Yuslia Noviani / Perfil

- Información

|

5+ años

experiencia

|

0

productos

|

0

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

Amigos

126

Solicitudes

Enviadas

Yuslia Noviani

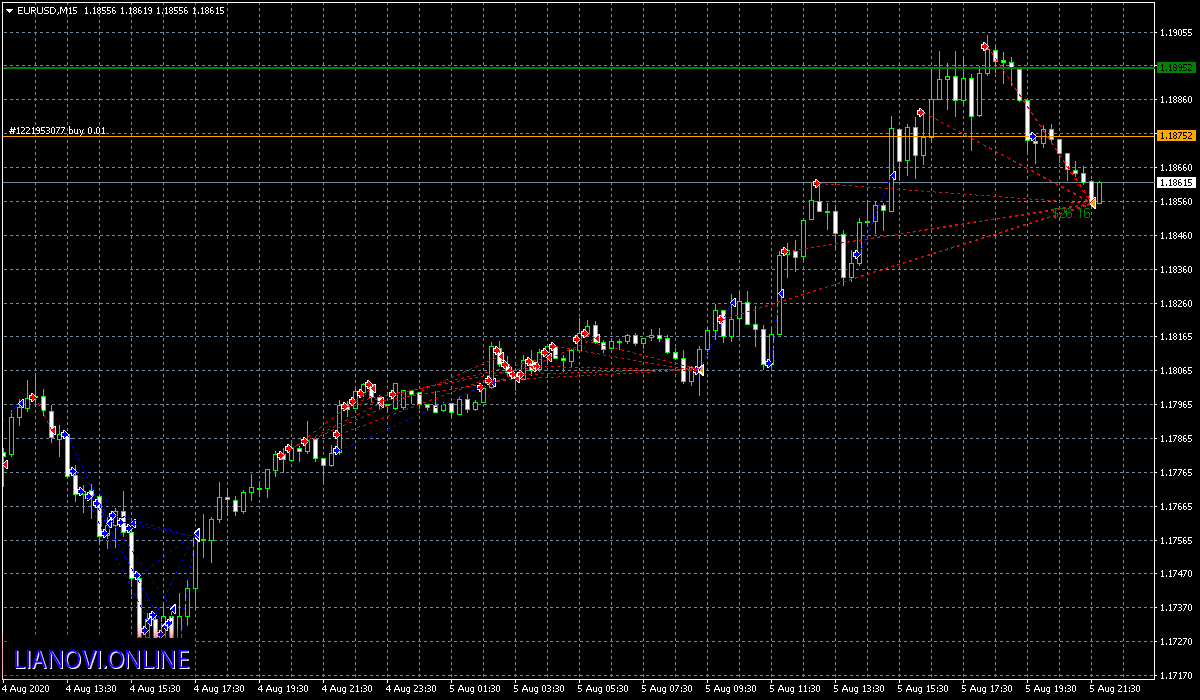

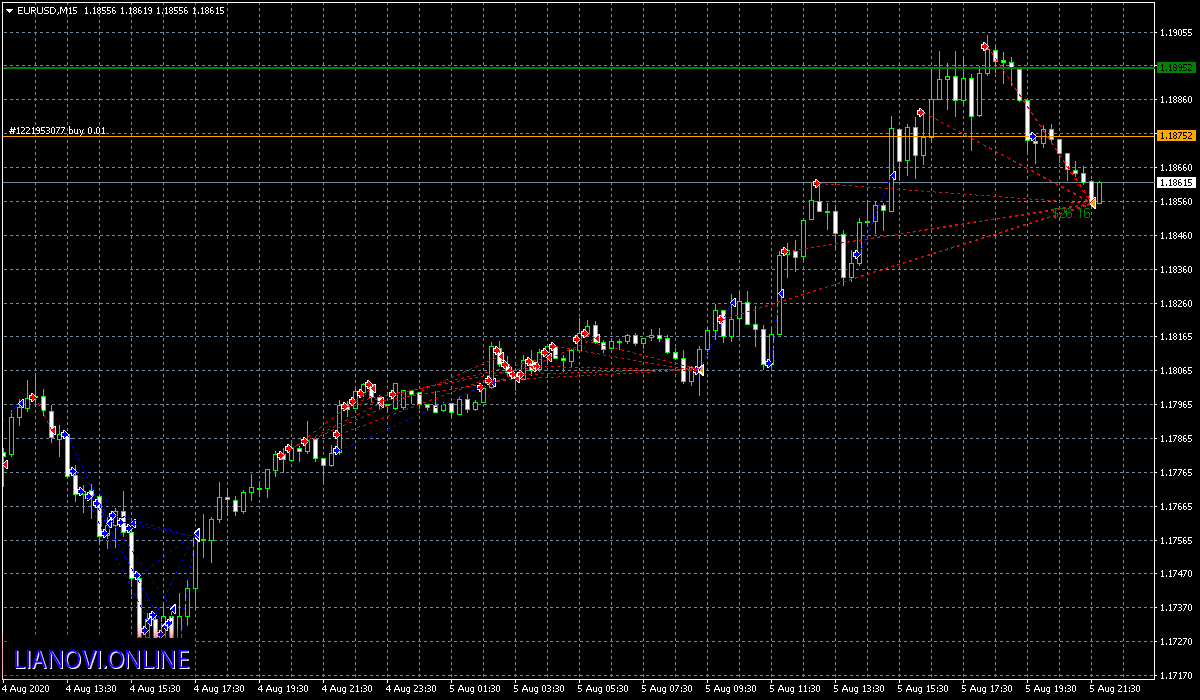

EURUSD.., Nice pullback !

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

Yuslia Noviani

USDCAD... Friendly Sell !

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

Yuslia Noviani

EURUSD.. no matter what.. it Closed !

https://lianovi.online

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

https://lianovi.online

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

Yuslia Noviani

NZDCHF.. just red and blue !

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

Yuslia Noviani

NZDUSD... It coming back ;)

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

Yuslia Noviani

GBPUSD.. BUY M15.. closed !

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

Yuslia Noviani

USDJPY... nice 😎😎

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

Yuslia Noviani

EURUSD... Closed !

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

Yuslia Noviani

#USDCHF... wake up early with profit

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

Yuslia Noviani

USDCAD.. OMG !!!

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

Yuslia Noviani

EURGBP.. closed with profit

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

Yuslia Noviani

AUDUSD... buy Only closed

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

Yuslia Noviani

GBPUSD... sell closed... buy closed. with profit ;)

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

Yuslia Noviani

EURUSD.. Close Sell. before bullish... nice !

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline #MQL5community

Yuslia Noviani

USDJPY...... yeayyy...

Please Visit: https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline

Please Visit: https://lianovi.online

#mql4 #MT4 #GBPUSD #GBPAUD #XAUUSD #EURUSD #AUDUSD #forexsignals #forextrader #lianovionline

Yuslia Noviani

Focus of the day July 13, 2020

Infections in the US are still a concern. But this – excuse the tautology – doesn’t seem to concern the market anymore. At least, not as much as it used to. Probably, investors are exhausted to stay anchored at pessimistic bay just because of the infections all the time. In addition to that, vaccine developers, particularly in the US, report successful results. That significantly improves the psychological background of the market.

Therefore, currently, the US dollar is down against most currency pairs. A similar light-mood picture is in the stock market so far. Very possibly, we are in for an optimistic week this time. If that’s the case, watch the USD lose more value, gold drift across $1 800, and oil… The oil will be having some interesting days ahead as this week’s OPEC meeting will delineate the plans of the cartel.

Latest news:

A US-EU trade war is looming while the US-China relationship left the stage for a while. Luxury imports from France will be subjected to tariffs in the US while the US IT production will be taxed in the EU. The stock market on both sides should give a short-term reaction while the long-term consequences will depend on how the confrontation goes.

The oil market is going through fierce volatility as the OPEC meeting this Wednesday is approaching. On the one side, there is a recent drop to $38.5 in WTI price as Russia and Iran are reported to plan output increase. On the other hand, the IEA assures that there will be a sharp increase in oil demand in the coming months as world economies will be doing much better as recovery goes on. Strategically, the global demand should have the upper hand. Therefore, expect an upward trend in the long term, with somewhat increased volatility in the short term.

$1 800 has been secured by the gold price last week and so far look pretty safe to stay there. Although lighter moods seem to infiltrate the market more and more, somewhat chaotic news coming from different ends of the globe keeps the uncertainty in the place. For this reason, despite the optimism, it is unlikely the gold price leaves its newly reached highs. Rather, it floats sideways waiting for another turn to a heavier outlook.

https://lianovi.online/2020/07/13/focus-of-the-day-july-13-2020/

Infections in the US are still a concern. But this – excuse the tautology – doesn’t seem to concern the market anymore. At least, not as much as it used to. Probably, investors are exhausted to stay anchored at pessimistic bay just because of the infections all the time. In addition to that, vaccine developers, particularly in the US, report successful results. That significantly improves the psychological background of the market.

Therefore, currently, the US dollar is down against most currency pairs. A similar light-mood picture is in the stock market so far. Very possibly, we are in for an optimistic week this time. If that’s the case, watch the USD lose more value, gold drift across $1 800, and oil… The oil will be having some interesting days ahead as this week’s OPEC meeting will delineate the plans of the cartel.

Latest news:

A US-EU trade war is looming while the US-China relationship left the stage for a while. Luxury imports from France will be subjected to tariffs in the US while the US IT production will be taxed in the EU. The stock market on both sides should give a short-term reaction while the long-term consequences will depend on how the confrontation goes.

The oil market is going through fierce volatility as the OPEC meeting this Wednesday is approaching. On the one side, there is a recent drop to $38.5 in WTI price as Russia and Iran are reported to plan output increase. On the other hand, the IEA assures that there will be a sharp increase in oil demand in the coming months as world economies will be doing much better as recovery goes on. Strategically, the global demand should have the upper hand. Therefore, expect an upward trend in the long term, with somewhat increased volatility in the short term.

$1 800 has been secured by the gold price last week and so far look pretty safe to stay there. Although lighter moods seem to infiltrate the market more and more, somewhat chaotic news coming from different ends of the globe keeps the uncertainty in the place. For this reason, despite the optimism, it is unlikely the gold price leaves its newly reached highs. Rather, it floats sideways waiting for another turn to a heavier outlook.

https://lianovi.online/2020/07/13/focus-of-the-day-july-13-2020/

Yuslia Noviani

USD/CAD: Canadian positive data vs US negative data

The Canadian employment change has been released at the same time with the US PPI. The best opportunity of this week for traders!

What happened?

952 900 Canadians have been hired during June. Analysts expected that only 700 000 people would find jobs. This data gave a good sign that the Canadian labor market is gradually recovering. In comparison, the previous report showed that 289 600 people were employed during May. However, the Canadian unemployment rate came worse than expected: 12.3%, that was more by 0.3% than the forecast.

Two types of Producer Price Indexes (PPI) were released: the Core PPI and the PPI. The Core PPI shows the change in the price of finished goods and services sold by producers, excluding food and energy. Unlike it, the PPI includes food and energy. Both of them turned out worse than analysts anticipated. The results you can see below.

Actual Forecast Previous

Core PPI -0.3% 0.1 -0.1%

PPI -0.2% 0.4% 0.4%

How to trade USD/CAD?

Opportunities like this come along quite rarely. The Canadian dollar got two tailwinds at the same time. As a result, USD/CAD started moving down. Based on fundamental factors we can assume that the pair should go down further. It has already broken through two moving averages, but there is one left – the 50-period moving average at 1.3570. If the price crosses it, it may plummet to the next support level at 1.3525, which it has touched several times already. The move below this level will push the price to the low of June 9 at 1.3375. Resistance levels are at 1.3610 and 1.3685.

https://lianovi.online

The Canadian employment change has been released at the same time with the US PPI. The best opportunity of this week for traders!

What happened?

952 900 Canadians have been hired during June. Analysts expected that only 700 000 people would find jobs. This data gave a good sign that the Canadian labor market is gradually recovering. In comparison, the previous report showed that 289 600 people were employed during May. However, the Canadian unemployment rate came worse than expected: 12.3%, that was more by 0.3% than the forecast.

Two types of Producer Price Indexes (PPI) were released: the Core PPI and the PPI. The Core PPI shows the change in the price of finished goods and services sold by producers, excluding food and energy. Unlike it, the PPI includes food and energy. Both of them turned out worse than analysts anticipated. The results you can see below.

Actual Forecast Previous

Core PPI -0.3% 0.1 -0.1%

PPI -0.2% 0.4% 0.4%

How to trade USD/CAD?

Opportunities like this come along quite rarely. The Canadian dollar got two tailwinds at the same time. As a result, USD/CAD started moving down. Based on fundamental factors we can assume that the pair should go down further. It has already broken through two moving averages, but there is one left – the 50-period moving average at 1.3570. If the price crosses it, it may plummet to the next support level at 1.3525, which it has touched several times already. The move below this level will push the price to the low of June 9 at 1.3375. Resistance levels are at 1.3610 and 1.3685.

https://lianovi.online

Yuslia Noviani

EUR/JPY: on the way up

EUR/JPY is likely to move further within an uptrend. The cyclical movement is clearly shown on the 4-hour chart. It has been climbing up since June 22 with short corrections. It’s widely expected that the story can repeat again this time. However, the pair may meet the resistance at 121.50. Wait until it crosses this level, as it will clear the way upwards to the next resistance at 121.85 near the 50% Fibonacci retracement level. Look for support levels at 121.00 and 120.70.

Trade idea for EUR/JPY

BUY 121.55; TP1 121.85; TP2 122.50; SL 121.40

EUR/JPY is likely to move further within an uptrend. The cyclical movement is clearly shown on the 4-hour chart. It has been climbing up since June 22 with short corrections. It’s widely expected that the story can repeat again this time. However, the pair may meet the resistance at 121.50. Wait until it crosses this level, as it will clear the way upwards to the next resistance at 121.85 near the 50% Fibonacci retracement level. Look for support levels at 121.00 and 120.70.

Trade idea for EUR/JPY

BUY 121.55; TP1 121.85; TP2 122.50; SL 121.40

: