ramkumar1992 / プロファイル

ramkumar1992

パブリッシュされた投稿NSE extends deadline for providing client details to Oct 10

The National Stock Exchange (NSE) has asked its trading members to provide mobile numbers and e-mail addresses of their clients by October 10 to facilitate dissemination of instant trade alerts. This is the second extension given by the stock exchange...

ソーシャルネットワーク上でシェアする · 1

152

ramkumar1992

The Weekly Volume Report: Kiwi Turnover Surges

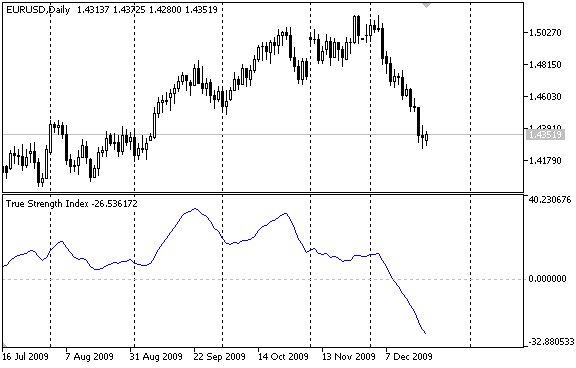

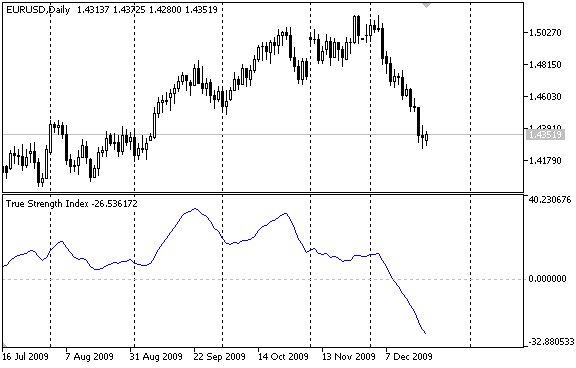

USD/JPY is in consolidation mode below key long-term trendline resistance near 109.50

A steady rise in volume has accompanied the move higher since July

The steady rise in On-Balance-Volume is supportive

Price move under 107.35 on above average volume, however, would force a re-think of the broader positve bias

USD/JPY is in consolidation mode below key long-term trendline resistance near 109.50

A steady rise in volume has accompanied the move higher since July

The steady rise in On-Balance-Volume is supportive

Price move under 107.35 on above average volume, however, would force a re-think of the broader positve bias

ramkumar1992

laplacianlab:

I think there is some misunderstanding of concept. I assume that both symbols, of course, don't need to be synchronized! The synchronization you talk about will never occur in the current bar, I agree with you. But what is wrong with this? It is assumed that the last value of this indicator is a mere representation of the ratio.

However, Gold and Silver are synchronized once the bars of each frame are closed and known, once the bars are known. This is the reason why the graphics are plotted ok. I think this indicator is not bugged, angevoyager, you should argue your point of view I think. Thks anyway for your opinion, always welcome.

I think there is some misunderstanding of concept. I assume that both symbols, of course, don't need to be synchronized! The synchronization you talk about will never occur in the current bar, I agree with you. But what is wrong with this? It is assumed that the last value of this indicator is a mere representation of the ratio.

However, Gold and Silver are synchronized once the bars of each frame are closed and known, once the bars are known. This is the reason why the graphics are plotted ok. I think this indicator is not bugged, angevoyager, you should argue your point of view I think. Thks anyway for your opinion, always welcome.

ramkumar1992

シェアされた作者MetaQuotesの記事

MQL5クラウドネットワークを使った速度アップ

お使いになられているパソコンのコア数はいくつでしょうか?トレーディングストラテジーの最適化のために使えるパソコンは何台あるでしょうか?ここではMQL5クラウドネットワークを使い、マウスをクリックするだけで世界中のコンピューターパワーを利用して計算を早くするための方法を紹介します。"時は金なり"ということわざは、近年より話題となってきました。重要な計算を何十時間もあるいは何日間も待つことはできませこん。

ramkumar1992

MetaQuotes

What you should know about indicators

Dozens of articles about indicators are available on this site. You'll find here examples of indicators and articles about how to create indicators . However, a beginner may have some difficulties choosing where to start when learning how to create

ramkumar1992

パブリッシュされた投稿Samsung launches Galaxy Alpha 4G smartphone at Rs 39,990

Korean handset maker Samsung on Saturday launched a 4G device under its galaxy series that will be available in market in first week of October for Rs 39,990. The company said it plans to bring more 4G-enabled devices in near future in a lower price range...

ソーシャルネットワーク上でシェアする · 1

173

ramkumar1992

パブリッシュされた投稿Gold price rises on stray buying support, silver recovers

Gold prices gained modestly, in an otherwise lacklustre and cautious trade at the domestic bullion market in Mumbai on Saturday owing to stray buying support. Elsewhere, silver recovered owing to renewed industrial buying. Standard gold (99...

ソーシャルネットワーク上でシェアする · 1

170

ramkumar1992

パブリッシュされた投稿Banks hit as stock markets get a coal shock Read more at: http://indiatoday.intoday.in/section/110/1/business.html

Banks hit as stock markets get a coal shock Bank stocks led the decliners with heavyweights such as State Bank of India slumping 4.4 per cent and ICICI ending 3.4 per cent lower as investors interpreted the court ruling as negative. http://indiatoday.intoday.in/section/110/1/business.html...

ソーシャルネットワーク上でシェアする · 1

155

ramkumar1992

パブリッシュされた投稿Quenching Chennai's Thirst

EXECUTIVE SUMMARY: Water, a politically sensitive commodity, has always been underpriced in India. This sector has bankrupted most state-run water utilities and made the private sector wary of getting into it - thereby leaving large parts of the country water-starved...

ソーシャルネットワーク上でシェアする · 1

217

ramkumar1992

パブリッシュされた投稿Foreign Direct Investment,

FDI also means First Develop India and not just Foreign Direct Investment, he says NEW DELHI, SEPT 25: Prime Minister Narendra Modi has asked India Inc to first focus on developing the country and then look abroad. "FDI also means First Develop India and not just Foreign Direct Investment...

ソーシャルネットワーク上でシェアする · 1

163

ramkumar1992

FDI also means First Develop India and not just Foreign Direct Investment, he says

NEW DELHI, SEPT 25:

Prime Minister Narendra Modi has asked India Inc to first focus on developing the country and then look abroad.

"FDI also means First Develop India and not just Foreign Direct Investment. Both the FDIs should move on parallel tracks," the PM said, while launching the 'Make in India' campaign here on Thursday.

Modi stressed on effective and easy governance, besides employment generation. "Investors have to understand that the purchasing power of India has to go up for expanding," he said.

Kicking off the ‘Make in India’ campaign, he said his government’s focus will be on physical infrastructure creation as well as creating a digital network for making India a hub for global manufacturing of goods ranging from cars to software, satellites to submarines and paper to power.

“I do not only talk about good governance. I talk about effective governance and easy governance,” he said, while launching the ‘Make in India’ campaign that was attended by a galaxy of industrialists and business leaders, including Cyrus Mistry, Mukesh Ambani, Azim Premji, Kumar Mangalam Birla, Chanda Kocchar and Y C Deveshwar.

Calling upon domestic and international companies to invest in India, the Prime Minister said his government’s focus is not only to ‘Look East’ but also to ‘Link West’.

“We want highways. We also want i-ways — information ways for a Digital India,” Modi said, adding “Make in India is not a slogan, not an invitation’’.

Recalling the scenario of last two-three years where “companies were looking to move out of country”, he said three months of the NDA government has reversed the mood with its focus on easing the process of doing business in the country.

“Government is committed to development. This is not a political agenda, but an article of faith,” he said, while stressing on public-private partnership as well as skill development for increasing the share of manufacturing in GDP.

Modi said the world is ready to come to Asia and India offers best destination as it is a vibrant democracy with demographic dividend and huge demand.

Earlier, the Commerce and Industry Minister, Nirmala Sitaraman, assured de-licensing, de-regulation and radical changes to attract domestic and foreign investors into the country.

In an event to mark the launch of the 'Make in India' initiative, she said that the Government would focus on 25 sectors to push manufacturing, including automobiles, textiles, leather, electronics, engineering and IT.

She said that the Government aims to raise the share of manufacturing to 25 per cent of GDP from 15 per cent. Under the new initiative a dedicated team would facilitate investors 24x7. It may be noted that the Prime Minister Narendra Modi announced the new mission in his Independence Day speech this year.

The Minister said many new initiatives had been announced, including liberalisation of the FDI regime in sectors such as defence and the Railways. But this was just the beginning and many more measures would be initiated, she said, while adding that the effort would be to remove the tag of a country riddled with red-tapism.

In his remarks, the Chairman of Reliance industries, Mukesh Ambani, announced investment of Rs. 1.80 lakh crore in the next 12-15 months which, in turn, would create 1.25 lakh jobs. He also hoped that implementation of GST would help to create a single market

NEW DELHI, SEPT 25:

Prime Minister Narendra Modi has asked India Inc to first focus on developing the country and then look abroad.

"FDI also means First Develop India and not just Foreign Direct Investment. Both the FDIs should move on parallel tracks," the PM said, while launching the 'Make in India' campaign here on Thursday.

Modi stressed on effective and easy governance, besides employment generation. "Investors have to understand that the purchasing power of India has to go up for expanding," he said.

Kicking off the ‘Make in India’ campaign, he said his government’s focus will be on physical infrastructure creation as well as creating a digital network for making India a hub for global manufacturing of goods ranging from cars to software, satellites to submarines and paper to power.

“I do not only talk about good governance. I talk about effective governance and easy governance,” he said, while launching the ‘Make in India’ campaign that was attended by a galaxy of industrialists and business leaders, including Cyrus Mistry, Mukesh Ambani, Azim Premji, Kumar Mangalam Birla, Chanda Kocchar and Y C Deveshwar.

Calling upon domestic and international companies to invest in India, the Prime Minister said his government’s focus is not only to ‘Look East’ but also to ‘Link West’.

“We want highways. We also want i-ways — information ways for a Digital India,” Modi said, adding “Make in India is not a slogan, not an invitation’’.

Recalling the scenario of last two-three years where “companies were looking to move out of country”, he said three months of the NDA government has reversed the mood with its focus on easing the process of doing business in the country.

“Government is committed to development. This is not a political agenda, but an article of faith,” he said, while stressing on public-private partnership as well as skill development for increasing the share of manufacturing in GDP.

Modi said the world is ready to come to Asia and India offers best destination as it is a vibrant democracy with demographic dividend and huge demand.

Earlier, the Commerce and Industry Minister, Nirmala Sitaraman, assured de-licensing, de-regulation and radical changes to attract domestic and foreign investors into the country.

In an event to mark the launch of the 'Make in India' initiative, she said that the Government would focus on 25 sectors to push manufacturing, including automobiles, textiles, leather, electronics, engineering and IT.

She said that the Government aims to raise the share of manufacturing to 25 per cent of GDP from 15 per cent. Under the new initiative a dedicated team would facilitate investors 24x7. It may be noted that the Prime Minister Narendra Modi announced the new mission in his Independence Day speech this year.

The Minister said many new initiatives had been announced, including liberalisation of the FDI regime in sectors such as defence and the Railways. But this was just the beginning and many more measures would be initiated, she said, while adding that the effort would be to remove the tag of a country riddled with red-tapism.

In his remarks, the Chairman of Reliance industries, Mukesh Ambani, announced investment of Rs. 1.80 lakh crore in the next 12-15 months which, in turn, would create 1.25 lakh jobs. He also hoped that implementation of GST would help to create a single market

ramkumar1992

FDI also means First Develop India and not just Foreign Direct Investment, he says

NEW DELHI, SEPT 25:

Prime Minister Narendra Modi has asked India Inc to first focus on developing the country and then look abroad.

"FDI also means First Develop India and not just Foreign Direct Investment. Both the FDIs should move on parallel tracks," the PM said, while launching the 'Make in India' campaign here on Thursday.

Modi stressed on effective and easy governance, besides employment generation. "Investors have to understand that the purchasing power of India has to go up for expanding," he said.

Kicking off the ‘Make in India’ campaign, he said his government’s focus will be on physical infrastructure creation as well as creating a digital network for making India a hub for global manufacturing of goods ranging from cars to software, satellites to submarines and paper to power.

“I do not only talk about good governance. I talk about effective governance and easy governance,” he said, while launching the ‘Make in India’ campaign that was attended by a galaxy of industrialists and business leaders, including Cyrus Mistry, Mukesh Ambani, Azim Premji, Kumar Mangalam Birla, Chanda Kocchar and Y C Deveshwar.

Calling upon domestic and international companies to invest in India, the Prime Minister said his government’s focus is not only to ‘Look East’ but also to ‘Link West’.

“We want highways. We also want i-ways — information ways for a Digital India,” Modi said, adding “Make in India is not a slogan, not an invitation’’.

Recalling the scenario of last two-three years where “companies were looking to move out of country”, he said three months of the NDA government has reversed the mood with its focus on easing the process of doing business in the country.

