Mirza Baig / Profile

- Information

|

12+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

::: You must expect to be stung by bees when in search of honey :::

::: He who is not courageous enough to take risks will accomplish nothing in life :::

::: He who is not courageous enough to take risks will accomplish nothing in life :::

Friends

299

Requests

Outgoing

Mirza Baig

shared author's Roberto Jacobs code

BBMACD_V2

BBMACD_v2 is the Bollinger Bands® and MACD indicator in the same place at separate window version 2.

Mirza Baig

Sergey Golubev

SIX BASIC TENETS OF DOW THEORY 1. The Average Discounts Everything One of the basic premises of technical analysis is the idea that the market reflects every possible factors, and information that can possibly affect overall supply and demand...

Mirza Baig

shared author's laplacianlab article

Building a Social Technology Startup, Part II: Programming an MQL5 REST Client

Let's now shape the PHP-based Twitter idea which was introduced in the first part of this article. We are assembling the different parts of the SDSS. Regarding the client side of the system architecture, we are relying on the new MQL5 WebRequest() function for sending trading signals via HTTP.

Mirza Baig

Sergey Golubev

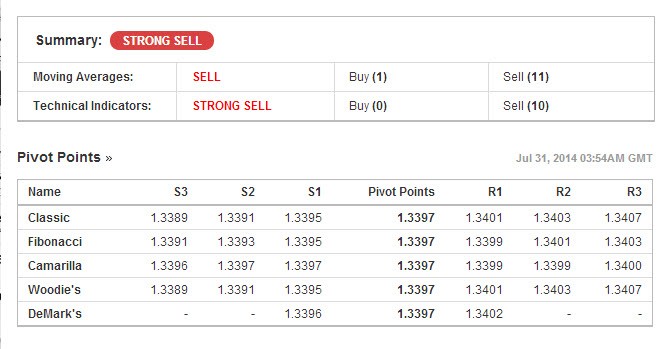

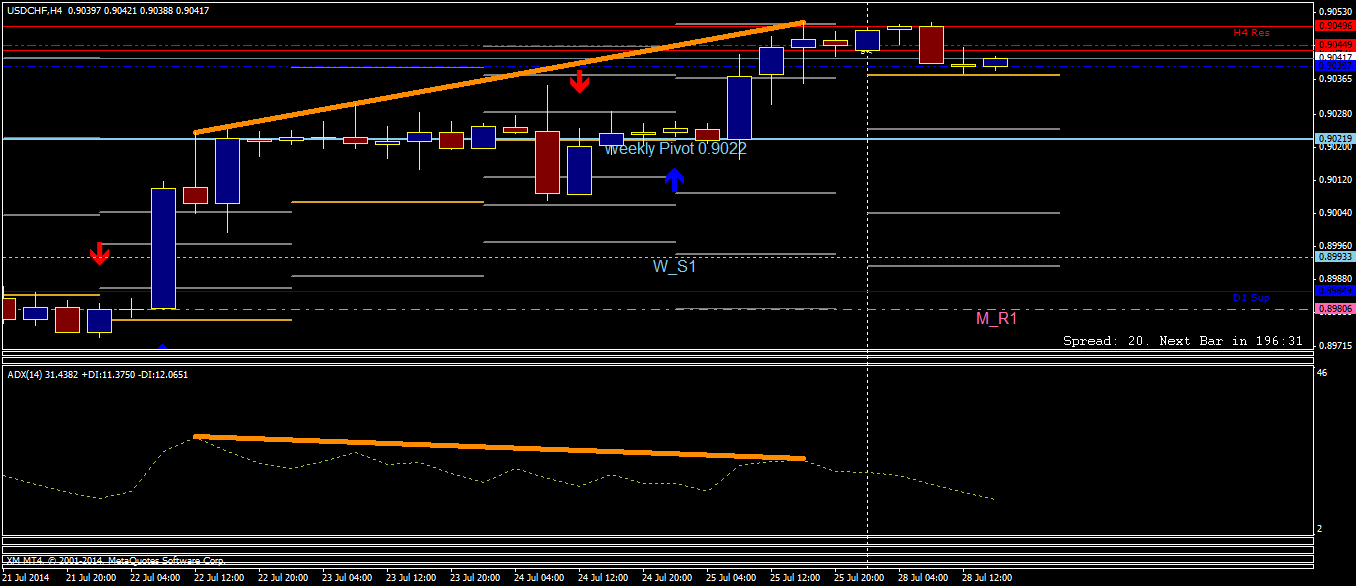

AUDUSD Technical Strategy: Pending Long Clear candlestick reversal patterns absent on the daily chart Harami on the four hour timeframe awaiting confirmation AUD/USD is awaiting guidance near the 0.9320 mark with candlestick reversal signals lacking on the daily chart...

Mirza Baig

mazen nafee

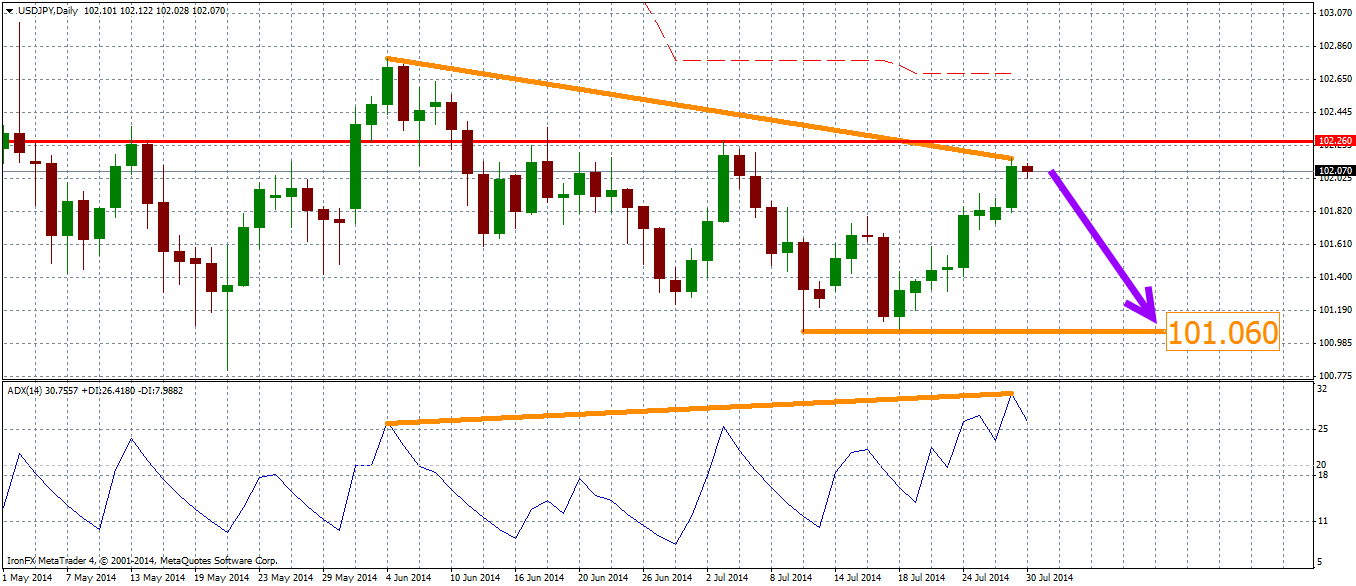

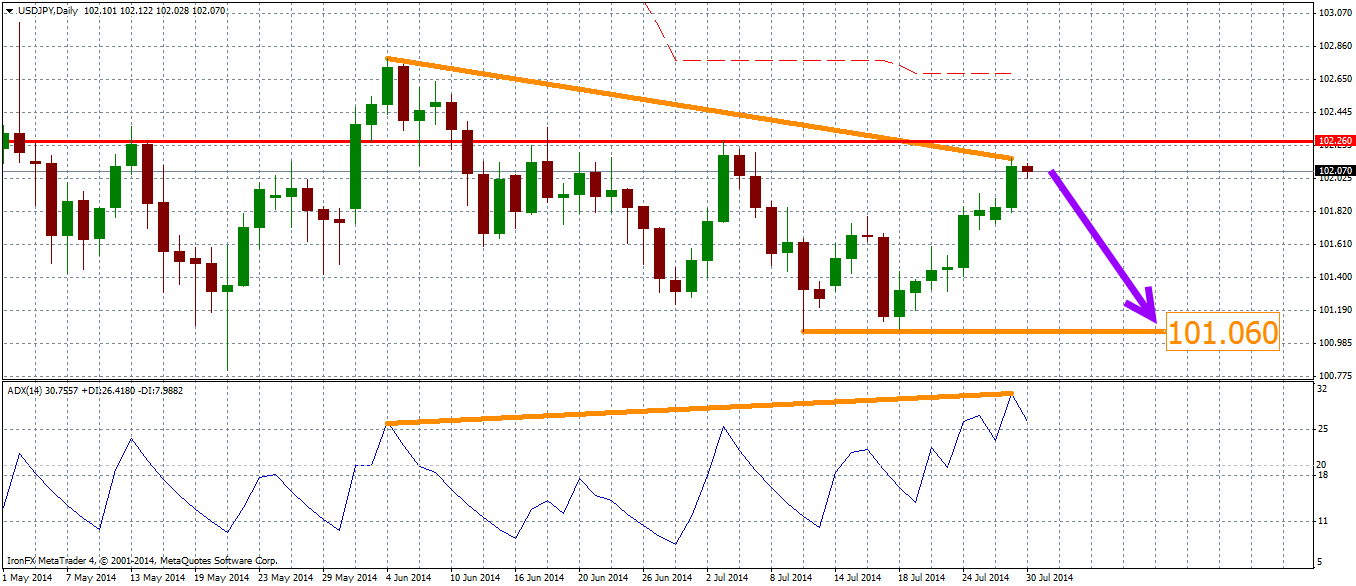

Comment to topic USDJPY Analysis

Daily Chart Bearish Divergence (DMI+) My preference: Short positions Below 102.26 with targets @ 101.60

: