Version 3.35

2025.04.22

Japan AI Exo Scalp EA — Version 3.35 Release Notes

==================================================

Version 3.35 refines the “Three‑Arrows” framework with a focus on

short‑term scalping performance. Key changes from v3.34 are listed below.

────────────────────────────────────────────

1. Optional DI filter

────────────────────────────────────────────

* New input `UseDiffDI` lets you **toggle the +DI/−DI spread filter**.

Choose between a *fast mode* (EMA20 only) and a *precise mode*

(EMA20 + diffDI20) depending on market conditions.

────────────────────────────────────────────

2. Streamlined short‑term metrics

────────────────────────────────────────────

* Removed EMA100 / EMA200 and long‑term diffDI.

Core indicators are now **EMA20 and ATR20 only**, cutting CPU usage

and memory footprint.

────────────────────────────────────────────

3. Revamped prompt for sharper trade signals

────────────────────────────────────────────

* `BuildPromptWithForecast()` rewritten to suit the latest models

(o‑family, GPT‑4.1, GPT‑3.5).

* The JSON payload automatically includes or omits diffDI20,

so the model receives exactly the data it needs.

* Result: **better balance between signal frequency and accuracy**.

────────────────────────────────────────────

4. Temperature tuning for optimal model diversity

────────────────────────────────────────────

* Raised the temperature of the 2nd Arrow (GPT‑4.1) to 0.6,

keeping the 1st (o‑mini) and 3rd (GPT‑3.5) unchanged.

* Enhances viewpoint diversity without sacrificing consensus stability.

────────────────────────────────────────────

5. Final fix for entry‑skip / SELL bias

────────────────────────────────────────────

* Resolved spread‑scaling issues on certain brokers that caused

excessive SELLs or skipped entries.

* `OpenPosition()` now auto‑detects digit precision.

────────────────────────────────────────────

■ Why this upgrade matters

────────────────────────────────────────────

1. **Operational flexibility** — switch the DI filter on or off in seconds.

2. **Lower resource usage** — lighter indicator set accelerates tests

and live execution.

3. **Higher signal quality** — new prompt and temperature scheme

capture market turns without over‑filtering.

────────────────────────────────────────────

We will continue refining the EA based on user feedback and testing.

Enjoy trading with Version 3.35!

Version 3.33

2025.04.20

Version 3.33 2025‑04‑17

We have further optimized the prompt that feeds short‑, medium‑, and long‑term FX indicators to GPT, improving the EA’s decision accuracy and response speed. Key changes:

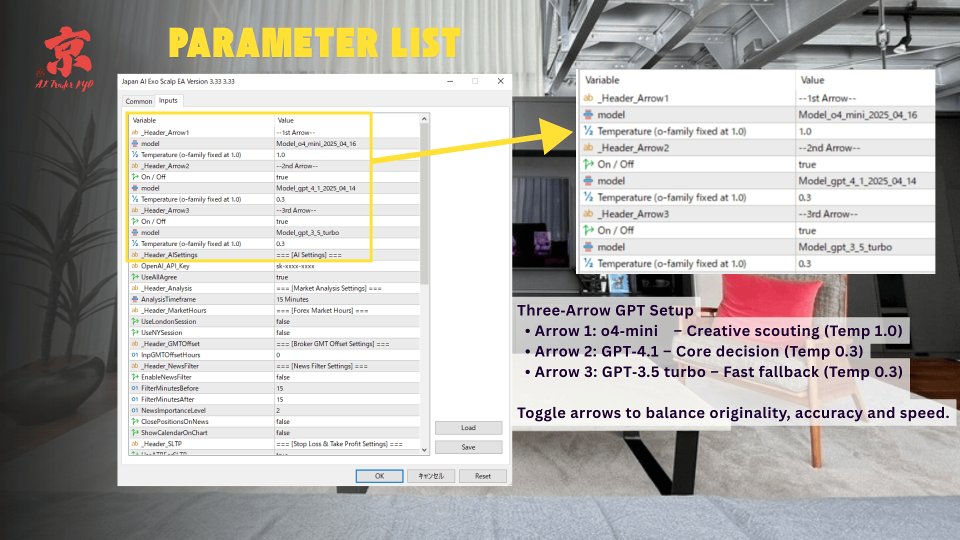

1. Redesigned “Three Arrows” parameter layout

- The 1st, 2nd, and 3rd Arrows now live in separate sections, letting you manage model, temperature, and on/off status together.

- The 2nd and 3rd Arrows can be disabled with a single switch and are automatically removed from the consensus when off.

2. Model‑specific temperature policy

- All o‑family models are fixed at 1.0; GPT models use the temperature you specify. Fewer settings, more stable outputs.

3. Finer spread filter

- Added conversion for 5‑digit brokers (1 pip = 10 points) and set the default threshold to 3 pips to block trades under excessive spreads.

4. Volatility‑adaptive ATR SL/TP

- SL_ATR_Factor and TP_ATR_Factor now auto‑adjust ±20 % by comparing the latest ATR with the 50‑bar average, balancing risk and reward during sharp moves.

5. Code cleanup & unified parameter names

- Merged duplicate structs/functions and removed obsolete comments.

- Clearer names such as SpreadThreshold → SpreadThresholdPip help prevent setup errors.

6. Full backward compatibility

- Risk controls, trailing logic, news filter, and MagicNumber remain unchanged.

- Presets created for v3.31 load perfectly via automatic field mapping.

Version 3.31

2025.04.15

Japan AI Exo Scalp EA – Version 3.31 Release Notes

We have refined the prompt design to more systematically send short-, medium-, and long-term currency forecast data to GPT, further enhancing the EA’s decision accuracy. Below are the new features and improvements introduced in this version:

1. Three Arrows (GPT Models) On/Off Functionality

- The second and third arrows can now be toggled on or off in the parameters. The first arrow (1st Arrow) is always enabled, while the second (2nd Arrow) and third (3rd Arrow) can be freely switched on or off.

- Any arrow that is disabled will be excluded from the consensus logic.

2. Removal of "UseAllAgree"

- The option to trade only when all three models agree has been removed.

- The EA now uses an integrated logic based on the number of active models:

- With only one model enabled, it relies on a single signal.

- With two models enabled, both need to agree on BUY/SELL.

- With three models enabled, a two-of-three majority applies.

3. Code Organization and Duplicate Definition Resolution

- We consolidated repeated struct definitions, reducing compile errors.

- C++-style struct initializations have been replaced to avoid errors under MQL syntax.

4. Adjustments to the Re-query Logic (During Drawdowns)

- If a significant drawdown (≥ 1.5× ATR) is detected, an additional GPT query is triggered. Even if the second or third arrow is disabled, the logic functions smoothly.

- Closure decisions are unified so that if at least two models oppose (NO or opposite direction), the position is closed.

5. Overall Behavior and Parameters Remain Largely Unchanged

- Short-, medium-, and long-term indicators continue to be used for GPT-based consensus logic.

- No changes have been made to existing parameters such as risk management, trailing stops, or news filters.

We plan to further improve functionality and logic based on user feedback and backtesting results. We invite you to experience the new features in this updated version.

Version 3.3

2025.04.09

Version 3.02 Update Information

1. Improved TP Settings

- In previous versions (3.00), the TP range was extremely narrow, causing positions to close almost immediately.

- In 3.01, by modifying the prompts sent to GPT and revising the EA’s internal logic, the TP range is now more appropriately configured.

2. Expanded Break-Even Settings

- Users can now enable or disable the break-even (set SL to entry price) feature individually.

- This allows for more flexible profit and loss risk management after entering a trade.

3. Addition of the Latest Model “gpt-4o-2024-08-06”

- Newly integrated gpt-4o-2024-08-06 provides more advanced analysis and more consistent signals.

- It enhances short-term market response accuracy while reducing unnecessary noise, aiming for overall performance improvements.

4. Expanded Consensus Logic Options (All 3 Confirmation)

- In addition to majority voting (where at least 2 models agree on BUY or SELL), a new mode has been introduced where a trade is only entered if all 3 models agree (All 3 Confirmation).

- Users seeking stricter signals can opt for unanimous agreement, while those desiring more frequent trades can proceed with 2-model consensus according to their trading policy.

Version 3.0

2025.04.08

What’s New in Japan AI Exo Scalp EA Version 3.0 ?

This model draws inspiration from the teachings of the Japanese Warring States commander, Mōri Motonari, who famously demonstrated that while a single arrow can be easily broken, three arrows together cannot be broken. By harnessing OpenAI’s flagship trio of models, we have built a completely new trading system.

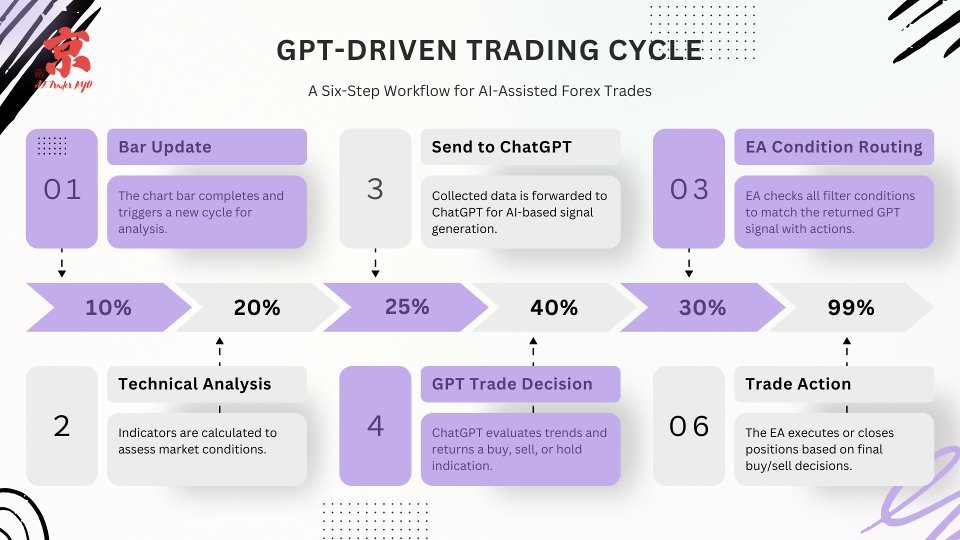

1. Multi-Model Consensus (Three-Arrows Concept)

- Old Version (2.63): Used a single ChatGPT endpoint (e.g., o1-mini) to generate a simple BUY, SELL, or NO signal. No consensus mechanism existed; signals were purely based on that one endpoint.

- New Version (3.0): Integrates three different GPT models (e.g., o1-mini-2024-09-12, o3-mini, and gpt-3.5-turbo) in parallel. Each model independently analyzes the indicator data and returns:

- "signal": "BUY or SELL or NO"

- "peak_price": float

The EA then performs a majority vote (2 out of 3) or unanimous (3 out of 3) to finalize the trading signal. This “three-arrows” method draws inspiration from the historical lesson by Mōri Motonari, illustrating that one arrow can be broken easily, but three together are much stronger.

2. Automatic N-Bars Prediction per Timeframe

- Old Version (2.63): Typically used M15 or a fixed set of bars for forecasting (like “next 12 bars”). The prompt was basically the same for all timeframes.

- New Version (3.0): The EA now calculates forecastBars dynamically with GetForecastBarsByPeriod(). For example, based on extensive testing, we have arrived at these optimal values:

Timeframe → Recommended N (bars)

M1 → 10

M2 → 8

M3 → 6

M4 → 8

M5 → 10

M6 → 10

M10 → 9

M12 → 10

M15 → 12

M20 → 12

M30 → 12

H1 → 12

H4 → 20

H6 → 16

H8 → 15

H12 → 12

D1 → 7

W1 → 4

MN1 → 6

This helps the EA tailor its forecast instructions specifically to each timeframe, telling the GPT models precisely how many bars ahead to consider when predicting the highest price.

3. Dynamic Peak Price (TP) Setting

- Old Version (2.63): The system only generated a BUY/SELL/NO signal, while TP/SL were typically static (e.g., ATR-based or fixed pips). ChatGPT had limited influence on the final TP level.

- New Version (3.0): Each GPT model returns a peak_price. The EA aggregates these peak_price values, applies simple outlier filtering (e.g., removing the farthest from the median) or picks the “conservative” one if only 2 models agree, then uses that as the dynamic TP. This allows the EA to adapt its profit target to real-time model predictions.

4. Expanded Prompt with Consistency Rules

- Old Version (2.63): The prompt was shorter and did not specify how “peak_price” should relate to the signal. The output was prone to contradictions (e.g., SELL but peak_price above current price).

- New Version (3.0): The prompt explicitly instructs the GPT:

- If signal=BUY, then peak_price >= current price

- If signal=SELL, then peak_price <= current price

That way, the AI attempts to keep the signal and the peak_price logically consistent.

5. Three-Arrows Parsing & Majority Vote

- Old Version (2.63): Called one ChatGPT model. “NO SIGNAL” was typical if the model was uncertain. No multi-endpoint parsing code was present.

- New Version (3.0): The new EA calls SendChatGptRequest() three times (once per arrow). Each response is parsed with ParseChatGptResponseSingleModel(), collecting signal and peak_price. Then ParseChatGptResponseThree() merges them:

- If 3 are BUY → BUY SIGNAL

- If 3 are SELL → SELL SIGNAL

- If 2 are BUY → BUY SIGNAL (with “conservative” peak_price chosen among those 2)

- If 2 are SELL → SELL SIGNAL (with “conservative” peak_price chosen among those 2)

- Otherwise → NO SIGNAL

6. Updated Trailing Stop & BE (Optional)

- Old Version (2.63): Basic trailing was implemented but only had a single approach (TrailingStartPips / TrailingStopPips). No mention of break-even or further refinement in the base code example.

- New Version (3.0): The UpdateTrailingStop() method can optionally incorporate a break-even threshold, letting the EA protect a portion of profits once the market has moved enough in favor. This is not mandatory, but an example is shown in the code. This helps lock in profits while still pursuing a big win if price continues in the favorable direction.

7. Increased Maximum Trades & Additional Controls

- Old Version (2.63): Typically had a MaxTradesPerDay of 300, and a simpler set of filters (News, Time).

- New Version (3.0): Increased daily trade cap, more refined session filters, and advanced checks around news. Users may easily turn these features on/off in the Input parameters.

8. Conclusion

Overall, the jump from v2.63 to v3.0 represents a major shift to a more robust, consensus-driven AI approach. By integrating three GPT endpoints, dynamically shaping the forecast horizon based on timeframe, and applying logical constraints to peak_price vs. signal, Japan AI Exo Scalp EA 3.0 aims for significantly improved consistency and adaptiveness in its trading strategy.

9. Significant Reduction in GPT Data Load

- Old Version (2.63): Sent large chunks of market data to the GPT endpoint, which could slow down requests or exceed token limits.

- New Version (3.0): By implementing a data compression method and converting technical data into a more compact format, the EA reduces the data size sent to GPT by about 1/4 compared to version 2.63. This means faster processing, fewer tokens used, and overall better performance when communicating with the models.

Version 2.63

2025.04.01

New Version Release Notes

This update modifies the chat model selection and the handling of the Temperature (creativity parameter),

allowing for more stable operation and flexible settings. Below are the main changes:

---

**1. Fixed Temperature for o1 / o3 Models**

- For “reasoning series” models such as o1-mini-2024-09-12, o3-mini, and o1,

we have fixed the Temperature (creativity) at 1.0, prioritizing the quality and consistency of reasoning.

- Therefore, even if you specify 0.1 or 2.0 in the EA, the actual applied value will be 1.0.

---

**2. Variable Temperature for GPT Models (Achieving More Optimized Temperature Adjustment)**

- When selecting standard GPT series such as gpt-3.5-turbo, gpt-4-turbo, or gpt-4.5-preview,

the Temperature set in the EA’s input parameters will be applied as is.

- Temperature control has been further optimized, allowing for finer adjustments

from more strict (e.g. 0.1) to more creative (e.g. 1.0–2.0).

---

**3. Other Refinements**

- Added Print logs to confirm the final Temperature used and note any differences

between the user’s specified value and the actual value.

- These changes do not affect the overall EA operation or trading logic,

but they make the Temperature settings more transparent.

---

These are the main changes and improvements in the new version. Please note that after the update,

if you select an o1/o3 model, the Temperature will effectively remain at 1.0 regardless of any changes.

If you choose a GPT model, you can continue to freely configure the Temperature as before,

so feel free to adjust it to your preference.

Version 2.62

2025.03.26

Latest Update

1. New Feature: Introduced Trailing Start, allowing you to automatically follow the stop level once a certain profit in pips is reached.

2. Fixed an issue where the trailing stop would not activate with some high-leverage dealers.

3. Improved overall stability of the logic.

4. Added initial setting examples for recommended timeframes.

―――――――――――――――――――――――――――――――――――――――

■ By Timeframe: Recommended Settings (Text Version)

● M15 (15-minute chart)

・TrailingStartPips (Activation Profit): 5–10 pips

・TrailingStopPips (Follow Distance): 5–10 pips

・Note: More scalping-oriented / Sensitive follow-up

● M30 (30-minute chart)

・TrailingStartPips (Activation Profit): 10–15 pips

・TrailingStopPips (Follow Distance): 10–15 pips

・Note: Suitable for novice day traders

● H1 (1-hour chart)

・TrailingStartPips (Activation Profit): 15–30 pips

・TrailingStopPips (Follow Distance): 15–25 pips

・Note: Strong trend-following setup

―――――――――――――――――――――――――――――――――――――――

With this update, a new “Trailing Start” feature has been added, allowing you to specify the timing to begin trailing the stop more flexibly. This caters to traders looking for tighter trailing for scalping, as well as those wanting a wider approach for capturing larger trends in swing trading.

We have also fixed cases in high-leverage environments where trailing would fail to activate, so you can now protect profits or aim for profit-taking more reliably than ever.

Try out the settings that best suit your trading style and timeframe. Further improvements are planned, so we appreciate your continued support.

Version 2.61

2025.03.20

We will be responding to all messages received today (by midnight). Please note that if we send messages repeatedly within a short period, the MQL system may prevent further messages from being sent for a certain duration. We will address each request in order, so we appreciate your patience. We apologize again for any inconvenience caused.

Latest Update

1. News Filter Function

- We have added a new News Filter feature to this EA.

It references the MQL5 economic calendar and can suspend trading for a certain period before and after major news releases.

- News Filter ON/OFF

• You can configure whether to halt new entries when important news is announced.

• By specifying the number of minutes before and after a release, you can effectively avoid rapid market fluctuations.

- Importance Level Filter

• You can choose to stop only High-impact news (importance level 3), stop Medium (2) and above, or stop everything including Low (1).

• In the MQL5 calendar, importance is managed as 1=Low, 2=Medium, 3=High.

• You can also aim for potential profits by allowing only High-impact events to remain tradable, enabling flexible strategies.

- Automatic Position Closure

• The News Filter can be set to automatically close any currently held positions when triggered.

• This helps manage risk during major market moves around significant news announcements.

2. Economic Calendar Display on Charts

- In this version, we have added a feature that visually displays economic events on your trading chart.

1) Vertical Lines

• Vertical lines are automatically drawn for events within the past and upcoming 24 hours.

• The line colors vary by High/Medium/Low news impact, making it easy to distinguish events visually.

2) Color Coding and Tooltips

• High (level 3) → Red

• Medium (level 2) → Orange

• Low (level 1) → Green

• Hovering over a line displays a tooltip with details such as the event name, time, and importance level.

3) Customizable

• Set the “ShowCalendarOnChart” parameter to true to enable display; if set to false, no lines will be drawn.

• Your existing trading logic remains unchanged, as this feature is purely for informational purposes.

- In summary:

• The News Filter reduces risk from sudden market moves, and the new chart display provides a visual overview of economic events.

• This version simultaneously improves safety and convenience.

• We encourage you to utilize these new features for safer, more efficient trading.

Version 2.51

2025.03.18

Simple Fix Update

A file-write error (5004) occurred because the WriteDebugCsv() function, which writes debug logs to a CSV file within the EA, was causing issues. Therefore, we set the DebugToCSV flag to false to disable CSV output.

Version 2.50

2025.03.17

Latest Update

We sincerely apologize for any inconvenience caused by our inability to respond directly. We will reply as soon as possible after March 20, so please bear with us until then. We appreciate your cooperation.

This EA now includes the following new or improved features:

Version 2.5 is a major update that lets you choose from 6 GPT models.

Compare each GPT model’s accuracy and cost performance as needed.

1. GMT Offset Feature

- Use `InpGMTOffsetHours` to account for your broker server’s time offset.

- For example: If GMT+3, set “3.” If GMT-5, set “-5,” enabling alignment with London or NY session times.

2. Fixed Lot Feature

- If `UseFixedLot = true`, the EA will always use `FixedLotSize` and ignore `RiskPercent`.

- If `UseFixedLot = false`, it calculates lot size based on `RiskPercent` as before.

3. GPT Model Selection

- Choose from 6 different GPT models via the dropdown in Inputs.

- The EA will then use the selected model for ChatGPT API requests (entries and exits).

## Forex Market Forecast: Model Evaluations (Up to 10 Stars)

Please also refer to the estimated cost for 7000 tokens per single request.

1) o1-mini-2024-09-12

[Accuracy] ★★★★★★★★☆☆ (8/10)

[Real-Time Data Use] ★★★★★★★★☆☆ (8/10)

[Short/Long Adaptability] ★★★★★★★☆☆☆ (7/10)

[Response & Efficiency] ★★★★★★☆☆☆☆ (6/10)

[Cost Performance] ★★★★★★★☆☆☆ (7/10)

[Est. Cost for 7000 Tokens/Single Request] $0.02 - $0.03

2) o3-mini

[Accuracy] ★★★★★★★★☆☆ (8/10)

[Real-Time Data Use] ★★★★★★★★☆☆ (8/10)

[Short/Long Adaptability] ★★★★★★★☆☆☆ (7/10)

[Response & Efficiency] ★★★★★★★★☆☆ (8/10)

[Cost Performance] ★★★★★★★☆☆☆ (7/10)

[Est. Cost for 7000 Tokens/Single Request] $0.02 - $0.03

3) gpt-3.5-turbo

[Accuracy] ★★★★★★★☆☆☆ (7/10)

[Real-Time Data Use] ★★★★★★★☆☆☆ (7/10)

[Short/Long Adaptability] ★★★★★★★☆☆☆ (7/10)

[Response & Efficiency] ★★★★★★★★★☆ (9/10)

[Cost Performance] ★★★★★★★★★☆ (9/10)

[Est. Cost for 7000 Tokens/Single Request] $0.013 - $0.02

4) gpt-4-turbo

[Accuracy] ★★★★★★★★★☆ (9/10)

[Real-Time Data Use] ★★★★★★★★★☆ (9/10)

[Short/Long Adaptability] ★★★★★★★★★☆ (9/10)

[Response & Efficiency] ★★★★★★★☆☆☆ (7/10)

[Cost Performance] ★★★★★★★★★☆ (9/10)

[Est. Cost for 7000 Tokens/Single Request] $0.04 - $0.06

5) o1

[Accuracy] ★★★★★★★★★☆ (9/10)

[Real-Time Data Use] ★★★★★★★★★☆ (9/10)

[Short/Long Adaptability] ★★★★★★★★★☆ (9/10)

[Response & Efficiency] ★★★☆☆☆☆☆☆☆ (3/10)

[Cost Performance] ★★★★☆☆☆☆☆☆ (4/10)

[Est. Cost for 7000 Tokens/Single Request] $0.26 - $0.39

6) gpt-4.5-preview

[Accuracy] ★★★★★★★★★★ (10/10)

[Real-Time Data Use] ★★★★★★★★★★ (10/10)

[Short/Long Adaptability] ★★★★★★★★★★ (10/10)

[Response & Efficiency] ★★★★☆☆☆☆☆☆ (4/10)

[Cost Performance] ★★☆☆☆☆☆☆☆☆ (2/10)

[Est. Cost for 7000 Tokens/Single Request] $0.70 - $1.00

---

## Q&A

Q: I changed “RiskPercent,” but it always trades 0.01 lots. Why?

A: Mainly two reasons:

- Risk calculation: If the calculated risk-based lot is below the broker’s minimum, it will default to 0.01.

- Broker restrictions: Some brokers only allow a minimum of 0.01 lot.

Q: Will this be fixed in a future version?

A: Yes. This version adds a parameter for fixed-lot usage. By setting the Lot Setting to “true,” you can always trade a fixed lot (e.g., 0.05) instead of using the risk-based calculation.

Q: I keep getting a 429 error. What does that mean?

A: 429 typically indicates hitting the OpenAI rate limit or insufficient API credit. Check your Billing & Usage on OpenAI. If it’s rate-limited, try reducing BarsNeeded or using a higher timeframe to reduce request frequency.

Version 2.42

2025.03.14

Latest Update

Although we are able to release updates in compliance with the regulations, we still cannot view any comments or messages, and we sincerely apologize for the continued inconvenience. Full functionality is scheduled to be restored on March 20, and we are doing our utmost to expedite the process. We appreciate your patience.

In response to requests from many of you, we have added the parameter sets at the bottom of the product page description. For now, they are available in English and Japanese, and we will gradually support additional languages, so please stay tuned.

New Feature

・Now compatible with the ChatGPT o1 model!

Simply set the ChatGptModel parameter to “o1” to use this higher-level model compared to the mini version.

・We expect improved reasoning and inference capabilities, which should enhance your trading performance.

Improvements

・Made parameter items easier to read and organized the trading environment for better usability.

Answers to Frequently Asked Questions

**Q: I can’t trade.**

**A:** In most cases, this is caused by insufficient OpenAI API credit. First, please log in to your OpenAI dashboard and check if you have enough credit. If your balance is insufficient, please add more credit.

Also, please check the “Toolbox” → “Experts” tab at the bottom of your MetaTrader 5 screen to see if there are any error messages. If there is a recorded error, it may contain the cause of the issue.

Version 2.41

2025.03.13

Introducing the Latest Update

Experience a more streamlined and intuitive trading environment with these new enhancements:

・New Feature: Now integrates New York and London market hours, allowing you to focus your trades on high-liquidity periods.

・Improvement: Refined parameter settings that make setup and adjustments even easier.

・Enhanced GPT Accuracy: Get more precise signals and insights for every trade, providing stronger support for your decisions.

In this update, you can restrict trading to high-liquidity periods by toggling two new parameters:

・UseLondonSession (8:00–17:00 server time)

・UseNYSession (13:00–22:00 server time)

Simply set each to true to activate trading only during that session (setting both to true covers the London–NY overlap). By focusing on periods of higher market liquidity, the EA benefits from tighter spreads and stronger price movements, reducing the drawbacks of low-volatility hours and offering more robust entry opportunities.

UseLondonSession = false

UseNYSession = false

If both parameters are set to false, there is no time-based restriction on trading.

The EA can trade around the clock, potentially yielding more entry opportunities, but you should be aware of possible low-liquidity periods and wider spreads in off-peak hours.

Version 2.33

2025.03.12

1)Fixed an issue on certain high leverage accounts or older MT5 builds where previous positions wouldn’t always close, stacking multiple trades. After testing on over 30 accounts (including suffixes), the problem no longer occurs.

2) Cooldown Feature

Parameter Name:

UseCooldown (true/false)

CooldownBars (integer)

How to Enable:

In the EA inputs, set UseCooldown = true.

Set CooldownBars to the number of bars you want the EA to wait after a position closes before it can open another new trade.

Short Timeframe Example (like M5/M15):

If you’re scalping on M15 or lower, you might want a slightly larger “bar count,” like 3–5 bars, so the EA doesn’t jump right back into a trade the very next minute or two. This helps reduce “choppy” re-entries if the market is crazy volatile.

Long Timeframe Example (H1/H4):

On bigger timeframes, you often don’t need as many bars for cooldown because each bar already covers more time. Something like 1 or 2 bars of cooldown can be enough, especially on H1 or H4.

Tip:

If you notice too many consecutive losses happening, try increasing CooldownBars or switching it from false to true to give the EA a “breather” between trades.

3) Trailing Stop Feature

Parameter Name:

UseTrailingStop (true/false)

TrailingStopPips (double)

How to Enable:

In the EA inputs, set UseTrailingStop = true.

Adjust TrailingStopPips to your preference. If set to 20, that means once your open trade has at least 20 pips of profit, the EA automatically moves its SL upwards (for BUY) or downwards (for SELL) to lock in some gains.

Recommended Usage:

If you’re trading short-term and want to “lock in” small, quick profits, you might keep TrailingStopPips around 10–20.

For more medium- or long-term trades, some folks set it higher, like 30–50 pips, to give trades room to “breathe” and avoid premature stoppage.

Trailing stops are perfect if you want to catch an extended run and avoid having to manually move the stop.

Version 2.2

2025.03.10

Fix: Resolved an issue where the EA mistakenly closed positions of the same currency pair traded by another EA, even when different magic numbers were assigned.

Stability Improvement: Enhanced position management accuracy and improved compatibility for running multiple EAs simultaneously.

Version 2.1

2025.03.07

March 7, 2025: Adjusted the parameters and GPT response in line with market conditions.

I've only used this on a live account for about two days, but so far, it's profitable, especially on USDJPY and EURUSD. What really stands out is the developer support - I'm not sure Mikoto sleeps at all given how quickly he responds to both private DMs and questions in the groupchat, especially considering the US / JPY timezone difference. New releases and features are always in the works, and a new update came out within a day of purchasing the EA. Keep up the good work!