Gold Force Index

- Indicatori

- Pieter Gerhardus Van Zyl

- Versione: 1.0

- Attivazioni: 20

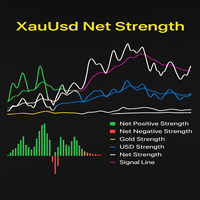

Gold Force Index is a relative strength oscillator designed to compare Gold and the US Dollar in a clean, intuitive way. It visualizes which side of the market currently holds dominance by transforming multi-market data into two normalized strength curves displayed in a separate indicator window. The focus is clarity: instead of reacting to short-term price noise, the indicator highlights sustained shifts in strength that often precede meaningful market moves.

Both strength readings are plotted on a 0–100 scale, making them easy to interpret across all timeframes. The design emphasizes balance and stability, allowing traders to quickly assess whether Gold or USD is gaining influence without relying on subjective chart interpretation. Smooth histogram plots help reduce visual clutter while still preserving responsiveness, making the indicator suitable for scalping, intraday trading, and higher-timeframe analysis.

How to use

-

Strength comparison

-

When the Gold line remains above the USD line, market conditions favor Gold-related instruments.

-

When the USD line stays above Gold, Dollar strength is dominant and Gold momentum may weaken.

-

-

Crossovers

Crossings between the two strength lines highlight potential shifts in market control. These moments are best used as confirmation rather than standalone entry signals. -

Bias and filtering

Use Gold Force Index to define directional bias before entering trades on XAUUSD or USD pairs. Trades aligned with the stronger side tend to have higher follow-through. -

Timing support

Combine the indicator with your existing entry strategy to avoid trading against broader strength conditions.

Gold Force Index is intended as a context tool, helping you stay aligned with underlying market pressure rather than reacting to price alone.