“Government is committed to development. This is not a political agenda, but an article of faith,” he said, while stressing on public-private partnership as well as skill development for increasing the share of manufacturing in GDP.

Modi said the world is ready to come to Asia and India offers best destination as it is a vibrant democracy with demographic dividend and huge demand.

Earlier, the Commerce and Industry Minister, Nirmala Sitaraman, assured de-licensing, de-regulation and radical changes to attract domestic and foreign investors into the country.

In an event to mark the launch of the 'Make in India' initiative, she said that the Government would focus on 25 sectors to push manufacturing, including automobiles, textiles, leather, electronics, engineering and IT.

She said that the Government aims to raise the share of manufacturing to 25 per cent of GDP from 15 per cent. Under the new initiative a dedicated team would facilitate investors 24x7. It may be noted that the Prime Minister Narendra Modi announced the new mission in his Independence Day speech this year.

The Minister said many new initiatives had been announced, including liberalisation of the FDI regime in sectors such as defence and the Railways. But this was just the beginning and many more measures would be initiated, she said, while adding that the effort would be to remove the tag of a country riddled with red-tapism.

In his remarks, the Chairman of Reliance industries, Mukesh Ambani, announced investment of Rs. 1.80 lakh crore in the next 12-15 months which, in turn, would create 1.25 lakh jobs. He also hoped that implementation of GST would help to create a single market

NEW DELHI, SEPT 25:

Prime Minister Narendra Modi has asked India Inc to first focus on developing the country and then look abroad.

"FDI also means First Develop India and not just Foreign Direct Investment. Both the FDIs should move on parallel tracks," the PM said, while launching the 'Make in India' campaign here on Thursday.

Modi stressed on effective and easy governance, besides employment generation. "Investors have to understand that the purchasing power of India has to go up for expanding," he said.

Kicking off the ‘Make in India’ campaign, he said his government’s focus will be on physical infrastructure creation as well as creating a digital network for making India a hub for global manufacturing of goods ranging from cars to software, satellites to submarines and paper to power.

“I do not only talk about good governance. I talk about effective governance and easy governance,” he said, while launching the ‘Make in India’ campaign that was attended by a galaxy of industrialists and business leaders, including Cyrus Mistry, Mukesh Ambani, Azim Premji, Kumar Mangalam Birla, Chanda Kocchar and Y C Deveshwar.

Calling upon domestic and international companies to invest in India, the Prime Minister said his government’s focus is not only to ‘Look East’ but also to ‘Link West’.

“We want highways. We also want i-ways — information ways for a Digital India,” Modi said, adding “Make in India is not a slogan, not an invitation’’.

Recalling the scenario of last two-three years where “companies were looking to move out of country”, he said three months of the NDA government has reversed the mood with its focus on easing the process of doing business in the country.

“Government is committed to development. This is not a political agenda, but an article of faith,” he said, while stressing on public-private partnership as well as skill development for increasing the share of manufacturing in GDP.

Modi said the world is ready to come to Asia and India offers best destination as it is a vibrant democracy with demographic dividend and huge demand.

Earlier, the Commerce and Industry Minister, Nirmala Sitaraman, assured de-licensing, de-regulation and radical changes to attract domestic and foreign investors into the country.

In an event to mark the launch of the 'Make in India' initiative, she said that the Government would focus on 25 sectors to push manufacturing, including automobiles, textiles, leather, electronics, engineering and IT.

She said that the Government aims to raise the share of manufacturing to 25 per cent of GDP from 15 per cent. Under the new initiative a dedicated team would facilitate investors 24x7. It may be noted that the Prime Minister Narendra Modi announced the new mission in his Independence Day speech this year.

The Minister said many new initiatives had been announced, including liberalisation of the FDI regime in sectors such as defence and the Railways. But this was just the beginning and many more measures would be initiated, she said, while adding that the effort would be to remove the tag of a country riddled with red-tapism.

In his remarks, the Chairman of Reliance industries, Mukesh Ambani, announced investment of Rs. 1.80 lakh crore in the next 12-15 months which, in turn, would create 1.25 lakh jobs. He also hoped that implementation of GST would help to create a single market

ramkumar1992

パブリッシュされた投稿Banks

The Reserve Bank of India on Monday said bank accounts will not become inoperative if a dividend cheque has been credited in it in the previous two years...

ソーシャルネットワーク上でシェアする · 1

124

ramkumar1992

The Reserve Bank of India on Monday said bank accounts will not become inoperative if a dividend cheque has been credited in it in the previous two years.

"Since dividend on shares is credited to Savings Bank accounts as per the mandate of the customer, the same should be treated as a customer induced transaction.

"As such, the account should be treated as operative account as long as the dividend is credited to the Savings Bank account," the central bank said in a notification.

A bank account becomes inoperative or dormant if no credit or debit transaction has been conducted for a period of two years.

RBI further said that the account should be treated as operative account as long as the dividend is credited to the Savings Bank account.

This clarification has been issued in view of the doubts raised by some bankers whether an account in which only dividend has been credited can be treated as inoperative after two years

"Since dividend on shares is credited to Savings Bank accounts as per the mandate of the customer, the same should be treated as a customer induced transaction.

"As such, the account should be treated as operative account as long as the dividend is credited to the Savings Bank account," the central bank said in a notification.

A bank account becomes inoperative or dormant if no credit or debit transaction has been conducted for a period of two years.

RBI further said that the account should be treated as operative account as long as the dividend is credited to the Savings Bank account.

This clarification has been issued in view of the doubts raised by some bankers whether an account in which only dividend has been credited can be treated as inoperative after two years

ramkumar1992

RBI initiates inspection of Syndicate Bank

The RBI has initiated an inspection of the accounts of Syndicate Bank, whose CMD S K Jain was recently arrested by the CBI for allegedly taking a bribe.

The RBI has initiated an inspection of the accounts of Syndicate Bank, whose CMD S K Jain was recently arrested by the CBI for allegedly taking a bribe.

ramkumar1992

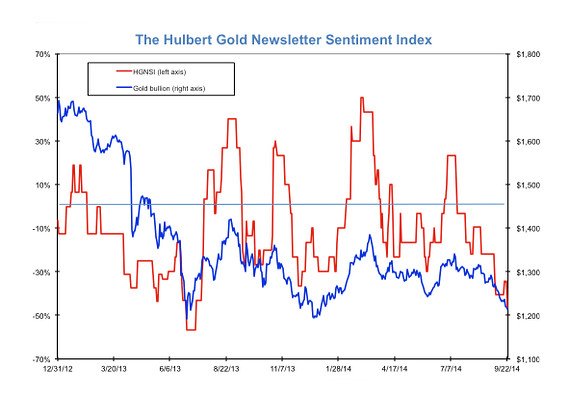

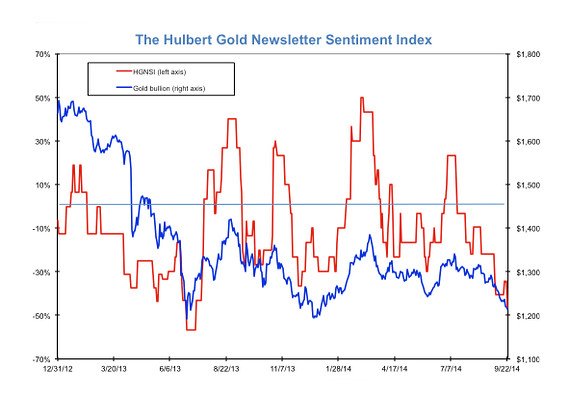

Gold may rebound as extreme bearishness sets in

CHAPEL HILL, N.C. (MarketWatch) — What does contrarian analysis have to say about gold now?

Time

Gold - Electronic (COMEX) Dec 2014

7 Jul

21 Jul

4 Aug

18 Aug

1 Sep

15 Sep

US:GCZ4$1,200$1,250$1,300$1,350

It was two weeks ago when I reported that sentiment analysis, at long last, was on the side of the bulls — at least for a tradeable rally. Yet, far from rallying, bullion today is $18 per ounce lower — a nine-month low — than it was then.

Does this mean contrarian analysis was wrong? Have contrarians reconsidered their bullish turn?

No is the answer, on both counts.

Consider the average recommended gold market exposure level among a subset of short-term gold market timers tracked by the Hulbert Financial Digest (as measured by the Hulbert Gold Newsletter Sentiment Index, or HGNSI). This average currently stands at minus 46.9%, which means that the average short-term gold timer is now allocating nearly half his clients’ gold-oriented portfolios to going short.

That is an aggressively bearish posture, which is unlikely to be profitable according to contrarian analysis.

Two weeks ago, when I last wrote about gold sentiment, the HGNSI stood at minus 40.6%. So contrarians are even more bullish today than they were then.

There’s been only one time in the past 30 years when the HGNSI got any lower than it is today. That came in June 2013, when the HGNSI fell to minus 56.7%. As you can see from the accompanying chart, gold soon — within a matter of a couple weeks — began a rally that, by late August, had tacked more than $200 on to the price of an ounce of gold.

Notice that gold’s 2013 summer rally didn’t begin immediately after the HGNSI dropped to the levels we’re seeing today. That’s hardly a criticism, of course, since no trading system can pick the market’s turning points with pinpoint accuracy.

Nevertheless, according to the econometric tests to which I have subjected the 30 years’ worth of my sentiment data, the gold market performs appreciably better following low HGNSI readings rather than it does high ones. Contrarian analysis hasn’t always worked, needless to say, but it’s more successful than it is a failure.

The time frame over which the HGNSI has its greatest explanatory power, according to my econometric tests, is one to three months. That means, assuming contrarian analysis will get its recent call right, gold will be higher during the last quarter of this year than it is today.

How long will gold’s rally last and how far will gold rise? The answer depends on how quickly the currently bearish gold timers jump on the bullish bandwagon. In the summer of 2013, for example, the HGNSI remained below minus 40% for nearly a month after the rally began, during which time gold rose more than $100.

That suggested that the bearishness that then prevailed was stubbornly held, which is a bullish omen according to contrarian analysis. If the gold timers exhibit similar stubbornness in coming weeks, contrarians would expect gold’s next rally to be that much stronger.

In contrast, if the gold timers instead are quick to become bullish again, gold’s rally will most likely be that much weaker.

Fortunately, contrarians don’t need to forecast, letting the sentiment data tell the story themselves.

CHAPEL HILL, N.C. (MarketWatch) — What does contrarian analysis have to say about gold now?

Time

Gold - Electronic (COMEX) Dec 2014

7 Jul

21 Jul

4 Aug

18 Aug

1 Sep

15 Sep

US:GCZ4$1,200$1,250$1,300$1,350

It was two weeks ago when I reported that sentiment analysis, at long last, was on the side of the bulls — at least for a tradeable rally. Yet, far from rallying, bullion today is $18 per ounce lower — a nine-month low — than it was then.

Does this mean contrarian analysis was wrong? Have contrarians reconsidered their bullish turn?

No is the answer, on both counts.

Consider the average recommended gold market exposure level among a subset of short-term gold market timers tracked by the Hulbert Financial Digest (as measured by the Hulbert Gold Newsletter Sentiment Index, or HGNSI). This average currently stands at minus 46.9%, which means that the average short-term gold timer is now allocating nearly half his clients’ gold-oriented portfolios to going short.

That is an aggressively bearish posture, which is unlikely to be profitable according to contrarian analysis.

Two weeks ago, when I last wrote about gold sentiment, the HGNSI stood at minus 40.6%. So contrarians are even more bullish today than they were then.

There’s been only one time in the past 30 years when the HGNSI got any lower than it is today. That came in June 2013, when the HGNSI fell to minus 56.7%. As you can see from the accompanying chart, gold soon — within a matter of a couple weeks — began a rally that, by late August, had tacked more than $200 on to the price of an ounce of gold.

Notice that gold’s 2013 summer rally didn’t begin immediately after the HGNSI dropped to the levels we’re seeing today. That’s hardly a criticism, of course, since no trading system can pick the market’s turning points with pinpoint accuracy.

Nevertheless, according to the econometric tests to which I have subjected the 30 years’ worth of my sentiment data, the gold market performs appreciably better following low HGNSI readings rather than it does high ones. Contrarian analysis hasn’t always worked, needless to say, but it’s more successful than it is a failure.

The time frame over which the HGNSI has its greatest explanatory power, according to my econometric tests, is one to three months. That means, assuming contrarian analysis will get its recent call right, gold will be higher during the last quarter of this year than it is today.

How long will gold’s rally last and how far will gold rise? The answer depends on how quickly the currently bearish gold timers jump on the bullish bandwagon. In the summer of 2013, for example, the HGNSI remained below minus 40% for nearly a month after the rally began, during which time gold rose more than $100.

That suggested that the bearishness that then prevailed was stubbornly held, which is a bullish omen according to contrarian analysis. If the gold timers exhibit similar stubbornness in coming weeks, contrarians would expect gold’s next rally to be that much stronger.

In contrast, if the gold timers instead are quick to become bullish again, gold’s rally will most likely be that much weaker.

Fortunately, contrarians don’t need to forecast, letting the sentiment data tell the story themselves.

: