EA Iron Man

- Experts

- Vitali Vasilenka

- Version: 11.0

- Updated: 18 May 2024

- Activations: 5

Attention traders - To receive gifts after purchase, write to me in a private message!

You receive after purchase:

- Indicator

- Trading panel

- Access to VIP chat

- A month of access to the channel using signals.

- Unique settings

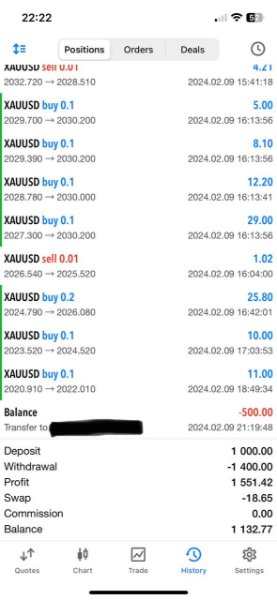

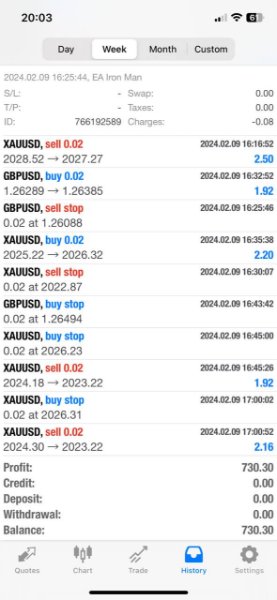

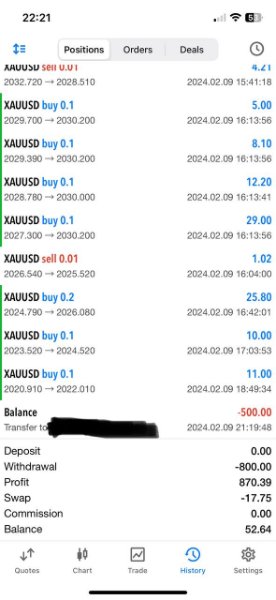

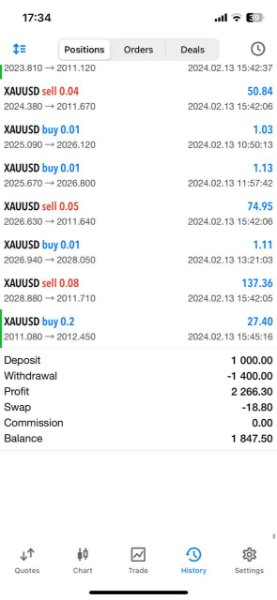

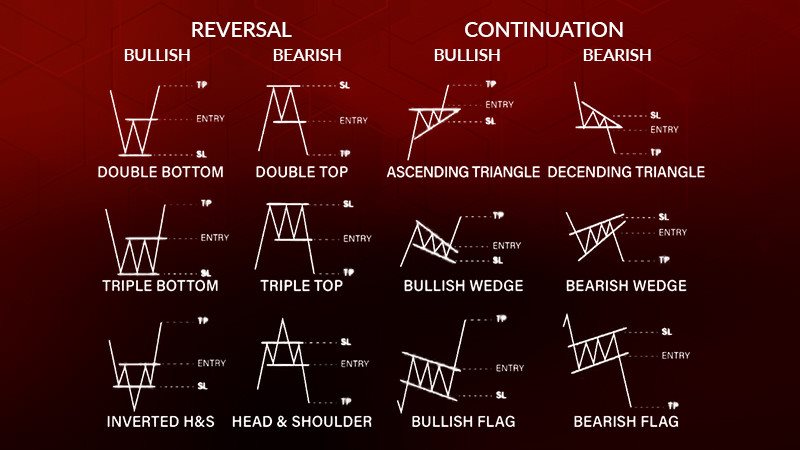

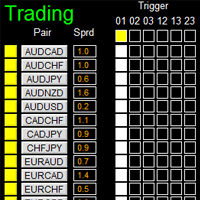

EA Iron Man is a powerful trading algorithm designed for automated trading in financial markets. This advisor includes 25 trading patterns that are used to make decisions about entering and exiting positions.

The EA is an advanced trading solution, providing traders with the ability to automate strategies based on a variety of trading patterns, while providing stable risk management and the ability to dynamically adapt to market changes..

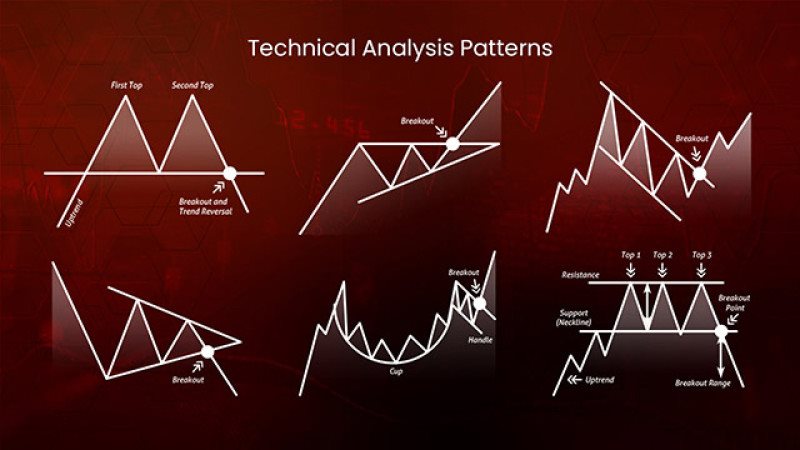

Iron Man has a rich set of trading patterns, including, for example, double tops, triple days, pin bars, and others. These patterns provide the basis for the algorithm, allowing it to analyze historical data and predict possible price movements.

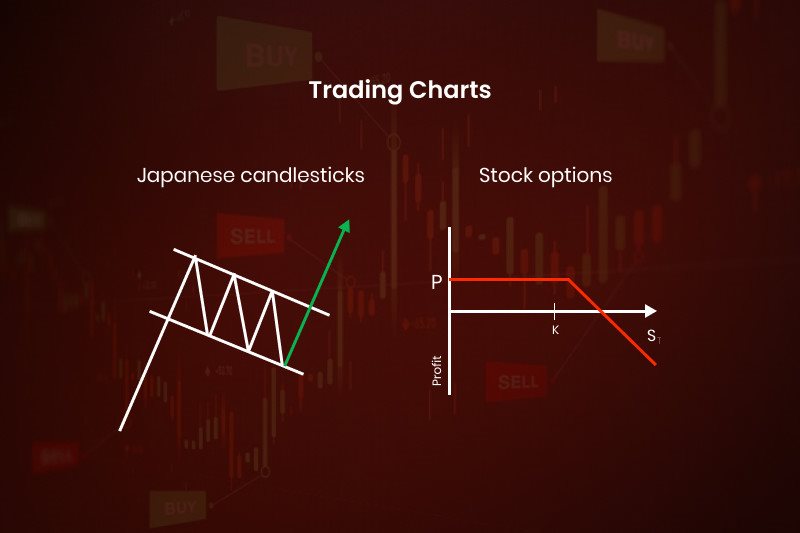

Technical Analysis: The advisor uses technical analysis to identify trends, support and resistance levels, and other key aspects of market dynamics. This helps identify opportunities for successful transactions.

Risk Management: Iron Man - Includes risk management strategies such as fixed stop losses and take profits, allowing you to effectively manage risk and maximize potential profits.

25 trading patterns: Each of the 25 trading patterns is included in the algorithm, taking into account unique market conditions. This allows the advisor to be flexible and adaptable to different trading scenarios.

Parameter Optimization: The algorithm can automatically optimize its parameters to better suit current market conditions and improve trading efficiency.

- Double Tops and Double Bottoms: Similar to Double Tops, but involve two tops instead of one.

- Triple Tops and Triple Bottoms: Similar to double tops and bottoms, but include three tops or bottoms.

- Candlestick Stars: Such as the evening and morning star, candlestick patterns that warn of a possible trend change.

- Rectangles: Patterns that form between horizontal support and resistance lines.

- Wedges: Triangular patterns, but with a shallower angle.

- Channels: Parallel lines of support and resistance that limit price movement.

- Double Stars: Candlestick patterns that include two stars.

- Triple Stars: Candlestick patterns that include three stars.

- Candlestick Carpets: A group of candles that form a specific pattern.

- Candlestick Sticks: Specific candlestick formations that warn of possible changes.

- Candlestick Front: Candlestick formations that form at the leading edge of a trend.

- Candlestick Cloud: The formation of cloud-like candles that can indicate a change in trend.

- Candlestick Triangles: Candlestick formations that create triangular patterns.

- Gaps: Gaps between prices that can warn of upcoming changes.

- Flag and Pennant Formations: Short-term resting patterns, usually after a sharp move.

- Special Candlestick Patterns: For example, “Three White Soldiers” and “Three Black Crows”.

- Inverse Head and Shoulders: The mirror version of Head and Shoulders, indicating the possible start of an uptrend.

- Rising Wedge: A reverse sloping wedge that can signal a possible reversal.

This EA has unique ability in deploying accurate algorithm with good result. Good EA, will continue use it!!