Daniel Bancans / Perfil

- Información

|

10+ años

experiencia

|

0

productos

|

0

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

PlusFX have been trading Forex for over 10 years now. Through the years we have developed a trading system that is solid and profitable. We are based in London and focus on the major currencies usually those are Euro, Pound and USD. We now look to share our system so that other traders can profit from it.

Amigos

240

Solicitudes

Enviadas

Daniel Bancans

The past few weeks has been a considerably strong week for the EURUSD due to the the weakening US Dollar. The pairing managed to push to the 1.134 mark which sits on a declining resistance line...

Daniel Bancans

The Bank of Japan, last night decided to leave their current stimulus plan unchanged, in addition to the current benchmark rate at -0.10%. The members votes 8-1 to keep the current stimulus package at ¥80 trillion. The members also voted 7-2 to keep the benchmark rate unchanged...

Daniel Bancans

Post publicado Weekly Forecast: BoJ, Fed and BoE policy meeting this week

This week will have the Bank of Japan, Bank of England and the Federal Reserve policy meetings where the benchmark rates are expected to remain unchanged...

Daniel Bancans

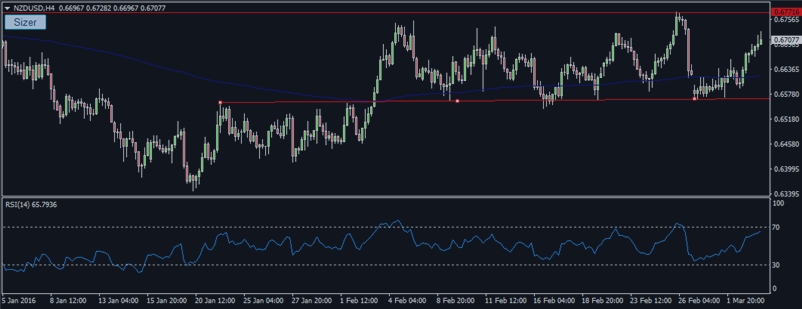

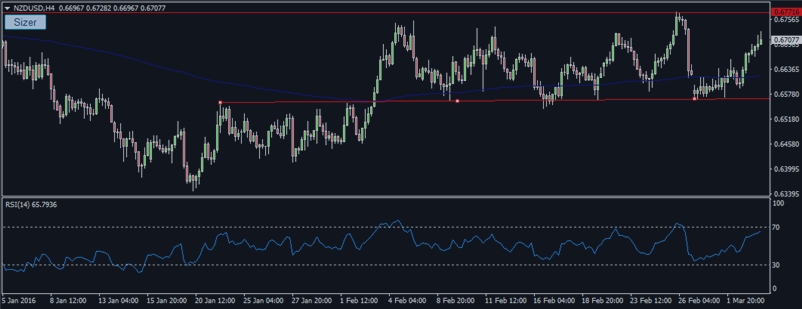

Despite the large drop from the NZD after a surprise decrease in interest rates, the NZD/USD has regained a large majority of those losses today as the USD opens weak. The NZD/USD has been trading within an inclining channel since the start of February...

Compartir en las redes sociales · 1

116

Daniel Bancans

On the EUR/USD daily chart you can see the price has retraced back to the 38.2% fibonacci line where is is forming doji candlestick formations which hint at a possible continuation downwards. Price is still below the 200 EMA, therefore this looks like a good bearish setup...

Daniel Bancans

Chinese Exports fall to lowest since 2009 as Euro drops prior to ECB

9 marzo 2016, 13:47

Yesterday say yet another poor news revelation from China with the contracted exports falling -25.4% in USD term Despite this Chinese markets actually trade higher yesterday with hopes that the PBoC will increase stimulus. Chinese exports plummeted one quarter in February;- 25...

Daniel Bancans

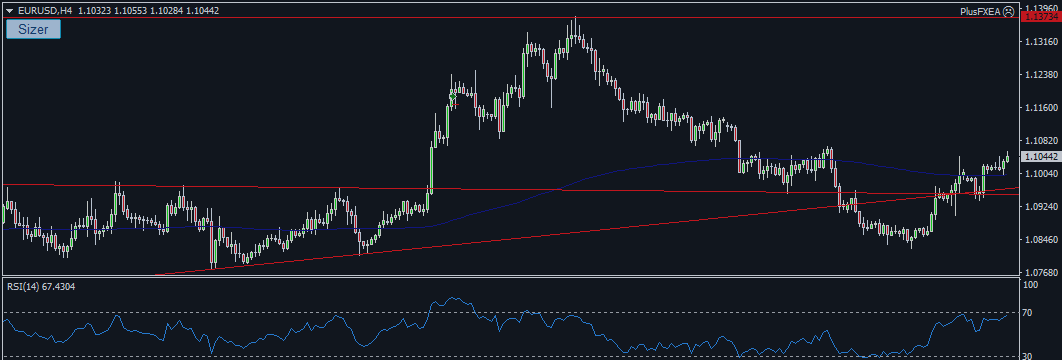

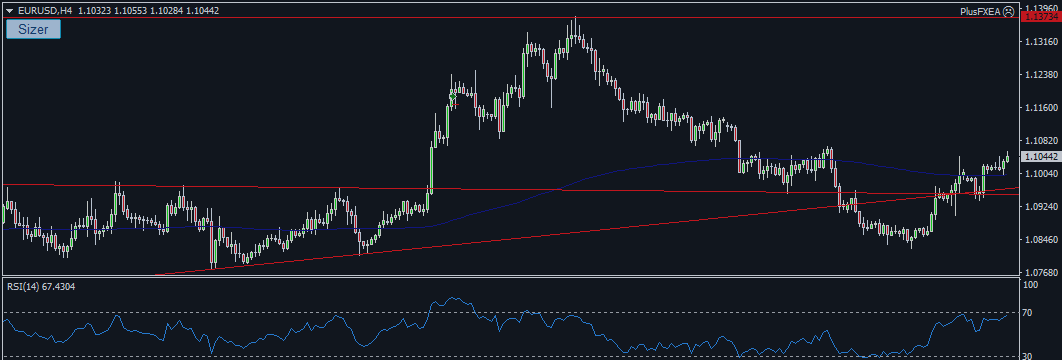

The EUR/USD 4 hour chart shows the price breaking the 200 EMA which may see the price proceed to the previous high at 1.137. However, the RSI is at 67 which is fairly overbought which implies that the movement is running out of momentum...

Daniel Bancans

The USD/CAD has been trading within a declining channel for the past few weeks. The price recently touched the support line and bounced off of it. It is showing a good long setup and looks to target the declining resistance line at 1...

Daniel Bancans

The USD/JPY 4 hour chart shows the price has been range trading between the 23.6% fibonacci line and the 38.2% fibonacci line. The price is currently sitting on the 23.6% fibonacci retracement. The 38...

Daniel Bancans

AUD/USD: USD retraces as Bullish trend might be losing momentum

7 marzo 2016, 15:48

The AUD/USD had an excellent week last week due to the weakening dollar. However, the dollar has started the week strong and has caused a fair gap in the markets during the opening last night. The price broke the 200 EMA very strongly, therefore we are not expecting it the drop below it this week...

Daniel Bancans

EUR/USD: volatile end to the week suggests further movement

4 marzo 2016, 17:02

The EUR/USD has had a fairly positive end to the week and finishing off with a very volatile day today due to the nonfarm payrolls and other US economic news releases. The price is now sitting on the 200 EMA where it has formed a shooting star candlestick formation and is looking to drop...

Compartir en las redes sociales · 1

139

Daniel Bancans

The US nonfarm payrolls has smashed the expected 190 expectations and jumped to 242 in February, which is a considerable amount. Unemployment rate remain unchanged at the 8 year low of 4.9% which is expected. Upon the news the USD is up slightly, however the movement is being held back by a poor trade balance (-45.68 against expected -44.00) and a reduction in average hourly rate (down to 2.2% from 2.5%) Which indicates inflation is not increasing sufficiently for an interest rate rise.

Despite the positive nonfarm payrolls the USD is still looking in a poor state, with unemployment rate staying at an 8 year low and the growing trade balance deficit. More at www.plusfxtrading.com

Despite the positive nonfarm payrolls the USD is still looking in a poor state, with unemployment rate staying at an 8 year low and the growing trade balance deficit. More at www.plusfxtrading.com

Daniel Bancans

The 4 hour USD/CAD Chart shows the price is hugging the declining support line. The price has been range trading between the support and resistance since the end of January. However, price looks to be making a continuation upwards to continue with its long term bullish trend...

Daniel Bancans

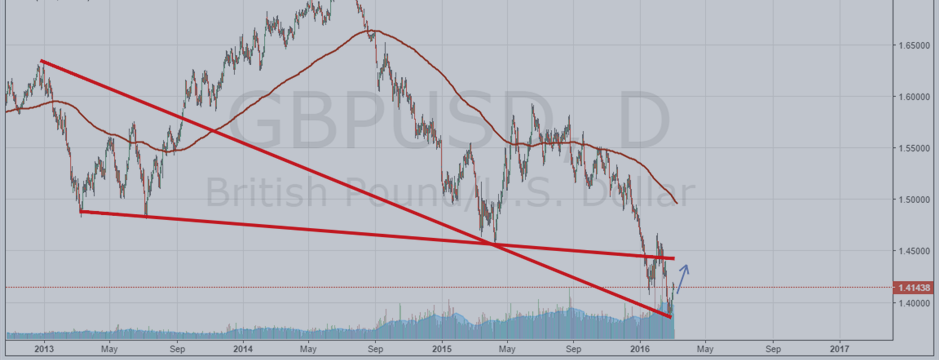

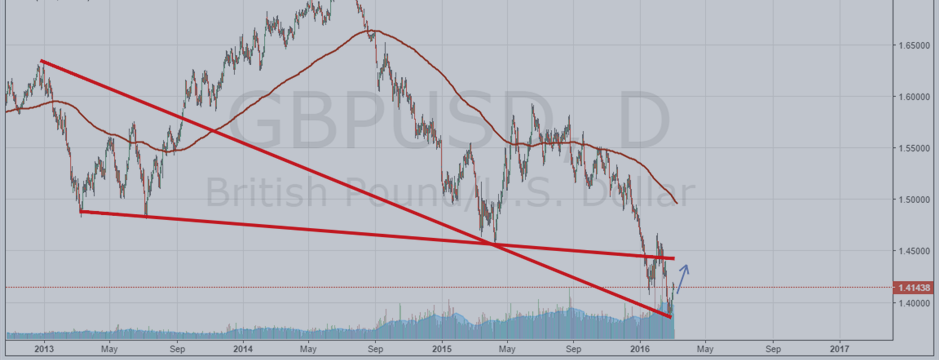

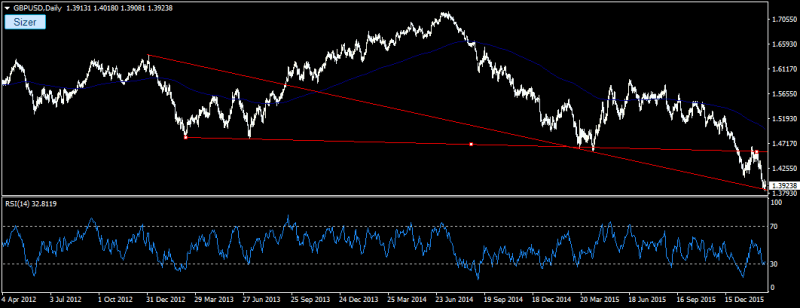

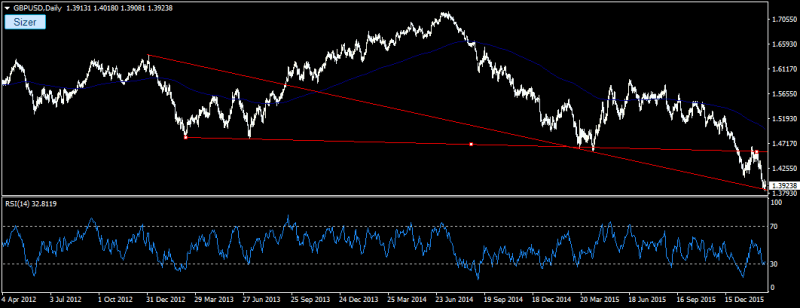

The GBP/USD has been a very bearish pairing over the past year. With the price hitting fresh lows not seen since 2009. Therefore we have had to turn our eye to the long term charts to see if we can see which direction the GBP/USD looks to be moving next...

Daniel Bancans

Investors are focusing their attention on February’s US jobs report which will be released at 13:30 GMT. We are expecting the Nonfarm payrolls which is expected to rise from January’s disappointing 151 to 190, the unemployment rate and inflation of wages is expected to remain unchanged at 4...

Daniel Bancans

The Euro has had a positive day today due to a positive Markit PMI Composite and Markit services PMI for February. The results came in just above expectations at 53 and 53.30...

Daniel Bancans

The NZD/USD is a very volatile paring for the moment, it is currently range trading between the previous high at the 0.677 mark and the 200 EMA. The 4 Hour chart above reflects the positive few days the Kiwi has had and has nearly regained the losses made at the end of February...

Daniel Bancans

The USD/JPY has been fairly flat over the past couple of days. It currently sits between the 23.6% and the 38.2% fibonacci retracements where it looks to be range trading for now.A slight RSI divergence has also appeared which indicates a further move ahead is possible...

Daniel Bancans

GBP/USD: possible swing upwards forming.

The GBP/USD daily chart on a whole is looking bearish. The price has dropped a considerable amount over the past few weeks. However, the price is touching a declining support mark which was previously a resistance line. We are looking to gain some profits from the upwards swings here, as the price is oversold in addition to the support line being touched.

When we get bullish confirmation then we will enter long with the scope to hold the position for a few days. The target will be a previously strong support line which is now the closest resistance line at 1.466. The trend overall is downwards, we are looking to benefit off the swing highs.

Www.plusfxtrading.com

The GBP/USD daily chart on a whole is looking bearish. The price has dropped a considerable amount over the past few weeks. However, the price is touching a declining support mark which was previously a resistance line. We are looking to gain some profits from the upwards swings here, as the price is oversold in addition to the support line being touched.

When we get bullish confirmation then we will enter long with the scope to hold the position for a few days. The target will be a previously strong support line which is now the closest resistance line at 1.466. The trend overall is downwards, we are looking to benefit off the swing highs.

Www.plusfxtrading.com

: