Specification

I am looking to have a custom indicator created that marks my customizable orderblock/FVG zones on the chart and can then detect price re-enters and exits the unmitigated portion of this zone and will change color to show this. After a portion of the zone is mitigated or filled, the zone is redrawn to only the unmitigated zone. Zones are also deleted after price passed through the orderblock.

The fair value gap and orderblock concepts are common price action concepts that can be found in many trading communities. This guide will not explain these concepts as they are easily found on the internet.

The indicator should do the following:

Step 1 Zone Specification and Drawing

1. The indicator should work for both bullish and bearish orderblock/fvg zones. If needed two separate indicators for bullish or bearish fvg/orderblock zones can be made.

2. The indicator should be able to differentiate between the FVG zone that we expect to be filled and the orderblock zone as well as join them for display of the zone on the chart.

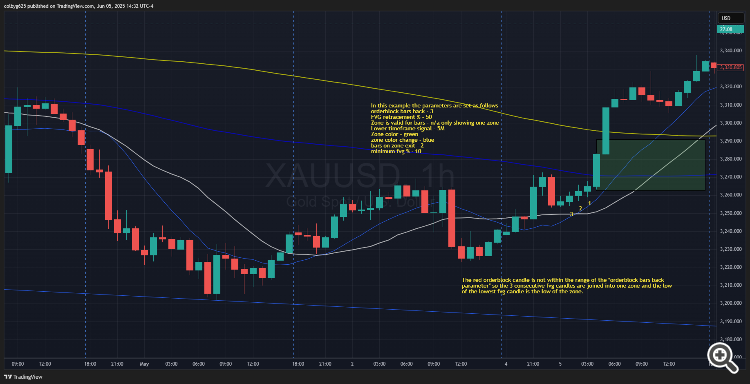

3. The indicator should create a separate zone for each Orderblock/FVG. Fair value gaps can only be joined into a single zone if they do not have an opposite closing orderblock candle within the range of bars set by the "orderblock bars back" parameter and they are in consecutive order.

4. Only draw zones for fair value gaps that are equal to or greater than the % the bar range specified by the "minimum FVG %" parameter.

5. Have the zone be customizable by a variable parameter or how deep a percentage of retracement into the FVG where the zone will begin. Always start the zone at the % retracement into the FVG specified by the parameter known as "FVG Retracement %", even if the start of the orderblock is at a lower retracement percentage.

6. Group price gaps into the FVG/orderblock zone. Include the price gap in the FVG zone that when filled/mitigated leads to eventual deactivation and end of projection of the zone.

7. Have the zone customizable by a variable parameter know as "orderblock bars back" of how many bars to look back behind the FVG and group into the orderblock. The end of this zone should be marked at the tip of the orderblock group. For bullish zones this would be the low of the lowest red candle in the amount of bars behind the FVG specified by the "orderblock bars back" parameter.

8. If there is no orderblock to the left of a FVG within the amount of bars specified by the "orderblock bars back" threshold, mark only the zone starting at the "FVG retracement %" parameter to the end (low or high) of the bar that contains the FVG. If two or more FVG's are joined without an orderblock, the end of the low of the zone should be the low of the lowest candle in the chain of FVG candles for bullish examples and the opposite for bearish.

9. Have the zone be customizable by a variable parameter of how many bars this zone stays on the chart. This parameter will be known as "zone is valid for bars"

10. Draw the orderblock/FVG zone on the chart that projects into current prices. All the way over to the righthand edge of the chart.

Step 2 Lower time frame binary signal generation to be known as "Inside POI Zone"

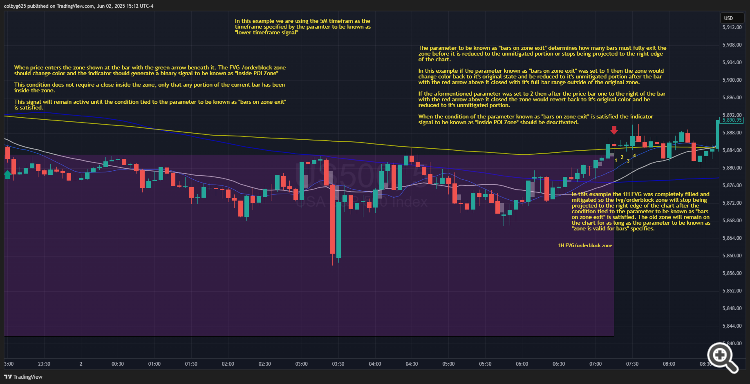

11.Calculate zones based on the close of every bar of the lower time frame specified in the parameter to be known as "lower timeframe signal".

12.Detect when any portion of the current price bar of the timeframe specified by the parameter to be known as "lower timeframe signal" enters a fvg/orderblock zone.

13. This will cause that specific zone to change color and for the indicator to generate a signal to be known as "Inside POI Zone"

14. The zone resting color and color that they change to upon price's entry into the zone will be parameters to be known as "zone color" and "zone color change" respectively.

15. After an amount of bars specified by the parameter "bars on zone exit" has their bar range completely exit the zone, the zone will be reduced to it's unmitigated/unfilled portion and change color back to it's original state, if they is no fvg left to fill then the zone will stop being projected into the right hand edge of the chart. This will also deactivate the indicator signal to be known as "Inside POI Zone".

16. Old or deactivated zones with no FVG left to fill or mitigate will remain on the chart for as long as the parameter to be known as "zone is valid for bars" specifies.

17. The indicator signal to be named "Inside POI Zone" can be displayed in a bottom window of the chart as a binary signal where the top of the window is marked as 1 and the bottom is marked as 0. A horizontal line inside this window will move back and forth between the bottom and top of the window whenever the indicator signal is active or not.

Step 3 Zone reduction and deactivation

18. After price exits a zone completely for the entire range of the bars for an amount of bars specified by the parameter to be known as "bars on zone exit" on the time frame specified by the parameter to be known as "lower timeframe signal" the zone that price left will then be reduced by the amount that price traveled into and filled/mitigated the FVG of the fvg/orderblock zone. The zone will also change back to it's original color before an indicator signal was generated.

19. If there is no amount of FVG in the fvg/orderblock zone left to fill/mitigate then the zone should be stop being projected to the right edge of the chart and that fvg/orderblock zone can no longer generate the indicator signal. Other fvg/orderblock zones on the chart will still maintain the ability to generate the indicator signal.

20. If at any time price crosses completely through a fvg/orderblock zone. That zone should be deactivated and stop being projected to the right edge of the chart and not be able to generate indicator signals.

Parameters explained.

1.Bars behind FVG to group into orderblock. We should call this "Orderblock bars back"

2. % retracement into FVG to start zone. 0-100%. We should call this "FVG Retracement %"

3. Bars that the Zone stays valid for and remains on the chart. We can call this "Zone is valid for bars"

4. Lower timeframe to use for triggering the signal condition. When a bar of this specified timeframe has any portion of it inside the zone. for example 5M candles inside of 1H orderblock/FVG zone. We can call this "Lower time frame bar signal".

5. Zone color. We can call this "zone color" this will allow us to change the color of the zone that the indicator draws.

6. Zone color change. We can call this "zone color change". When price is printing bars on the selectable lower time frame with any portion inside the zone. The zone should change color to a selectable color.

7. Bars on Zone Exit. Named as "Bars on Zone Exit" Determines how many bars need to close with their entire bar range outside of the zone for it to change color back to the original condition and then redraw or deactivate the zone.

8.Minimum FVG %. Named as "minimum fvg %". The minimum FVG size as a percentage of the bar range that is required in order to draw a zone. Too small a FVG and it should not be valid and not draw the zone.

Parameter List

1. Orderblock Bars Back - number

2. FVG Retracement % - % expressed as a number 0-100

3. Zone is Valid for Bars - number

4. Lower Timeframe Bar Signal - Slide down bar with selection of a range of time frames from 1Minute to 1Day.

5.Zone Color - Selection of colors

6. Zone Color Change - Selection of colors.

7. Bars on Zone Exit - number

8. Minimum FVG % - % expressed as a number 0-100

Responded

1

Rating

Projects

0

0%

Arbitration

0

Overdue

0

Free

2

Rating

Projects

474

39%

Arbitration

103

41%

/

23%

Overdue

79

17%

Busy

Published: 2 codes

3

Rating

Projects

11

18%

Arbitration

4

0%

/

100%

Overdue

4

36%

Free

4

Rating

Projects

25

0%

Arbitration

4

0%

/

100%

Overdue

5

20%

Working

5

Rating

Projects

421

54%

Arbitration

20

55%

/

15%

Overdue

29

7%

Working

6

Rating

Projects

236

32%

Arbitration

30

27%

/

30%

Overdue

26

11%

Free

7

Rating

Projects

243

74%

Arbitration

7

100%

/

0%

Overdue

1

0%

Free

Published: 1 article

8

Rating

Projects

20

35%

Arbitration

3

0%

/

100%

Overdue

0

Free

Published: 1 code

9

Rating

Projects

0

0%

Arbitration

4

0%

/

75%

Overdue

0

Free

10

Rating

Projects

259

30%

Arbitration

0

Overdue

3

1%

Free

Published: 2 codes

11

Rating

Projects

89

43%

Arbitration

4

0%

/

100%

Overdue

3

3%

Working

12

Rating

Projects

91

13%

Arbitration

34

26%

/

59%

Overdue

37

41%

Free

13

Rating

Projects

3

33%

Arbitration

1

0%

/

100%

Overdue

0

Free

14

Rating

Projects

0

0%

Arbitration

0

Overdue

0

Free

15

Rating

Projects

0

0%

Arbitration

1

0%

/

100%

Overdue

0

Free

Published: 2 codes

16

Rating

Projects

0

0%

Arbitration

0

Overdue

0

Free

17

Rating

Projects

945

47%

Arbitration

309

58%

/

27%

Overdue

125

13%

Free

Similar orders

Pinescript

100+ USD

I’m looking for a Pine Script developer who can reverse engineer the “Swing Only” logic of the Polytrends indicator on TradingView. The goal is to recreate how the swing trends are detected and plotted so it can be used as a custom indicator. If you have experience with TradingView Pine Script and reverse-engineering indicator logic , please reach out

Combine the two indicators into one indicator. I want it to have both Dark and Light mode depending on MT5 theme. I want to be able to configure colours of each Lines and rectangles plotted. I will provide the codes for both separate indicators

Para Jardo

300+ USD

Safe NerdWallet is not a lender. Not all applicants will qualify for the full amount or lowest available rates. Rates for poor or fair credit can be over 36%. NerdWallet Compare, Inc. NMLS 1617539 Fin. Lender loans per DFPI Fin. Lenders Lic 60DBO-74812 NMLS Consumer Access | Licenses and Disclosures California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation

2 FX pairs M15 execution with higher timeframe bias Session-based trading (UK time) Fixed % risk per trade Controlled pyramiding (add to winners only) Strict daily loss limits (FTMO-style) Proper order handling (SL always set) Basic logging (CSV) Strategy logic will be provided in detail after NDA / agreement. Must deliver: Source code (.mq5) Compiled file (.ex5) Clean, well-commented code Short support window for

Tradingview indicator

30+ USD

Hi, are you able to create a script/indicator on tradingview that displays a chart screener and it allows me to input multiple tickers on the rows. then the colums with be like "premarket high, premarket low, previous day high, previous day low" . When each or both of the levels break, there will pop up a circle on the chart screener, signaling to me what names are above both PM high and previous day high or maybe

I need an Expert Advisor for MetaTrader 5 (MQL5) to trade XAUUSD based on a simple price movement cycle. Strategy logic: • The EA opens a Buy and a Sell at the same time (one pair per cycle). • Only ONE Sell position must exist at any time. • Every Buy must be opened together with a Sell. Cycle rules: • Step movement = 10 USD in gold price. • CycleEntryPrice = the OPEN PRICE of the last cycle BUY order. • If price

Build MT5 Expert Advisor – LadyKiller EA

1000 - 2000 USD

I am looking for a professional MQL5 developer to build a MetaTrader 5 Expert Advisor from scratch. The EA will be called LadyKiller EA. It must trade only the following instruments: • XAUUSD (Gold) • US30 / Dow Jones Index Requirements: • Strong and reliable buy and sell entry logic • Stop Loss and Take Profit system • Risk management (lot size control) • Maximum trades protection • Drawdown protection • Trend

I need an mql5 EA which can be used with 100$ capital very low drawdown The EA should be high frequency trading special for XAUUSD and btcusd or binary options but also the EA should be testable via strategy tester and demo test for five days is needed NO SELECTION CAN BE DONE WITHOUT TESTING when applying make sure you send the backtester results with demo EA testable via strategy tester

Hello, I'm looking to find out the cost of creating a mobile trading robot. I've tried to describe it as thoroughly as possible in the following document. I look forward to your response. I'd like to know the costs, delivery time, and how you plan to implement it before making a decision

DO NOT RESPOND TO WORK WITH ANY AI. ( I CAN ALSO DO THAT ) NEED REAL DEVELOPING SKILL Hedge Add-On Rules for Existing EA Core Idea SL becomes hypothetical (virtual) for the initial basket and for the hedge basket . When price hits the virtual SL level , EA does not close the losing trades. Instead, EA opens one hedge basket in the opposite direction. Original basket direction Hedge basket direction (opposite) Inputs

Project information

Budget

100 - 200 USD

Deadline

from 7 to 14 day(s)