Sajjad Ahmed / Profile

Pro Forex Trader

I am in Forex trading since 15 years. I have strong programmimg skills of developing EAs, Scripts and Indicators in MQL4/MQL5 languages.

As a trader, I prefer Sniper Entries with 1:5 risk-to-reward ratio.

As a trader, I prefer Sniper Entries with 1:5 risk-to-reward ratio.

Sajjad Ahmed

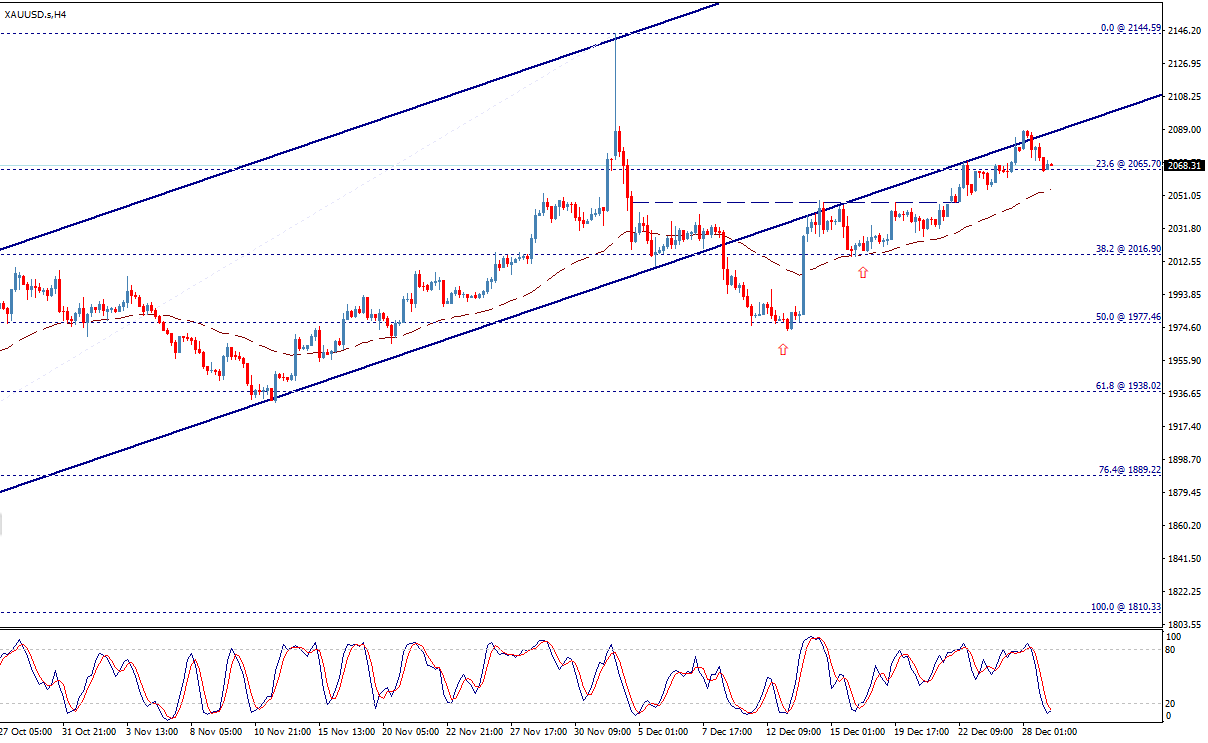

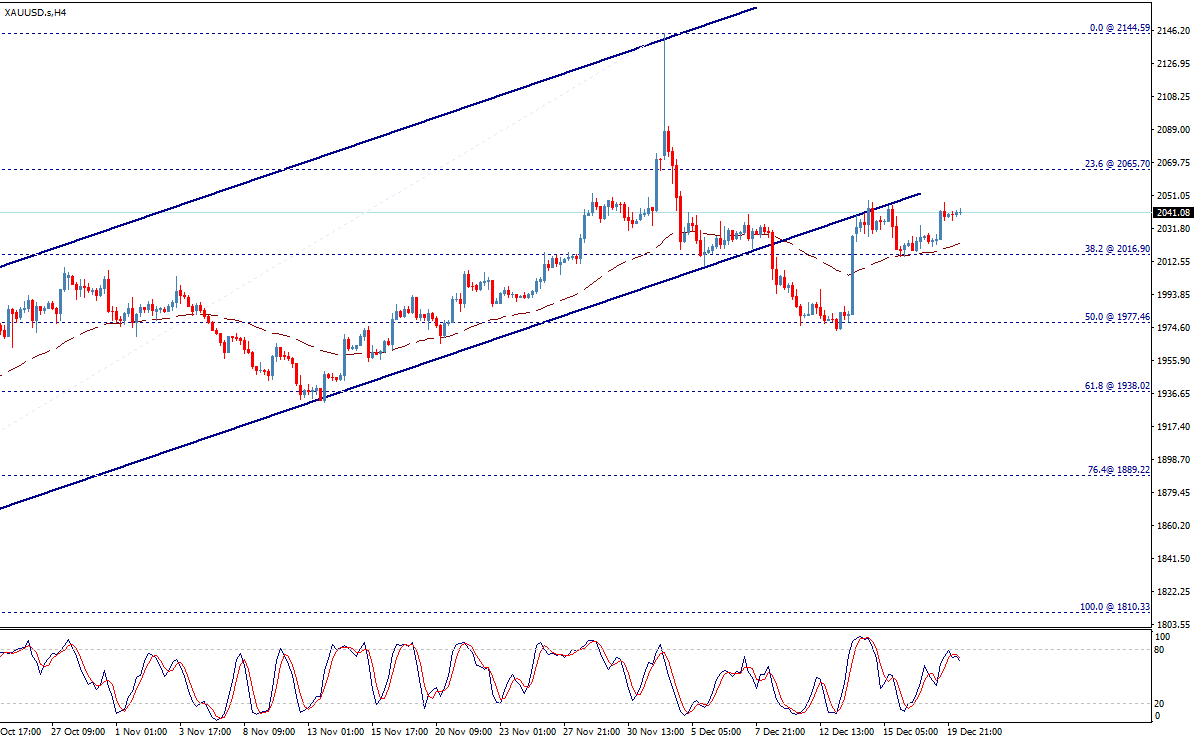

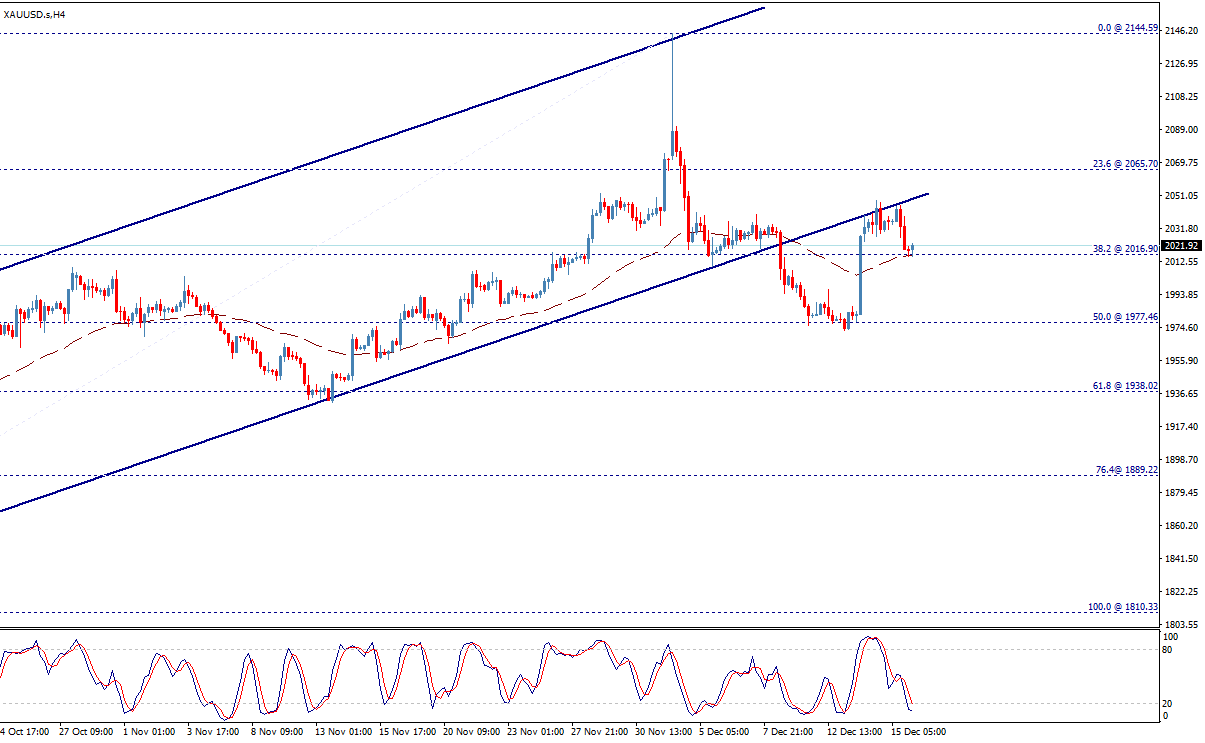

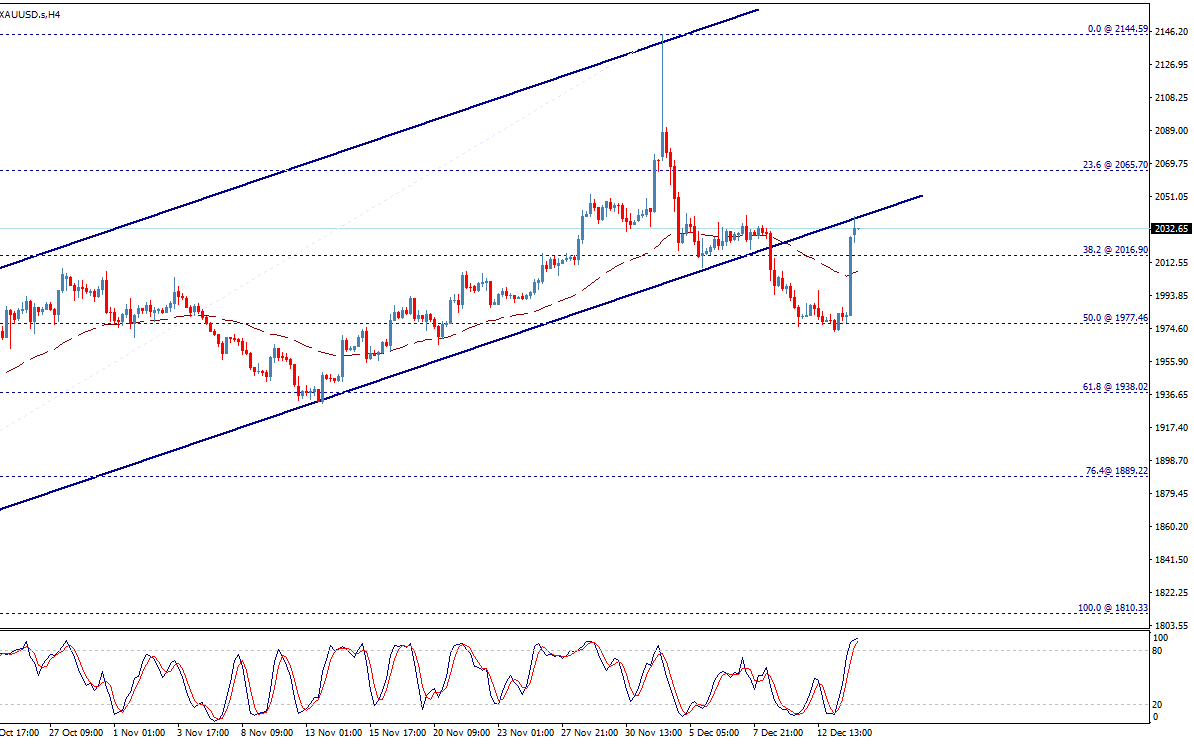

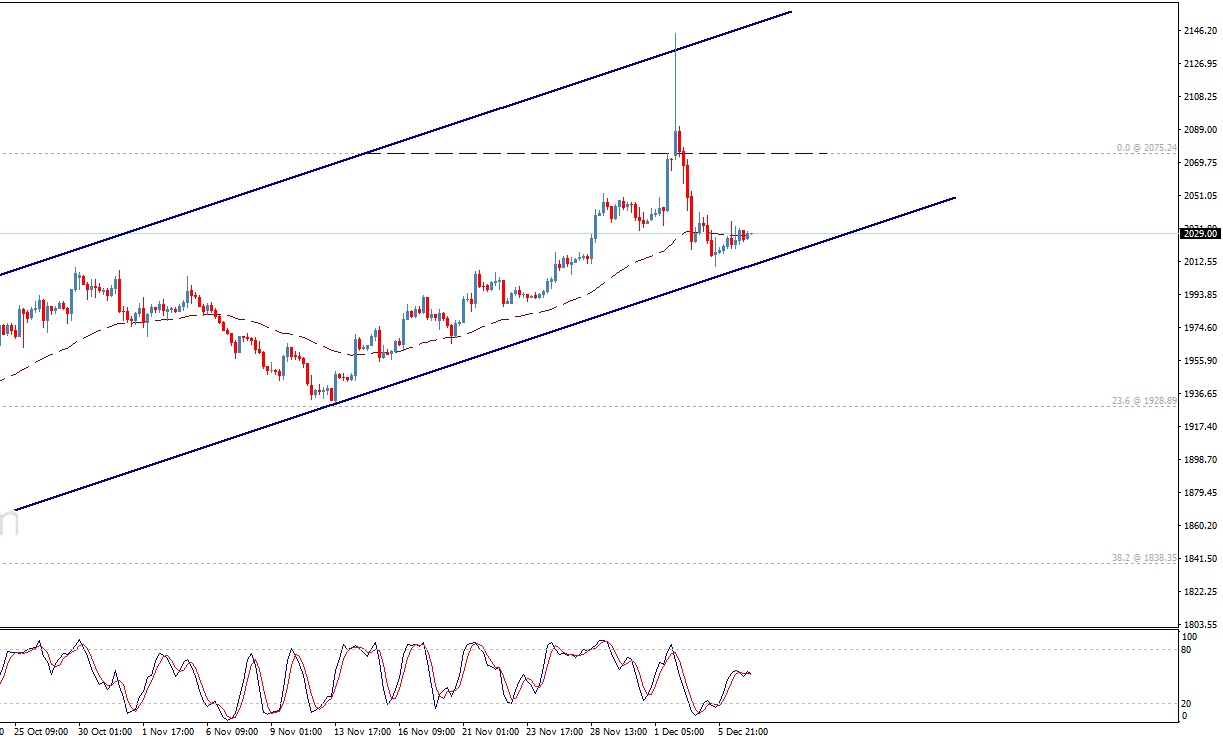

Gold tests the key support 2065.70 - Analysis

Gold has declined to test the key support 2065.70, however it consolidates above it, accompanied by clear bullish signals through stochastic, while the EMA50 also continues in favor of bullish trend.

Therefore, we are waiting for new bullish trades in the upcoming sessions, and the targets begin by surpassing 2090.00 with chances of heading towards 2100.00 followed by 2144.60 as next main targets.

However, settling below 2065.70 support will stop the expected rise and push the price to return to the correctional bearish track again.

Gold has declined to test the key support 2065.70, however it consolidates above it, accompanied by clear bullish signals through stochastic, while the EMA50 also continues in favor of bullish trend.

Therefore, we are waiting for new bullish trades in the upcoming sessions, and the targets begin by surpassing 2090.00 with chances of heading towards 2100.00 followed by 2144.60 as next main targets.

However, settling below 2065.70 support will stop the expected rise and push the price to return to the correctional bearish track again.

Sajjad Ahmed

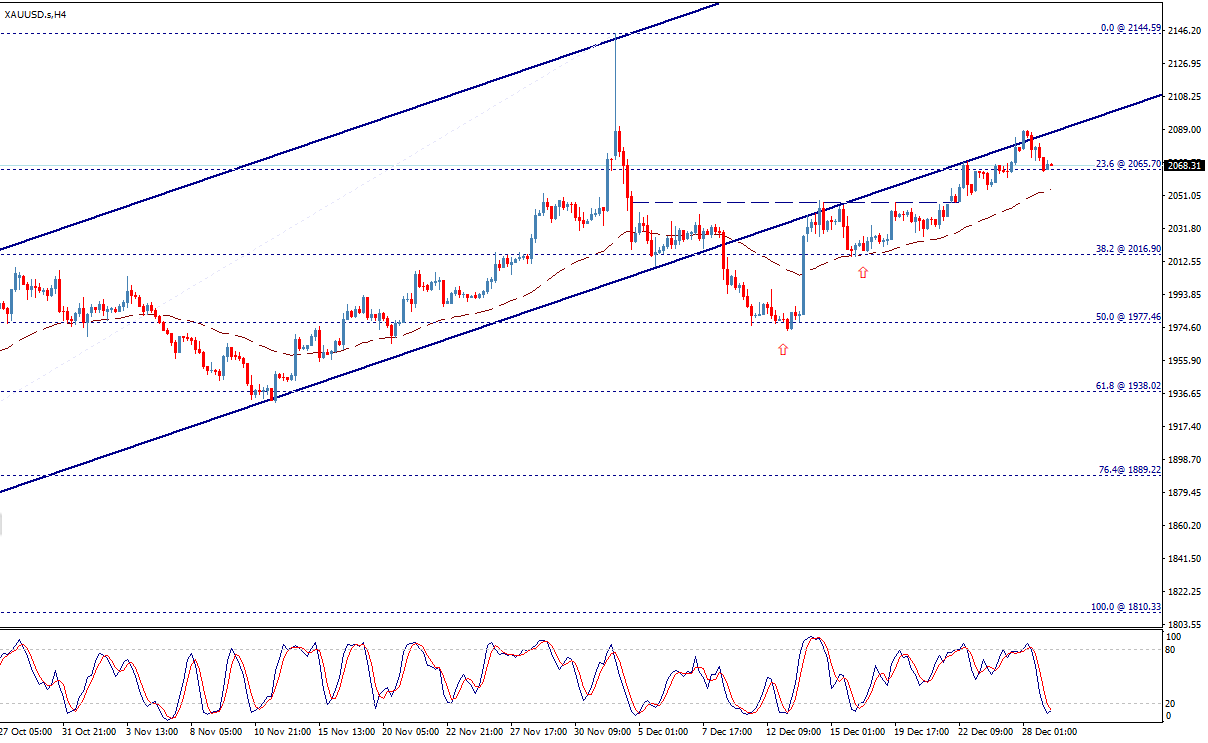

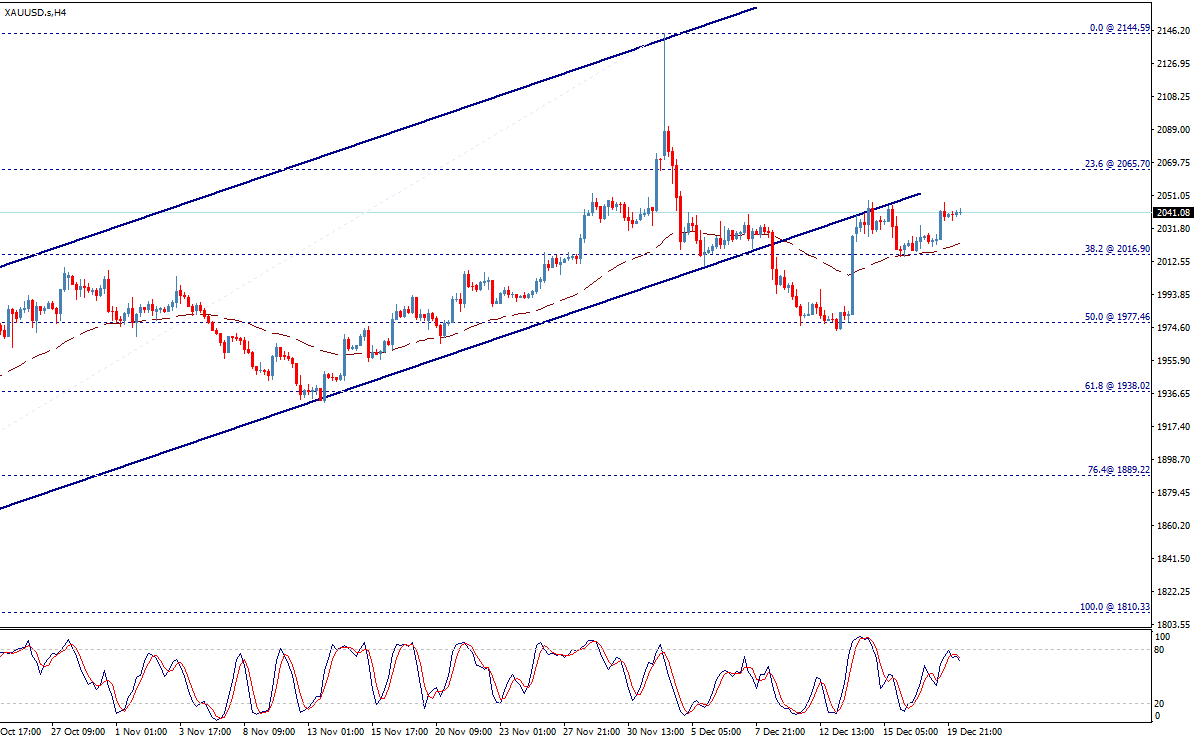

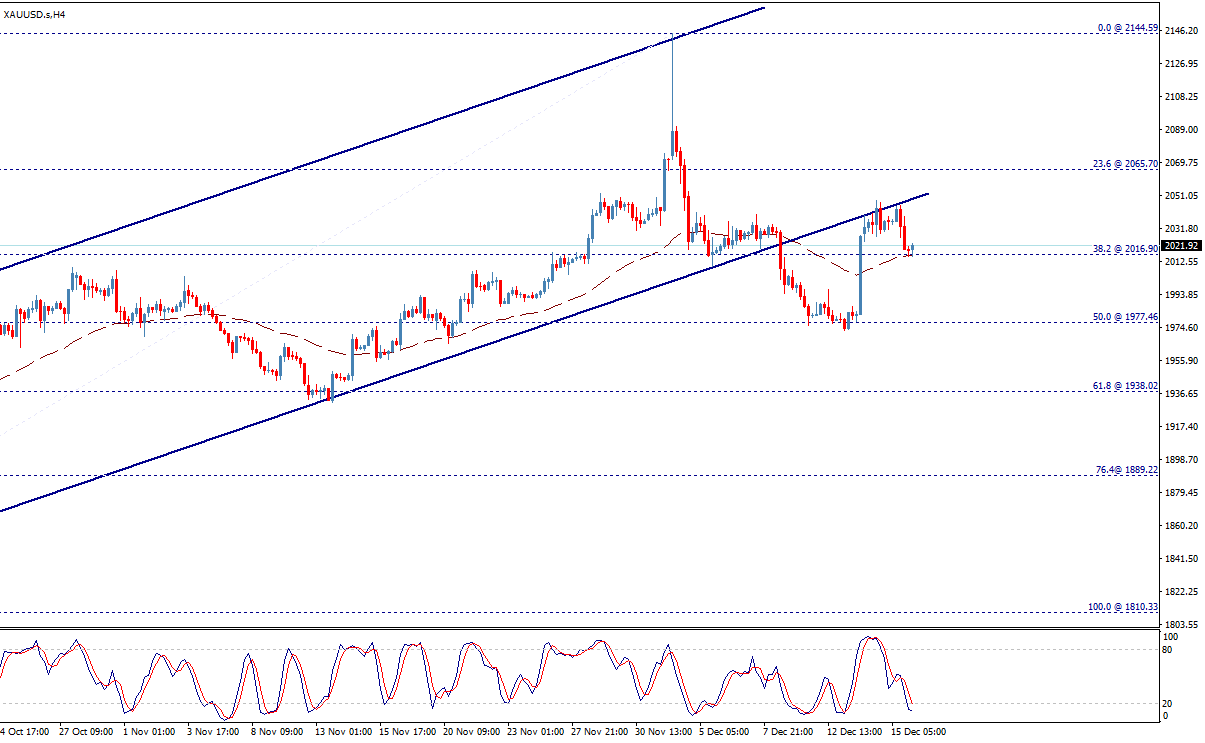

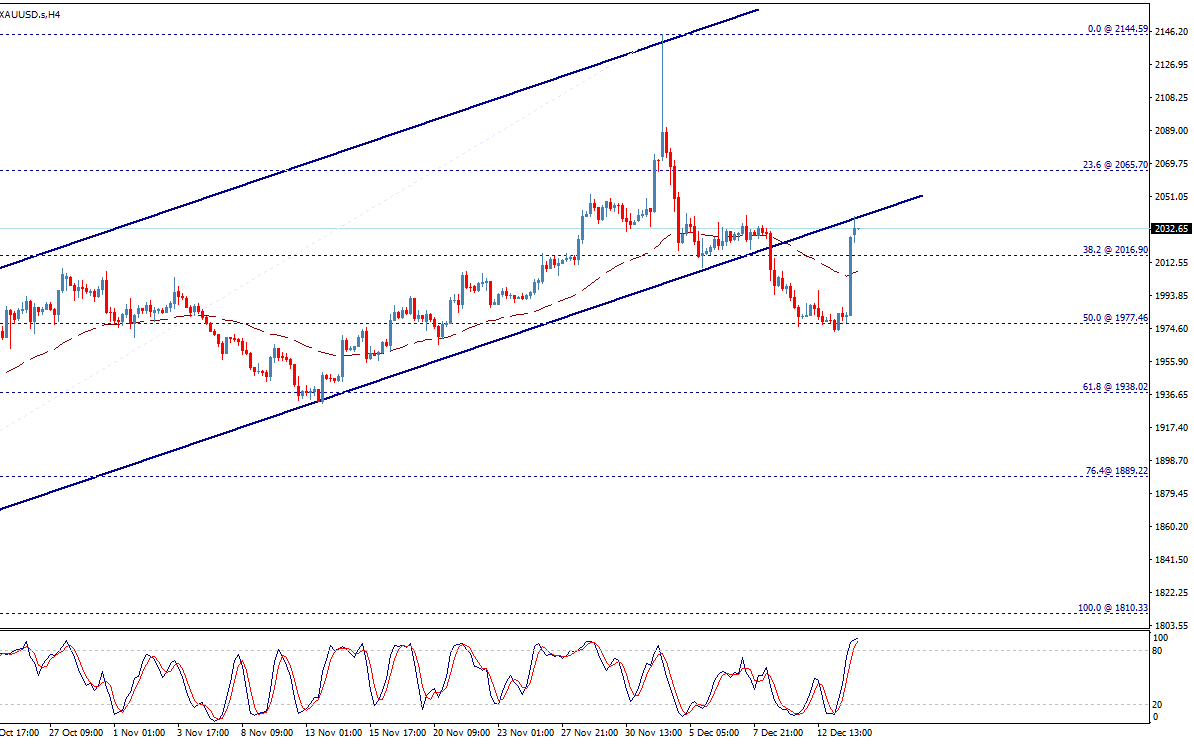

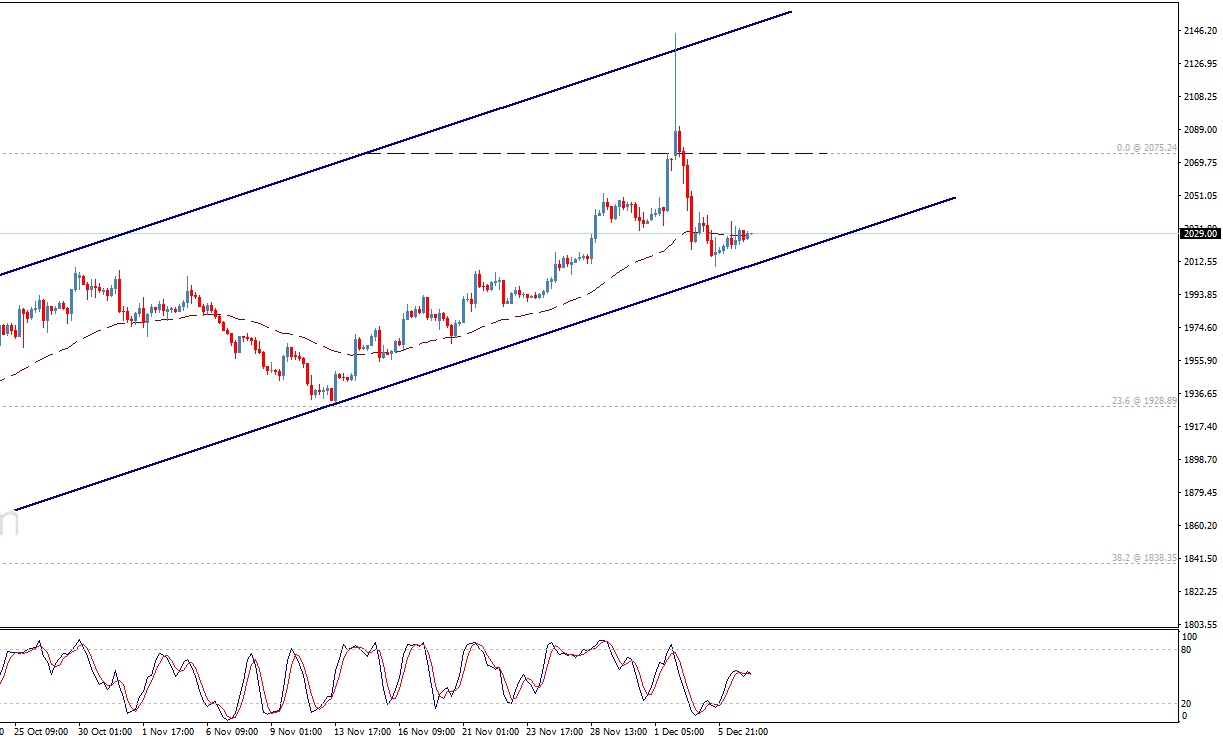

Gold forms bullish pattern – Analysis

Gold continues to fluctuate within sideways track, however, there is double top pattern formed with its confirmation line at 2046.50, and breaking this level will provide strong positive motive that will push the price to surpass our waited target at 2065.70 and head towards 2100.00 areas as a next main station.

Therefore, we will continue to suggest the bullish trend for the upcoming period, as supported by the EMA50.

However, it is important to hold above 2016.90 support to achieve the expected targets.

Gold continues to fluctuate within sideways track, however, there is double top pattern formed with its confirmation line at 2046.50, and breaking this level will provide strong positive motive that will push the price to surpass our waited target at 2065.70 and head towards 2100.00 areas as a next main station.

Therefore, we will continue to suggest the bullish trend for the upcoming period, as supported by the EMA50.

However, it is important to hold above 2016.90 support to achieve the expected targets.

Sajjad Ahmed

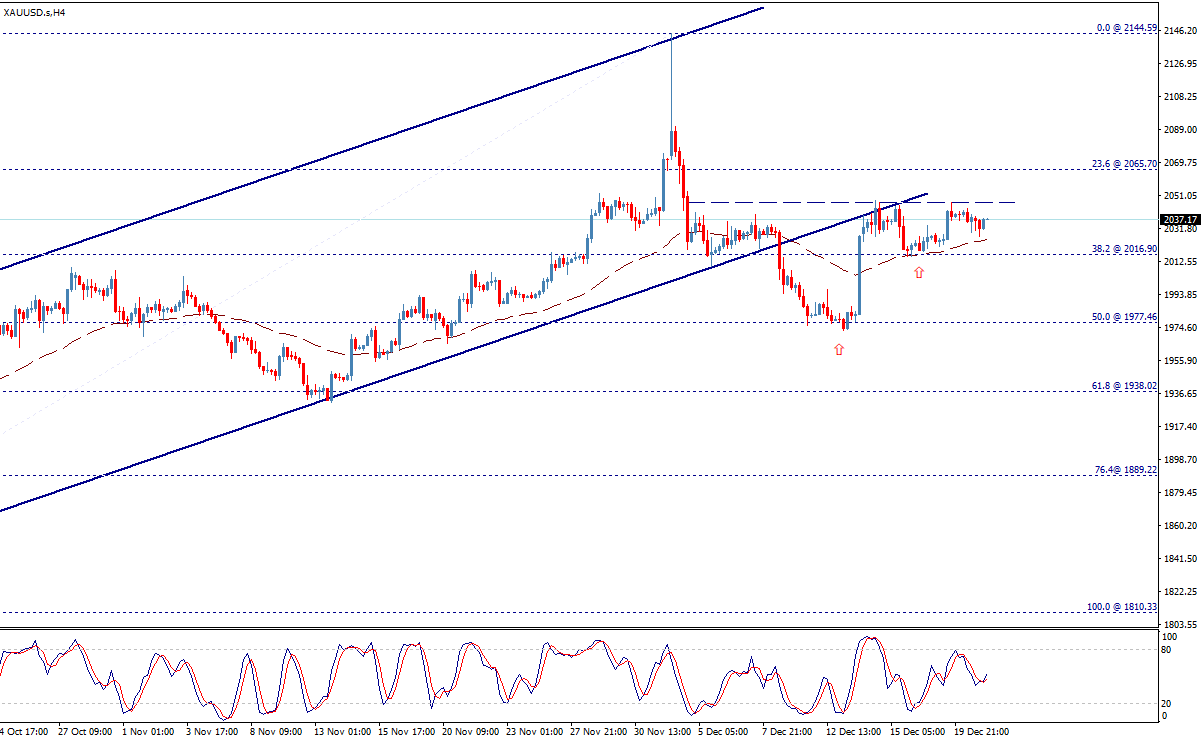

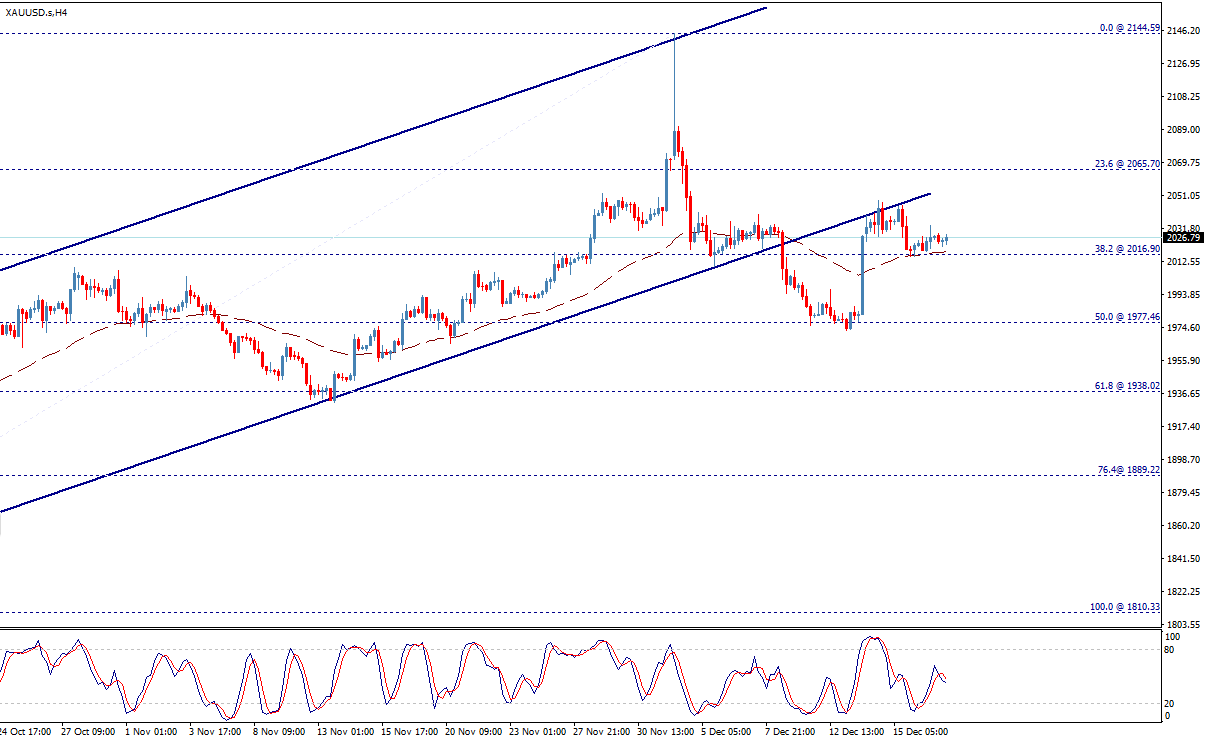

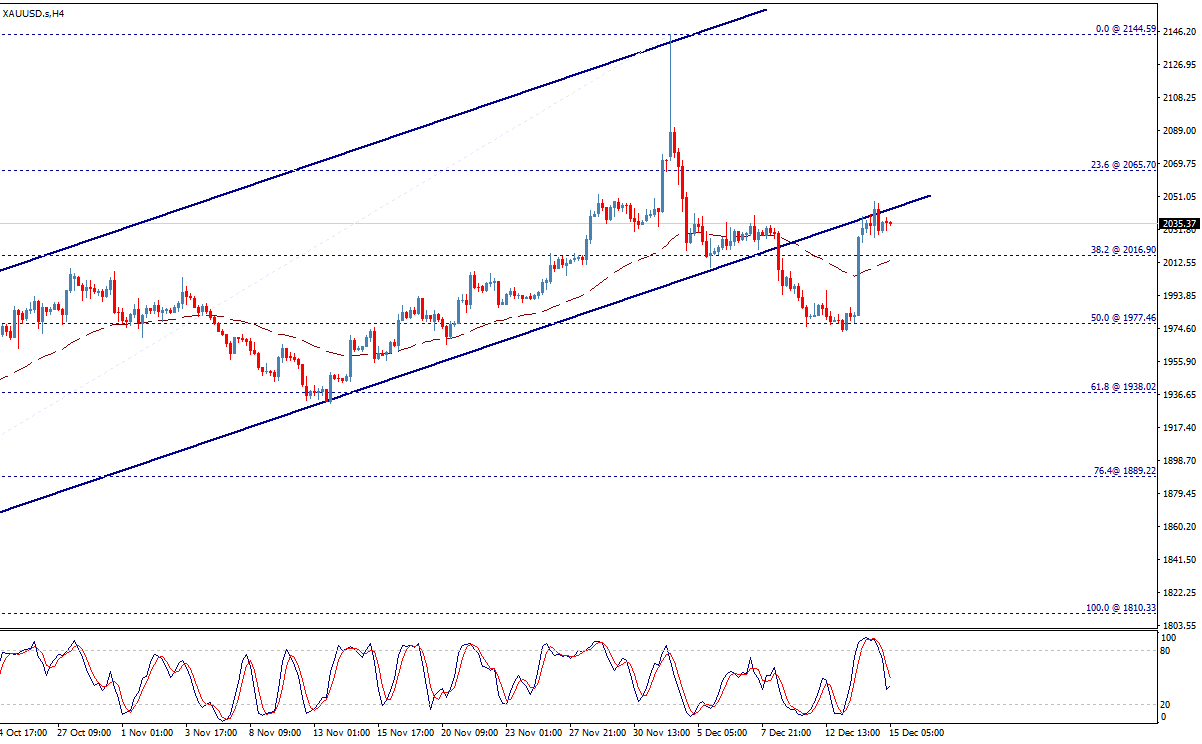

Gold resumes the rise – Analysis

Gold fluctuates within tight track, settling around 2040.00 level, after the rise that it witnessed yesterday, waiting for more bullish bias to visit 2065.70 that represents our next main target, to keep the bullish trend scenario active for the upcoming period.

The EMA50 continues to support the suggested bullish wave, and the price needs positive momentum that assist to resume the positive trades and achieve the mentioned target.

Alternatively, breaking 2016.90 will stop the bullish trend and push the price to return to the correctional bearish track again.

Gold fluctuates within tight track, settling around 2040.00 level, after the rise that it witnessed yesterday, waiting for more bullish bias to visit 2065.70 that represents our next main target, to keep the bullish trend scenario active for the upcoming period.

The EMA50 continues to support the suggested bullish wave, and the price needs positive momentum that assist to resume the positive trades and achieve the mentioned target.

Alternatively, breaking 2016.90 will stop the bullish trend and push the price to return to the correctional bearish track again.

Sajjad Ahmed

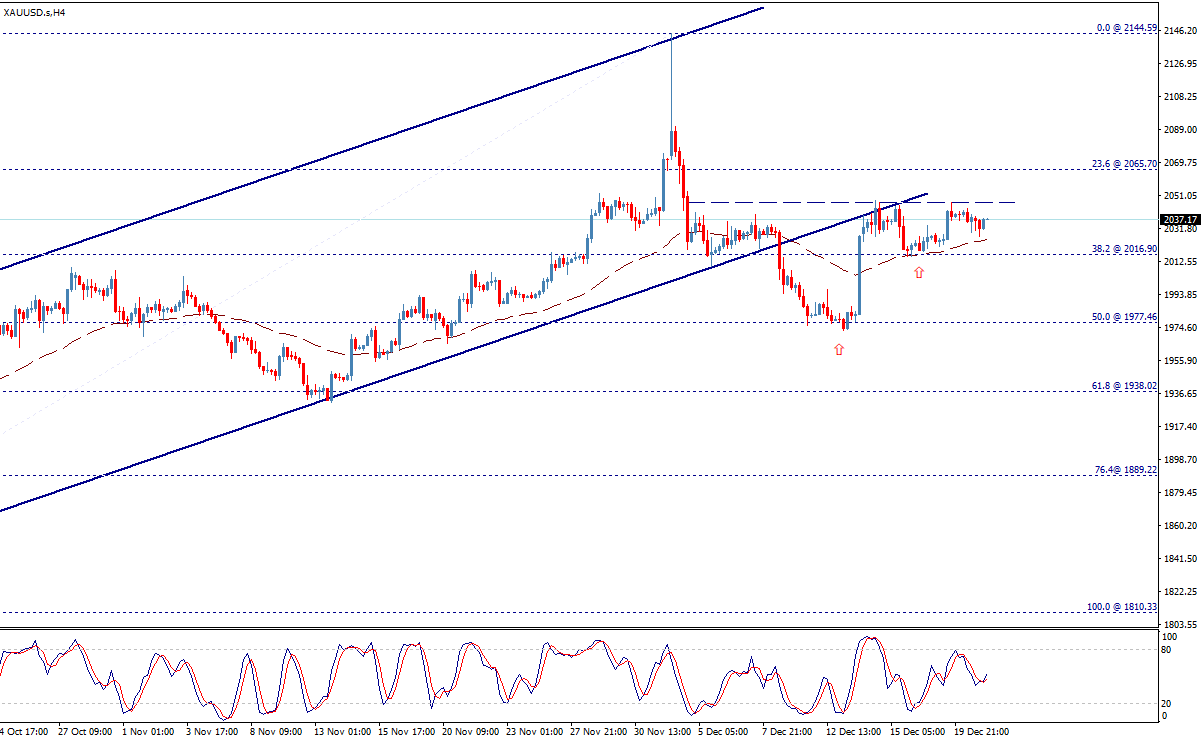

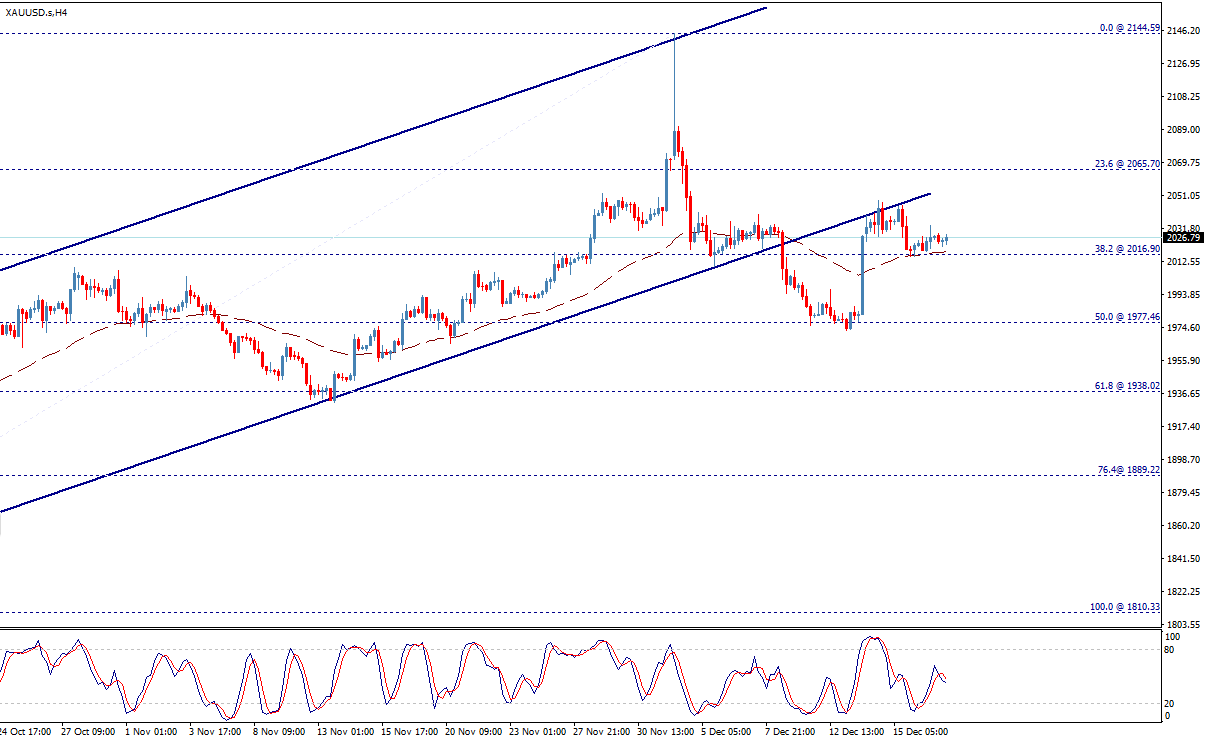

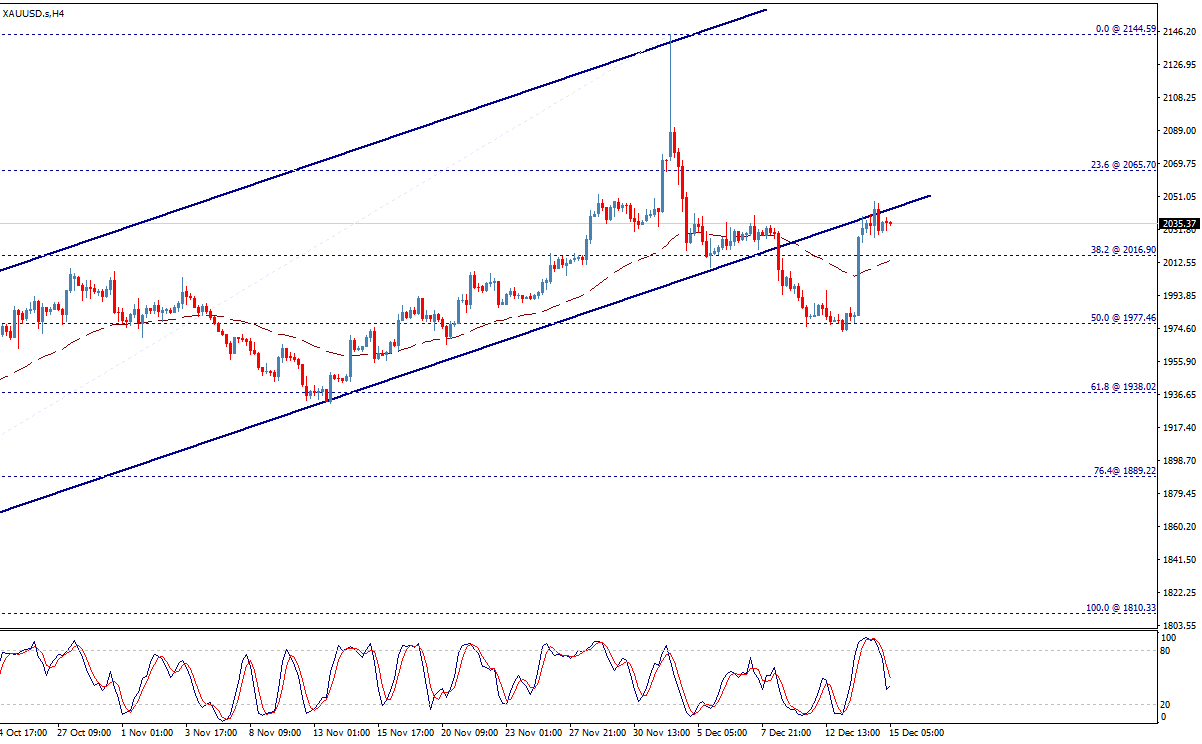

Gold needs strong positive momentum to rise – Analysis

Gold showed slight positive trades in attempt to move upwards from 2016.90 level, getting continuous support by the EMA50, waiting to gather positive momentum to achieve more rise that targets 2065.70 areas mainly.

Therefore, the bullish trend scenario will remain valid and active for the upcoming period.

However, breaking 2016.90 will stop the suggested rise and push the price to achieve new bearish correction.

Gold showed slight positive trades in attempt to move upwards from 2016.90 level, getting continuous support by the EMA50, waiting to gather positive momentum to achieve more rise that targets 2065.70 areas mainly.

Therefore, the bullish trend scenario will remain valid and active for the upcoming period.

However, breaking 2016.90 will stop the suggested rise and push the price to achieve new bearish correction.

Sajjad Ahmed

Gold tests the support 2016.90 – Analysis

Gold has bounced bearishly to test the key support 2016.90, on Friday, leaning on this level to start attempting new bullish wave, to resume the expected bullish trend to test 2065.70 upwards.

The EMA50 meets the mentioned support to add more strength to it, while stochastic provides new positive signals, which support the expectations to rise in the upcoming sessions.

Alternatively, breaking 2016.90 support downwards will stop the positive scenario and push the price to return to the correctional bearish track again.

Gold has bounced bearishly to test the key support 2016.90, on Friday, leaning on this level to start attempting new bullish wave, to resume the expected bullish trend to test 2065.70 upwards.

The EMA50 meets the mentioned support to add more strength to it, while stochastic provides new positive signals, which support the expectations to rise in the upcoming sessions.

Alternatively, breaking 2016.90 support downwards will stop the positive scenario and push the price to return to the correctional bearish track again.

Sajjad Ahmed

Gold needs bullish motive – Analysis

Gold continues to fluctuate around the broken support of the bullish channel, noticing that stochastic is overlapping positively, waiting to resume the bullish trades and confirm the return to the mentioned bullish channel, followed by testing 2065.70.

Therefore, we will continue to suggest the bullish trend for the upcoming period, supported by moving above the EMA50.

However, it is important to hold above 2016.90 support to continue the expected bullish wave.

Gold continues to fluctuate around the broken support of the bullish channel, noticing that stochastic is overlapping positively, waiting to resume the bullish trades and confirm the return to the mentioned bullish channel, followed by testing 2065.70.

Therefore, we will continue to suggest the bullish trend for the upcoming period, supported by moving above the EMA50.

However, it is important to hold above 2016.90 support to continue the expected bullish wave.

Sajjad Ahmed

Gold stops the bearish correction – Analysis

Gold has broken 2016.90 level strongly after initially breaking 1990 and is settled above 2016.90, attempting to return to the bullish channel, to hint stopping the bearish correction. Its next target may be 2065.70.

Therefore, the bullish bias will be suggested for today, it might be preceded by some sideways fluctuation due to stochastic negativity.

Alternatively, breaking 2016.90 downwards will stop the expected rise and push the price to return to the bearish correctional track.

Gold has broken 2016.90 level strongly after initially breaking 1990 and is settled above 2016.90, attempting to return to the bullish channel, to hint stopping the bearish correction. Its next target may be 2065.70.

Therefore, the bullish bias will be suggested for today, it might be preceded by some sideways fluctuation due to stochastic negativity.

Alternatively, breaking 2016.90 downwards will stop the expected rise and push the price to return to the bearish correctional track.

Sajjad Ahmed

Gold awaits the break of 1977.46 support – Analysis

Gold is fluctuating around 1977.46 support since yesterday, waiting to get negative motive to break this level followed by opening the way to decline towards our next correctional target 1938.00.

Alternatively, breaking 1990.00 upwards might motivate the price to rise and test the key resistance 2016.90 before any new negative attempt.

Gold is fluctuating around 1977.46 support since yesterday, waiting to get negative motive to break this level followed by opening the way to decline towards our next correctional target 1938.00.

Alternatively, breaking 1990.00 upwards might motivate the price to rise and test the key resistance 2016.90 before any new negative attempt.

Sajjad Ahmed

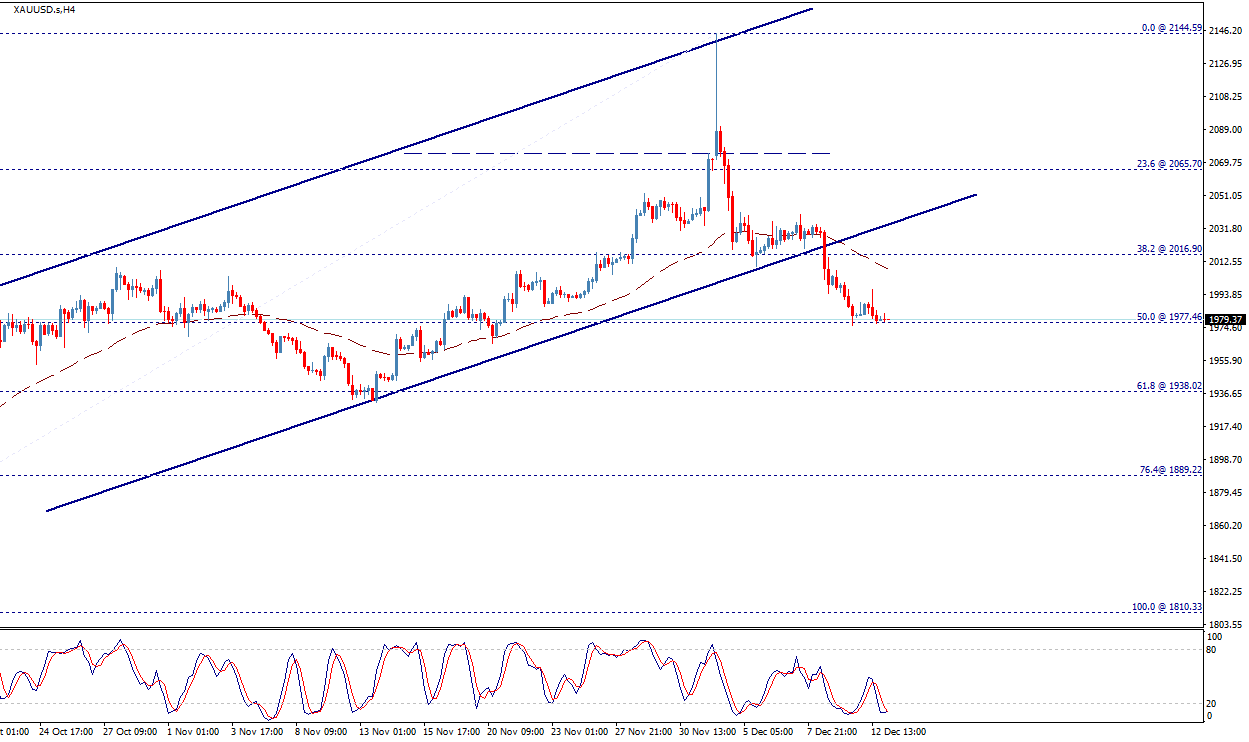

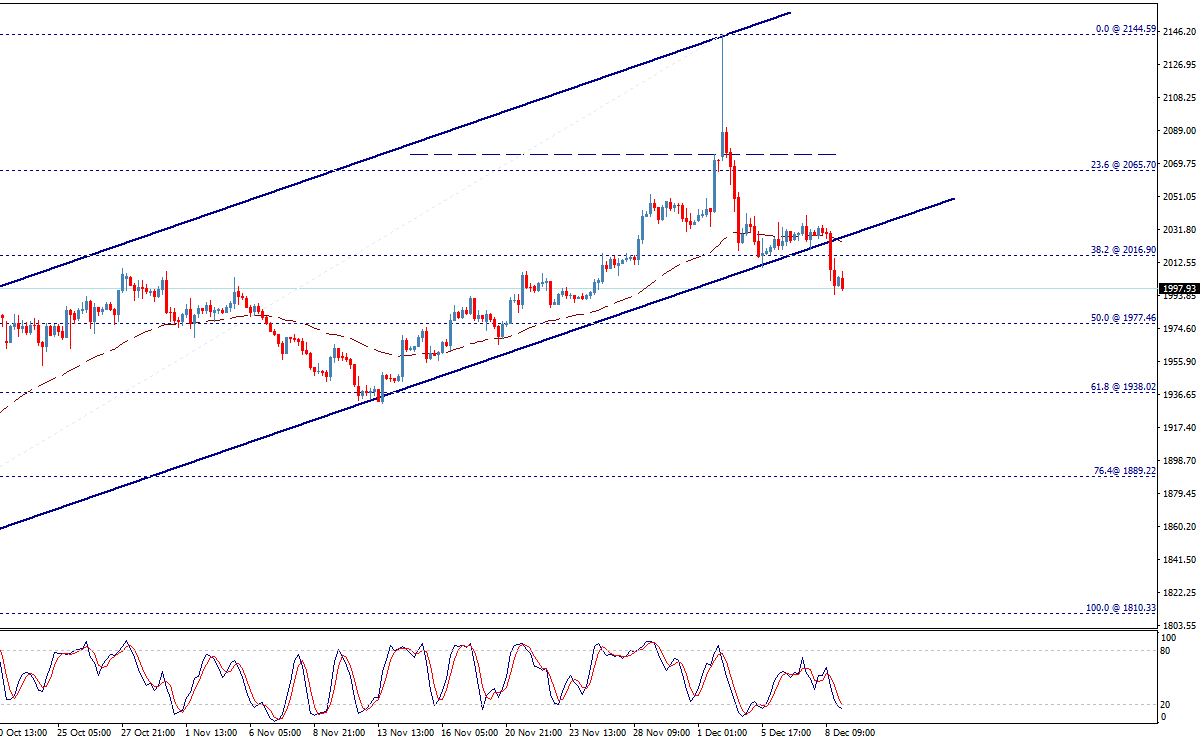

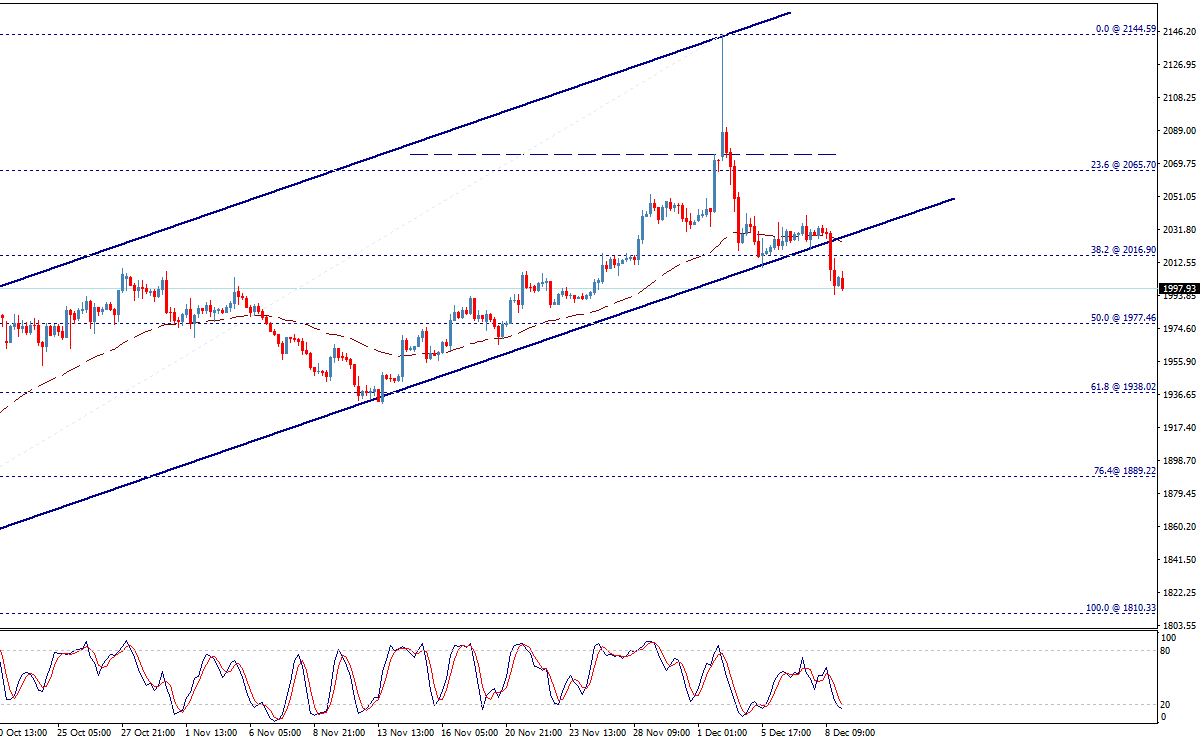

Gold declined to touch my expected target 1977.46 – Analysis

Gold declined to touch my waited target at 1977.46, which represents 50% Fibonacci correction level for the bullish wave.

Falling under negative pressure formed by the EMA50, it is suggested to break 1977.46 level to head towards the next correctional target 1938.00.

Alternatively, failing to achieve the required break of 1977.46 level downwards will push the price to rise and test 2016.90.

Gold declined to touch my waited target at 1977.46, which represents 50% Fibonacci correction level for the bullish wave.

Falling under negative pressure formed by the EMA50, it is suggested to break 1977.46 level to head towards the next correctional target 1938.00.

Alternatively, failing to achieve the required break of 1977.46 level downwards will push the price to rise and test 2016.90.

Sajjad Ahmed

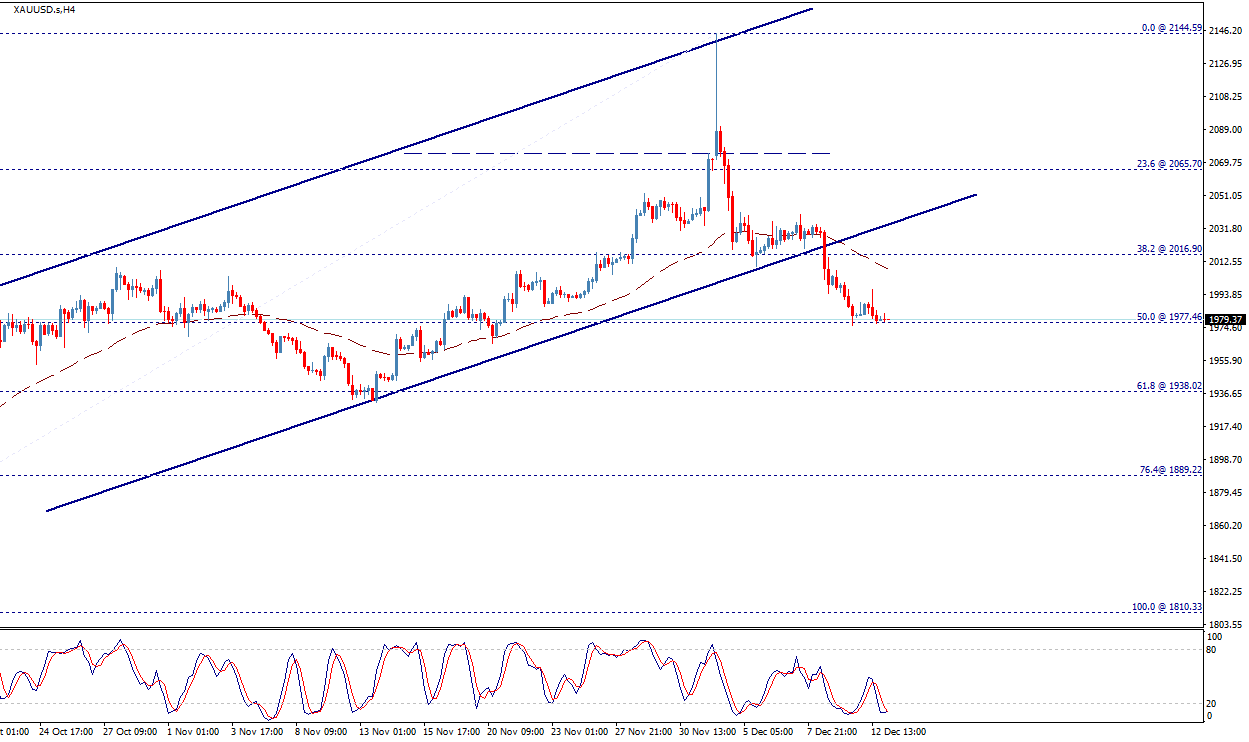

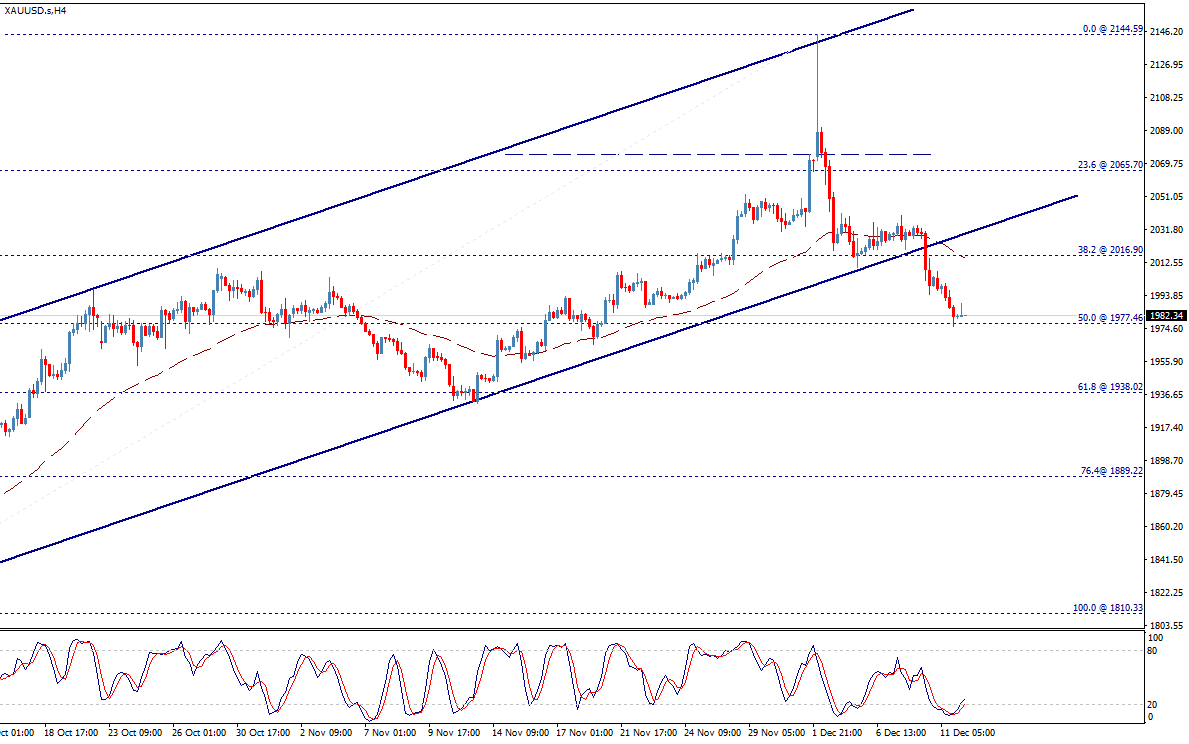

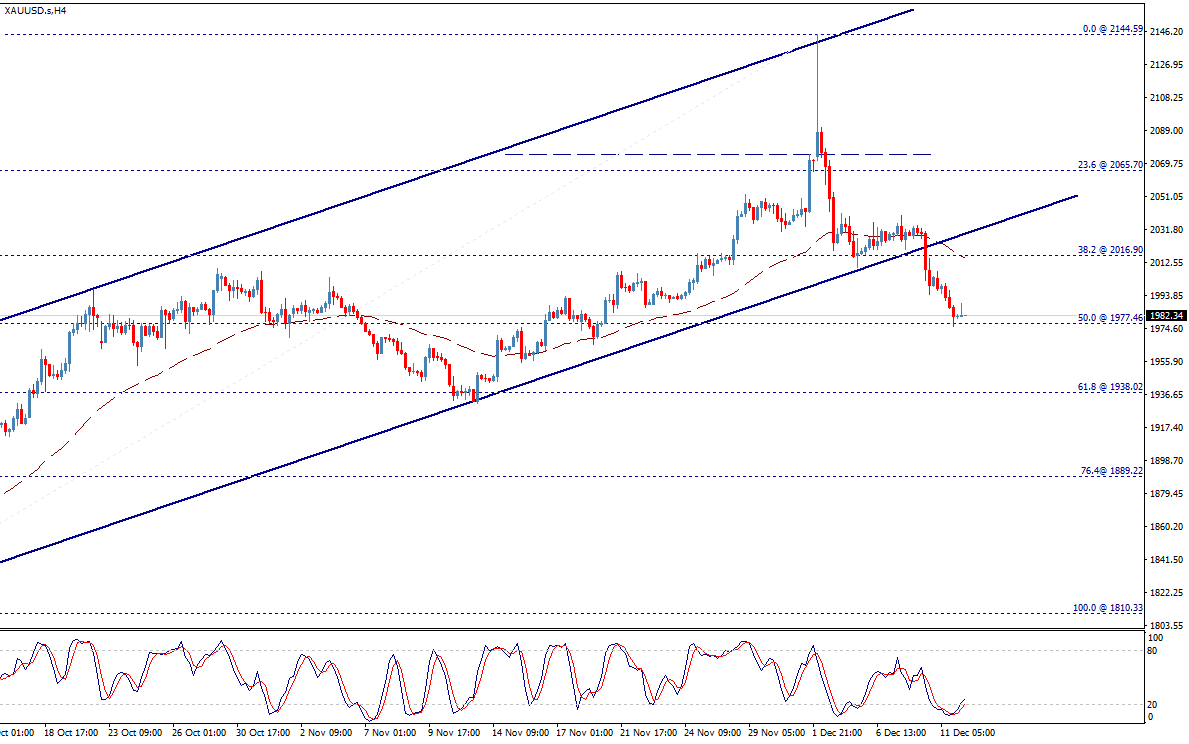

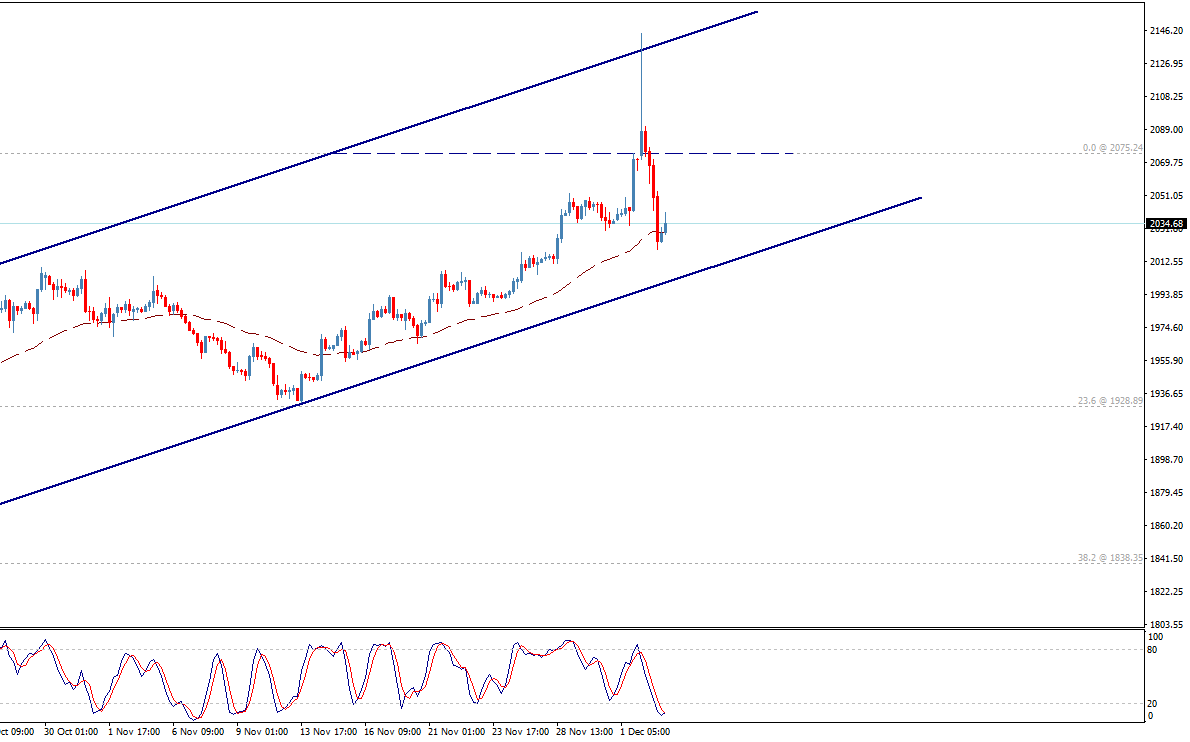

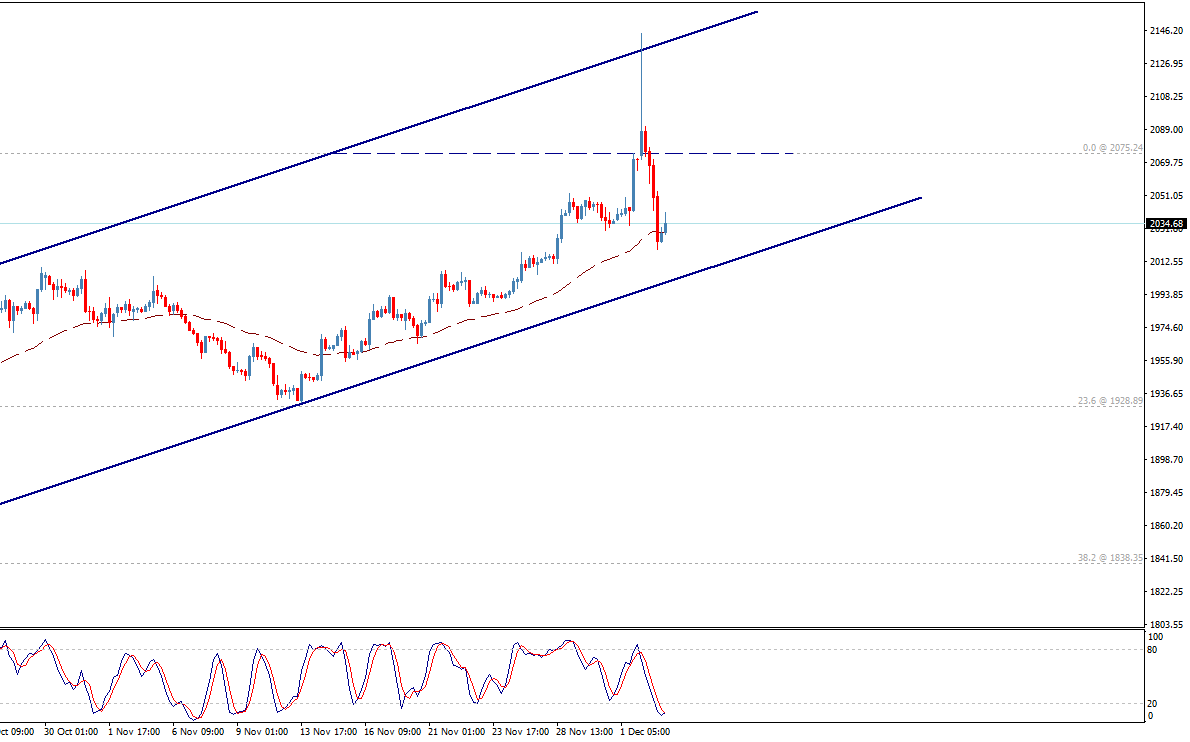

Gold begins bearish correction after breaking bullish channel’s support - Analysis

Gold confirmed breaking the bullish channel’s support line 2016.00 and ended yesterday below it.

This indicates the start of bearish correction, to visit 1977.46 as a next correctional target and after breaking this level, price will be pushed to 1938.00 areas as a next negative station. The EMA50 is also creating negative pressure.

Alternatively, breaching 2016.90 followed by 2027.50 levels will stop the negative scenario and lead the price to regain the main bullish track again.

Gold confirmed breaking the bullish channel’s support line 2016.00 and ended yesterday below it.

This indicates the start of bearish correction, to visit 1977.46 as a next correctional target and after breaking this level, price will be pushed to 1938.00 areas as a next negative station. The EMA50 is also creating negative pressure.

Alternatively, breaching 2016.90 followed by 2027.50 levels will stop the negative scenario and lead the price to regain the main bullish track again.

Sajjad Ahmed

Gold within tight range – Analysis

Gold is within tight range since yesterday, hovering around the EMA50 in H4 chart. Thus, no change to the expected bullish trend scenario for the upcoming period, reminding you that our waited target is 2075.25.

However, holding above 2016.00 is important for expected rise, as breaking it will start bearish correction.

Gold is within tight range since yesterday, hovering around the EMA50 in H4 chart. Thus, no change to the expected bullish trend scenario for the upcoming period, reminding you that our waited target is 2075.25.

However, holding above 2016.00 is important for expected rise, as breaking it will start bearish correction.

Sajjad Ahmed

Gold needs positive motive to rise – Analysis

Gold hovers around the EMA50, waiting to get positive momentum for resuming the expected bullish trend, organized inside the bullish channel, reminding you that our next bullish target is located at 2075.25 level.

However, holding above 2010.00 is important for expected rise, as breaking it will start bearish correction.

Gold hovers around the EMA50, waiting to get positive momentum for resuming the expected bullish trend, organized inside the bullish channel, reminding you that our next bullish target is located at 2075.25 level.

However, holding above 2010.00 is important for expected rise, as breaking it will start bearish correction.

Sajjad Ahmed

Gold attempts bullishly – Analysis

Gold declined and approached the bullish channel’s support line around 2009.00, and then begins to rebound to resume the bullish trend within the bullish channel, on its way towards 2075.25.

Therefore, the bullish bias is expected for today, supported by stochastic positivity, and breaching 2030.00 resistance will ease the mission to achieve the expected rise.

However, breaking 2006.00 will stop the bullish trend and push the price to start bearish correction.

Gold declined and approached the bullish channel’s support line around 2009.00, and then begins to rebound to resume the bullish trend within the bullish channel, on its way towards 2075.25.

Therefore, the bullish bias is expected for today, supported by stochastic positivity, and breaching 2030.00 resistance will ease the mission to achieve the expected rise.

However, breaking 2006.00 will stop the bullish trend and push the price to start bearish correction.

Sajjad Ahmed

Gold continues to decline – Analysis

Gold continued to decline to reach the first negative target at 2035.00, and continuation of the bearish bias is suggested, for today.

Breaking the support 2030.00 will ease the mission to decline towards 2000.00 i.e. bullish channel’s support.

Alternatively, consolidating above 2030.00 will attempt to achieve gains towards 2075.25.

Gold continued to decline to reach the first negative target at 2035.00, and continuation of the bearish bias is suggested, for today.

Breaking the support 2030.00 will ease the mission to decline towards 2000.00 i.e. bullish channel’s support.

Alternatively, consolidating above 2030.00 will attempt to achieve gains towards 2075.25.

Sajjad Ahmed

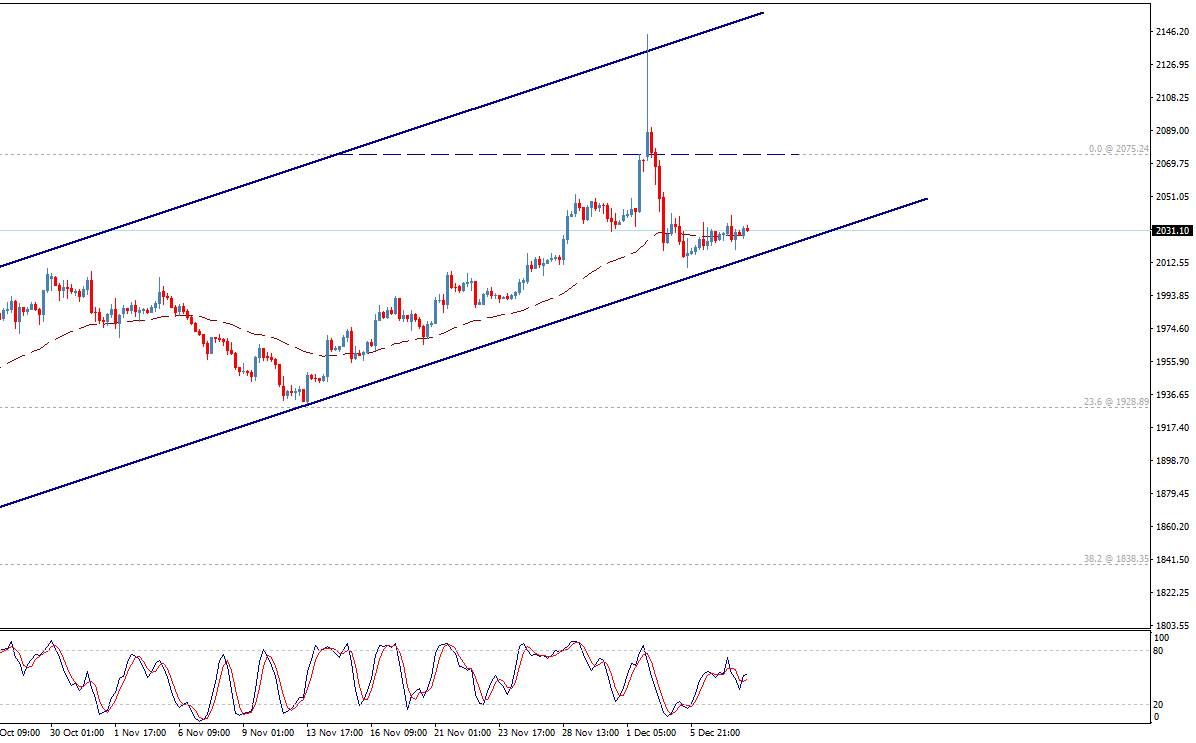

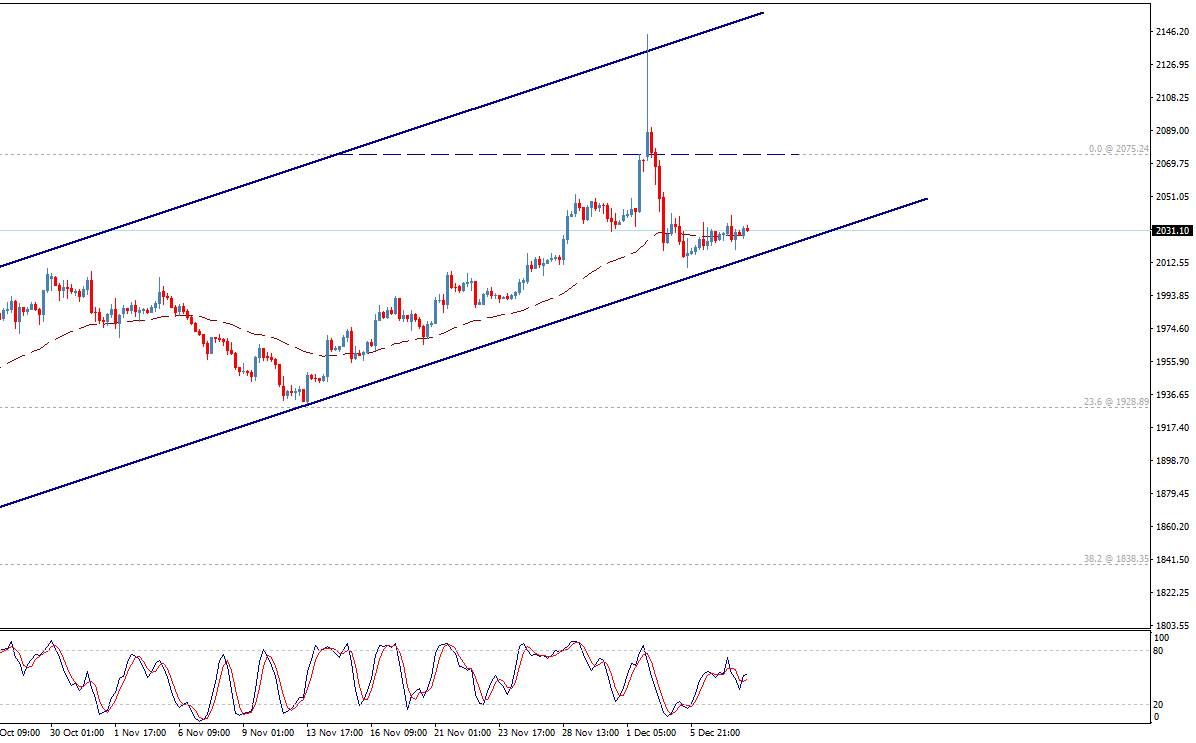

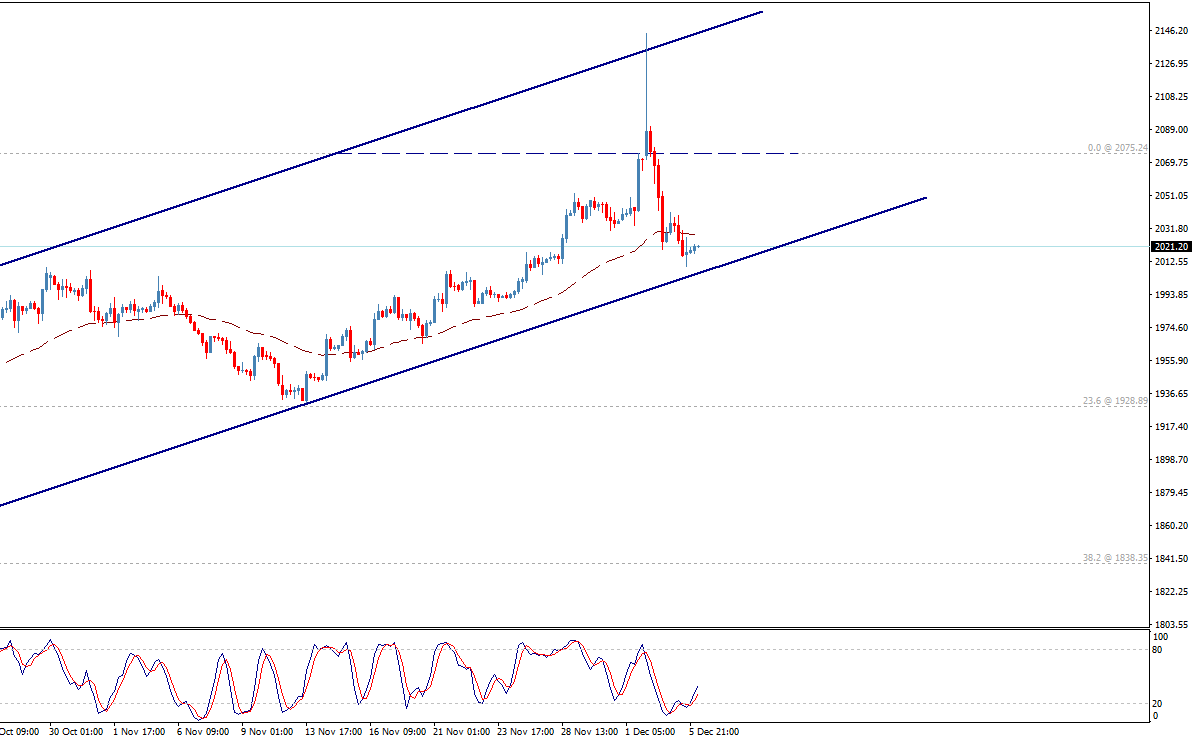

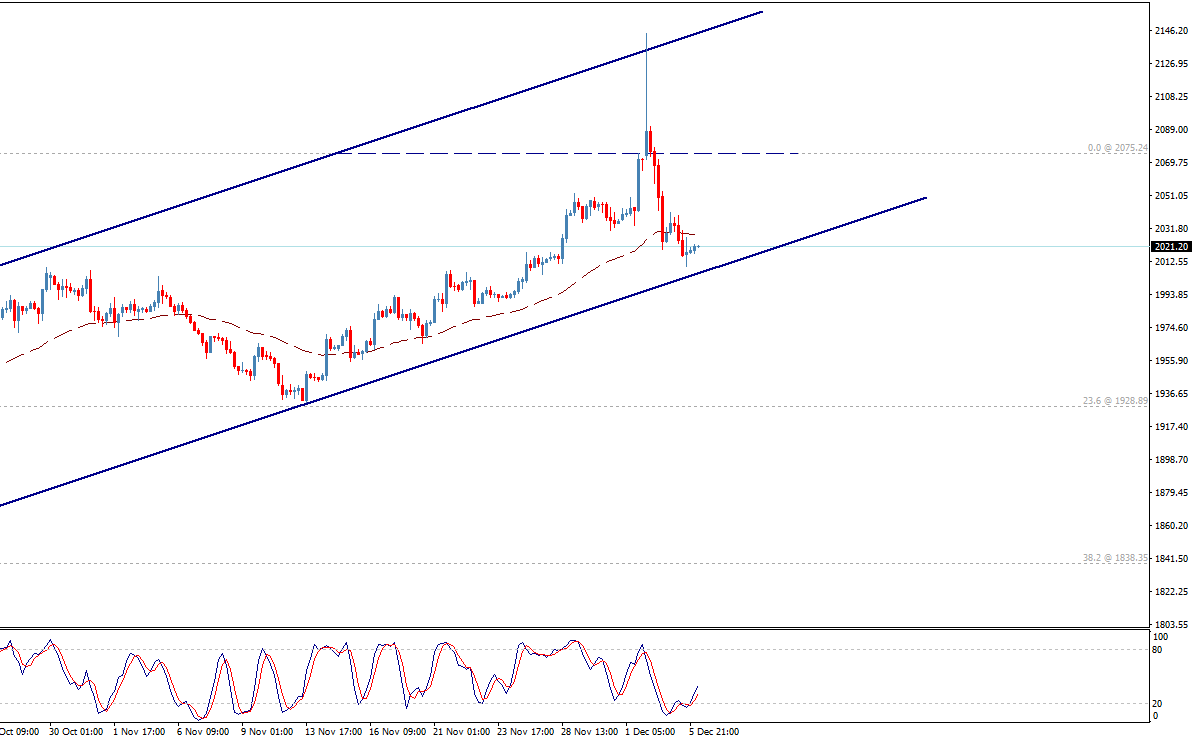

Gold settles around 2075.25 after hitting record high – Analysis

Gold opened today with strong rise to surpass our expected target at 2075.25 and records new historical highs at 2144.60 level, and then declined quickly to settle around the first level 2075.25. The level 2075.25 is key support now.

We suggest bullish bias today, supported by the EMA50, to test 2100.00 level which can extend to 2135.00.

Alternatively, breaking key support 2075.25 will stop the expected rise and push the price to achieve some bearish correction.

Gold opened today with strong rise to surpass our expected target at 2075.25 and records new historical highs at 2144.60 level, and then declined quickly to settle around the first level 2075.25. The level 2075.25 is key support now.

We suggest bullish bias today, supported by the EMA50, to test 2100.00 level which can extend to 2135.00.

Alternatively, breaking key support 2075.25 will stop the expected rise and push the price to achieve some bearish correction.

Sajjad Ahmed

Gold is awaiting rise – Analysis

The sideways range is dominating gold since yesterday, however, Stochastic overlaps positively now, waiting to resume the main bullish trend, towards 2075.25 areas mainly. The bullish channel continues to establish the suggested bullish bias.

However, breaking 2030.00 might push the price to decline and test 2009.30 initially before any new attempt to rise.

The sideways range is dominating gold since yesterday, however, Stochastic overlaps positively now, waiting to resume the main bullish trend, towards 2075.25 areas mainly. The bullish channel continues to establish the suggested bullish bias.

However, breaking 2030.00 might push the price to decline and test 2009.30 initially before any new attempt to rise.

Sajjad Ahmed

Gold is awaiting more rise – Analysis

Gold fluctuates around the intraday bullish channel’s resistance around 2047.00, waiting to get positive momentum to resume the main bullish trend, which targets 2075.25 areas. The EMA50 continues to support the suggested bullish wave.

Alternatively, breaking 2037.00 level will put the price under negative pressure that targets testing 2020.00 areas and might extend to 2009.30 before any new attempt to rise.

Gold fluctuates around the intraday bullish channel’s resistance around 2047.00, waiting to get positive momentum to resume the main bullish trend, which targets 2075.25 areas. The EMA50 continues to support the suggested bullish wave.

Alternatively, breaking 2037.00 level will put the price under negative pressure that targets testing 2020.00 areas and might extend to 2009.30 before any new attempt to rise.

Sajjad Ahmed

Gold failed to break 2030.00 downwards – Analysis

Gold showed some slight bearish bias, affected by stochastic negativity, but failed to break 2030.00 level.

If Gold breaks 2047.00 upwards, it will be Bullish and move towards our next main target at 2075.25.

Alternatively, Gold should break 2030.00 downwards, to turn to Bearish scenario, otherwise it is Bullish.

Gold showed some slight bearish bias, affected by stochastic negativity, but failed to break 2030.00 level.

If Gold breaks 2047.00 upwards, it will be Bullish and move towards our next main target at 2075.25.

Alternatively, Gold should break 2030.00 downwards, to turn to Bearish scenario, otherwise it is Bullish.

Sajjad Ahmed

Gold breaches our waited target 2030.00 – Analysis

Gold opens today with more positivity and approached our waited extended target at 2055.00 after breaching 2030.00 level.

Now Gold attempts to confirm surpassing the intraday bullish channel’s resistance around 2047.00, as shown in chart, waiting to get positive motive to continue rising and achieve 2075.25 areas. The EMA50 continues to support the suggested bullish wave.

Alternatively, failing to surpass the current resistance around 2047.00 will push the price to decline towards the key support 2009.30 before any new attempt to rise.

Gold opens today with more positivity and approached our waited extended target at 2055.00 after breaching 2030.00 level.

Now Gold attempts to confirm surpassing the intraday bullish channel’s resistance around 2047.00, as shown in chart, waiting to get positive motive to continue rising and achieve 2075.25 areas. The EMA50 continues to support the suggested bullish wave.

Alternatively, failing to surpass the current resistance around 2047.00 will push the price to decline towards the key support 2009.30 before any new attempt to rise.

Sajjad Ahmed

Gold attempts positively – Analysis

Gold has shown new positive trades after leaning on 2009.30 level in the previous sessions, to support our expected bullish trend, organized inside the bullish channels, noting that our next target is located at 2030.00.

Stochastic current negativity might cause some temporary sideways fluctuation until the price gets positive momentum to resume the suggested bullish wave,

Please note that Bullish scenario will remain valid unless breaking 2009.30 level followed by 2003.40 level and holding below them for resuming bearish trend.

The expected trading range for today is between 2000.00 support and 2035.00 resistance.

The expected trend for today: Bullish

Gold has shown new positive trades after leaning on 2009.30 level in the previous sessions, to support our expected bullish trend, organized inside the bullish channels, noting that our next target is located at 2030.00.

Stochastic current negativity might cause some temporary sideways fluctuation until the price gets positive momentum to resume the suggested bullish wave,

Please note that Bullish scenario will remain valid unless breaking 2009.30 level followed by 2003.40 level and holding below them for resuming bearish trend.

The expected trading range for today is between 2000.00 support and 2035.00 resistance.

The expected trend for today: Bullish

: