Juan Carlos Barradas Ramirez / プロファイル

- 情報

|

2 年

経験

|

0

製品

|

0

デモバージョン

|

|

0

ジョブ

|

1

シグナル

|

0

購読者

|

I hold a Bachelor's degree in Actuarial Science; a Master's degree in Quantitative Finance; and I'm a CFA Charterholder. I have professional experience in derivatives trading, and as a portfolio manager of investment funds in global banks.

https://jcarlosbarradasrz1.wixsite.com/jcb-edge-fund

https://jcarlosbarradasrz1.wixsite.com/jcb-edge-fund

Juan Carlos Barradas Ramirez

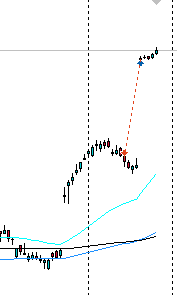

Worst trade for US Equity Trading signal: I short a company that in the next three days a company agreed to buy it... Right in the middle!

Juan Carlos Barradas Ramirez

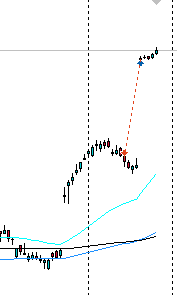

Strong bear movement of the S&P 500. My US Equity Trading signal is successfully following this trend by letting some shorts to continue, stopping some loses in few longs, and realizing some profits.

: