Muhammad Syamil Bin Abdullah / Profile

- Information

|

12+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

Muhammad Syamil Bin Abdullah

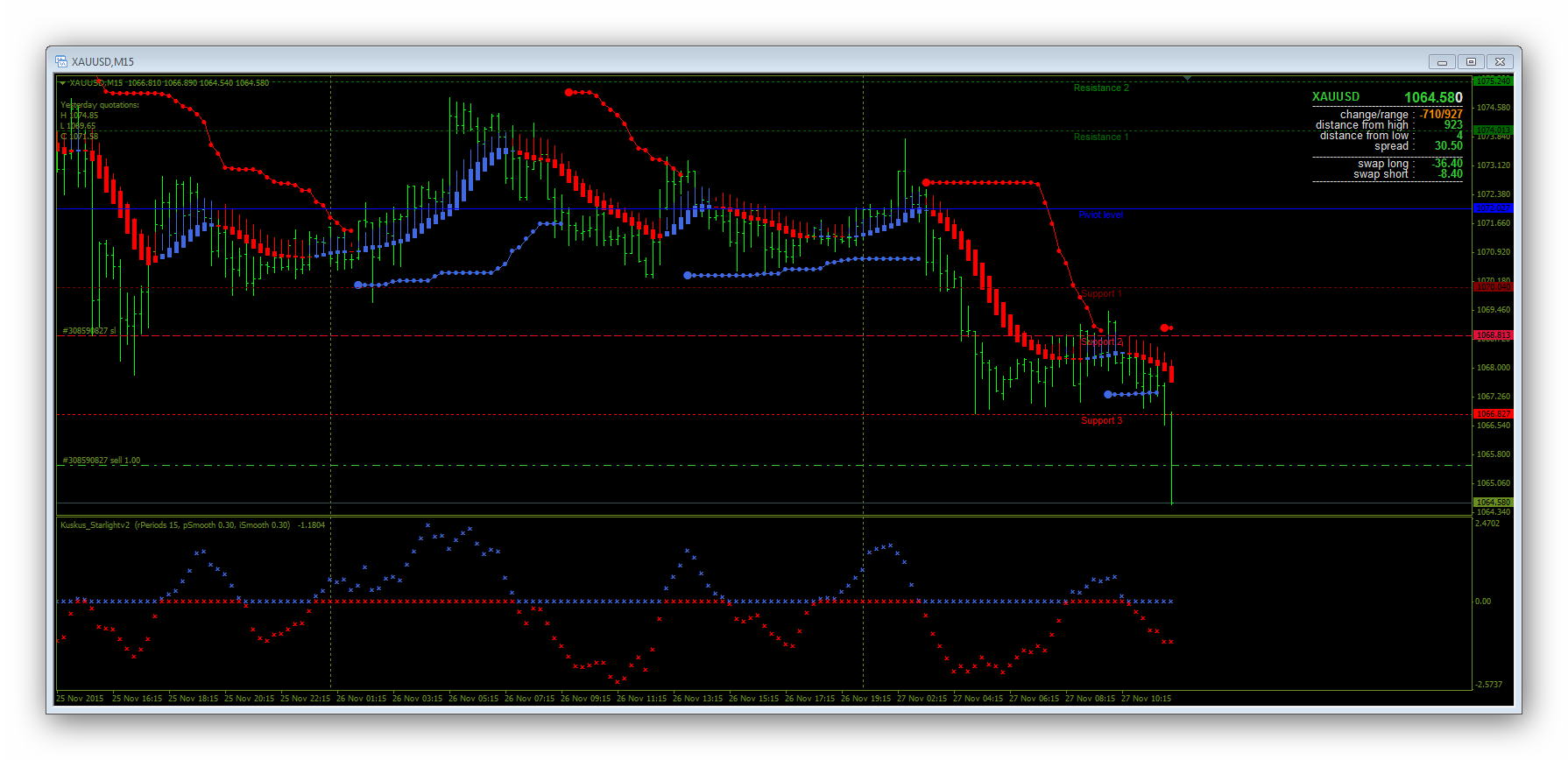

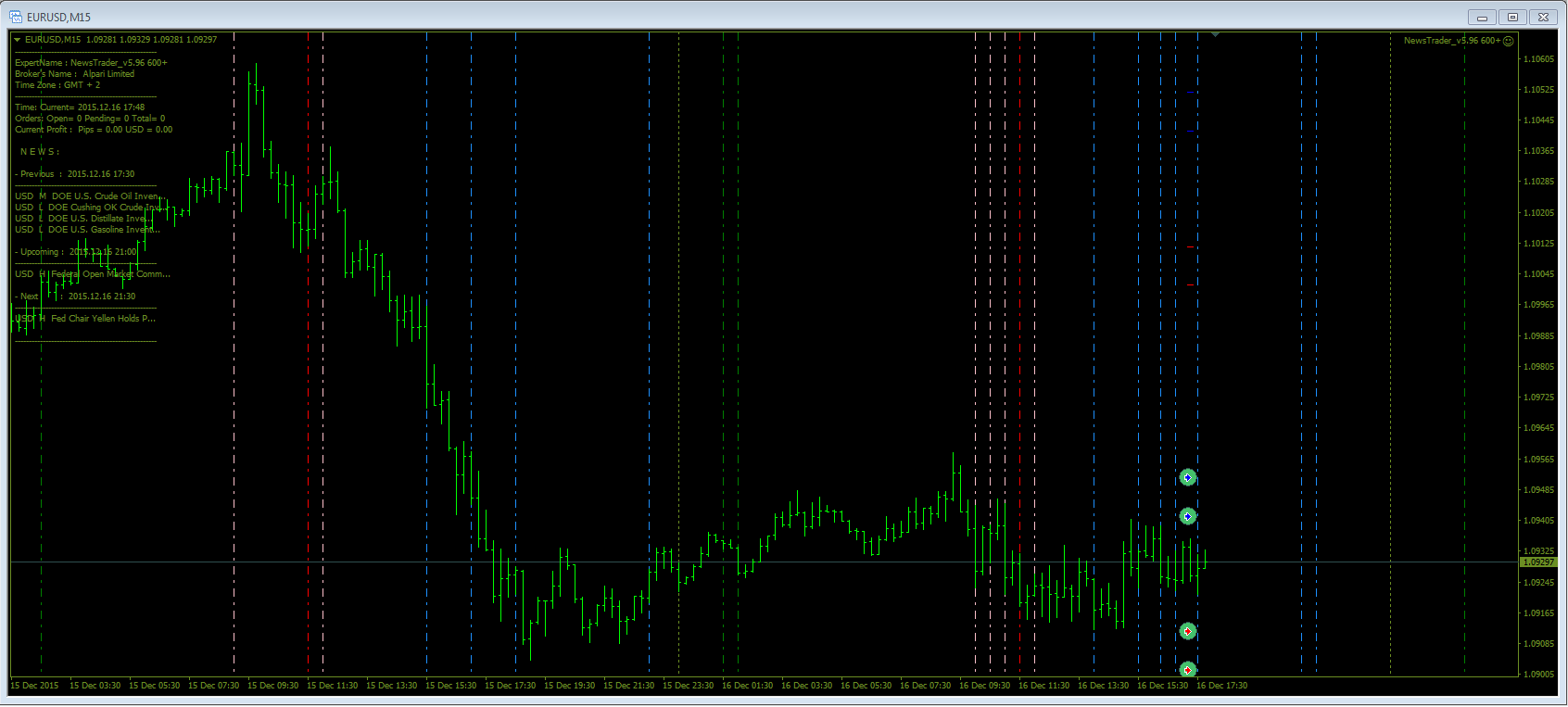

EURUSD currently trading sideways, expected to be more volatile during FED rate decision announcement.

Muhammad Syamil Bin Abdullah

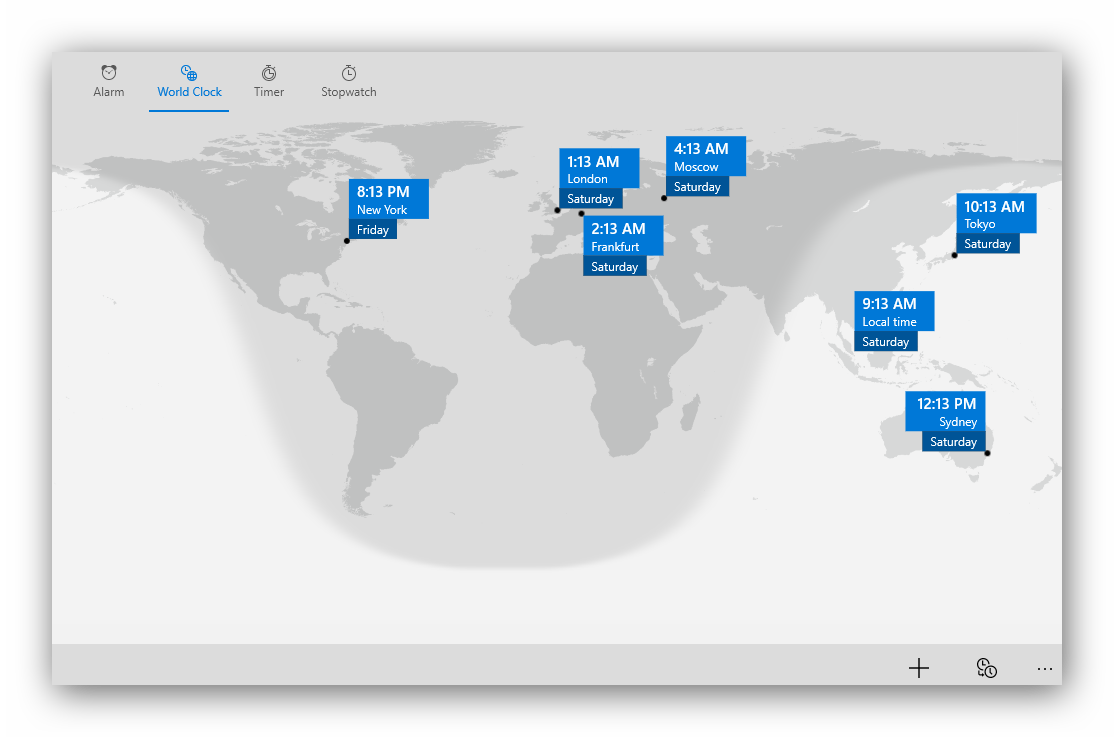

The only apps i like from Windows 10, is the Alarm & Clock which able to display world clock a very useful for forex traders.

Muhammad Syamil Bin Abdullah

What's really happen to us nowadays? Where are the macho guys in the 70's 80's 90's? I'm sick of those guys pretending to be woman!!!

Muhammad Syamil Bin Abdullah

Breaking News : Powerful earthquake hits Nepal http://edition.cnn.com/2015/05/12/asia/nepal-earthquake/index.html

Muhammad Syamil Bin Abdullah

Investors poured money into China's stock market Monday on the first day of trading in a program that opened up the country's markets to trading through Hong Kong.

Global investors snapped up a total of 6.9 billion yuan ($1.12 billion) of Chinese stocks in the premarket session, representing 54% of the $2.1 billion daily quota. By the midday trading break Monday, 82% of the daily quota had been filled.

Demand for Hong Kong stocks from mainland investors was more limited, with just 11% of the quota used by midday.

The Shanghai-Hong Kong Stock Connect trading link opens up mainland Chinese markets to global capital, allowing international investors access to shares traded in Shanghai, while also granting wealthy Chinese individuals access to Hong Kong-listed equities.

China's Shanghai Composite was up 0.7% at 2495.80 after rising as much as 1.2% in early trading. The Hang Seng Index was down 0.5% at 23974.17 and the Hang Seng China Enterprises Index--which tracks mainland shares listed in the city--fell 0.9% to 10664.31.

Investors focused on some of the largest and most liquid names in Shanghai, including auto maker SAIC Motor Corp., which rose 2.2%. Drinks maker Kweichow Moutai Co. Ltd.--a popular bet on China's rising domestic consumption--gained 4.7%.

Also trading higher in Shanghai was state-owned railway operator Daqin Railway Co. Ltd., which jumped 8.1%. The company is China's largest rail transporter of coal by shipment volume.

The scheme permits up to $49 billion of inflows into Shanghai and $40.8 billion into Hong Kong in total. A daily quota also applies, limiting daily net inflows of $2.1 billion and $1.7 billion respectively.

The program "is a new opportunity to invest, a new partnership model and is really the beginning of a new era" for Hong Kong's relationship with the mainland, said Charles Li, chief executive of Hong Kong Exchanges and Clearing.

Following a glitzy ceremony in Hong Kong attended by the city's chief executive, Leung Chun-ying, early trading appeared to proceed smoothly.

Asked about the relatively muted gains of the first day of trade, Mr. Li said the program was "a massive bridge" that will be here for decades.

"At this point, safety and smooth travel is much more important than how many cars have actually crossed the bridge," Mr. Li said.

Stock Connect expands access beyond the handpicked group of fund managers who until Monday were the only foreigners China's communist government had permitted to invest in domestic financial instruments, including stocks and bonds. Such investment has totaled $112 billion since 2003.

Mia Lamar

Global investors snapped up a total of 6.9 billion yuan ($1.12 billion) of Chinese stocks in the premarket session, representing 54% of the $2.1 billion daily quota. By the midday trading break Monday, 82% of the daily quota had been filled.

Demand for Hong Kong stocks from mainland investors was more limited, with just 11% of the quota used by midday.

The Shanghai-Hong Kong Stock Connect trading link opens up mainland Chinese markets to global capital, allowing international investors access to shares traded in Shanghai, while also granting wealthy Chinese individuals access to Hong Kong-listed equities.

China's Shanghai Composite was up 0.7% at 2495.80 after rising as much as 1.2% in early trading. The Hang Seng Index was down 0.5% at 23974.17 and the Hang Seng China Enterprises Index--which tracks mainland shares listed in the city--fell 0.9% to 10664.31.

Investors focused on some of the largest and most liquid names in Shanghai, including auto maker SAIC Motor Corp., which rose 2.2%. Drinks maker Kweichow Moutai Co. Ltd.--a popular bet on China's rising domestic consumption--gained 4.7%.

Also trading higher in Shanghai was state-owned railway operator Daqin Railway Co. Ltd., which jumped 8.1%. The company is China's largest rail transporter of coal by shipment volume.

The scheme permits up to $49 billion of inflows into Shanghai and $40.8 billion into Hong Kong in total. A daily quota also applies, limiting daily net inflows of $2.1 billion and $1.7 billion respectively.

The program "is a new opportunity to invest, a new partnership model and is really the beginning of a new era" for Hong Kong's relationship with the mainland, said Charles Li, chief executive of Hong Kong Exchanges and Clearing.

Following a glitzy ceremony in Hong Kong attended by the city's chief executive, Leung Chun-ying, early trading appeared to proceed smoothly.

Asked about the relatively muted gains of the first day of trade, Mr. Li said the program was "a massive bridge" that will be here for decades.

"At this point, safety and smooth travel is much more important than how many cars have actually crossed the bridge," Mr. Li said.

Stock Connect expands access beyond the handpicked group of fund managers who until Monday were the only foreigners China's communist government had permitted to invest in domestic financial instruments, including stocks and bonds. Such investment has totaled $112 billion since 2003.

Mia Lamar

Muhammad Syamil Bin Abdullah

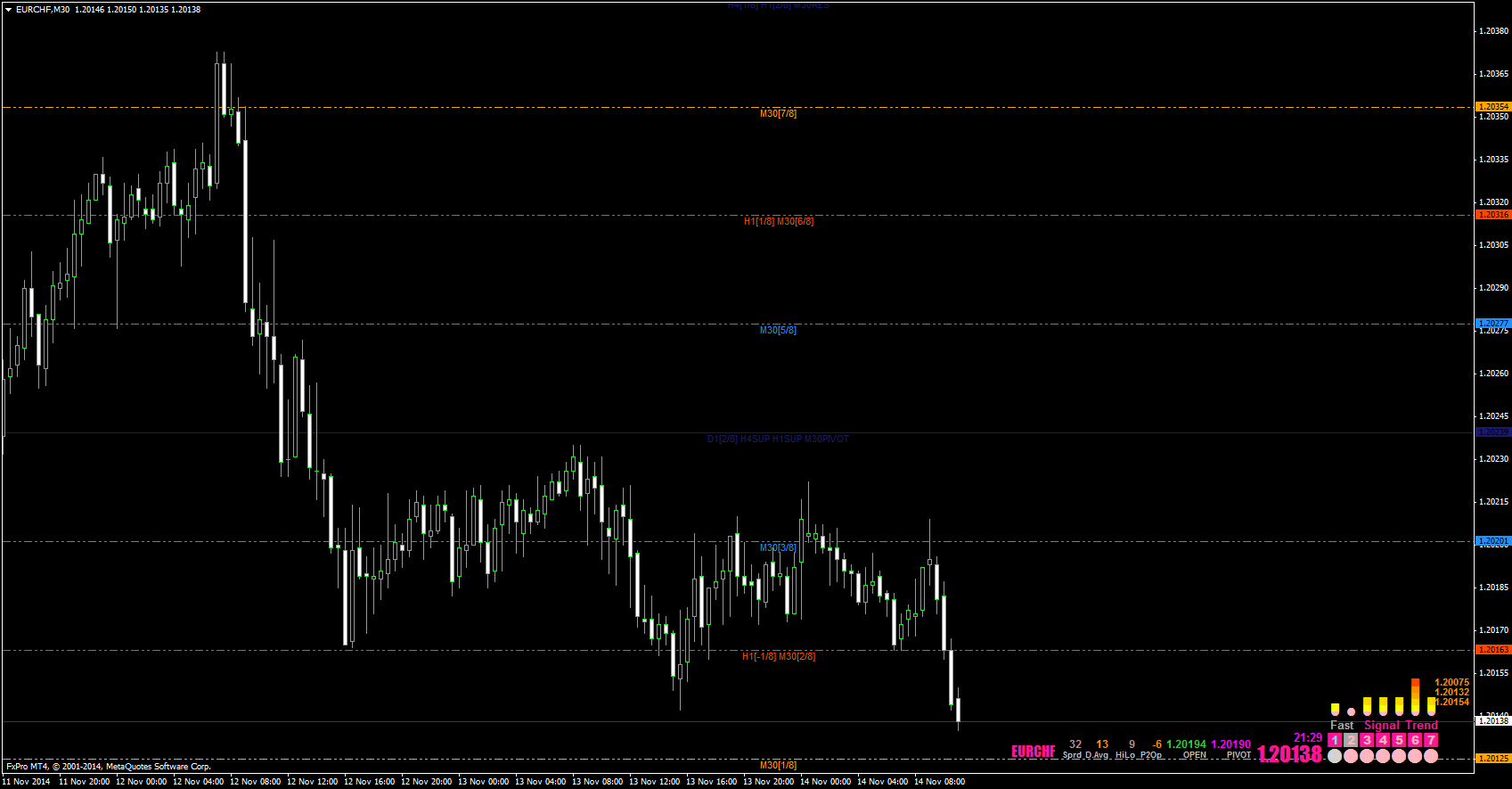

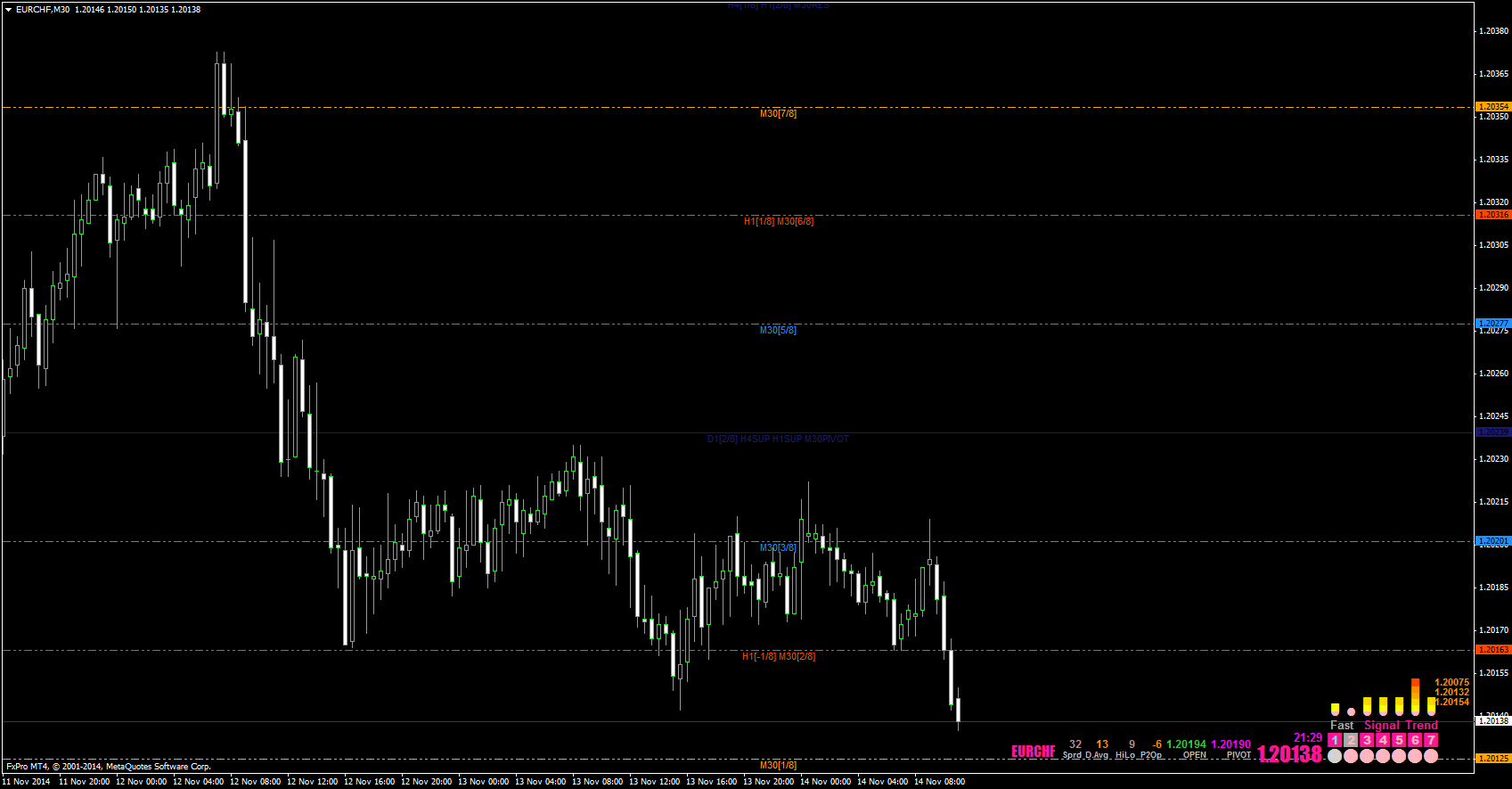

0900 GMT If you're one of the brave souls selling EUR/CHF, be advised that Citigroup mentioned to its clients Monday that there was a huge bid resting at 1.20. A person familiar with the matter said it was close to EUR10 billion but that the depth of book visible on trading systems now doesn't allow a view that far down. Still, reasonable to assume there's strong buying interest below here. Friday, Citi notes that actual trading flows in EUR/CHF are very thin. Spot now at 1.2016. (matthew.cowley@wsj.com)

: