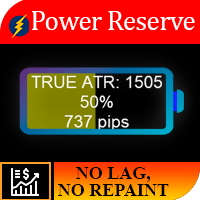

Power Reserve MT4

- Indicators

- Sergey Batudayev

- Version: 1.5

- Updated: 24 September 2021

- Activations: 5

Work logic

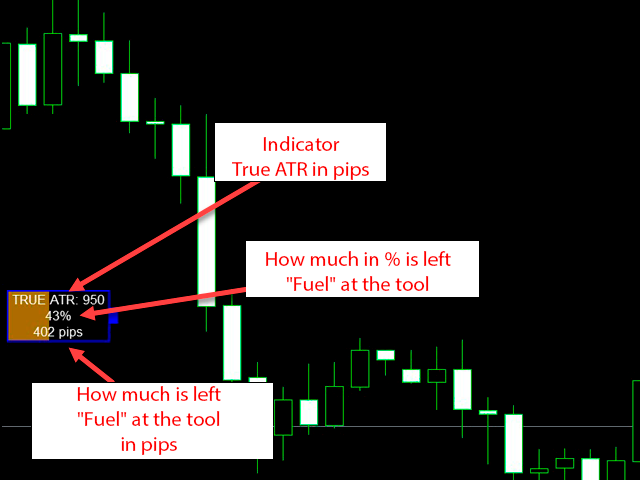

The importance of this indicator lies in the fact that it allows you to understand how much “fuel is still left at the instrument.” Imagine the situation, you left in a car with a half-discharged battery, on average, this amount of energy is usually enough for a car for 250 km, so if you want to, you cannot overcome a distance of 700 km. So for each instrument, there is a certain daily price movement, and as a result of statistical observations, it was revealed that 95% of the time the asset passes 1 ATR per day, and only 5% of the time 2 or more ATR.

Example, daily ATR EURUSD = 682 pips. You enter a trade, say for a breakout of the level with a TP of 500 pips, it would seem that you set the correct TP size, but you did not take into account that the asset had already passed 90% of its daily ATR by the time the trade was opened, and accordingly, the instrument most likely does not have enough energy to receive you TP, if you saw that the instrument has only 10% of the charge left, you would most likely either adjust the TP or not enter the deal at all.

The Power Reserve indicator calculates how much in% and in points the instrument used up energy and how much it still has.

The indicator itself is made in the form of a battery charge indicator, which we are used to seeing in electronic devices.

The indicator calculates the average price movement based on the improved ATR (excluding abnormally small and abnormally large price movements), then the resulting amount is compared with the value that the instrument has already overcome at the moment.

Recommended Robot Scalper - https://www.mql5.com/en/market/product/77108

There are 2 options for calculating the remaining power reserve:

a) the calculation is carried out at the maximum and minimum prices (option High / Low)

b) from the opening price to the current price (Open / Close option)

Variables

Time Frame – selection of a chart on which the indicator will be calculated. It is recommended to analyze on the daily TF.

Period – time interval for which indicators will be calculated.

To calculate from – options for calculating the price, described in the logic of work.

Font size – control the size of the indicator on the chart

Transparency in% OFF mode – transparency of the indicator background.

X / Y coordinate – adjust the position of the indicator on the chart along the x and y axes.

User didn't leave any comment to the rating