Gary Comey / Профиль

- Информация

|

11+ лет

опыт работы

|

0

продуктов

|

0

демо-версий

|

|

0

работ

|

2

сигналов

|

774

подписчиков

|

http://www.blackwavetrader.com Я являюсь зарегистрированным биржевым брокером с 2000 года, когда начал работать в Fexco Stockbroking, которая с тех пор купила Goodbody, одного из крупнейших ирландских брокеров. Я являюсь членом Института банкиров в Ирландии. Я зарегистрирован в Обществе технических аналитиков в Великобритании и некоторое время работал в отрасли, в том числе в IG Group и Fidelity.

Друзья

1802

Заявки

Исходящие

Gary Comey

Опубликовал MetaTrader 4 сигнал

Blackwave Plus — это системная торговая стратегия с акцентом на контроль риска и стабильность. Используются количественные модели, диверсификация по валютным парам и адаптивное управление позициями. Основная цель — сохранение капитала и последовательный рост

Gary Comey

We’re now back into the rhythm of our regular weekly updates. The first full trading week of January saw capital increase by 0.24%, achieved primarily through the CHFJPY and GBPUSD EAs, both of which kept trading tight, controlled, and fully automated.

It’s a small number by design, but an important one. Early January liquidity is rarely generous, and the priority at this stage of the year is not acceleration but stability. The EAs did exactly what they were intended to do: participate selectively, manage risk, and step aside when conditions didn’t warrant exposure. I was almost sure we would get more action around non-farm payrolls on Friday but alas the only action was CHFJPY and that was early in the morning before the release.

2026 marks an important milestone internally. This is year ten for the upgraded Blackwave California framework and year three for the upgraded Blackwave Pacific. While the underlying philosophy remains unchanged, the current generation of EAs has been materially enhanced using artificial intelligence — not to make them more aggressive, but to make them more adaptive, robust, and consistent across changing market conditions.

At this stage, the work is less about invention and more about execution. The systems are built, tested, and understood. The task now is simply to let them operate, monitor risk, and allow time and compounding to do what they tend to do best when left undisturbed.

There are a few manual trades that I am looking to get out of too, namely AUDCHF and AUDNZD are top of the list . AUDCHF is knocking on 0.5350-0.54 again. Those positive SWAPs are massive now and represent about 3-3.5% of the value of the account itself which is great! Both AUDNZD positions have negative SWAP’s but I won’t be adding here unless I see that we have reduced risk elsewhere by exiting other manual trades. Indeed, even reduced risk elsewhere might not prompt me to add anything to AUDNZD. I am not in any hurry really. The market will be ready when it’s ready and in the meantime the EA’s are doing a fantastic job increasing equity.

I wish you all a positive week to come and I hope those New Year resolutions include your financial goals too.

Gary

https://www.blackwave-forextrader.com

It’s a small number by design, but an important one. Early January liquidity is rarely generous, and the priority at this stage of the year is not acceleration but stability. The EAs did exactly what they were intended to do: participate selectively, manage risk, and step aside when conditions didn’t warrant exposure. I was almost sure we would get more action around non-farm payrolls on Friday but alas the only action was CHFJPY and that was early in the morning before the release.

2026 marks an important milestone internally. This is year ten for the upgraded Blackwave California framework and year three for the upgraded Blackwave Pacific. While the underlying philosophy remains unchanged, the current generation of EAs has been materially enhanced using artificial intelligence — not to make them more aggressive, but to make them more adaptive, robust, and consistent across changing market conditions.

At this stage, the work is less about invention and more about execution. The systems are built, tested, and understood. The task now is simply to let them operate, monitor risk, and allow time and compounding to do what they tend to do best when left undisturbed.

There are a few manual trades that I am looking to get out of too, namely AUDCHF and AUDNZD are top of the list . AUDCHF is knocking on 0.5350-0.54 again. Those positive SWAPs are massive now and represent about 3-3.5% of the value of the account itself which is great! Both AUDNZD positions have negative SWAP’s but I won’t be adding here unless I see that we have reduced risk elsewhere by exiting other manual trades. Indeed, even reduced risk elsewhere might not prompt me to add anything to AUDNZD. I am not in any hurry really. The market will be ready when it’s ready and in the meantime the EA’s are doing a fantastic job increasing equity.

I wish you all a positive week to come and I hope those New Year resolutions include your financial goals too.

Gary

https://www.blackwave-forextrader.com

Gary Comey

Good morning,As we move toward year-end, we currently stand at 26.63% capital gain for the year, with three effective Forex trading days remaining before markets pause again for New Year’s Day.It’s important to be transparent: open positions are carrying a 10–12% drawdown, which places current equity growth closer to 15–17%. That still slightly outperforms the S&P 500, and—more importantly—there is every chance that capital gain can convert into realised equity given the time required for the strategy to fully play out. Patience remains part of the process.

If you’ve been following me for any length of time, you’ll know I have a very clear priority for 2026:to add another apartment to the Bluewave portfolio.A few weeks ago, I took €14,000 of Airbnb income and added it directly to my trading capital. The reason is simple: the larger the capital base, the more of the heavy lifting is done by time and compounding, rather than effort.In Dubai, apartments are typically purchased using state-backed developer payment plans. You might put down roughly 24% in the first 60 days, followed by 1% per month, with occasional larger installments.

For off-plan properties, handover is often 2–3 years away, after which the apartment can go straight onto Airbnb and begin earning its keep. The entire purchase can usually be completed within eight years.At that point, Bluewave owns another small square on the Monopoly board — one that pays rent every time we pass go.This idea ties directly into Episode 9 of the Blackwave Mindset podcast, where we discuss what I call the circular system:Blackwave grows capital through forex tradingThat capital is used to acquire real assetsThose assets generate predictable cash flowThat cash flow can then be reinvested back into BlackwaveRound and round we go — deliberately.

It’s the same principle described in The Richest Man in Babylon:make each gold piece earn, and let its children earn, and its children’s children earn.This is not about chasing trades. It’s about building a system where money works harder than you do.If this approach resonates with you, I’ll be opening space for new investors in 2026.The minimum investment is €10,000 — not out of exclusivity, but realism. Anything less is unlikely to materially change your life or mine.As always, thank you for your continued trust and patience.— Gary

https://www.blackwave-forextrader.com

If you’ve been following me for any length of time, you’ll know I have a very clear priority for 2026:to add another apartment to the Bluewave portfolio.A few weeks ago, I took €14,000 of Airbnb income and added it directly to my trading capital. The reason is simple: the larger the capital base, the more of the heavy lifting is done by time and compounding, rather than effort.In Dubai, apartments are typically purchased using state-backed developer payment plans. You might put down roughly 24% in the first 60 days, followed by 1% per month, with occasional larger installments.

For off-plan properties, handover is often 2–3 years away, after which the apartment can go straight onto Airbnb and begin earning its keep. The entire purchase can usually be completed within eight years.At that point, Bluewave owns another small square on the Monopoly board — one that pays rent every time we pass go.This idea ties directly into Episode 9 of the Blackwave Mindset podcast, where we discuss what I call the circular system:Blackwave grows capital through forex tradingThat capital is used to acquire real assetsThose assets generate predictable cash flowThat cash flow can then be reinvested back into BlackwaveRound and round we go — deliberately.

It’s the same principle described in The Richest Man in Babylon:make each gold piece earn, and let its children earn, and its children’s children earn.This is not about chasing trades. It’s about building a system where money works harder than you do.If this approach resonates with you, I’ll be opening space for new investors in 2026.The minimum investment is €10,000 — not out of exclusivity, but realism. Anything less is unlikely to materially change your life or mine.As always, thank you for your continued trust and patience.— Gary

https://www.blackwave-forextrader.com

Gary Comey

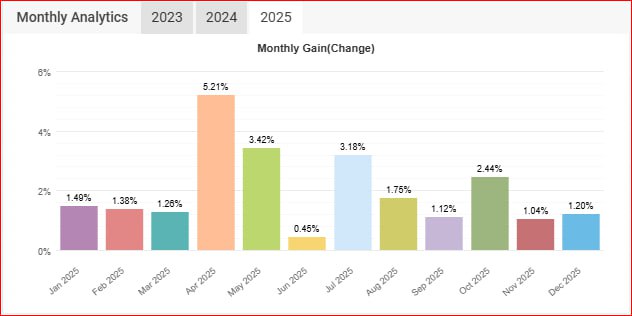

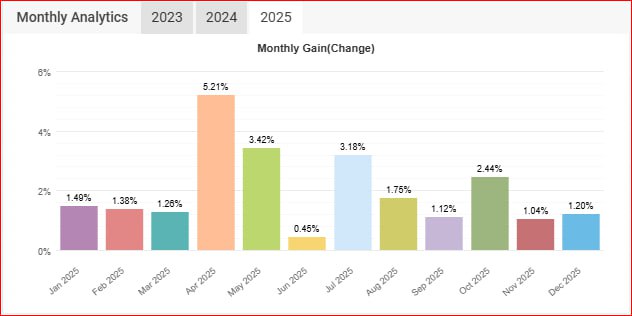

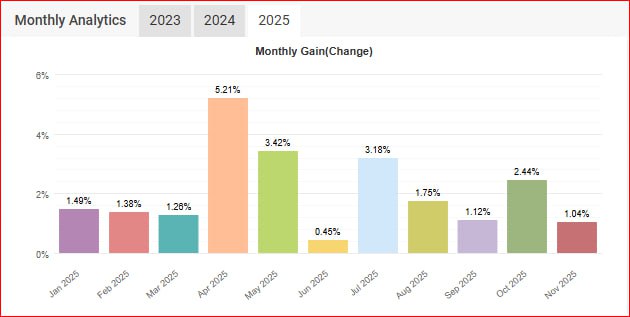

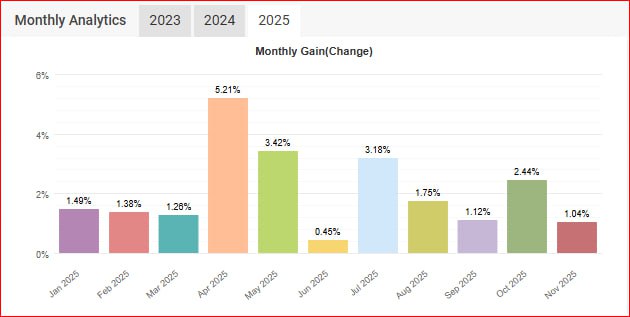

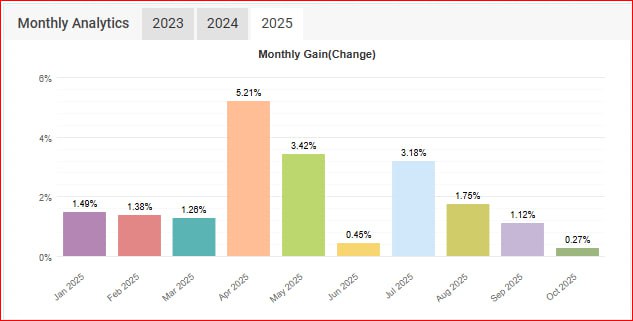

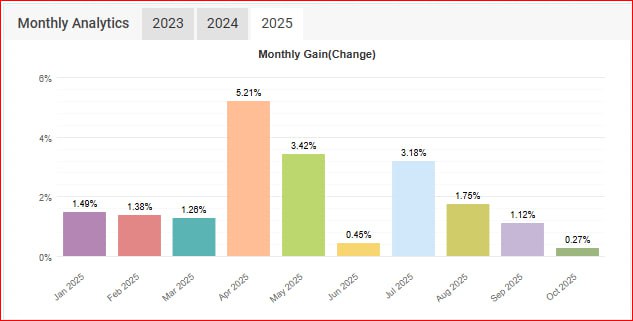

As at 19 December we’re at 26.48% YTD capital growth, with December up 1.08% so far. With shortened trading weeks ahead, activity will naturally thin out, but I remain attentive where required — and the EAs, of course, never switch off.

What’s going particularly well is the EA architecture itself. I’m actually looking forward to the demo account reaching an 8% drawdown (if and when it happens), as it will allow clients to see the H4 Guardian doing exactly what it was designed to do: protect equity decisively, then step back cleanly once drawdown contracts below 6%.

AUDCHF has tested patience again, getting close to profit before pulling back. That’s frustrating, but the broader structure remains constructive, with higher highs and higher lows on the weekly chart and a measured move above 0.54 still very much in play. This pair traded at 0.57 this time last year.

I continue to refine and improve the strategy, and I expect to have more to say on this in January. That said, it’s important not to underestimate the depth of work already embedded here — over 10 years of manual trading experience, now reinforced by AI-reviewed code and disciplined risk structuring.

As ever, steady, methodical progress.

Finally as this is my last weekly update before Christmas I wish you all a happy Christmas. Frankly it's a difficult time of year for many families and if that is true for you then I particularly wish you some peace and absolutely some goodwill. Then I wish for you what I will wish for myself...lots of money and perhaps turning more risky forex into stable assets in 2026.

https://www.blackwave-forextrader.com

What’s going particularly well is the EA architecture itself. I’m actually looking forward to the demo account reaching an 8% drawdown (if and when it happens), as it will allow clients to see the H4 Guardian doing exactly what it was designed to do: protect equity decisively, then step back cleanly once drawdown contracts below 6%.

AUDCHF has tested patience again, getting close to profit before pulling back. That’s frustrating, but the broader structure remains constructive, with higher highs and higher lows on the weekly chart and a measured move above 0.54 still very much in play. This pair traded at 0.57 this time last year.

I continue to refine and improve the strategy, and I expect to have more to say on this in January. That said, it’s important not to underestimate the depth of work already embedded here — over 10 years of manual trading experience, now reinforced by AI-reviewed code and disciplined risk structuring.

As ever, steady, methodical progress.

Finally as this is my last weekly update before Christmas I wish you all a happy Christmas. Frankly it's a difficult time of year for many families and if that is true for you then I particularly wish you some peace and absolutely some goodwill. Then I wish for you what I will wish for myself...lots of money and perhaps turning more risky forex into stable assets in 2026.

https://www.blackwave-forextrader.com

Gary Comey

Weekly Update

Capital growth now sits at 25.92% YTD. A steady week overall with the EA’s in and out of GBPUSD and CHFJPY, trading cleanly and without drama.

AUDCHF continues to test patience — back around 0.5300 after trading up to 0.5380 earlier in the week. Still targeting profit above 0.5400, with the positive swaps continuing to work in our favour. Hopefully the finish line on that trade is now in sight.

Steady, disciplined trading as we head towards year-end. https://www.blackwave-forextrader.com

Capital growth now sits at 25.92% YTD. A steady week overall with the EA’s in and out of GBPUSD and CHFJPY, trading cleanly and without drama.

AUDCHF continues to test patience — back around 0.5300 after trading up to 0.5380 earlier in the week. Still targeting profit above 0.5400, with the positive swaps continuing to work in our favour. Hopefully the finish line on that trade is now in sight.

Steady, disciplined trading as we head towards year-end. https://www.blackwave-forextrader.com

Gary Comey

Weekly Update

2025 capital growth now stands at 25.52% with three weeks left in the year. Happy with the numbers — this is exactly where steady compounding begins to show its strength.

For context:

• AIB 30-day notice deposit: 1.5% per year

• S&P 500 YTD: 13.8%

Blackwave continues to outperform both with controlled risk and a calm trading profile.

The dual-engine strategy is running smoothly: hedging activates at 8% DD, adds incremental gains, and then withdraws again below 6% with no footprint. Light-touch, simple, and powerful — exactly what it was designed to be.

From here, the plan is the same: keep things stable, avoid noise, and let compounding do the heavy lifting.

I am running the EA's in seven managed accounts across three brokers. Sometimes the timing is a little different in say IC Markets vs Blackwell but it's a powerful dual engine either way. Close to TP on GBPUSD and if you are following the demo, close to TP on CHFJPY & GBPUSD. After next week things will quieten down but hey...25-26% is likely where we finish the year and if you could have offered me that in January I would have taken your hand off. 25% per year over 5 years for example is not 125% by the way,,,,it's more like 3x.

Join the demo and at zero cost see for yourself: https://www.blackwave-forextrader.com

2025 capital growth now stands at 25.52% with three weeks left in the year. Happy with the numbers — this is exactly where steady compounding begins to show its strength.

For context:

• AIB 30-day notice deposit: 1.5% per year

• S&P 500 YTD: 13.8%

Blackwave continues to outperform both with controlled risk and a calm trading profile.

The dual-engine strategy is running smoothly: hedging activates at 8% DD, adds incremental gains, and then withdraws again below 6% with no footprint. Light-touch, simple, and powerful — exactly what it was designed to be.

From here, the plan is the same: keep things stable, avoid noise, and let compounding do the heavy lifting.

I am running the EA's in seven managed accounts across three brokers. Sometimes the timing is a little different in say IC Markets vs Blackwell but it's a powerful dual engine either way. Close to TP on GBPUSD and if you are following the demo, close to TP on CHFJPY & GBPUSD. After next week things will quieten down but hey...25-26% is likely where we finish the year and if you could have offered me that in January I would have taken your hand off. 25% per year over 5 years for example is not 125% by the way,,,,it's more like 3x.

Join the demo and at zero cost see for yourself: https://www.blackwave-forextrader.com

Gary Comey

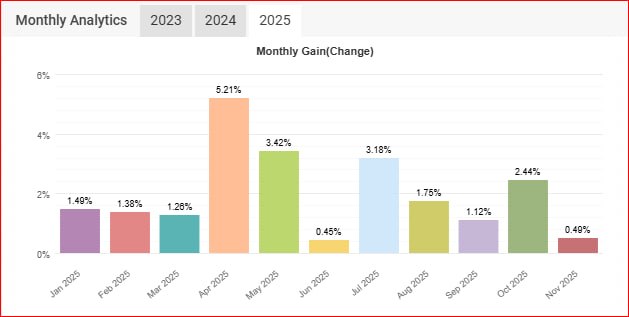

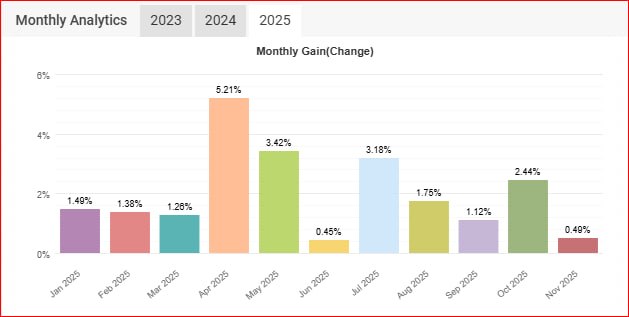

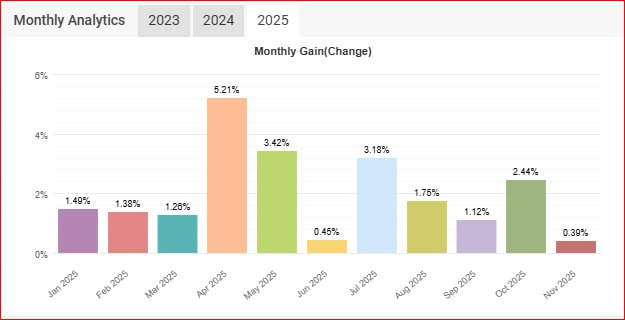

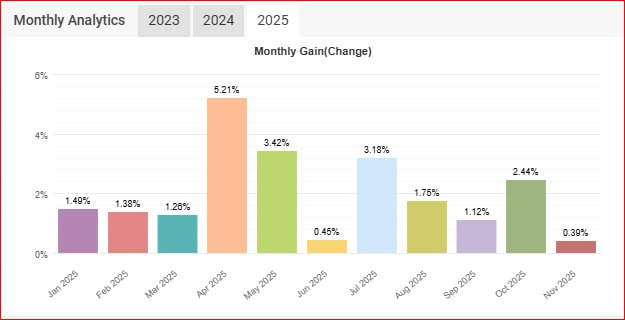

November 1% so now we enter December with capital up 25.13% YTD and four weeks to go. When we look back on the year it will have been good I think. I am happy enough with 25% so everything else is just Christmas cake from here on. Once trading remains stable and slightly boring then we are managing capital the way it should be managed. The EA's are sitting in the long grass waiting as always for either an entry or a TP. Welcome to my clients in the process of setting up and/or transferring money in. I said to a client last night and it's true for us all "think about what your objective is for the money. If you’re clear on what you want it to achieve — growth, income, a future purchase, or simply building capital — it usually becomes much easier to know what level you really want to invest. Confidence plays a part, of course, but clarity of purpose normally makes the decision obvious."

Looking ahead, December is usually a quieter month — thinner markets, fewer trading days, and a general winding down across the industry. That suits us. Stability is the goal. Boring is the goal. We’ve had our strong periods this year, some dips, some recovery, and now we’re in that phase where good stewardship matters more than anything dramatic.

The systems are doing exactly what they’re built to do: wait. They step forward only when the conditions line up and they step back when the market isn’t offering clean opportunities. It’s the same discipline I want the wider portfolio to reflect as we close out the year.

To those setting up new accounts or transferring funds in: welcome aboard. You’re joining at a clean point in the calendar.

As always, I appreciate everyone’s trust. Let’s finish the year quietly, sensibly, and with the confidence that 2026 will give us new opportunities to build on what we’ve done. https://www.blackwave-forextrader.com

Looking ahead, December is usually a quieter month — thinner markets, fewer trading days, and a general winding down across the industry. That suits us. Stability is the goal. Boring is the goal. We’ve had our strong periods this year, some dips, some recovery, and now we’re in that phase where good stewardship matters more than anything dramatic.

The systems are doing exactly what they’re built to do: wait. They step forward only when the conditions line up and they step back when the market isn’t offering clean opportunities. It’s the same discipline I want the wider portfolio to reflect as we close out the year.

To those setting up new accounts or transferring funds in: welcome aboard. You’re joining at a clean point in the calendar.

As always, I appreciate everyone’s trust. Let’s finish the year quietly, sensibly, and with the confidence that 2026 will give us new opportunities to build on what we’ve done. https://www.blackwave-forextrader.com

Gary Comey

24.45% YTD, which is solid, but this month hasn’t had the same bite as last month — that’s just the nature of the game. The DD bounced around during the week but finished in a healthy enough place.

I added another €14,000 of my own capital into Blackwave. Always important to have skin in the game.

AUD/CHF continues to test patience. If we can finally clear 0.53 and hold, then 0.54 isn’t a big ask. We keep revisiting 0.53 — sooner or later (it feels like later) that old door gives way.

The EAs are working away in the background and we were in and out of GBPUSD during the week. CHFJPY has a small DD but began turning back in our favour on Friday.

On the personal front: the Dubai brokers are burning up my phone since I made property enquiries. I’m not ready yet, but I did book a one-bed near the Marina for a week in February. Time to put boots on the ground and get a proper feel for the place.

https://www.blackwave-forextrader.com

I added another €14,000 of my own capital into Blackwave. Always important to have skin in the game.

AUD/CHF continues to test patience. If we can finally clear 0.53 and hold, then 0.54 isn’t a big ask. We keep revisiting 0.53 — sooner or later (it feels like later) that old door gives way.

The EAs are working away in the background and we were in and out of GBPUSD during the week. CHFJPY has a small DD but began turning back in our favour on Friday.

On the personal front: the Dubai brokers are burning up my phone since I made property enquiries. I’m not ready yet, but I did book a one-bed near the Marina for a week in February. Time to put boots on the ground and get a proper feel for the place.

https://www.blackwave-forextrader.com

Gary Comey

Good evening all. 0.39% so far in November. I added some short AUDNZD manual trades in the live accounts last week. Right now the trend is strong but Kiwi is close to support against the greenback and AUDNZD is at significant resistance and obviously way overbought. It won't take much of a pull back to make our November but in the mean-time the plucky EA's are continuing to perform well as you can see from the automated post to Telegram directly from the EA's themselves in the moment of the trade being executed or closed. https://www.blackwave-forextrader.com

Gary Comey

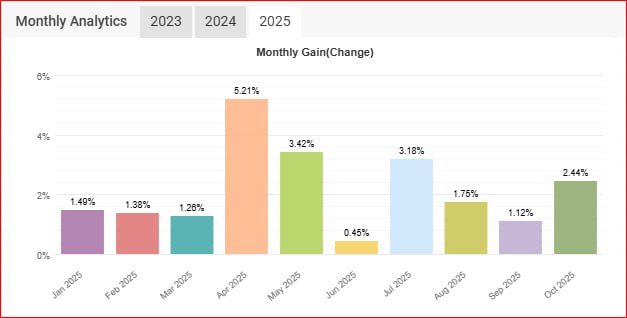

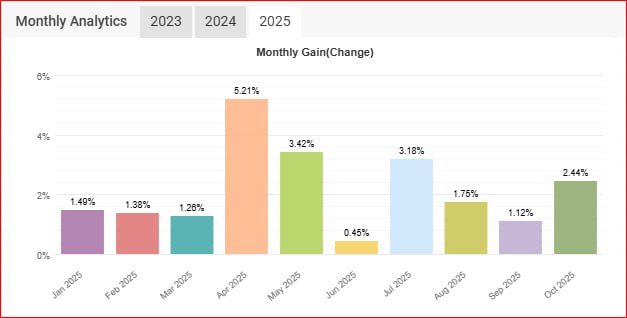

Good morning. October done.Cash up 2.44% this month and 23.84% year-to-date.

I’ve also added a small deposit to my own Blackwave Pacific account — just under 1%, so not huge, but it’s in the right direction. The first goal is €70K, then €100K, and after that I’ll figure it out further.

Right now, I’ve had six poker chips sitting on my desk for a year. Each one represents €10,000 of Blackwave’s own capital in play. It’s been like this because of withdrawals, not lack of progress. But withdrawals are paused — and this morning, a small deposit. Between Blackwave Pacific and Blackwave California I am not far off a seventh poker chip now.

It’s a modest win, but they all add up. I know they add up because the last time I began this same process, I ended up with sixty poker chips and two apartments in Portugal.

I’d also like to thank two of my clients who increased their investments quite significantly this week. It’s appreciated.

Let’s keep it nice and methodical — build, build, build. No big deal. https://www.blackwave-forextrader.com

I’ve also added a small deposit to my own Blackwave Pacific account — just under 1%, so not huge, but it’s in the right direction. The first goal is €70K, then €100K, and after that I’ll figure it out further.

Right now, I’ve had six poker chips sitting on my desk for a year. Each one represents €10,000 of Blackwave’s own capital in play. It’s been like this because of withdrawals, not lack of progress. But withdrawals are paused — and this morning, a small deposit. Between Blackwave Pacific and Blackwave California I am not far off a seventh poker chip now.

It’s a modest win, but they all add up. I know they add up because the last time I began this same process, I ended up with sixty poker chips and two apartments in Portugal.

I’d also like to thank two of my clients who increased their investments quite significantly this week. It’s appreciated.

Let’s keep it nice and methodical — build, build, build. No big deal. https://www.blackwave-forextrader.com

Gary Comey

October 1.81% with a week to go. Over the past two years, the climb has been tough but useful. I’ve continued refining both my trading systems and my own discipline, and the results are beginning to show with new client deposits.

I’ve recently paused withdrawals to let equity growth run its course. Even though AUDCHF dipped back below 0.52, my equity position is again trending toward the upper end of its recent range. With the newly developed EAs — built on my own strategy and enhanced through AI — I expect the performance curve to strengthen.

Client capital now represents around 15% of what it was in the early days, and I want to acknowledge those clients for their quiet confidence. We’re on this journey together — a second Ironman of sorts — and I remain committed to rewarding that trust.

When AUDCHF inevitably closes, I anticipate equity should rise by roughly another 15%. My next personal milestone remains €100,000 in Blackwave Pacific (around $10,000 in Blackwave California) — the point where compounding really begins to take over. https://www.blackwave-forextrader.com

I’ve recently paused withdrawals to let equity growth run its course. Even though AUDCHF dipped back below 0.52, my equity position is again trending toward the upper end of its recent range. With the newly developed EAs — built on my own strategy and enhanced through AI — I expect the performance curve to strengthen.

Client capital now represents around 15% of what it was in the early days, and I want to acknowledge those clients for their quiet confidence. We’re on this journey together — a second Ironman of sorts — and I remain committed to rewarding that trust.

When AUDCHF inevitably closes, I anticipate equity should rise by roughly another 15%. My next personal milestone remains €100,000 in Blackwave Pacific (around $10,000 in Blackwave California) — the point where compounding really begins to take over. https://www.blackwave-forextrader.com

Gary Comey

A client I met at a birthday party last week smiled and said, “I notice my balance is creeping higher.”

That, in essence, sums up the current tone of trading — steady, deliberate progress.

We’re sitting at +1% for the month with two full trading weeks still ahead, and +22.07% for the year with roughly ten weeks to run. In fund management terms, that’s a decent showing — consistent, measured growth without drama.

In a year when the S&P 500 has delivered such eye-catching returns, it’s easy to forget that foreign exchange is not designed to follow equity cycles. It’s an entirely different ecosystem — a place where capital works independently of stocks, bonds, or real estate. That’s precisely why a Blackwave managed account can complement a well-diversified portfolio rather than compete with it.

And as the song says, “It’s beginning to look a lot like Christmas.”

By the time it arrives, it should also be beginning to look a lot like >25%.

https://www.blackwave-forextrader.com

That, in essence, sums up the current tone of trading — steady, deliberate progress.

We’re sitting at +1% for the month with two full trading weeks still ahead, and +22.07% for the year with roughly ten weeks to run. In fund management terms, that’s a decent showing — consistent, measured growth without drama.

In a year when the S&P 500 has delivered such eye-catching returns, it’s easy to forget that foreign exchange is not designed to follow equity cycles. It’s an entirely different ecosystem — a place where capital works independently of stocks, bonds, or real estate. That’s precisely why a Blackwave managed account can complement a well-diversified portfolio rather than compete with it.

And as the song says, “It’s beginning to look a lot like Christmas.”

By the time it arrives, it should also be beginning to look a lot like >25%.

https://www.blackwave-forextrader.com

Gary Comey

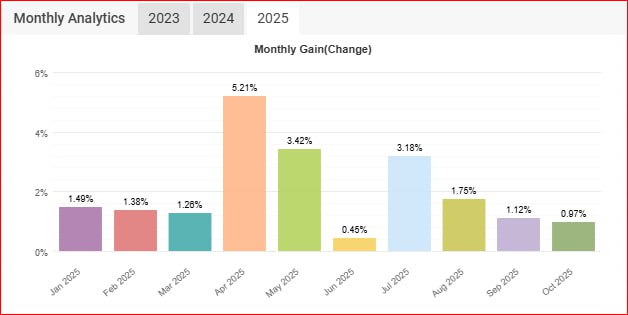

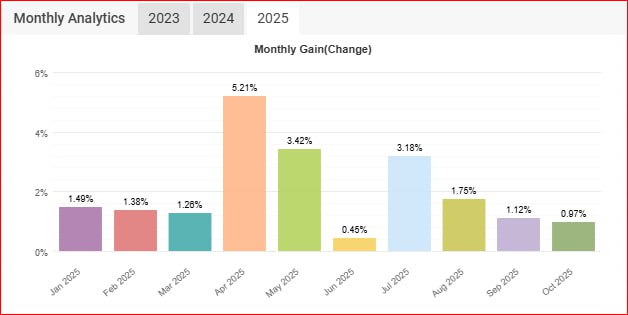

Good afternoon. Here’s our usual update. As we move into mid-October, performance stands at +0.45% for the month and +21.43% cash growth year-to-date. Equity is continuing to climb as well.

This is now year three of Blackwave Pacific Hedged and year nine of Blackwave California — hard to believe how far both have come.

During the week, AUDCHF made another push up to 0.53, though we had a bit of Trump-related volatility on Friday around the China sanctions news — so, whatever. I also closed some AUDNZD positions before the weekend, but I’m looking to get back in next week if conditions line up.

The EAs are running perfectly, and as always, you can watch them trade live for free on the MT5 app.

On my end, I’m aiming to build the balance of Blackwave Pacific Hedged up to €100,000, mainly by easing off withdrawals (or stopping them entirely). They say the first €100K is the hardest. That’s just my own plan — clients can continue to add or withdraw funds as they wish. https://www.blackwave-forextrader.com

This is now year three of Blackwave Pacific Hedged and year nine of Blackwave California — hard to believe how far both have come.

During the week, AUDCHF made another push up to 0.53, though we had a bit of Trump-related volatility on Friday around the China sanctions news — so, whatever. I also closed some AUDNZD positions before the weekend, but I’m looking to get back in next week if conditions line up.

The EAs are running perfectly, and as always, you can watch them trade live for free on the MT5 app.

On my end, I’m aiming to build the balance of Blackwave Pacific Hedged up to €100,000, mainly by easing off withdrawals (or stopping them entirely). They say the first €100K is the hardest. That’s just my own plan — clients can continue to add or withdraw funds as they wish. https://www.blackwave-forextrader.com

Gary Comey

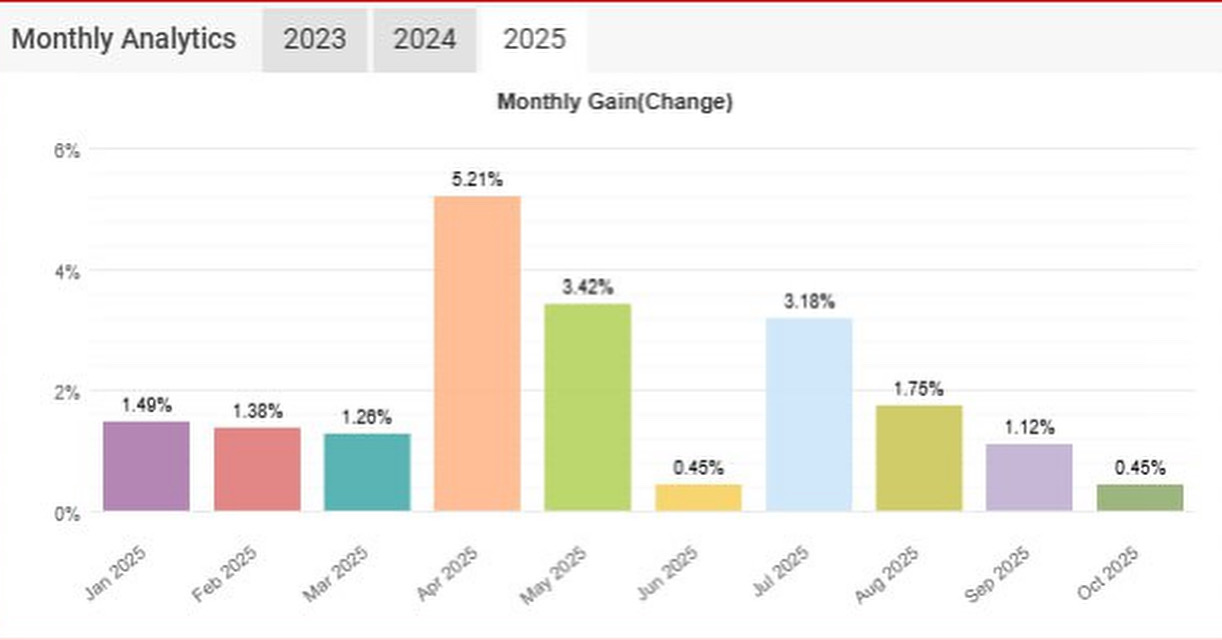

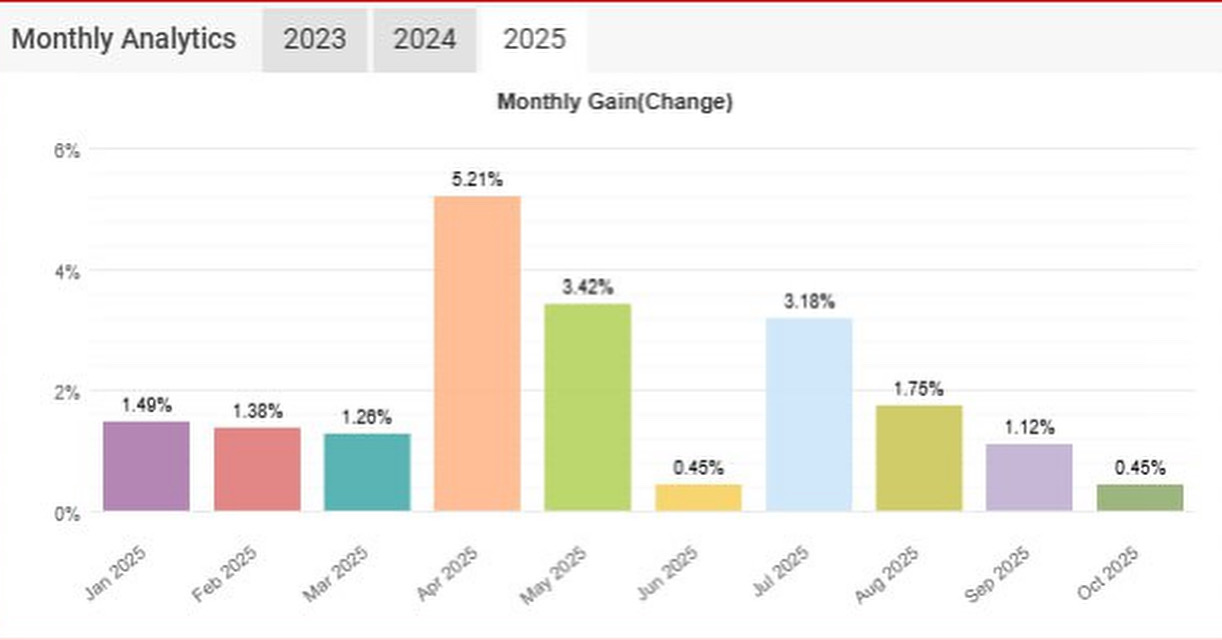

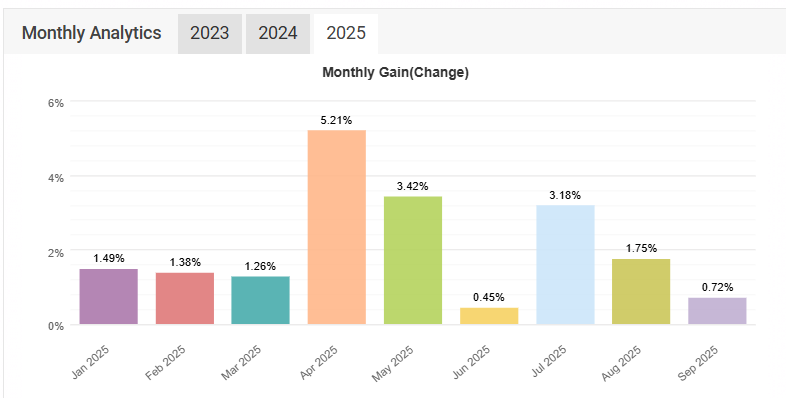

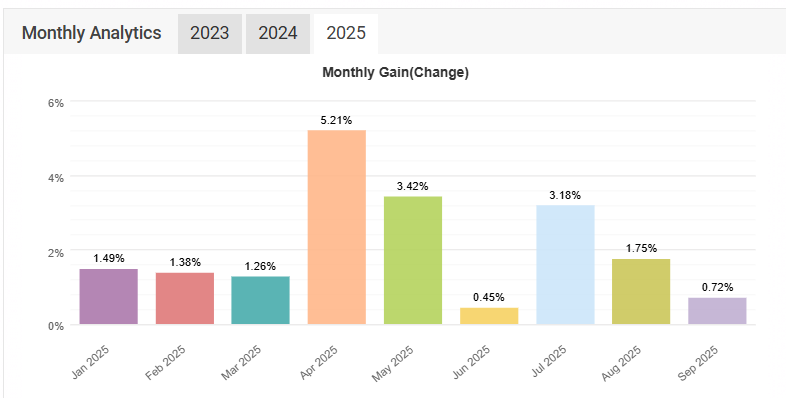

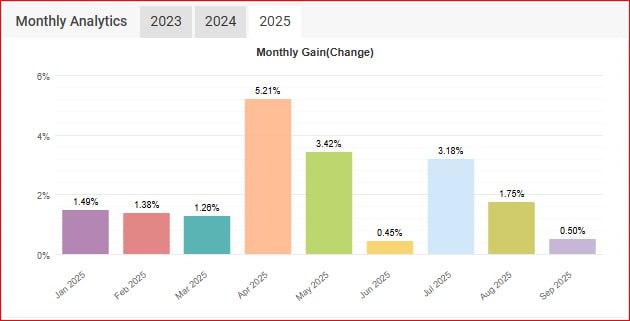

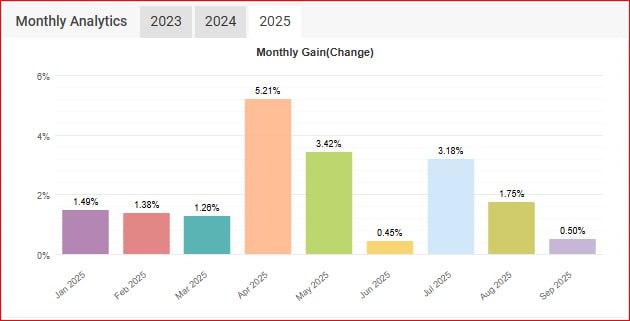

Blackwave’s trading strategy has continued to demonstrate strong consistency and disciplined risk management throughout 2025, achieving an overall +65.18% gain to date with an average monthly return of 2.36%. We are at 21% so far for 2025 so it would be reasonable to forecast 25-28% for the year. The approach has maintained stable equity growth and effective drawdown control, supported by a 79% win rate and over €25,000 in net profit. These results reflect a data-driven, institutionally inspired but a patient methodology designed for sustainable long-term performance and capital preservation.

Obviously the new EA's add an element of further progress both in terms of discipline and consistency. I don't believe for one moment that the EA's are the "holy grail" and neither should you. However I have been beating the "living sh*t" out of them in terms of testing, back testing, peer reviewing them, second guessing them and they can take a beating.

If you’d like to see that discipline in action, you can join the free Blackwave demo account. Watch trades being opened, managed, and closed in real time — full transparency, real data, and no marketing fluff. It’s the best way to see exactly how the system performs under live conditions. https://blackwave-forextrader.com/free-demo-account/

Obviously the new EA's add an element of further progress both in terms of discipline and consistency. I don't believe for one moment that the EA's are the "holy grail" and neither should you. However I have been beating the "living sh*t" out of them in terms of testing, back testing, peer reviewing them, second guessing them and they can take a beating.

If you’d like to see that discipline in action, you can join the free Blackwave demo account. Watch trades being opened, managed, and closed in real time — full transparency, real data, and no marketing fluff. It’s the best way to see exactly how the system performs under live conditions. https://blackwave-forextrader.com/free-demo-account/

Gary Comey

Good evening. Long story cut short this is us. Almost 21% so far this year and almost 65% total gain. It's okay. If it's too good you would want to be suspicious.

Our automated positions are running exactly as expected, both in live trading and in back testing. As part of automating the bot messages to Telegram and X, I re-ran full tests on the GBPUSD and CHFJPY EAs and they proved to be remarkably robust. I ran them from January 2010 right up to last Friday — just think what they had to survive over that 15-year stretch: Gulf Wars, volcanoes, earthquakes, tsunamis, Covid-19 and Brexit, Trump 1 and Trump 2, the Ukraine war, to name just a few. Covid, as it turned out, was straightforward enough, but the Central Bank scramble to rein in inflation afterwards was a nightmare, as you’ll remember.

The process of developing these EAs seemed simple at first — just a conversation about my strategy that went on for two days before I even asked for a line of code. That project is now several months old, and what has come out of it is code that is extremely powerful, robust and, frankly, long overdue. People have advised me to do this before and I resisted, but now that I have, I can’t believe it took me this long.

I view these EAs almost like individual traders, with me as Head of the Desk watching over their shoulders. There will always be human oversight. I’m genuinely enthusiastic about the whole project of automating my manual strategy, and I strongly encourage anyone with an intellectual interest in trading to download the MT5 app, grab the investor password from my website, and watch this thing trade in and out for yourself right here; https://blackwave-forextrader.com/free-demo-account/

A few of you have written off Blackwave over the last two years, but going back to my triathlons, I don’t give up easily. I believe this is only the beginning of Chapter 2. There’s room for a company that not only seeks client money but also commits its own capital to the very same strategy. In addition to the regulated banks and brokers we already use, I can see Blackwave itself being regulated in Malta or Cyprus in the near future.

The clearest benefit to anyone looking in from the outside is the managed account. It’s up 21% so far this year, and that performance is being delivered with full transparency — every trade visible, every entry and exit accounted for and myfxbook statistics made publicly available. To my mind, that combination of automation, oversight, and proven results is a compelling proposition for anyone considering an investment. Thanks everyone. By this time next week we'll have a fuller picture of September.

Our automated positions are running exactly as expected, both in live trading and in back testing. As part of automating the bot messages to Telegram and X, I re-ran full tests on the GBPUSD and CHFJPY EAs and they proved to be remarkably robust. I ran them from January 2010 right up to last Friday — just think what they had to survive over that 15-year stretch: Gulf Wars, volcanoes, earthquakes, tsunamis, Covid-19 and Brexit, Trump 1 and Trump 2, the Ukraine war, to name just a few. Covid, as it turned out, was straightforward enough, but the Central Bank scramble to rein in inflation afterwards was a nightmare, as you’ll remember.

The process of developing these EAs seemed simple at first — just a conversation about my strategy that went on for two days before I even asked for a line of code. That project is now several months old, and what has come out of it is code that is extremely powerful, robust and, frankly, long overdue. People have advised me to do this before and I resisted, but now that I have, I can’t believe it took me this long.

I view these EAs almost like individual traders, with me as Head of the Desk watching over their shoulders. There will always be human oversight. I’m genuinely enthusiastic about the whole project of automating my manual strategy, and I strongly encourage anyone with an intellectual interest in trading to download the MT5 app, grab the investor password from my website, and watch this thing trade in and out for yourself right here; https://blackwave-forextrader.com/free-demo-account/

A few of you have written off Blackwave over the last two years, but going back to my triathlons, I don’t give up easily. I believe this is only the beginning of Chapter 2. There’s room for a company that not only seeks client money but also commits its own capital to the very same strategy. In addition to the regulated banks and brokers we already use, I can see Blackwave itself being regulated in Malta or Cyprus in the near future.

The clearest benefit to anyone looking in from the outside is the managed account. It’s up 21% so far this year, and that performance is being delivered with full transparency — every trade visible, every entry and exit accounted for and myfxbook statistics made publicly available. To my mind, that combination of automation, oversight, and proven results is a compelling proposition for anyone considering an investment. Thanks everyone. By this time next week we'll have a fuller picture of September.

Gary Comey

Good evening. I'm back from the pool 😊. 1.08% with a week and a bit to go. Hopefully above 2% for the month and nicely above 60% absolute gain for the account. Steady as she goes while we wait for the AUDCHF.

Next week should see my social media begin to automate more too. Trade updates will be automatic on X and here in Telegram. You could call me a signal provider if you want but it's free. The reason I think it should be free is that it's very difficult to be awake 24/5 to receive my trades and act accordingly. Also the notifications don't give any advice about your position size and as WE ALL KNOW in this channel, position size is a main part of risk control.

However if you consider these notifications in addition to the already FREE access to watch the trading live on the MT5 app I think it is a powerful statement of confidence in the AI developed version of my manual swing trading strategy. 1) You see the notifications within seconds both on Telegram and on X/Twitter. 2) You can watch them trading live in the MT5 app too and right here https://blackwave-forextrader.com/free-demo-account/

Then and only then when you get a bit of confidence you can open an account at Blackwell Global and put your new "live" details into the MT5 app and watch it trade there too, except this time it's your real money trading. To be honest from my old days working for big financial services firms I think this ticks a few "Code of Ethics" boxes. When do you get this much visibility signing up for any product at your local broker or bank? But hey, it's supposed to be a salesy thing primarily but I suggest to you it's a code of ethics thing as a side-effect. Enjoy the weekend and thank already to the new clients this week.

Watch out of the new automated messages next week. 😊

Next week should see my social media begin to automate more too. Trade updates will be automatic on X and here in Telegram. You could call me a signal provider if you want but it's free. The reason I think it should be free is that it's very difficult to be awake 24/5 to receive my trades and act accordingly. Also the notifications don't give any advice about your position size and as WE ALL KNOW in this channel, position size is a main part of risk control.

However if you consider these notifications in addition to the already FREE access to watch the trading live on the MT5 app I think it is a powerful statement of confidence in the AI developed version of my manual swing trading strategy. 1) You see the notifications within seconds both on Telegram and on X/Twitter. 2) You can watch them trading live in the MT5 app too and right here https://blackwave-forextrader.com/free-demo-account/

Then and only then when you get a bit of confidence you can open an account at Blackwell Global and put your new "live" details into the MT5 app and watch it trade there too, except this time it's your real money trading. To be honest from my old days working for big financial services firms I think this ticks a few "Code of Ethics" boxes. When do you get this much visibility signing up for any product at your local broker or bank? But hey, it's supposed to be a salesy thing primarily but I suggest to you it's a code of ethics thing as a side-effect. Enjoy the weekend and thank already to the new clients this week.

Watch out of the new automated messages next week. 😊

Gary Comey

This gives an absolute gain of 60% and YTD 20.41%. It all adds up. I was hoping to see my EA's execute some GBPUSD or CHFJPY trades last week but not much doing because the set up was not perfect (though close at times). https://www.blackwave-forextrader.com

Gary Comey

0.5% for the first week of September and 20.15% Year-To-Date. What is under the hood of this EA is exciting. While we still wait for the AUDCHF positions we are in and out of GBPUSD like a caffeinated squirrel collecting nuts for the winter. 😊 https://www.blackwave-forextrader.com

Gary Comey

I am pleased with the performance of the Intraday EA. RSI 72/28 means you don't catch every H1 swing but it also makes the drawdown slightly lower when you do because your first entry is "better". I was right about chairman Powell's speech, We went from quiet to rapid movements very quickly and the EA actually entered a GBPUSD position, got to it's TP in seconds, closed the position, and then re-entered (as RSI was still above 72). So we go into the weekend carrying a few Cable positions. Those in the managed accounts are seeing this for the first time since I traded this in my own account first (testing on myself first). GBPUSD is naturally a bigger mover than EURGBP so you should see more trades.

AUDCHF is disappointing to be honest. I know it is a swing trading timeframe but this feels more like buy and hold. We still get a very decent positive SWAP of course but I'd rather be out. That said it will come good and I definitely have the patience. Average entry is circa 0.5487 but in reality we would be profitable sooner than that with the positive SWAPS accumulated.

It's my birthday on Monday. It will be the 29th anniversary of my 21st birthday (50). I still remember my actual 21st. I flew to New York by myself and spent the week wandering around Manhattan and taking in the sights. First time on a plane! First time in America, first time abroad! I didn't have nearly enough money so I stayed at the Y,M.C.A and shared a room with a guy from Tipperary that I met in the queue at the reception desk who was only over to renew his Green Card. I spent many of my days in the MET museum and my evenings in Mullen's Bar on 23rd street talking to the locals. Barman was called Jim and he knew me when I returned years later. It's gone now, I think it's a bike shop, or at least it was a few years ago. New York is always changing but that trip began my life long love of that crazy city and it's palpable energy. It's always inspired me.

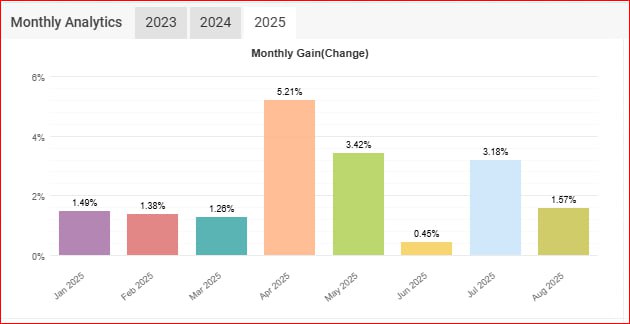

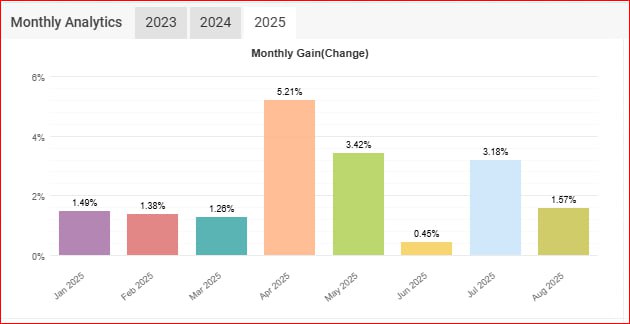

So if you look at the image above (looks like Manhattan) we're at 1.57% capital growth for August with a week to go. 20% YTD. A good alternative investment if you've already got a pension, real estate or other investments too. These EA's are only going to get better. I have already "peer reviewed" them with the recently released ChatGPT 5 and it had nothing meaningful to add…a good sign.

Https://www.blackwave-forextrader.com

AUDCHF is disappointing to be honest. I know it is a swing trading timeframe but this feels more like buy and hold. We still get a very decent positive SWAP of course but I'd rather be out. That said it will come good and I definitely have the patience. Average entry is circa 0.5487 but in reality we would be profitable sooner than that with the positive SWAPS accumulated.

It's my birthday on Monday. It will be the 29th anniversary of my 21st birthday (50). I still remember my actual 21st. I flew to New York by myself and spent the week wandering around Manhattan and taking in the sights. First time on a plane! First time in America, first time abroad! I didn't have nearly enough money so I stayed at the Y,M.C.A and shared a room with a guy from Tipperary that I met in the queue at the reception desk who was only over to renew his Green Card. I spent many of my days in the MET museum and my evenings in Mullen's Bar on 23rd street talking to the locals. Barman was called Jim and he knew me when I returned years later. It's gone now, I think it's a bike shop, or at least it was a few years ago. New York is always changing but that trip began my life long love of that crazy city and it's palpable energy. It's always inspired me.

So if you look at the image above (looks like Manhattan) we're at 1.57% capital growth for August with a week to go. 20% YTD. A good alternative investment if you've already got a pension, real estate or other investments too. These EA's are only going to get better. I have already "peer reviewed" them with the recently released ChatGPT 5 and it had nothing meaningful to add…a good sign.

Https://www.blackwave-forextrader.com

Gary Comey

✅ Preview Account (Free)Watch live trades with investor password access. A taste of the system. 👉 Free Demo

https://blackwave-forextrader.com/free-demo-account/

https://blackwave-forextrader.com/free-demo-account/

: