Babak Alamdar / Profilo

- Informazioni

|

1 anno

esperienza

|

8

prodotti

|

842

versioni demo

|

|

0

lavori

|

5

segnali

|

0

iscritti

|

⭐️As a Forex Specialist, I've been around since 2007.

⭐️Besides that, I've been a professional algorithm trader for a long time.

👆My Telegram ID: https://t.me/BabakMt4

🛑 Telegram group: There is a private Telegram group where only users are added.

🔥We have negotiated VIP conditions with the best forex brokers for our clients.

💥For ICMarkets, the commission on "RAW" accounts will be $5.5 instead of $7 (or the equivalent in other currencies): IC Markets link https://www.icmarkets.com/?camp=57072

👀Leverage 1:500 for EU residents with IC Markets trading conditions: IC Trading link https://www.ictrading.com/?camp=77385

💥For FPmarkets, the commission on "RAW" accounts will be $4.5 instead of $6 (or the equivalent in other currencies): FPmarkets link https://www.fpmarkets.com/?fpm-affiliate-utm-source=IB&fpm-affiliate-pcode=15806&fpm-affiliate-agt=15806

💥For Pepperstone: https://track.pepperstonepartners.com/visit/?bta=39122%26nci=5399

⚠️If you already have an existing IC Markets profile, you can connect it to our program. To do this, email IC Markets support (partners@icmarkets.com), requesting to connect your profile to the referral number 57072.

⚠️If you already have an existing IC Trading profile, you can connect it to our program. To do this, email IC Trading support (partners@ictrading.com), requesting to connect your profile to the referral number 77385.

⚠️If you already have an existing FP Markets profile, you can connect it to our program. To do this, email FP Markets support (partners@fpmarkets.com), requesting to connect your profile to the referral number 15806.

⚠️⚠️⚠️Anyone

- using this link: https://www.darwinexzero.com/?fpr=0ifuw%26coupon=GOLDPULSEAI or

- Use the coupon code GOLDPULSEAI when signing up

--> will get a discount on their sign-up

✅VPS--------> For premium quality VPS from "beeksfinancial" (Ultra speed with Fiber optic) with a 50% Discounted package you can apply: https://cp.commercialnetworkservices.net/aff.php?aff=1560

⭐️Besides that, I've been a professional algorithm trader for a long time.

👆My Telegram ID: https://t.me/BabakMt4

🛑 Telegram group: There is a private Telegram group where only users are added.

🔥We have negotiated VIP conditions with the best forex brokers for our clients.

💥For ICMarkets, the commission on "RAW" accounts will be $5.5 instead of $7 (or the equivalent in other currencies): IC Markets link https://www.icmarkets.com/?camp=57072

👀Leverage 1:500 for EU residents with IC Markets trading conditions: IC Trading link https://www.ictrading.com/?camp=77385

💥For FPmarkets, the commission on "RAW" accounts will be $4.5 instead of $6 (or the equivalent in other currencies): FPmarkets link https://www.fpmarkets.com/?fpm-affiliate-utm-source=IB&fpm-affiliate-pcode=15806&fpm-affiliate-agt=15806

💥For Pepperstone: https://track.pepperstonepartners.com/visit/?bta=39122%26nci=5399

⚠️If you already have an existing IC Markets profile, you can connect it to our program. To do this, email IC Markets support (partners@icmarkets.com), requesting to connect your profile to the referral number 57072.

⚠️If you already have an existing IC Trading profile, you can connect it to our program. To do this, email IC Trading support (partners@ictrading.com), requesting to connect your profile to the referral number 77385.

⚠️If you already have an existing FP Markets profile, you can connect it to our program. To do this, email FP Markets support (partners@fpmarkets.com), requesting to connect your profile to the referral number 15806.

⚠️⚠️⚠️Anyone

- using this link: https://www.darwinexzero.com/?fpr=0ifuw%26coupon=GOLDPULSEAI or

- Use the coupon code GOLDPULSEAI when signing up

--> will get a discount on their sign-up

✅VPS--------> For premium quality VPS from "beeksfinancial" (Ultra speed with Fiber optic) with a 50% Discounted package you can apply: https://cp.commercialnetworkservices.net/aff.php?aff=1560

Amici

627

Richieste

In uscita

Babak Alamdar

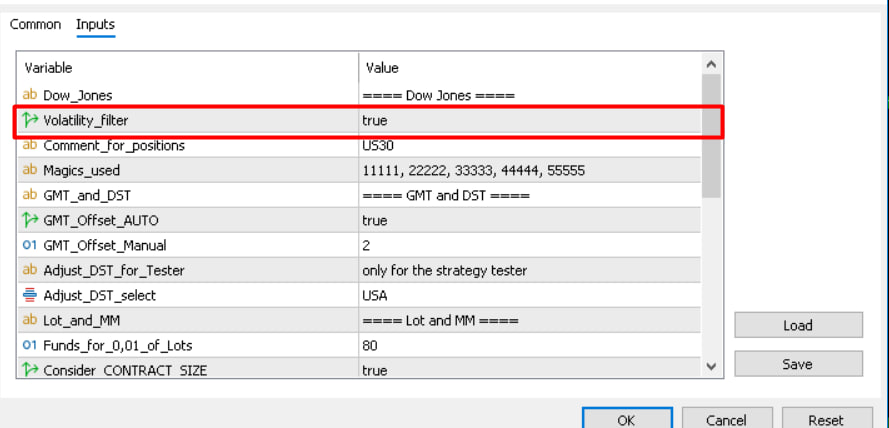

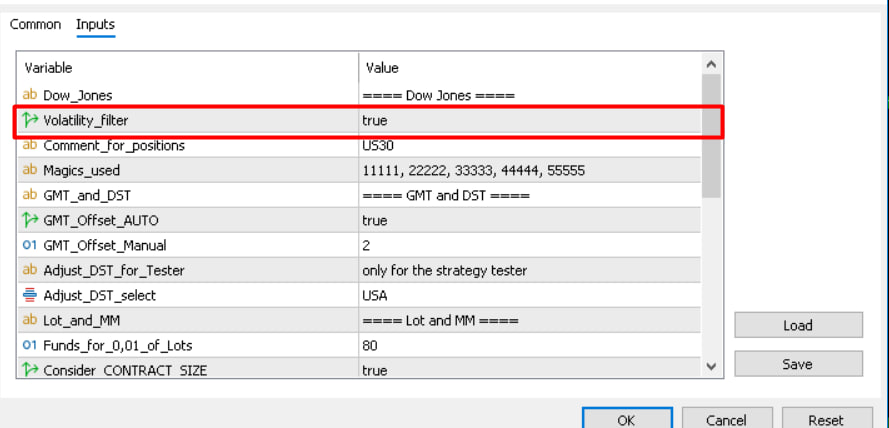

📢 DAX EA — Update Version 1.2 Released

Dear users,

The new version 1.2 of DAX EA is now available.

🆕 What’s new:

A new sector has been added: Intraday_Single_Strategy

When this strategy is enabled, all other strategies are inactive by default

This offers a safer and more stable configuration during the current market conditions

⚙️ How to update:

Remove the EA from the chart

Update to version 1.2

Attach the EA again

In the inputs, change the value of the first strategy from False → True (as shown in the screenshot)

📄 More details:

Full explanation is available in the EA’s comment notes.

Thank you for your support — and good luck with the new setup!

Dear users,

The new version 1.2 of DAX EA is now available.

🆕 What’s new:

A new sector has been added: Intraday_Single_Strategy

When this strategy is enabled, all other strategies are inactive by default

This offers a safer and more stable configuration during the current market conditions

⚙️ How to update:

Remove the EA from the chart

Update to version 1.2

Attach the EA again

In the inputs, change the value of the first strategy from False → True (as shown in the screenshot)

📄 More details:

Full explanation is available in the EA’s comment notes.

Thank you for your support — and good luck with the new setup!

Babak Alamdar

📢 GoldMind EA — Update 1.93 Released

Dear users,

The new version 1.93 of GoldMind is now available.

🛠️ What’s new in this update:

Strategy logic has been improved

Better filtering during unstable market conditions

Internal components optimized for smoother performance

💡 Important:

For a clean update, it is recommended to remove the EA from your chart and attach it again after updating to version 1.93.

No other settings need to be changed.

Thank you for your support, and I wish everyone strong results in the upcoming trading sessions.

Dear users,

The new version 1.93 of GoldMind is now available.

🛠️ What’s new in this update:

Strategy logic has been improved

Better filtering during unstable market conditions

Internal components optimized for smoother performance

💡 Important:

For a clean update, it is recommended to remove the EA from your chart and attach it again after updating to version 1.93.

No other settings need to be changed.

Thank you for your support, and I wish everyone strong results in the upcoming trading sessions.

Babak Alamdar

✨ Important Clarification for All Traders ✨

Recently I’ve been speaking with several full-time traders and I want to share some key insights based on their feedback and my own experience as both a trader and financial advisor.

📌 First of all: every person has a different time horizon, objective, and risk tolerance. What we do with leverage is not like holding assets in spot — it is speculative trading.

⏳ Time horizon for speculative trading is not short-term. On average, it should be seen as 3–5 years, because only within this period the market shows all phases (range, trend, volatility spikes, liquidity traps, etc.).

⚠️ Some traders come with the hope of getting rich overnight, using high-risk setups and risky strategies. I can promise you: all of them will lose. If your horizon doesn’t match the 3–5 years nature of speculative trading, then EA trading is not for you. (And of course I’m not talking about grid/martingale with huge stop losses — there your first loss is your last loss.)

🔍 Many users wrongly evaluate systems after just one month. Example: one of the most reliable and popular Gold EAs on the market launched during a range phase. It was a breakout system, so all early buyers went into heavy drawdown (30%+ even on low risk) during the first 4 months because of false breakouts. Most gave up. But after that period, when the market shifted, new users saw growth and were happy — same EA, different phase.

💡 The key is this:

Speculative trading requires the right time horizon. One month or three months is not enough. It’s about where you start in the market phase and how long you can stay through cycles.

📊 Rough guideline for 5 years:

Conservative (≤20% DD): ~4× growth

Moderate (20–35% DD): ~8× growth

Aggressive (35–60% DD): up to ~100× growth

These are approximate — real results can be higher or lower — but what matters most is not the exact number, it’s the time horizon.

⚖️ One more important reality:

All your successful EAs in your portfolio right now can become your big losers in 6 months, and the losers in your portfolio today can turn into your best winners in 6 months. The market changes phases. If you see systems and strategies designed on naturally strong foundations, the only way to succeed is to set your risk according to your tolerance and stay in the game long enough to survive tough periods.

👉 If you want to succeed in speculative trading with EAs, you must align your expectations with the reality of the market phases.

Recently I’ve been speaking with several full-time traders and I want to share some key insights based on their feedback and my own experience as both a trader and financial advisor.

📌 First of all: every person has a different time horizon, objective, and risk tolerance. What we do with leverage is not like holding assets in spot — it is speculative trading.

⏳ Time horizon for speculative trading is not short-term. On average, it should be seen as 3–5 years, because only within this period the market shows all phases (range, trend, volatility spikes, liquidity traps, etc.).

⚠️ Some traders come with the hope of getting rich overnight, using high-risk setups and risky strategies. I can promise you: all of them will lose. If your horizon doesn’t match the 3–5 years nature of speculative trading, then EA trading is not for you. (And of course I’m not talking about grid/martingale with huge stop losses — there your first loss is your last loss.)

🔍 Many users wrongly evaluate systems after just one month. Example: one of the most reliable and popular Gold EAs on the market launched during a range phase. It was a breakout system, so all early buyers went into heavy drawdown (30%+ even on low risk) during the first 4 months because of false breakouts. Most gave up. But after that period, when the market shifted, new users saw growth and were happy — same EA, different phase.

💡 The key is this:

Speculative trading requires the right time horizon. One month or three months is not enough. It’s about where you start in the market phase and how long you can stay through cycles.

📊 Rough guideline for 5 years:

Conservative (≤20% DD): ~4× growth

Moderate (20–35% DD): ~8× growth

Aggressive (35–60% DD): up to ~100× growth

These are approximate — real results can be higher or lower — but what matters most is not the exact number, it’s the time horizon.

⚖️ One more important reality:

All your successful EAs in your portfolio right now can become your big losers in 6 months, and the losers in your portfolio today can turn into your best winners in 6 months. The market changes phases. If you see systems and strategies designed on naturally strong foundations, the only way to succeed is to set your risk according to your tolerance and stay in the game long enough to survive tough periods.

👉 If you want to succeed in speculative trading with EAs, you must align your expectations with the reality of the market phases.

Babak Alamdar

✨ Finally, Gold support and resistance levels have formed — and today we had successful trades with both GoldMind and GoldPulse ✅

I also want to address a few points that some users have recently raised, since they may be on other traders’ minds too:

📌 About GoldMind & GoldPulse

These are not breakout systems, but long-term strategies built on the ICT manipulation phase.

Sometimes they enter quiet phases — this is normal. If you check the live signal history, you’ll see similar curves in the past that always recovered.

With Volatility Filter = True, both EAs are more selective. You’ll see fewer but higher-quality trades.

If you want more activity (not recommended for GoldPulse), you can run GoldMind on two charts with different magic numbers: one with the filter ON and one OFF, each with half risk.

📌 About US30 & NASDAQ EA

These two EAs have been very solid in the past months, but right now indices are at all-time highs (ATHs). That means limited movement, lower liquidity, and more slippage — especially on ICMarkets. I see this as a temporary phase.

For US100 (NASDAQ EA): On ICMarkets, I recommend turning News Sector = OFF, because server freezes around news time have caused some losses.

For US30 EA: Please use the latest update and keep Volatility Filter = True. This was designed specifically to protect against ICMarkets’ slippage.

📌 About DAX EA

DAX has also been affected by the ATH environment. The last two months were very different from earlier this year. But once volatility returns, DAX recovers quickly.

📌 My Own Trading Approach

I’m also a full-time trader and I use all my EAs for my own investments.

I don’t judge results month by month. The market often moves in 2–3 month phases. If after 3–6 months I see something that needs improvement, I make the adjustments.

Compared to other index EAs on the market, I can confidently say mine have been performing much better overall. The main difficulties came from ICMarkets’ conditions, and with the latest updates, these issues should now be resolved.

✅ Bottom line: All of these EAs are designed for long-term stability, not for chasing short-term monthly noise. Stick to the process, and you’ll see why they are built differently than the flashy “one-month wonders.”

I also want to address a few points that some users have recently raised, since they may be on other traders’ minds too:

📌 About GoldMind & GoldPulse

These are not breakout systems, but long-term strategies built on the ICT manipulation phase.

Sometimes they enter quiet phases — this is normal. If you check the live signal history, you’ll see similar curves in the past that always recovered.

With Volatility Filter = True, both EAs are more selective. You’ll see fewer but higher-quality trades.

If you want more activity (not recommended for GoldPulse), you can run GoldMind on two charts with different magic numbers: one with the filter ON and one OFF, each with half risk.

📌 About US30 & NASDAQ EA

These two EAs have been very solid in the past months, but right now indices are at all-time highs (ATHs). That means limited movement, lower liquidity, and more slippage — especially on ICMarkets. I see this as a temporary phase.

For US100 (NASDAQ EA): On ICMarkets, I recommend turning News Sector = OFF, because server freezes around news time have caused some losses.

For US30 EA: Please use the latest update and keep Volatility Filter = True. This was designed specifically to protect against ICMarkets’ slippage.

📌 About DAX EA

DAX has also been affected by the ATH environment. The last two months were very different from earlier this year. But once volatility returns, DAX recovers quickly.

📌 My Own Trading Approach

I’m also a full-time trader and I use all my EAs for my own investments.

I don’t judge results month by month. The market often moves in 2–3 month phases. If after 3–6 months I see something that needs improvement, I make the adjustments.

Compared to other index EAs on the market, I can confidently say mine have been performing much better overall. The main difficulties came from ICMarkets’ conditions, and with the latest updates, these issues should now be resolved.

✅ Bottom line: All of these EAs are designed for long-term stability, not for chasing short-term monthly noise. Stick to the process, and you’ll see why they are built differently than the flashy “one-month wonders.”

Babak Alamdar

❓ FAQ: Why did GoldPulse or GoldMind (with Volatility Filter = True) only take 1–2 trades recently? Is this normal?

✅ Yes, this is completely normal.

GoldPulse and GoldMind are not breakout systems. They are long-term Gold strategies built on the ICT manipulation phase.

When Gold breaks to a new level, there’s often “open air” without strong support or resistance. It takes time before new levels form. With Volatility Filter = True, both EAs become much more selective and only open trades when conditions are optimal.

These systems are designed with short stop losses, so they naturally filter out weak setups. By contrast, Gold EAs that trade constantly at every price level usually:

Use large stop losses (commonly $30–$70 per 0.01 lot XAUUSD), or

Rely on martingale/grid strategies.

📌 Extra Tip: If you set Volatility Filter = False, you will get more trades. This is not recommended for GoldPulse, but for GoldMind you can run it on two charts with different magic numbers — one with the filter ON, one with the filter OFF, each at half risk. This way you balance stability with more activity.

✅ Yes, this is completely normal.

GoldPulse and GoldMind are not breakout systems. They are long-term Gold strategies built on the ICT manipulation phase.

When Gold breaks to a new level, there’s often “open air” without strong support or resistance. It takes time before new levels form. With Volatility Filter = True, both EAs become much more selective and only open trades when conditions are optimal.

These systems are designed with short stop losses, so they naturally filter out weak setups. By contrast, Gold EAs that trade constantly at every price level usually:

Use large stop losses (commonly $30–$70 per 0.01 lot XAUUSD), or

Rely on martingale/grid strategies.

📌 Extra Tip: If you set Volatility Filter = False, you will get more trades. This is not recommended for GoldPulse, but for GoldMind you can run it on two charts with different magic numbers — one with the filter ON, one with the filter OFF, each at half risk. This way you balance stability with more activity.

Babak Alamdar

🚀 The market is full of “colorful” new robots 🤖 with fresh signals — often less than 3 months old (sometimes just 1 month). They get heavily pumped 📈 and attract everyone’s attention 👀.

⚖️ Most people compare them with older products and signals, see that the older ones haven’t performed well recently, and get drawn to the new ones ✨.

⚠️ But keep in mind: in the short term (under 3 months) every market can follow very specific monthly patterns 📊. These flashy robots with 1-month signals are just catching that short-term move. You may enjoy them now 😎, but next month the same account could be blown 💥.

✅ Robots with more than 3 months of live signal are already proving themselves in today’s tough market conditions — especially on indices 📉📊.

❌ Those that only show backtests or an over-fitted 1-month signal don’t stand a chance in the long run ⏳.

🎭 It’s like I see the market is ranging now, so I quickly release a reversal range bot 🔄 — sure, it works this month. But stretch the horizon beyond 3 months, and that same strategy may fail completely ❌.

⚖️ Most people compare them with older products and signals, see that the older ones haven’t performed well recently, and get drawn to the new ones ✨.

⚠️ But keep in mind: in the short term (under 3 months) every market can follow very specific monthly patterns 📊. These flashy robots with 1-month signals are just catching that short-term move. You may enjoy them now 😎, but next month the same account could be blown 💥.

✅ Robots with more than 3 months of live signal are already proving themselves in today’s tough market conditions — especially on indices 📉📊.

❌ Those that only show backtests or an over-fitted 1-month signal don’t stand a chance in the long run ⏳.

🎭 It’s like I see the market is ranging now, so I quickly release a reversal range bot 🔄 — sure, it works this month. But stretch the horizon beyond 3 months, and that same strategy may fail completely ❌.

Babak Alamdar

💡 About Pricing and Promotions

Sometimes I see users ask: “Why not launch at $99? I’ve seen other sellers do it.”

Here are some important points:

1️⃣ In all my years of trading, I have never seen a seller with a live signal (3+ months of stable results) launch at $99.

Promotions at $99 are almost always for EAs based only on backtests, with no real trading history.

In that case, buyers are essentially beta testers. Sellers adjust the EA later based on feedback, while users take the real risk.

2️⃣ When an EA is launched with a proven live signal, the value is very different. You are not buying a “test bot” — you are buying a ready-to-trade, stable system with:

Multi-currency support

Multi-strategy integration (many sellers charge separately for each system, but here you get it all-in-one)

Time, energy, and years of development work behind it

3️⃣ About the price itself:

MQL5 takes 20% commission on every sale.

I personally pay around 40% tax on income.

➡️ So, even if I launch at $249, after costs and deductions, the amount left is far lower.

Selling such a system at $99 with live results would not even cover the development costs, let alone make sense for long-term support and updates.

⚖️ Fair Value:

A launch price of $249+ for a tested, live-verified EA is not expensive — it is fair and sustainable. It ensures quality, continuous updates, and long-term commitment.

👉 Remember: a cheap price may feel attractive at first, but in trading tools, cheap almost always means you become the tester.

Sometimes I see users ask: “Why not launch at $99? I’ve seen other sellers do it.”

Here are some important points:

1️⃣ In all my years of trading, I have never seen a seller with a live signal (3+ months of stable results) launch at $99.

Promotions at $99 are almost always for EAs based only on backtests, with no real trading history.

In that case, buyers are essentially beta testers. Sellers adjust the EA later based on feedback, while users take the real risk.

2️⃣ When an EA is launched with a proven live signal, the value is very different. You are not buying a “test bot” — you are buying a ready-to-trade, stable system with:

Multi-currency support

Multi-strategy integration (many sellers charge separately for each system, but here you get it all-in-one)

Time, energy, and years of development work behind it

3️⃣ About the price itself:

MQL5 takes 20% commission on every sale.

I personally pay around 40% tax on income.

➡️ So, even if I launch at $249, after costs and deductions, the amount left is far lower.

Selling such a system at $99 with live results would not even cover the development costs, let alone make sense for long-term support and updates.

⚖️ Fair Value:

A launch price of $249+ for a tested, live-verified EA is not expensive — it is fair and sustainable. It ensures quality, continuous updates, and long-term commitment.

👉 Remember: a cheap price may feel attractive at first, but in trading tools, cheap almost always means you become the tester.

Babak Alamdar

📌 Choosing the Right Broker for Scalping

For scalping strategies (like DAX EA), broker quality is critical. Scalping requires:

Low spreads

Low slippage

Fast ECN execution

🔹 Top brokers for scalping

ICMarkets, IC Trading, FPMarkets, Fusion Markets – reliable for scalping systems.

🔹 Average brokers

Tickmill (and recently ICMarkets & IC Trading since summer, due to server freezes and negative slippage that affect profits).

🔹 Bad brokers for scalping

FBS, Pepperstone, and others in the same category.

⚠️ Reminder:

We are not committed to using grade B or bad brokers when results are unstable. The best practice is to run a realtick backtest directly on the broker’s platform while connected to your live account.

If the backtest with real ticks is not profitable, then live trading will definitely be worse (due to execution delays, server freezes, and negative slippage).

❗ Still, some users insist on using under-average or bad brokers for scalping and expect stable results. It doesn’t work that way.

👉 The solution is simple: switch to a better broker that provides stable conditions.

✅ Note: Based on my tests, since this summer, FPMarkets and Fusion Markets have been performing better than other brokers.

For scalping strategies (like DAX EA), broker quality is critical. Scalping requires:

Low spreads

Low slippage

Fast ECN execution

🔹 Top brokers for scalping

ICMarkets, IC Trading, FPMarkets, Fusion Markets – reliable for scalping systems.

🔹 Average brokers

Tickmill (and recently ICMarkets & IC Trading since summer, due to server freezes and negative slippage that affect profits).

🔹 Bad brokers for scalping

FBS, Pepperstone, and others in the same category.

⚠️ Reminder:

We are not committed to using grade B or bad brokers when results are unstable. The best practice is to run a realtick backtest directly on the broker’s platform while connected to your live account.

If the backtest with real ticks is not profitable, then live trading will definitely be worse (due to execution delays, server freezes, and negative slippage).

❗ Still, some users insist on using under-average or bad brokers for scalping and expect stable results. It doesn’t work that way.

👉 The solution is simple: switch to a better broker that provides stable conditions.

✅ Note: Based on my tests, since this summer, FPMarkets and Fusion Markets have been performing better than other brokers.

Babak Alamdar

📢 Many of you asked about the difference between GoldPulse and the new GoldiFire. Here’s a clear comparison:

GoldPulse EA

Scalping strategies

3 pairs (XAUUSD, XAUEUR, XAUGBP) active during the day, others mainly at night

Avoids “killing zones” (first hours of EU/UK and US sessions)

Focused on shorter trades, lower frequency outside XAUUSD

GoldiFire EA

The most advanced gold system I’ve built

Trades all gold pairs intraday, across all sessions

No restrictions in “killing zones”

Strategies are intraday (not scalping)

Adjustable Trading Frequency 0–100 (0 = highest accuracy, 100 = very active)

Supports both Grid and Stop-loss trading

In Stop-loss mode, SL is dynamic by % risk, with full customization (or you can use my VIP set files)

👉 In short: GoldPulse = scalping, limited pairs/sessions. GoldiFire = full intraday system, all pairs, more power and flexibility.

GoldPulse EA

Scalping strategies

3 pairs (XAUUSD, XAUEUR, XAUGBP) active during the day, others mainly at night

Avoids “killing zones” (first hours of EU/UK and US sessions)

Focused on shorter trades, lower frequency outside XAUUSD

GoldiFire EA

The most advanced gold system I’ve built

Trades all gold pairs intraday, across all sessions

No restrictions in “killing zones”

Strategies are intraday (not scalping)

Adjustable Trading Frequency 0–100 (0 = highest accuracy, 100 = very active)

Supports both Grid and Stop-loss trading

In Stop-loss mode, SL is dynamic by % risk, with full customization (or you can use my VIP set files)

👉 In short: GoldPulse = scalping, limited pairs/sessions. GoldiFire = full intraday system, all pairs, more power and flexibility.

Babak Alamdar

🔥 GoldiFire EA – The Most Powerful Gold Trading System

After 18 years of trading experience, I created GoldiFire – the most powerful gold trading system I have ever developed.

✨ For the first time, an EA can trade all gold pairs intraday with specialized strategies for each pair, including:

🔸 XAUUSD

🔸 XAUEUR

🔸 XAUGBP

🔸 XAUCHF

🔸 XAUAUD

🔸 XAUSGD

🔸 XAUJPY

🔸 XAUCNH

💡 The advantage of trading all gold pairs is that currencies do not move in the same way against gold. Their correlation can be positive or negative depending on market conditions. By trading all pairs together, GoldiFire diversifies exposure, maximizes profit opportunities, and reduces the risk of relying on just a single pair.

⚡ Why Choose GoldiFire?

✅ 8 EAs in 1: Each gold pair runs its own dedicated strategy, tailored to its unique behavior against gold.

✅ Adjustable Trading Frequency: Flexible setting from 0 to 100, allowing both conservative and high-frequency trading styles.

✅ Smart Market Timing: Based on ICT principles, including the Manipulation Phase, where market makers and banks grab liquidity from retail traders before the true move begins.

✅ Live-Proven Results: Verified signal with more than 100% profit in 4 months while maintaining low drawdown.

✅ Prop Firm Ready: Risk controls and trading logic designed for both personal investment accounts and prop firm rules.

After 18 years of trading experience, I created GoldiFire – the most powerful gold trading system I have ever developed.

✨ For the first time, an EA can trade all gold pairs intraday with specialized strategies for each pair, including:

🔸 XAUUSD

🔸 XAUEUR

🔸 XAUGBP

🔸 XAUCHF

🔸 XAUAUD

🔸 XAUSGD

🔸 XAUJPY

🔸 XAUCNH

💡 The advantage of trading all gold pairs is that currencies do not move in the same way against gold. Their correlation can be positive or negative depending on market conditions. By trading all pairs together, GoldiFire diversifies exposure, maximizes profit opportunities, and reduces the risk of relying on just a single pair.

⚡ Why Choose GoldiFire?

✅ 8 EAs in 1: Each gold pair runs its own dedicated strategy, tailored to its unique behavior against gold.

✅ Adjustable Trading Frequency: Flexible setting from 0 to 100, allowing both conservative and high-frequency trading styles.

✅ Smart Market Timing: Based on ICT principles, including the Manipulation Phase, where market makers and banks grab liquidity from retail traders before the true move begins.

✅ Live-Proven Results: Verified signal with more than 100% profit in 4 months while maintaining low drawdown.

✅ Prop Firm Ready: Risk controls and trading logic designed for both personal investment accounts and prop firm rules.

Babak Alamdar

📢 Update 1.51 Released – US30 Dow Jones EA

We’ve added a brand-new Volatility Filter to improve trade accuracy.

✅ When enabled, the EA will filter trades based on volatility for higher precision.

✅ When disabled, the EA will behave exactly like the previous version.

🔄 This means you can now run two versions in parallel on separate charts within the same terminal — giving you more flexibility and strategy options.

Upgrade today and take advantage of the enhanced accuracy!

🔗 US30 Dow Jones EA: https://www.mql5.com/en/market/product/126120

🔗 Seller products: https://www.mql5.com/en/users/babakalamdar/seller

🔗 Public Chat: https://www.mql5.com/en/messages/0265500debafdb01

🔗 Public Channel: https://www.mql5.com/en/channels/commodities

We’ve added a brand-new Volatility Filter to improve trade accuracy.

✅ When enabled, the EA will filter trades based on volatility for higher precision.

✅ When disabled, the EA will behave exactly like the previous version.

🔄 This means you can now run two versions in parallel on separate charts within the same terminal — giving you more flexibility and strategy options.

Upgrade today and take advantage of the enhanced accuracy!

🔗 US30 Dow Jones EA: https://www.mql5.com/en/market/product/126120

🔗 Seller products: https://www.mql5.com/en/users/babakalamdar/seller

🔗 Public Chat: https://www.mql5.com/en/messages/0265500debafdb01

🔗 Public Channel: https://www.mql5.com/en/channels/commodities

Babak Alamdar

DAX EA, Latest trades. running default. ( Fast closing = False)

As I mentioned before, when the market comes out of the Tiny range, then profits will be much bigger

🔗 Seller products: https://www.mql5.com/en/users/babakalamdar/seller

🔗 Public Chat: https://www.mql5.com/en/messages/0265500debafdb01

🔗 Public Channel: https://www.mql5.com/en/channels/commodities

As I mentioned before, when the market comes out of the Tiny range, then profits will be much bigger

🔗 Seller products: https://www.mql5.com/en/users/babakalamdar/seller

🔗 Public Chat: https://www.mql5.com/en/messages/0265500debafdb01

🔗 Public Channel: https://www.mql5.com/en/channels/commodities

Babak Alamdar

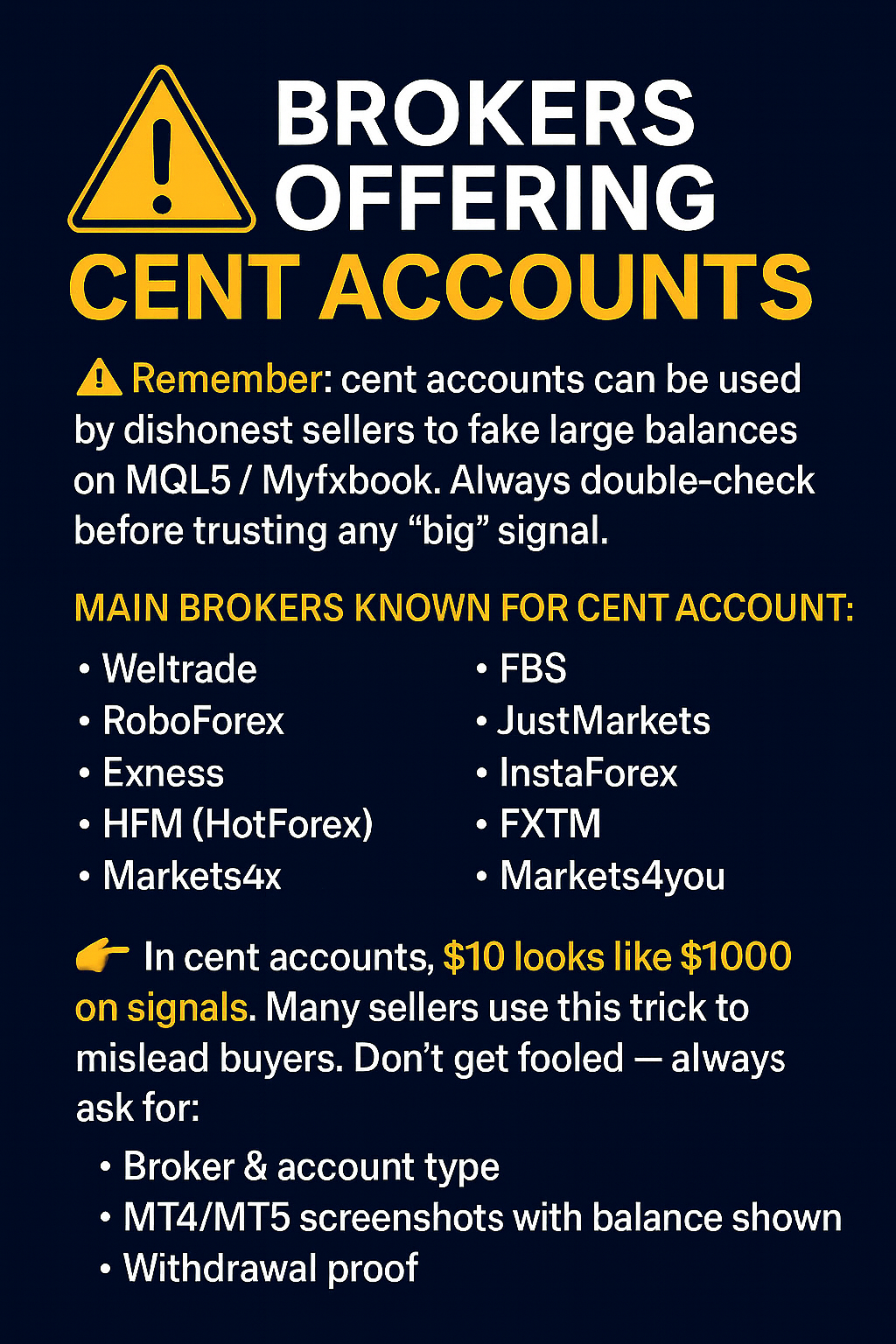

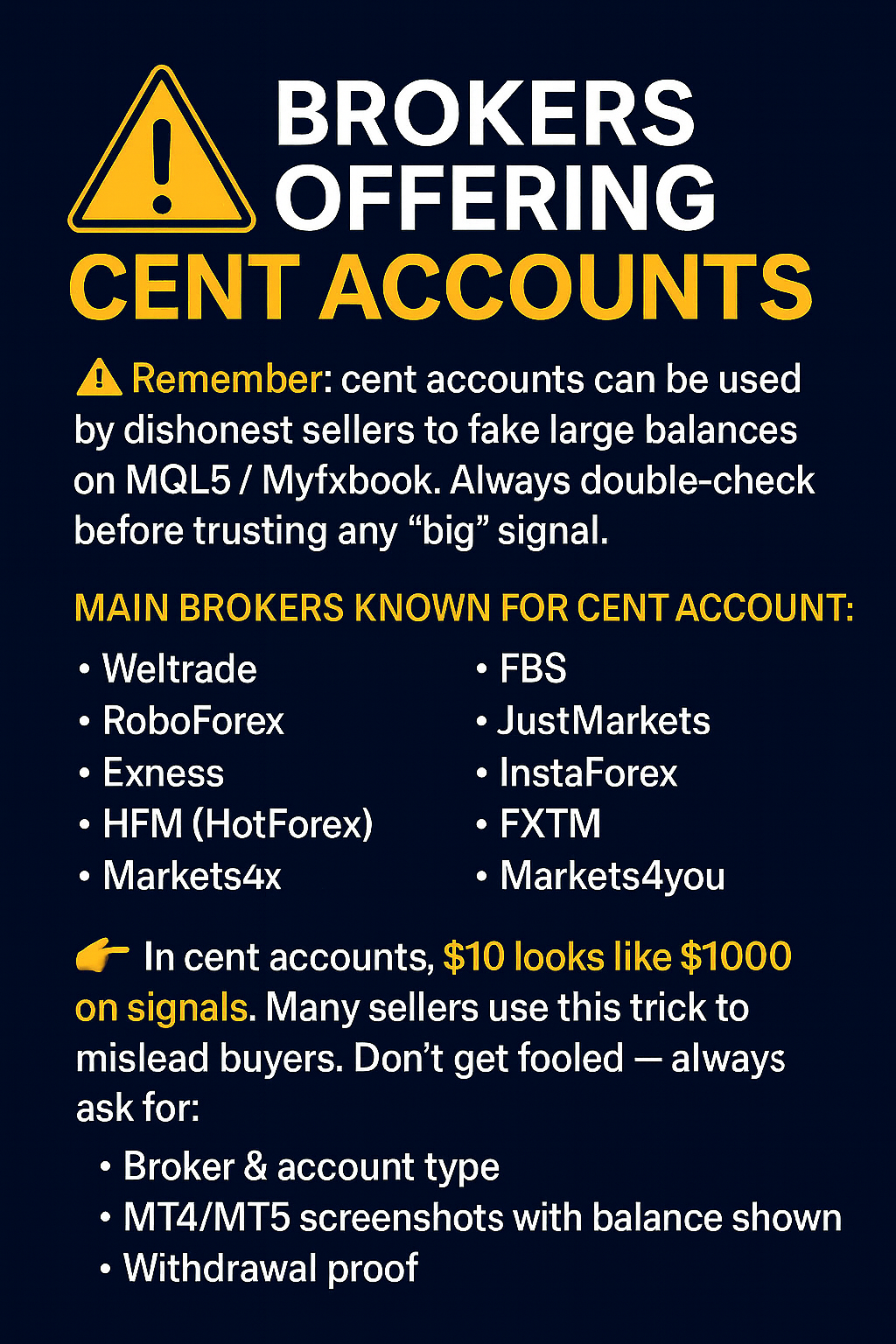

🛑 The Cent-Account Trick: what every MQL5 buyer must know

What is a cent account?

A cent account is a broker account where the broker’s platform tracks funds in cents (or a 100× smaller currency unit). For example, putting $10 into a cent account can display as 1000 units on some reporting tools if those tools treat the account units as dollars. When a viewing platform (or a seller) orients the display incorrectly, small real balances can appear to be large live accounts.

In practice, that means:

You deposit $10 → broker shows 1000 (because they are showing cents) → some third-party pages show that 1000 as “$1,000”.

The account looks like $1k, $10k, or more, while it’s actually pennies.

Why dishonest sellers use cent accounts (two main reasons)

To impress buyers.

A tiny deposit looks like a large live account. Buyers see a “$10,000 signal” and assume the seller runs large capital and has confidence in the EA.

To manipulate performance/backtests.

Sellers can:

Open many Cent accounts with $5–$50 each,

Execute trades with exaggerated lot sizes relative to the displayed balance to pump returns,

Let many of those small accounts blow up, cherry-pick the lucky account, and then attach the “lucky” one to their EA page or backtest as a success story.

These tactics are especially common with high-risk strategies (huge SLs, grids, martingale) and with lesser-known/unregulated brokers that offer easy cent accounts.

📌 Brokers Offering Cent Accounts

⚠️ Remember: cent accounts can be used by dishonest sellers to fake large balances on MQL5 / Myfxbook. Always double-check before trusting any “big” signal.

Main brokers known for cent accounts:

Weltrade

RoboForex

Exness

HFM (HotForex)

FBS

JustMarkets

InstaForex

FXTM

Markets4you

👉 In cent accounts, $10 looks like $1000 on signals. Many sellers use this trick to mislead buyers. Don’t get fooled — always ask for:

Broker & account type

MT4/MT5 screenshots with balance shown

Withdrawal proof

What is a cent account?

A cent account is a broker account where the broker’s platform tracks funds in cents (or a 100× smaller currency unit). For example, putting $10 into a cent account can display as 1000 units on some reporting tools if those tools treat the account units as dollars. When a viewing platform (or a seller) orients the display incorrectly, small real balances can appear to be large live accounts.

In practice, that means:

You deposit $10 → broker shows 1000 (because they are showing cents) → some third-party pages show that 1000 as “$1,000”.

The account looks like $1k, $10k, or more, while it’s actually pennies.

Why dishonest sellers use cent accounts (two main reasons)

To impress buyers.

A tiny deposit looks like a large live account. Buyers see a “$10,000 signal” and assume the seller runs large capital and has confidence in the EA.

To manipulate performance/backtests.

Sellers can:

Open many Cent accounts with $5–$50 each,

Execute trades with exaggerated lot sizes relative to the displayed balance to pump returns,

Let many of those small accounts blow up, cherry-pick the lucky account, and then attach the “lucky” one to their EA page or backtest as a success story.

These tactics are especially common with high-risk strategies (huge SLs, grids, martingale) and with lesser-known/unregulated brokers that offer easy cent accounts.

📌 Brokers Offering Cent Accounts

⚠️ Remember: cent accounts can be used by dishonest sellers to fake large balances on MQL5 / Myfxbook. Always double-check before trusting any “big” signal.

Main brokers known for cent accounts:

Weltrade

RoboForex

Exness

HFM (HotForex)

FBS

JustMarkets

InstaForex

FXTM

Markets4you

👉 In cent accounts, $10 looks like $1000 on signals. Many sellers use this trick to mislead buyers. Don’t get fooled — always ask for:

Broker & account type

MT4/MT5 screenshots with balance shown

Withdrawal proof

Babak Alamdar

Why Long-Term Traders Are Rare

In my years of trading, I’ve seen that only a very small number of traders — less than 5% — manage to stay in the market long term. Why? Because most people enter with the wrong expectations. They hear stories of quick riches, and they come in hoping to get wealthy overnight, without truly understanding the risk.

But let’s be clear: trading with leverage is speculative by nature. It carries one of the highest levels of risk across all investment types.

When you walk into a bank for investment, they don’t simply throw you into the stock market. They sit you down and ask about:

Your objective

Your risk tolerance

Your time horizon

For example, if you’re 18 years old, saving to buy your first home in one year, and that money is all you have — no responsible advisor would ever suggest stocks or indices. They would guide you toward deposits or bonds. Even bank treasury managers, with access to vast resources, consider 10–15% annual profit with less than 20% drawdown a huge success. And yes — even they lose money sometimes.

My Index EAs: Built for Reality, Not Illusion

My US100, US30, and DAX EAs are based on breakout logic, but not the simple “support and resistance touch” you see in basic systems. Those may work in theory, but in practice they get destroyed during sideways accumulation phases or by market maker manipulation in low liquidity times.

My EAs use filters to detect true momentum — strong, fast moves during the killing zones when institutional orders flow into the market. The systems don’t just trigger because a level was touched. There must be real, powerful price movement.

Of course, no system avoids losses entirely. During accumulation phases, there will be drawdowns — that’s the cost of being in the game until the breakout arrives. The key is to minimize risk so you can survive long enough to capture the winners.

When I say “long term,” I mean at least 5 years of consistent performance — not a few weeks of pumped signals. That’s why most signals disappear; they chase quick gains, or they rely on risky grid/martingale logic. Those don’t lose often, but when they do, the entire deposit is gone.

For Impatient Users

I share this because sometimes impatient users call a system a “scam” after a period of drawdown. But any trader, even a beginner, can tell the difference between a random EA and a system with real strategies behind it.

The truth is, index markets have changed dramatically in the past 6 years. Values have multiplied, and the structure has shifted. Fixed stop loss, fixed TP, fixed parameters — these systems eventually fail because they don’t adapt. My work has always focused on building EAs that adjust to the new reality of the market.

✅ Trading is not about fast money. It’s about survival, risk control, and consistency. If you can stay in the game long enough, the winners will come.

In my years of trading, I’ve seen that only a very small number of traders — less than 5% — manage to stay in the market long term. Why? Because most people enter with the wrong expectations. They hear stories of quick riches, and they come in hoping to get wealthy overnight, without truly understanding the risk.

But let’s be clear: trading with leverage is speculative by nature. It carries one of the highest levels of risk across all investment types.

When you walk into a bank for investment, they don’t simply throw you into the stock market. They sit you down and ask about:

Your objective

Your risk tolerance

Your time horizon

For example, if you’re 18 years old, saving to buy your first home in one year, and that money is all you have — no responsible advisor would ever suggest stocks or indices. They would guide you toward deposits or bonds. Even bank treasury managers, with access to vast resources, consider 10–15% annual profit with less than 20% drawdown a huge success. And yes — even they lose money sometimes.

My Index EAs: Built for Reality, Not Illusion

My US100, US30, and DAX EAs are based on breakout logic, but not the simple “support and resistance touch” you see in basic systems. Those may work in theory, but in practice they get destroyed during sideways accumulation phases or by market maker manipulation in low liquidity times.

My EAs use filters to detect true momentum — strong, fast moves during the killing zones when institutional orders flow into the market. The systems don’t just trigger because a level was touched. There must be real, powerful price movement.

Of course, no system avoids losses entirely. During accumulation phases, there will be drawdowns — that’s the cost of being in the game until the breakout arrives. The key is to minimize risk so you can survive long enough to capture the winners.

When I say “long term,” I mean at least 5 years of consistent performance — not a few weeks of pumped signals. That’s why most signals disappear; they chase quick gains, or they rely on risky grid/martingale logic. Those don’t lose often, but when they do, the entire deposit is gone.

For Impatient Users

I share this because sometimes impatient users call a system a “scam” after a period of drawdown. But any trader, even a beginner, can tell the difference between a random EA and a system with real strategies behind it.

The truth is, index markets have changed dramatically in the past 6 years. Values have multiplied, and the structure has shifted. Fixed stop loss, fixed TP, fixed parameters — these systems eventually fail because they don’t adapt. My work has always focused on building EAs that adjust to the new reality of the market.

✅ Trading is not about fast money. It’s about survival, risk control, and consistency. If you can stay in the game long enough, the winners will come.

Babak Alamdar

🔥 ONLY 2 COPIES LEFT – $499

Then the price jumps to $799 — Final Price: $999

⛔️ No grid

⛔️ No martingale

✅ Tight SL, real institutional logic

✅ Designed for high-performance, low-risk DAX trading

🔹 Proven strategies

🔹 Real trades

🔹 Real signals

🎯 Final Price: $999

🚀 NEW: Buy Now and Get 2 Expert Advisors FREE

👉 Secure your copy now or pay $300 more tomorrow.

🔗 DAX EA: https://www.mql5.com/en/market/product/129289

🔗 Public Chat: https://www.mql5.com/en/messages/0265500debafdb01

🔗 Public Channel: https://www.mql5.com/en/channels/commodities

🔗 3rd Party Review: https://www.youtube.com/watch?v=ivAXGrkndp4

If you’re ready to break free from outdated bots and get back in sync with the market, now’s your chance! ⏳

Then the price jumps to $799 — Final Price: $999

⛔️ No grid

⛔️ No martingale

✅ Tight SL, real institutional logic

✅ Designed for high-performance, low-risk DAX trading

🔹 Proven strategies

🔹 Real trades

🔹 Real signals

🎯 Final Price: $999

🚀 NEW: Buy Now and Get 2 Expert Advisors FREE

👉 Secure your copy now or pay $300 more tomorrow.

🔗 DAX EA: https://www.mql5.com/en/market/product/129289

🔗 Public Chat: https://www.mql5.com/en/messages/0265500debafdb01

🔗 Public Channel: https://www.mql5.com/en/channels/commodities

🔗 3rd Party Review: https://www.youtube.com/watch?v=ivAXGrkndp4

If you’re ready to break free from outdated bots and get back in sync with the market, now’s your chance! ⏳

Babak Alamdar

🔥 ONLY 2 COPIES LEFT – $499

Then the price jumps to $799 — Final Price: $999

⛔️ No grid

⛔️ No martingale

✅ Tight SL, real institutional logic

✅ Designed for high-performance, low-risk DAX trading

🔹 Proven strategies

🔹 Real trades

🔹 Real signals

🎯 Final Price: $999

🚀 NEW: Buy Now and Get 2 Expert Advisors FREE

👉 Secure your copy now or pay $300 more tomorrow.

🔗 DAX EA: https://www.mql5.com/en/market/product/129289

🔗 Public Chat: https://www.mql5.com/en/messages/0265500debafdb01

🔗 Public Channel: https://www.mql5.com/en/channels/commodities

🔗 3rd Party Review: https://www.youtube.com/watch?v=ivAXGrkndp4

If you’re ready to break free from outdated bots and get back in sync with the market, now’s your chance! ⏳

Then the price jumps to $799 — Final Price: $999

⛔️ No grid

⛔️ No martingale

✅ Tight SL, real institutional logic

✅ Designed for high-performance, low-risk DAX trading

🔹 Proven strategies

🔹 Real trades

🔹 Real signals

🎯 Final Price: $999

🚀 NEW: Buy Now and Get 2 Expert Advisors FREE

👉 Secure your copy now or pay $300 more tomorrow.

🔗 DAX EA: https://www.mql5.com/en/market/product/129289

🔗 Public Chat: https://www.mql5.com/en/messages/0265500debafdb01

🔗 Public Channel: https://www.mql5.com/en/channels/commodities

🔗 3rd Party Review: https://www.youtube.com/watch?v=ivAXGrkndp4

If you’re ready to break free from outdated bots and get back in sync with the market, now’s your chance! ⏳

Babak Alamdar

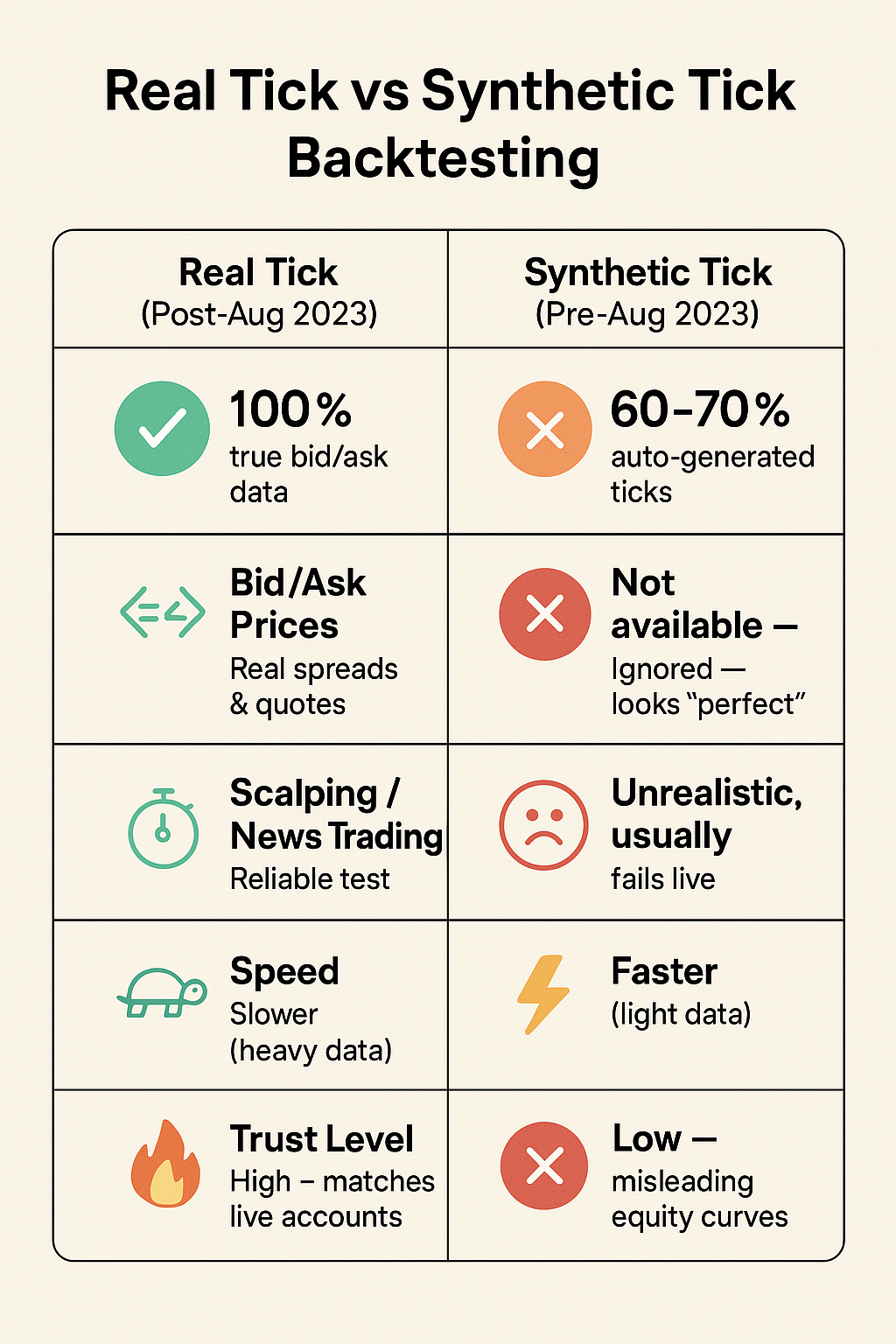

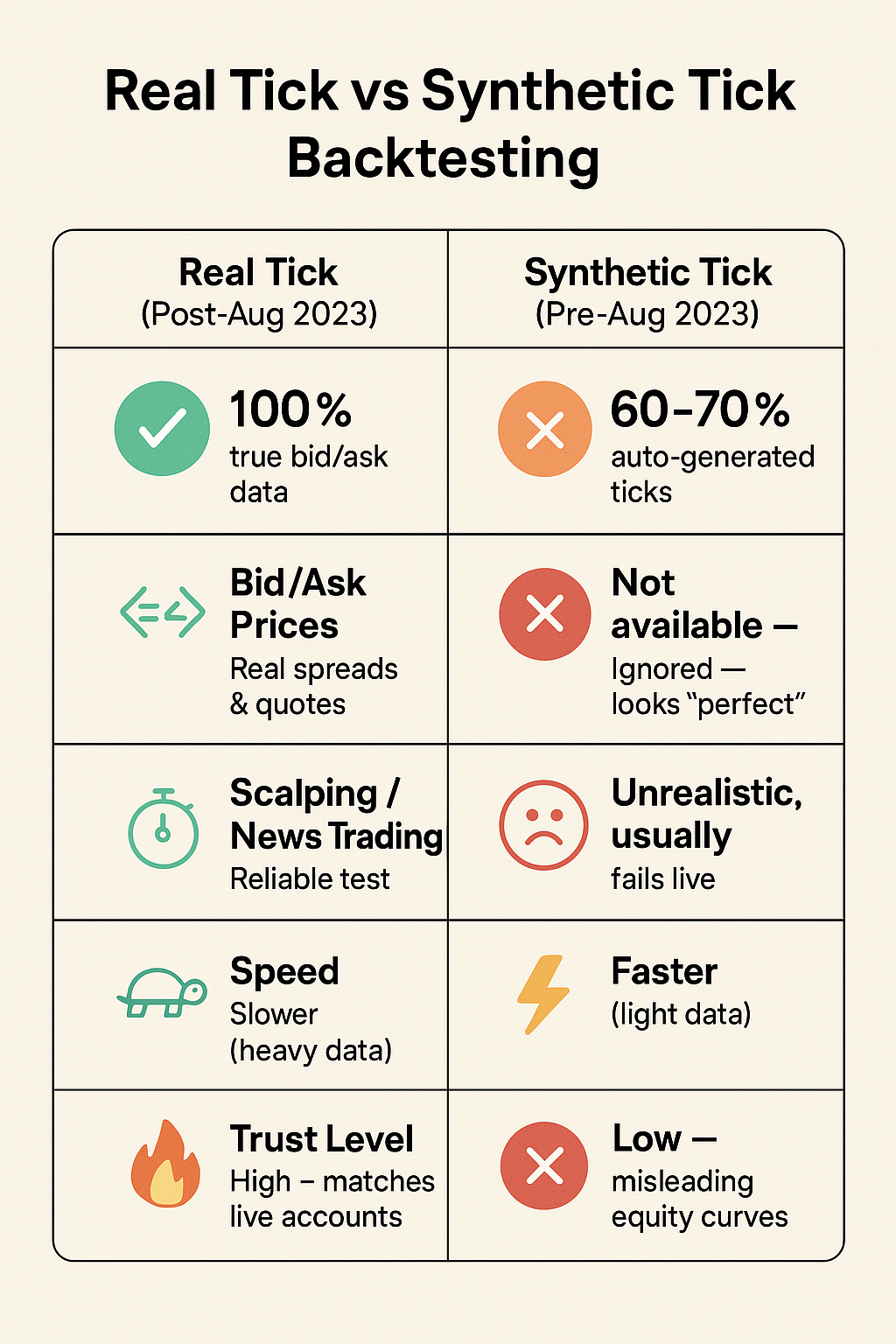

✅ Why Real Tick Data is the Only Way to Truly Test an EA

If you want to understand how an EA will actually behave on a real account, there’s only one way: real tick data testing.

Most Expert Advisors look amazing in backtests, showing millions in profit with perfect equity curves. But then they crash and burn in live trading. Why?

👉 Because real tick data was only introduced to MetaTrader terminals after August 2023.

That means only the last 2 years offer truly accurate data with real-time bid and ask prices, spreads, and execution lags — the very things that affect real trades.

Yet many developers still optimize EAs using data before that date — data that doesn't include real tick structure. What’s the result?

❌ Unrealistic slippage

❌ No real spreads

❌ Perfect fills that never happen in reality

And to make it worse, many use 1-minute OHLC data (Open-High-Low-Close). Yes, it’s fast — but it gives a totally misleading view of how an EA will trade live.

🛑 1-min OHLC is not enough for scalping, news trading, or any strategy sensitive to ticks.

✅ Real Tick Data: Slow but Accurate

Sure, real tick backtesting takes longer — but it’s the only valid method to:

Measure true slippage impact

See realistic spreads

Simulate real broker execution

Validate fast-entry strategies like scalping or news logic

If your EA can’t survive in a real tick environment, it won’t survive on a real account.

❓What happens if I backtest with real tick data before August 2023?

If you select real tick mode on data older than August 2023, the terminal has no true tick history to work with.

👉 What actually happens:

The tester internally switches to "Every Tick" simulation (synthetic ticks generated from 1-minute OHLC bars).

Your modeling quality instantly drops — instead of a clean 100% (real tick), you’ll typically see 60–70% quality.

The “real tick” label becomes misleading, because it’s no longer real — it’s just artificially generated ticks.

⚠️ Why this matters

Any slippage-sensitive strategy (scalpers, news bots, breakout systems) will show fake stability in backtests.

Trades may look perfect, but that stability won’t exist in live trading.

You’ll see strategies “printing money” in history — but in reality, they’ll fail as soon as they go live.

✅ Bottom line:

Post-August 2023 → real tick is valid, 100% modeling accuracy.

Pre-August 2023 → tester reverts to synthetic ticks, accuracy drops to ~60–70%, making the results unreliable.

🔗 Seller products: https://www.mql5.com/en/users/babakalamdar/seller

🔗 Public Chat: https://www.mql5.com/en/messages/0265500debafdb01

🔗 Public Channel: https://www.mql5.com/en/channels/commodities

If you want to understand how an EA will actually behave on a real account, there’s only one way: real tick data testing.

Most Expert Advisors look amazing in backtests, showing millions in profit with perfect equity curves. But then they crash and burn in live trading. Why?

👉 Because real tick data was only introduced to MetaTrader terminals after August 2023.

That means only the last 2 years offer truly accurate data with real-time bid and ask prices, spreads, and execution lags — the very things that affect real trades.

Yet many developers still optimize EAs using data before that date — data that doesn't include real tick structure. What’s the result?

❌ Unrealistic slippage

❌ No real spreads

❌ Perfect fills that never happen in reality

And to make it worse, many use 1-minute OHLC data (Open-High-Low-Close). Yes, it’s fast — but it gives a totally misleading view of how an EA will trade live.

🛑 1-min OHLC is not enough for scalping, news trading, or any strategy sensitive to ticks.

✅ Real Tick Data: Slow but Accurate

Sure, real tick backtesting takes longer — but it’s the only valid method to:

Measure true slippage impact

See realistic spreads

Simulate real broker execution

Validate fast-entry strategies like scalping or news logic

If your EA can’t survive in a real tick environment, it won’t survive on a real account.

❓What happens if I backtest with real tick data before August 2023?

If you select real tick mode on data older than August 2023, the terminal has no true tick history to work with.

👉 What actually happens:

The tester internally switches to "Every Tick" simulation (synthetic ticks generated from 1-minute OHLC bars).

Your modeling quality instantly drops — instead of a clean 100% (real tick), you’ll typically see 60–70% quality.

The “real tick” label becomes misleading, because it’s no longer real — it’s just artificially generated ticks.

⚠️ Why this matters

Any slippage-sensitive strategy (scalpers, news bots, breakout systems) will show fake stability in backtests.

Trades may look perfect, but that stability won’t exist in live trading.

You’ll see strategies “printing money” in history — but in reality, they’ll fail as soon as they go live.

✅ Bottom line:

Post-August 2023 → real tick is valid, 100% modeling accuracy.

Pre-August 2023 → tester reverts to synthetic ticks, accuracy drops to ~60–70%, making the results unreliable.

🔗 Seller products: https://www.mql5.com/en/users/babakalamdar/seller

🔗 Public Chat: https://www.mql5.com/en/messages/0265500debafdb01

🔗 Public Channel: https://www.mql5.com/en/channels/commodities

Babak Alamdar

🚀 Big Announcement: Index Ultimate Release! 🚀

In just 2 weeks, I’ll officially release Index Ultimate — the most powerful index EA I have ever built.

🔥 Key Highlights:

📈 Over 1 year of live track record

💰 More than +120% profit with very low drawdown

📊 Supports US100, US30, and DAX

⚡️ Intraday solution with very active trading

✅ Works perfectly on both personal accounts and prop firms

⛔️ No grid

⛔️ No martingale

✅ Tight SL, real institutional logic

🎉 Special Launch Promo

For the first 24 hours only, members can grab it at a one-time price of just $249 (a few hours only!). After that, the price will increase.

👉 This is your chance to secure the best index solution ever at the lowest cost!

Stay tuned — the countdown has started! ⏳

I remember a time when if someone had a product with such a long-term 📊 stable signal, they would start pricing at a minimum of $2,000 💵!

Building such a solid track record is not something just anyone can do ⭐️.

But unfortunately, the market has become unfair ❌ — flooded with fake products 🤥, manipulated signals 🎭, and misleading backtests 🧪. Out of genuine care ❤️, I really want to change this environment.

My team is still strongly against this pricing ⚔️, but I’m trying to convince them 💪.

🔗 Seller products: https://www.mql5.com/en/users/babakalamdar/seller

🔗 Public Chat: https://www.mql5.com/en/messages/0265500debafdb01

🔗 Public Channel: https://www.mql5.com/en/channels/commodities

In just 2 weeks, I’ll officially release Index Ultimate — the most powerful index EA I have ever built.

🔥 Key Highlights:

📈 Over 1 year of live track record

💰 More than +120% profit with very low drawdown

📊 Supports US100, US30, and DAX

⚡️ Intraday solution with very active trading

✅ Works perfectly on both personal accounts and prop firms

⛔️ No grid

⛔️ No martingale

✅ Tight SL, real institutional logic

🎉 Special Launch Promo

For the first 24 hours only, members can grab it at a one-time price of just $249 (a few hours only!). After that, the price will increase.

👉 This is your chance to secure the best index solution ever at the lowest cost!

Stay tuned — the countdown has started! ⏳

I remember a time when if someone had a product with such a long-term 📊 stable signal, they would start pricing at a minimum of $2,000 💵!

Building such a solid track record is not something just anyone can do ⭐️.

But unfortunately, the market has become unfair ❌ — flooded with fake products 🤥, manipulated signals 🎭, and misleading backtests 🧪. Out of genuine care ❤️, I really want to change this environment.

My team is still strongly against this pricing ⚔️, but I’m trying to convince them 💪.

🔗 Seller products: https://www.mql5.com/en/users/babakalamdar/seller

🔗 Public Chat: https://www.mql5.com/en/messages/0265500debafdb01

🔗 Public Channel: https://www.mql5.com/en/channels/commodities

Babak Alamdar

⚠️ Reminder: Beware of Fake EAs

Some illegal Telegram groups are advertising a fake EA under my name. Please note:

❌ That is NOT my DAX EA – it’s just a useless martingale EA promoted by scammers to fool people.

✅ I only sell my EAs officially on the MQL5 marketplace. Any EA offered elsewhere, even if they misuse my link, is 100% fake.

You can easily check this yourself: run a backtest of the original EA from my official MQL5 page and compare it with the fake one — the difference is obvious.

Stay safe and always double-check before purchasing.

🔗 Seller products: https://www.mql5.com/en/users/babakalamdar/seller

🔗 Public Chat: https://www.mql5.com/en/messages/0265500debafdb01

🔗 Public Channel: https://www.mql5.com/en/channels/commodities

Some illegal Telegram groups are advertising a fake EA under my name. Please note:

❌ That is NOT my DAX EA – it’s just a useless martingale EA promoted by scammers to fool people.

✅ I only sell my EAs officially on the MQL5 marketplace. Any EA offered elsewhere, even if they misuse my link, is 100% fake.

You can easily check this yourself: run a backtest of the original EA from my official MQL5 page and compare it with the fake one — the difference is obvious.

Stay safe and always double-check before purchasing.

🔗 Seller products: https://www.mql5.com/en/users/babakalamdar/seller

🔗 Public Chat: https://www.mql5.com/en/messages/0265500debafdb01

🔗 Public Channel: https://www.mql5.com/en/channels/commodities

Babak Alamdar

⚠️ Important Notice – DAX EA ⚠️

Recently, some scammers have been posting a fake EA and trying to fool people by saying it’s my DAX EA. They even misuse my official links to introduce their fake product.

✅ Please be aware:

I only sell DAX EA officially on MQL5 – nowhere else.

All my products are protected with the highest security, and it’s impossible to crack or share them outside MQL5.

👉 If you see my name connected to an EA outside MQL5, it’s 100% fake. Always double-check the official MQL5 link to avoid being scammed.

🚨 Today I noticed some Telegram groups started spreading this fake EA. Many users who bought it already contacted me for support — they are getting weird trades outside of DAX EA’s normal working times and asking me for help. Please understand: I have nothing to do with it.

🔗 Seller products: https://www.mql5.com/en/users/babakalamdar/seller

🔗 Public Chat: https://www.mql5.com/en/messages/0265500debafdb01

🔗 Public Channel: https://www.mql5.com/en/channels/commodities

Recently, some scammers have been posting a fake EA and trying to fool people by saying it’s my DAX EA. They even misuse my official links to introduce their fake product.

✅ Please be aware:

I only sell DAX EA officially on MQL5 – nowhere else.

All my products are protected with the highest security, and it’s impossible to crack or share them outside MQL5.

👉 If you see my name connected to an EA outside MQL5, it’s 100% fake. Always double-check the official MQL5 link to avoid being scammed.

🚨 Today I noticed some Telegram groups started spreading this fake EA. Many users who bought it already contacted me for support — they are getting weird trades outside of DAX EA’s normal working times and asking me for help. Please understand: I have nothing to do with it.

🔗 Seller products: https://www.mql5.com/en/users/babakalamdar/seller

🔗 Public Chat: https://www.mql5.com/en/messages/0265500debafdb01

🔗 Public Channel: https://www.mql5.com/en/channels/commodities

: