Benjamin de Vries / Perfil

- Información

|

11+ años

experiencia

|

0

productos

|

0

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

General Manager Europe/USA

en

Amsterdam/NY

[2013-10-2]

Damian Benjamin de Vries is my full name. But most of you know me as Benjamin (Franklin).

I'm a daytrader (binary and forex) for 9 years and an active (panel)member on several international informative forex websites. For 5 years also a fund manager due to my self-employment.

I was a member of the IAB group (nowadays Odin Hedge group) rated by Barclays. For my track record, I am referring you to Barclays. For a while, I am also a general manager for Europe and the USA @ one of the largest global investment companies based in NY (GS ltd).

In my personal life, I am a single man that enjoys life. I love music and sports (fitness and kickboxing). I am very devoted to what I do.

Always a pleasure to meet new traders and insiders to discuss ideas and opportunities.

[2013-9-10]

At the moment I get a lot of requests about Odin Hedge, please use their own email since I am not a member anymore. Thanks.

[2014-9-8]

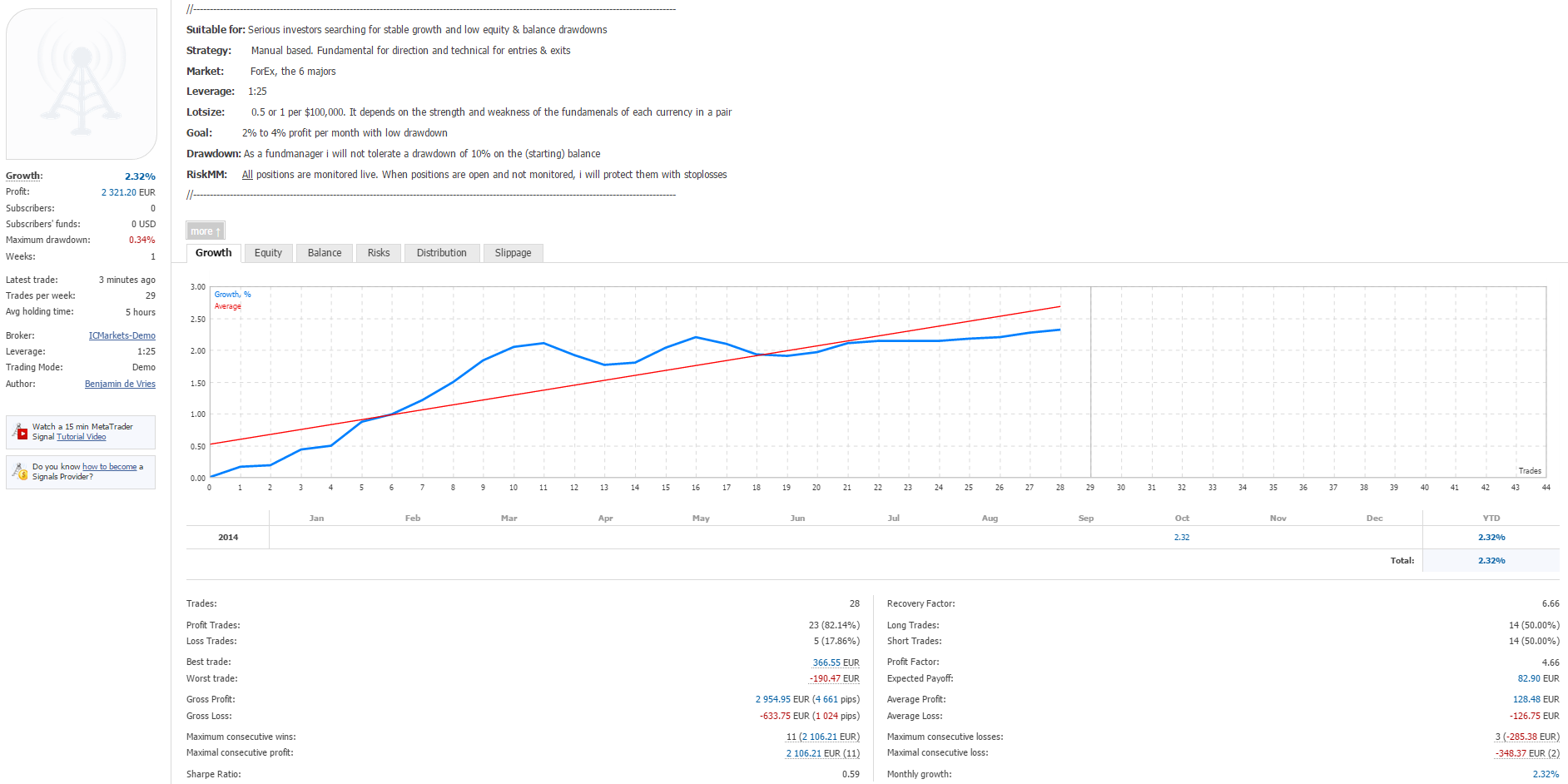

My signal (Fund Manager Pro) will be live someday. But that would be only for a couple of weeks. That way you can monitor my skills 'live'.

Keep track of my status beneath. Have fun!

[2017-2-19]

Made some changes regarding my availability in time for trading due to private circumstances. So I won't be able to respond within the same day in private.

Thanks for your understandings.

[2019-10-11]

Since I am related to an investment company, I can’t allow any new capital in person. Please contact me in pvt to discuss all available possibilities.

Damian Benjamin de Vries is my full name. But most of you know me as Benjamin (Franklin).

I'm a daytrader (binary and forex) for 9 years and an active (panel)member on several international informative forex websites. For 5 years also a fund manager due to my self-employment.

I was a member of the IAB group (nowadays Odin Hedge group) rated by Barclays. For my track record, I am referring you to Barclays. For a while, I am also a general manager for Europe and the USA @ one of the largest global investment companies based in NY (GS ltd).

In my personal life, I am a single man that enjoys life. I love music and sports (fitness and kickboxing). I am very devoted to what I do.

Always a pleasure to meet new traders and insiders to discuss ideas and opportunities.

[2013-9-10]

At the moment I get a lot of requests about Odin Hedge, please use their own email since I am not a member anymore. Thanks.

[2014-9-8]

My signal (Fund Manager Pro) will be live someday. But that would be only for a couple of weeks. That way you can monitor my skills 'live'.

Keep track of my status beneath. Have fun!

[2017-2-19]

Made some changes regarding my availability in time for trading due to private circumstances. So I won't be able to respond within the same day in private.

Thanks for your understandings.

[2019-10-11]

Since I am related to an investment company, I can’t allow any new capital in person. Please contact me in pvt to discuss all available possibilities.

Amigos

332

Solicitudes

Enviadas

Benjamin de Vries

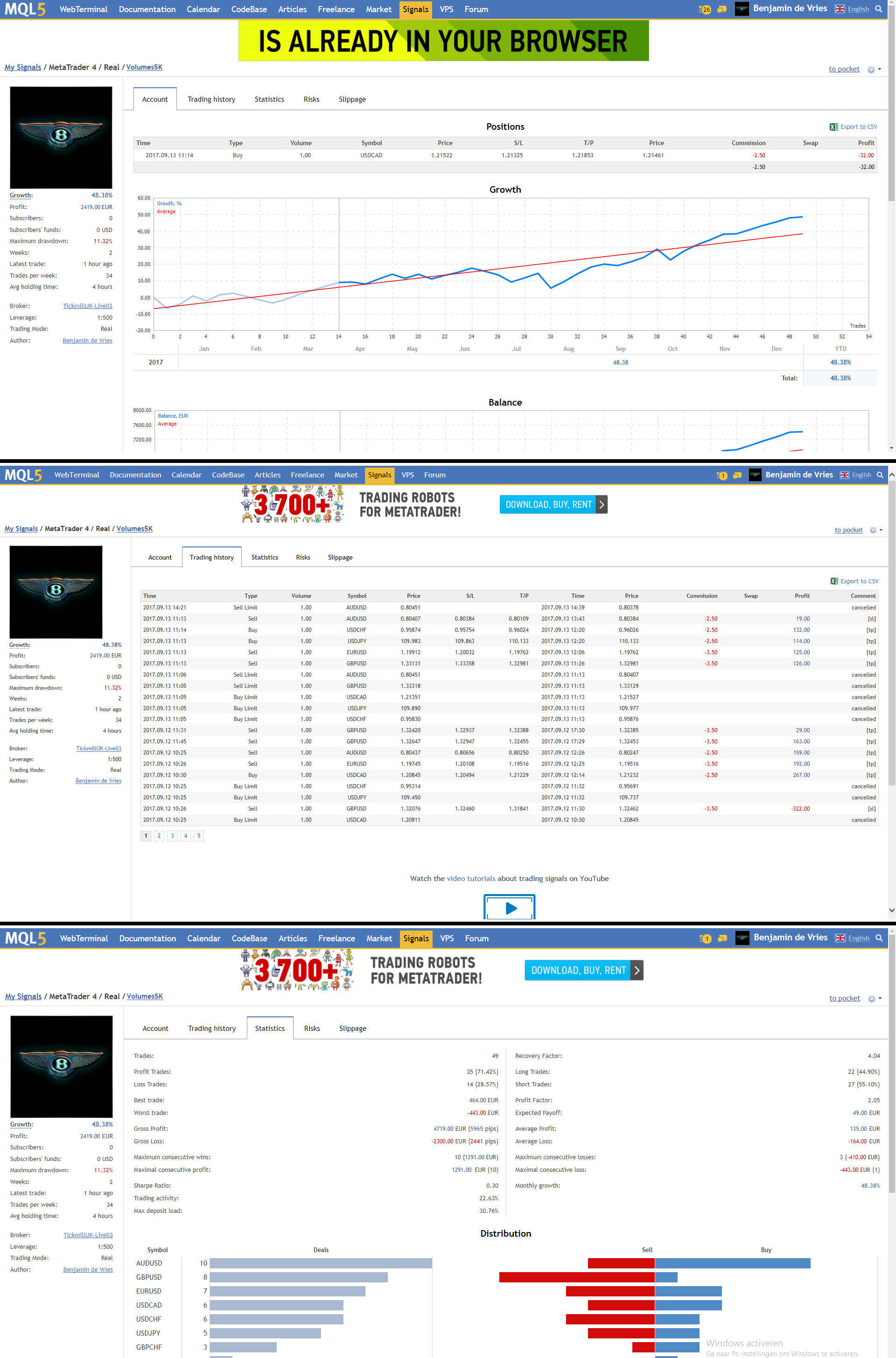

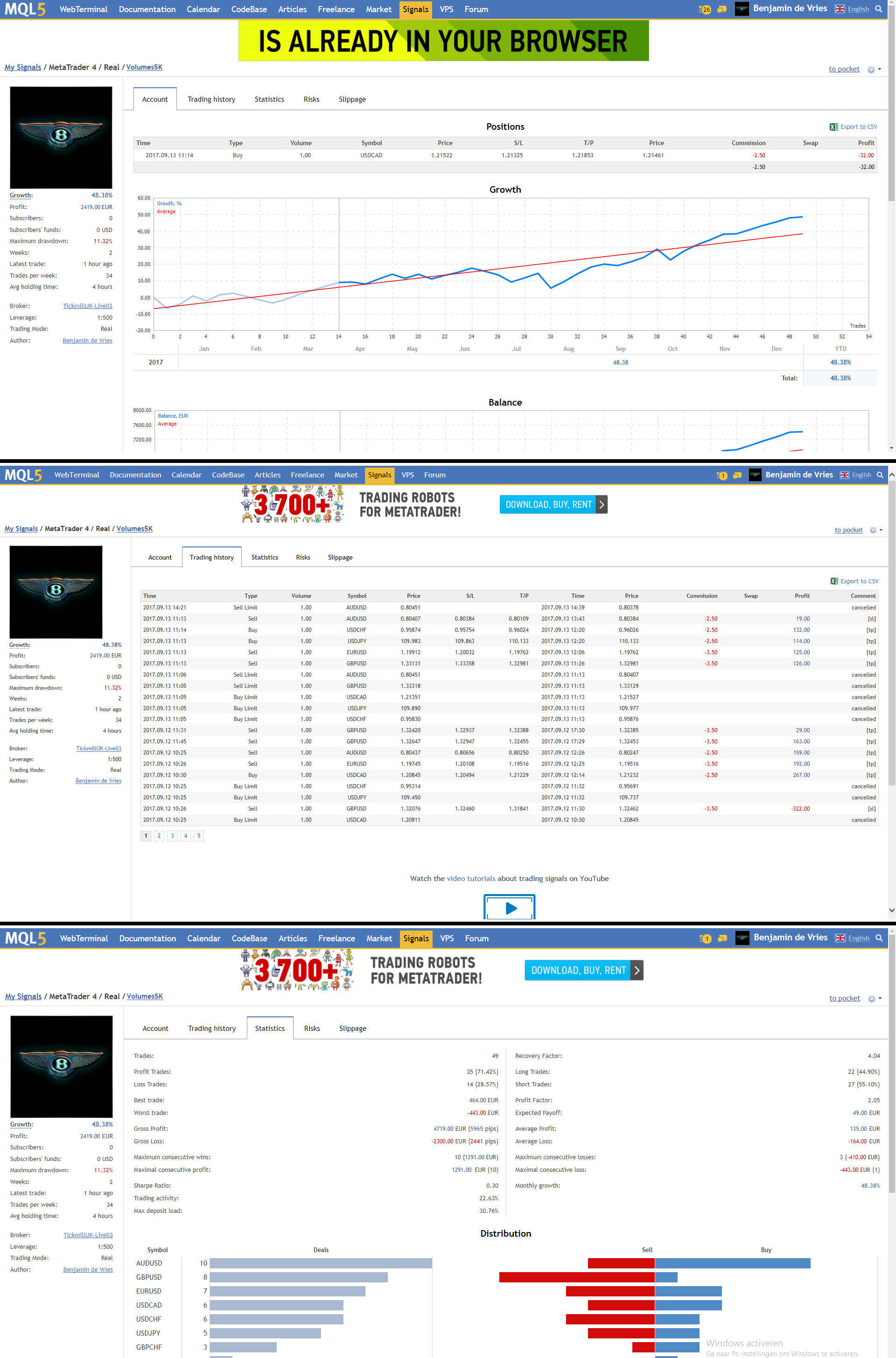

My tradings are solid but i wanted to challenge myself. So i deposited € 5,000 into a new account to play with.

I set myself the following rules;

- No larger DD than 15% (normally i use 2% so this percentage would be very risky)

- Target of 25% profit per month

- Always use tight SL

- Keeping risk/reward ratio ~1:1

- Winratio at least 56%

- Grow my lotsizes every month to keep myself focussed and keep the challenge alive

- No Martingale kind of methods or opening the same positions multiple times

- No EA's

- Trading multiple pairs

Some facts that are important;

- I use a legit broker, so no vague history editing/buying brokerage (unfortunate there are many among us that use

those dirty tricks. Be aware and study a signal as if you study your own charts before entering)

- I have a commissions discount

- I risk what i can afford to lose without regrets

So i started my challenge:

I set myself the following rules;

- No larger DD than 15% (normally i use 2% so this percentage would be very risky)

- Target of 25% profit per month

- Always use tight SL

- Keeping risk/reward ratio ~1:1

- Winratio at least 56%

- Grow my lotsizes every month to keep myself focussed and keep the challenge alive

- No Martingale kind of methods or opening the same positions multiple times

- No EA's

- Trading multiple pairs

Some facts that are important;

- I use a legit broker, so no vague history editing/buying brokerage (unfortunate there are many among us that use

those dirty tricks. Be aware and study a signal as if you study your own charts before entering)

- I have a commissions discount

- I risk what i can afford to lose without regrets

So i started my challenge:

Angela1985

2017.09.15

When is it available for us??

Benjamin de Vries

2017.09.18

When there would be more interest in it, i will make it available

OliderTiger

2021.07.01

Hey Benjamin, could you please check your messages?

Benjamin de Vries

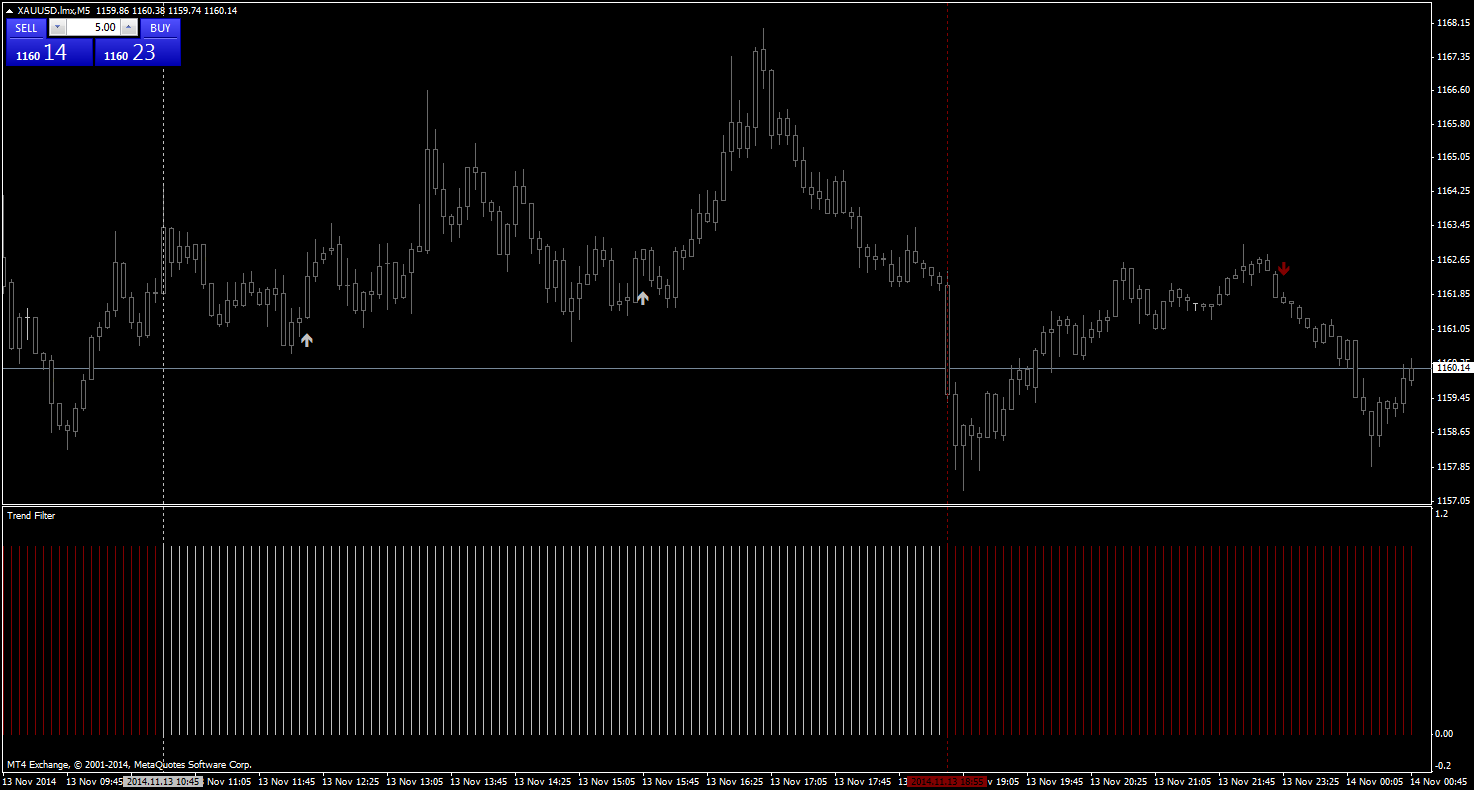

Progress! Made the entry algo in line with the trend filter. Last thing to do is calculating the exits. After 19 months the whole system is, finally, almost ready to perform automatic or manual. The 2 indicators together uses almost 1000 lines of code. And that's even after compressing the code! Here's a glimp:

Benjamin de Vries

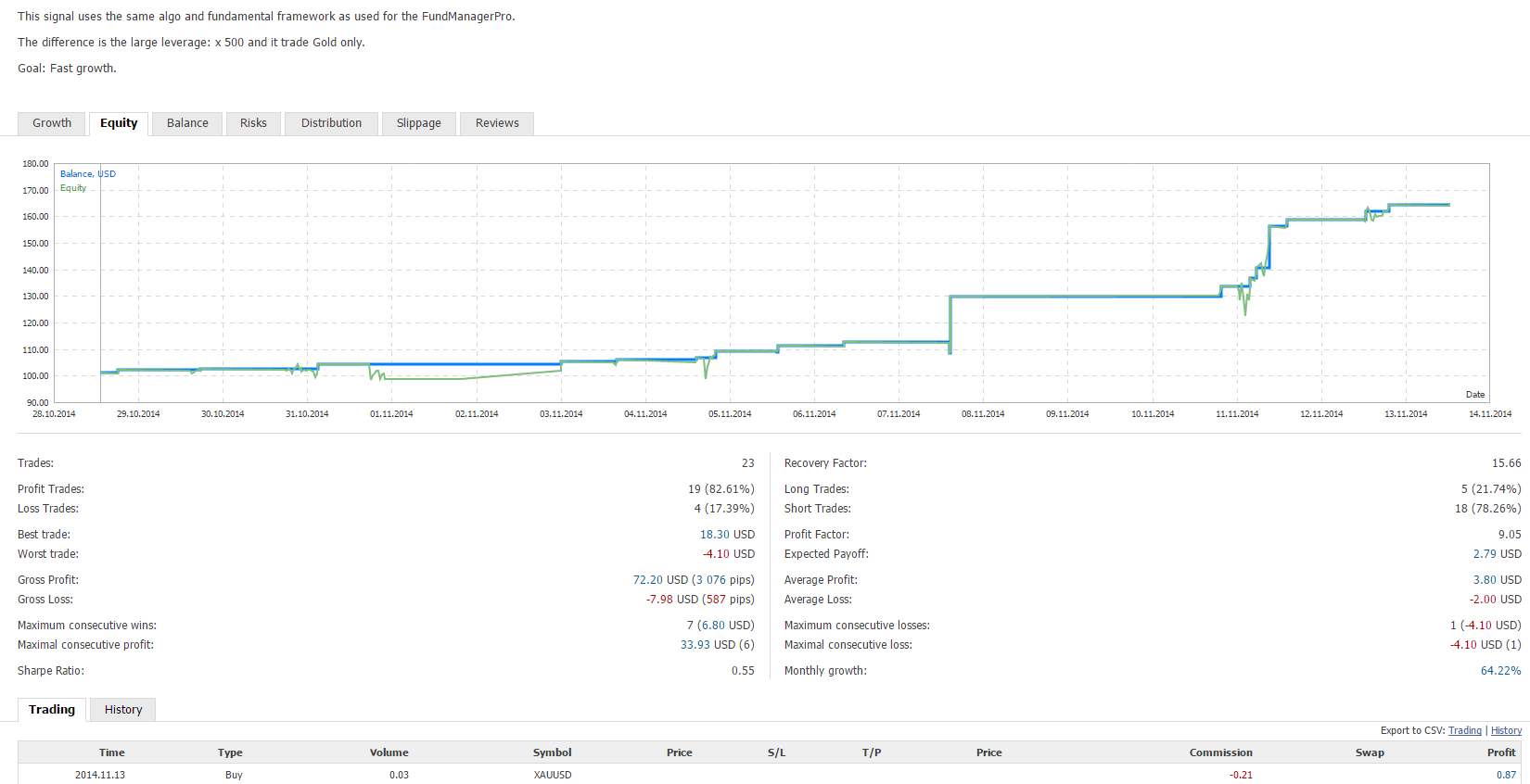

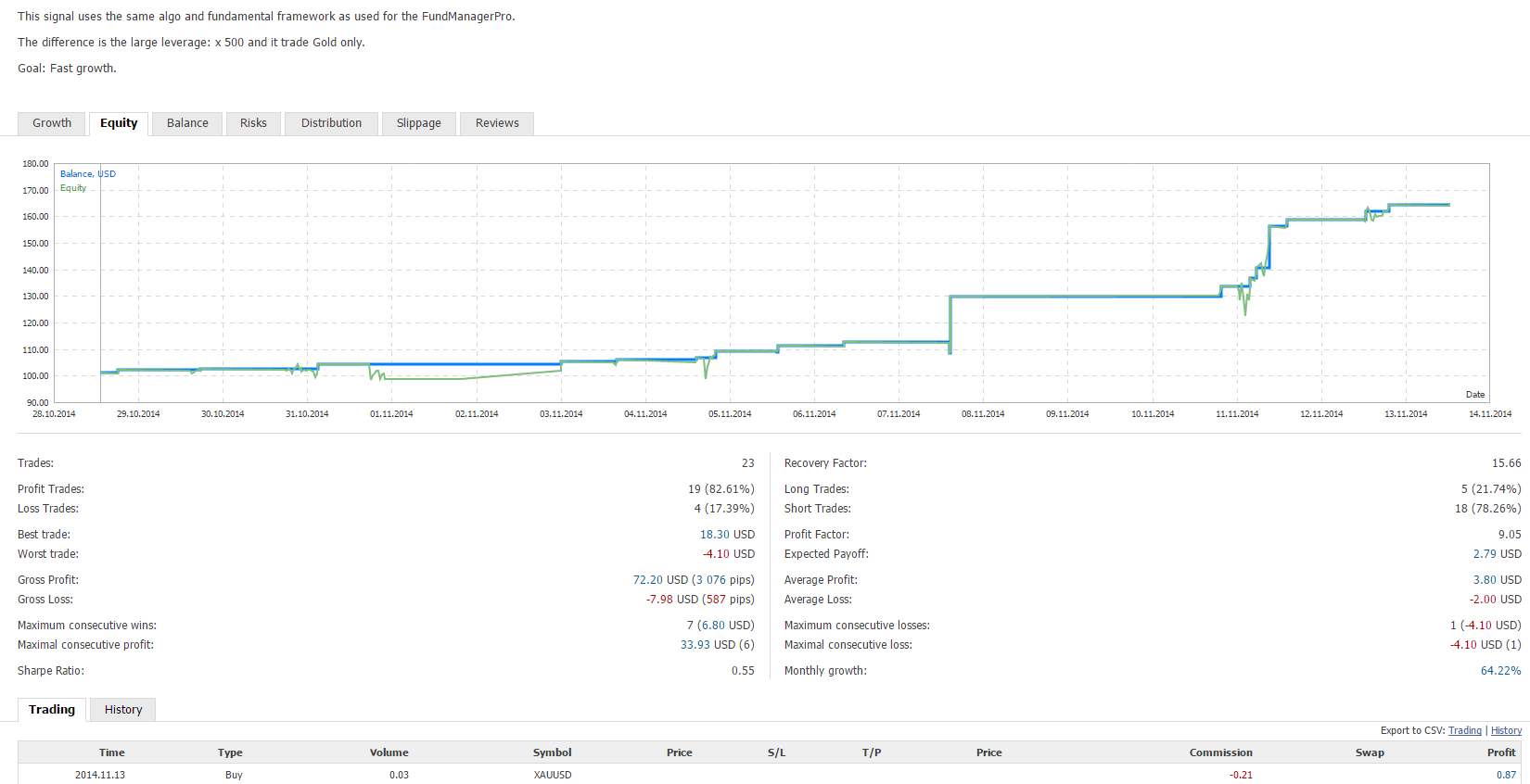

Live GoldFund signal is heading up towards 75% growth in a month starting with the smallest $100.

Not bad but i will improve the strategy while it runs.

Screenshot tells us more about the real equity growth & drawdown then all the statistics out there.

Not bad but i will improve the strategy while it runs.

Screenshot tells us more about the real equity growth & drawdown then all the statistics out there.

Benjamin de Vries

Live Gold signal. Same algo but with bigger risk asked on request. Firstly, i will test it the 4 weeks but results are ok.

If i would trade it more frequently, it could go to 50% gain per month but with bigger risk.

If i would trade it more frequently, it could go to 50% gain per month but with bigger risk.

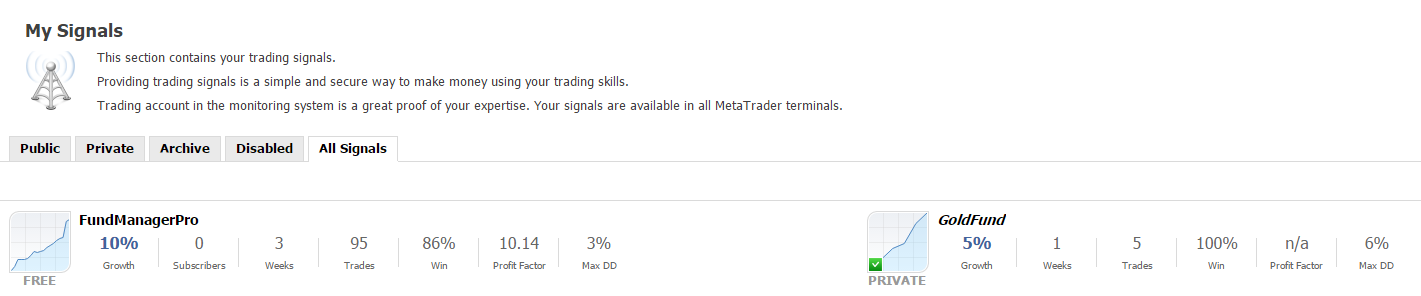

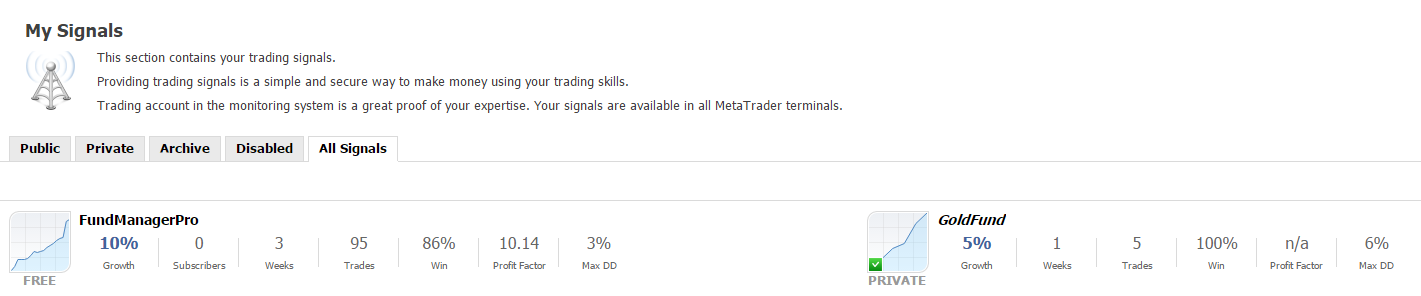

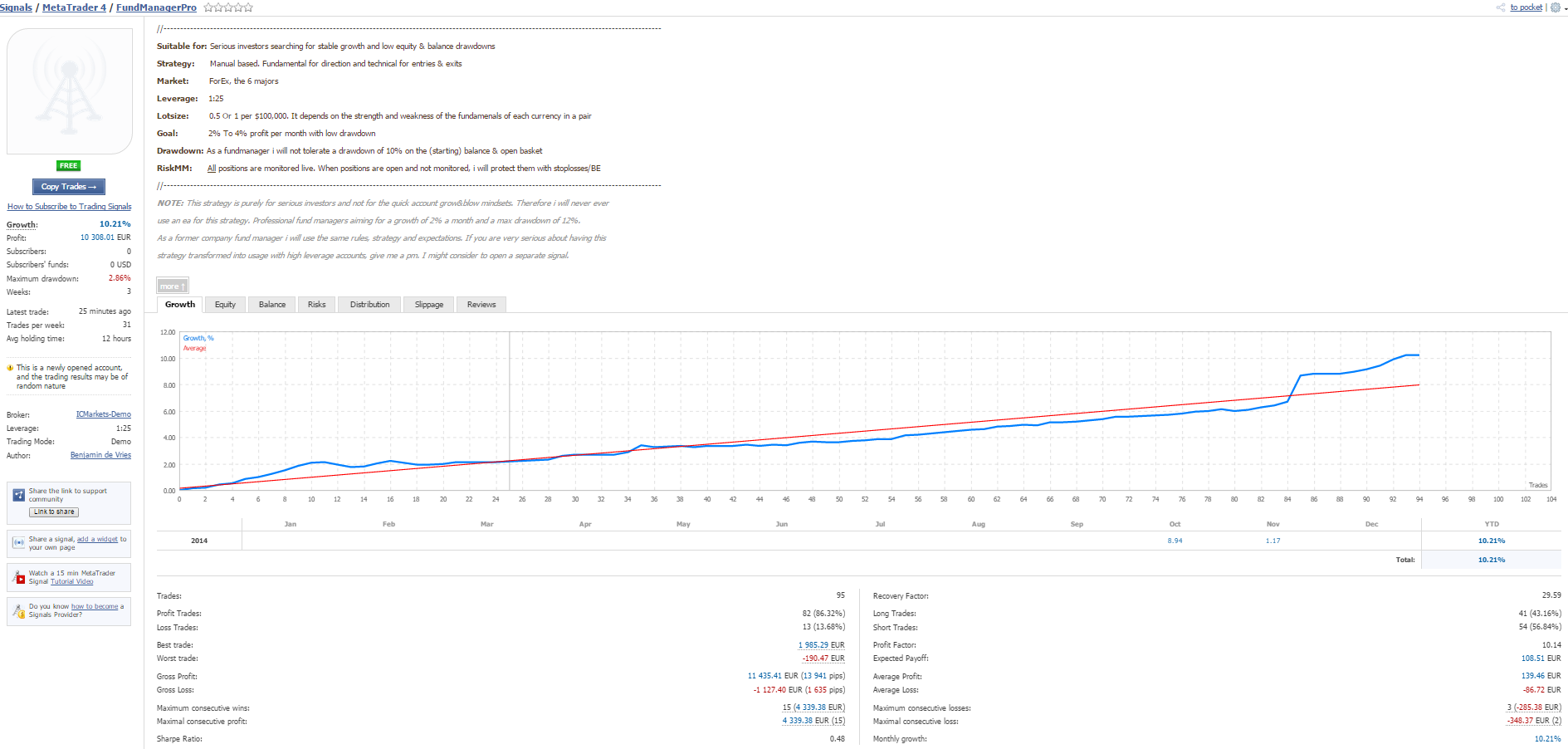

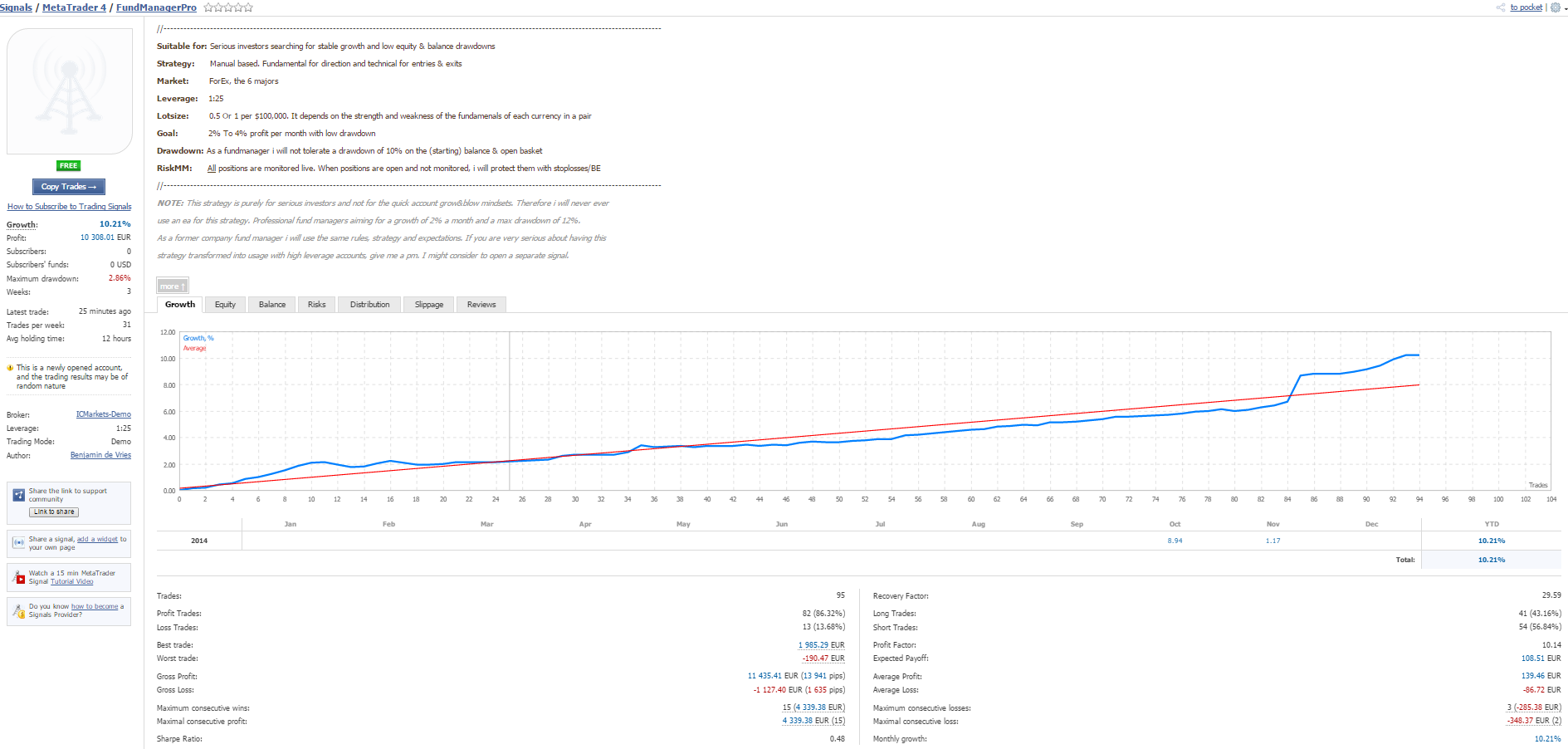

Benjamin de Vries

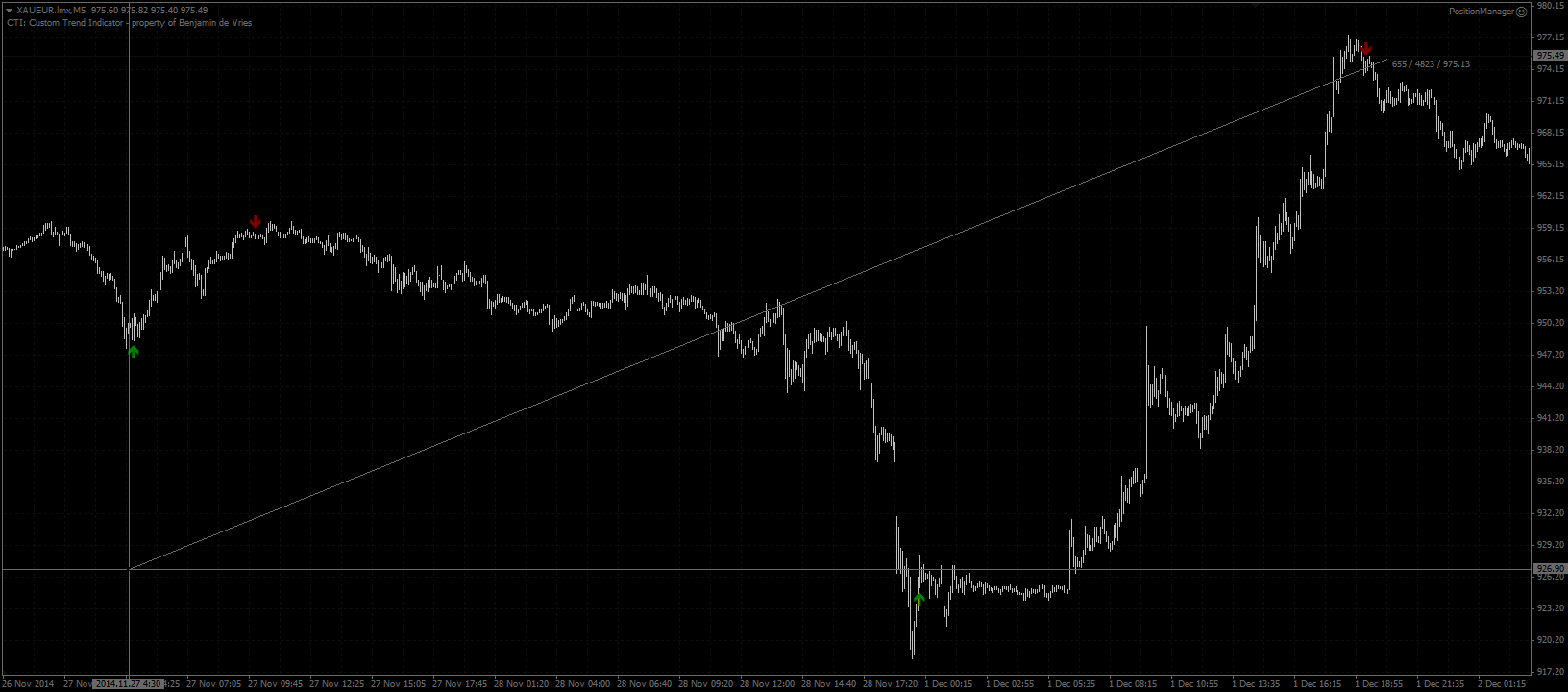

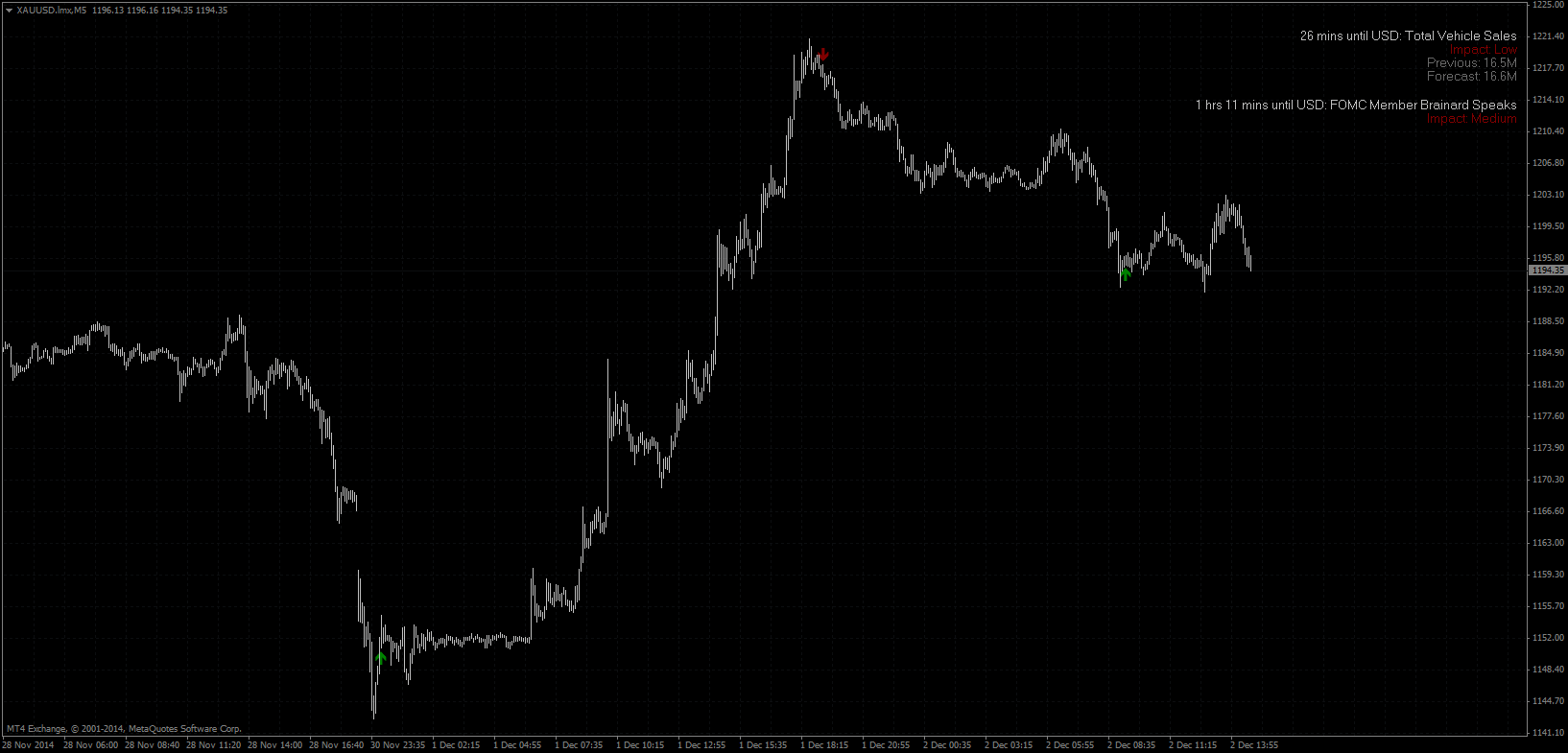

Custom Indicator operates exactly how i want it in combination with my fundamental findings.

Running on demo since 3 weeks based on fund managers role (very low risk, low leverage).

Profit of $10,000 in 3 weeks is not bad with profitfactor 10.

If based on the average signal, do the math!

Running on demo since 3 weeks based on fund managers role (very low risk, low leverage).

Profit of $10,000 in 3 weeks is not bad with profitfactor 10.

If based on the average signal, do the math!

Benjamin de Vries

Calculation Ra based RR ratio for buy could be:

If nLev2-nLev1 > nLev1-pLev1;

If price > ( (nLev1+pLev1) /2 ) then TP1 = nLev2, TP2 = nLev3 and SL = pLev1.

Positive BE will be set when TP1 got hit. Positive BE = Entry + ( ( ( (nLev1+nLev2) /2 ) - spread) - 5)

If nLev2-nLev1 > nLev1-pLev1;

If price > ( (nLev1+pLev1) /2 ) then TP1 = nLev2, TP2 = nLev3 and SL = pLev1.

Positive BE will be set when TP1 got hit. Positive BE = Entry + ( ( ( (nLev1+nLev2) /2 ) - spread) - 5)

Benjamin de Vries

For my own info....

System is renewed with a custom day2day updated fibo s&r levels. Entry and exits are based on these levels in the testing phase. Testing full exits on levels. Next test is based on partial closing at every level. All latest tests are real trades as the filter is operating successfull and do not need any adjustments anymore.

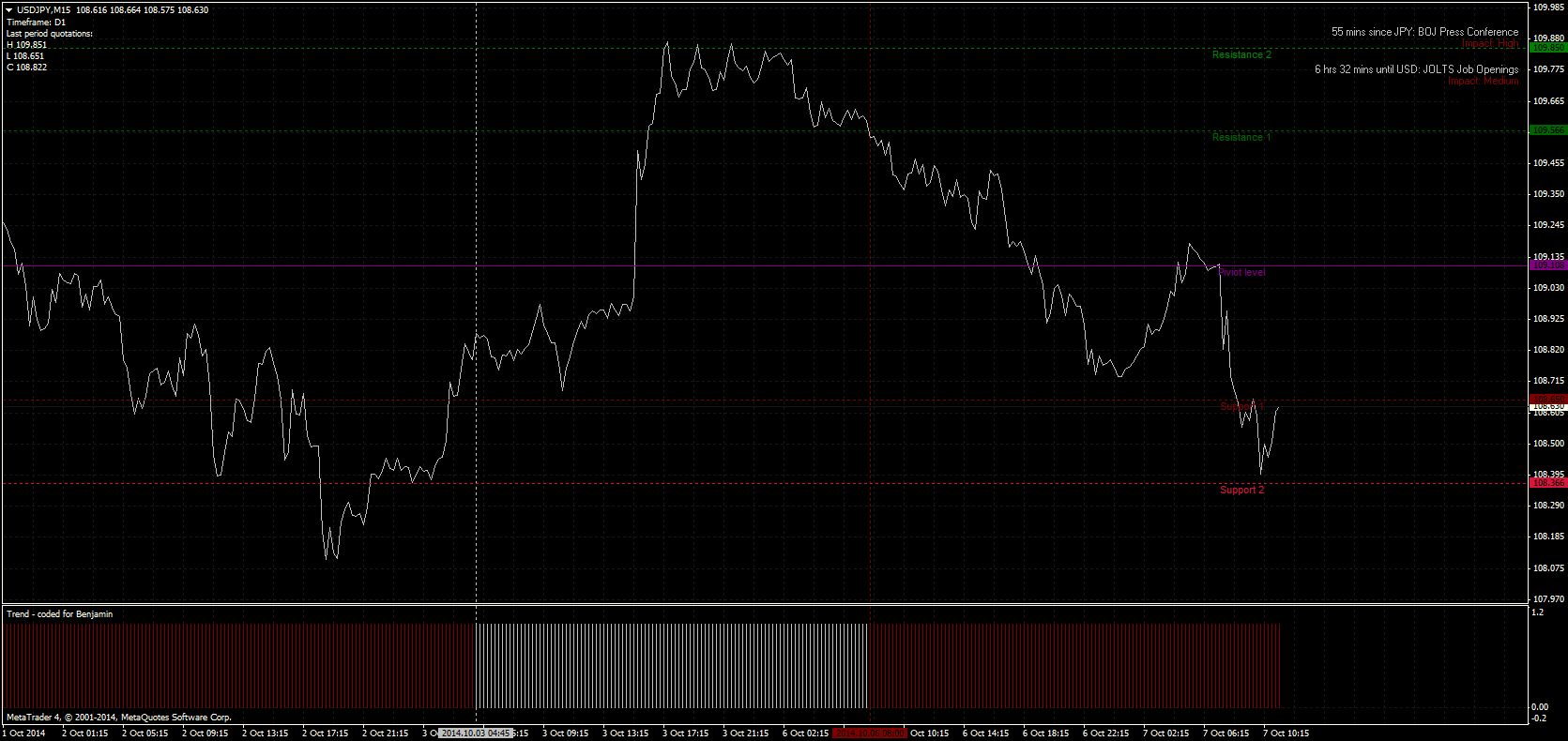

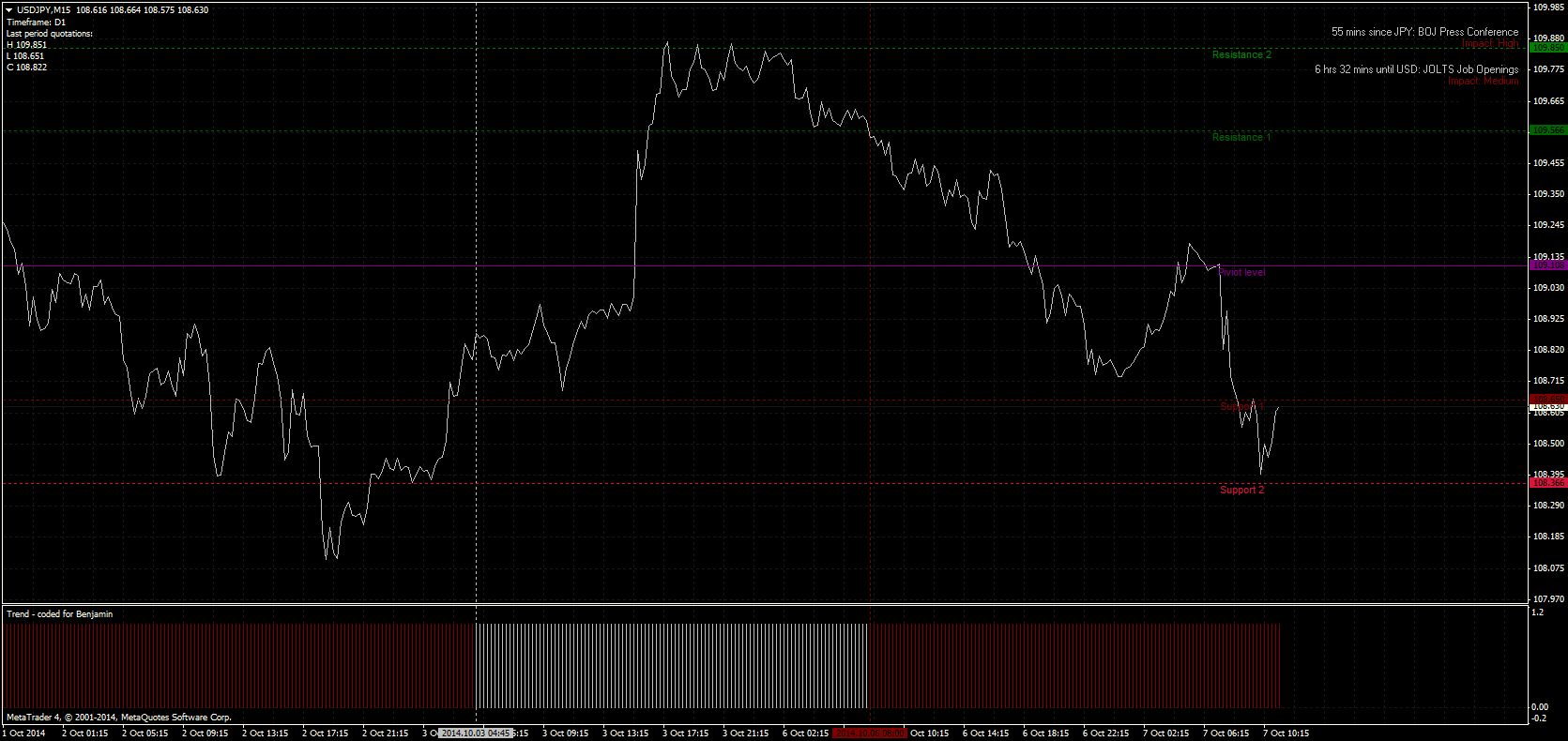

USD/JPY: Entry based on trend change. A choppy correlaion to USD/CAD but the JPY had a tighter day2day range last week. Thats why Support 1 (TP) got hit. Next time to study would be: Distance in levels = Range in pips (Ra). RR ratio based on next level (nRa) versus previous level (pRa) with a certain minimum of 1:1 wich is dynamic based on moment of entry. If entry is above a level for sell, the Ra based RR ratio must be (logical) larger/positive. So if this is the case, there must be a minimum calculated as well.

System is renewed with a custom day2day updated fibo s&r levels. Entry and exits are based on these levels in the testing phase. Testing full exits on levels. Next test is based on partial closing at every level. All latest tests are real trades as the filter is operating successfull and do not need any adjustments anymore.

USD/JPY: Entry based on trend change. A choppy correlaion to USD/CAD but the JPY had a tighter day2day range last week. Thats why Support 1 (TP) got hit. Next time to study would be: Distance in levels = Range in pips (Ra). RR ratio based on next level (nRa) versus previous level (pRa) with a certain minimum of 1:1 wich is dynamic based on moment of entry. If entry is above a level for sell, the Ra based RR ratio must be (logical) larger/positive. So if this is the case, there must be a minimum calculated as well.

Benjamin de Vries

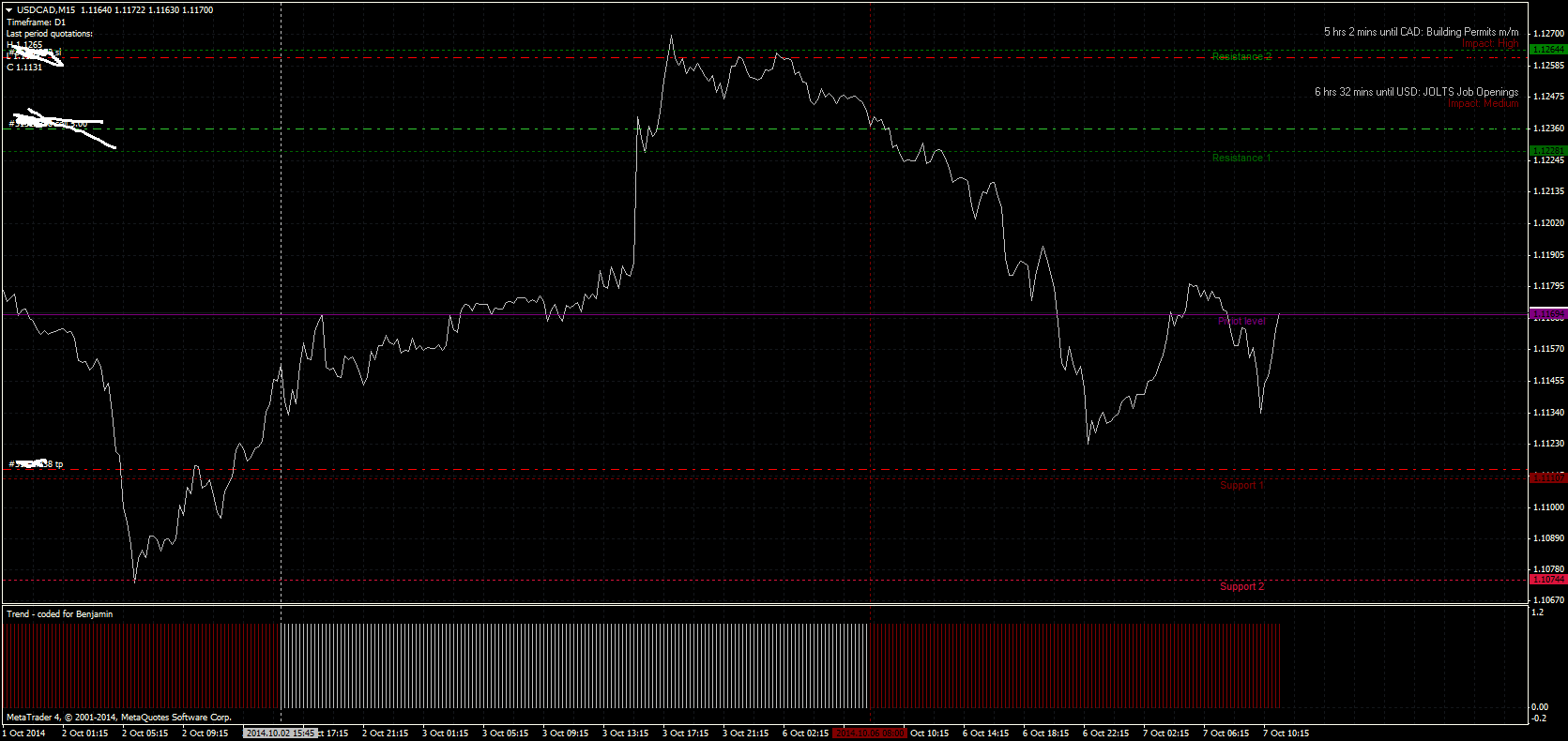

For my own info....

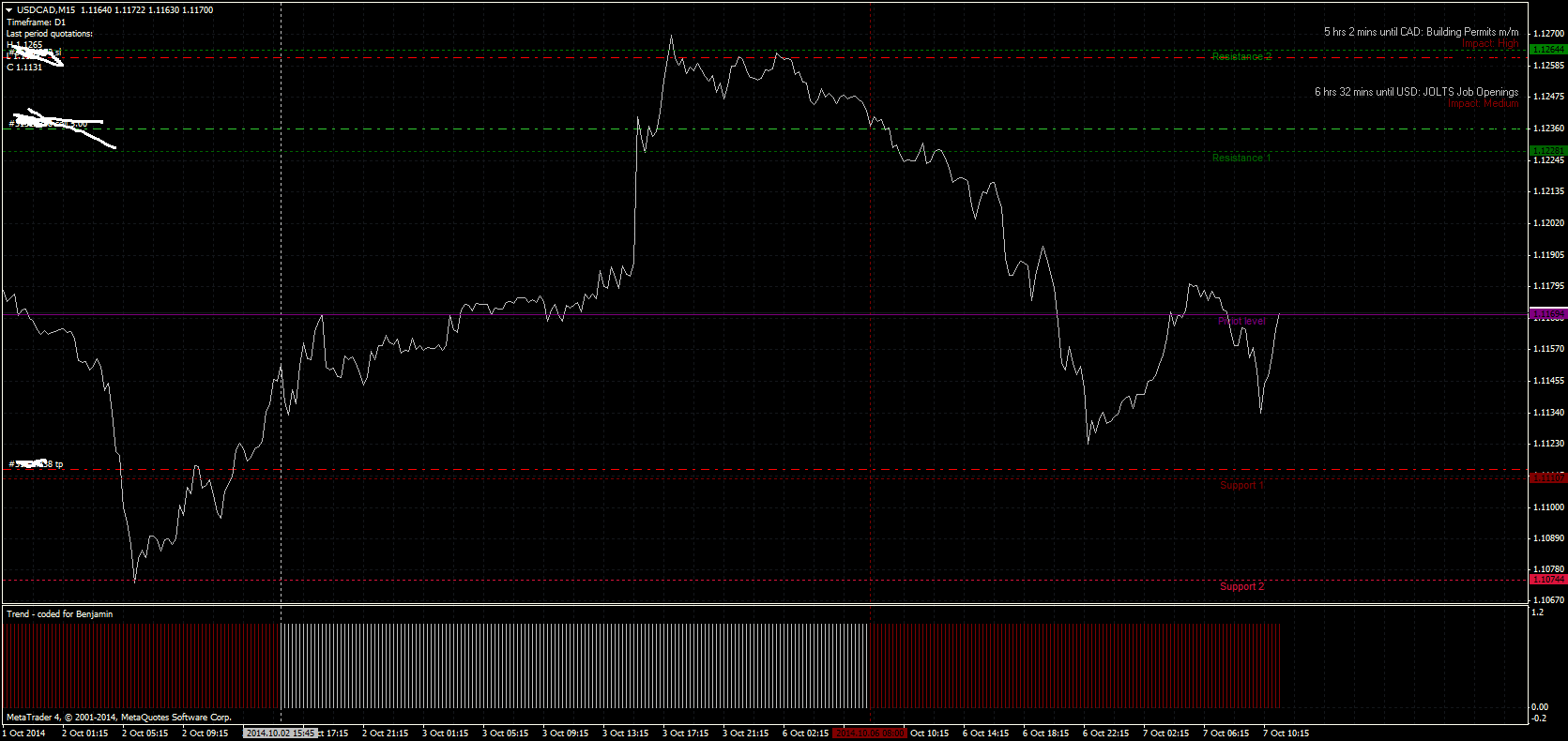

System is renewed with a custom day2day updated fibo s&r levels. Entry and exits are based on these levels in the testing phase. Testing full exits on levels. Next test is based on partial closing at every level. All latest tests are real trades as the filter is operating successfull and do not need any adjustments anymore.

USD/CAD: Entry at trend change. Bit risky because the price was slightly above Resistance 1, but i must have confident on the final Filter. TP is Support 1, but maybe it should have been Pivot. For next study: calculate distances between all levels and implement the right RR ratio thus the best TP1, TP2 and SL levels. I will set BE for now. If it get higher then 1.11810, i will close the position. Otherwise, leave the TP 1 in tact.

System is renewed with a custom day2day updated fibo s&r levels. Entry and exits are based on these levels in the testing phase. Testing full exits on levels. Next test is based on partial closing at every level. All latest tests are real trades as the filter is operating successfull and do not need any adjustments anymore.

USD/CAD: Entry at trend change. Bit risky because the price was slightly above Resistance 1, but i must have confident on the final Filter. TP is Support 1, but maybe it should have been Pivot. For next study: calculate distances between all levels and implement the right RR ratio thus the best TP1, TP2 and SL levels. I will set BE for now. If it get higher then 1.11810, i will close the position. Otherwise, leave the TP 1 in tact.

Benjamin de Vries

For my own info....

System is renewed with a custom day2day updated fibo s&r levels. Entry and exits are based on these levels in the testing phase. Testing full exits on levels. Next test is based on partial closing at every level. All latest tests are real trades as the filter is operating successfull and do not need any adjustments anymore.

AUD/USD: Latest trade entered on trend change and below Pivot. TP is Resistance 2 but didn't got reached by a few pips. Maybe close it just below Resistance 2 for now. Next test would be; close 50% on Resistance 1 and set the remainings BE and TP2 at Resistance 2.

System is renewed with a custom day2day updated fibo s&r levels. Entry and exits are based on these levels in the testing phase. Testing full exits on levels. Next test is based on partial closing at every level. All latest tests are real trades as the filter is operating successfull and do not need any adjustments anymore.

AUD/USD: Latest trade entered on trend change and below Pivot. TP is Resistance 2 but didn't got reached by a few pips. Maybe close it just below Resistance 2 for now. Next test would be; close 50% on Resistance 1 and set the remainings BE and TP2 at Resistance 2.

Benjamin de Vries

For my own info....

System is almost ready for commercial usage. Coded the indicators myself and are non lagging and non repainting/recalculating. The Ben Trend V2 indicator combines several technical and mathematical aspects.

Technicals: 1 Trend, 1 Oscillator, 2 Volumes.

Mathematical: New period vs Historical period average reaction in percentage in extreme zones/exhaustion levels/fuel levels.

X numbers Candle lengths and direction versus exact same historical candles.

Trading only from GMT 08:00 til max 23:00 and 1 position per trendbox. Not many signals on a day, but the winratio is 67,37% since the forward testing and live trading (19 months). The Risk/Reward dropped from 1:1 to a final minimal 2.5:1 to max 3:1. Traded only the 6 majors and all the calculations are based on the 6 majors to have the average result. Best result is on Eur/Usd with 69,11% winratio and an average use of R/R 2.8:1. Best results are generated between GMT 08:00 and 16:00.

System is almost ready for commercial usage. Coded the indicators myself and are non lagging and non repainting/recalculating. The Ben Trend V2 indicator combines several technical and mathematical aspects.

Technicals: 1 Trend, 1 Oscillator, 2 Volumes.

Mathematical: New period vs Historical period average reaction in percentage in extreme zones/exhaustion levels/fuel levels.

X numbers Candle lengths and direction versus exact same historical candles.

Trading only from GMT 08:00 til max 23:00 and 1 position per trendbox. Not many signals on a day, but the winratio is 67,37% since the forward testing and live trading (19 months). The Risk/Reward dropped from 1:1 to a final minimal 2.5:1 to max 3:1. Traded only the 6 majors and all the calculations are based on the 6 majors to have the average result. Best result is on Eur/Usd with 69,11% winratio and an average use of R/R 2.8:1. Best results are generated between GMT 08:00 and 16:00.

: