Job finished

Specification

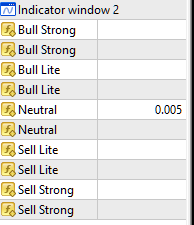

i have a simple and specific requirement to modify an indicator. This indicator has 10 buffers for colour as below:

i would like to delete the duplicate buffers for use in EA lab which has a maximum of 8 allowed.

The code is below:

//+------------------------------------------------------------------+

//| iRimbab_1.mq4 |

//| Copyright 2019, MetaQuotes Software Corp. |

//| https://www.mql5.com |

//+------------------------------------------------------------------+

#property copyright "Copyright 2019, MetaQuotes Software Corp."

#property link "https://www.mql5.com"

#property version "1.00"

#property strict

#property indicator_separate_window

#property indicator_buffers 10

#property indicator_label1 "Bull Strong"

#property indicator_color1 clrBlue

#property indicator_type1 DRAW_HISTOGRAM

#property indicator_width1 4

#property indicator_label4 "Bull Lite"

#property indicator_color4 clrBlue

#property indicator_type4 DRAW_HISTOGRAM

#property indicator_width4 4

#property indicator_label6 "Neutral"

#property indicator_color6 clrGray

#property indicator_type6 DRAW_HISTOGRAM

#property indicator_width6 4

#property indicator_label7 "Sell Lite"

#property indicator_color7 clrRed

#property indicator_type7 DRAW_HISTOGRAM

#property indicator_width7 4

#property indicator_label9 "Sell Strong"

#property indicator_color9 clrRed

#property indicator_type9 DRAW_HISTOGRAM

#property indicator_width9 4

//---

enum E_MODE

{

MOD_RSI =0, //RSI

MOD_STO =1, //STOCHASTIC

MOD_ADX =2 //ADX

};

//---

enum E_TYPE

{

TYP_ALMA =0, //ALMA

TYP_EMA =1, //EMA

TYP_WMA =2, //WMA

TYP_SMA =3, //SMA

TYP_SMMA =4, //SMMA

TYP_HMA =5 //HMA

};

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

input int Length =6; //Period of Evaluation

input int Smooth =1; //Period of Smoothing

input ENUM_APPLIED_PRICE Source =PRICE_CLOSE; //Source

input E_MODE Mode =MOD_RSI; //Indicator Method

input E_TYPE Type =TYP_WMA; //MA

input double Offset =0.85; //* Arnaud Legoux (ALMA) Only - Offset Value

input double Sigma =6.0; //* Arnaud Legoux (ALMA) Only - Sigma Value

input int MaxBar =1000; //Max Bars

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

#include <MovingAverages.mqh>

//---

double BS[];

double BSZ[];

double BL[];

double BLZ[];

double Nt[];

double NtZ[];

double SL[];

double SLZ[];

double SS[];

double SSZ[];

double MA[];

double Bull[];

double Bear[];

double Temp[];

double Price[];

double AvBull[];

double AvBear[];

double SmBull[];

double SmBear[];

double W[];

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int OnInit()

{

Comment("");

IndicatorBuffers(19);

int cnt=0;

SetIndexBuffer(cnt,BS,INDICATOR_DATA);

SetIndexEmptyValue(cnt,NULL);

cnt++;

SetIndexBuffer(cnt,BSZ,INDICATOR_DATA);

SetIndexEmptyValue(cnt,NULL);

cnt++;

SetIndexBuffer(cnt,BL,INDICATOR_DATA);

SetIndexEmptyValue(cnt,NULL);

cnt++;

SetIndexBuffer(cnt,BLZ,INDICATOR_DATA);

SetIndexEmptyValue(cnt,NULL);

cnt++;

SetIndexBuffer(cnt,Nt,INDICATOR_DATA);

SetIndexEmptyValue(cnt,NULL);

cnt++;

SetIndexBuffer(cnt,NtZ,INDICATOR_DATA);

SetIndexEmptyValue(cnt,NULL);

cnt++;

SetIndexBuffer(cnt,SL,INDICATOR_DATA);

SetIndexEmptyValue(cnt,NULL);

cnt++;

SetIndexBuffer(cnt,SLZ,INDICATOR_DATA);

SetIndexEmptyValue(cnt,NULL);

cnt++;

SetIndexBuffer(cnt,SS,INDICATOR_DATA);

SetIndexEmptyValue(cnt,NULL);

cnt++;

SetIndexBuffer(cnt,SSZ,INDICATOR_DATA);

SetIndexEmptyValue(cnt,NULL);

cnt++;

SetIndexBuffer(cnt,MA,INDICATOR_CALCULATIONS);

SetIndexEmptyValue(cnt,NULL);

cnt++;

SetIndexBuffer(cnt,Bull,INDICATOR_CALCULATIONS);

SetIndexEmptyValue(cnt,NULL);

cnt++;

SetIndexBuffer(cnt,Bear,INDICATOR_CALCULATIONS);

SetIndexEmptyValue(cnt,NULL);

cnt++;

SetIndexBuffer(cnt,Temp,INDICATOR_CALCULATIONS);

SetIndexEmptyValue(cnt,NULL);

cnt++;

SetIndexBuffer(cnt,Price,INDICATOR_CALCULATIONS);

SetIndexEmptyValue(cnt,NULL);

cnt++;

SetIndexBuffer(cnt,AvBull,INDICATOR_CALCULATIONS);

SetIndexEmptyValue(cnt,NULL);

cnt++;

SetIndexBuffer(cnt,AvBear,INDICATOR_CALCULATIONS);

SetIndexEmptyValue(cnt,NULL);

cnt++;

SetIndexBuffer(cnt,SmBull,INDICATOR_CALCULATIONS);

SetIndexEmptyValue(cnt,NULL);

cnt++;

SetIndexBuffer(cnt,SmBear,INDICATOR_CALCULATIONS);

IndicatorSetInteger(INDICATOR_DIGITS,_Digits+1);

IndicatorSetString(INDICATOR_SHORTNAME,

MQLInfoString(MQL_PROGRAM_NAME)+" ("+

IntegerToString(Length)+", "+

IntegerToString(Smooth)+", "+

StringSubstr(EnumToString(Source),StringLen("PRICE_"))+", "+

StringSubstr(EnumToString(Mode),StringLen("MOD_"))+", "+

StringSubstr(EnumToString(Type),StringLen("TYP_"))+", "+

DoubleToString(Offset,2)+", "+

DoubleToString(Sigma,2)+")");

return(INIT_SUCCEEDED);

}

//+------------------------------------------------------------------+

//| Custom indicator iteration function |

//+------------------------------------------------------------------+

int OnCalculate(const int rates_total,

const int prev_calculated,

const datetime &time[],

const double &open[],

const double &high[],

const double &low[],

const double &close[],

const long &tick_volume[],

const long &volume[],

const int &spread[])

{

int limit=rates_total-prev_calculated;

if(limit>1)

{

limit=fmin(MaxBar,rates_total)-Length-2;

for(int i=0; i<rates_total; i++)

PlotZ(i);

if(Type==TYP_ALMA)

{

ArrayResize(W,Length);

double m=floor(Offset*(Length-1));

double s=Length/Sigma;

double wSum=0;

double t=(2*s*s);

for(int i=0; i<Length; i++)

{

W[i]=exp(-((i-m)*(i-m))/((t==NULL) ?1.0 :t));

wSum+= W[i];

}

for(int i=0; i<Length; i++)

W[i]=W[i]/wSum;

}

}

else

limit++;

for(int i=limit; i>=0; i--)

{

PlotZ(i);

Price[i]=Price(Source,i,open[i],high[i],low[i],close[i]);

switch(Type)

{

case TYP_HMA:

Temp[i]=iMA(_Symbol,PERIOD_CURRENT,(int)floor(Length/2),0,MODE_LWMA,Source,i)*2-iMA(_Symbol,PERIOD_CURRENT,Length,0,MODE_LWMA,Source,i);

break;

}

}

for(int i=limit; i>=0; i--)

{

MA[i]=iMA(_Symbol,PERIOD_CURRENT,1,0,MODE_SMA,Source,i);

switch(Mode)

{

case MOD_STO:

Bull[i]=MA[i]-MA[ArrayMinimum(MA,Length,i)];

Bear[i]=MA[ArrayMaximum(MA,Length,i)]-MA[i];

break;

case MOD_RSI:

Bull[i]=0.5*(fabs(MA[i]-MA[i+1])+(MA[i]-MA[i+1]));

Bear[i]=0.5*(fabs(MA[i]-MA[i+1])-(MA[i]-MA[i+1]));

break;

case MOD_ADX:

Bull[i]=0.5*(fabs(high[i]-high[i+1])+(high[i]-high[i+1]));

Bear[i]=0.5*(fabs(low[i+1]-low[i])+(low[i+1]-low[i]));

break;

}

AvBull[i]=MA(Bull,Length,i);

AvBear[i]=MA(Bear,Length,i);

}

for(int i=limit; i>=0; i--)

{

SmBull[i]=MA(AvBull,Smooth,i);

SmBear[i]=MA(AvBear,Smooth,i);

double dif=fabs(SmBull[i]-SmBear[i]);

if(dif>SmBull[i])

{

if(SmBear[i]<SmBear[i+1])

SS[i]=dif;

else

SL[i]=dif;

continue;

}

if(dif>SmBear[i])

{

if(SmBull[i]<SmBull[i+1])

BS[i]=dif;

else

BL[i]=dif;

continue;

}

Nt[i]=dif;

}

return(rates_total);

}

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

double MA(double &vBuf[],const int vLen,const int vxPos)

{

double sum=0.0;

switch(Type)

{

case TYP_SMA:

return(iMAOnArray(vBuf,0,vLen,0,MODE_SMA,vxPos));

case TYP_EMA:

return(iMAOnArray(vBuf,0,vLen,0,MODE_EMA,vxPos));

case TYP_SMMA:

return(iMAOnArray(vBuf,0,vLen,0,MODE_SMMA,vxPos));

case TYP_WMA:

return(iMAOnArray(vBuf,0,vLen,0,MODE_LWMA,vxPos));

case TYP_HMA:

return(iMAOnArray(vBuf,0,(int)floor(sqrt(vLen)),0,MODE_LWMA,vxPos));

case TYP_ALMA:

for(int i=0; i<vLen; i++)

sum+=vBuf[vxPos+(vLen-1-i)]*W[i];

return(sum);

}

return(NULL);

}

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

double Price(const ENUM_APPLIED_PRICE vApp,const int vxPos,const double vOp,const double vHi,const double vLo,const double vCl)

{

switch(vApp)

{

case PRICE_CLOSE:

return(vCl);

case PRICE_HIGH:

return(vHi);

case PRICE_LOW:

return(vLo);

case PRICE_OPEN:

return(vOp);

case PRICE_MEDIAN:

return((vHi+vLo)/2.0);

case PRICE_TYPICAL:

return((vHi+vLo+vCl)/3.0);

case PRICE_WEIGHTED:

return((vHi+vLo+vCl+vCl)/4.0);

}

return(NULL);

}

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

void PlotZ(int vxPos)

{

BS[vxPos]=NULL;

BSZ[vxPos]=NULL;

BL[vxPos]=NULL;

BLZ[vxPos]=NULL;

Nt[vxPos]=NULL;

NtZ[vxPos]=NULL;

SL[vxPos]=NULL;

SLZ[vxPos]=NULL;

SS[vxPos]=NULL;

SSZ[vxPos]=NULL;

MA[vxPos]=NULL;

Bull[vxPos]=NULL;

Bear[vxPos]=NULL;

Temp[vxPos]=NULL;

Price[vxPos]=NULL;

AvBull[vxPos]=NULL;

AvBear[vxPos]=NULL;

SmBull[vxPos]=NULL;

SmBear[vxPos]=NULL;

}

//+------------------------------------------------------------------+

//---

//---

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

//---