Evgeniy Piskachev / プロファイル

- 情報

|

11+ 年

経験

|

0

製品

|

0

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

In the forex market for over 5 years . In trade used technical analysis indicators , as well as economic and political news. If you are interested in more conservative and lucrative trade might trust.

Evgeniy Piskachev

パブリッシュされた投稿Нефть против рубля!!!

Рубль вновь подешевел до границы плавающего коридора ЦБ и обновил минимумы утром пятницы, а участники рынка вернулись к покупкам валюты у Центробанка не найдя нужных им объемов на рынке, несмотря на отскок нефти с экстремальных минимумов, текущий налоговый период и надежды на геополитическую разр...

ソーシャルネットワーク上でシェアする · 5

111

Evgeniy Piskachev

The pound edged lower against the U.S. dollar on Friday, as Thursday's upbeat U.S. economic reports continued to support demand for the greenback and investors eyed the release of additional U.S. data later in the day.

Forex - Pound edges lower vs. broadly stronger dollarPound slips lower vs. dollar on strong U.S. data

GBP/USD hit 1.6030 during European morning trade, the session low; the pair subsequently consolidated at 1.6055, shedding 0.20%.

Cable was likely to find support at 1.5940, Thursday's low and resistance at 1.6182, the high of October 8.

The dollar strengthened broadly on Thursday after the U.S. Department of Labor reported that the number of individuals filing for initial jobless benefits in the week ending October 11 decreased by 23,000 to a 14-year low of 264,000 from the previous week’s total of 287,000.

Analysts had expected jobless claims to rise by 3,000 to 290,000 last week.

A separate report showed that U.S. industrial production climbed 1.0% last month, beating expectations for a 0.4% rise.

The greenback's gains were limited however as St. Louis Federal Reserve President James Bullard said the U.S. central bank may want to maintain its bond buying for now given a drop in inflation expectations.

Sterling was steady against the euro, with EUR/GBP inching up 0.06% to 0.7967.

Sentiment on the euro remained vulnerable amid growing concerns over the threat of deflation in the euro zone after revised data on Thursday showed that bloc's consumer price inflation rose by 0.3% in September, in line with expectations.

Forex - Pound edges lower vs. broadly stronger dollarPound slips lower vs. dollar on strong U.S. data

GBP/USD hit 1.6030 during European morning trade, the session low; the pair subsequently consolidated at 1.6055, shedding 0.20%.

Cable was likely to find support at 1.5940, Thursday's low and resistance at 1.6182, the high of October 8.

The dollar strengthened broadly on Thursday after the U.S. Department of Labor reported that the number of individuals filing for initial jobless benefits in the week ending October 11 decreased by 23,000 to a 14-year low of 264,000 from the previous week’s total of 287,000.

Analysts had expected jobless claims to rise by 3,000 to 290,000 last week.

A separate report showed that U.S. industrial production climbed 1.0% last month, beating expectations for a 0.4% rise.

The greenback's gains were limited however as St. Louis Federal Reserve President James Bullard said the U.S. central bank may want to maintain its bond buying for now given a drop in inflation expectations.

Sterling was steady against the euro, with EUR/GBP inching up 0.06% to 0.7967.

Sentiment on the euro remained vulnerable amid growing concerns over the threat of deflation in the euro zone after revised data on Thursday showed that bloc's consumer price inflation rose by 0.3% in September, in line with expectations.

Evgeniy Piskachev

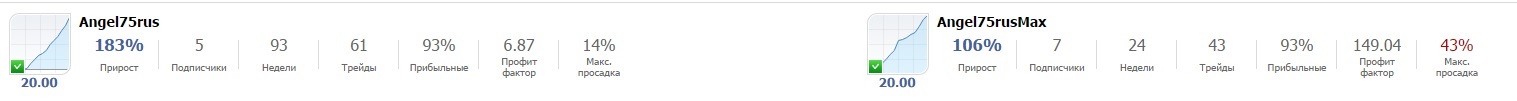

Join! ! ! Stablly 15-20% a month! ! !

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

Evgeniy Piskachev

パブリッシュされた投稿Фьючерсы на золото

Фьючерсы на золото снизились во время американской сессии в Четверг. В Подразделении Нью-Йоркской товарной биржи Комекс, Фьючерсы на золото с поставкой на Декабрь торгуются на USD1.240,30 за тройскую унцию на момент подписания падая на 0,36%. Это раньше торговалось на сессионном минимуме USD1...

ソーシャルネットワーク上でシェアする · 3

97

Evgeniy Piskachev

パブリッシュされた投稿Доллар слабеет

Потребительская инфляция в еврозоне остается на крайне низком уровне с октября 2013 года, когда она преодолела сверху вниз уровень в 1.0%. Показатель сегодня вышел на уровне в 0.4% в месячном выражении и 0.3% в годовом...

ソーシャルネットワーク上でシェアする · 3

103

Evgeniy Piskachev

Показатель "Промышленное производство Колумбии" в прошлом месяце неожиданно изменился. Об этом свидетельствуют официальные данные за четверг.

Показатель Показатель "Промышленное производство Колумбии" : 0,3% против прогноза в 1,0%В отчете, который был предоставлен организацией, которая называется "Banco de la Republica Colombia", было сказано, что показатель, который отображает показатель "Промышленное производство Колумбии" изменился, с учетом сезонных колебаний до 0,3% с 1,6% за прошлый месяц.

Аналитики ожидали, что показатель "Промышленное производство Колумбии" снижение к 1,0% в прошлом месяце.

Показатель Показатель "Промышленное производство Колумбии" : 0,3% против прогноза в 1,0%В отчете, который был предоставлен организацией, которая называется "Banco de la Republica Colombia", было сказано, что показатель, который отображает показатель "Промышленное производство Колумбии" изменился, с учетом сезонных колебаний до 0,3% с 1,6% за прошлый месяц.

Аналитики ожидали, что показатель "Промышленное производство Колумбии" снижение к 1,0% в прошлом месяце.

Evgeniy Piskachev

U.S. stocks ended near flat after another choppy session on Thursday as economic data eased fears about the potential effect of a weakening global economy on the United States.

Strong data stops the bleeding on Wall StreetStrong data stops the bleeding on Wall Street

The Dow Jones industrial average (DJI) fell 24.95 points, or 0.15 percent, to 16,116.79, the S&P 500 (SPX) gained 0.26 points, or 0.01 percent, to 1,862.75 and the Nasdaq Composite (IXIC) added 2.07 points, or 0.05 percent, to 4,217.39.

The Dow fell for a sixth straight session, matching a streak last seen in August 2013, but indexes closed well off their lows. The S&P fell as much as 1.5 percent earlier.

Strong data stops the bleeding on Wall StreetStrong data stops the bleeding on Wall Street

The Dow Jones industrial average (DJI) fell 24.95 points, or 0.15 percent, to 16,116.79, the S&P 500 (SPX) gained 0.26 points, or 0.01 percent, to 1,862.75 and the Nasdaq Composite (IXIC) added 2.07 points, or 0.05 percent, to 4,217.39.

The Dow fell for a sixth straight session, matching a streak last seen in August 2013, but indexes closed well off their lows. The S&P fell as much as 1.5 percent earlier.

Evgeniy Piskachev

パブリッシュされた投稿Эх, Автралия!!!

Австралийский доллар потянулся за остальными валютами G10, попытавшимися развить коррекцию против его американского тезки после выхода в свет разочаровывающей статистики по розничным продажам и ценам производителей на фоне обвала фондовых индексов США, однако увлекаться ростом себе дороже...

ソーシャルネットワーク上でシェアする · 5

106

Evgeniy Piskachev

パブリッシュされた投稿Фунт ждет своего часа

В четверг фунт почти не изменился по отношению к доллару США, по-прежнему колеблется вблизи 11-месячного минимума, поскольку американская валюта оправилась от резких потерь, спровоцированных слабыми экономическими отчетами...

ソーシャルネットワーク上でシェアする · 4

116

Evgeniy Piskachev

The pound was almost unchanged against the U.S. dollar on Thursday, still hovering close to an 11-month low as the greenback recovered from the previous day's sharp losses due to weak U.S. economic reports.

Forex - GBP/USD almost unchanged, near 11-month lowsPound holds steady close to 11-month trough vs. dollar

GBP/USD hit 1.5951 during European morning trade, the session low; the pair subsequently consolidated at 1.6002, easing 0.11%.

Cable was likely to find support at 1.5873, Wednesday's low and an 11-month low and resistance at 1.6103, the high of October 14.

The greenback came under broad selling pressure on Wednesday after a string of disappointing U.S. data further dampened expectations for an early rate hike by the Federal Reserve.

Official data showed that U.S. retail sales fell 0.3% last month, more than the expected 0.1% slip, while core retail sales, which exclude automobiles, dropped 0.2% in September, confounding expectations for a 0.3% gain.

A separate report showed that U.S. producer price inflation slipped 0.1% last month, disappointing expectations for a 0.1% rise, while the Federal Reserve of New York reported that its manufacturing index tumbled to a six-month low of 6.2 in October from a reading of 27.5 the previous month.

The pound showed little reaction to data on Wednesday showing that the U.K. claimant count declined less than expected in August, although the unemployment rate fell to the lowest level since October 2008.

Forex - GBP/USD almost unchanged, near 11-month lowsPound holds steady close to 11-month trough vs. dollar

GBP/USD hit 1.5951 during European morning trade, the session low; the pair subsequently consolidated at 1.6002, easing 0.11%.

Cable was likely to find support at 1.5873, Wednesday's low and an 11-month low and resistance at 1.6103, the high of October 14.

The greenback came under broad selling pressure on Wednesday after a string of disappointing U.S. data further dampened expectations for an early rate hike by the Federal Reserve.

Official data showed that U.S. retail sales fell 0.3% last month, more than the expected 0.1% slip, while core retail sales, which exclude automobiles, dropped 0.2% in September, confounding expectations for a 0.3% gain.

A separate report showed that U.S. producer price inflation slipped 0.1% last month, disappointing expectations for a 0.1% rise, while the Federal Reserve of New York reported that its manufacturing index tumbled to a six-month low of 6.2 in October from a reading of 27.5 the previous month.

The pound showed little reaction to data on Wednesday showing that the U.K. claimant count declined less than expected in August, although the unemployment rate fell to the lowest level since October 2008.

Evgeniy Piskachev

U.S. stocks fell on Wednesday on continued worries about weak global demand, but managed to close well above session lows that briefly pushed the S&P 500 and Nasdaq into negative territory for the year.

Small-caps and energy shares, which have been among the market's weakest performers, provided some of the late-day support, with the Russell 2000 index (TOY) ending up 1 percent and the S&P energy index up 0.4 percent.

Adding to the day's worries, a second nurse in Texas tested positive for the Ebola virus, a week after Thomas Eric Duncan, the first Ebola patient diagnosed in the United States, died.

The day's losses threatened to wipe out 2014 gains for the S&P 500 and Nasdaq, with the S&P 500 down more than 3 percent at its low. The Dow industrials fell further into the red for the year, down for the fifth consecutive session.

The S&P 500 is now down 7.4 percent from its Sept. 18 record closing high, and is up just 0.8 percent for the year.

"If you look at the lows of the day, maybe we've put in a little bit of a trading bottom here. But I don't think it makes these concerns about aggregate demand and inflation go away ... that's really what's weakening the market," said David Joy, chief market strategist at Ameriprise Financial in Boston.

Small-caps and energy shares, which have been among the market's weakest performers, provided some of the late-day support, with the Russell 2000 index (TOY) ending up 1 percent and the S&P energy index up 0.4 percent.

Adding to the day's worries, a second nurse in Texas tested positive for the Ebola virus, a week after Thomas Eric Duncan, the first Ebola patient diagnosed in the United States, died.

The day's losses threatened to wipe out 2014 gains for the S&P 500 and Nasdaq, with the S&P 500 down more than 3 percent at its low. The Dow industrials fell further into the red for the year, down for the fifth consecutive session.

The S&P 500 is now down 7.4 percent from its Sept. 18 record closing high, and is up just 0.8 percent for the year.

"If you look at the lows of the day, maybe we've put in a little bit of a trading bottom here. But I don't think it makes these concerns about aggregate demand and inflation go away ... that's really what's weakening the market," said David Joy, chief market strategist at Ameriprise Financial in Boston.

Evgeniy Piskachev

U.S. natural gas futures rebounded from the previous session's losses on Wednesday, as market players monitored near-term weather forecasts to gauge the strength of demand for the fuel ahead of Thursday’s closely-watched supply report.

Natural gas futures bounce off 4-week low ahead of storage reportNatural gas futures edge higher ahead of weekly storage report

On the New York Mercantile Exchange, natural gas for delivery in November traded at $3.842 per million British thermal units during U.S. morning hours, up 2.5 cents, or 0.67%.

A day earlier, natural gas prices fell to $3.806, the lowest since September 12, before settling at $3.816, down 10.0 cents, or 2.55%.

Futures were likely to find support at $3.786 per million British thermal units, the low from September 12 and resistance at $3.955, the high from October 14.

The U.S. Energy Information Administration’s weekly storage report slated for release on Thursday is expected to show an increase of 98 billion cubic feet for the week ending October 10.

Inventories rose by 79 billion cubic feet in the same week a year earlier, while the five-year average change is a build of 78 billion cubic feet.

Natural gas futures bounce off 4-week low ahead of storage reportNatural gas futures edge higher ahead of weekly storage report

On the New York Mercantile Exchange, natural gas for delivery in November traded at $3.842 per million British thermal units during U.S. morning hours, up 2.5 cents, or 0.67%.

A day earlier, natural gas prices fell to $3.806, the lowest since September 12, before settling at $3.816, down 10.0 cents, or 2.55%.

Futures were likely to find support at $3.786 per million British thermal units, the low from September 12 and resistance at $3.955, the high from October 14.

The U.S. Energy Information Administration’s weekly storage report slated for release on Thursday is expected to show an increase of 98 billion cubic feet for the week ending October 10.

Inventories rose by 79 billion cubic feet in the same week a year earlier, while the five-year average change is a build of 78 billion cubic feet.

Evgeniy Piskachev

The pound remained close to 11-month lows against the U.S. dollar on Tuesday, as lower than expected U.K. inflation data continued to weigh, as well as growing concerns over the outlook for global economic growth.

Forex - Pound remains close to 11-month lows vs. dollarPound remains sharply lower vs. dollar, U.K. data still weighs

GBP/USD hit 0.9468 during U.S. morning trade, the pair's lowest since November 2013; the pair subsequently consolidated at 1.5923, tumbling 1%.

Cable was likely to find support at 1.5852 and resistance at 1.6128, Monday's high.

The pound weakened broadly after data earlier showed that U.K. inflation data slowed to a five-year low last month.

In a report, the U.K. Office for National Statistics said the rate of consumer price inflation slowed to 1.2% last month from 1.5% in August. Analysts had expected U.K. CPI to fall to 1.4% in September.

Month-over-month, consumer price inflation was flat in September, after rising 0.4% in August.

Core CPI, which excludes food, energy, alcohol, and tobacco costs rose at a rate of 1.5% last month, down from 1.9% in August. Analysts had expected core prices to rise 1.8% in September.

Meanwhile, market sentiment remained under pressure amid global economic growth concerns after the International Monetary Fund cut its forecasts for global growth in 2014 and 2015 last week.

Forex - Pound remains close to 11-month lows vs. dollarPound remains sharply lower vs. dollar, U.K. data still weighs

GBP/USD hit 0.9468 during U.S. morning trade, the pair's lowest since November 2013; the pair subsequently consolidated at 1.5923, tumbling 1%.

Cable was likely to find support at 1.5852 and resistance at 1.6128, Monday's high.

The pound weakened broadly after data earlier showed that U.K. inflation data slowed to a five-year low last month.

In a report, the U.K. Office for National Statistics said the rate of consumer price inflation slowed to 1.2% last month from 1.5% in August. Analysts had expected U.K. CPI to fall to 1.4% in September.

Month-over-month, consumer price inflation was flat in September, after rising 0.4% in August.

Core CPI, which excludes food, energy, alcohol, and tobacco costs rose at a rate of 1.5% last month, down from 1.9% in August. Analysts had expected core prices to rise 1.8% in September.

Meanwhile, market sentiment remained under pressure amid global economic growth concerns after the International Monetary Fund cut its forecasts for global growth in 2014 and 2015 last week.

Evgeniy Piskachev

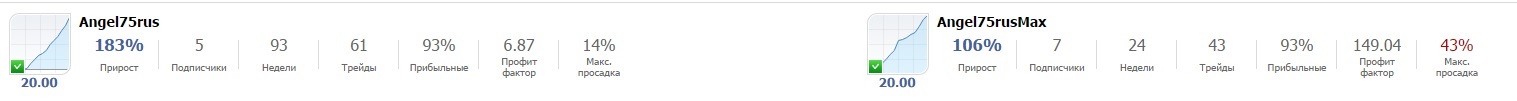

Join! ! ! Stablly 15-20% a month! ! !

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/58648

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/58648

Evgeniy Piskachev

U.S. stock index futures were little changed on Tuesday, after the S&P 500 suffered its worst three-day drop since November 2011, ahead of earnings results from companies such as Johnson & Johnson (N:JNJ) and Citigroup (N:C).

* JPMorgan Chase (N:JPM) shares edged down 0.4 percent to $57.95 in premarket, after the biggest U.S. bank posted third-quarter earnings. The results were released earlier than anticipated on an investment website ahead of its official release on Tuesday.

* The benchmark S&P closed below its 200-day moving average for the first time since Nov. 16, 2012 on Monday and is now down 6.8 percent from its record closing high on September 18 on concerns global economic weakness could hurt U.S. earnings and the potential spread of Ebola.

* The CBOE Volatility index (VIX) ended Monday's session at 24.64, its highest close since June 2012.

* S&P 500 companies are expected to show earnings growth of 6.4 percent in the third quarter, according to Thomson Reuters data, with revenue growth expected at 4 percent. After the close, Dow component and chipmaker Intel (O:INTC) is set to post results.

* European stocks fell early, losing ground for the seventh time in 10 sessions and Japanese stocks skidded to two-month lows. But Asian shares outside Japan managed to climb 0.6 percent thanks to bargain-hunting. (EU)

* S&P 500 e-minis were up 3 points, or 0.16 percent, with 298,424 contracts changing hands.

* Nasdaq 100 e-minis rose 5.25 points, or 0.14 percent, in volume of 34,930 contracts.

* Dow e-minis advanced 9 points, or 0.06 percent, with 45,494 contracts changing hands.

© Reuters. Traders work on the floor of the New York Stock Exchange

* JPMorgan Chase (N:JPM) shares edged down 0.4 percent to $57.95 in premarket, after the biggest U.S. bank posted third-quarter earnings. The results were released earlier than anticipated on an investment website ahead of its official release on Tuesday.

* The benchmark S&P closed below its 200-day moving average for the first time since Nov. 16, 2012 on Monday and is now down 6.8 percent from its record closing high on September 18 on concerns global economic weakness could hurt U.S. earnings and the potential spread of Ebola.

* The CBOE Volatility index (VIX) ended Monday's session at 24.64, its highest close since June 2012.

* S&P 500 companies are expected to show earnings growth of 6.4 percent in the third quarter, according to Thomson Reuters data, with revenue growth expected at 4 percent. After the close, Dow component and chipmaker Intel (O:INTC) is set to post results.

* European stocks fell early, losing ground for the seventh time in 10 sessions and Japanese stocks skidded to two-month lows. But Asian shares outside Japan managed to climb 0.6 percent thanks to bargain-hunting. (EU)

* S&P 500 e-minis were up 3 points, or 0.16 percent, with 298,424 contracts changing hands.

* Nasdaq 100 e-minis rose 5.25 points, or 0.14 percent, in volume of 34,930 contracts.

* Dow e-minis advanced 9 points, or 0.06 percent, with 45,494 contracts changing hands.

© Reuters. Traders work on the floor of the New York Stock Exchange

Evgeniy Piskachev

According to the report, 51.3% of market participants held long positions in the S&P 500 last week, up from 50.3% in the previous week. A reading between 50%-70% is bullish for the instrument.

In the commodities market, 61.6% of investors were bullish on gold, compared to 66.5% a week earlier.

Meanwhile, 36.2% held long positions in EUR/USD last week, down from 44.5% in the preceding week, while 49.1% of investors were long in GBP/USD, compared to 55.9% a week earlier.

Elsewhere, 61.0% of market participants held long positions in USD/JPY last week, down slightly from 62.2% a week earlier, while 54.5% of investors were long USD/CHF, up from 50.4% in the preceding week.

Amongst the commodity-linked currencies, 43.8% were long USD/CAD, compared to 51.1% a week earlier, 44.4% held long positions in AUD/USD, down from 52.9% in the preceding week, while 57.2% were long NZD/USD, little changed from 57.1% a week earlier.

In the commodities market, 61.6% of investors were bullish on gold, compared to 66.5% a week earlier.

Meanwhile, 36.2% held long positions in EUR/USD last week, down from 44.5% in the preceding week, while 49.1% of investors were long in GBP/USD, compared to 55.9% a week earlier.

Elsewhere, 61.0% of market participants held long positions in USD/JPY last week, down slightly from 62.2% a week earlier, while 54.5% of investors were long USD/CHF, up from 50.4% in the preceding week.

Amongst the commodity-linked currencies, 43.8% were long USD/CAD, compared to 51.1% a week earlier, 44.4% held long positions in AUD/USD, down from 52.9% in the preceding week, while 57.2% were long NZD/USD, little changed from 57.1% a week earlier.

Evgeniy Piskachev

Join! ! ! Stablly 15-20% a month! ! !

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/58648

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/58648

Evgeniy Piskachev

The euro declined against the dollar on Friday amid concerns the European economy is floundering and may require fresh stimulus measures from the European Central Bank.

Forex - EUR/USD weekly outlook: October 13 - 17EUR/USD ends the week up 0.91%

EUR/USD hit 1.2790 on Thursday, the pair’s highest level since September 24, before subsequently consolidating at 1.2629 by close of trade on Friday, down 0.48% for the day but still 0.91% higher for the week.

The pair is likely to find support at 1.2582, the low from October 6, and resistance at 1.2790, the high from October 9.

Market sentiment was hit by fears that Germany, the euro zone’s largest economy is being dragged into a recession after recent data indicated unexpected weakness in manufacturing and exports.

Data released on Thursday showed that German exports fell 5.8% in August, and this followed weak industrial output figures on Tuesday.

Earlier in the week, the International Monetary Fund cut its forecasts for global growth in 2014 and 2015 and warned that global growth may never reach its pre-crisis levels ever again.

The fund revised down its growth forecasts for the euro area’s three largest economies Germany, France and Italy.

Steep declines in commodity-price declines also fuelled fears that the global economy is slowing. Brent crude oil prices fell to their lowest level for nearly four years on Friday.

The dollar weakened after the minutes of the Federal Reserve’s September meeting released Wednesday showed that some officials were concerned over a slowdown in global growth and the impact of the stronger dollar on the U.S. inflation outlook.

"Some participants expressed concern that the persistent shortfall of economic growth and inflation in the euro area could lead to a further appreciation of the dollar and have adverse effects on the U.S. external sector," the minutes said.

The minutes prompted investors to trim back expectations for an earlier-than-expected hike in U.S. interest rates.

On Friday, Fed Vice Chairman Stanley Fischer said weaker-than-expected global growth could prompt it to slow the pace of eventual interest rate hikes.

The US Dollar Index, which tracks the performance of the greenback against a basket of six major currencies, ended the week down 1% at 85.92. The move ended a 12-week rally that saw the index gain more than 8% since early July.

In the week ahead, investors will be awaiting U.S. data on retail sales and industrial production for fresh indications on the strength of the economic recovery. Tuesday’s ZEW report on German economic sentiment will also be closely watched.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Forex - EUR/USD weekly outlook: October 13 - 17EUR/USD ends the week up 0.91%

EUR/USD hit 1.2790 on Thursday, the pair’s highest level since September 24, before subsequently consolidating at 1.2629 by close of trade on Friday, down 0.48% for the day but still 0.91% higher for the week.

The pair is likely to find support at 1.2582, the low from October 6, and resistance at 1.2790, the high from October 9.

Market sentiment was hit by fears that Germany, the euro zone’s largest economy is being dragged into a recession after recent data indicated unexpected weakness in manufacturing and exports.

Data released on Thursday showed that German exports fell 5.8% in August, and this followed weak industrial output figures on Tuesday.

Earlier in the week, the International Monetary Fund cut its forecasts for global growth in 2014 and 2015 and warned that global growth may never reach its pre-crisis levels ever again.

The fund revised down its growth forecasts for the euro area’s three largest economies Germany, France and Italy.

Steep declines in commodity-price declines also fuelled fears that the global economy is slowing. Brent crude oil prices fell to their lowest level for nearly four years on Friday.

The dollar weakened after the minutes of the Federal Reserve’s September meeting released Wednesday showed that some officials were concerned over a slowdown in global growth and the impact of the stronger dollar on the U.S. inflation outlook.

"Some participants expressed concern that the persistent shortfall of economic growth and inflation in the euro area could lead to a further appreciation of the dollar and have adverse effects on the U.S. external sector," the minutes said.

The minutes prompted investors to trim back expectations for an earlier-than-expected hike in U.S. interest rates.

On Friday, Fed Vice Chairman Stanley Fischer said weaker-than-expected global growth could prompt it to slow the pace of eventual interest rate hikes.

The US Dollar Index, which tracks the performance of the greenback against a basket of six major currencies, ended the week down 1% at 85.92. The move ended a 12-week rally that saw the index gain more than 8% since early July.

In the week ahead, investors will be awaiting U.S. data on retail sales and industrial production for fresh indications on the strength of the economic recovery. Tuesday’s ZEW report on German economic sentiment will also be closely watched.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Evgeniy Piskachev

Join! ! ! Stablly 15-20% a month! ! !

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/58648

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/58648

: