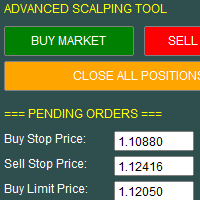

Insync Index

- Indicatori

- Antonello Belgrano

- Versione: 1.0

- Attivazioni: 5

Insync Index Oscillator

A powerful and efficient tool for identifying market trends and momentum. The Insync Index Oscillator is designed to provide traders with clear, actionable insights by analyzing price movements and market conditions. With its intuitive design and fast, accurate signals, it helps traders make more informed decisions without the noise.

Perfect for both short-term and long-term strategies, the Insync Index Oscillator delivers reliable results for any trading style. Get ahead of the market with precision, simplicity, and speed.

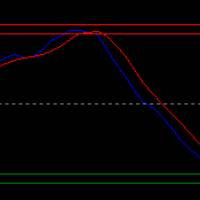

InSync Index – Master Oscillator

The InSync Index is a consensus indicator that combines signals from multiple technical indicators to identify significant market reversal points. Created by Norm North in the '90s, this tool helps traders spot moments when the market might be due for a correction or reversal.

How it works:

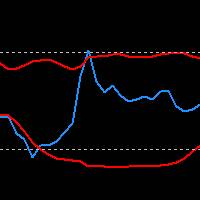

The InSync Index collects signals from 10-15 classic technical indicators such as RSI, MACD, Stochastic, CCI, Bollinger Bands, and others. Each indicator provides a score of +1 (overbought), -1 (oversold), or 0 (neutral). The scores are summed up to give a final value that reflects the consensus among the indicators.

Interpretation:

-

+55 / +60 and above: Extreme overbought. Likely signal for a downward reversal.

-

–55 / –60 and below: Extreme oversold. Likely signal for an upward reversal.

-

Close to 0: Sideways market or no consensus.

Main Signals:

When the InSync Index reaches an extreme value and then moves back toward zero, it provides an entry signal. For example, a shift from –62 to –48 often signals a strong bounce.

Core Theory:

The InSync Index measures how many indicators are giving the same signal. When most indicators are synchronized, the market is likely exhausted and ready to change direction.