Andres Felipe Mera / Profile

- Information

|

2 years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

I am an economist and trader with experience in financial markets. My passion for markets and my deep theoretical knowledge have allowed me to excel in my field.

With over a decade of experience, I have worked at various renowned financial institutions, where I have played key roles in market analysis and strategic decision making. My background spans both the public and private sectors, which has given me a comprehensive perspective of the economic and political factors that influence markets.

As a trader, I am disciplined and patient. I know that success in the financial markets requires a combination of knowledge, technical skills, and an emotionally balanced mindset. I have developed a well-defined trading strategy and strictly follow my rules, which allows me to stay in control and avoid impulsive reactions to market volatility.

It is a pleasure for me to be able to share this operation with each one of you... regards

With over a decade of experience, I have worked at various renowned financial institutions, where I have played key roles in market analysis and strategic decision making. My background spans both the public and private sectors, which has given me a comprehensive perspective of the economic and political factors that influence markets.

As a trader, I am disciplined and patient. I know that success in the financial markets requires a combination of knowledge, technical skills, and an emotionally balanced mindset. I have developed a well-defined trading strategy and strictly follow my rules, which allows me to stay in control and avoid impulsive reactions to market volatility.

It is a pleasure for me to be able to share this operation with each one of you... regards

Andres Felipe Mera

Published post 6 meses ganando con mi estrategia y algunas reflexiones

Análisis de Resultados – 6 Meses de Trading 📊 Crecimiento Total: 199% 🔹 Últimos 6 meses: Rendimiento sostenido con un crecimiento acumulado superior al 90%. 🔹 Picos de reducción: Momentos de volatilidad, pero con recuperación rápida...

Share on social networks · 2

54

Andres Felipe Mera

Market Wrap: Forex

The U.S. dollar index was little changed at 107.97.

EUR/USD gained 22 pips to 1.0382.

USD/JPY jumped 195 pips (+1.28%) to 154.43, extending its rebound to a third session.

GBP/USD was largely flat at 1.2440.

AUD/USD fell 17 pips to 0.6277.

USD/CHF added 5 pips to 0.9134, and USD/CAD advanced 20 pips to 1.4303.

Bitcoin regained some traction, climbing over 2% to 97,960 dollars.

Market Wrap: Stocks and Commodities

On Wednesday, U.S. stocks closed lower as hotter-than-expected inflation data hinted at fewer interest-rate cuts going forward.

The Dow Jones Industrial Average fell 225 points (-0.50%) to 44,368, the S&P 500 slipped 16 points (-0.27%) to 6,051, while the Nasdaq 100 edged up 25 points (+0.12%) to 21,719.

U.S. consumer prices increased 3.0% year on year in January (vs +2.9% expected), marking the fourth consecutive month of rising inflation. Core inflation also accelerated to 3.3% year on year (vs 3.1% expected).

In his testimony before the House Financial Services Committee, Federal Reserve Chair Jerome Powell said the central bank would keep policy restrictive for now.

Meanwhile, the U.S. 10-Year Treasury yield jumped 10 basis points to 4.637%.

Palantir Technologies (PLTR) gained 4.24% to close at a record level of 117.39 dollars.

Meta Platforms (META) added 0.78% to 725.38 dollars, also a record closing level.

CVS Health (CVS) surged 14.95%, becoming the top performer in the S&P 500. The pharmacy and healthcare company's quarterly earnings exceeded market expectations, and the stock was upgraded to "overweight" at Cantor Fitzgerald.

Gilead Sciences (GILD) jumped 7.46% on stronger-than-expected quarterly results.

Lyft (LYFT) tumbled 7.92% on lower-than-expected quarterly sales and underwhelming current-quarter bookings guidance.

European stocks advanced further, with the DAX 40 gaining 0.50%, the CAC 40 up 0.17%, and the FTSE 100 up 0.34%.

U.S. WTI crude-oil futures fell 1.95 dollars (-2.66%) to 71.37 dollars a barrel, ending a three-session rebound. Oil prices were under pressure after U.S. President Donald Trump started discussing the Russia-Ukraine war in separate phone calls with Russian and Ukrainian presidents.

Gold price added 6 dollars to 2,903 dollars an ounce.

Market Wrap: Asian Session

In Asian trading hours, USD/JPY eased to 154.25. Japan's producer prices index rose 4.2% year-on-year in January, above 4.1% estimated.

Meanwhile, EUR/USD advanced to 1.0400 and GBP/USD climbed to 1.2460.

Gold edged up to 2,907 dollars.

Bitcoin was steady at 97,380 dollars.

Expected Today

The eurozone's industrial production is expected to drop 0.3% month-on-month in December.

Germany's final reading of January inflation rate is estimated to be up 2.3% year-on-year.

U.K. gross domestic product is expected to grow 1.0% year-on-year in the fourth quarter, while industrial production is estimated to be up 0.2% month-on-month in December.

In the U.S., producer prices index growth is anticipated to edge up to 3.4% year-on-year in January, while weekly initial jobless claims are estimated at 215,000.

The U.S. dollar index was little changed at 107.97.

EUR/USD gained 22 pips to 1.0382.

USD/JPY jumped 195 pips (+1.28%) to 154.43, extending its rebound to a third session.

GBP/USD was largely flat at 1.2440.

AUD/USD fell 17 pips to 0.6277.

USD/CHF added 5 pips to 0.9134, and USD/CAD advanced 20 pips to 1.4303.

Bitcoin regained some traction, climbing over 2% to 97,960 dollars.

Market Wrap: Stocks and Commodities

On Wednesday, U.S. stocks closed lower as hotter-than-expected inflation data hinted at fewer interest-rate cuts going forward.

The Dow Jones Industrial Average fell 225 points (-0.50%) to 44,368, the S&P 500 slipped 16 points (-0.27%) to 6,051, while the Nasdaq 100 edged up 25 points (+0.12%) to 21,719.

U.S. consumer prices increased 3.0% year on year in January (vs +2.9% expected), marking the fourth consecutive month of rising inflation. Core inflation also accelerated to 3.3% year on year (vs 3.1% expected).

In his testimony before the House Financial Services Committee, Federal Reserve Chair Jerome Powell said the central bank would keep policy restrictive for now.

Meanwhile, the U.S. 10-Year Treasury yield jumped 10 basis points to 4.637%.

Palantir Technologies (PLTR) gained 4.24% to close at a record level of 117.39 dollars.

Meta Platforms (META) added 0.78% to 725.38 dollars, also a record closing level.

CVS Health (CVS) surged 14.95%, becoming the top performer in the S&P 500. The pharmacy and healthcare company's quarterly earnings exceeded market expectations, and the stock was upgraded to "overweight" at Cantor Fitzgerald.

Gilead Sciences (GILD) jumped 7.46% on stronger-than-expected quarterly results.

Lyft (LYFT) tumbled 7.92% on lower-than-expected quarterly sales and underwhelming current-quarter bookings guidance.

European stocks advanced further, with the DAX 40 gaining 0.50%, the CAC 40 up 0.17%, and the FTSE 100 up 0.34%.

U.S. WTI crude-oil futures fell 1.95 dollars (-2.66%) to 71.37 dollars a barrel, ending a three-session rebound. Oil prices were under pressure after U.S. President Donald Trump started discussing the Russia-Ukraine war in separate phone calls with Russian and Ukrainian presidents.

Gold price added 6 dollars to 2,903 dollars an ounce.

Market Wrap: Asian Session

In Asian trading hours, USD/JPY eased to 154.25. Japan's producer prices index rose 4.2% year-on-year in January, above 4.1% estimated.

Meanwhile, EUR/USD advanced to 1.0400 and GBP/USD climbed to 1.2460.

Gold edged up to 2,907 dollars.

Bitcoin was steady at 97,380 dollars.

Expected Today

The eurozone's industrial production is expected to drop 0.3% month-on-month in December.

Germany's final reading of January inflation rate is estimated to be up 2.3% year-on-year.

U.K. gross domestic product is expected to grow 1.0% year-on-year in the fourth quarter, while industrial production is estimated to be up 0.2% month-on-month in December.

In the U.S., producer prices index growth is anticipated to edge up to 3.4% year-on-year in January, while weekly initial jobless claims are estimated at 215,000.

Andres Felipe Mera

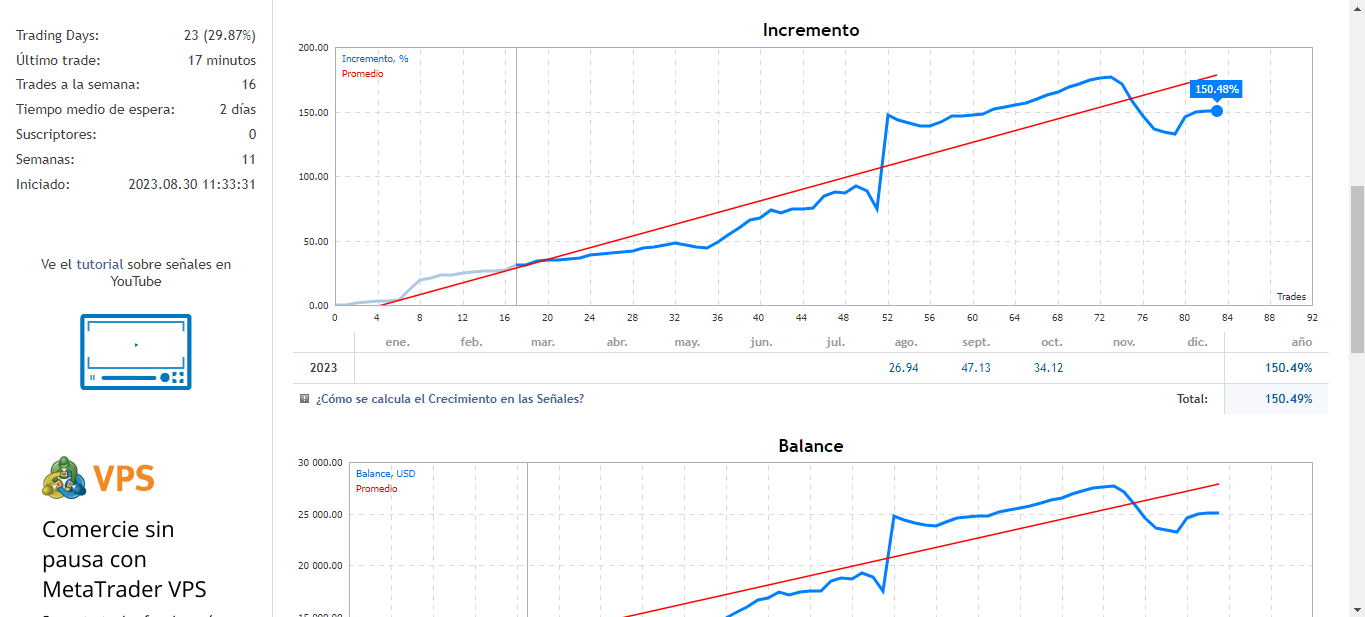

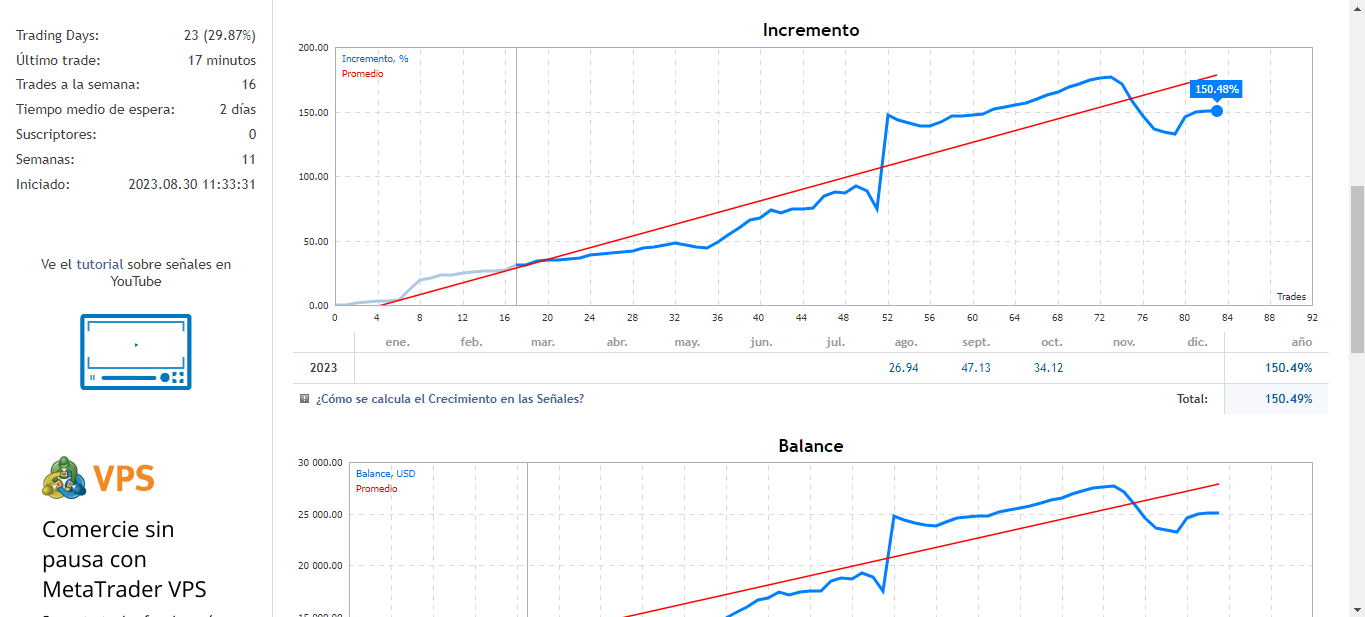

Hoy quiero compartir con ustedes los resultados de mi estrategia de trading en los últimos 3 meses, donde he logrado obtener un rendimiento del 150% de rentabilidad sobre mi capital inicial.

Mi estrategia se basa en el concepto de smart money, que se refiere al dinero que mueven los grandes inversores institucionales y que generan las tendencias y los movimientos más importantes en el mercado. Para identificar el smart money, utilizo herramientas de análisis técnico como el volumen, el precio y los patrones gráficos. También uso indicadores como el RSI, el MACD y las medias móviles para confirmar las señales de entrada y salida.

Además, aplico técnicas de cobertura para proteger mi posición en caso de que el mercado se mueva en contra de mi pronóstico. La cobertura consiste en abrir una operación contraria a la principal, con un activo correlacionado o inversamente correlacionado, para reducir el riesgo y la exposición al mercado. Por ejemplo, si tengo una posición larga en el NASDAQ, puedo abrir una posición corta en el oro, que suele tener una correlación negativa con el índice bursátil.

Los principales activos que opero son el NASDAQ y el oro, ya que son dos de los más líquidos y volátiles del mercado. El NASDAQ es el índice que agrupa a las principales empresas tecnológicas de Estados Unidos, como Apple, Microsoft, Amazon y Facebook. El oro es un metal precioso que se considera un activo refugio, es decir, que aumenta su valor en tiempos de incertidumbre o crisis económica.

Mi estrategia se basa en el concepto de smart money, que se refiere al dinero que mueven los grandes inversores institucionales y que generan las tendencias y los movimientos más importantes en el mercado. Para identificar el smart money, utilizo herramientas de análisis técnico como el volumen, el precio y los patrones gráficos. También uso indicadores como el RSI, el MACD y las medias móviles para confirmar las señales de entrada y salida.

Además, aplico técnicas de cobertura para proteger mi posición en caso de que el mercado se mueva en contra de mi pronóstico. La cobertura consiste en abrir una operación contraria a la principal, con un activo correlacionado o inversamente correlacionado, para reducir el riesgo y la exposición al mercado. Por ejemplo, si tengo una posición larga en el NASDAQ, puedo abrir una posición corta en el oro, que suele tener una correlación negativa con el índice bursátil.

Los principales activos que opero son el NASDAQ y el oro, ya que son dos de los más líquidos y volátiles del mercado. El NASDAQ es el índice que agrupa a las principales empresas tecnológicas de Estados Unidos, como Apple, Microsoft, Amazon y Facebook. El oro es un metal precioso que se considera un activo refugio, es decir, que aumenta su valor en tiempos de incertidumbre o crisis económica.

Andres Felipe Mera

The Smart Money concepts strategy is based on the following steps to follow to carry out all operations, whether they are upwards (purchases) or downwards (sales).

Trend detection: bullish or bearish (on 30-minute charts)

Detection of the area of interest (in 30-minute graphs):

2.1. In an uptrend: Demand zones (for purchases)

2.2. In downtrend: Supply zones (for sales)

3. Confirmation: change of structure in the area of interest (in 1-minute charts)

4. Operative:

4.1. Definition of the entry point (on 1-minute charts)

4.2. Stop loss placement (on 1-minute charts)

4.3. Placement of the take profit (on 30-minute charts)

----------------------------------------------------------------------------------------------------------

La estrategia de Smart Money concepts se basa en los siguientes pasos a seguir para realizar todas las operaciones, ya sean al alza (compras) o a la baja (ventas).

1. Detección de la tendencia: alcista o bajista (en gráficos de 30 minutos)

2. Detección de la zona de interés (en gráficos de 30 minutos):

2.1. En tendencia alcista: Zonas de demanda (para compras)

2.2. En tendencia bajista: Zonas de oferta (para ventas)

3. Confirmación: cambio de estructura en zona de interés (en gráficos de 1 minuto)

4. Operativa:

4.1. Definición del punto de entrada (en gráficos de 1 minuto)

4.2. Colocación del stop loss (en gráficos de 1 minuto)

4.3. Colocación del take profit (en gráficos de 30 minutos)

Trend detection: bullish or bearish (on 30-minute charts)

Detection of the area of interest (in 30-minute graphs):

2.1. In an uptrend: Demand zones (for purchases)

2.2. In downtrend: Supply zones (for sales)

3. Confirmation: change of structure in the area of interest (in 1-minute charts)

4. Operative:

4.1. Definition of the entry point (on 1-minute charts)

4.2. Stop loss placement (on 1-minute charts)

4.3. Placement of the take profit (on 30-minute charts)

----------------------------------------------------------------------------------------------------------

La estrategia de Smart Money concepts se basa en los siguientes pasos a seguir para realizar todas las operaciones, ya sean al alza (compras) o a la baja (ventas).

1. Detección de la tendencia: alcista o bajista (en gráficos de 30 minutos)

2. Detección de la zona de interés (en gráficos de 30 minutos):

2.1. En tendencia alcista: Zonas de demanda (para compras)

2.2. En tendencia bajista: Zonas de oferta (para ventas)

3. Confirmación: cambio de estructura en zona de interés (en gráficos de 1 minuto)

4. Operativa:

4.1. Definición del punto de entrada (en gráficos de 1 minuto)

4.2. Colocación del stop loss (en gráficos de 1 minuto)

4.3. Colocación del take profit (en gráficos de 30 minutos)

: