Gary Comey / Perfil

- Información

|

10+ años

experiencia

|

0

productos

|

0

versiones demo

|

|

0

trabajos

|

3

señales

|

786

suscriptores

|

http://www.blackwavetrader.com Soy un corredor de bolsa registrado desde 2000 cuando comencé a trabajar para Fexco Stockbroking, que desde entonces ha comprado Goodbody, uno de los corredores más grandes de Irlanda. Soy miembro del Instituto de Banqueros en Irlanda. Estoy registrado en la Sociedad de Analistas Técnicos en el Reino Unido y he trabajado en la industria durante algún tiempo, incluso en IG Group y Fidelity.

Amigos

1806

Solicitudes

Enviadas

Gary Comey

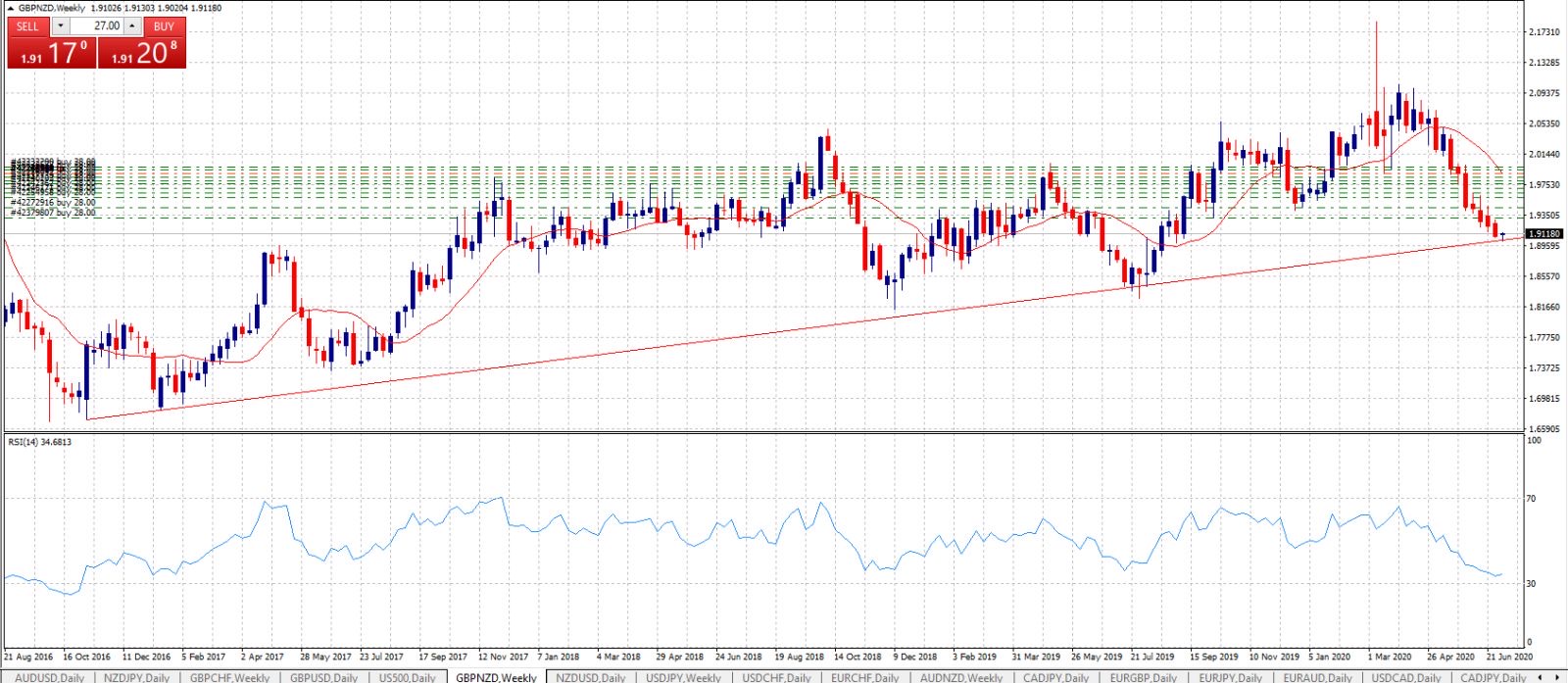

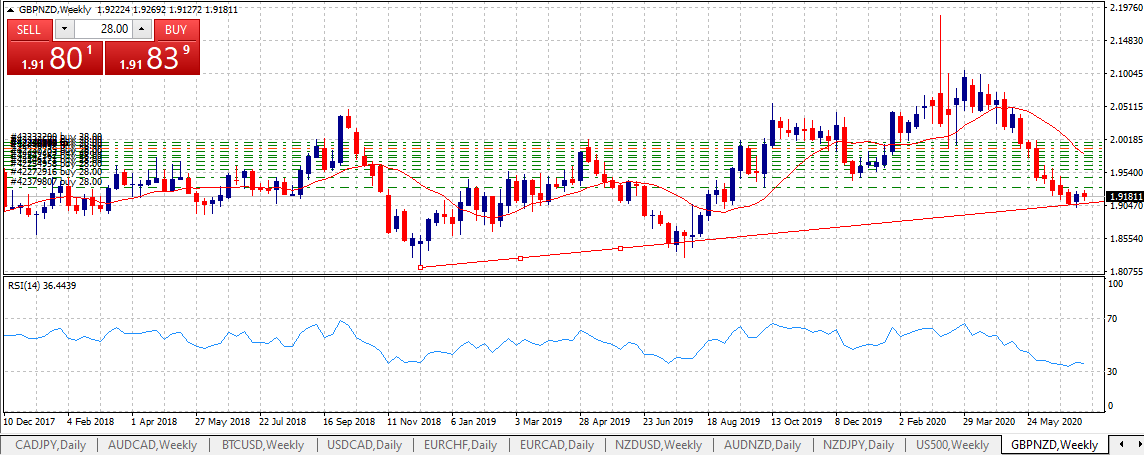

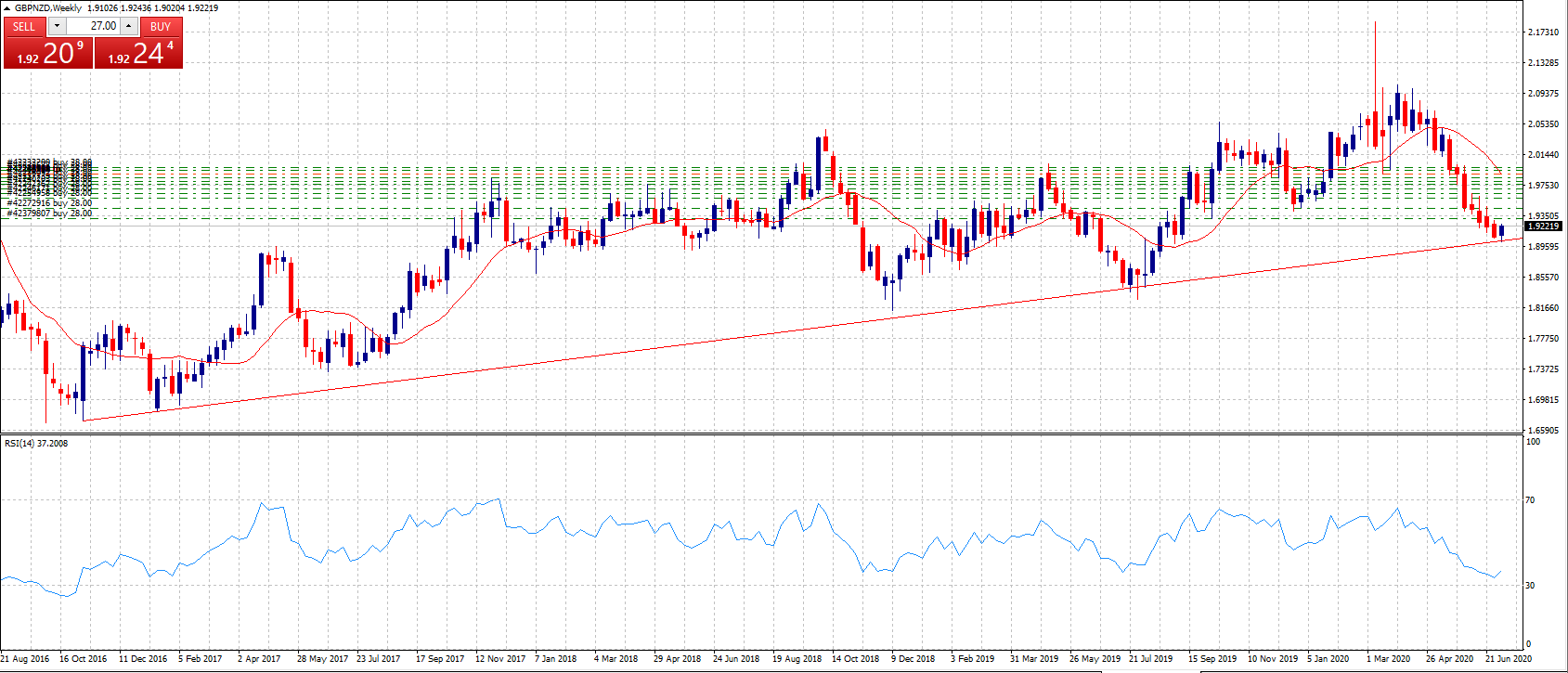

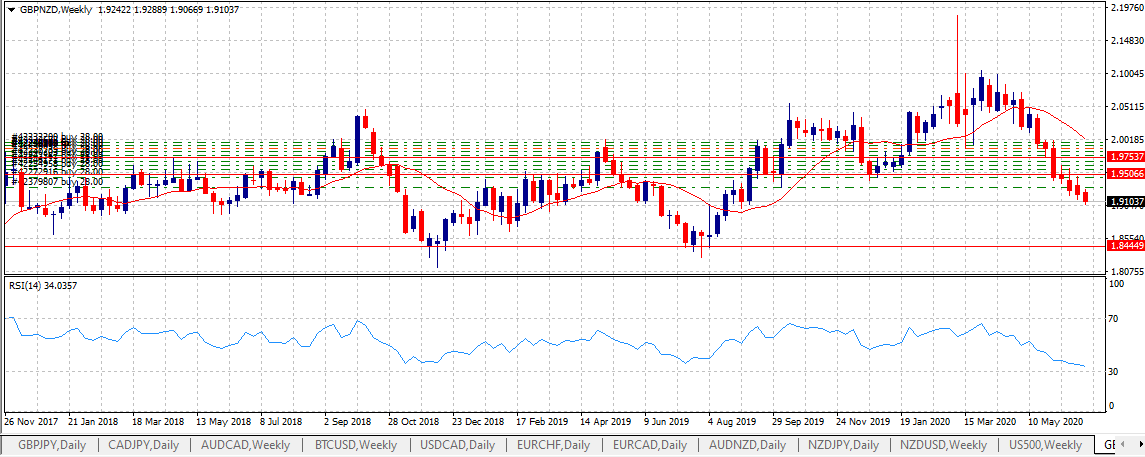

Tentative rally off longer term support continues slowly though as I said last week there can be plenty of false starts off a market "bottom" assuming a market bottom is what we got last week. After putting in a new low last week the market has tended to range sideways with an overall tighter range than in previous weeks which is interesting. The high of this weeks candle is higher than last weeks high which is a first in 11 or twelve weeks and that is interesting too. The 14 period MA is all the way higher at 1.98 and of course given enough patience the market will no doubt come back to that level and further for that matter. GBPNZD is a big mover and that can tend to exacerbate both profits and DD's (and emotions) given a fixed position size however I am happier with the stuttering move in our direction than with the previous weeks price action.

Gary Comey

So below is the latest picture. As you can see the market appears for now to be rallying off longer term support putting the drawdown back within stressed parameters. A few good days does not mean we can start picking out our new fur coat though, there are plenty of false starts in markets and picking tops or bottoms is always very difficult and fraught with errors. Tensions on the trade front are rising and some countries are partially going back into lockdown. This may be partly what's causing the weakening Kiwi as capital looks for safer assets though I think most of the move is down to Sterling strength which is stronger against the Euro and the Dollar too. A proper flight to safe assets caused for example by geopolitical tension would I think help the trade considerably. I like that GBPNZD has held up today above the Daily 14 period Moving Average for the first time in a few weeks. It may be a bit much to ask but last weeks high was 1.9288 and it would be encouraging to get and hold above it too. If we close tonight near the current level then it will be considerably less worrying than where we were at the start the week.

Gary Comey

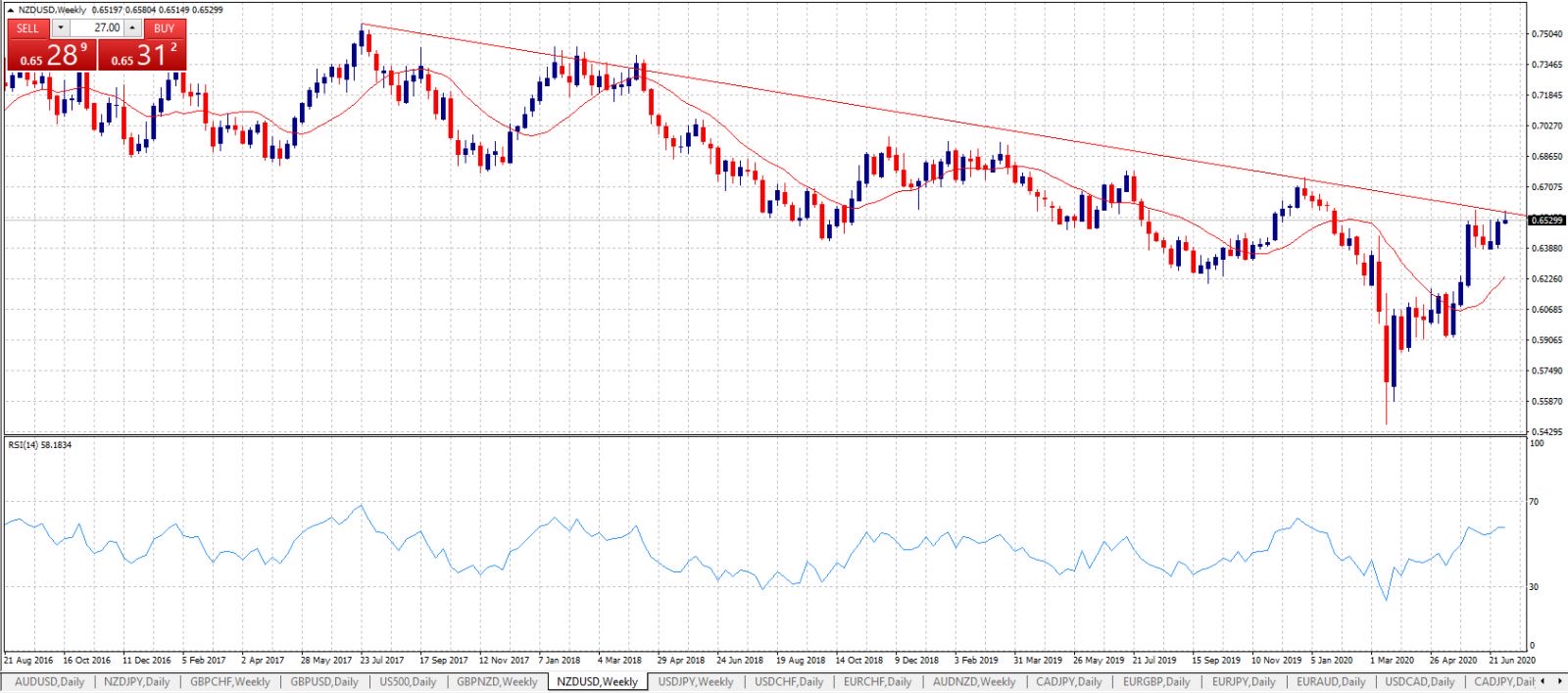

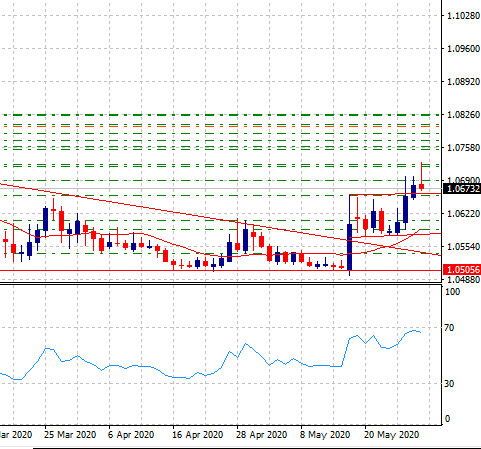

Re:Alpine: The first graph below is NZDUSD, we are not trading this pair but I wanted to highlight the level of resistance Kiwi has now met. The second is GBPNZD and we are trading that. In this second graph Sterling is the base currency but as you can see there is now some technical support at around this level for Sterling against the recently strengthening Kiwi.

There will be a U.K mini budget tomorrow with a significant stimulus element. There are some indications that the possibility of a Joe Biden win in November is now beginning to get traction. Irrespective of your politics this represents uncertainty and the NZD will weaken on uncertainty being a risk correlated asset. So therefore, we may have a coincidence of technical support and fundamental support to the trade.

The brass tax here is that looking at the high-risk Alpine clients account I have some options. Firstly, we are 700 pips from complete Armageddon in the Alpine client account and I don’t really see this market going down to 1.83 but that is a fairly large cushion so Plan A is do nothing and if the price does indeed find a bid down here then doing nothing is Plan A. So far today is a good day and we have taken out yesterday’s high and come back to within level of DD I would have predicted was possible.

IF however we approach a 60% DD in Alpine then I could cut the three biggest losing positions bought at the highest level. That would represent a 20% loss to the cash position but usefully it would bring down my average entry to circa 1.9635 and also buy us another 140 odd pips (840 in total then) before complete Armageddon. Let’s call that Plan B but Plan B is not a definite Plan but rather another tool I can use. A 20% hit to the cash would be crap and take me a few months to get back but it would give us the wiggle room to get out of the situation within a few months be back to where we began.

Obviously in a fluid market plans need to be fluid too so I don’t want to jump too far ahead with the “what if’s” about Pacific and the lower risk versions of the strategy because I think it’s better to evaluate at the time but at least there is the bones of a plan for the next two steps ahead. Hope that makes sense.

There will be a U.K mini budget tomorrow with a significant stimulus element. There are some indications that the possibility of a Joe Biden win in November is now beginning to get traction. Irrespective of your politics this represents uncertainty and the NZD will weaken on uncertainty being a risk correlated asset. So therefore, we may have a coincidence of technical support and fundamental support to the trade.

The brass tax here is that looking at the high-risk Alpine clients account I have some options. Firstly, we are 700 pips from complete Armageddon in the Alpine client account and I don’t really see this market going down to 1.83 but that is a fairly large cushion so Plan A is do nothing and if the price does indeed find a bid down here then doing nothing is Plan A. So far today is a good day and we have taken out yesterday’s high and come back to within level of DD I would have predicted was possible.

IF however we approach a 60% DD in Alpine then I could cut the three biggest losing positions bought at the highest level. That would represent a 20% loss to the cash position but usefully it would bring down my average entry to circa 1.9635 and also buy us another 140 odd pips (840 in total then) before complete Armageddon. Let’s call that Plan B but Plan B is not a definite Plan but rather another tool I can use. A 20% hit to the cash would be crap and take me a few months to get back but it would give us the wiggle room to get out of the situation within a few months be back to where we began.

Obviously in a fluid market plans need to be fluid too so I don’t want to jump too far ahead with the “what if’s” about Pacific and the lower risk versions of the strategy because I think it’s better to evaluate at the time but at least there is the bones of a plan for the next two steps ahead. Hope that makes sense.

Gary Comey

To be honest I needed a break from trading but then the market doesn't care much for what I think, I'm a flea on the back of a lion and of all markets GBPNZD is a big enough lion.

Every now and then the market growls at you and you are forced to decide is your strategy sound or not. People are always corresponding with me making suggestions/updates to my strategy and asking for my opinion of their strategies. This morning a guy wondered about hedging the position but I won't. If it's an RSI strategy and I am buying when oversold why would I sell at this level of RSI? Panic presumably but I am not.

I wouldn't be where I am if I wasn't curious about strategies but I feel I've settled on this strategy and figure it's best to become the best I can be at this strategy rather than keep moving from one to the other. Any trader I've ever known who's successful definitely does not have a new strategy every week. It's helpful to know what you're about when the proverbial sh8t hits the fan. If you were in any doubt about your strategy you would surely fold.

Above is the weekly chart of GBPNZD. As I said my strategy is basically an RSI strategy. Relative strength is a moving average oscillator and the bet is that even though the moving average obviously follows the price, the price can get too far away from the moving average from time to time either on the buy side or sell side. If you look above at lower part of the screen shot this happens from time to time. The market then always comes back to the moving average and then further which is obviously still following the price. So hey presto we buy when oversold and sell when overbought across a grid. Actually this strategy is not so healthy when you think about it because the price can really move far off the moving average crushing you before the inevitable re-tracement sparked by some piece of news or whatever. Therefore to dull the madness of this strategy I have "POSITION SIZE", in other words don't bet too much on any individual position. Over the years that's refined into HIGH, MEDIUM and LOW risk versions. Most of my money is in MEDIUM. $282K to be exact. Anyway I began buying this when close to oversold on a daily time frame. It worked fine for a while then eventually the Lion turned and bit. Now we are well into the position as per the strategy and frankly now it's a waiting game. Plenty of guys would continue to add to the position but that would be to allow the madness of the strategy to take over. Therefore I won't.

There will be lots of U.K vs E.U news in the coming weeks but I am sure if we look back soon enough the market has no doubt returned and surpassed the moving average a few times. Where will we be? I think I will have turned a profit. We've faced this wall of worry many times since 2015 and patience of a saint plus position size got us out of it. I developed the strategy and called it Blackwave because of the wave pattern of markets.

Every now and then the market growls at you and you are forced to decide is your strategy sound or not. People are always corresponding with me making suggestions/updates to my strategy and asking for my opinion of their strategies. This morning a guy wondered about hedging the position but I won't. If it's an RSI strategy and I am buying when oversold why would I sell at this level of RSI? Panic presumably but I am not.

I wouldn't be where I am if I wasn't curious about strategies but I feel I've settled on this strategy and figure it's best to become the best I can be at this strategy rather than keep moving from one to the other. Any trader I've ever known who's successful definitely does not have a new strategy every week. It's helpful to know what you're about when the proverbial sh8t hits the fan. If you were in any doubt about your strategy you would surely fold.

Above is the weekly chart of GBPNZD. As I said my strategy is basically an RSI strategy. Relative strength is a moving average oscillator and the bet is that even though the moving average obviously follows the price, the price can get too far away from the moving average from time to time either on the buy side or sell side. If you look above at lower part of the screen shot this happens from time to time. The market then always comes back to the moving average and then further which is obviously still following the price. So hey presto we buy when oversold and sell when overbought across a grid. Actually this strategy is not so healthy when you think about it because the price can really move far off the moving average crushing you before the inevitable re-tracement sparked by some piece of news or whatever. Therefore to dull the madness of this strategy I have "POSITION SIZE", in other words don't bet too much on any individual position. Over the years that's refined into HIGH, MEDIUM and LOW risk versions. Most of my money is in MEDIUM. $282K to be exact. Anyway I began buying this when close to oversold on a daily time frame. It worked fine for a while then eventually the Lion turned and bit. Now we are well into the position as per the strategy and frankly now it's a waiting game. Plenty of guys would continue to add to the position but that would be to allow the madness of the strategy to take over. Therefore I won't.

There will be lots of U.K vs E.U news in the coming weeks but I am sure if we look back soon enough the market has no doubt returned and surpassed the moving average a few times. Where will we be? I think I will have turned a profit. We've faced this wall of worry many times since 2015 and patience of a saint plus position size got us out of it. I developed the strategy and called it Blackwave because of the wave pattern of markets.

Fabio Cavalloni

2020.07.04

No doubts that you know what you are doing since years and years: your reverse strategy handled with your rules always provided big profits despite of also big drawdowns. Lot of news are coming about UK and EU also, but what will happens with a weekly candle like the one with huge spike in the past (2020.03.08) ?

You have not an hard stop loss right? I suppose that lowest red line on chart is your stop out level and highest one is average price: now we are in the middle. Of course in a very oversold market there are more possibility that it will come back but... what do you think about waiting for a weekly candle that give some signal about reversing? Now it seems you entered first trade after a big bearish weekly candle, and you continued adding trades without any confirmation outside of distance from your average price.

Think about what I said and, write to me if you want to discuss more about some ideas, I always like to talk, learn and (sometimes) teach something.

Have a nice weekend Gary!

You have not an hard stop loss right? I suppose that lowest red line on chart is your stop out level and highest one is average price: now we are in the middle. Of course in a very oversold market there are more possibility that it will come back but... what do you think about waiting for a weekly candle that give some signal about reversing? Now it seems you entered first trade after a big bearish weekly candle, and you continued adding trades without any confirmation outside of distance from your average price.

Think about what I said and, write to me if you want to discuss more about some ideas, I always like to talk, learn and (sometimes) teach something.

Have a nice weekend Gary!

[Eliminado]

2020.07.04

We only talk to show how smart we can be --- like me now, is sooo simple using this keyboard. Other people likes to produce profits, huge ones like Gary and build wealth along the bumpy road. REAL FACT: all strategies at one point in time in 100% cases will face the LION in the battle ring and you'll be forced by human nature to watch and see if your past results are built on sand with luck or have been made to stand out to last in the face of a angry crowd. This 'LION" is KING by nature and cannot forget that you are a little winner and took his place to try to be a KING like him, but guess what: will wait and wait with patience, will watch your little steps then when you are a little tired or to confident into your little actions, he will get back to you and force to fight again to test if you are a real lion or just another brave rabbit. You'll fight this kind of battles until you quit or you become a true LION.Along the time quitters must live the house. Lions should stay at the same table with other lions which made it through hard times. And this table is so tiny, it looks like a shadow: 3-5% are LIONS, the percentage difference are just met and food for this little table! Conclusion: quit or fight to win or keep your seat. Along the road I've checked: Gary is still on that table and yes, the bigger Lion is asking him to live, again. Is just a test, and Gary knows!

Gary Comey

The performance of the U.S equity market has been remarkable. I think it should get complicated for markets now that we are back close to the previous highs. With all the trillions promised I can understand how that would inflate markets but are we now to go to new highs and forget about the virus which is now causing re-openings to be delayed and postponed. Are things really THAT OKAY! For our trade to work we could definitely do with some weakness which pulls money out of the Kiwi and weakens it against the pound. There are some signs of it running into longer term resistance at least against the Greenback by about 0.6585. Lets see if the most recent lows can hold. I noticed that on the 22nd and 23rd we put in new low but finished closer to the highs on both days. Sign of a bottoming process? We will only know in retrospect.

Gary Comey

Definitely a testing enough market. Typically I was supposed to be taking a break from trading after this basket closed but it's making me pay for the break I guess. My expectation that 1.9375 was thereabouts the low was clearly wrong so as I said at the end of last weeks mail the strategy calls for control of the quantity of positions and position size and that's where we are right now. Equity markets continue to rally towards the previous highs and Sterling is having it's own issues namely bond buying by the Bank of England. So the trend is still down and the market remains oversold on multiple timeframes. Time for cool heads.

Gary Comey

Last week I wrote about the Pound though could well have mentioned the Euro or the Canadian dollar amongst a few others when I said it's "advance against the greenback has been strong which is in all sorts of trouble and losing it's safe haven status for now as again the preception of risk has declined." That story changed somewhat this week. New doubts about Covid 19 Wave No. 2 so....the S&P500 dropped and SO CALLED safe havens like the Swiss Franc, the U.S Dollar strengthened again. Not surprisingly so called riskier assets like the NZD weakened against the Pound. Round and round we go and it was starting to look good for being long GBPNZD. It didn't help us that at -20% U.K GDP monthly data was a bit worse than the -18% expected and the S&P500 has bounced a little today strengthening the NZD as will happen in this financial market ecosystem. So, we are officially still in a downtrend in GBPNZD though we may be forming a base by 1.9375 as it has rallied off that area after testing it on the 8th and 9th of June. President Clinton once said "You Can Put Wings On A Pig But That Doesn't Make It An Eagle". Perhaps the easy trade in the winged pig that is the S&P 500 is over and that is useful to know. We've had a very significant rally off the lows to the point where the S&P was nearly positive for the year which makes no sense. Things are likely to get complicated for the equity markets for a little while as we figure out what's risky and what are companies worth again. In such a scenario life for the NZD should stay complicated too hence my instinct that 1.9375 is thereabouts an attempt to form a bottom. All this is not withstanding the actual trading strategy and that the fact that the weekly 14 period MA is all the way higher at 2.02 and the market remains daily and almost weekly oversold. The strategy calls for control of the quantity of positions and the position size and buying when oversold though it would be boring to tell you that every week.

Gary Comey

Our EURCHF trade closed in profit though things moved on quickly with the GBPNZD DD I guess. I announced that a 15% cash withdrawal was perfectly fine but by the time some of you got around to requesting it things had moved on. I am keen to get out of this trade in June and when I do I am finished trading until July, my first break in trading since 2015 but hopefully a welcome "back to cash" notification for you guys. I'm going to Portugal on the 24th to sign papers for a second apartment bought by Blackwave as another asset on the balance sheet. God knows we take the risk so this is what reward feels like to me. I am looking for a very decent profit in GBPNZD but lets see how the market develops.

The Kiwi is ironically strong for the same reason the Swiss Franc weakened,namely the perception that risk has declined. I agree it has declined but to this extent I doubt, 20% unemployment, China tension and riots in the U.S? Nevertheless it's futile to agrue with the price. The other side of this pair is the Pound. It's advance against the greenback has been strong which is in all sorts of trouble and losing it's safe haven status for now as again the preception of risk has declined. It has advanced significanly and may be about to break out of resistance at circa 1.2650. Today's NFP data may be significant and the U.K's talks with the E.U perhaps less so. If it does a stronger Pound suits out trade. This mornings position may be the final one in this basket because with so many points in GBPNZD any given percentage move is a lot of points. This market is oversold hourly, 4 hourly, daily and almost weekly as it sits close to weekly support levels from the December lows. Average entry is circa 1.9750.

The Kiwi is ironically strong for the same reason the Swiss Franc weakened,namely the perception that risk has declined. I agree it has declined but to this extent I doubt, 20% unemployment, China tension and riots in the U.S? Nevertheless it's futile to agrue with the price. The other side of this pair is the Pound. It's advance against the greenback has been strong which is in all sorts of trouble and losing it's safe haven status for now as again the preception of risk has declined. It has advanced significanly and may be about to break out of resistance at circa 1.2650. Today's NFP data may be significant and the U.K's talks with the E.U perhaps less so. If it does a stronger Pound suits out trade. This mornings position may be the final one in this basket because with so many points in GBPNZD any given percentage move is a lot of points. This market is oversold hourly, 4 hourly, daily and almost weekly as it sits close to weekly support levels from the December lows. Average entry is circa 1.9750.

Gary Comey

Month: 4.93%. Week: 2.42%. EURCHF continues to recover from the significant flight to safety that's been going on all year so far. First we broke out of the wedge formation, then put in a flag type formation and today the price action has been positive with the market trading well above 1.07 and into overbought territory both daily and especially hourly. The wind has been in the sails of the Euro with positive news flow from Germany and from the Eurozone in general. Benign inflation figures leave the ECB room to be expansionary on top of the good mood music coming from Europe about expansionary fiscal policies. Right now we probably need EURCHF to work off the extreme overbought levels but next week will hopefully allow a continuation of this move higher. There are a number of data points that may allow for the move to continue. More specific German stimulus plans on Tuesday. ECB rate decision and Monetary Policy Statement and press conference on Thursday and then Non-Farm Payrolls on Friday. The upper end of this move is probably 1.08 where we begin to see more significant resistance as defined by the Aug-Sep'19 low.

Gary Comey

Week: 1.32% EURCHF: So we got that technical break out of the wedge formation I was talking about before and that was useful. From a fundamental view they say it was caused by the prospects of a vaccine and also the Franco/German stimulus plan to be presented to the rest of the Euro Group. As they say in Ireland "grand". However nothing is ever straight forward and while EURUSD initially traded from 1.08 to above 1.10 it has since declined to 1.09 dragging EURCHF with it being it's cousin so to speak. Furthermore U.S / China tensions are rising again (there's a U.S election in November) so hey presto the Franc is once more in demand. That said I am hopeful because of the technical break and I've posted the graph. This bodes well for further Franc weakness in the coming sessions notwithstanding the Hong Kong protests that will occur over the weekend. AUDNZD having broke above resistance did not have the legs to continue advancing so we closed that trade this morning with a profit as it broke back down below what had now become support. As it is weekly overbought I am selling into AUDNZD strength again this evening as it retests the same technical level. DD is now as low as it's been for quite some time as the cash continues to advance.

Gary Comey

I believe in supporting kids and investing in the future of the country. Blackwave Ltd has donated €1000 of your fees to....

https://www.gofundme.com/f/9yuctw-Good-Grub?utm_source=customer&utm_medium=copy_link&utm_campaign=m_pd+share-sheet

https://www.gofundme.com/f/9yuctw-Good-Grub?utm_source=customer&utm_medium=copy_link&utm_campaign=m_pd+share-sheet

Mostrar todos los comentarios (4)

blackcat999 lee jun hao

2020.05.20

i copy signal ,but why my deal size only 0.01? are balance too low problem?

[Eliminado]

2020.05.30

Liu EA is SCAM.Be Careful

Gary Comey

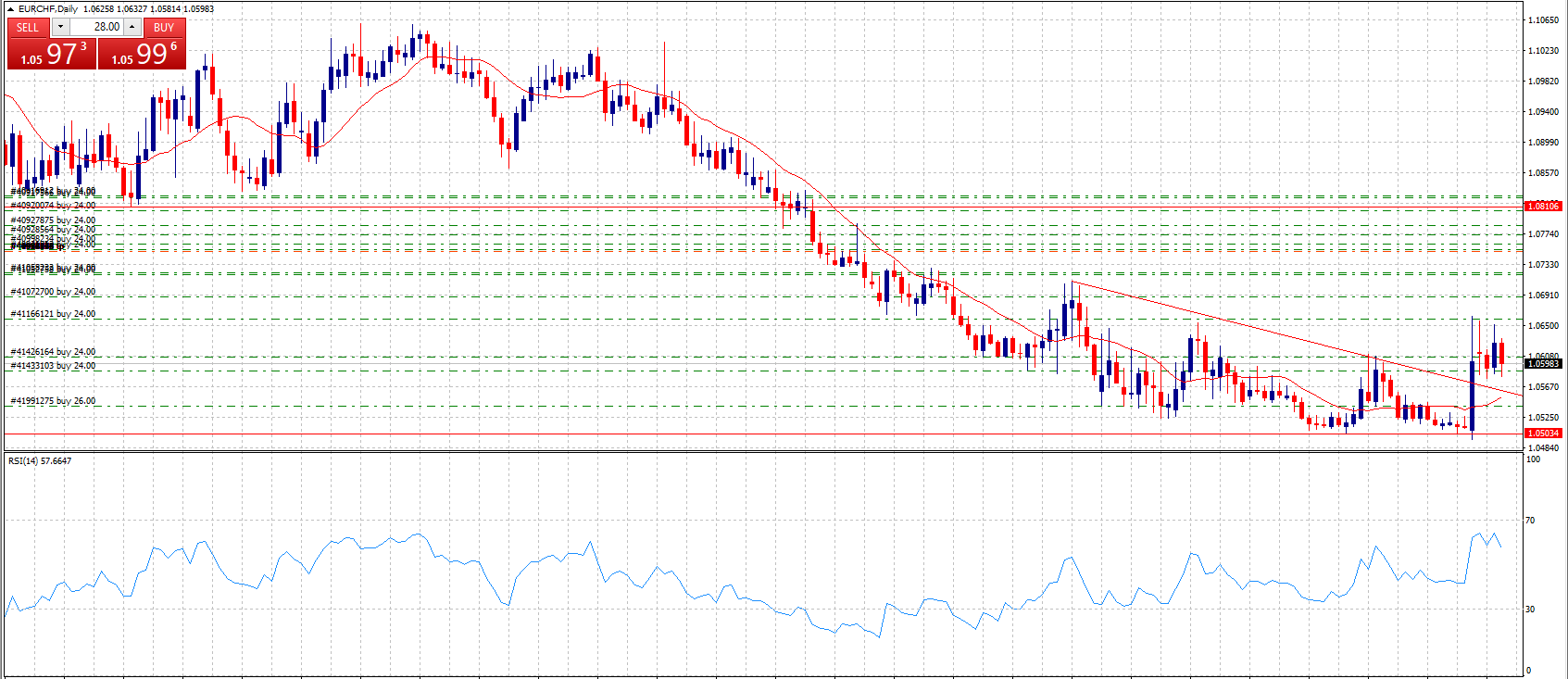

EURCHF continues it's multi-month decline with the range continuing to tighten into what looks like the apex of a wedge formation. On the one hand there are continuing flows into Switzerland by the many billions per week and at the other hand the SNB selling Francs to weaken their currency and protect their phama industry and their whole export economy also being hurt by the plague. Any time I trade EURCHF I remember the crash of 2014 when the SNB elimated the peg of 1.20 to the Euro which it had sold vast quantities of Francs to maintain. Since then it's behaviour has become more nuanced. They don't announce and level that they are prepared to defend like some sort of military strong point but sort of fight a rear guard action. Fighting, retreating and fighting again. It appears to be a more sophisticated policy. So right now 1.05 looks like where they've been fighting recently. I don't know if they will retreat but again there is the Euro element of this equation too and Christine Legarde has said they she will carry on regardless with QE policies in spite of the German court ruling this week. The point here is not so much that QE will weaken the Euro but that no QE will mean the Euro has an existential crisis and indeed the Euro did rally on her comments. Strange times! Then there is the whole virus thing and the re-opening of economies already underway. The issue is visibility. Nobody knows what a company is worth (especially when they refuse to give forward guidance) and so money is being parked in Switzerland. So on we proceed in an ever tightening range into this wedge, arguably closer to some visibility every day. AUDNZD came within perhaps 10-15 pips of closing for a profit today but it may not let us out this week. Right now close to breakeven on that trade.

Gary Comey

[Alpine] Cash April +5.33%. Week +0.84%. As I mentioned last week EURCHF was finishing on the highs and that boded well. Indeed the market did push higher this week though for the time being those higher prices are rejected and so officially the market is still in a process of putting in swing lower highs and lower lows. That said we did not get either a lower low or a higher high this week and so we are stuck hopefully in a bottoming process. The previous lower high was on March 26th at circa 1.0654 and it would be game on if we managed to get back above that in the coming sessions. The Western world is begining to talk about re-starting economies so we'll see what that does to safe haven assets. In the mean-time we've been trading other pairs and EURGBP provided the increase in cash this week.

Gary Comey

[Alpine] Week: Cash + 0.89%. EURCHF having put in yet another weekly low is finishing on the highs of the week which is actually encouraging me though the market remains oversold weekly and the range is fairly tight. A higher high in next weeks candle would probably initially target circa 1.0670 and that would indeed be progress. After that is 1.0710 and the trade is profitable. EURGBP continues to make us money and I'm a little disappointed the price action was slow enough that we could not close out a second basket of that this week. That said set-backs in the price have been limited and today is something of an inside day range wise but also a higher close than yesterday. The EURO Council of Ministers Meeting didn't give us the volatility I was hoping for but EURUSD is finishing on the highs of the day and some further Euro strength next week would be useful technically in terms of our big EURCHF trade while obviously increasing the cash further in terms of our EURGBP trade.

Gary Comey

Cash has been harder to come by this week. EURGBP's drop from weekly overbought in the high 0.94's into the high 86's took just four weeks and while not oversold the drop was fairly spectacular, puts us close to the weekly 14 period MA, and demonstrates the volatile environment we are in now. Borris Johnson lives to die another day (to quote Bond) and the pair is finding support right now in the 0.8690's in what could be the right shoulder of a head and shoulders pattern. In a sense that is all irrelevant anyway and what is more relevant is that we are 5 trades into the grid and buying after a steap decline. The action is less choppy than last week when we got quick action and profits.

EURCHF is the friend who's overstayed his welcome and just won't go fu*king home. It's now Monthly, Weekly and daily oversold and continuing to put in a series of daily swing lower highs and lower lows and is as low as it's been since 2015. Maybe it's the volatile stock market, the plague and the flight to safety or maybe it's the large red moon, it doesn't really matter I guess. When I buy something that is oversold or overbought there is always plenty of reasons and newsheadlines to prove I'm nuts.

The silverlining is this. 1. When the S&P500 bottomed in 2008 the headlines were at their worst and punters were liquidating pensions at S and P 666. When people talked about Sterling going to parity with the Euro as if it was a certainty after BREXIT, headlines were at their worst and only a fool would sell EURGBP short at 0.98.....right! I think we've past the worst headlines for COVID-19 and while the Italian economy is ruined I think we all know that too as does the ECB, solutions will have to be found even if it's E.U Federal Corona Bonds and this too shall pass. 2. The cash is going higher every month even while EURCHF refuses to ease up. This continues to provide some help with equity. The cash situation in the ALPINE account is 12% higher than on December 31st. 3. Lastly I think this has been a long view operation from the start and in that long view EURCHF is just another notable battle and will be won because of patience and position size. Every overbought bounce get sold and every oversold decline gets bought by thousands of traders yet so many of them lose money. I'm like a broken record but I think it's position size and patience. Many amateurs get bored. Boredom destroys millions of dollars.

Sorry for the long post. To quote Daniel Day Lewis in the movie Lincoln "once I start I get too lazy to stop".

EURCHF is the friend who's overstayed his welcome and just won't go fu*king home. It's now Monthly, Weekly and daily oversold and continuing to put in a series of daily swing lower highs and lower lows and is as low as it's been since 2015. Maybe it's the volatile stock market, the plague and the flight to safety or maybe it's the large red moon, it doesn't really matter I guess. When I buy something that is oversold or overbought there is always plenty of reasons and newsheadlines to prove I'm nuts.

The silverlining is this. 1. When the S&P500 bottomed in 2008 the headlines were at their worst and punters were liquidating pensions at S and P 666. When people talked about Sterling going to parity with the Euro as if it was a certainty after BREXIT, headlines were at their worst and only a fool would sell EURGBP short at 0.98.....right! I think we've past the worst headlines for COVID-19 and while the Italian economy is ruined I think we all know that too as does the ECB, solutions will have to be found even if it's E.U Federal Corona Bonds and this too shall pass. 2. The cash is going higher every month even while EURCHF refuses to ease up. This continues to provide some help with equity. The cash situation in the ALPINE account is 12% higher than on December 31st. 3. Lastly I think this has been a long view operation from the start and in that long view EURCHF is just another notable battle and will be won because of patience and position size. Every overbought bounce get sold and every oversold decline gets bought by thousands of traders yet so many of them lose money. I'm like a broken record but I think it's position size and patience. Many amateurs get bored. Boredom destroys millions of dollars.

Sorry for the long post. To quote Daniel Day Lewis in the movie Lincoln "once I start I get too lazy to stop".

Marton Papp

2020.04.18

WHy do you keep so much money on the account of your signal? Does that make sense,

Gary Comey

The $1m chip is waiting. I’m almost one third of the way.

Week: Cash +1.56%. Yet we still remain in this EURCHF DD. Pain in the ........Nevertheless the cash continues to grow while we let this pair play out. On April 13th I will 3 months into the EURCHF trade. In that period the cash is up 11.94% and recall the overnight interest on EURCHF is not onerous. One DD reminds me of previous ones. The NZDJPY DD of 2017 when I gave up after 3 months and took a loss only to see within a few weeks it would have been a profitable trade. The USDZAR DD of 2018 which was a little scary given the overnight interest and I seriously considered hedging but decided that was not the strategy. I think the brass tax of this is that it all comes down to the strategy. Does it work? I feel it does and this weeks cash proves it. We are at 4.4% in the middle of the month! Volatility has been our friend in CADJPY and then EURGBP as it should in grid strategy.

Week: Cash +1.56%. Yet we still remain in this EURCHF DD. Pain in the ........Nevertheless the cash continues to grow while we let this pair play out. On April 13th I will 3 months into the EURCHF trade. In that period the cash is up 11.94% and recall the overnight interest on EURCHF is not onerous. One DD reminds me of previous ones. The NZDJPY DD of 2017 when I gave up after 3 months and took a loss only to see within a few weeks it would have been a profitable trade. The USDZAR DD of 2018 which was a little scary given the overnight interest and I seriously considered hedging but decided that was not the strategy. I think the brass tax of this is that it all comes down to the strategy. Does it work? I feel it does and this weeks cash proves it. We are at 4.4% in the middle of the month! Volatility has been our friend in CADJPY and then EURGBP as it should in grid strategy.

[Eliminado]

2020.04.14

Gary Comey

Every time I accumulate another $10K in trading capital I take a poker chip from the box and put it on top of the stack. Added my 29th this morning. I think in 2015 I hardly had one chip.

The trading action has been quick in the last 24 hours as the price of oil rose and pulled up the Loonie with it. EURCHF declines are now quite prolonged however the overnight SWAPS are easily affordable. One or two pips will pay for them so it's not like the prolonged DD I had in 2018 in USDZAR where the overnight SWAPS were very expensive causing me to later alter the trading plan to exclude Exotic pairs in future. I think there is still too much fog in relation to global economies and that is why the Franc remains well bid.

I’m definitely happy to be almost at 3% so early in the month.

The trading action has been quick in the last 24 hours as the price of oil rose and pulled up the Loonie with it. EURCHF declines are now quite prolonged however the overnight SWAPS are easily affordable. One or two pips will pay for them so it's not like the prolonged DD I had in 2018 in USDZAR where the overnight SWAPS were very expensive causing me to later alter the trading plan to exclude Exotic pairs in future. I think there is still too much fog in relation to global economies and that is why the Franc remains well bid.

I’m definitely happy to be almost at 3% so early in the month.

Gary Comey

2020.04.09

Kilmartin, Blackwave Pacific trades 0.01 lots per $1700. You need you alter leverage to achieve that.

Gary Comey

2020.04.09

My mistake. Spell check 🙄. Kllm Blackwave Pacific trades 0.01 lots per $1700. You need you alter leverage to achieve that.

Gary Comey

[ALPINE] Week: Cash +2.11%. Recent oversold conditions have been somewhat rectified allowing me to take some profit in CADJPY as the price of oil somewhat recovered and the fear factor somewhat eased as governments and central banks again print their way out of trouble like they did in 2008/9/10.

The DD is reduced but volatile and sensitive to the pandemic fears. The next shoe to drop could be Italian debt but I guess that's always been a problem. EURCHF is a barometer of fear and stress and while the Franc remains strong the SWAPS in this are not too burdensome for our weekly oversold EURCHF position. What I am thinking here is that the volatility around equity markets and by extension currency markets may give us opportunities. The last time I thought that I bought CADJPY and OPEC collapsed over the weekend weakening the Canadian Dollar so influenced by the price of oil. OPEC is unlikely to collapse again this weekend having already done so and I am long CADJPY again. Indeed if Saudi and Russia come to a truce over a weekend we could benefit from a gap UP. However I am not depending on that but rather just the volatility which in theory at least is good for a grid strategy.

The DD is reduced but volatile and sensitive to the pandemic fears. The next shoe to drop could be Italian debt but I guess that's always been a problem. EURCHF is a barometer of fear and stress and while the Franc remains strong the SWAPS in this are not too burdensome for our weekly oversold EURCHF position. What I am thinking here is that the volatility around equity markets and by extension currency markets may give us opportunities. The last time I thought that I bought CADJPY and OPEC collapsed over the weekend weakening the Canadian Dollar so influenced by the price of oil. OPEC is unlikely to collapse again this weekend having already done so and I am long CADJPY again. Indeed if Saudi and Russia come to a truce over a weekend we could benefit from a gap UP. However I am not depending on that but rather just the volatility which in theory at least is good for a grid strategy.

: