Wagdy Abdelrahman / Profile

- Information

|

12+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

WAVES is my ROADMAP to the MARKET

Wagdy Abdelrahman

Added poll Do you have Bitcoin Wallet ?

-

28% (16)

-

51% (29)

-

4% (2)

-

18% (10)

Total voters: 57

Wagdy Abdelrahman

Sergey Golubev

Different Types of Forex Brokers (based on countingpips article)

ECN Forex Broker

ECN stands for electronic communications network. ECNs originated from the equities world and were used in stock trading in the US many are familiar with Archipelago ECN and Island ECN. The same concept is now used in the Forex trading world.

ECN is used to either match traders to each other or to match traders to a market provider. ECN brokers usually require a higher deposit amount in order for you to trade on that network. These amounts are usually between $25,000-$100,000 depending on the particular broker. ECN broker will also probably charge a per million commission rate to the trader.

STP Forex Broker

The STP here stands for straight through processing. These brokers will send the trade data and the account data through to another liquidity source. Clearing and settlement for the trades are done at this liquidity source. The STP Forex broker automates the entire trade process and limits manual intervention.

Market Makers

Market Makers are brokers that act in the capacity of a market maker broadcasts a price to his clients and is willing to assume the risk of the other side of the trade. During normal trading conditions the market maker may give instant execution and execution without any issues by during news events or economic events the broker may slow trading down disable trading or may have the climate have experience other issues.

ECN Forex Broker

ECN stands for electronic communications network. ECNs originated from the equities world and were used in stock trading in the US many are familiar with Archipelago ECN and Island ECN. The same concept is now used in the Forex trading world.

ECN is used to either match traders to each other or to match traders to a market provider. ECN brokers usually require a higher deposit amount in order for you to trade on that network. These amounts are usually between $25,000-$100,000 depending on the particular broker. ECN broker will also probably charge a per million commission rate to the trader.

STP Forex Broker

The STP here stands for straight through processing. These brokers will send the trade data and the account data through to another liquidity source. Clearing and settlement for the trades are done at this liquidity source. The STP Forex broker automates the entire trade process and limits manual intervention.

Market Makers

Market Makers are brokers that act in the capacity of a market maker broadcasts a price to his clients and is willing to assume the risk of the other side of the trade. During normal trading conditions the market maker may give instant execution and execution without any issues by during news events or economic events the broker may slow trading down disable trading or may have the climate have experience other issues.

Wagdy Abdelrahman

Sergey Golubev

Comment to topic Traders Joking

Bill Gates: People Don't Realize How Many Jobs Will Soon Be Replaced By Software Bots Big changes are coming to the labor market that people and governments aren't prepared for, Bill Gates believes

Wagdy Abdelrahman

Sergey Golubev

Comment to topic Traders Joking

Ministers of Defence of Norway, Sweden and Netherlands and Germany. Photo made by Minister of Defence of Netherlands ( Jeanine Hennis-Plasschaert - 3rd from the left)

Wagdy Abdelrahman

Sergey Golubev

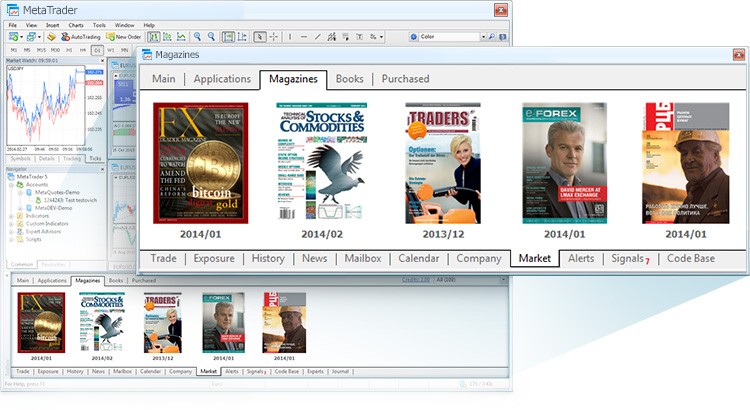

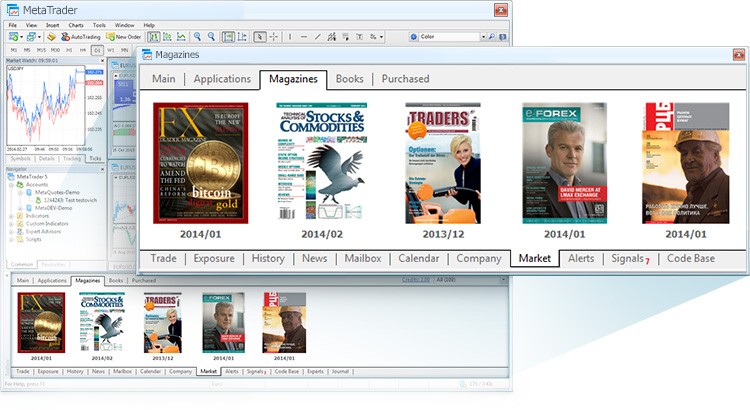

Comment to topic How to Start with Metatrader 5

MetaTrader 5 Platform Update Build 900: Magazines in MetaTrader Market and New MetaViewer

Wagdy Abdelrahman

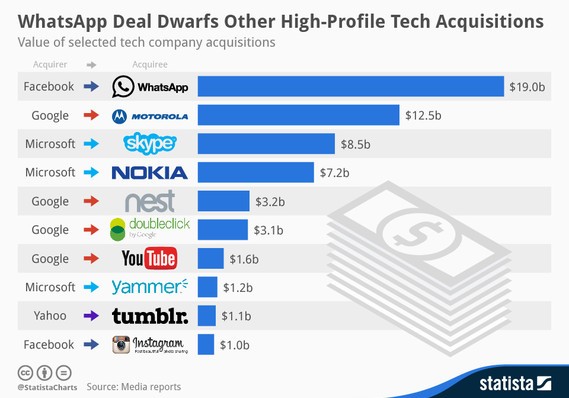

Facebook Chief Executive Mark Zuckerberg essentially confirmed Monday that the social network made a bid for Snapchat, even as he also said that his team will probably not make another offer anytime soon.

Speaking at the Mobile World Congress in Barcelona, Zuckerberg was asked if he was making another bid for Snapchat, Zuckerberg answered, “No.”

Reports surfaced in November that Facebook had offered to buy Snapchat for $3 billion, but that the proposal was turned down by the startup’s founders. Snapchat is a popular mobile messaging platform that lets users send photos that are erased seconds after they are sent.

Zuckerberg added: “After buying a company for $16 billion, you’re probably done for a while.”

Facebook FB +0.31% paid $16 billion to acquire WhatsApp, though the deal also includes $3 billion in restricted stock the founders and employees will receive, pushing the price tag up to $19 billion.

Zuckerberg defended the deal in Barcelona, reaffirming the social network’s belief that the mobile app could eventually reach a billion users.

“I could be wrong. I don’t think I am,” Zuckerberg said at a keynote interview during the Mobile World Congress in Barcelona. “WhatsApp is going to be such a huge business. … This is a good bet.”

Many analysts weren’t so sure especially given the hefty price tag, although Facebook got a bit of a lift Monday when Needham analyst Laura Martin upped her Facebook stock price target to $80 from $65.

Martin argued that the WhatsApp deal could actually pay off, telling clients in a note, “We believe it is premature to say Facebook overpaid until we see what happens over the next two years. If WhatsApp actually reaches 1 billion people in the next 12 to 18 months as Facebook projects, and then begins to monetize those users in fiscal year 2015 through usage of games, stamps/stickers and payments, it may turn out to be a reasonable price paid.”

In fact, Facebook has recovered a bit from the skepticism on Wall Street. After slipping on news of the deal, the stock has actually rallied since the WhatsApp acquisition was unveiled. Facebook shares hit a new high Monday, and were last trading up nearly 4%

Speaking at the Mobile World Congress in Barcelona, Zuckerberg was asked if he was making another bid for Snapchat, Zuckerberg answered, “No.”

Reports surfaced in November that Facebook had offered to buy Snapchat for $3 billion, but that the proposal was turned down by the startup’s founders. Snapchat is a popular mobile messaging platform that lets users send photos that are erased seconds after they are sent.

Zuckerberg added: “After buying a company for $16 billion, you’re probably done for a while.”

Facebook FB +0.31% paid $16 billion to acquire WhatsApp, though the deal also includes $3 billion in restricted stock the founders and employees will receive, pushing the price tag up to $19 billion.

Zuckerberg defended the deal in Barcelona, reaffirming the social network’s belief that the mobile app could eventually reach a billion users.

“I could be wrong. I don’t think I am,” Zuckerberg said at a keynote interview during the Mobile World Congress in Barcelona. “WhatsApp is going to be such a huge business. … This is a good bet.”

Many analysts weren’t so sure especially given the hefty price tag, although Facebook got a bit of a lift Monday when Needham analyst Laura Martin upped her Facebook stock price target to $80 from $65.

Martin argued that the WhatsApp deal could actually pay off, telling clients in a note, “We believe it is premature to say Facebook overpaid until we see what happens over the next two years. If WhatsApp actually reaches 1 billion people in the next 12 to 18 months as Facebook projects, and then begins to monetize those users in fiscal year 2015 through usage of games, stamps/stickers and payments, it may turn out to be a reasonable price paid.”

In fact, Facebook has recovered a bit from the skepticism on Wall Street. After slipping on news of the deal, the stock has actually rallied since the WhatsApp acquisition was unveiled. Facebook shares hit a new high Monday, and were last trading up nearly 4%

Wagdy Abdelrahman

I had a farm in Omaha’: Warren Buffett dishes out investment advice

A piece of advice from the Sage of Omaha? Find a good investment and hold onto it, don’t get swayed by daily ups and downs, and don’t listen to anyone else around you.

Easy to say if you are Warren Buffett, but in an excerpt from his annual letter to investors on Forbes, the billionaire investor says anyone can learn a lot from two small investments he made around two decades ago. The first is a 40-acre farm 50 miles north of Omaha that he bought for $280,000, much less than what a failed bank had lent against that farm years previously. What did he know about the farm? It had no downside and potentially substantial upside, though with the occasional bad crop.

“Now, 28 years later, the farm has tripled its earnings and is worth five times or more what I paid,” says the chairman and CEO of Berkshire Hathaway BRK.B -0.06% BRK.A , who admits he knows nothing about farming.

Another investment he made in 1993 was a New York retail property next to New York University, which was being sold by Resolution Trust Corp. in the wake of a bubble. Buffett said again he did a simple analysis: The property had been under-managed; its income would increase when several vacant stores were leased out; the biggest tenant was underpaying rent; and its its location was superb. He and a small group bought it, and annual distributions now exceed 35% of the initial investment.

Buffett says sure, income from the farm and the NYU property will go down in the coming decades. But the investments will be solid enough for his children and grandchildren.

Here are the five lessons he says the average investor can learn from these two simple investments:

You don’t have to be an expert to achieve satisfactory investment returns. Recognize your limitations, keep things simple and “don’t swing for the fences.” Don’t believe in or look for a quick profit.

Focus on the future productivity of the assets you are considering. Unless you can make a rough estimate of its future earnings, move on. You can’t evaluate everything, but you have to understand the actions you’re going take.

Avoid speculation, such as focusing on the prospective price change of an asset. “Half of all coin-flippers will win their first toss; none of those winners has an expectation of profit if he continues to play the game,” says the Sage.

Think about what that asset will produce, not about daily valuations. “Games are won by players who focus on the playing field — not by those whose eyes to the scoreboard,” says Buffett.

“Forming macro opinions or listening to the macro or market predictions of others is a waste of time” and even “dangerous, because it may blur your vision of the facts that are truly important,” he says.

How does Buffett buy stocks? He looks at whether he can sensibly estimate an earnings range for five years out or more. If the answer is yes, he’ll buy it if he can get it at a reasonable price in relation to the bottom boundary of his estimate. If he can’t estimate future earnings, he moves on.

“In the 54 years we have worked together, we have never forgone an attractive purchase because of the macro or political environment, or the views of other people. In fact, these subjects never come up when we make decisions,” he says.

And nonprofessional investors? The good news is that they don’t need to know how to predict future-earnings power, as American businesses have done well over time and will keep headed in that direction, he predicts. The nonprofessional should not be trying to pick “winners” all the time, but “own a cross-section of businesses that in aggregate are bound to do well. A low-cost S&P 50o index fund will achieve this goal.”

His final bit of advice for the nonprofessional? Accumulate shares over a long period, and never sell when the news is bad and stocks are well off their highs.

A piece of advice from the Sage of Omaha? Find a good investment and hold onto it, don’t get swayed by daily ups and downs, and don’t listen to anyone else around you.

Easy to say if you are Warren Buffett, but in an excerpt from his annual letter to investors on Forbes, the billionaire investor says anyone can learn a lot from two small investments he made around two decades ago. The first is a 40-acre farm 50 miles north of Omaha that he bought for $280,000, much less than what a failed bank had lent against that farm years previously. What did he know about the farm? It had no downside and potentially substantial upside, though with the occasional bad crop.

“Now, 28 years later, the farm has tripled its earnings and is worth five times or more what I paid,” says the chairman and CEO of Berkshire Hathaway BRK.B -0.06% BRK.A , who admits he knows nothing about farming.

Another investment he made in 1993 was a New York retail property next to New York University, which was being sold by Resolution Trust Corp. in the wake of a bubble. Buffett said again he did a simple analysis: The property had been under-managed; its income would increase when several vacant stores were leased out; the biggest tenant was underpaying rent; and its its location was superb. He and a small group bought it, and annual distributions now exceed 35% of the initial investment.

Buffett says sure, income from the farm and the NYU property will go down in the coming decades. But the investments will be solid enough for his children and grandchildren.

Here are the five lessons he says the average investor can learn from these two simple investments:

You don’t have to be an expert to achieve satisfactory investment returns. Recognize your limitations, keep things simple and “don’t swing for the fences.” Don’t believe in or look for a quick profit.

Focus on the future productivity of the assets you are considering. Unless you can make a rough estimate of its future earnings, move on. You can’t evaluate everything, but you have to understand the actions you’re going take.

Avoid speculation, such as focusing on the prospective price change of an asset. “Half of all coin-flippers will win their first toss; none of those winners has an expectation of profit if he continues to play the game,” says the Sage.

Think about what that asset will produce, not about daily valuations. “Games are won by players who focus on the playing field — not by those whose eyes to the scoreboard,” says Buffett.

“Forming macro opinions or listening to the macro or market predictions of others is a waste of time” and even “dangerous, because it may blur your vision of the facts that are truly important,” he says.

How does Buffett buy stocks? He looks at whether he can sensibly estimate an earnings range for five years out or more. If the answer is yes, he’ll buy it if he can get it at a reasonable price in relation to the bottom boundary of his estimate. If he can’t estimate future earnings, he moves on.

“In the 54 years we have worked together, we have never forgone an attractive purchase because of the macro or political environment, or the views of other people. In fact, these subjects never come up when we make decisions,” he says.

And nonprofessional investors? The good news is that they don’t need to know how to predict future-earnings power, as American businesses have done well over time and will keep headed in that direction, he predicts. The nonprofessional should not be trying to pick “winners” all the time, but “own a cross-section of businesses that in aggregate are bound to do well. A low-cost S&P 50o index fund will achieve this goal.”

His final bit of advice for the nonprofessional? Accumulate shares over a long period, and never sell when the news is bad and stocks are well off their highs.

Wagdy Abdelrahman

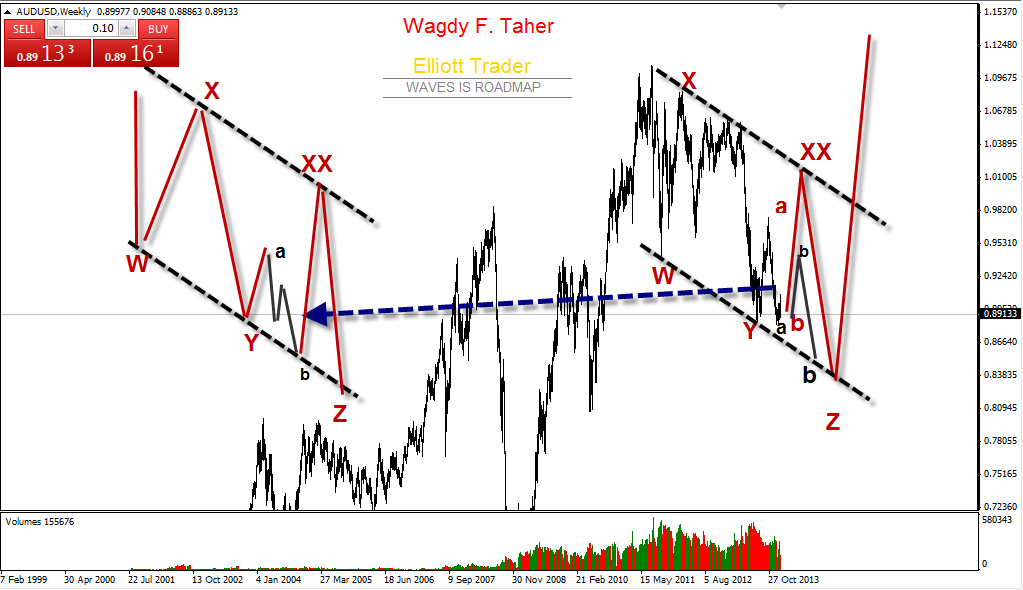

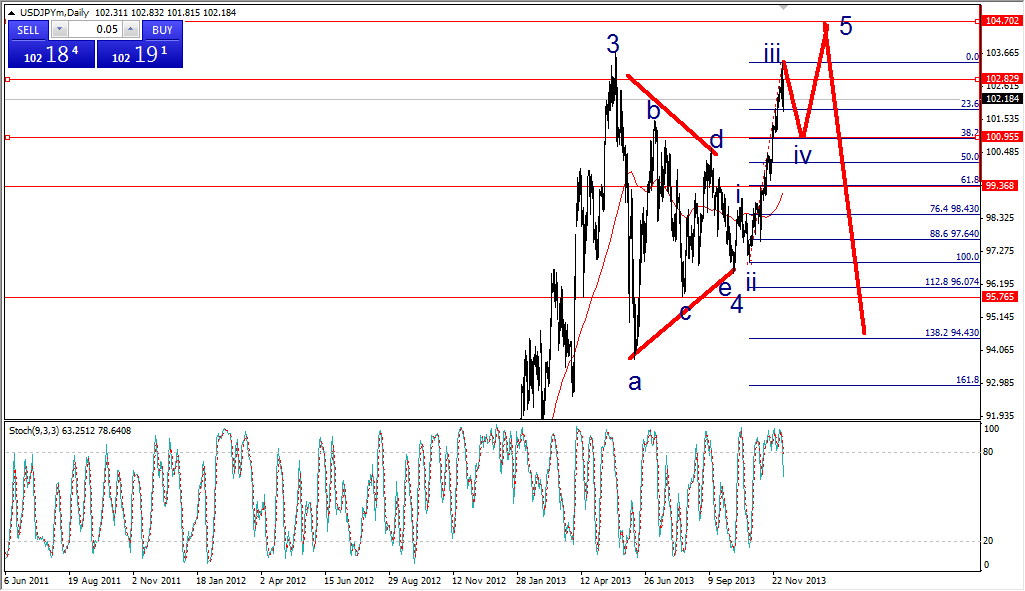

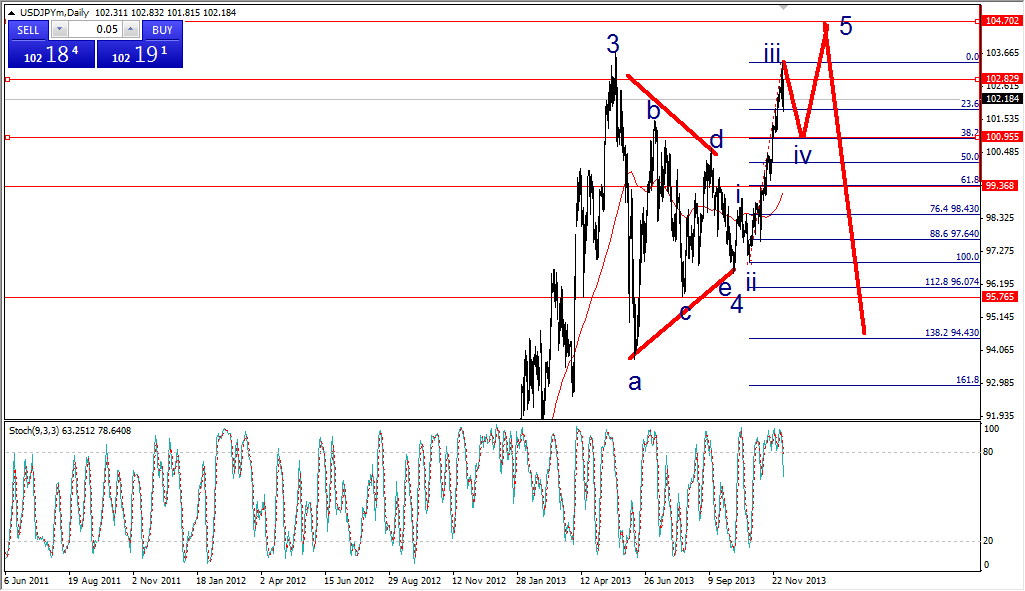

JPYUSD- Just Remind our main target for correcction wave of whole IM wave 76- 105 ...its correciton target is 95-94 ...

The max uptrend now is 104.60 then main target 95

The max uptrend now is 104.60 then main target 95

: