Sajjad Ahmed / Profile

As a trader, I prefer Sniper Entries with 1:5 risk-to-reward ratio.

The GBPJPY failed to confirm breaching 183.50 barrier, and suffer some losses by crawling towards 182.05.

The stochastic attempt to provide the negative momentum might force the price to suffer more losses towards the additional support 181.55 soon. Then we’ll be able to monitor its behavior to confirm the next trend.

On the other hand, succeeding to breach the 183.50 barrier and positive close above it will open the way to resume the main bullish move that depends on the main stability within the bullish channel, to target 100 to 150 pips above 183.50 barrier i.e. 184.40 and 185.00 levels.

The expected trading range for today is between 183.40 and 181.60

The expected trend for today: Bullish

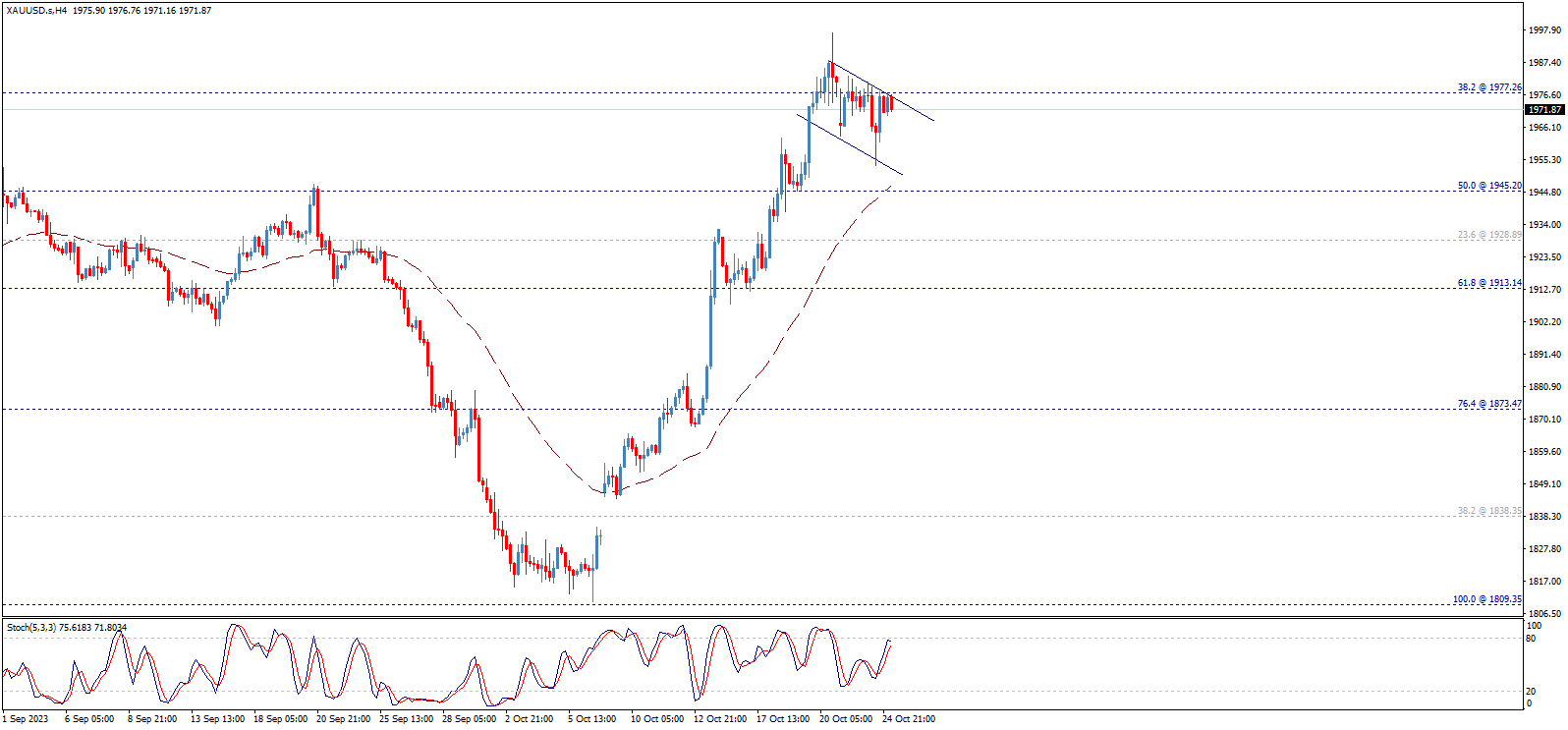

Yesterday, Gold price traded with strong negativity to approach 1945.20 areas, but we noticed that it recovered and again fluctuate around 1977.25, showing chances to resume the bullish trend.

Gold price’s recent trades are confined within minor bearish channel that we believe it forms bullish flag pattern as appears on the chart, thus, breaching 1977.25 will activate the positive effect of this pattern and push the price to head towards our main waited target at 2016.90.

However, failing to breach 1977.25 will put the price under the negative pressure again. Consolidating below 1977.25 level will stop the positive scenario and put the price under negative pressure that targets 1945.20 areas mainly.

The expected trading range for today is between 1960.00 support and 1990.00 resistance.

The expected trend for today: Bullish

The GBPJPY pair resisted the negative pressures recently by forming new bullish wave, to notice the attempt to surpass 183.50 barrier and provide new positive signal that reinforces the chances of regaining the bullish again.

However, the positive close above the breached 183.50 barrier is very important in order to take advantage of the major indicators to target 100 to 150 pips above this level i.e. 184.40 and 185.00 levels.

The expected trading range for today is between 183.20 and 184.40

The expected trend for today: Bullish

Gold price fluctuates around previously mentioned 1977.25 support level, showing positive trades now to move above this level, while the technical indicators continue to provide the positive signals that support the chances of achieving more rise in the upcoming sessions.

Therefore, we will continue to suggest the bullish trend on the intraday and short-term basis, which targets 2016.90 as a next main station.

However, failing to hold above 1977.25 will push the price to turn to decline and head towards 1945.20 areas.

The expected trading range for today is between 1965.00 support and 2000.00 resistance.

The expected trend for today: Bullish

Gold price opened today’s trading with strong decline to break 1977.25 level and settles below it, to hint potential turn to decline.

However, we notice that the price attempts to recover again, as

1. Stochastic gains the positive momentum clearly, which makes us suggest witnessing positive trades today.

2. The EMA50 also continues to support the suggested bullish wave.

The price needs to surpass the above mentioned 1977.25 level to confirm resuming the bullish wave towards its next main target located at 2016.90.

However, failing to surpass 1977.25 level will push the price to suffer additional losses and visit 1945.20 level.

The expected trading range for today is between 1960.00 support and 1995.00 resistance.

The expected trend for today: Bullish

The EURUSD pair continues to fluctuate between the key levels (1.0550 Support and 1.0640 Resistance), which keeps our neutrality valid until now, facing contradiction between the technical factors.

It makes us wait to confirm breaching above mentioned Support or Resistance, followed by detecting next destination clearly.

We remind you that breaching the 1.0640 Resistance will lead the price towards 1.0760 area.

On the other hand, breaking the 1.0550 Support will push the price to return to the main bearish track, achieving negative targets that start at 1.0450.

The expected trading range for today is between 1.0480 Support and 1.0665 Resistance.

The expected trend for today: Neutral

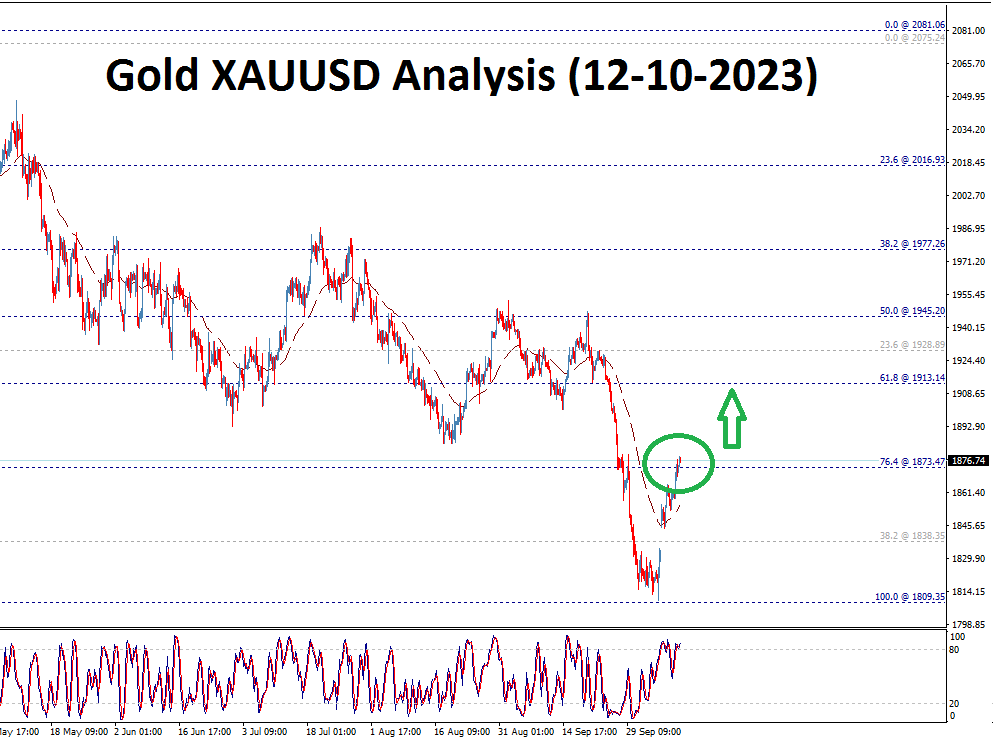

Gold price managed to breach 1873.50 level resistance, and closed the daily candlestick above it, to confirm the continuation of the bullish trend and open the way to head towards our next positive target at 1913.15.

Therefore, we will continue to suggest the bullish trend, getting good support by the EMA50. However, stochastic current negativity might cause some temporary sideways fluctuation before resuming the expected rise.

Note that, breaking 1873.50 level and holding below it will stop the bullish scenario and push the price to turn to drop.

The expected trading range for today is between 1865.00 Support and 1900.00 Resistance.

The expected trend for today: Bullish

The GBPUSD pair managed to breach the resistance level 1.2297 and close the daily bar above it, which supports the continuation of the bullish trend, opening the way towards next target at 1.2460 level.

Stochastic provides positive signals now that support achieving more gains in the upcoming sessions. However, breaking 1.2297 level downwards will stop the expected rise and push the price to drop.

The expected trading range for today is between 1.2260 level Support and 1.2410 level Resistance.

The expected trend for today: Bullish

This EA automatically moves SL to Entry Price (i.e. Breakeven), after your specified condition i.e. Market Price or Profit is achieved. Example Suppose, you want to move your trade’s SL to Breakeven i.e. same as its entry price, on fulfilling certain condition. But you don’t want to sit in front of PC or mobile for long time, waiting for market to fulfill your desired condition. Then this EA is for you, as Meta Trader has no option to automatically move SL to Breakeven. Just enter Ticket

This EA automatically moves SL to Entry Price (i.e. Breakeven), after your specified condition i.e. Market Price or Profit is achieved. Example Suppose, you want to move your trade’s SL to Breakeven i.e. same as its entry price, on fulfilling certain condition. But you don’t want to sit in front of PC or mobile for long time, waiting for market to fulfill your desired condition. Then this EA is for you, as Meta Trader has no option to automatically move SL to Breakeven. Just enter Ticket

This EA automatically closes all Open Trades and Pending Orders at your specified Net Profit or Net Loss. The TP and SL for a single trade can easily be set in Meta Trader, on individual basis and on hitting that TP or SL, the trade is automatically closed. However, if you have multiple trades and you want to set a Net TP and Net SL (in terms of profit & loss) for all of them, then Meta Trader cannot help you. Here comes this EA “Net TP Net SL Setter” using which you can set a Net TP and

This EA automatically closes all Open Trades and Pending Orders at your specified Net Profit or Net Loss. The TP and SL for a single trade can easily be set in Meta Trader, on individual basis and on hitting that TP or SL, the trade is automatically closed. However, if you have multiple trades and you want to set a Net TP and Net SL (in terms of profit & loss) for all of them, then Meta Trader cannot help you. Here comes this EA “Net TP Net SL Setter” using which you can set a Net TP and

This EA automatically closes all Open Trades and Pending Orders at your specified Date & Time. There is no option in Meta Trader to automatically close all Open Trades and Pending Orders at your specified Date & Time. Here comes this EA “Time Based AutoCloser” using which you just provide your desired Closing Date & Time and on reaching it, all open trades and pending orders will be automatically closed. Input of EA Your Desired Closing Date & Time (for example 2023.01.31

This EA automatically closes all Open Trades and Pending Orders at your specified Date & Time. There is no option in Meta Trader to automatically close all Open Trades and Pending Orders at your specified Date & Time. Here comes this EA “Time Based AutoCloser” using which you just provide your desired Closing Date & Time and on reaching it, all open trades and pending orders will be automatically closed. Input of EA Your Desired Closing Date & Time (for example 2023.01.31

This EA automatically closes all Open Trades and Pending Orders at your specified time, before weekend close. It is always a wise approach to close all your open trades and pending orders, before weekend close on Friday, due to following two reasons: There may be unfavorable big price gap on market open. There may be wide spreads , starting almost 30 minutes before market close & almost 30 minutes after market open. A pair that usually has a 3 pip spread may widen to 50

This EA automatically closes all Open Trades and Pending Orders at your specified time, before weekend close. It is always a wise approach to close all your open trades and pending orders, before weekend close on Friday, due to following two reasons: There may be unfavorable big price gap on market open. There may be wide spreads , starting almost 30 minutes before market close & almost 30 minutes after market open. A pair that usually has a 3 pip spread may widen to 50