Ijaz Nusayr Hussain / プロファイル

With over 10 years experience with the Foreign Exchange market I have developed systems that can be applied to FX trading to grow both retail and institutional accounts.

I have worked in various asset management firms where I was responsible of managing accounts with millions of euros in order to provide the clients with a regular and consistent return.

I have worked in various asset management firms where I was responsible of managing accounts with millions of euros in order to provide the clients with a regular and consistent return.

Ijaz Nusayr Hussain

Algorithms vs Humans

Nowadays, there is a lot of discussion regarding algorithmic trading vs manual trading. One of the main factors that drives this discussion is due to the increase of algorithmic trading systems in the markets.

With thousands of algorithms, many claiming to return significant returns on investment we take a look at whether or not algorithmic trading is viable and stable. Many claim that they have found the “holy grail” when it comes to algorithmic trading, the claims can boast such outcomes as 20% - 50% returns on investment month by month; surely turning investors into instant millionaires should this be the case.

We are beyond the point of believing these unrealistic claims. However, we should not let these steal away the validity of real and complex algorithms which do return profit on funds; albeit a significantly lower amount than those stated above. The truth is algorithmic trading can work and does work. Many major institutions and banks use highly optimised algorithms to take profits out of the markets on a day to day basis.

Like in any good discussion there are certainly advantages and disadvantages to both sides of the debate, some consider it impossible to say one method of trading is better than the other whereas there will be many that will be biased towards one or the other. Now, let’s review the advantages and disadvantages and dive further into this matter and see what we can discover.

The Algorithmic Trader

One of the most fundamental advantages of any algorithms is simply the nature of having a software trade for you. It is exact, perfectly disciplined, it will trade according to the criteria set and does not make mistakes (if programmed correctly of course).

One of the most common and biggest issues faced by traders as a whole is their ability to be disciplined and the ability to stick to their clearly defined plan. With algorithmic trading we are able to completely eradicate human emotions and be assured that the algorithms will stick to your defined trading dlan as set out at the offset; it is completely disciplined and will of course execute trades according to the parameters set out. Often, it is the ability to stick to a plan that is the difference between a profitable trader and a not so profitable trader.

Another key issue when trading is timing of execution; this can be vital to surviving in a market where over 6 trillion dollars are passed through on a day to day basis. An algorithm will always ensure that trades are executed at the correct level, it will ensure that entry conditions are perfect for opening a trade, it will ensure that the emotion of greed does not come into play. An algorithm will not get mixed up between a buy and a sell, it will not place incorrect stop and profit levels and one of the key issues; it will not change stop levels due to hope of a bad trade becoming better which can be detrimental to your end Profit and Loss account.

As well as the above mentioned points, the algorithm can take in more data, it can handle more instructions and it can monitor and manage multiple open positions at any one time. An algorithm can also call out to external sources at speeds of hundreds of times every minute to get external data to help improve trading quality where as it is impossible for us humans to maintain.

Not only does an algorithm have the ability to be perfectly disciplined, execute trades at perfect conditions, eradicate human emotions and call out to external sources but it also does not get tired. An algorithm can monitor, open and close trades at milliseconds and 24 hours a day, 5 days a week as long as the markets it is trading remains open. This is something which traders find physically and emotionally draining and a manual trader is also not able to monitor for 24 hours.

The Human Trader

The main point that a human trader has over an algorithm is the ability to make decisions based on the current scenarios to better manage both winning and losing trades. A human can see when a market is moving awkwardly and unexpectedly and take this into consideration before executing a trade. A human can also pull out of a trade early when markets do not favour them and remain within a trade when the momentum of the markets do favour them which ensures a higher level of reward reward to risk ratio.

Now that the advantages and disadvantages of both sides of the debate have been outlined what is the conclusion? In our expert opinion, algorithms are the future of trading, they are far more responsive than humans and they do not hold any emotions which allows them to gain better rewards and reduce risk. The major investment institutes now employ hundreds of skilled quantitatives to develop highly complex algorithms which undergo various tests in varying market conditions to ensure robustness and the ability to maintain and manage risk to keep it minimal.

Having said that, I strongly believe that algorithms should be used for execution and management of trades but we also require human interaction for spotting market conditions which are unfavourable as this is only visible to the human eye. By combining the 2 methods you will increase the chances of gaining better returns on investment.

Nowadays, there is a lot of discussion regarding algorithmic trading vs manual trading. One of the main factors that drives this discussion is due to the increase of algorithmic trading systems in the markets.

With thousands of algorithms, many claiming to return significant returns on investment we take a look at whether or not algorithmic trading is viable and stable. Many claim that they have found the “holy grail” when it comes to algorithmic trading, the claims can boast such outcomes as 20% - 50% returns on investment month by month; surely turning investors into instant millionaires should this be the case.

We are beyond the point of believing these unrealistic claims. However, we should not let these steal away the validity of real and complex algorithms which do return profit on funds; albeit a significantly lower amount than those stated above. The truth is algorithmic trading can work and does work. Many major institutions and banks use highly optimised algorithms to take profits out of the markets on a day to day basis.

Like in any good discussion there are certainly advantages and disadvantages to both sides of the debate, some consider it impossible to say one method of trading is better than the other whereas there will be many that will be biased towards one or the other. Now, let’s review the advantages and disadvantages and dive further into this matter and see what we can discover.

The Algorithmic Trader

One of the most fundamental advantages of any algorithms is simply the nature of having a software trade for you. It is exact, perfectly disciplined, it will trade according to the criteria set and does not make mistakes (if programmed correctly of course).

One of the most common and biggest issues faced by traders as a whole is their ability to be disciplined and the ability to stick to their clearly defined plan. With algorithmic trading we are able to completely eradicate human emotions and be assured that the algorithms will stick to your defined trading dlan as set out at the offset; it is completely disciplined and will of course execute trades according to the parameters set out. Often, it is the ability to stick to a plan that is the difference between a profitable trader and a not so profitable trader.

Another key issue when trading is timing of execution; this can be vital to surviving in a market where over 6 trillion dollars are passed through on a day to day basis. An algorithm will always ensure that trades are executed at the correct level, it will ensure that entry conditions are perfect for opening a trade, it will ensure that the emotion of greed does not come into play. An algorithm will not get mixed up between a buy and a sell, it will not place incorrect stop and profit levels and one of the key issues; it will not change stop levels due to hope of a bad trade becoming better which can be detrimental to your end Profit and Loss account.

As well as the above mentioned points, the algorithm can take in more data, it can handle more instructions and it can monitor and manage multiple open positions at any one time. An algorithm can also call out to external sources at speeds of hundreds of times every minute to get external data to help improve trading quality where as it is impossible for us humans to maintain.

Not only does an algorithm have the ability to be perfectly disciplined, execute trades at perfect conditions, eradicate human emotions and call out to external sources but it also does not get tired. An algorithm can monitor, open and close trades at milliseconds and 24 hours a day, 5 days a week as long as the markets it is trading remains open. This is something which traders find physically and emotionally draining and a manual trader is also not able to monitor for 24 hours.

The Human Trader

The main point that a human trader has over an algorithm is the ability to make decisions based on the current scenarios to better manage both winning and losing trades. A human can see when a market is moving awkwardly and unexpectedly and take this into consideration before executing a trade. A human can also pull out of a trade early when markets do not favour them and remain within a trade when the momentum of the markets do favour them which ensures a higher level of reward reward to risk ratio.

Now that the advantages and disadvantages of both sides of the debate have been outlined what is the conclusion? In our expert opinion, algorithms are the future of trading, they are far more responsive than humans and they do not hold any emotions which allows them to gain better rewards and reduce risk. The major investment institutes now employ hundreds of skilled quantitatives to develop highly complex algorithms which undergo various tests in varying market conditions to ensure robustness and the ability to maintain and manage risk to keep it minimal.

Having said that, I strongly believe that algorithms should be used for execution and management of trades but we also require human interaction for spotting market conditions which are unfavourable as this is only visible to the human eye. By combining the 2 methods you will increase the chances of gaining better returns on investment.

Ijaz Nusayr Hussain

Become an Introducer for Quantum Markets.

By introducing our managed account service to your clients and connections you can earn 5% a month on client profits for every client that successfully signs up with us. Start referring and start earning. Contact us now for more information.

By introducing our managed account service to your clients and connections you can earn 5% a month on client profits for every client that successfully signs up with us. Start referring and start earning. Contact us now for more information.

Ijaz Nusayr Hussain

The Power of Leverage. Now we all know that leverage can be a disaster but if applied correctly with good money management skills, leverage can become your best friend. At Quantum Markets we know when to buy in and when to close out. Ride the wave with leverage, dont use it to over expose yourself.

Ijaz Nusayr Hussain

QM Night Trade fully automated system releasing soon. At Quantum Markets we like to look for opportunities where opportunities may be hard to come by. So we have built a robust system that will generate profits without you needing to lift a finger. Stay tuned for more information... ;)

Ijaz Nusayr Hussain

For optimum results we recommend using our current broker with preferential trading conditions which can be accessed through our affiliate link. Sign up now at https://www.vantagefx.com/forex-trading/forex-trading-account/?affid=8334 Please make sure you select RAW ECN and leverage 1:500

Ijaz Nusayr Hussain

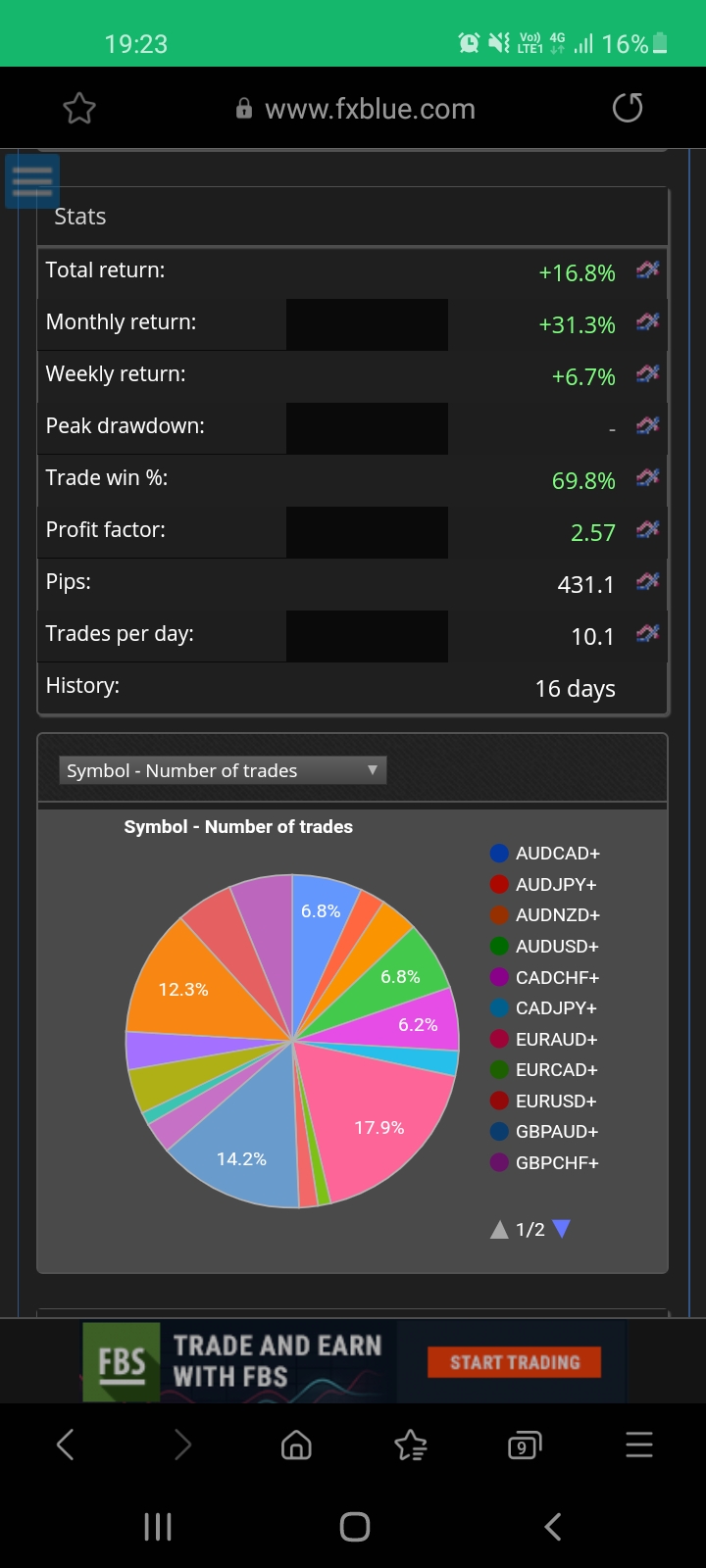

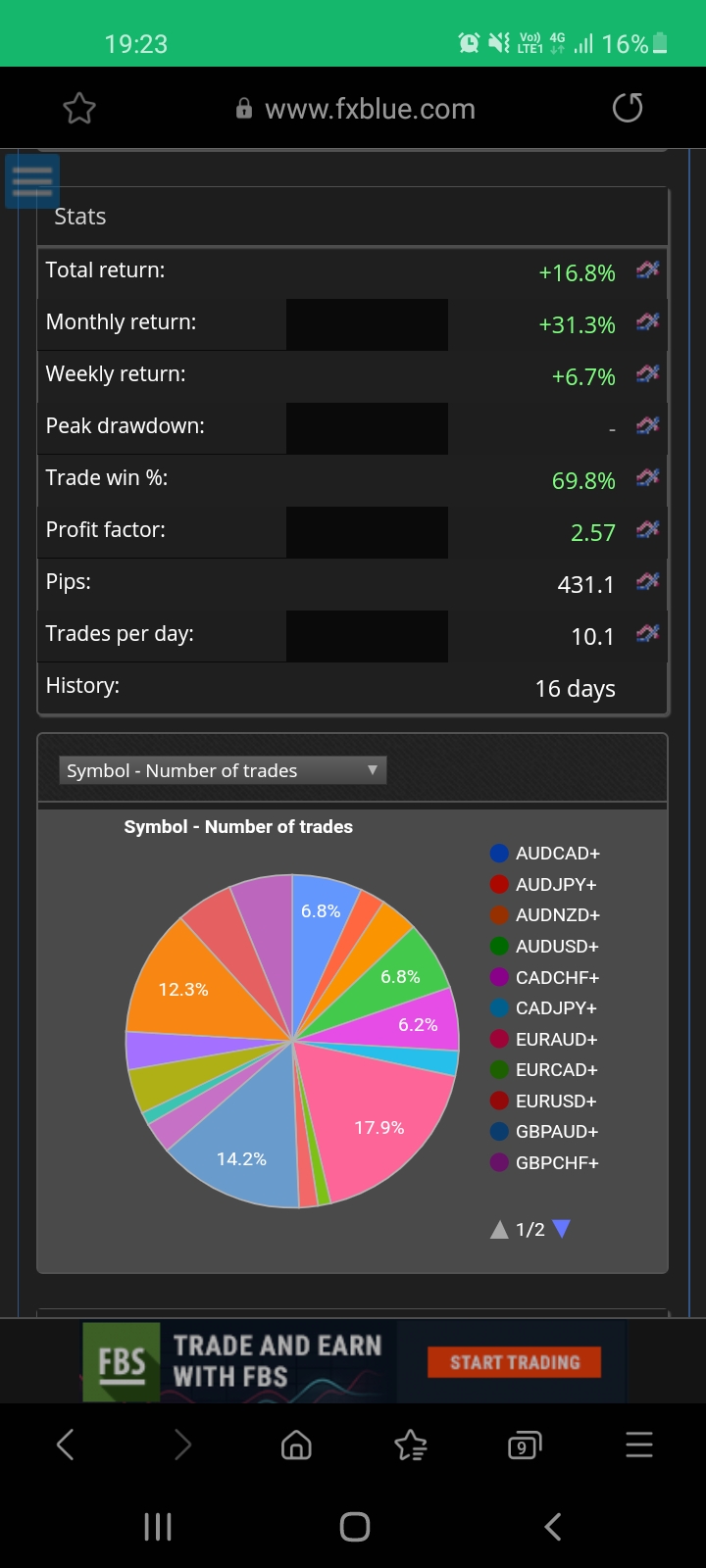

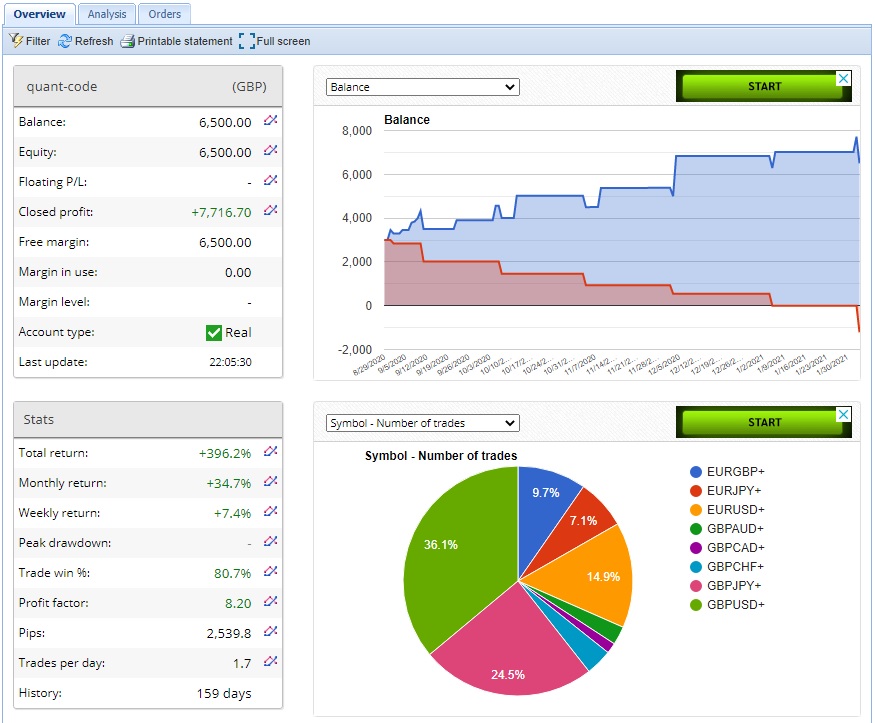

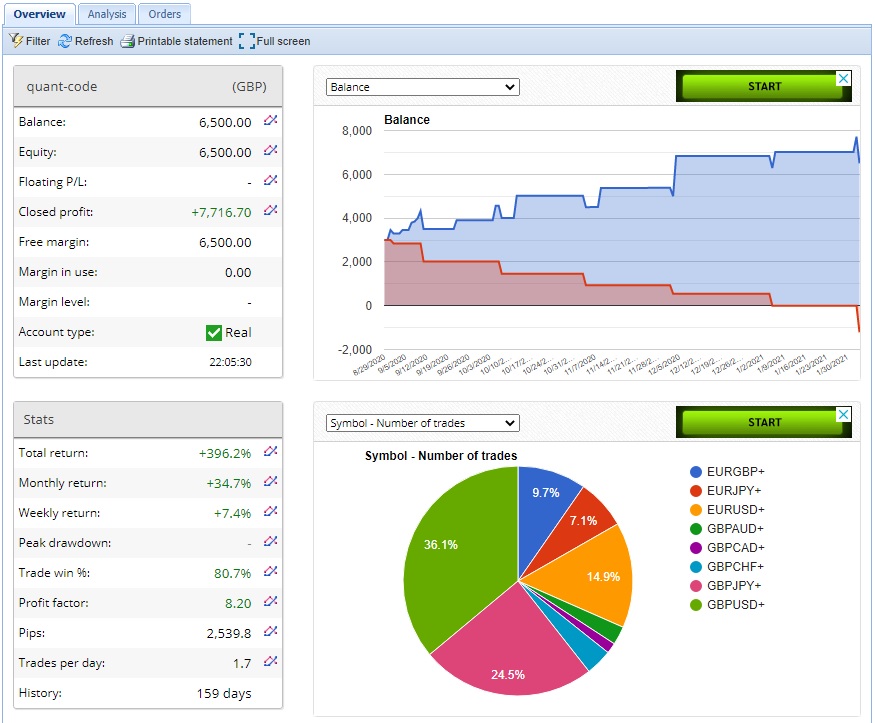

Use a system that works. Sign up with QM Frequency signal or managed account service now. Don't miss out. Results speak for themselves. Contact for more information.

: