting on for fast scalping.

⸻

Your task is not to look for an entrance. Your task is to make a decision.

The iVISTscalp5 indicator does not "open trades for you" — it:

🔹 saves hours of analysis;

Removes emotional inputs;

, structures the trade;

It helps to work according to the system, not according to an emotional impulse.

While others are looking at dozens of charts,

you can already see the calculated forecasts.

Trading is not about endless analysis.

Trading is about efficiency, discipline, and proper time management.

If you want to reduce your routine and focus on strategy, the iVISTscalp5 indicator is created for you.

https://www.mql5.com/en/market/product/70310?source=Site+Profile+Seller

Every trader knows:

📊 it takes the most time to find an entry point;

📈 Market structure analysis;

Waiting for the "perfect moment".

But what if a significant part of this work can be automated?

⸻

🔥 Fast scalping indicator iVISTscalp5 for MetaTrader 5:

✔️ Calculates the exact time of the expected entry;

✔️ Shows the potential number of points;

✔️ Generates a forecast for the week ahead;

✔️ Works with any financial instrument.

You can see possible trading windows in advance and understand what kind of movement the iVISTscalp5 system is counting on for fast scalping.

⸻

Your task is not to look for an entrance. Your task is to make a decision.

The iVISTscalp5 indicator does not "open trades for you" — it:

🔹 saves hours of analysis;

Removes emotional inputs;

, structures the trade;

It helps to work according to the system, not according to an emotional impulse.

While others are looking at dozens of charts,

you can already see the calculated forecasts.

Trading is not about endless analysis.

Trading is about efficiency, discipline, and proper time management.

If you want to reduce your routine and focus on strategy, the iVISTscalp5 indicator is created for you.

https://www.mql5.com/en/market/product/70310?source=Site+Profile+Seller

Vadym Zhukovskyi

https://www.youtube.com/watch?v=Slk_tRnK2O4

🌟#Timing BUY 14:20 (UTC+2)// 7 min/5weeks #XAUUSD 12.02.2026. #ivistscalp5 #scalping #forex

🌟#Timing BUY 14:20 (UTC+2)// 7 min/5weeks #XAUUSD 12.02.2026. #ivistscalp5 #scalping #forex

Vadym Zhukovskyi

Early #forecasting system - #iVISTscalp5 #forecast #Scalping

https://www.youtube.com/watch?v=Tr2KVCsHvQ0&t=23s

https://www.youtube.com/watch?v=Tr2KVCsHvQ0&t=23s

Vadym Zhukovskyi

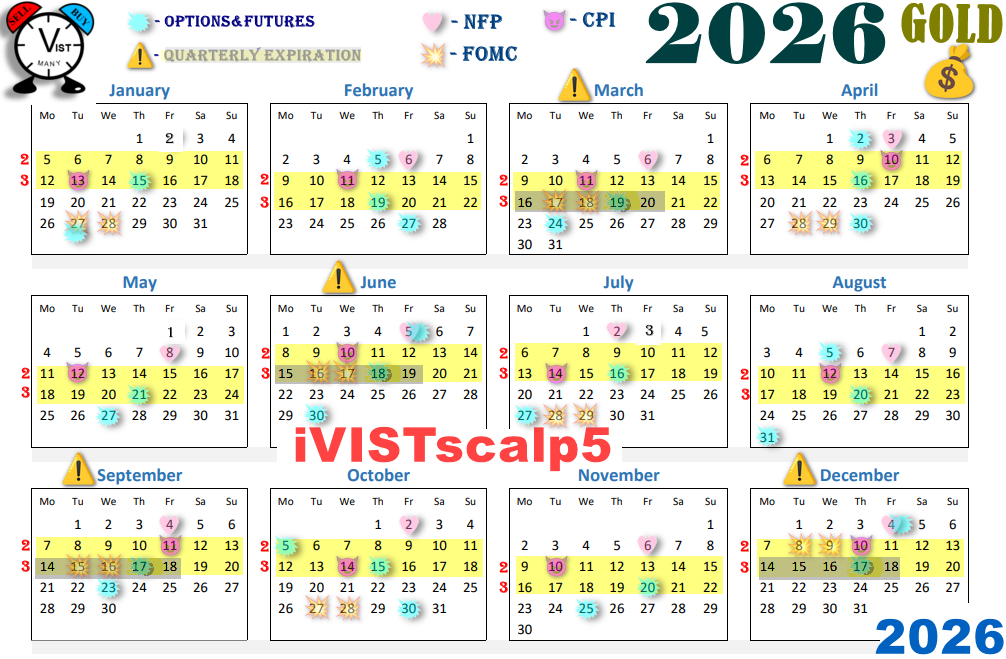

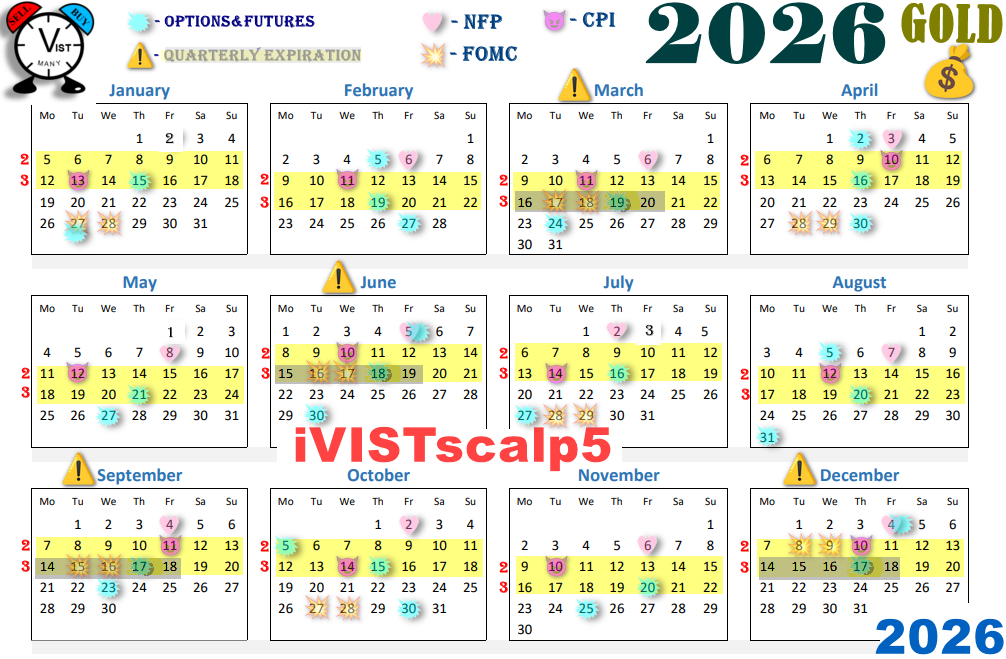

🗓 The 2026 calendar of major events that increase the volatility of #XAUUSD trading.

🌐The forecasts of the #iVISTscalp5 (https://www.mql5.com/en/market/product/70310?source=Site+Profile+Seller) indicator and the #ScalpAuT (https://www.mql5.com/en/market/product/97449?source=Site+Profile+Seller) bot two days before important news and on the day of the news need to be adjusted in the settings for 8 weeks of history. This is especially true for novice traders.

↗️📉 According to the forecasts of the #iVISTscalp5 indicator, the most effective weeks for trading are the second and third trading weeks.

❗️Always respect the risks. Good luck and profit! 💰🌟

🌐The forecasts of the #iVISTscalp5 (https://www.mql5.com/en/market/product/70310?source=Site+Profile+Seller) indicator and the #ScalpAuT (https://www.mql5.com/en/market/product/97449?source=Site+Profile+Seller) bot two days before important news and on the day of the news need to be adjusted in the settings for 8 weeks of history. This is especially true for novice traders.

↗️📉 According to the forecasts of the #iVISTscalp5 indicator, the most effective weeks for trading are the second and third trading weeks.

❗️Always respect the risks. Good luck and profit! 💰🌟

Vadym Zhukovskyi

Dear colleagues! Happy New Year 2026! We wish you and your families peace, goodness, and prosperity! Mindfulness is what makes us and our world better. Creativity is what improves us and our lives. Do good for yourself and for others! Be happy and loved!

Vadym Zhukovskyi

Here is the link (https://vistmany.com/status?token=eyJhbGciOiJIUzI1NiIsInR5cCI6IkpXVCJ9.eyJ1c2VybmFtZSI6InZpcCIsImV4cCI6MTc2NDgzMzgzNX0.cFVqfiCG8jhN_K5x-7w8CAqWuLjcwAcQOt0Ay1GWKTI) for #free access for a month. #Forecasts for fast #scalping on all financial instruments are available on our website. Use it with pleasure and profit. Analyze and work wisely. All forecasts are calculated by the #iVISTscalp5 indicator.

Vadym Zhukovskyi

🌟🚀🌉To the iVISTscalp5 indicator (https://www.mql5.com/en/market/product/70310?source=Site+Profile+Seller). Dynamic VWAP levels.

Vadym Zhukovskyi

⚡️Today we will study the importance of the trading week number for trading forecasts (timings) of the iVISTscalp5 (https://www.mql5.com/en/market/product/70310?source=Site+Profile+Seller) indicator.

🗓 1st trading week. Momentum phase — the most active beginning of the month, the market forms a new direction of movement for 7–10 days.

• Avoid entries before the release of NFP (Nonfarm Payrolls).

• The optimal strategy is to wait for the peak of momentum, then trade the pullback to the level before NFP.

• An ideal week for identifying a new trend.

• The risk of false movements is up to +1000 points per minute.

• Frequent widening of spreads and disappearance of liquidity before NFP.

• Do not open large volumes without confirmation of direction.

🗓 2nd trading week. Reaction phase - the market digests NFP data; often a major medium-term trend is formed.

• Advantage of entering after the CPI (Consumer Price Index) release.

• Trend continuation strategies work well.

• CPI can dramatically change the monthly trend.

• Avoid aggressive lot increases until the market reaction is clear.

🗓 3rd trading week. Balance/Waiting phase – the market stabilizes before the FOMC (Federal Open Market Committee).

• Trade from key support and resistance levels.

• Close or reduce positions before the FOMC statements.

• FOMC can cause strong false breakouts in either direction.

• Do not hold positions without stops during the news.

🗓 4th trading week. Correction/accumulation phase — profit taking, position restructuring, gradual reduction in volume.

• Use the boundaries of previous NFPs as a trading range.

• Advantage — range trading.

• Reduce position volume by 30–50%.

• Chaotic movements are possible due to fund rebalancing at the end of the month.

• Reduced liquidity — risk of sharp shadows and slippage.

🗓 First and last days of the month. Preparation phase for a new cycle — the market enters a state of expectation before the next NFP; often flat or manipulation.

• Analyze fundamental factors (FOMC minutes, PMI, spot demand).

• Prepare trading scenarios for the next month.

• Trade smaller volumes — focus on preserving capital. • Thin liquidity → high risk of stop losses and volatile movements.

• Do not open new positions without clear volatility.

🗓 1st trading week. Momentum phase — the most active beginning of the month, the market forms a new direction of movement for 7–10 days.

• Avoid entries before the release of NFP (Nonfarm Payrolls).

• The optimal strategy is to wait for the peak of momentum, then trade the pullback to the level before NFP.

• An ideal week for identifying a new trend.

• The risk of false movements is up to +1000 points per minute.

• Frequent widening of spreads and disappearance of liquidity before NFP.

• Do not open large volumes without confirmation of direction.

🗓 2nd trading week. Reaction phase - the market digests NFP data; often a major medium-term trend is formed.

• Advantage of entering after the CPI (Consumer Price Index) release.

• Trend continuation strategies work well.

• CPI can dramatically change the monthly trend.

• Avoid aggressive lot increases until the market reaction is clear.

🗓 3rd trading week. Balance/Waiting phase – the market stabilizes before the FOMC (Federal Open Market Committee).

• Trade from key support and resistance levels.

• Close or reduce positions before the FOMC statements.

• FOMC can cause strong false breakouts in either direction.

• Do not hold positions without stops during the news.

🗓 4th trading week. Correction/accumulation phase — profit taking, position restructuring, gradual reduction in volume.

• Use the boundaries of previous NFPs as a trading range.

• Advantage — range trading.

• Reduce position volume by 30–50%.

• Chaotic movements are possible due to fund rebalancing at the end of the month.

• Reduced liquidity — risk of sharp shadows and slippage.

🗓 First and last days of the month. Preparation phase for a new cycle — the market enters a state of expectation before the next NFP; often flat or manipulation.

• Analyze fundamental factors (FOMC minutes, PMI, spot demand).

• Prepare trading scenarios for the next month.

• Trade smaller volumes — focus on preserving capital. • Thin liquidity → high risk of stop losses and volatile movements.

• Do not open new positions without clear volatility.

Vadym Zhukovskyi

https://www.mql5.com/en/market/product/70310?source=Site+Profile+Seller

https://vistmany.com/vistlab

Time level #forecast for the week ahead. Fast #scalping on any financial instrument - #iVistScalp5 indicator

https://vistmany.com/vistlab

Time level #forecast for the week ahead. Fast #scalping on any financial instrument - #iVistScalp5 indicator

: