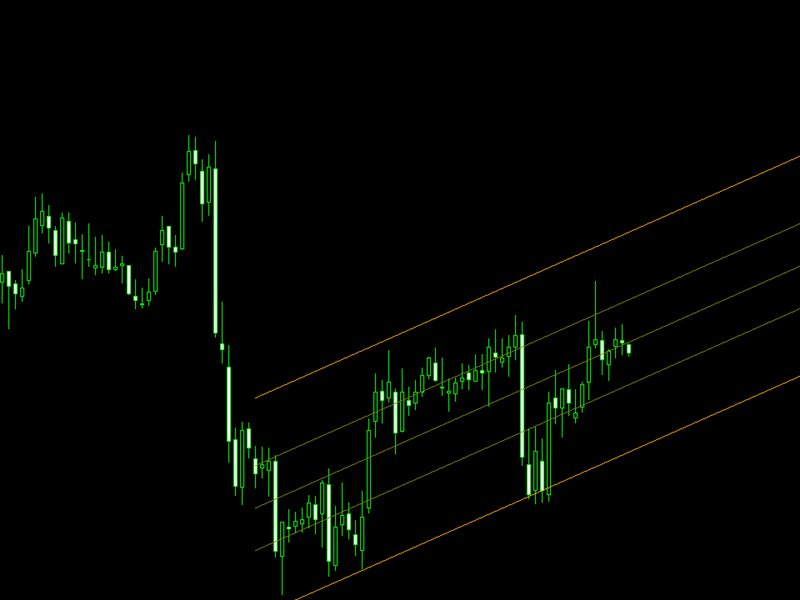

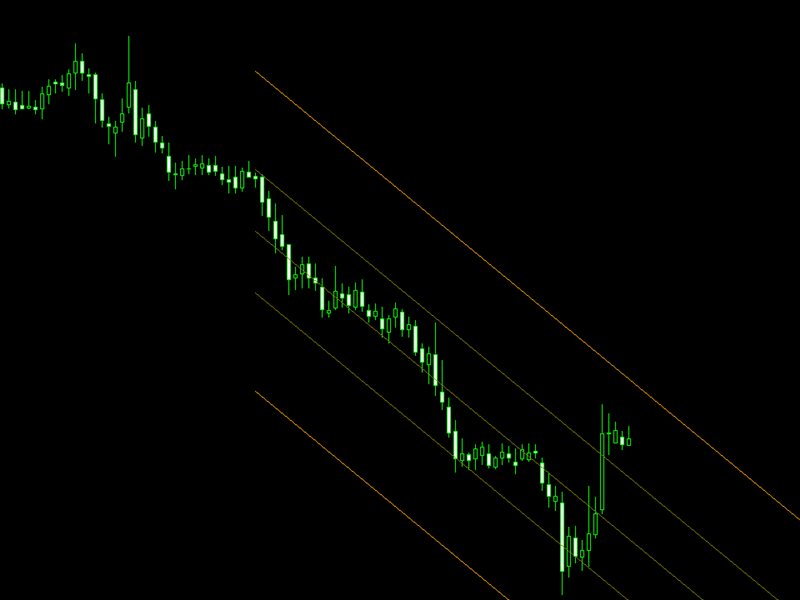

Std Channels

- Indicateurs

- Muhammed Emin Ugur

- Version: 1.0

- Activations: 10

Std Channels

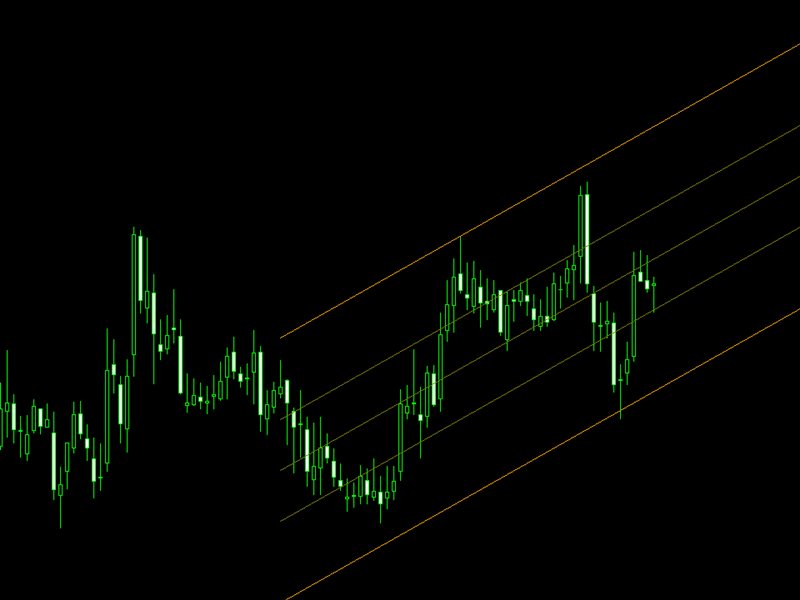

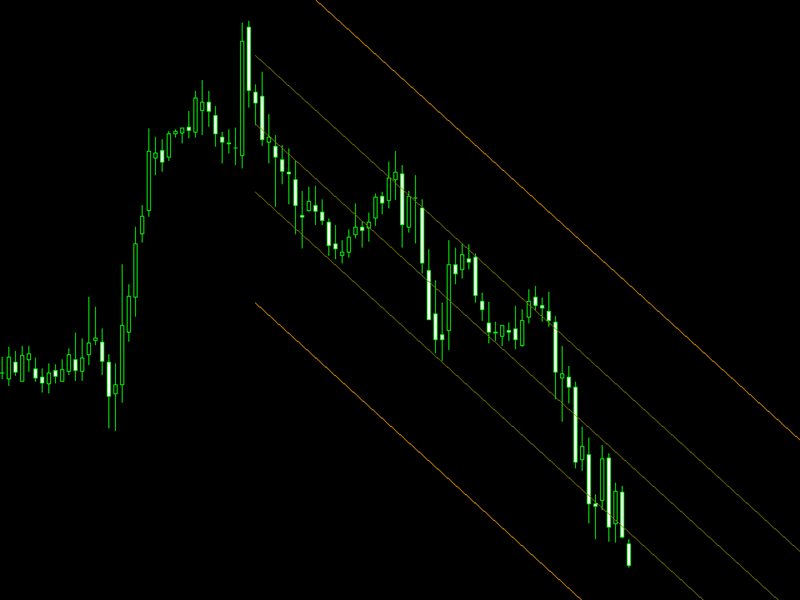

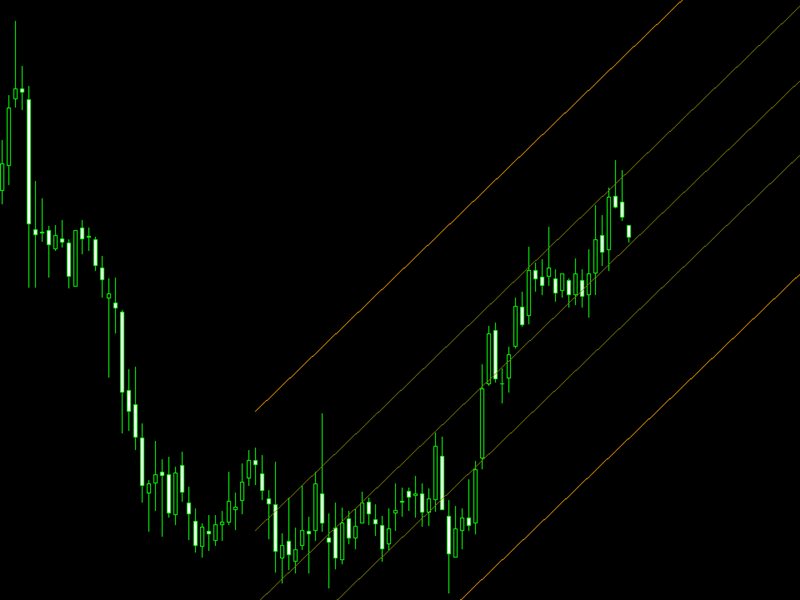

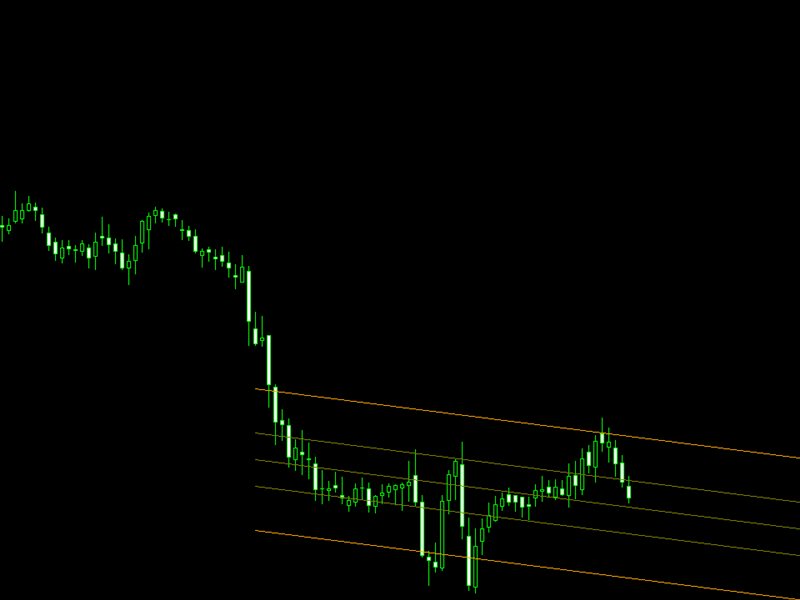

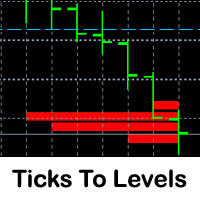

The Std Channels Indicator is a technical indicator that uses standard deviation to create five channels around a price chart. The channels are used to identify support and resistance levels, as well as trends and reversals.

The indicator is calculated by first calculating the standard deviation of the price data over a specified period of time. The channels are then created by adding and subtracting the standard deviation from the price data.

The five channels are as follows:

- Upper channel: The upper channel is the furthest away from the price data. It is used to identify resistance levels.

- Upper-middle channel: The upper-middle channel is closer to the price data than the upper channel. It is used to identify support and resistance levels.

- Middle channel: The middle channel is the closest to the price data. It is used to identify trends and reversals.

- Lower-middle channel: The lower-middle channel is closer to the price data than the lower channel. It is used to identify support and resistance levels.

- Lower channel: The lower channel is the furthest away from the price data. It is used to identify support levels.

The Std Channels Indicator can be used to identify potential trading opportunities in a number of ways. For example, traders can look for reversals when the price breaks out of a channel. They can also look for support and resistance levels to enter or exit trades.

Features:

- Uses standard deviation to create five channels around a price chart

- Channels are used to identify support and resistance levels, as well as trends and reversals

- Can be used to identify potential trading opportunities

Advantages:

- Simple to use

- Effective at identifying support and resistance levels

- Can be used to identify trends and reversals