Duy Van Dao / Perfil

- Información

|

5+ años

experiencia

|

0

productos

|

0

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

Duy Van Dao

Dear followers,

My signal based on some fillter to find the valid trade, it about:

1. Strong trend

2. Space, where price is, have enough R:R to open trade

3. Not buy when overbought and vice versa

Except for days when I anticipate sideways markets (usually holidays), I run EA 24/5. But EA only opens valid orders. Although the frequency of opening orders is quite high, however remember, we are not every day trading.

My signal based on some fillter to find the valid trade, it about:

1. Strong trend

2. Space, where price is, have enough R:R to open trade

3. Not buy when overbought and vice versa

Except for days when I anticipate sideways markets (usually holidays), I run EA 24/5. But EA only opens valid orders. Although the frequency of opening orders is quite high, however remember, we are not every day trading.

Duy Van Dao

Thank you Yang May Leong(https://www.mql5.com/en/users/ymleong) for this evaluation, im post here and i think It might help those who are watching my signals

1) stop loss is sometimes slight larger could be due to high volatility that created slippage especially so for minors/crosses

2020.04.08 02:57 Sell 0.02 GBPCHF 1.19621 1.20182 1.18528 2020.04.08 14:54 1.20193 -0.11 -11.78 [sl]

2020.04.08 02:57 Sell 0.02 GBPCHF 1.19621 1.20182 1.19078 2020.04.08 14:54 1.20193 -0.11 -11.78

*its not just these 2 trades i quickly took a look at just page 1 and saw a few lost trades having similar characteristics

Answer: I try to optimize the follower's account so I should set fixed lotsize, yes, this will have the disadvantage of different volatility between different pairs leading to some trade "big losses looking". I thought about this and tried to apply a filter to filter out pairs of similar and well-performing volatility and working real quite well. Also I prefer look at statistic and R:R more. Sell order GBPCHF that you are taking for example has Reward:Risk of both positions average is 1.45 (use $1 risk to buy $1.45 profit, with trend it will bring profit for long-term, that is statistic)

2) take profits usually slightly higher again due to slippage

2020.04.08 09:08 Buy 0.02 NZDUSD 0.59558 0.59253 0.60214 2020.04.08 18:26 0.60219 -0.11 13.22 [tp]

2020.04.08 13:30 Buy 0.02 AUDJPY 67.077 66.433 67.737 2020.04.08 18:26 67.741 -0.11 12.22 [tp]

2020.04.08 13:45 Buy 0.02 AUDCHF 0.59895 0.59408 0.60260 2020.04.08 17:54 0.60262 -0.11 7.57

*I didnt go thru entire trade history it will take a lot of my time, but I quickly saw that it seems average out the profits are also positive slippage. Took a look, ICMarkets, I am also a client since 2010 thus I can say for sure this is due to a good brokerage coz others wont give u positive slippage

Answer: Agree, slippage always is a problem in trading, and IC market is a great broker IMO

3) using 8/Apr trades batch, there is usually maximum of 2 per pair, this indicates quite a good risk allocation to avoid a currency going into tailspin, others are perhaps profitable. This also indicates its not a traditional grid but trades can be spaced 0 pips apart

2020.04.08 09:08 Buy 0.02 NZDUSD 0.59558 0.59253 0.60214 2020.04.08 18:26 0.60219 -0.11 13.22

2020.04.08 09:08 Buy 0.02 NZDUSD 0.59558 2020.04.08 22:31 0.60181 -0.11 12.46

There might be a scenario whereby if trades did latch onto a trend, both trades are in profit. Another scenario for a tight grid despite controlled by 2 maximum trades could be both are larger losses, such as above GBPCHF

Answer: It is actually a position for each pair, splitting it into 2 legs with the aim of closing 2 times at 2 targets and BE, but there are times when EA assesses the market well and target 2 "seems easy" to reach. Come, it will skip target 1

4) The EA obeys the SL (not sure whether there might be some human intervention coz EA trading is 100%), it will usually give a much lower win%, and in this case its only 65% winning rate, a ratio thats bit lower than 70%. If this ratio can be average out and maintained this EA has "legs" (aka can run). But going forwards this ratio may decrease which could lead to a small or even bigger losses for that month. The saving grace is average profit vs average loss 8.09 vs -5.01 which if can be maintained does indicate a more profitable strategy.

Answer: I don't know about the "legs" and "aka" you're talking about. And IMO, win rate is just apart of Reward:Risk, you should not analyze it individually and must be combine with R:R. For example, for me, I'm completely comfortable with a 30% win rate and bring R:R 5:1

5) The recovery rate is so-so at 8.47. This might be attributable to a higher drawdown of 33%.

Answer: Agree, as i said in my signal description, drawdown less than 50% and i use safety factor is 2 to calculate maximum drawdown is 100%. IMO, really hard to get this maximum drawdown number. However, nothing is certain in forex, and all cases need to be considered as much as possible.

6) some SL and TP are missing which is quite a concern as something is being hidden rather than being transparent its now translucent

Answer: No trade open without SL and TP. These trade is closed before market close and i don't know why SL and TP was removed before closed by EA. If you follow when position is running you will see

Summary

The strategy of trading with multipairs does have the effect of minimizing and "averaging" out the overall losses. Pairs are kept to maximum of 2 that lowers the risk but at same time, they might create same dd% and same losses/gains. Keeping each currency pair to just 1 might be better as both pairs are either with same profits or same losses, which average out the losses/profits resulting in average profit vs average losses to less than 2x. This might spell trouble going forwards due to market volatility that has increased to a huge extend and impact of covid on markets that can have at least 1-3 years to "recover". Its a concern that some trades have missing SL/TP that deviates from the strategy making it difficult to "calculate" the real risk, coupled with a high dd about 34% attributed to max trades per batch (found abt 22) and the double "whamy" of having 2 trades with 0pips spread

Answer: We have 8 major currencies. Suppose there are 4 very strong currencies and 4 very weak currencies at the same time, then the EA will open up to 4x4=16 positions (32 legs). On average, with each position of 0.02, we may lose an average of $15, if in the most unfavorable case, all lose we will lose up to $ 15 * 16 = $ 240. That is 120% of the $ 200 account. And this is similar to the 100% MD number I gave in the description. And you can see, the posibility of this happening are very low.

Your analysis is valuable, however there are some points you don't understand about my signal yet, which I mentioned about "transparent" in the description it means "really transparent". I don't want to be like some traders who only takes money from followers, I want us to make money. I have an effective signal, but to make money you need to understand its risks and your money management.

Thanks again Yang.

1) stop loss is sometimes slight larger could be due to high volatility that created slippage especially so for minors/crosses

2020.04.08 02:57 Sell 0.02 GBPCHF 1.19621 1.20182 1.18528 2020.04.08 14:54 1.20193 -0.11 -11.78 [sl]

2020.04.08 02:57 Sell 0.02 GBPCHF 1.19621 1.20182 1.19078 2020.04.08 14:54 1.20193 -0.11 -11.78

*its not just these 2 trades i quickly took a look at just page 1 and saw a few lost trades having similar characteristics

Answer: I try to optimize the follower's account so I should set fixed lotsize, yes, this will have the disadvantage of different volatility between different pairs leading to some trade "big losses looking". I thought about this and tried to apply a filter to filter out pairs of similar and well-performing volatility and working real quite well. Also I prefer look at statistic and R:R more. Sell order GBPCHF that you are taking for example has Reward:Risk of both positions average is 1.45 (use $1 risk to buy $1.45 profit, with trend it will bring profit for long-term, that is statistic)

2) take profits usually slightly higher again due to slippage

2020.04.08 09:08 Buy 0.02 NZDUSD 0.59558 0.59253 0.60214 2020.04.08 18:26 0.60219 -0.11 13.22 [tp]

2020.04.08 13:30 Buy 0.02 AUDJPY 67.077 66.433 67.737 2020.04.08 18:26 67.741 -0.11 12.22 [tp]

2020.04.08 13:45 Buy 0.02 AUDCHF 0.59895 0.59408 0.60260 2020.04.08 17:54 0.60262 -0.11 7.57

*I didnt go thru entire trade history it will take a lot of my time, but I quickly saw that it seems average out the profits are also positive slippage. Took a look, ICMarkets, I am also a client since 2010 thus I can say for sure this is due to a good brokerage coz others wont give u positive slippage

Answer: Agree, slippage always is a problem in trading, and IC market is a great broker IMO

3) using 8/Apr trades batch, there is usually maximum of 2 per pair, this indicates quite a good risk allocation to avoid a currency going into tailspin, others are perhaps profitable. This also indicates its not a traditional grid but trades can be spaced 0 pips apart

2020.04.08 09:08 Buy 0.02 NZDUSD 0.59558 0.59253 0.60214 2020.04.08 18:26 0.60219 -0.11 13.22

2020.04.08 09:08 Buy 0.02 NZDUSD 0.59558 2020.04.08 22:31 0.60181 -0.11 12.46

There might be a scenario whereby if trades did latch onto a trend, both trades are in profit. Another scenario for a tight grid despite controlled by 2 maximum trades could be both are larger losses, such as above GBPCHF

Answer: It is actually a position for each pair, splitting it into 2 legs with the aim of closing 2 times at 2 targets and BE, but there are times when EA assesses the market well and target 2 "seems easy" to reach. Come, it will skip target 1

4) The EA obeys the SL (not sure whether there might be some human intervention coz EA trading is 100%), it will usually give a much lower win%, and in this case its only 65% winning rate, a ratio thats bit lower than 70%. If this ratio can be average out and maintained this EA has "legs" (aka can run). But going forwards this ratio may decrease which could lead to a small or even bigger losses for that month. The saving grace is average profit vs average loss 8.09 vs -5.01 which if can be maintained does indicate a more profitable strategy.

Answer: I don't know about the "legs" and "aka" you're talking about. And IMO, win rate is just apart of Reward:Risk, you should not analyze it individually and must be combine with R:R. For example, for me, I'm completely comfortable with a 30% win rate and bring R:R 5:1

5) The recovery rate is so-so at 8.47. This might be attributable to a higher drawdown of 33%.

Answer: Agree, as i said in my signal description, drawdown less than 50% and i use safety factor is 2 to calculate maximum drawdown is 100%. IMO, really hard to get this maximum drawdown number. However, nothing is certain in forex, and all cases need to be considered as much as possible.

6) some SL and TP are missing which is quite a concern as something is being hidden rather than being transparent its now translucent

Answer: No trade open without SL and TP. These trade is closed before market close and i don't know why SL and TP was removed before closed by EA. If you follow when position is running you will see

Summary

The strategy of trading with multipairs does have the effect of minimizing and "averaging" out the overall losses. Pairs are kept to maximum of 2 that lowers the risk but at same time, they might create same dd% and same losses/gains. Keeping each currency pair to just 1 might be better as both pairs are either with same profits or same losses, which average out the losses/profits resulting in average profit vs average losses to less than 2x. This might spell trouble going forwards due to market volatility that has increased to a huge extend and impact of covid on markets that can have at least 1-3 years to "recover". Its a concern that some trades have missing SL/TP that deviates from the strategy making it difficult to "calculate" the real risk, coupled with a high dd about 34% attributed to max trades per batch (found abt 22) and the double "whamy" of having 2 trades with 0pips spread

Answer: We have 8 major currencies. Suppose there are 4 very strong currencies and 4 very weak currencies at the same time, then the EA will open up to 4x4=16 positions (32 legs). On average, with each position of 0.02, we may lose an average of $15, if in the most unfavorable case, all lose we will lose up to $ 15 * 16 = $ 240. That is 120% of the $ 200 account. And this is similar to the 100% MD number I gave in the description. And you can see, the posibility of this happening are very low.

Your analysis is valuable, however there are some points you don't understand about my signal yet, which I mentioned about "transparent" in the description it means "really transparent". I don't want to be like some traders who only takes money from followers, I want us to make money. I have an effective signal, but to make money you need to understand its risks and your money management.

Thanks again Yang.

Duy Van Dao

Update "Trend Follower" description:

"For invester:

1. If you can not control the risk, only invest with your eccepted to lose fund ($100 - $1000 is recommendation) or copy Trend Follower 2 signal https://www.mql5.com/en/signals/729203

2. I will keep my balance around at $ 200 and make withdrawal or add fund between 19:30 - 00:00 GMT, when EA is inactive. The purpose of this is to invester always open 0.01 lots per $ 100. Not a trick to beautify the data or something similar.

3. In forex trading, risk management is the most important part, we cannot make money without risk control. Note that the purpose I created this account is for followers to customize with your own risk management (or new people can learn risk control from it). If you have any concern, pls ask.

4. My business is completely transparent, risk and reward, nothing is hidden here, if you have any questions feel free message to me."

"For invester:

1. If you can not control the risk, only invest with your eccepted to lose fund ($100 - $1000 is recommendation) or copy Trend Follower 2 signal https://www.mql5.com/en/signals/729203

2. I will keep my balance around at $ 200 and make withdrawal or add fund between 19:30 - 00:00 GMT, when EA is inactive. The purpose of this is to invester always open 0.01 lots per $ 100. Not a trick to beautify the data or something similar.

3. In forex trading, risk management is the most important part, we cannot make money without risk control. Note that the purpose I created this account is for followers to customize with your own risk management (or new people can learn risk control from it). If you have any concern, pls ask.

4. My business is completely transparent, risk and reward, nothing is hidden here, if you have any questions feel free message to me."

Duy Van Dao

https://www.mql5.com/en/signals/719052

https://www.mql5.com/en/signals/729203

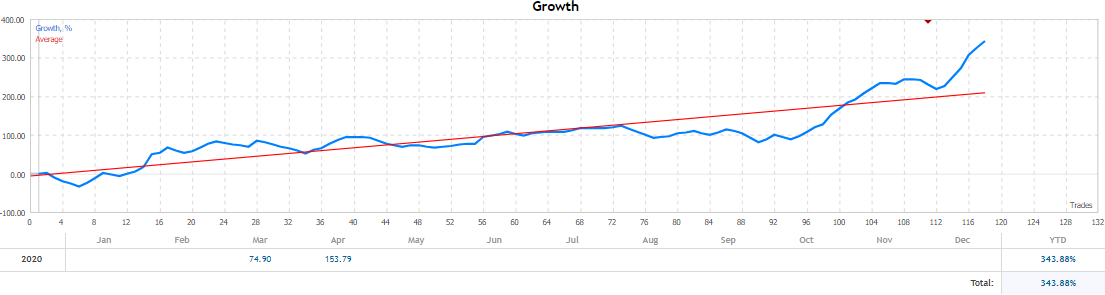

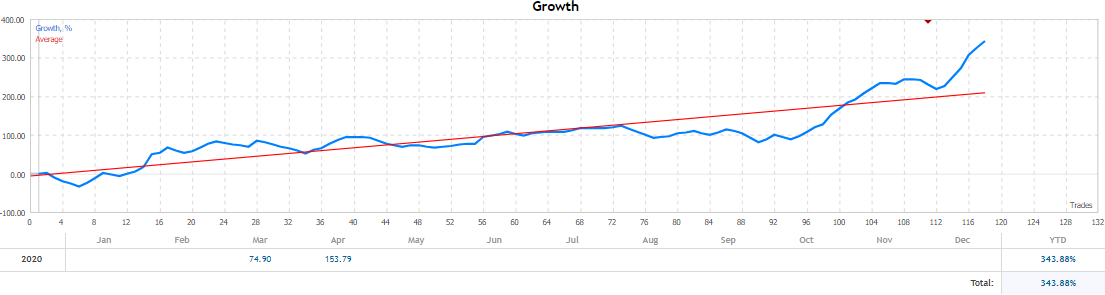

Mr.Market in recent weeks was good to me.

Add my signals to your shortlist and evaluate.

If you want to follow, remember to read the description carefully.

Stay green my friends.

https://www.mql5.com/en/signals/729203

Mr.Market in recent weeks was good to me.

Add my signals to your shortlist and evaluate.

If you want to follow, remember to read the description carefully.

Stay green my friends.

: