Muhammad Syamil Bin Abdullah / Profile

- Information

|

12+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

Muhammad Syamil Bin Abdullah

On a longer time forecast view, the DAX index futures weekly chart still in a bearish market mode, as we can see the example here shows a bearish Gartley pattern, 25 value point of pattern.

Muhammad Syamil Bin Abdullah

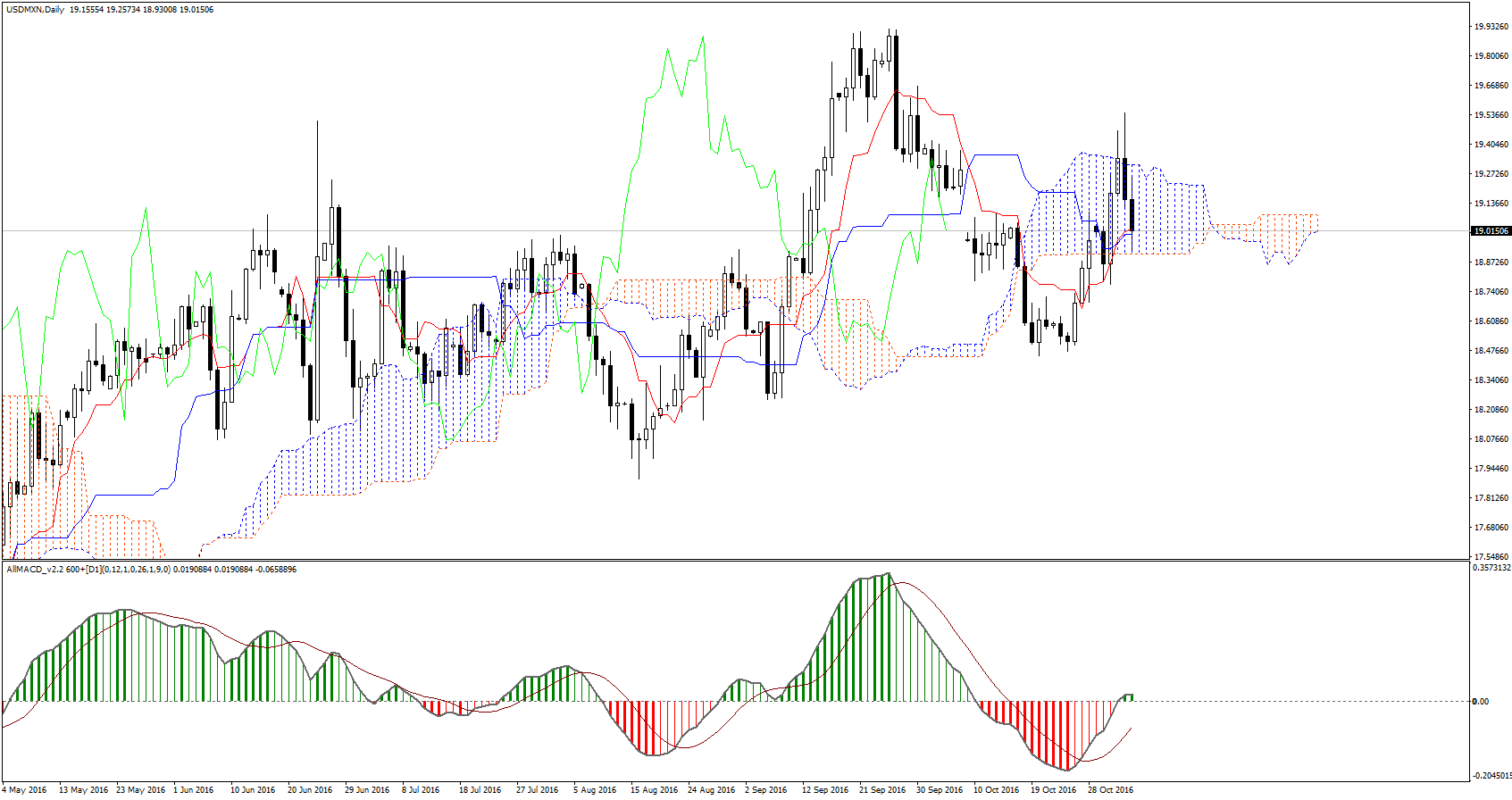

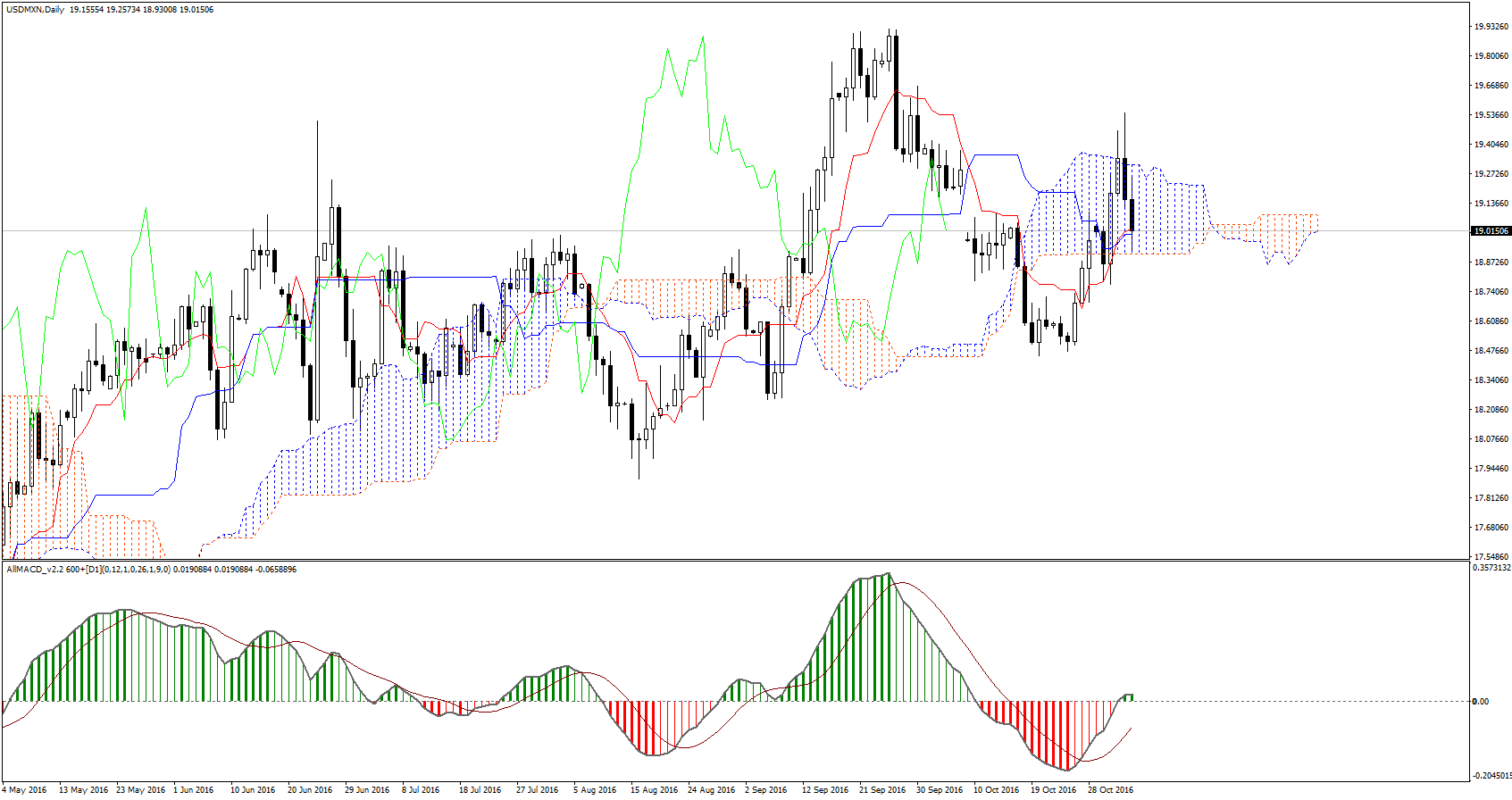

USDMXN will be more volatile during U.S election, from daily chart we can see this pair is inside ichimoku cloud which signalling non-trading zone.

Muhammad Syamil Bin Abdullah

This is indeed a good news.

MetaQuotes

Forexware delivers MetaTrader 5 Gateway to CQG

The MetaTrader 5 multi-asset platform continues expanding its trading features: the gateway to CQG platform goes live following the recent release of the gateway to Interactive Brokers . The application developed by Forexware provides direct

Muhammad Syamil Bin Abdullah

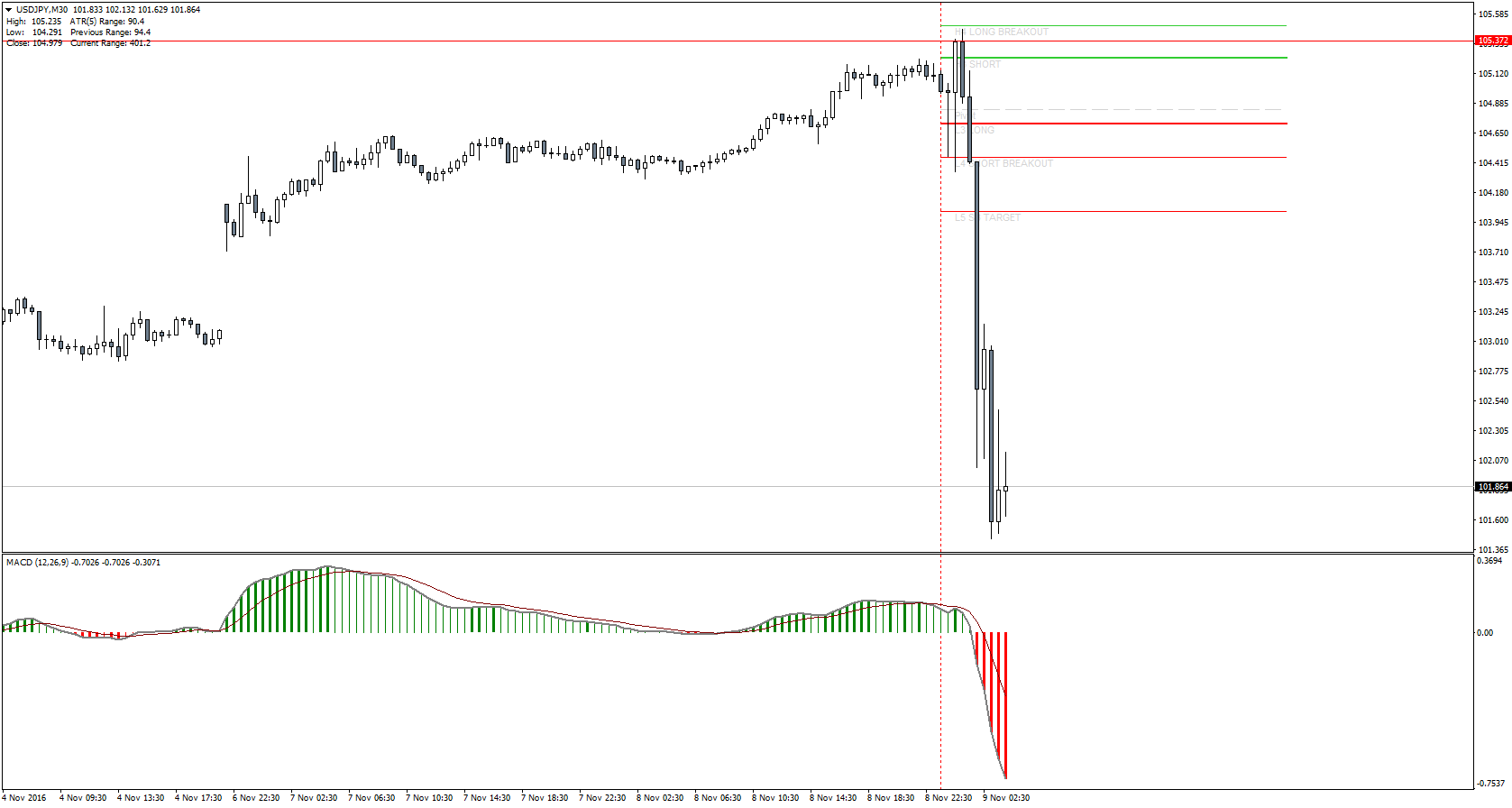

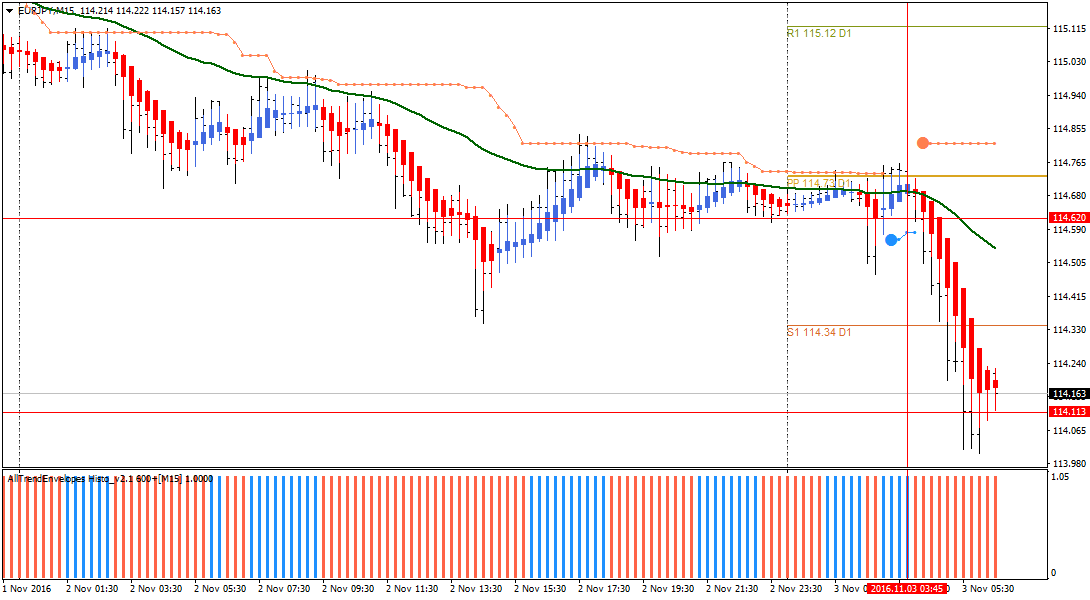

Traders must take note from their respective broker about leverage and margin requirements for opening position, as U.S election is near from 7th - 11th Nov the financial market will face uncertainty many brokers will raise their margin and lower leverage to avoid risk.

Muhammad Syamil Bin Abdullah

MetaQuotes

Dear friends! We wish you a happy New Year and Merry Christmas! Let it bring you professional success, good health and infinite strength for new achievements. May the coming year grant happiness, good luck and prosperity to you and your loved ones!

The year 2015 was very special for MetaQuotes as the company celebrated its 15-year anniversary. We implemented all objectives and projects scheduled for this year.

The company is rapidly developing and expanding its presence on the world stage. In 2015, MetaQuotes Software has opened three new offices — in Pakistan, Thailand and Japan. Now, we have twelve representative offices around the world! This year, MetaTrader 5 has been launched on Borsa Istanbul (BIST), Moscow Exchange Equity and Bond Market, Brazilian Securities, Commodities and Futures Exchange (BM&F Bovespa), Dubai Gold and Commodities Exchange (DGCX), Stock Exchange of Thailand (SET), South African Futures Exchange (SAFEX), and Pakistan Mercantile Exchange (PMEX). MetaTrader 4 trading platform has been localized in 39 languages, while MetaTrader 5 — in 30.

https://www.mql5.com/en/forum/70321

The year 2015 was very special for MetaQuotes as the company celebrated its 15-year anniversary. We implemented all objectives and projects scheduled for this year.

The company is rapidly developing and expanding its presence on the world stage. In 2015, MetaQuotes Software has opened three new offices — in Pakistan, Thailand and Japan. Now, we have twelve representative offices around the world! This year, MetaTrader 5 has been launched on Borsa Istanbul (BIST), Moscow Exchange Equity and Bond Market, Brazilian Securities, Commodities and Futures Exchange (BM&F Bovespa), Dubai Gold and Commodities Exchange (DGCX), Stock Exchange of Thailand (SET), South African Futures Exchange (SAFEX), and Pakistan Mercantile Exchange (PMEX). MetaTrader 4 trading platform has been localized in 39 languages, while MetaTrader 5 — in 30.

https://www.mql5.com/en/forum/70321

: